Study of AI

Ilya: the AI scientist shaping the world – YouTube

Tesla (TSLA) CEO Elon Musk seemed to agree with CEO of Scale AI Alexandr Wang suggesting that China’s DeepSeek has about 50,000 H100 Nvidia’s (NASDAQ:NVDA) chips, which they can’t talk about due to U.S. export controls.

- 01/23/2025 Stargate without Musk? How Oracle Plays Cheaply in AI – WSJ

- 01/21/2025 – ‘Operator’: OpenAI to show PhD-level ‘super-agent’ to US officials in private meeting

- 01/21/2025 – Forget the ‘Magnificent 7.’ These ‘MAGA 7’ stocks have soared since Trump’s election. – MarketWatch

applovin, robinhood, microstrategy, tesla, Ubiquiti, coinbase, Williams-Sonoma

The “Magnificent Seven” stocks have captured the attention of traders and dominated the market in recent years, as the price of their shares has soared and their market capitalizations have hit $1 trillion and more.

As Donald Trump returns to the White House, a new roster of stocks has become popular with traders and racked up significant gains since the presidential election.

Think of them as the “MAGA Seven.” These stocks, trading on U.S. exchanges, had market caps of $15 billion or higher on Nov. 5. Some of these companies are related — either directly or indirectly — to Trump or his administration’s policies; others are riding a bull-market wave. Their share prices have seen the biggest percentage increases since Trump won the election.

- 01/19/2025 – all things about CES Robert Scoble on X: “I did 35 videos at CES. The most mind blowing was #9 and the most important for the future is #29. But this is just a very small portion of what is at CES. The award winners are at https://t.co/chAVMamALV and those 500 products are the best of the best. Much easier to look” / X

I did 35 videos at CES. The most mind blowing was #9 and the most important for the future is #29. But this is just a very small portion of what is at CES. The award winners are at ces.tech/ces-innovation and those 500 products are the best of the best. Much easier to look through all of them than walking the huge halls. One thing I wish I had spent more time in is the medical device hall. I just didn’t have time, unfortunately, but the devices there, like new rings and watches that can sense the human body will bring a new kind of health care to humans.

#1: A new 3D sensor from @zadarlabs for robots and cars: x.com/Scobleizer/sta

#2: @Halliday_Global shows off its AI-driven glasses that have a small green and black monitor built into affordable and light frames: x.com/Scobleizer/sta

#3: Mustard Glasses shows off its lightweight AI-driven glasses: mustardglasses.com x.com/Scobleizer/sta #4: @bhaptics shows off its haptic vests and other accessories for using in VR: x.com/Scobleizer/sta

#5: Hurotics hurotics.com shows off its robots to help people move and do more. x.com/Scobleizer/sta

#6: Kolibree kolibree.com shows off AI-driven toothbrushes. x.com/Scobleizer/sta

#7: captify.glass AI glasses for the deaf. x.com/Scobleizer/sta

#8: @otreraenergy shows off a nuclear power generator for datacenters: x.com/Scobleizer/sta

#9: The nerds at @NETRIfr are making new computers out of human cells to test food and other things for toxicity. x.com/Scobleizer/sta

#10: A new gadget that helps you feel the internet: feeltechnology.com x.com/Scobleizer/sta

#34: @zoox shows its robotaxi.x.com/Scobleizer/sta #35: @Harman shows its prototype for car of the future. x.com/Scobleizer/sta

- 01/19/2025 – Sam Altman on agentic AI Sam Altman says the kid he’s expecting soon will never be smarter than AI, but thinks this ability will be valuable

OpenAI CEO Sam Altman said human ability will still be valued, but it won’t be “raw, intellectual horsepower.” In a podcast interview earlier this month, he also talked about the emergence of agentic AI.

On a Jan. 6 episode of the Re:Thinking podcast hosted by Adam Grant, Altman opened up about his ideas on the shifts that AI is going to spur.

“Eventually, I think the whole economy transforms,” he said. “We always find new jobs, even though every time we stare at a new technology, we assume they’re all going to go away.”

While he acknowledged that some jobs do go away, people also find better things to do too, and Altman predicted that’s what will happen with AI, saying it’s the next step in technological progress.

Then Grant pointed to an idea that human agility will be valued amid the AI revolution, rather than ability. Altman said ability will still be valued, but it won’t be “raw, intellectual horsepower.”

“I mean, the kind of dumb version of this would be figuring out what questions to ask will be more important than figuring out the answer,” he added.

One day, everyone will have “a personal AI team, full of virtual experts in different areas, working together to create almost anything we can imagine,” Altman wrote in his 2024 blog post.

“AI models will soon serve as autonomous personal assistants who carry out specific tasks on our behalf like coordinating medical care on your behalf. At some point further down the road, AI systems are going to get so good that they help us make better next-generation systems and make scientific progress across the board,” he added.

As far as timelines go, Altman wrote in a January 2025 blog post that he thinks this year “we may see the first AI agents ‘join the workforce’ and materially change the output of companies.”

He said in December at The New York Times’ DealBook Summit he thinks we’ll achieve AGI “sooner than most people in the world think and it will matter much less.”

“We are now confident we know how to build AGI as we have traditionally understood it,” he added in his January post.

Beyond AGI, the company is also turning its attention to superintelligence, which it defines as “future AI systems dramatically more capable than even AGI.”

“Superintelligent tools could massively accelerate scientific discovery and innovation well beyond what we are capable of doing on our own, and in turn massively increase abundance and prosperity,” he wrote in his blog post earlier this year.

- 01/06/2025 – OpenAI CEO Sam Altman: We are now confident we will build AGI and release it this year – AIG is coming this year

- 01/06/2025 – Amazon is investing heavily into Ai and robotics in year 2025

According to Elon, Microsoft owns OpenAI and it can cut off OpenAi at any time

- 12/15/2024 – I need to use Grok soon

(1) Elon Musk on X: “And Grok 3 will be a major leap forward” / X

- 12/14/2024 – Satya Nadella | BG2 w/ Bill Gurley & Brad Gerstner

Open Source bi-weekly convo w/ Bill Gurley and Brad Gerstner on all things tech, markets, investing & capitalism. This week they are joined by Satya Nadella, CEO of Microsoft, to discuss becoming Microsoft’s CEO, Advice for CEO’s, Microsoft’s Investment in OpenAI, Legacy Search, Ten Blue Links, Consumer and Enterprise AI, The Future of AI Agents, Infinite Memory, CoPilot, Microsoft’s Capital Expenditure, Open AI’s future, AI safety & more. Enjoy another episode of BG2.

Timestamps:

- (00:00) Intro

- (01:31) Becoming Microsoft CEO

- (06:42) Satya’s Memo to CEO Committee

- (10:42) Satya’s Advantage as a CEO

- (11:34) Advice for CEOs

- (15:01) Microsoft’s Investment in OpenAI

- (19:42) AI Arms Race

- (23:55) Legacy Search and Consumer AI

- (28:07) The Future of AI Agents

- (38:32) Near-Infinite Memory

- (39:47) Copilot Approach to AI Adoption

- (50:26) Leveraging AI within Microsoft

- (56:03) CapX

- (01:00:20) The Cost of Model Scaling and Inference

- (01:15:15) Open AI Conversion to Profit

- (01:18:05) Next Steps for OpenAI

- (01:19:43) Open vs. Closed and Safe AI

- 12/14/2024 – (1) Elon Musk on X: “https://t.co/oA9MfGz05M” / X – Microsoft CEO Satya Nadella said they want to own all IPs of OpenAI and bet all farm on it. Will xAI fight microsoft?

- 12/08/2024 – (1) Jawwwn on X: “$PLTR CEO Dr. Alex Karp at the Reagan National Defense Forum🔮 “America is in the very beginning of a revolution that we own- the AI revolution. We own it. It should basically be called the “US AI revolution.”🇺🇸 “Every single relevant company in the world, is in this country. https://t.co/Ksb8uv3LAL” / X

$PLTR CEO Dr. Alex Karp at the Reagan National Defense Forum “America is in the very beginning of a revolution that we own- the AI revolution. We own it. It should basically be called the “US AI revolution.” “Every single relevant company in the world, is in this country. The second tier of those companies are in this country. The JV of these companies are in this country. “There is no other place to do technology really at scale besides America. Europe has basically decided to regulate its basically anemic and nonexistent tech scene out of production. All of those people want to come to America. The American tech community is booming” “A lot of these LLMs incorrectly applied, are basically just science projects. If you have the right layer to implement them, you can transform your business in days. “It’s not happening anywhere else. It’s not happening in Europe. Who wants to build a company in China or Russia? It’s happening right here.

(1) Elon Musk on X: “Based” / X

(1) Katherine Boyle on X: “Best two minutes you’ll watch all weekend. https://t.co/nquGdeBDvr” / X

OpenAI inks deal to upgrade Anduril’s anti-drone tech | TechCrunch

- 12/06/2024 – OpenAI’s Sam Altman: Musk’s xAI is a serious competitor

- 12/06/2024 – Inside Sam Altman’s Vision for ChatGPT and AI’s Future | Watch

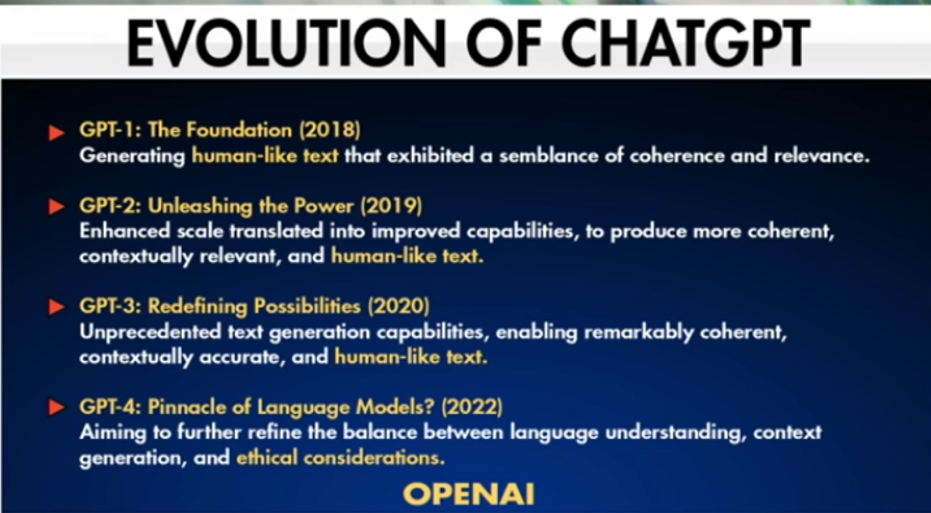

Sam Altman’s journey from Silicon Valley innovator to the mastermind behind ChatGPT is as fascinating as the AI itself. Explore how OpenAI evolved, the challenges of AGI development, and why this could redefine our relationship with technology forever.

Sam Altman: AI is a ‘scientific achievement of humanity’ that will be embedded in everything | Watch

- 12/06/2024 – (1) David Sacks on X: “https://t.co/Li86cNDuP8” / X David as the AI and Crypto Czar might be good for AI, tsla and crypto

Trump Plans to Appoint Musk Confidant David Sacks as AI, Crypto Czar – WSJ Tech investor was one of the most outspoken supporters of Trump in Silicon Valley

- 12/05/2024 – Altimeter’s Brad Gerstner explains why A.I. tech tools will be ‘bigger than the internet’ – YouTube

Summary : Brad Gerstner, shares his views on AI and its exponential growth. He emphasizes that AI allows us to extract knowledge from information and make better decisions. The host mentions that Gerstner has made building his portfolio central to AI and mentions companies like NVIDIA, Meta, Microsoft, and Snowflake that express their belief in AI’s potential. Gerstner agrees and states that it’s an evolution rather than a revolution. He explains that the goal has always been to help people discover information and get better answers. He highlights the acceleration in AI development, including OpenAI’s ChatGPT models. Gerstner mentions rearchitecting their portfolio in anticipation of the AI revolution and the value creation and destruction that comes with it. He brings up the example of platform disruptions in the past, such as the web and mobile/cloud, and suggests that Alphabet (Google’s parent company) may need to reassess its portfolio around tech and AI. He explains the shift from static web pages to a conversational approach, where users can ask questions and receive answers directly. Overall, the conversation explores the transformative potential of AI and its impact on various industries and investment strategies.

- 12/04/2024 – OpenAI CEO Altman says Elon Musk won’t use political clout against rivals: report | Seeking Alpha

Speaking at the New York Times’ DealBook Summit in New York City on Wednesday, Altman said the tech industry will see the first examples of artificial general intelligence in 2025, and it will use different tools to complete it, the report added.

At first, the introduction of AGI — or “superintelligence” as some define it — will have minimal effect, said Altman. Eventually, it will “be more intense than people think,” Altman said, adding that with every major technological development, there has been significant job displacement.

Artificial general intelligence is the ability in which an AI system can perform a complicated task.

Dell Technologies (DELL) stock sank as much as 12% early Wednesday after the company took a cautious approach to its forecast for investors while warning that AI growth “will not be linear.”

“AI is a robust opportunity … and interest in our portfolio is [at] an all-time high with no signs of slowing down,” Dell COO Jeffrey Clarke said during a call with investors Tuesday night. “That said, this business will not be linear, especially as customers navigate an underlying silicon road map that is changing.”

Dell’s AI server revenues fell 9% in the third quarter from the prior period.

On top of a broader slump in the market for personal computers, that nonlinear growth in the AI space contributed to Dell’s lower full-year outlook for its fiscal year 2025 ending in February.

On the call, Clarke mostly cited a slower-than-expected recovery in the PC market when asked about Dell’s lower guidance, but he also pointed to customers’ shifting trends toward the newest AI chips. Clarke said Dell’s consumers are looking to use Nvidia’s (NVDA) latest Blackwell AI chips in Dell’s servers and those chips have faced some delays. Last week, Nvidia said “production is in full steam” for these chips.

“We saw in Q3 a shift and a pretty rapid shift of the orders moving towards our Blackwell design,” said Clarke, noting that orders for its servers with the Blackwell design make up “a significant portion” of its backlog.

TD Cowen analyst Krish Sankar noted that Dell’s fall in AI server revenue in the most recent quarter was “mostly due to the well-understood Blackwell pushouts.”

Sankar added that Dell’s rising backlog and orders of AI servers worth an estimated $8 billion for the third quarter “are a better representation of actual demand,” noting Dell’s AI pipeline “now stands slightly below $20B.”

Dell CEO Michael Dell said on Nov. 17 that the company had officially shipped its first PowerEdge server using Nvidia’s Blackwell AI chips.

Ives: This tech market will be on fire as the AI revolution hits its next phase. (CNBC)

He thinks Nasdaq will be 2500 in year 2025

The first stage of the AI revolution was dominated by hardware, server, and compute companies — those that laid the critical infrastructure essential for AI’s rapid ascent [ $NVDA, $TSM, $ASML, $AVGO, $MSFT, $AMZN, $GOOGL, etc. ]. The Q3 earnings cycle confirmed that the AI revolution is now entering its second stage, where the focus shifts from infrastructure to applications — the application layer is where intelligence moves from concept to execution. What makes the application layer so explosive is its ability to scale rapidly with minimal marginal costs. Unlike hardware, which requires physical production and distribution, software can be deployed instantly and iteratively. The shift to Stage 2 is where the true economic value of AI is unlocked. Hardware may have built the foundation, but the software application layer is where the winners will deliver outsized returns to shareholders by embedding intelligence into every aspect of modern life. I believe that $PLTR, $SNOW, $CRWD, $NET & $MDB will be the biggest winners of this second stage.

- 11/21/2024 – Dan Ives on PLTR, Elon Musk and “The Trade of 2025”

the trade of 2025 – AI software companies

- 11/16/2024 – A Powerful AI Breakthrough Is About to Transform the World – WSJ

The technology driving ChatGPT is capable of so much more. What’s coming next will make talking bots look like mere distractions