Study of GHBWF and MSOS

Study of GHBWF (former name: MRCWF and MRCQF)and MSOS

GHBWF and MSOS recommended readings

Bull thesis points (and Catalysts)

- Senate approval of Cannabis federal legalization

- Quarterly earning

- Senators Push U.S. Attorney General To Decriminalize Marijuana ‘Now’ As Congress Debates Reform Bills. Warren and Booker requested that Garland respond to their request by October 20.

- Rep. Nancy Mace ( R- South Carolina) to draft legalization bill

- German, Mexico, Italy, Switzerland, Luxembourg have all started to legalize recreational cannabis. The pressure is on for US, China, etc. On a global scale, cannabis will be considered a great if not green and global investment.

- more and more celebrities are supporting legalization of Cannabis

- so far institutions cannot invest in MSOS, banks cannot finance cannabis due to legalization issue. Once it is resolved, big blue wave will come

Bear thesis points (and Risks)

- liquidity of MRCWF is not too good, sometimes is only about 10,000 per day

- 3X over-supply in California hurts profit, and it might take years to sort out

- Big pharm and doctors will always push prescribed medicines versus natural supplements such as cannabis, unless doctors can see big profit from it

Valuation and financial analysis

Plan of actions (or non-actions)

****************Developing News and commentaries*********************

- 05/16/2024 – U.S. Attorney General Begins Formal Process to Reschedule Marijuana – WSJ Proposed rule would make drug accessible

Attorney General Merrick Garland has officially initiated the process to reschedule marijuana, the Justice Department said Thursday, moving a proposal to reclassify it as a less dangerous drug one step closer to enactment.

The Justice Department said that Garland had submitted a notice of proposed rulemaking to the Federal Register, starting the process of evaluating a schedule change.

The process also involves a period for public comment, plus the consideration of the Drug Enforcement Administration.

Marijuana has been classified as a Schedule I substance, the government’s most restrictive classification, since 1970. The proposed rule would move the drug to a Schedule III classification, making it accessible with a medical prescription.

A proposal for the rule change was submitted late last month to the White House for review. President Biden called on regulators to reconsider the classification in 2022.

President Joe Biden has announced that his administration is officially moving to reschedule marijuana under federal law, applauding the “monumental” action that follows an extensive administrative review that he directed.

The Justice Department will soon post its proposed rule to move cannabis from Schedule I to Schedule III under the Controlled Substances Act (CSA) in the Federal Register, a senior administration official said on Thursday. There will then be a 60-day public comment period before the rule is potentially finalized.

“This is monumental,” Biden said in a video announcing the rescheduling news. “Today my administration took a major step to reclassify marijuana from a Schedule I to a Schedule III drug. It’s an important move towards reversing longstanding inequities.”

To that end, Senate Majority Leader Chuck Schumer (D-NY) and colleagues have reintroduced legislation to federally legalize cannabis and impose certain regulations. The bill’s prospects are dubious in the current divided Congress, however.

Meanwhile, the top Democrat in the U.S. House said that the Biden administration’s move to reschedule marijuana is a “step in the right direction,” but it should be followed up with congressional action such as passing the legalization bill Schumer filed.

- 05/16/2024 – Biden administration reportedly moves to reclassify marijuana (NASDAQ:CGC) | Seeking Alpha

President Biden has reportedly announced that his administration has taken a major step to reclassify marijuana from a Schedule I to a Schedule III substance.

According to Marijuana Moment, Biden made the comments via video Thursday. The news outlet said the Justice Department will soon post its proposed rule for the rescheduling under the Controlled Substances Act in the Federal Register.

- 05/05/2024 – Reclassifying Marijuana Could Unlock Billions in Tax Savings for Cannabis Companies – WSJ Proposed change could lift income-tax burden that wipes out most licensed marijuana retailers’ earnings

Many U.S. cannabis businesses could become profitable for the first time if the Biden administration follows through on its plan to reclassify marijuana as a less dangerous drug.

That is because the change could lift a heavy income-tax burden: Section 280E of the federal tax code currently bars cannabis businesses from claiming deductions on many basic business expenses. That rule often results in an effective tax rate of 70% or more, wiping out most licensed marijuana retailers’ earnings.

“It’s an absolute game-changer,” said Boris Jordan, executive chairman of Curaleaf Holdings, which operates 145 dispensaries and 19 cultivation sites across the U.S. “It’s something we’ve been waiting for, for the better part of 10 years.”

- 10/20/2022 –

Cannabis Investing – Five Trends to Know

- 10/07/2022 – from Tilson

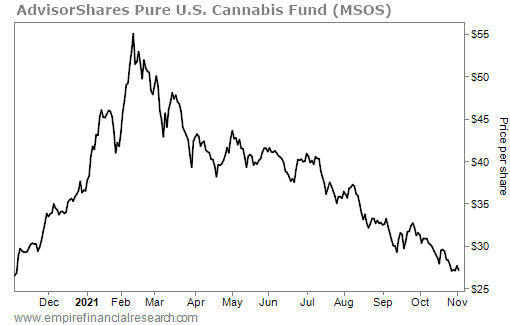

I’ve gotten a lot of calls right this year, but my biggest mistake was being way too early recommending cannabis stocks. On December 29, I cited the AdvisorShares Pure U.S. Cannabis Fund (MSOS) as my top pick for 2022 and, through yesterday afternoon, it was down 65% since then.

Ouch!

The hardest thing in investing is figuring out when you’re wrong – in which case, you should pull the plug – or just early – in which case, you should hang on or even buy more.

I’m convinced that the latter is the case and that the sector has 300% upside in the next couple of years, as I outlined in the “Market Reversal Summit” I recently hosted, which you can watch right here. (During the summit, I also explained how to get access to the name and ticker symbol of a small, well-positioned stock poised to soar as the cannabis sector takes off.)

In addition, here are highlights of a presentation I did in April at the Benzinga Cannabis Capital Conference:

|

I would give the exact same presentation today – I would just need to update the last two slides to reflect the even cheaper prices and lower valuations right now.

My investment thesis got a huge boost yesterday – as did MSOS, which soared 34% – thanks to this unexpected news: Biden Pardons Thousands Convicted of Marijuana Possession Under Federal Law. This is the key part for investors:

[President Joe Biden] said his administration would review whether marijuana should still be in the same legal category as drugs like heroin and LSD…

Mr. Biden also said Thursday that he has asked the attorney general to review how marijuana is legally categorized, which helps determine what kind of penalties are involved.

“The federal government currently classifies marijuana as a Schedule 1 substance,” he said, “the same as heroin and LSD and more serious than fentanyl. It makes no sense.”

In summary, I think we’ll look back on yesterday’s big jump as just the beginning of an incredible move…

- 10/07/2022 -from Todd Harrison

🇺🇸 #cannabis 🌿 👀 pic.twitter.com/JTQE1jm8Kt

— Todd Harrison (@todd_harrison) October 6, 2022

- 04/12/2022 – #SAFEBankingAct is on the list , let us see what will happen

Note last item on the list here.. not a long list and its on it (at the end).. https://t.co/GKrQohUuEt

— Graham Farrar (@grahamfarrar) April 11, 2022

- 04/11/2022 – Todd believes in the long term view of GHBWF. Worth keep watching it

I’m in the business on the east coast and own stock in $IIPR and only ONE plant touching cannabis company. #Glasshouse @glasshouse_ca

Just buy the shit out of it, sit tight, and check back with me in 2-3 years and tell me how much you’ve made $GHBWF https://t.co/ki3zMfs28l

— Todd Sullivan (@ToddSullivan) April 11, 2022

- 04/01/2022 – even though House approves bill legalizing marijuana, there are still lots of roadblocks in the senate. Future is uncertain

House approves bill legalizing marijuana

The House passed legislation on Friday to legalize marijuana nationwide and eliminate the longstanding criminal penalties for anyone who distributes or possesses it.

Lawmakers passed the bill largely along party lines, 220-204, with three Republicans joining all but two Democrats in support.

-

- 03/25/2022 – Cannabis stocks were surging Friday after the House of Representatives said next week it would consider a bill to decriminalize marijuana. A similar bill passed in 2020, but stalled in the then-Republican controlled Senate. Analysts believe this bill could suffer a similar fate. Boltansky believes Congress will ultimately fail to pass comprehensive marijuana reform, but that failure could push lawmakers to clear legislation that could, at the very least, open up the cannabis’ industry access to banking. If the banking bill is passed, we will have a significant tailwind for cannabis stocks

Tilray, Sundial, and Other Cannabis Stocks Buzz. The House Will Consider Decriminalization.

Cannabis stocks were surging Friday after the House of Representatives said next week it would consider a bill to decriminalize marijuana.

Weed stocks spiked on Thursday following news of next week’s potential vote, and were on track to extend the rally on Friday.

Tilray Brands (ticker: TLRY ) stock was up 14%, while Sundial Growers ( SNDL ) gained 13%, Canopy Growth ( CGC) 8%, Cronos Group ( CRON) 4%, and Aurora Cannabis ( ACB) 10%.

The House bill, called the Marijuana Opportunity Reinvestment and Expungement Act, or MORE Act, would remove marijuana from the list of scheduled substances. It would also seek to establish a process to expunge prior cannabis convictions.

The House Committee on Rules is scheduled to hold a hearing on the bill on Monday, with a House vote likely to follow later in the week.

A similar bill passed in 2020, but stalled in the then-Republican controlled Senate. Analysts believe this bill could suffer a similar fate.

“We expect the MORE Act to clear the House once again, but we view it primarily as a messaging bill as it has no viable path to passage through the Senate,” wrote BTIG strategist Isaac Boltansky in a research note.

Boltansky believes Congress will ultimately fail to pass comprehensive marijuana reform, but that failure could push lawmakers to clear legislation that could, at the very least, open up the cannabis’ industry access to banking. Although cannabis sales currently are licensed in over 30 states, U.S. banks are essentially barred from providing services to any cannabis-related businesses, from dispensaries to distributors.

The Secure and Fair Enforcement Banking Act, or SAFE Act, is currently winding its way through Congress. If approved, it would prohibit federal banking regulators from penalizing banks that work with cannabis businesses legalized by states. In Boltansky’s view, if the MORE Act fails, SAFE will be a “logical legislative fallback,” and legislation could pass in the second half of 2022. That legislation could include a handful of additional cannabis measures, such as funding for cannabis research, he added.

-

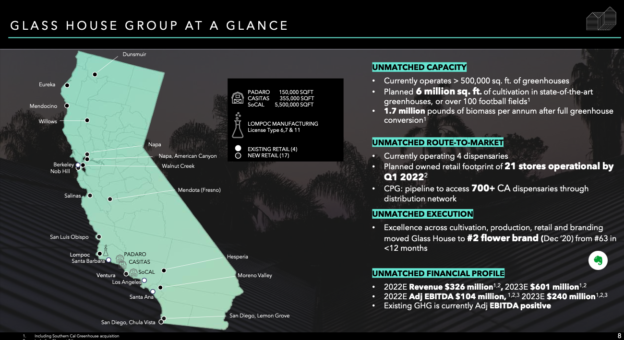

- 03/16/2022 – This approval validates the thesis on the investment and nobody, I mean nobody, commented on it. Remember, I did not enter this thinking it was going to double or triple in a couple of months. I’m looking for 10X or more over the next few years. They are building out the infrastructure and have premium brands and a rapidly expanding retail footprint. Just sit back and wait….

Subs: Great News No One Noticed

Glass House Brands Receives Licenses to Operate SoCal Greenhouse Facility

- California State Cannabis and Ventura County Cultivation Licenses Received

- 30k Clones Arrived at Facility Immediately Following Licensing, Cultivation Has Already Begun

- First Phase of Facility Construction is Proceeding on Schedule

- “The receipt of the required licenses for our SoCal Facility is one of Glass House’s most significant milestones to date, and we are beyond thrilled to initiate planting in our recently converted greenhouse,” said Kyle Kazan, Glass House Chairman and CEO. “With our first harvest only months away and the first phase of the retrofit of the SoCal Facility nearing completion, we are on track to becoming the leader in cannabis cultivation capacity. However, it is our best-in-class craft cannabis cultivation practices; and our high quality and low-cost production capabilities that will provide us with a competitive advantage in the world’s largest cannabis market.”

- 01/13/2022 – Tilson’s number 1 pick of year 2022 is MSOS

Whitney Tilson Joins to Discuss 2022 Outlook! | Benzinga Cannabis Hour

- Cannabis stocks in Canada might be in bubble while there is a lot of potential for US sector because the former is too crowd, and the latter lacks institutional investors

- so far institutions cannot invest in MSOS, banks cannot finance cannabis due to legalization issue. Once it is resolved, big blue wave will come

- the sell-off of MSOS might be overdone.

- lots of cannabis investors are irrational, either too enthusiastic or too scared, good for rational value investor to take advantage here

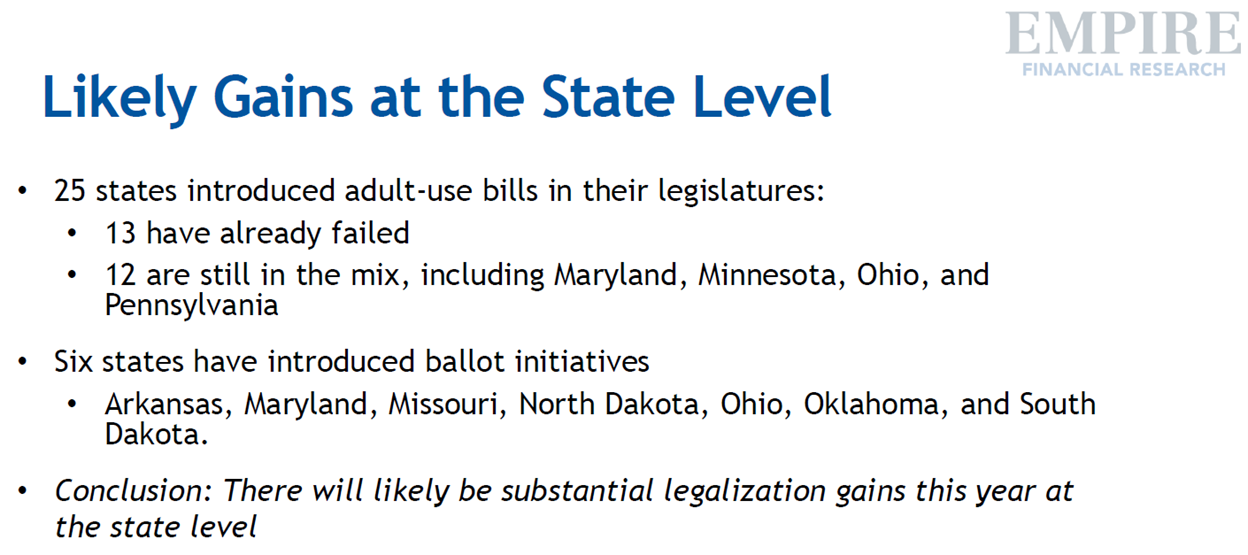

- the major catalysts did not pan out so far, such as SAFE bank act, federal legalization not yet taken effect. however, more and more states are legalizing it, more voters for it, politician will follow voters, regulators will follow politicians. The long term trend is still intact and probably irreversible.

- the fundamental is strong, positive cash flow.

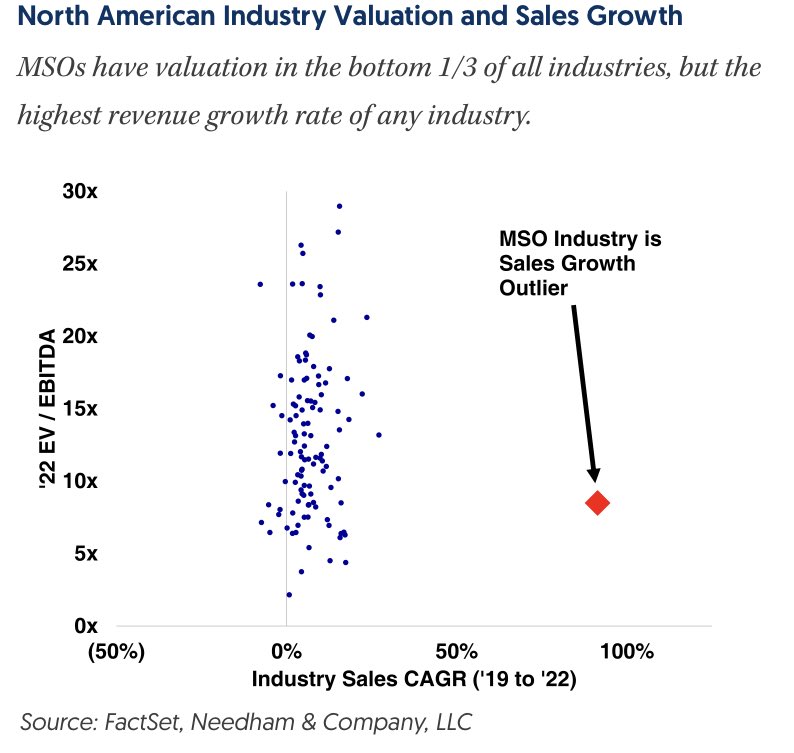

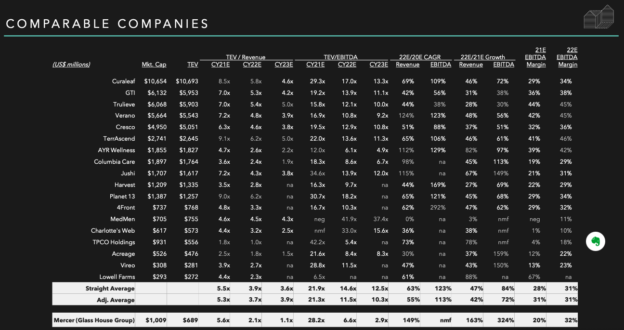

- valuation is historical low, P/rev~3, P/Ebita~9 (close to CV-19 March 2020 time point); highest point P/Rev ~8, P/Ebita~22

- they have positive cash flow, they can buy back stocks, go private or merge with SPAC

- Biotech sector is another Tilson’s pick, hard to do valuation

-

- 01/03/2022 – one graph shows how undervalue MSOS is. One augument:

This isn’t a compelling argument, the valuations are low on the industry and firms due to intense competition and commoditization of the space – not to mention perpetual regulation risks

- 01/03/2022 – one graph shows how undervalue MSOS is. One augument:

Graham Farrar @grahamfarrar Replying to @todd_harrison

My favorite chart. If wasn’t all in on cannabis already, I’d go all in now.

One argument: Mitch Anderson @Mitchelldeanan2 Replying to @todd_harrison

This isn’t a compelling argument, the valuations are low on the industry and firms due to intense competition and commoditization of the space – not to mention perpetual regulation risks

-

- 11/27/2021 – more and more celebrities are supporting legalization of Cannabis. Star power!

‘I use it for life’: Mike Tyson joins the list of celebrities launching a cannabis line

- Mike Tyson told CNBC cannabis makes him a “different person” and that he’s releasing his Tyson 2.0 cannabis line to help others looking for emotional and physical relief.

- “It’s really all about the love of the medicine,” the co-founder and chief brand officer of Tyson 2.0 said. “I put a great deal of time in agriculture and discovering the right strain.”

The family of music legend and cannabis advocate Bob Marley launched the “Marley Natural” cannabis line in 2016. Rapper and mogul Jay-Z created the “Monogram” cannabis line in 2020. Actor and comedian Seth Rogen, known for stoner comedies, started his “Houseplant” cannabis company in 2019. Martha Stewart launched her namesake CBD brand in 2020 and markets the line of wellness products for people and pets.

Tyson, 55, said he uses his cannabis line for wellness as well, noting, “I use it for life.”

“If I don’t use it for a week or three days, something of that capacity, I’m totally a different person. And I’m not a likable person,” he said.

-

- 11/27/2021 – German, Mexico, Italy, Switzerland, Luxembourg have all started to legalize recreational cannabis. The pressure is on for US, China, etc. On a global scale, cannabis will be considered a great if not green and global investment.

It’s Official: New Ruling German Coalition to Legalize Recreational Cannabis Use

The news has been rumbling for a week after a German language magazine first reported the news. Now it is official. Germany will be legalizing recreational use cannabis as early as 2022.

Even the most die-hard “medical only” German voices within the cannabis industry have been posting the news all over their social media including LinkedIn for the past week, even before the news was official. But as of Wednesday, that has changed, officially. The new so-called “Traffic Light Coalition” will indeed be legalizing recreational use cannabis with a bill to do so introduced in the German Bundestag next year.

Coming as it is on the international news of Mexico implementing recreational reform by year’s end and Italians potentially having the ability to vote on legalizing personal possession and home grow as of next spring, not to mention both Luxembourg and Switzerland definitely moving ahead with their own recreational markets, it is clear that full and final cannabis reform is now a mainstream topic and goal on a federal level of many countries.

This will also, undoubtedly spur on the debate in the U.S. If Germany can do this, less than four years after federal legalization of its medical market, what is the U.S. waiting for? Or for that matter China? In the latter case, with a corporate real estate market melting down, perhaps finally, and on a global scale, cannabis will be considered a great if not green and global investment.

In the meantime, the last days of Prohibition have clearly arrived and on a global level.

-

- 11/20/2021 – good interview of cannabis freedom fighter @RepNncyMace who is drafting a thoughtful bipartisan bill, and she has her own touching experience with Cannabis

— Weldon Angelos (@weldon_angelos) November 19, 2021

-

- 11/14/2021 – Not a good quarter for sales and net profit, not a good 4Q21 outlook, these are the reasons why warrant price drops significantly. Wholesale biomass revenue fell 18% despite a more than doubling of unit volume sales as flower wholesale prices fell by 48%, negatively impacting revenue by $4.1 million. Retail revenues increased by $1.4 million or 37% with the addition of a new dispensary which opened in Q1 2021. The drop in gross margin from 2020 to 2021 was driven by the previously mentioned $4.1 million drop in wholesale cannabis revenue due to lower wholesale cannabis prices. The California wholesale market faced considerable pricing challenges, as a result of overproduction in the third quarter. While we expect the weakness in pricing to persist in the near term, we have proven the strength of our efficient operating model and the ability of our team to navigate a rapidly changing industry.

However, according to Todd: This is NOT a one or two-year play. The warrants expire in 2026 and I expect to be holding them for a considerable time as the company gets built out and legalization is enacted in the US at the federal level. I will take advantage of these dips to add more to my holdings. At the end of the day the company is executing on the main metrics I purchased it:

First things first. Nothing in this report concerns me at all.

Why did I buy this? Let’s look back. This company is building over 5mm sft of cultivation (currently 300k sft) and over 21 best-in-class dispensaries featuring the top brand in California. Both of these initiatives are in the process of being rolled out. As someone who operates in this industry, I can promise you this will not be an even rollout. This isn’t like opening a coffee shop where a company can accurately predict the timing of events. The cannabis industry is fraught with delays and regulatory hurdles very few other industries have to deal with. A common phrase in the industry is “hurry up and wait” meaning one busts their ass to get things done only to wait for regulatory or local approvals which are impossible to predict with any real accuracy.

This is NOT a one or two-year play. The warrants expire in 2026 and I expect to be holding them for a considerable time as the company gets built out and legalization is enacted in the US at the federal level. I will take advantage of these dips to add more to my holdings. At the end of the day the company is executing on the main metrics I purchased it:

- top quality product

- secure the huge cultivation

- continue dispensary rollout

All of these are happening. I’ll be a buyer this week with this price drop.

Glass House Brands Reports Third Quarter 2021 Financial Results

Third Quarter 2021 Highlights

(Unless otherwise stated, all results are in U.S. dollars)

- Net Sales increased 29% to $17.2 million from $13.3 million in Q3 2020 and declined 8% sequentially from $18.7 million in Q2 2021.

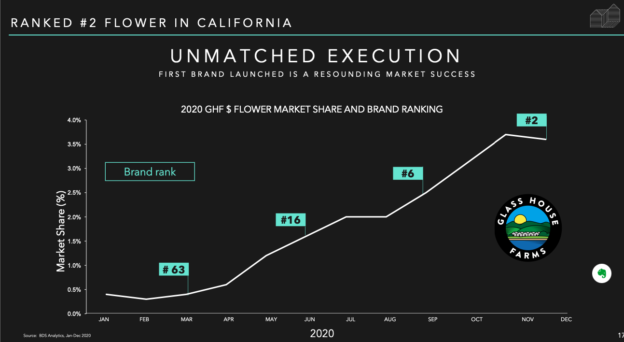

- Glass House Farms, the Company’s house cannabis brand, was the No. 1 ranked brand by sales in California in Q3 2021 and is the No. 2 brand YTD Q3 2021 according to BDSA.

- Equivalent Dry Pound Production was a record high 28,268 pounds in Q3 2021, up 30% year-over-year and 22% sequentially.

- Cost per Equivalent Dry Pound of Production fell 7% sequentially to $179.

- Gross Profit was $2.3 million compared to $4.9 million in Q3 2020 and $8.6 million in Q2 2021.

- Gross Margin of 14% compared to 37% in Q3 2020, and 46% in Q2 2021.

- Adjusted EBITDA1 of $(5.4) million compared to $0.2 million in Q3 2020 and $2.2 millionfrom Q2 2021.

- Adjusted EBITDA Margin1 was (31)% compared to 2% in Q3 2020, and 12% in Q2 2021.

- YTD Q3 2021 Net Sales grew 63% to $51.1 million from 31.3 million in Q3 2020.

- YTD Q3 2021 Adjusted EBITDA1 was $(2.6) million from (1.4) million in Q3 2020.

- Cash balance was $28.9 million at quarter-end.

Mr. Kazan added, “The California wholesale market faced considerable pricing challenges, as a result of overproduction in the third quarter. While we expect the weakness in pricing to persist in the near term, we have proven the strength of our efficient operating model and the ability of our team to navigate a rapidly changing industry. Our Glass House Farms brand was the top-selling cannabis flower brand in California in Q3 2021 according to BDSA, and we believe that the best operators, such as ourselves, will thrive despite the difficult market conditions.”

Q4 2021 Outlook

Regarding the projections provided in the Outlook section of the Company’s listing prospectus dated May 6, 2021, filed at the time of the de-SPAC and listing, Glass House no longer expects to achieve the 2021 and 2022 revenue and profitability targets set at that time. Factors include the dramatic drop in cannabis pricing that has occurred in recent months, the delay in closing the purchase of the SoCal facility versus the Company’s original expectations, and the developments noted in its November 4th, 2021 press release regarding Element 7.

The Company anticipates Q4 2021 revenues to be flat to down slightly compared to Q3 2021 revenues of $17.2M. This outlook assumes that the current difficult operating conditions in California will remain unchanged at least through the end of the calendar year, with no improvement in Cannabis wholesale prices, as well as a continuation of the sequential trend from Q3 of flat to declining California retail sales. Regarding the operating outlook for 2022, Glass House plans to provide some basic guidance during its Q4 2021 results call, at which time the Company’s budgeting process for 2022 will be complete and Q1 2022 operating conditions in the California cannabis market will be known.

- 11/09/2021 – Is MSOS low enough to buy? Tilson is in

A Historic Set-Up for Cannabis?

Thanks to his comments, I did some work and a few months later bought shares of the ETF he had mentioned – the AdvisorShares Pure U.S. Cannabis Fund (MSOS). A few months later, I sold it at the peak of the market melt-up in February, after it had roughly doubled. It was a combination of dumb luck and a weak stomach on my part.

And Todd, who believed in the space before most others, isn’t wavering… not one bit.

In his blog and his newsletter – both excellent starting points for anybody researching cannabis – he acknowledges the risks, challenges, and what a roller coaster the investing space has been. But he also says…

The fact remains that U.S. cannabis is an under-owned and misunderstood growth story trading at value multiples, and we expect incremental Federal change to complement continued state-level adoption and drive an expanding TAM (total addressable market).

Given that large swaths of the global population still consider cannabis to be a vice product – a gateway drug – we expect the perceptional migration to wellness to both illuminate and inflate the consumer curve as this secular bull market matures.

He adds…

It’s easy to get discouraged after eight straight months of market malaise. We remind ourselves often that the last few years – and importantly, the next few years – are the fulcrum of a historic and seismic shift as The War on Drugs is repealed and cannabis moves into a taxable realm. There are numerous agendas and political motivations driving this gut-wrenching volatility.

It is not easy, nor is it supposed to be, and therein lies our task at hand.

To be sure, if regulators don’t get in the way, Aaron makes it clear it could simply take much longer for the thesis to play out than he expects in a wildly volatile market that has no patience.

But to hear him tell it…

This is a generational investment opportunity in an industry with phenomenal growth and limited access to capital. We aim to invest before full legalization occurs and believe that patient capital will be well rewarded in the years to come.

Patience? Years? For those who get it right, that’s the difference between investing and trading… And some would say true wealth creation.

- 11/07/2021 – Graham and Tilson both refer to Todd Harrison on this subject. Worth reading

Todd Harrison On The ‘Trade Of A Lifetime’

Todd Harrison’s blog: Recipe for an Upside Surprise

When a generational opportunity meets the trade of a lifetime

- 10/28/2021 – Big Pharm and doctors will always push prescribed medicines versus natural supplements. So the resistance to legalization might be big.

People Are Using Marijuana to Treat Anxiety and Depression, but the Science Is Murky – WSJ

Wary of side effects from conventional drugs, some people are using cannabis as a treatment. Doctors aren’t sure that’s a good idea.

- 10/19/2021 – CA is suffering from serious oversupply, which is expected to take years to sort out. Someday Glass House is able to get indoor quality weed for $100 a pound,” Kazan said. “That’s going to be a game-changer. current price is about $1000 ~ $4000 per pound.

California’s Top Cannabis Execs Talk Conditions in the World’s Largest Market

Greetings from sunny Ojai, California, where the top names in cannabis and psychedelics industries have converged for Trailblazers, an invite-only conference geared towards the two nascent and disruptive industries. Executives from various MSOs and SSOs — including Verano, Ayr, The Parent Company, Glass House Farms, and others — as well as the sector’s top bankers and analysts — like those from Roth Capital, Jeffries, BTIG, Seaport, Ladenburg, CB1—have gathered to talk shop.

Naturally, the chatter at the gathering is focused on legislative issues — will SAFE come before federal legalization and when might that happen, if so?; when will interstate commerce enter the chat?

But after the first day of panels and discussions, the liveliest discussion centered on the state of California, which currently operates the planet’s largest legal cannabis market. For obvious reasons, eyes are on the Golden State at a pivotal moment in its legalization cycle. The state is suffering from serious oversupply, which is expected to take years to sort out, according to the direst estimates. Relatedly, the state’s unlicensed market is surging, helping to “unofficially” absorb some of that oversupply while also threatening the profits and long-term health and viability of the legal market. It’s also the country’s most dynamic market with flashy brands and consistent innovation in the CPG sector.

“Last year we were at record highs but, truthfully, we expected this to happen earlier,” Kazan said about the oversupply issue. “It happened in Colorado and Oregon and there was a natural shakeout. I’ve been an investor my whole career and we’re in a cycle now, like anything else. It’s been months long so far and it’s going to be longer until we see relief there,” he said.

For his part, he’s optimistic about his own company’s ability to weather the storm. “We made a bet on the largest cultivation facility on the planet,” Kazan said, referring to the 5.5 million-square-foot facility the brand recently purchased. “We believe in it and we knew this was going to happen,” Kazan said of the facility purchase and oversupply problem, respectively. He added that because the brand is vertically integrated, they don’t necessarily need to “be successful at the retail level — we can push brands through.”

“It sucks for the whole supply chain, but the ones that are really going to feel that in the near-term are cultivators,” Hawkins said. “They make plans and put seeds in the ground, what amounts to real capital, and then it’s taken out of the ground for an entirely different price,” he added, highlighting the real-time volatility being experienced by the state’s growers.

Glass House, which is known for its proprietary techniques in greenhouse growing, is also heavily betting on innovation. Kazan dangles a future target that he believes is possible once the company is able to scale to the size of cultivation it has been actively planning for, one that will benefit all consumers with legal access to his cannabis: “We know that someday, we’ll be able to get indoor quality weed for $100 a pound,” he said. “That’s going to be a game-changer.”

Whatever the exact figure, the common belief is that it’s so much cannabis that the market is flooded, prices are crashing, and legal growers—in the red this year—may finally be forced out of business.

“It’s gonna be a bloodbath,” said one industry insider, who works in wholesale sales and distribution, speaking on condition of anonymity in order to speak freely.

According to the most recent public estimate—published in 2017—the state’s appetite for cannabis is about 2.3 million pounds. That includes medical and adult-use consumption.

That’s roughly consistent with the amount of cannabis on which the state Department of Tax and Fee Administration reported collecting cultivation taxes between July 2020 and July 2021, according to the most recent data available.

But in mid-2021, the state may be producing up to three times as much cannabis as the state can consume, according to Natalynne DeLapp, executive director of the Humboldt County Growers Alliance.

- 10/09/2021 – good to have Amazon’s support to legalize cannabis at fed level. It will be huge if Amazon can legally deliver cannabis in the future. There are three bills will help end marijuana prohibition: MORE, SAFE and CAO. Biden Administration’s position on cannabis is contradictory.

Inside Amazon’s Support To Legalize Marijuana At The Federal Level

Amazon is taking action to push cannabis legalization at the federal level. It realized that the lack of national regulation on cannabis creates several hurdles that undermine its growth. But beyond its official claims, cannabis legalization would pave Amazon the way to enter the cannabis industry.

In June, Amazon announced to treat cannabis in the same way as alcohol by no longer including marijuana in its comprehensive drug screening program for any positions not regulated by the Department of Transportation.

Bloomberg reported that Amazon also advised its delivery partners to prominently advertise that they won’t screen applicants for marijuana use. Such a move could boost the number of job applicants by as much as 400%.

Cannabis lobbyist groups are monitoring three bills that may ease the industry and end marijuana prohibition:

- The Marijuana Opportunity Reinvestment and Expungement (MORE) Act aims to end the criminalization of cannabis by removing it from the list of controlled substances. It would eliminate related criminal penalties and enact several criminal and social justice reforms, including the expungement of prior convictions.

- The Secure and Fair Enforcement (SAFE) Banking Act aims to ensure access to financial services to cannabis-related l businesses and service providers by removing ambiguities at the federal level. It would also pave the way for more financial institutions to serve the cannabis industry.

- The Cannabis Administration and Opportunity (CAO) Act aims to remove cannabis from the list of controlled substances. Such a move would effectively legalize cannabis at the federal level while still allowing states to set their policies.

Asked how the Biden Administration will react to such initiatives, Justin Strekal, Political Director at NORML, explained that U.S. President Joe Biden has shown that he can evolve in these issues.

However, Strekal thinks that the Biden Administration’s position on cannabis is contradictory. The White House supports decriminalization, and it is in favor of rescheduling marijuana within the Controlled Substances Act (CSA) to Schedule II.

Strekal noted that federal law criminalizes the substances within the Schedule II classification. “You can’t both decriminalize and reschedule and schedule II. What ultimately needs to be done is entirely removing or de-scheduling marijuana from the CSA,” he said.

- 10/09/2021 – Senators Push U.S. Attorney General To Decriminalize Marijuana ‘Now’ As Congress Debates Reform Bills. Warren and Booker requested that Garland respond to their request by October 20.

detailed letter is here booker-warren-marijuana-letter-to-garland

As congressional lawmakers pursue marijuana legalization, a pair of U.S. senators is calling on Attorney General Merrick Garland to use his own authority to swiftly end federal cannabis prohibition.

Sens. Elizabeth Warren (D-MA) and Cory Booker (D-NJ) sent a letter on Wednesday making the case that the Justice Department should initiate a descheduling process in order to “allow states to regulate cannabis as they see fit, begin to remedy the harm caused by decades of racial disparities in enforcement of cannabis laws, and facilitate valuable medical research.”

“While Congress works to pass comprehensive cannabis reform, you can act now to decriminalize cannabis,” the letter, which was first reported by The News Station, states.

“It is far past time to decriminalize the use of cannabis in the United States,” it continues, noting that President Joe Biden voiced support for marijuana decriminalization and expungements on the campaign trail. The president has maintained an opposition to adult-use legalization, however.

In any case, a reading of the relevant statute raises some questions about whether the attorney general has the explicit authority to unilaterally remove marijuana from the CSA, rather than simply move it to a lower schedule.

Federal law says that if international treaties to which the U.S. is a party require control of any given substance, the attorney general “shall issue an order controlling such drug under the schedule he deems most appropriate to carry out such obligations, without regard to” the separate HHS review.

Warren and Booker requested that Garland respond to their request by October 20.

This letter comes one week after the House Judiciary Committee approved a bill to federally legalize cannabis and promote social equity that was introduced by Chairman Jerrold Nadler (D-NY).

Booker, meanwhile, is working alongside Senate Majority Leader Chuck Schumer (D-NY) and Senate Finance Committee Chairman Ron Wyden (D-OR) on their own legalization proposal that was unveiled in July but is still being finalized.

- 10/06/2021 – As Farrar looks to the future, it’s full steam ahead in the expectation that interstate commerce will open up, either before or in tandem with federal legalization. Glass House recently bought a 5.5-million-square-foot cultivation facility and plans to grow even more in anticipation of these changes, Farrar says. That puts Glass House on track to be the largest cultivator in the state, if not the country. The company’s current market cap is $275 mil.

Will Glass House Farms Become the World’s Largest Cannabis Grow?

Glass House is poised to become one of the largest Cannabis cultivators on planet Earth

Glass House Farms is currently the top-selling Cannabis flower brand in California, thanks in part to the company’s 500,000-square-foot growing footprint, but also to the quality of the Cannabis grown. Glass House grows sun grown Cannabis, yes, but in a special way: Rather than growing fully outdoors or indoors, Farrar and his team harness the power of the sun and mix it with the benefits of climate-controlled greenhouses for a potent result that’s the best of both growing methods.

This kind of innovation comes second nature to Farrar, who studied microbiology and biochemistry at CU Boulder many moons ago, after growing up in Santa Barbara. A self-described techie, he also was a weed smoker from a fairly young age, so it was inevitable that the two would combine.

Fast forward to today and he’s now growing for his own company, which debuted on the Canadian stock exchange this past July with a $275 million market capitalization, and was started during the Prop 215 days.

As Farrar looks to the future, it’s full steam ahead in the expectation that interstate commerce will open up, either before or in tandem with federal legalization. Glass House recently bought a 5.5-million-square-foot cultivation facility and plans to grow even more in anticipation of these changes, Farrar says. That puts Glass House on track to be the largest cultivator in the state, if not the country.

- 09/30/2021 – a big win of Cannabis federal legalization from House vote

House Judiciary Committee approves marijuana legalization bill

- The House Judiciary Committee has voted to approve a bill that would legalize marijuana on the federal level.

- H.R. 3617, the Marijuana Opportunity Reinvestment and Expungement Act (MORE Act), removes cannabis from the list of federally controlled substances, expunges federal marijuana convictions, and provides aid to those harmed by the War on Drugs.

- The measure passed on a 26-15 vote.

- Chairman Jerrold Nadler (D-N.Y.), the bill’s sponsor, said in opening remarks, “Whatever one’s views are on the use of marijuana for recreational or medicinal use, the policy of arrests, prosecution, and incarceration at the federal level has proven unwise, and unjust.”

- Multi-state operators: Trulieve (OTCQX:TCNNF -2.3%); Harvest Health & Recreation (OTCQX:HRVSF -2.6%); Curaleaf (OTCPK:CURLF -0.4%); Acreage Holdings (OTCQX:ACRHF -1.8%); Cresco Labs (OTCQX:CRLBF -0.3%); Green Thumb Industries (OTCQX:GTBIF -1.7%); and MedMen Enterprises (OTCQB:MMNFF +3.5%).

- Senate Majority Leader Chuck Schumer (D-N.Y.) has said he would like to see a marijuana legalization bill advance before a banking reform bill that would benefit cannabis businesses.

- 09/29/2021 – A great video on Cannabis: It is complicated on whether Cannabis is really beneficial or not; Cannabis, at a low dose, can help reduce anxiety, help insomnia, relax someone; In 1996, cannabis was legalized in California for medical use. But federally, it remains a Schedule I drug, like heroin, making research difficult and leaving patients like Elizabeth Pinkham on their own. Cannabis can be beneficial for seizure or autism. Long term take of Cannabis is harmful for adultescent. Cannabis can be harmful for pregnancy’s women. It is not a benign material. Needs extensive research to understand it.

The Cannabis Question

As state-legalized cannabis spreads, NOVA explores its little-known risks and benefits.

NOVA investigates the story of cannabis from the criminalization that has disproportionately harmed communities of color to the latest medical understanding of the plant. What risks does cannabis pose to the developing brain? How much do we know about its potential medical benefits? As cannabis becomes socially accepted, scientists are exploring its long-term health consequences. (Premiered September 29, 2021)

Tune in to a live panel discussion and audience Q&A featuring experts and producers from “The Cannabis Question” Thursday, October 7th at 6PM ET. Register for the event here.

- CHINAZO CUNNINGHAM (Albert Einstein College of Medicine): Really, the questions are, “for what conditions is it beneficial?” and “for what conditions is it harmful?” It’s not black and white, and it’s complicated.

- As federal law blocks science, an unintended public health experiment is underway.

- MATTHEW HILL: Cannabis is genuinely one of the most fascinating discussion topics I’ve ever seen, because of how emotionally polarizing it is amongst people. And it’s very strange, because the entire field of cannabis science is very poorly developed. There’s not been a lot of research, and there’s a lot of things that we don’t understand. And yet, what we have in society is groups of people that very fervently believe it is this panacea that can cure any disease that exists or it’s the “devil’s grass,” and it’s going to cause the downfall of society, not recognizing that the reality of cannabis is somewhere in the middle. NARRATOR: Americans everywhere are turning to cannabis, seeking relief from a wide range of ailments, including veterans, like Sean Worsley, who uses cannabis to treat his post-traumatic stress disorder, caused by combat in Iraq.

-

RYAN VANDREY (Johns Hopkins University): Cannabis, at a low dose, can help reduce anxiety, relax someone. And individuals who have P.T.S.D. that newly initiate cannabis use report it being life-changing. So, “I can sleep for the first time in two years,” and “I can go to the grocery store without being so intense and on edge.” That’s why individuals with P.T.S.D. heavily gravitate towards cannabis use.

NARRATOR: For thousands of years, humans have cultivated cannabis for its fiber, seeds, and medicinal properties. Ancient Hindu texts claim it was brought by the god Shiva for the pleasure of humanity. The plant contains over 400 chemicals, including cannabinoids, which are most abundant in the resin glands of budding female plants.

In the 1960s, Israeli scientist Raphael Mechoulam isolated T.H.C., the psychoactive cannabinoid that makes users feel high. The discovery launched a new chapter in neuroscience.

DANIELE PIOMELLI (University of California, Irvine): Cannabis opened a window into the functioning of our body, completely unexpected window, because what was discovered was that T.H.C. binds to receptors in the brain and outside the brain, and when it does so, when it binds to these receptors, the cells now behave differently.

NARRATOR: Cannabinoid receptors, named after cannabis, are found on nearly every organ in the body. They bind with our own cannabis-like molecules, called endocannabinoids, which regulate functions like sleep, cognition, memory and mood. Unlike other brain chemicals, they travel backwards across the synapse, where they control the release of most neurotransmitters.

STACI GRUBER: One of the most amazing things that happened was the discovery of the endocannabinoid system. Every mammal has one. And this is a system of chemicals and receptors throughout the brain and body. And really, the primary goal of the endocannabinoid system is homeostasis, keeping things in balance.

NARRATOR: At Mount Sinai Hospital, neuroscientist Yasmin Hurd remembers the first time she looked for cannabinoid receptors in the human brain, seen here in vivid red, orange and yellow colors.

YASMIN HURD: The cannabinoid receptor is the most abundant receptor in the brain. When we looked at where these receptors were expressed, they’re expressed in brain regions relevant for motor coordination, cognition, memory, emotional regulation, reward. All of these brain areas are key to so many normal behaviors, obviously, but also psychiatric disorders as well.

NARRATOR: A key role of the endocannabinoid system is to manage stress. In fact, the first endocannabinoid found in our body was given a Sanskrit name, “anandamide,” meaning “bliss.”

MATTHEW HILL: In response to stress, our body mobilizes an endocannabinoid signal. And so, if something aversive happens to us, and we suddenly see a threat in front of us, our body kind of goes into a high alert mode and we shoot up. Once we’ve been removed from that threat though, our body needs to turn that stress response back off. And what we have learned is that this burst of endocannabinoids that occurs in response to stress is really critical for that recovery phase.

NARRATOR: Scientists suspect this signal goes awry in people with P.T.S.D., and that’s why T.H.C., which mimics our own endocannabinoids, might help.

RYAN VANDREY: And so, when you look at individuals that have P.T.S.D. and use cannabis, in short term trials, you see very beneficial outcomes. But if all they do is use cannabis, and they don’t engage in other behavior therapies to help work through their trauma, they’re not treating the root cause of the disorder. And it’s important to recognize that T.H.C. at higher doses increases anxiety.

CHINAZO CUNNINGHAM (Albert Einstein College of Medicine): Cannabis is not a miracle; nothing is a miracle. And so, really, the questions are, “for what conditions is it beneficial?” and “for what conditions is it harmful?” And, “for whom is it beneficial?” and “for whom is it harmful?” So, it’s shades of gray. It’s not black and white, and it’s complicated.

NARRATOR: In 1996, cannabis was legalized in California for medical use. But federally, it remains a Schedule I drug, like heroin, making research difficult and leaving patients like Elizabeth Pinkham on their own.

-

STEVE D’ANGELO (Founder of Harborside, Inc.): My staff needs to do the best that they can to try and guide people to the products that are going to serve them the best. But my staff, they’re not trained doctors, and really we should have is cannabis medicine being taught at every single medical school across the United States. And that’s not happening now, because of federal law.

YASMIN HURD: It’s really a voter-approved, quote/unquote, medicine. People say, “Oh, there’s medical cannabis that’s approved.” It has not been. It has not gone through F.D.A. rigorous research process, and that’s what’s critical for medicine.

ELIZABETH PINKHAM: I think it would be great if there was a bit more science behind this. But I think, in the meantime, you have to do what works for you, and you have to figure this out as you go.

NARRATOR: But it’s challenging. Scientists aren’t sure whether cannabis sativa, indica and ruderalis are distinct species, but most cultivars grown today are hybrids. They have distinct chemicals, called “terpenes,” which create flavors and smells. And, in addition to T.H.C., the plant contains over 100 other cannabinoids.

One, called C.B.D., is flooding the market.

ZIVA COOPER: One in seven adults in the United States are using C.B.D. You see C.B.D. everywhere. You see it in the pet stores, you see it at Bed Bath and Beyond®, at Whole Foods®. And so, there’s a multi-billion-dollar industry that’s built on this plant and all these different hypotheses of what these different chemicals can do to help us. But these products are coming online much faster than we can actually research them.

-

CATHERINE JACOBSON: I knew nothing about cannabis, but I did some research, and I found out that, obviously, there are many different chemicals in cannabis. The two most prominent are C.B.D. and T.H.C. We know that T.H.C. makes people high. C.B.D. doesn’t do that. And so, my preference was, of course, to try C.B.D. first.

NARRATOR: C.B.D. doesn’t bind to cannabinoid receptors directly, but its presence seems to reduce the impact of T.H.C. It also increases levels of anandamide, our bliss molecule, and interacts with receptors like serotonin, which affect our mood. Yet in 2011, it was hard to find extracts high in C.B.D.

- in 2018, F.D.A. approval of the first C.B.D. drug, called Epidiolex®. In certain types of epilepsy, it can reduce seizures by some 40 percent.

-

NARRATOR: Scores of clinical trials are now underway, including at U.C. San Diego’s Center for Medicinal Cannabis Research.

Fourteen-year-old Braylon has severe autism. His parents are hoping C.B.D. might help.

- Thousands of cognitive tests reveal that teens who use cannabis regularly struggle more on learning and memory tasks than those who don’t.

ANGEL FLORES: It made me realize that memory is probably the biggest thing that impacts me with cannabis. But definitely, if I stop for a little bit, I have a feeling that it would be easy to remember those things.

NARRATOR: Research shows after a period of abstinence, cognitive performance can bounce back. And the brain changes? Other studies link them to alcohol or genetic and environmental influences.

- RYAN BOGDAN (Washington University in St. Louis): One of the things we are most interested in was prenatal exposures. And we saw that there were a fair number of mothers in this study, just like what we’re seeing in the general population, that used cannabis during their pregnancy.

RYAN BOGDAN: So, among kids who were exposed to cannabis following their mother’s knowledge of their pregnancy, they experienced more psychotic-like experiences, they experienced more depression and anxiety-like behavior, they’re breaking more rules, they have more attentional thought problems.

NARRATOR: Psychotic-like experiences are also associated with an increased risk for mental illnesses like schizophrenia and depression.

CYNTHIA ROGERS: We know that the use of cannabis during pregnancy is increasing. We’ve seen advertisements online, social media, targeting women saying this is something that’s safe for you to use during pregnancy for things like nausea or insomnia. And these women are not trying to harm their babies, they’re just trying to get through what can be a challenging time.

- usage of cannabis might also relate to the racial equalization

- 09/29/2021 – knowledge of Cannabis and Marijuana

What’s the difference between cannabis and marijuana?

The legal marijuana market is projected to hit nearly $91 billion by the year 2027. As sales continue in a booming direction, more people are starting to become curious about the varieties of plants available, as well as the terminology used when talking about them.

If you’re one of these people, you’ve probably wondered about the difference between cannabis and marijuana. To the untrained eye, these two words have the same basic meaning. However, they’re actually quite a bit different.

Want to know more? We have you covered. Read on to learn the difference between cannabis and marijuana.

What is Cannabis?

“Cannabis” is a term for a genus of flowering plants within the Cannabaceae family. This includes around 170 different plant species, which are divided into the categories of Cannabis ruderalis, Cannabis Sativa, and Cannabis Indica. Both marijuana and hemp are considered cannabis plants.

What is Marijuana?

The Cannabis genus of plants contains varieties of both hemp and marijuana species. Although they belong to the same genus, these two plant species are incredibly different.

When it comes to hemp vs. marijuana, the two have very different applications. Marijuana is the only plant containing THC (tetrahydrocannabinol), which is the cannabinoid responsible for getting you “high.”

Marijuana also contains CBD (cannabidiol), another known cannabinoid that won’t get you high, but has many reported beneficial effects, such as pain relief and relaxation. Different strains of marijuana will feature different concentrations of CBD and THC, leading to different effects when consumed.

Hemp, on the other hand, contains CBD and not THC. It’s also one of the most useful building materials in the world, with the potential to make rope, clothing, paper, and much more.

The Difference Between CBD and THC

To put it simply, THC is marijuana’s intoxicating cannabinoid, whereas CBD offers a more relaxing, non-intoxicating effect. If you’re more interested in CBD rather than THC, you can try a CBD oil, tincture, or another type of supplement.

If you’re wondering, “does CBD oil have THC?”, the answer is this: not always. There are CBD supplement varieties that are completely THC-free or have trace amounts of THC (O.3% or less). However, some “full-spectrum” blends will contain different concentrations of CBD and THC together.

The Difference Between Cannabis and Marijuana

Going back to the difference between cannabis and marijuana, cannabis is the genus while marijuana is the species. Both hemp and marijuana plants belong to the cannabis genus. In other words, all marijuana is cannabis, but not all cannabis is marijuana.

Getting to Know Marijuana Terminology

As marijuana and THC carts become more and more popular, some of the words in the industry can seem a little mystifying. There’s cannabis vs. marijuana, hemp vs. marijuana, THC vs. CBD, and so much more.

At least when it comes to cannabis vs. marijuana, there is no longer a need for confusion. Now that you know the difference between cannabis and marijuana, you’ll be a step closer to knowing everything you need to know.

- 09/27/2021 – Why can’t GH list on NYSE or NASDAQ?

Cannabis – Trade Canadian MJ, Invest In MSOS

Liquidity is Key: Since cannabis is still an illegal substance and considered a Schedule I drug, U.S. MSOs can’t be traded on a major stock exchange such as NASDAQ or NYSE, and therefore they need to settle for trading on the OTC. When trading on the NYSE/NASDAQ, the liquidity is much better. In a highly speculative sector such as cannabis, traders love taking advantage of that environment and the dream behind the stocks: they can manipulate the stocks into big rallies and drive the stocks into high valuation that sometimes doesn’t make sense. Trading on the OTC brings much less attention to investors from many aspects and those are the main ones that reduce the liquidity:

- Exposure – OTC is considered a secondary stock exchange and much less attractive, many brokers do not allow their customers to trade on the OTC.

- Analyst coverage – Mostly, we won’t see the big analysts recommend buying a stock that is traded on the OTC and most coverage currently is about the Canadian LPs.

- Institution Investing – The penetration of institutional investment in the OTC is small, that is because of the alleged risk in most of the stocks traded there. Usually companies are traded on the OTC because they do not want or can’t withstand the regulation of the higher exchanges. For the majority of the cannabis stocks it’s just not the case – they are there because they have no other choice. Lately, we do see some more institutional investment in the U.S. MSOs, but that’s just the tip of the iceberg of what they will be able to achieve when up-listing and get the government legitimacy.

We are standing now at historical times for the cannabis space, up-listing into major exchanges is closer than ever, and it’s only a matter of time until terms will ripen and the true leaders of the sector will be revealed to the general public. The Canadian players will step aside and clear the way to the US MSOs.

Outperforming cannabis mutual fund converts to an ETF

- Foothill Capital Management is converting its Cannabis Growth Fund (CANIX) mutual fund into the Cannabis Growth ETF (NYSEARCA:BUDX).

- The move comes as the traditional mutual fund found itself outperforming many Cannabis ETFs, yet not garnering the amount of fund flows one would expect.

- BUDX has returned investors +94.5% over the 12 months ended June 30, but only attracted $5.05M assets under management despite launching in May 2019.

- So, the fund is becoming an actively managed ETF that will trade on the New York Stock Exchange. In addition, BUDX will have an expense ratio of 0.79%, down from the 1.32% ratio it had as CANIX.

- BUDX will presumably have the same top holdings as CANIX did. As of June 30, that included Innovative Industrial Properties (NYSE:IIPR) at 10.41%, Tilray (NASDAQ:TLRY) weighted at 7.85% and GrowGeneration Corp (NASDAQ:GRWG) at 7.81%.

- BUDX will compete with the world’s largest cannabis ETF — ETFMG Alternative Harvest ETF (NYSEARCA:MJ), which has over $1B in assets under management.

- Other competitors include AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS), AdvisorShares Pure Cannabis ETF (NYSEARCA:YOLO), Global X Cannabis ETF (NASDAQ:POTX) and Spinnaker ETF Series – The Cannabis ETF (NYSEARCA:THCX).

- 09/24/2021 – first House (sept 29), then senate. We will see whether it can be passed or not

House Judiciary Committee to mark up marijuana legalization bill next week

- The House Judiciary Committee on Sept. 29 will mark up a bill that could pave the way for federal legalization of marijuana.

- The panel will consider H.R. 3617, also known as the Marijuana Opportunity Reinvestment and Expungement Act of 2021.

- The legislation would decriminalize cannabis on the federal level, declassify it as a controlled substance, and provide aid through the Small Business Administration to those impacted by the War on Drugs.

- 09/22/2021 – it is huge if it passes Senate vote

House OKs bill to facilitate banking for cannabis companies

- The U.S. House of Representatives approved a bill enabling banks to do business with cannabis companies without fear of penalty, Bloomberg reports.

- The so-called SAFE Banking Act would be a boon for marijuana companies, which have so-far used to deal in cash because of federal restrictions, which implied extra security costs and logistical problems.

- The measure was approved by voice vote as part of the National Defense Authorization Act (NDAA) for fiscal year 2022.

- Also, Senate Banking Committee Ranking Member Pat Toomey (R-PA), has previously voiced support for advancing the SAFE Banking Act.

- Recently, at the Rules Committee hearing on Monday, Rep. Warren Davidson (R-OH) spoke in favor of adding marijuana banking to the defense bill, arguing that there’s a “national security issue” related to illicit drug trafficking that the SAFE Banking Act could help to address.

- Advocates who support broader cannabis reform said the banking measure is a good first step.

- As of now, some 36 states now allow medical or recreational use of marijuana.

- 09/20/2021 – The recent drop in the stock was due to the uncertainty around financing the acquisition of the Ventura greenhouse.

Sound Investor 05 Aug. 2021, 2:43 PM Comments (1.16K) Follow

This is an important CC. Glasshouse needs to up its IR game. The recent drop in the stock was due to the uncertainty around financing the acquisition of the Ventura greenhouse. It all worked out in the end for Glasshouse but the radio silence caused the stock to drop 50% in a month. Thats not how a public company is supposed to communicate with its investor base. Graham and Kyle are both very smart and will learn from this. The prospects of the current operating business is great, the long term pathway towards dominance of the legal CA market is even better.

this is the news to cut the warrant price in half on July 02

Glass House Brands Provides Update on Proposed Strategic Investment

SANTA BARBARA, Calif. and TORONTO, July 2, 2021 /CNW/ – Glass House Brands Inc. (“Glass House” or the “Company”)(NEO: GLAS.A.U), one of the fastest-growing, vertically integrated cannabis and hemp companies in the U.S., today announced that its previously announced conditional agreement to accept a $50 million strategic investment (the “Strategic Investment”) from TPCO Holding Corp. (“The Parent Company”) has been terminated by mutual agreement of the parties effective today and the Strategic Investment will not be completed at this time. Glass House will consider future partnership opportunities with The Parent Company after the purchase and retrofit of the 5.5 m square foot greenhouse cultivation facility located in Ventura County, California (the “Camarillo Greenhouse Facility”).

Glass House does not expect the termination of the Strategic Investment to affect current purchase and development plans for the Camarillo Greenhouse Facility, its acquisition of seventeen retail licenses, or the pre-transfer construction currently occurring with respect to four of those retail locations, or its ongoing land use permitting with respect to recently won licenses in Isla Vista and Santa Ynez, California.

Glass House expects to complete the purchase of the Camarillo Greenhouse facility this quarter and is currently negotiating with several banks and other lenders for property secured financing, the majority of which is expected to be used for the retrofit.

- 09/19/2021 – This is going to be very significant in the coming years. The market is not even remotely pricing in the production capabilities this gives them as Federal legalization looms in the next 2-4 years.

Glass House Brands Completes 5.5 million Square Foot Southern California Greenhouse Facility Acquisition

Amended Purchase Agreement Reduces Price by $25,000,000

LONG BEACH, Calif. and TORONTO, Sept. 15, 2021 /CNW/ – Glass House Brands Inc. (“Glass House” or the “Company”) (NEO: GLAS.A.U) (NEO: GLAS.WT.U) (OTCQX: GLASF) (OTCQX: GHBWF), one of the fastest-growing, vertically integrated cannabis and hemp companies in the U.S., today announced that its subsidiary has completed its previously announced acquisition of an approximately 5.5 million square foot greenhouse facility located in Southern California (the “SoCal Facility”) for total consideration of $93.0 million in cash, reduced from $118 million previously, plus stock considerations payable to the original holder of the option to purchase the SoCal Facility (the “Option Holder”).

- Approximately 160 acres of agricultural property located in Ventura County, California

- Approximately 125 acres of ultra-high-tech and efficient KUBO Ultra-Clima greenhouses, on-site well, water treatment facilities, automated roof washing system, supplemental lights, and natural gas cogeneration facilities producing power, heat, and CO2.

- Includes six greenhouses totaling approximately 5.5 million square feet:

- Phase 1 of the SoCal Facility retrofit will include the conversion of two greenhouses and two packhouses totaling approximately 1.7 million square feet and is expected to be completed in Q1 2022, with initial planting expected to follow shortly thereafter, contingent on regulatory approval.

- Planned upgrades include:

- Installation of black-out curtains, ebb and flood floors, high-density gutter system, dry rooms, and processing facilities.

- Upgraded HVAC system to further optimize climate conditions.

- Automated nutrient delivery and irrigation systems.

- The initial Phase 1 capacity is expected to conservatively produce over 180,000 dry pounds of sellable cannabis (Flower, Smalls, and Trim), representing a more than 300% increase from our current capacity.

- 08/26/2021 – Great irresistible product

GLASS HOUSE FARMS INTRODUCES NEW LINE OF INFUSED PRE-ROLLS

The release, developed in collaboration with award-winning partner FIELD Extracts, includes four flavors of live resin- and diamond-infused joints

- 08/12/2021 – Graham Farrar on GH: origin story, taking a computer systems approach to cultivation, smart and obvious collaborations, and why operating in California is like training for the World Cup. Next generation’s embrace of cannabis, especially female.

E6 – Graham Farrar from Glass House Brands

In this episode of the CPG podcast, we get to sit down and talk to one of the industry’s most passionate and innovative cannabis producers—Graham Farrar of Glass House Brands. On a farm situated near Santa Barbara, Graham and his team strive to perfect some of the best flower products the industry has ever experienced. We talk about their origin story, taking a computer systems approach to cultivation, smart and obvious collaborations, and why operating in California is like training for the World Cup. Please enjoy this latest episode and remember to like, subscribe, and download!

- 07/23/2021 – tailwind on Cannabis from Amazon, could it be huge?

Amazon endorsed legal weed. Will it now fight to make it happen?

The company’s money and power could be a game-changer for federal cannabis policy.

Amazon has one of the more relaxed stances on cannabis among major U.S. employers. It supports legalization and made the decision to stop drug testing employees for cannabis, which will expand the company’s prospective employee pool. Though its online delivery infrastructure is unmatched, advocates say the company has given no indication that it plans to get into the weed business itself if cannabis is legalized nationwide.

There are some indications, however, that Amazon is interested in trying to convince other companies and Congress to support legalization. A number of advocacy and industry groups, including Drug Policy Alliance, the National Organization for the Reform of Marijuana Laws and Canopy Growth Inc., have reported meeting with Amazon officials in the past month to discuss federal marijuana policy.

Amazon said last month that its “public policy team will be actively supporting The Marijuana Opportunity Reinvestment and Expungement Act,” otherwise known as the MORE Act, which would decriminalize cannabis and provide for expungement of some non-violent cannabis offenses, had been a long time coming. The company had preliminary conversations about whether to get involved in the national conversation on CBD — a substance contained in the cannabis plant that was federally legalized in 2018 — and marijuana last year, according to a person with direct knowledge of the matter, but there were internal disagreements about whether the company should do so and what the optics would be.

- 07/15/2021 – ticker name changed to GHBWF

LONG BEACH, Calif. and TORONTO, July 15, 2021 /CNW/ – Glass House Brands Inc. (“Glass House” or the “Company”) (NEO: GLAS.A.U) (NEO: GLAS.WT.U) (OTCQX: GLASF) (OTCQX: GHBWF), one of the fastest-growing, vertically integrated cannabis and hemp companies in the U.S., is pleased to announce that, effective immediately, it has changed its tickers on the OTCQX in the United States from MRCQF and MRCWF to GLASF and GHBWF, respectively. No action is required by existing shareholders with respect to the trading symbol change.

About Glass House

Glass House Brands Inc. is one of the fastest-growing, vertically integrated cannabis and hemp companies in the U.S., with a decisive focus on the California market and building leading, lasting brands to serve consumers across all segments. From its greenhouse cultivation operations to its manufacturing practices, from brand-building to retailing, the company’s efforts are rooted in the respect for people, the environment, and the community that co-founders Kyle Kazan and Graham Farrarinstilled at the outset. Through its portfolio of brands, which includes Glass House Farms, Forbidden Flowers, and Mama Sue Wellness, Glass House is committed to realizing its vision of excellence: outstanding cannabis products, produced sustainably, for the benefit of all. For more information and company updates, visit www.glasshousegroup.com.

SOURCE Glass House Brands Inc.

- 07/09/2021 – 1Q21 financial results

Glass House Brands Reports First Quarter 2021 Financial Results

First Quarter 2021 Financial Highlights

(Unless otherwise stated, all results are in U.S. dollars)

- Net Sales increased 136% to $15.2 million compared to $6.4 million in Q1 2020

- Adjusted EBITDA increased $3.3 million to $0.6 million compared to $(2.7) million in Q1 2020

Q1 2020 Financial Summary

|

Q1 2021 |

Q1 2020 |

|

|

Net Revenue |

$15,240,281 |

$6,449,327 |

|

YoY increase |

136% |

|

|

Gross profit (loss) |

5,441,996 |

1,463,484 |

|

% of Net Sales |

36% |

23% |

|

Operating Expenses: |

||

|

Sales and Marketing |

488,535 |

354,425 |

|

General & Administrative Expense |

5,835,731 |

4,107,858 |

|

Total operating expenses |

10,401,471 |

5,638,734 |

|

Loss from operations |

(4,959,475) |

(4,175,250) |

|

Net loss |

(13,153,793) |

(5,140,654) |

|

Adjusted EBITDA1 |

567,954 |

(2,734,248) |

Revenue for the three months ended March 31, 2021 (“Q1 2021”) was $15.2 million, representing an increase of $8.8 million or 136% from $6.4 million for the three months ended March 31, 2020 (“Q1 2020”). The increase was primarily due to additional cannabis production from the Company’s second greenhouse cultivation facility, which commenced operations in Q1 2020. The expansion of the cultivation facility was increased from 113,000 square feet during 2020 to over 390,000 square feet by the end of 2020. In Q1 2021 the Company’s wholesale and wholesale CPG revenue increased by $7.2 million or 230% compared to Q1 2020. The Company’s cannabis retail dispensaries also contributed consistent revenue growth, increasing $1.6 million, or 49% in Q1 2021 compared to Q1 2020.

Cost of goods sold in Q1 2021 was $9.7 million, an increase of $4.8 million, or 97%, compared with $4.9 million in Q1 2020. Q1 2021 gross profit was $5.4 million, representing a gross margin of 36%, compared with a gross profit of $1.4 million, representing a gross margin of 23% in Q1 2020. Gross margin expansion in Q1 2021 was driven by the Company’s continual improvement and efficiencies related to its cultivation facilities during the year ended 2020 through March 31, 2021.

Total operating expenses in Q1 2021 were $10.4 million, an increase of $4.7 million, or 84%, compared to total expenses of $5.6 million in Q1 2020. General and administrative expenses Q1 2021 and Q1 2020 were $5.8 million and $4.1 million, respectively, an increase of $1.7 million, or 42%. The increase in general and administrative expenses is primarily attributed to the Company’s initiatives of operational expansion and used to support corporate, cultivation, and retail operations. Sales and marketing expenses in Q1 2021 and Q1 2020 were $0.5 million and $0.4 million, respectively, an increase of $0.1 million, or 38%. The increase in sales and marketing expenses is primarily attributed to the increase in the Company’s efforts related to digital media and marketing research expenses.

Q1 2021 adjusted EBITDA, a non-GAAP measure that excludes depreciation and amortization, interest expense, income taxes, share-based compensation, (income) loss on equity method investments, (gain) loss on change in fair value of derivative liabilities, acquisition-related professional fees, and loss on disposition of subsidiary was $0.6 million compared to a $2.7 million loss in Q1, 2020. The $3.3 million increase in adjusted EBITDA is due to higher gross profit partially offset by higher operating expenses.

Cash and cash equivalents, were $11.6 million as of March 31, 2021, compared to $3.6 million as of March 31, 2020. Subsequent to the quarter-end, the Company completed a Preferred Stock offering exchanging both principal and interest accrued to participating investors and issued both Company Preferred Stock and warrants. The completion of the Preferred Stock offering triggered the conversion of all of the Company’s outstanding Convertible Promissory Notes, resulting in over $37.6 million of notes payable being converted to equity.

Financial results and analyses are available on the Company’s investor relations website (https://ir.glasshousegroup.com/) and SEDAR (www.sedar.com).

- 07/06/2021 – GLAS.A.U is IPOed

Mercer Park Completes Qualifying Transaction

Toronto | July 6, 2021 – NEO is excited to welcome California-based Glass House Brands Inc. (“Glass House”), following its public markets debut yesterday on the NEO Exchange, with a market capitalization in excess of US$275,000,000. Glass House is available for trading under the symbol GLAS.A.U.

A fully integrated cannabis brand-building business, Glass House is the qualifying transaction of Mercer Park Brand Acquisition Corp. (“Mercer Park”), a Special Purpose Acquisition Company (“SPAC”) focused on the cannabis sector. Backed by finance and banking industry veteran Jonathan Sandelman, Mercer Park completed its initial public offering and began trading on the NEO Exchange on May 13, 2019.

“When we formed Mercer Park Brand Acquisition Corp, we aimed to create a platform that could launch the first national cannabis brands in the United States,” said Mercer Park Chairman Jonathan Sandelman. “This took us to California, with its ideal growing climate and community of talented and experienced growers, where we ultimately chose to partner with Glass House Group and this incredible portfolio of assets and talent. It also took us to the NEO Exchange as the ideal platform to fund our vision. NEO’s flexibility, support, and experience with SPACs has played an important role in financing the emerging cannabis sector.”

With a strong retail and wholesale network in California – the world’s largest cannabis market – Glass House strives to deliver outstanding craft cannabis products, produced sustainably, for the benefit of all. “Today marks a significant turning point for our business,” said Kyle Kazan, Glass House Chairman and CEO. “With one of the most enviable retail and cultivation footprints in California, we are well positioned to execute on the significant opportunities ahead while delivering strong value for our shareholders.”

“The Glass House listing is yet another testament to the power of SPACs as a springboard for lighthouse M&A deals,” remarked Jos Schmitt, President and CEO of NEO. “With the right stock exchange to support the launch, a qualifying transaction is well-positioned to hit the ground running. As the Canadian exchange of choice for SPACs and a long-time advocate for the cannabis industry, NEO is honoured to play an integral role in the capital markets journey for Glass House. We look forward to providing all the benefits of a Tier 1 exchange, including access to institutional investors, increased quality of trading, and our white glove service and support.”

Yesterday’s launch marks the second qualifying transaction by NEO-listed SPACs in 2021, following on the heels of The Parent Company, which resulted from a successful qualifying transaction by Subversive Capital Acquisition Corp., in January. Three additional cannabis SPACs have also listed on the NEO Exchange this year, including Silver Spike III Acquisition Corp., BGP Acquisition Corp., and Choice Consolidation Corp.

Investors can trade shares of Glass House Group (NEO:GLAS.A.U) through their usual investment channels, including discount brokerage platforms and full-service dealers.

- 07/02/2021 – basic knowledge of investment in SPAC warrants

SPAC Warrants 101: What Investors Need to Know

We break down one of the most misunderstood parts about SPAC investing.

- 07/02/2021 – study of management team

Making It in Marijuana: An Interview With Ayr Wellness CEO Jonathan Sandelman (Chairman, Mercer Park LP, CEO, Ayr Wellness)

interview on youtube: Once In A Lifetime Moment In Cannabis – Interview With AYR Wellness CEO Jonathan Sandelman

A great guy with solid answers, life experience and great confidence. Seems to be very trustful.

Jonathan Sandelman, Chairman, Chief Executive Officer and Corporate Secretary of Ayr Wellness, Mr. Sandelman is a 30-year veteran of banking and finance, with a history of generating shareholder value. He served as president of Bank of America Securities after building its capital markets businesses through the early 2000s, building Bank of America beyond its roots as a consumer and corporate lender, and subsequently founded and served as CEO of the multi-billion dollar asset manager Sandelman Partners.

Built to Produce: Jonathan Sandelman on Ayr Wellness’ Cannabis Acquisitions

study of relevant company from seeking alpha: AYRWF

Kyle Kazan, Co founder, Chairman & CEO of Glass House Group

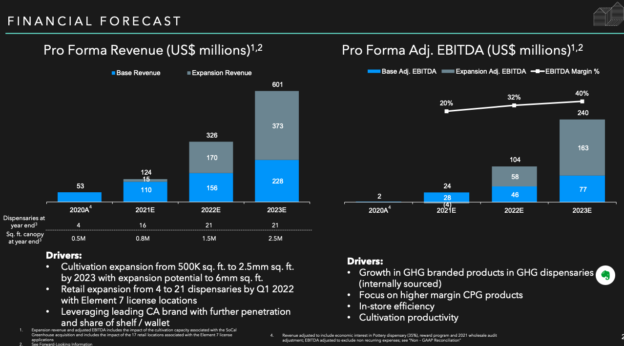

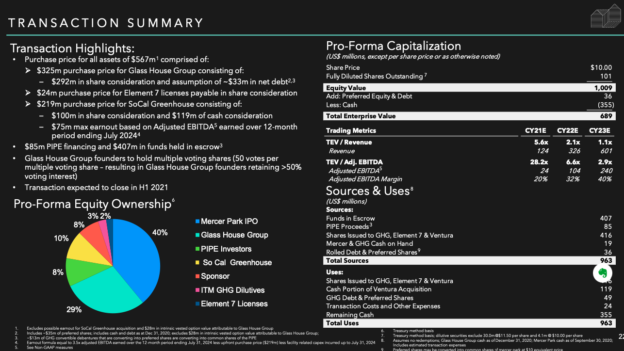

- 07/02/2021 – background of MRCWF: a total payment of $567 million. Including an $85 million private placement, the combined company will have $355 million of cash available after the deal closes in the first half of this year.

Mercer Park SPAC to Acquire California Cannabis Firm Glass House for $567 Million

For its part, Toronto-based Mercer Park said it would pay a total of $567 million, including $325 million for the Glass House business, $219 million for the Southern California Greenhouse operation, and $24 million for 17 retail licenses from cannabis retailer Element 7.

Shareholders from all three companies will “roll 100% of their current ownership into Glass House Group stock,” the release notes.

Including an $85 million private placement, the combined company will have $355 million of cash available after the deal closes in the first half of this year.

- 07/01/2021 – A great article on investment of MRCWF

The Most Valuable Greenhouse in America

The Optionality Imbedded Inside the Mercer Park/Glass House Transaction