Energy and Metals – Part II

- 06/05/2021 – need to read

Schlumberger sees ‘exceptional growth cycle’ ahead for oil and gas business

- 06/03/2021 – will this cause oil price to spike in the short and mid-term, but wind down in the 10 to 20 years long term?

Big Setbacks Propel Oil Giants Toward a ‘Tipping Point’

A surprising mix of environmentalists, pension fund managers and big money investors have scored startling victories against oil and coal, opening new battle fronts in the climate fight.

If the ruling of the lower court stands, though, analysts said, Shell would most certainly have to reorient its business to reduce oil in its portfolio and halt its growth in liquefied natural gas, in which Shell is an industry leader. That is a matter of concern for the investors who have their money in the oil and gas reserves of companies like Shell, said Patrick Parenteau, a professor at Vermont Law School. “A decision telling a company, ‘You’ve got to get out of the oil business.’ For cautious individuals within the financial community, that’s got to cause them serious concerns.”

Climate Revolt Against Big Oil May Lead To Surge In Crude Prices

significantly reduced investments in developing new resources—which are already low after the 2020 oil price collapse—could lead to a supply crunch down the road. This will, in turn, result in an oil price spike when oil supply struggles to catch up with demand.

Some would argue that oil demand would fall anyway, and the world wouldn’t need as much supply as it did over the past decade. But there are currently no signs that oil demand is getting ready for a drastic fall, despite wishful thinking and net-zero scenarios, including the one from the International Energy Agency’s (IEA) bombshell report that suggested no new investment in oil and gas needs to be approved beyond this year’s commitments if the world is to reach net-zero emissions by 2050.

- 06/02/2021 – metals trading booming due to infrastructure boom spurred by the global energy transition. The shift to a low carbon world, involving electric vehicles, renewables and energy storage, over the coming years is expected to further increase demand and prices

Energy transition spurs hiring spree in metals trading

NEW YORK/LONDON (Reuters) – Trafigura, Gunvor Group and Bluecrest Capital Management have hired traders as they seek to profit from an infrastructure boom spurred by the global energy transition, six sources with direct knowledge of the matter said.

Robust manufacturing activity, as the world emerges from pandemic lockdowns and as government stimulus drives spending, has boosted metals demand and expectations of tight supplies have pushed copper and aluminium prices to multi-year highs.

The shift to a low carbon world, involving electric vehicles, renewables and energy storage, over the coming years is expected to further increase demand and prices, creating money-making opportunities for traders and funds.

- 06/01/2021 – shales poised to deliver record free cash flow, discipline on capital investment, focus on paying down debt and pay back dividend. Oil jobs come back slowly, oil rigs back in measured pace. Cautious: mountain of debt might be back when interest rate starts hike. If the debts are fixed rate, then OK. But variable rates are bad.

| WHAT BLOOMBERG INTELLIGENCE SAYS |

|---|

| Oil volume isn’t likely to grow much even above $60. Though an imperfect comparison, E&Ps may look more like utilities in the future, with a sharper focus on returns on capital and variable dividends. |

Shale Explorers Ace Quarterly Exams With More to Prove This Year

The industry, much maligned by investors for excessive spending without returns to show for it, has managed to resist a 22% run-up in oil prices during the first three months of this year, holding output almost flat.

“We emerge from earnings season with continued confidence in a disciplined response from covered E&Ps to higher commodity prices,” Goldman Sachs Group Inc. analysts including Neil Mehta wrote Monday in a note to investors. While one quarter of discipline may not be sufficient for explorers to prove their commitment to moderation, there are at least signs that they’re finally heeding investors’ pleas for austerity, the analysts wrote.

Bloomberg Intelligence, 2021 figure is estimate while remaining years are actual numbers

Free cash flow is perhaps the most closely watched metric in the shale patch these days, and so far, the sector is projected to make more of it than ever before, based on a Bloomberg Intelligence analysis of 31 independent U.S. oil and gas companies.

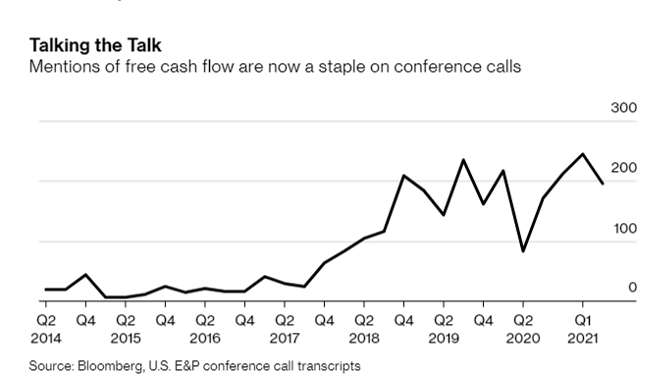

While talking about “free cash flow” dipped a bit from three months earlier, it’s still the hottest topic on earnings calls hosted by U.S. oil explorers and producers. Over the past 12 months, it’s come up 822 times during calls and presentations, an increase of more than 1,000% from the same period five years earlier.

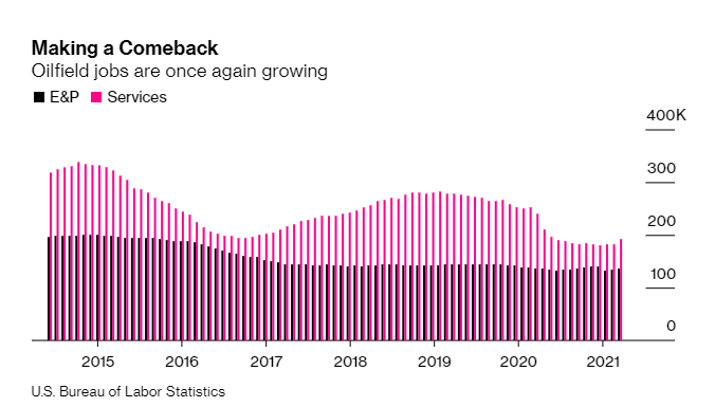

U.S. producers responded to last year’s oil collapse by cutting 2020 capital spending almost in half, and that translates into thousands of jobs lost.

Now that the industry is climbing back, so are the jobs. But there’s still caution in hiring. Although the 9,900 oil-support positions added in March was the largest monthly gain on record, the overall number of U.S. workers in oil and gas remains almost a quarter less than a couple years ago.

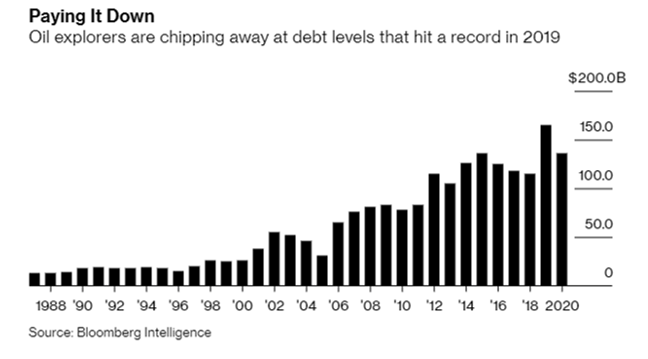

Companies are once again forced to face their mounting debts, this time after leverage ballooned to more than $150 billion at the end of 2019. Following up on last year’s reduction, explorers are using their out-sized cash this year to do more.

“As our portfolio generates increasing free cash flow, we’ll first prioritize debt reduction, and then cash returns to shareholders through dividend increases and opportunistic share repurchases,” Hess Corp. CEO John Hess told analysts and investors last month on a conference call.

Marathon Oil Corp., in giving up its corporate aircraft program to cut costs, said this month it will double its goal of debt reduction this year to $1 billion.

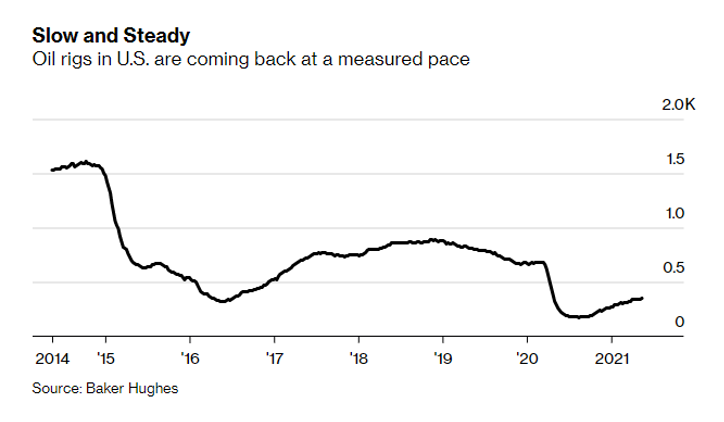

And while drilling is returning from the depths of last year’s lockdown, the number of rigs hunting for oil still remains at roughly half the level they were at before the global pandemic wrecked oil prices in early 2020.

- 06/01/2021 – record cash flow, discipline on capital investment, pay down debt and pay more dividend and buyback (in the future Qs) are all good for investors. Most analysts believe this would be a theme through at least all of 2021.

U.S. Shale Is Finally Giving Shareholders A Payday

Unlike in the previous downturn in 2015-2016, U.S. shale producers are exiting the 2020 oil price and demand collapse with their promises intact to rein in production growth and return more cash to increasingly demanding shareholders.

The first-quarter earnings and conference calls highlighted a previously unheard-of restraint from public shale firms. Listed producers generated record cash flows, but they are not reinvesting most of those back to drilling. Instead, shale operators are now channeling cash flow toward reducing debts and rewarding shareholders.

Despite the first-quarter rally of over 20 percent in oil prices, U.S. shale did not break the promises to keep a lid on production and prioritize returns.

While analysts are not surprised that this time—unlike in any other time in recent history—American producers refrained from raising production, some industry observers question how long this restraint will last. Most analysts believe this would be a theme through at least all of 2021.

Judging from the first-quarter earnings calls, most public U.S. shale firms will be sticking to the new priority of sending cash shareholders’ way, not sinking it in the ground to chase record production, at least for a few quarters until global oil demand and supply-demand fundamentals return to pre-crisis levels.

ecord Free Cash Flows

Many U.S. shale producers generated record free cash flows in the first quarter, and the sector as a whole is expected to continue generating more free cash flow than at any given point in the past, according to a Bloomberg Intelligence analysis of 31 independent firms.

- 05/31/2021 – “A new court ruling against Royal Dutch Shell and shareholder votes at ExxonMobil and Chevron highlights the increasing credit risk for major oil producers over concerns about climate change,” in addition, Rising shareholder demand for investment in climate policies would raise Big Oil’s capital costs and could reduce the availability of capital for oil firms failing to meet investor expectations, according to Moody’s. – these are negative for oil stocks

Moody’s: Credit Risk Is Growing For Big Oil

This week’s climate-related actions in boardrooms and courtrooms involving some of the largest international oil companies signal rising threat to the sector, Moody’s Investor Service said in a comment on the industry.

“A new court ruling against Royal Dutch Shell and shareholder votes at ExxonMobil and Chevron highlights the increasing credit risk for major oil producers over concerns about climate change,” Moody’s said.

Moody’s added that Exxon’s board vote was also the most important because it is binding, unlike the court case, which can be appealed.

Rising shareholder demand for investment in climate policies would raise Big Oil’s capital costs and could reduce the availability of capital for oil firms failing to meet investor expectations, according to Moody’s.

- 05/31/2021 – restraints on big oil companies are good for OPEC to control oil price, not good for consumers

OPEC Could Win Big As Supermajors Fend Off Environmentalists

Every investment of the world’s top international oil firms will now come under increased scrutiny and, most likely, criticism from activists and climate campaigners.

However, it’s currently the profits from oil and gas that help Big Oil to channel more investments into renewable energy, hydrogen technology, or carbon capture and storage – or as BP has put the spin on it “Performing while transforming.”

The more investors revolt against Big Oil, the more opportunities OPEC and its national oil companies will have to step up and say they need to pump more oil to keep the global energy supply and oil prices stable.

- 05/25/2021 – XOM CEO Woods is seemed to be very investor friendly, but will he do enough for energy transition?

Exxon vs. Activists: Battle Over Future of Oil and Gas Reaches Showdown – WSJ

Shareholders vote Wednesday on a bid for four board seats by investors seeking a company commitment to reach carbon neutrality by 2050

Exxon’s stock has recovered after plummeting during the pandemic, Yet still only trades at about 1.5 times its book value, down from about 3.5 times book value shortly after Mr. Raymond left.

Other investors said they had spoken directly to Mr. Woods in recent months and that he had improved investor outreach since becoming chief executive. But, they said, Mr.Woods is unwavering about his views that demand for oil and gas will increase in coming years and unwilling to entertain suggestions that Exxon ought to hedge its bets.

Engine No. 1 has said Exxon’s moves since the proxy fight began are inadequate. It has portrayed Exxon’s low-carbon unit as an exercise in greenwashing, more about public relations than investment. The fund said Exxon refused to meet with its candidates. Exxon said it reviewed Engine No. 1’s candidates and determined they didn’t meet the board’s standards.

Despite the contention, Engine No. 1 said it wasn’t calling for Exxon to unwind its oil and gas business but to gradually diversify itself to be ready for a world that will need less oil and gas. Committing itself to cutting carbon emissions to zero isn’t only a benefit to society but a business imperative for Exxon in a changing energy market, it said.

Mr. Woods is adamant that Exxon will be a leader in the energy transition. Exxon was making substantial investments to reduce carbon emissions, he said, while meeting the world’s need for oil and gas.

“Whatever the future shapes up to be,” Mr. Woods said, “we will be more valuable. That is the objective that we’re working for.”

XOM added two new directors in March 2021

Exxon Adds New Board Members Amid Activist Pressure – WSJ

Oil giant says Jeffrey Ubben and Michael Angelakis would join its board, but Engine No. 1 plans to continue proxy fight

- 05/20/2021 – the oil market driver going forward is not Iran, it’s the demand recovery we are observing. The key demand variable that continues to lag is jet fuel demand, which will require global air travel to rebound meaningfully. This will take time.

Iranian Oil Sanctions Set To Be Lifted: What Does It Mean For Global Oil Markets?

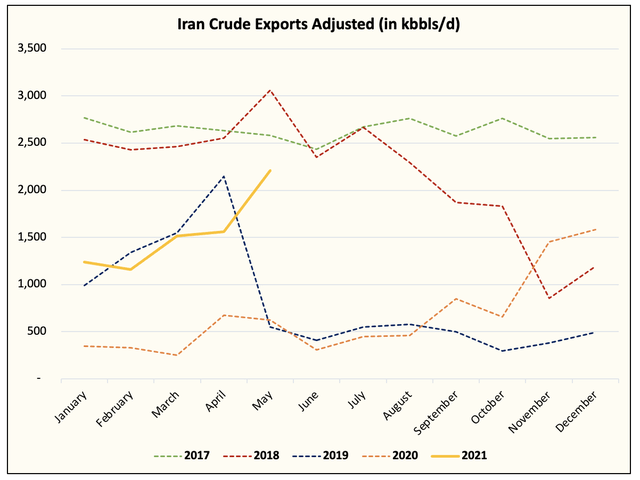

- Oil sanctions are set to be lifted on Iran at any time, and the oil market has largely priced this in.

- Ever since Nov 2020 last year, Iran’s crude/condensate exports have skyrocketed.

- With volumes now close to ~2.2 mb/d today, the oil market won’t need to absorb much more (500k to 700k b/d).

- Our global supply/demand model had already accounted for Iranian barrels returning by H2 2021, and the deficit is still expected to be -2+ mb/d.

- Global oil demand will continue to be the key driver with jet fuel being the primary component.

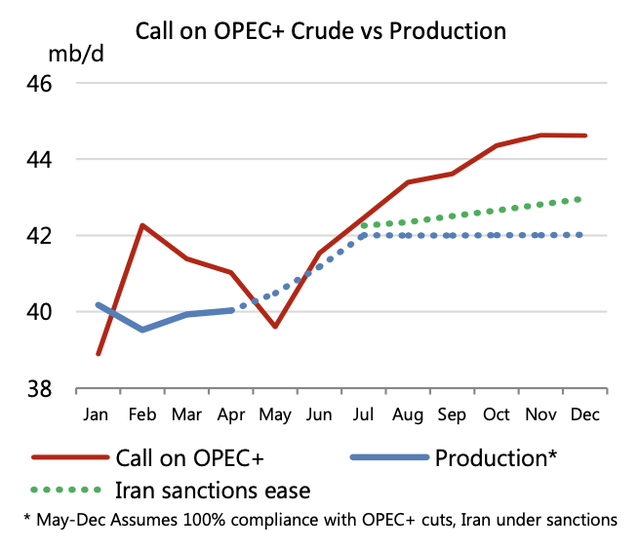

In IEA’s latest oil market report, the energy agency laid out what global supply/demand would look like assuming Iranian sanctions fully lifted.

As you can see, Call on OPEC+ remains well above OPEC+ production inclusive of Iranian barrels returning. As a result, the actual impact on oil market balance is rather meaningless all things considered.

Sentiment-wise, however, we’re seeing a bit more pressure on fund flows as generalists will want to watch and see how the global oil markets develop before re-entering into energy stocks. One thing to note though is that despite the news of Iranian sanctions practically being lifted, energy stocks are only down slightly.

- 05/05/2021 – reopening might help oil industry

Oil Close To Hitting $70 As The U.S. And Europe Reopen

Starting mid-May, New York, New Jersey, and Connecticut will remove the majority of the capacity restrictions for restaurants and offices. In Europe, the European Commission proposes that the European Union (EU) allow entry for non-essential travel for anyone who has received the last dose of an EU-approved vaccine at least two weeks before arrival.

Some of the largest EU economies—including major travel destinations such as Italy—are also gradually reopening, signaling increased domestic travel first and international arrivals later.

Italy will start allowing domestic traveling between regions from mid-May and could welcome EU travelers from mid-June, Italian Prime Minister Mario Draghi said on Tuesday, adding that “Italy is ready to welcome the world again.”

- 04/30/2021 – Oil companies start to make profit, but there are lots of deeply skeptics of the industry notwithstanding climbing commodity prices. In addition, the rapidly rising Covid-19 case numbers in India and South America is a negative. Another positive news is that most oil companies are pledged fiscal restraint to use the free cash flow to pay out investors and reduce debt.

Big Oil Companies Recover as Prices Rebound – WSJ

Exxon, Chevron, other large oil companies notched profits in the first quarter, a year after the coronavirus led to historic losses

The optimism about oil and gas demand rebounding is being tempered by concerns about rapidly rising Covid-19 case numbers in India and South America, said Bjornar Tonhaugen, an analyst at Rystad Energy. Reduced economic activity in India alone may sap as much as 900,000 barrels of oil a day from global demand, according to Rystad.

“For the moment optimism is helping prices, but every trader’s eyes are on India,” Mr. Tonhaugen said. “The oil bulls are out again but it’s doubtful that they are having a confident and calm sleep.”

Despite the improving conditions, Chevron has pledged to keep capital expenditures austere. Mr. Wirth said capital spending decreased 43% from last year during the quarter, citing its corporate restructuring last year that saw as much as 15% of its workforce laid off. Exxon also has pledged fiscal restraint, saying its plan to cut annual capital spending by about 30% remains unchanged.

- 04/28/2021 – there was a scenario that played out in 2009 and 2010, when the oil industry and its allies convinced many workers pending climate-change legislation would raise energy prices. Protesting workers helped kill a carbon-pricing plan known as “cap-and-trade.”. Will it happen again this time? Not sure. But I need to read the history first.

Biden Argues Tackling Climate Change Doesn’t Mean Cutting Jobs

A week after making his case to the world on the U.S. role fighting climate change, President Biden made his case to the American people with another effort to convince them it won’t hurt the economy.

He dug into his infrastructure and climate initiatives early in his speech tonight, touting the potential for new jobs building renewable power units and electric-vehicle charging stations.

“Now I know some of you at home are wondering whether these jobs are for you,” Mr. Biden. “So many of you, so many of the folks I grew up with feel left behind, forgotten, in an economy that’s so rapidly changing, it’s frightening. I want to speak directly to you.”

If people in those communities don’t have faith Mr. Biden can protect their employment, the president’s plans to address climate change could founder. That’s the scenario that played out in 2009 and 2010, when the oil industry and its allies convinced many workers pending climate-change legislation would raise energy prices. Protesting workers helped kill a carbon-pricing plan known as “cap-and-trade.”

Expect Mr. Biden to make this case over and over again in the months to come, an effort to avoid the same outcome.

“There’s simply no reason why the blades for wind turbines can’t be built in Pittsburgh instead of Beijing. No reason. None.” Mr. Biden said. “These are good-paying jobs that can’t be outsourced.”

- 04/21/2021 – it is not good if this law passes

Crude Oil Prices Drop as US Push Through With Anti-OPEC Bill

In line with the general risk-off sentiment, oil prices have come under notable selling pressure with both Brent and WTI crude futures falling 2-2.5%. Alongside this, the move lower in oil prices had been exacerbated by reports that the US House Judiciary Committee had passed a bill that would open OPEC to antitrust lawsuits over production cuts, making it illegal for any foreign state to act collectively to limit the production of oil or set prices.

However, while the initial reaction has seen oil prices drop, the likelihood that such a bill will be signed into law is still small at this stage. Similar bills have been introduced in Congress for the best part of two decades with little success. While oil prices are up over 30% having recently hit a monthly high at $68, this is still below levels of $100 over a decade ago where similar bills have been passed in the full house. That said being, should the bill manage to gain traction, it would have to pass both chambers in Congress and signed by President Biden, however, at present, that seems unlikely.

- 04/16/2021 – the oil industry might not be good in the long run

Oil to hit $40 by 2030 if climate goals are met -consultancy

* In scenario, Wood Mackenzie sees sharp drop in demand

* Oil demand could drop to 35 million bpd by 2050

Global oil prices could drop to around $40 a barrel by 2030 if governments push to reduce fuel consumption in step with U.N.-backed plans to limit global warming, a leading energy consultancy said on Thursday.

In a report outlining a scenario where the world acts decisively to tackle greenhouse gas emissions by electrifying transport and industry, Edinburgh-based Wood Mackenzie said oil consumption would begin a steep drop as early as in 2023.

The decline in demand would accelerate to a rate of 2 million barrels of oil per day (bpd) to reach 35 million bpd by 2050, accounting for a 60% drop in carbon emissions from oil use from today’s levels.

Report: 2035 100% EVs is possible. A new report shows that, with the right policy, it is technically and economically feasible for all new car and truck sales to be electric by 2035.

North American oil bankruptcies hit 5-year high. Oil and gas bankruptcies in North America hit their highest first-quarter level since 2016, according to Haynes and Boone. There were eight bankruptcies in the first quarter.

Big Oil’s $110 billion asset sale target could prove big ask

Oil prices hit their lowest since 1999 in April after a collapse in demand caused by coronavirus-related travel restrictions. They have since recovered to around $40 a barrel, but are not expected to rise dramatically in coming years.

Reduced investments by the majors could however lead to tighter supply and higher oil prices, which would increase the value of their resources, Soden added.

The majors need to sell assets to boost revenues and reduce debt amassed in the wake of the oil price collapse.

European companies including BP, Shell and Total are also looking to focus their oil and gas operations on the most profitable and least polluting projects after pledging to slash carbon emissions in coming decades.

Exxon and BP each hope to sell $25 billion of assets in the coming years, while Shell aims to dispose of $5 billion a year.

Spiro Youakim, global head of natural resources at investment bank Lazard, told Reuters that oil company boards should consider spinning off unwanted oil and gas production and refining businesses to attract new investors as buyers such as private equity lose appetite.

“The majors’ portfolios are exceedingly large and they include more peripheral assets which could be run more effectively by different types of investors,” Youakim said.

- 04/12/2021 – sanctions on Iran might be irrelevant since it has already exported 1 mil barrel to China per day in March. So the lift of sanctions might mean nothing to Iran. OPEC+ is very nervous about the ramp up of Iran oil production

Iran’s Oil Exports Render Sanctions Irrelevant

- 04/12/2021 – Saudi needs higher oil price for profit and diversification

The $7 Trillion Reason Saudi Arabia Is Cutting Oil Production

Strict production discipline by OPEC and its partners is the #1 reason why oil prices have managed to stage a remarkable recovery and stay relatively high after plunging to historical lows in 2020. Early this month, oil prices reacted positively after OPEC and its non-OPEC partners, aka OPEC+, reached a favorable agreement to start gradually curbing production cuts beginning in May. Starting next month, OPEC+ will allow an additional 350,000 barrels per day to join the markets, with another 350,000 coming in June and June and 450,000 barrels per day slated for July. Currently, OPEC is holding back just over 7 million barrels per day, with Saudi Arabia voluntarily cutting an additional 1 million barrels per day.

Diversifying the economy

Whereas Saudi Arabia, the region’s largest economy of the GCC (Gulf Cooperation Council) boasts the largest economy and the lowest production costs of any Arab nation, the harsh reality is that the country needs significantly higher oil prices than the current WTI price of $59.50 per barrel to balance its books.

Indeed, Saudi Arabia’s fiscal breakeven price of $76.10 per barrel means that it remains heavily in the red, with only Qatar being able to record a surplus thanks to its low breakeven point of $39.90 per barrel.

Budget deficit

Source: Reuters

Saudi Arabia desperately needs higher oil prices not only to balance its books but also to lower its dependence on crude.

Betting on clean energy

On the energy front, Saudi Arabia is clearly committed to moving from crude to cleaner energy sources.

- 04/09/2021 – demand concern on spreading Covid cases and lockdown measures weight down oil price

Oil prices are set to post a loss this week, following several days of up-and-down trading. The story is the same – a jockeying between market tightness and concerns about demand amid spreading Covid cases and lockdown measures. from oilprice.com

- 04/09/2021 – keep in mind of the increase of oil supply from Iran. By the end of April comes the end of Chinese refinery maintenance, China might import more oil from countries other than Iran.

Iran Talks Ongoing While Physical Crude Market Deals With Black Market Barrels

- While Iran and US dish it out on how they can go back to the JCPOA, the oil market already is having to contend with ~1.5 mb/d of crude/condensate exports.

- This leaves an extra ~1.2 mb/d left for Iran to export if all sanctions are lifted.

- Physical oil market remains weak as the black barrels make their way into the market, and with no sanction enforcement, this will continue.

- But total global oil supplies continue to fall making China’s game of chicken with the oil market using Iranian barrels temporary at best.

- As for energy equities, we are seeing signs of a bottoming pattern forming.

The reason being is that as the overhang in the other barrels get bought and stored, and with demand recovery still continuing albeit choppier than previously expected, sooner or later, China will have to buy from others. This will then return things back to normal and push spreads higher.

The question again is obviously timing, but we think it’s still sometime around the end of April when we see crude starting to go back higher. This timing also coincides with the end of Chinese refinery maintenance.

- 04/08/2021 – oil companies might turn profit in 2021

Big Oil Set To Return To Profit In 2021

Vitol, Shell and Exxon are all expected to announce profits in Q1 2021 following a turbulent 2020. The three companies are profiting from increased oil demand and a rise in oil prices, giving analysts hope for a strong year in oil and gas. Shell announced this week that it expects to make its first profit from oil production in the first quarter of 2021 since the beginning of the Covid-19 pandemic. The company’s upstream unit, which mainly manages crude exploration and production, has gained from the surge in oil prices over the past few months.

Shell’s statement comes despite targets being hindered by the winter storm that hit Texas in February, decreasing the company’s production by around 20,000 bpd of oil in the first three months of the year, reducing its expected earnings by around $200 million.

Shell was hit hard as oil demand decreased in Q2 of 2020, despite steadily picking up again in the second half of the year before stricter pandemic restrictions were reintroduced. Although Shell remained stable overall, its upstream unit suffered a loss of $1.5 billion in the second quarter of 2020.

BP Plc, another company that was struck hard by the pandemic, announced this week that it has reduced its net debt to $35 billion a year earlier than anticipated, meaning the company can recommence share buybacks.

- 04/08/2021 – Biden’s policy might benefit oil industry somewhat

The Oil Industry Receives An Unexpected Boost From Biden

Despite this rhetoric, it seems that the Biden administration is now throwing the oil industry a bone. The president’s much-touted infrastructure initiative is going to call for asphalt – lots and lots of asphalt – in an unexpected boon for the domestic oil sector. Last week Biden presented his $2.25 trillion infrastructure proposal that will provide a number of economic opportunities for oil, including $115 billion allocated to roads and bridges, and an additional $16 billion to get out of work oilfield laborers back into paid positions plugging abandoned wells across the United States.

The biggest opportunity, however, lies in the sky-high asphalt demand embedded in the infrastructure spending bill. The biggest winners may not be in the domestic market though. Since asphalt is derived from “the heaviest and most-dense material in a barrel of crude” this development could stand to benefit Canada’s struggling oil sands the most, which will be ecstatic for any new market for their heavy crude bitumen.

The jobs can’t come fast enough. “Home to the world’s third-biggest oil workforce, the U.S. saw an 11% cut to headcount in 2020 that reduced the ranks of employed to just under 1 million,” Bloomberg reports. “Another 10,000 or so job cuts are expected this year.” While the Biden administration has been straightforward that there will be oilfield industry casualties from the green energy transition, so far it does seem that they’re doing what they can to soften the blow. It appears that even the infrastructure investments into renewable energy will benefit oilfield workers in the end – and ultimately large oil states like Texas will play a major role in the future of wind, solar, and energy storage in the U.S.

- 04/05/2021 – rising coronavirus cases would pressure demand for fuel in weeks ahead

Oil Prices Retreat Amid Demand Worries – WSJ

Investors weighing whether rising coronavirus cases would pressure demand for fuel in weeks ahead

Investors are weighing whether rising coronavirus cases around the world and a sluggish vaccine rollout in Europe would pressure demand for fuel in the weeks ahead. French President Emmanuel Macron announced a national lockdown last Wednesday, and the pandemic is also worsening in other large economies such as India.

Brent crude, the global gauge of oil prices, fell 3.2% to $62.77 a barrel Monday.

Analysts say that oil prices are now hovering around a sweet spot that supports earnings for energy producers without causing a much bigger climb in gasoline prices that would further pressure consumers at the pump. After U.S. crude prices rose as high as $66 last month, some investors had worried that a continued increase would hurt the economy as more consumers get vaccinated and travel this summer.

Even though many analysts viewed last week’s OPEC decision as a sign of confidence that demand will surge, some traders are now questioning those wagers.

“The strong bullish response to the production decision was an overreaction,” Jim Ritterbusch, president of energy advisory firm Ritterbusch & Associates, said in a note.

If demand falters, some investors expect OPEC+ to reverse last week’s announced supply increases. Saudi Arabia, the de facto head of the cartel, has sought to maintain output cuts, while other large producers like Russia have pushed to roll them back. The group has frequently changed course in the past year as forecasters struggle to predict how demand will shift during the pandemic.

- 04/01/2021 – OPEC+ agree to boost oil production is a compromised decision, US energy secretary might also play a role to ask for “affordable price” of oil. One comment from Roger Diwan, Vice President at IHS Markit “Increasing production by ~1 million b/d over 3 months when product demand is expected to rise by ~3 million b/d over the same period is not bearish. It is conservative anticipation, but anticipation nonetheless.” Is this true?

OPEC, Allies Agree to Boost Output, Betting on Demand Rebound – WSJ

Producers to add more than two million barrels a day in coming months despite rising Covid-19 cases in U.S., fresh lockdowns in Europe

OPEC and an alliance of other top oil producers agreed to boost their collective production by more than two million barrels a day over coming months, betting on resurgent demand as they and the rest of the world assess the economic consequences of the pandemic’s trajectory.

The Organization of the Petroleum Exporting Countries and a group of other big producers led by Russia agreed to boost output in May by 350,000 barrels a day, and by the same amount again in June, according to delegates. They agreed to then increase output by another 450,000 barrels a day in July. Saudi Arabia, meanwhile, agreed to start easing separate, unilateral cuts of one million barrels a day that it put in place earlier this year. It plans to end those cuts altogether by the end of July, delegates said.

The agreement Thursday between the two groups, together called OPEC+, was a compromise between Saudi Arabia, OPEC’s de facto leader, and Russia. Saudi Arabia had sought to maintain cuts, skeptical of a quick return in oil demand during the pandemic. Russia, meanwhile, has said the world already needs more oil to feed resurgent economies in many regions.

Traders took the OPEC easing in stride, with analysts saying the boost was measured. Brent, the international crude benchmark, was up 1.2% to $63.52 a barrel. Futures for West Texas Intermediate, the U.S. benchmark, was rising 1.6% to $60.08 a barrel.

OPEC and allies to boost production after US calls Saudi Arabia

The Organization of the Petroleum Exporting Countries and allied producers have agreed to gradually increase their output over the next three months. The move follows a sharp increase in oil prices, and a call from the United States to keep energy affordable.

External forces were pressuring the group to change course. Jennifer Granholm, the US energy secretary, said that she had a “positive” call with Saudi energy minister Prince Abdulaziz Bin Salman ahead of the meeting. “We reaffirmed the importance of international cooperation to ensure affordable and reliable sources of energy for consumers,” Granholm said on Twitter.

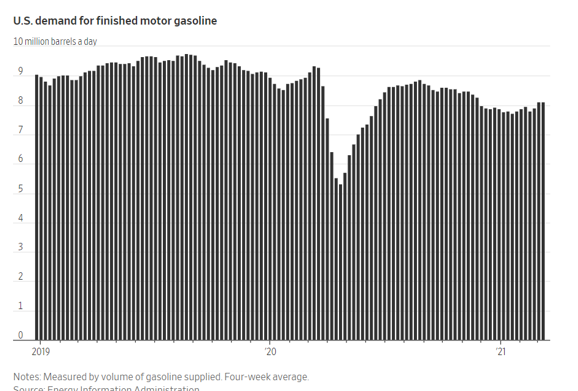

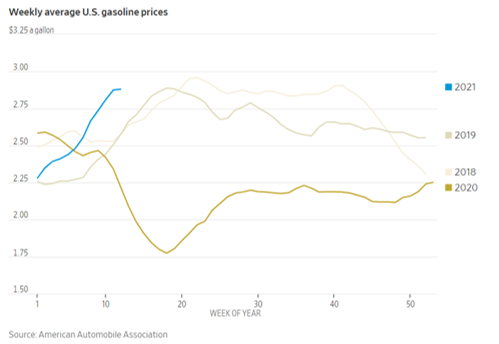

The timing and substance of the call suggest that the United States would like to see oil supplies increase following a 70% spike in the price of Brent crude, the global benchmark, over the past five months. US gasoline prices have also risen sharply to an average of $2.88 per gallon.

Prince Abdulaziz denied on Thursday that US pressure had played a role in the decision to increase output, telling reporters that he had not discussed oil markets with Granholm.

“We did not talk about oil, oil markets or oil prices. period,” he said.

OPEC Meeting: Saudis Look To Unwind Unilateral Output Cuts

Oil prices gave up earlier gains and turned lower as of 11:39 a.m. EDT on Thursday, after reports emerged that Saudi Arabia was offering to gradually ease its additional unilateral cut of 1 million bpd, on top of the OPEC+ group also gradually easing the cuts in the next three months.

Going into the behind-closed-doors session, the key ministers of Russia and Saudi Arabia spoke at the opening of the meeting, and had somewhat diverging views. Russia appeared more optimistic about oil demand recovery and the market as a whole, while Saudi Arabia hinted at another cautious approach.

Commenting on the planned OPEC+ production rise in the next three months, Roger Diwan, Vice President at IHS Markit, tweeted:

“Increasing production by ~1 million b/d over 3 months when product demand is expected to rise by ~3 million b/d over the same period is not bearish. It is conservative anticipation, but anticipation nonetheless.”

Oil Demand Boosted By Highest Number Of Flights Since COVID Started

The number of commercial flights looks to have hit a post-pandemic high in the past days, outstripping the previous high from Christmas travel and potentially boding well for jet fuel demand going forward.

In the United States, the number of air travelers in a day exceeded 1.5 million at the end of March, for the first time since the middle of March 2020, in a good sign for oil demand as U.S. citizens start to travel more, including by plane.

Travel and consumption patterns in the world’s top oil consumer, the United States, and in the world’s top oil importer, China, point to recovering demand for petroleum products. Those two countries—major consumers of crude—could lead global oil demand out of the woods and lead the global consumption rebound later this year.

While air travel could rebound from the record lows of last year, renewed lockdowns in Europe continue to be a concern for forecasters, including the OPEC+ group, whose Joint Technical Committee (JTC) revised down this week its oil demand growth forecast for 2021 by 300,000 barrels per day (bpd). The JTC’s base-case scenario, according to a report Reuters has seen, now forecasts demand growth of 5.6 million bpd, down by 300,000 bpd compared to the previous forecast.

- 03/30/2021 – Exxon Mobil and Chevron Corp have scaled back activity dramatically in the top U.S. shale oil field. Both companies are likely to increase Permian spending next year. Many shale companies have hedged a majority of expected 2021 oil production at an average price below $45 a barrel, well below current market prices, Enverus’ Andy McConn said. The hedges reduce exposure to the recent increase in oil prices, discouraging near-term growth.

Exxon, Chevron take a slow walk on the path to U.S. shale recovery

Exxon Mobil and Chevron Corp have scaled back activity dramatically in the top U.S. shale oil field, where just a year ago the two companies were dominating in the high-desert landscape.

The cautious approach of the two largest U.S. oil companies is a major reason domestic oil production has been slow to rebound since prices crashed during pandemic lockdowns in 2020. Production now is about 11 million barrels per day (bpd), down sharply from the record of nearly 13 million bpd hit in late 2019.

The share of drilling activity by Exxon and Chevron in the Permian Basin oil field in Texas and New Mexico dropped to less than 5% this month from 28% last spring, according to data from Rystad Energy.

“We essentially hit a pause button,” said Chevron Chief Financial Officer Pierre Breber. “When the world was oversupplied we didn’t see the virtue in putting more capital to add barrels.” (Graphic: Exxon and Chevron slash Permian drilling, here)

Both companies are likely to increase Permian spending next year, said Stewart Glickman, energy equity analyst at CFRA Research. (Graphic: Permian DUCs slide, )

Exxon and Chevron are not the only producers keeping spending down. Many shale companies have hedged a majority of expected 2021 oil production at an average price below $45 a barrel, well below current market prices, Enverus’ Andy McConn said. The hedges reduce exposure to the recent increase in oil prices, discouraging near-term growth. (Graphic: Permian oil production stalls, )

Reporting by Jennifer Hiller and Devika Krishna Kumar

- 03/26/2021 – Oil has bounced around with significant volatility this week, dragged down by slow vaccinations, lockdowns, and speculative outflows, but pushed back up on Suez Canal bottlenecks. Analyst sentiment is also all over the place. Bank lending to fossil fuels down 9%. Moody’s cuts ExxonMobil. Chinese refinery maintenance and renewed lockdowns in Europe put pressure on crude, forcing traders to mark down prices.

Friday, March 26th, 2021

Goldman remains bullish. In a Friday note, Goldman Sachs noted bearish fears, but struck an upbeat tone: “We continue to view the decline in prices as overshooting the shifts in oil fundamentals,” the bank said. “In particular, we expect a slower ramp-up in OPEC+ production this spring to help offset both slower EM and EU demand recovery and higher Iranian exports, with global demand still set to increase sharply through the summer.”

Bank lending to fossil fuels down 9%. Bank lending to fossil fuels declined by 9% in 2020 due to the pandemic and the ensuing downturn. The 60 largest banks lent more than $750 billion to 2,300 fossil fuel companies in 2020, down from $824 billion in 2019, according to a report by Rainforest Action Network, Reclaim Finance, Oil Change International, and other non-governmental organizations

$3 gasoline nears. Average retail gasoline prices rose to about $2.88 per gallon in the U.S. last week. Analysts say $3 is likely by summer.

Moody’s cuts ExxonMobil. Moody’s cut ExxonMobil (NYSE: XOM) to Aa2 from Aa1, with a stable outlook. “ExxonMobil’s large increase in debt in 2020 and accompanying deterioration in financial leverage metrics following the onset of the coronavirus pandemic looks unlikely to be fully reversed in the next few years,” said Pete Speer, Moody’s Senior Vice President.

Asian market soft, pressuring prices. Chinese refinery maintenance and renewed lockdowns in Europe put pressure on crude, forcing traders to mark down prices. “Barrels are struggling to find homes in the export market as Asia still isn’t buying and Europe is struggling as well,” said Scott Shelton, energy specialist at United ICAP.

China boosts oil and gas spending. PetroChina is planning to spend $36.6 billion in capex this year, making it the world’s top spender, just above Saudi Aramco’s (TADAWUL: 2222) $35 billion. The top spender from the western oil majors is Royal Dutch Shell (NYSE: RDS.A) at $20.5 billion.

- 03/25/2021 – U.S. drillers are back to drilling. OPEC’s action is hard to predict. Biden administration policies will lead to tighter oil supply. XOM’s debt is high. – conflicting factors for oil price. Watch out

OPEC’s Biggest Fear Is Becoming A Reality

U.S. oil drillers are no longer sitting in the trenches, waiting for the pandemic storm to pass. They are once again in growth mode, according to the first-quarter energy survey by the Dallas Federal Reserve. As oil prices rebound, activity in the oil patch is expanding, respondents to the Dallas Fed Energy Survey said. And it is expanding strongly: from a reading of just 18.5 for the fourth quarter of 2020, the business activity index of the survey soared as high as 53.6 over the first quarter of this year.

The data supports evidence from other agencies: the number of active drilling rigs is steadily rising. So is production: according to the latest weekly report by the Energy Information Administration, oil production last week averaged 11 million bpd. That’s still 2 million bpd below the average for this time last year, but above the average for a week earlier and the four-week average for the period ending on March 19. The signs seem to point to what OPEC feared the most: U.S. shale is returning.

Capital spending is returning, the Dallas Fed reported in its survey. From an index of 12.5 for the fourth quarter of 2020, it has now gone up to 31. What’s more, the industry is upbeat about the future, too, planning to boost spending further next year.

So, U.S. drillers are back to drilling, with West Texas Intermediate comfortably higher than breakeven prices, even in the costliest parts of the shale patch. What would OPEC do?

“While the price increases have been welcome news, OPEC+ is a sword of Damocles: if U.S. operators raise capital expenditures, OPEC+ will open its taps and flood the market,” one industry executive said. “There is a tense detente currently.”

This tense détente will likely continue as OPEC cannot really afford to open its taps right now—not when oil prices are still lower than what Saudi Arabia needs to balance its budget. If the respondents in the Dallas Fed survey are right, they will continue to be lower for a while longer.

In their price forecasts, industry insiders gave an average price projection for West Texas Intermediate of $61.13 per barrel. This compared with an average of $49.77 last quarter. The range of price forecasts was telling, too: projections varied from a low of $45 per barrel to a high of $85 per barrel, reflecting the return of price optimism in one of the industries that suffered the worst blow from the pandemic.

The optimism is in part fuelled by expectations that Biden administration policies will lead to tighter oil supply, which will automatically push prices higher. Yet, some executives are not focusing on the pros.

“With the current political sentiment being against oil and gas, I am beginning to question how much longer I will continue to risk capital in this business. I am waiting to see what tax law changes come out of Washington, D.C.,” one executive told the Dallas Fed.

- 03/25/2021 – Europe tightening lockdown restrictions has driven down the oil

Oil prices under renewed pressure on fears rising COVID cases will dent demand

“Europe tightening lockdown restrictions has unnerved the markets, but COVID cases are also rising sharply in key developing economies such as India and Brazil, whose oil consumption is also a key factor in supporting prices,” said Sophie Griffiths, market analyst at Oanda, in a note. “In a short period, the outlook for global recovery has deteriorated, raising questions over future demand.”

India reported 47, 262 cases and 275 deaths on Wednesday, marking its biggest daily rise this year, the BBC reported. Brazil has seen a spike in infections, while total deaths in the country from COVID-19 exceeded the 300,000 threshold, making it the second country to do so, according to the Associated Press.

Germany’s Merkel admits ‘mistake’ and reverses Easter lockdown

- German Chancellor Angela Merkel has reversed plans for a lockdown over Easter amid criticism from experts and officials over the move.

- Experts said it would have little impact on a third wave of infections sweeping the country.

- Merkel said plans to place the country in a strict lockdown over the Easter holiday — which would have seen all shops and churches close from April 1-5 — were a “mistake.”

Germany is not alone in having to adjust plans around Easter; Italy is to reimpose a national lockdown over the period for the second-year running while Paris and other parts of France are again under a partial lockdown.

- 03/24/2021 – we might have more demand for motor gasoline given economy reopening. If adding in infrastructure plan, we might have more and more demand

Leap in Gas Prices Puts $3 a Gallon in Sight – WSJ

Analysts expect crowded highways and diminished stockpiles to lift gas prices into the summer driving season

- 03/23/2021 – more air travel, more oil consumption

Jet Fuel Demand Set To Recover As U.S. Air Travel Picks Up

The number of U.S. air travelers exceeded 1.5 million on Sunday, for the first time since the middle of March 2020, in a good sign for oil demand as U.S. citizens start to travel more, including by plane.

According to data from the U.S. Transportation Security Administration (TSA), as many as 1,543,115 travelers passed through security checkpoints at U.S. airports this past Sunday, the highest number of travelers since March 13, 2020. The last time U.S. airline passenger numbers topped 1.5 million was on March 15, 2020, when 1,519,192 travelers were screened at American airports, just before flights began being grounded as mobility was restricted at the start of the pandemic.

The U.S. air traveler numbers have now been above 1 million for a 12th straight day to March 22, the TSA data showed.

- 03/23/2021 – large crude inventory build unexpected

Oil Prices Fall Further After API Reports Crude Inventory Build

The American Petroleum Institute (API) reported on Tuesday a build in crude oil inventories of 2.927 million barrels for the week ending March 19.

Analysts had predicted a much smaller inventory build of 272,000 barrels for the week.

In the previous week, the API reported a draw in oil inventories of 1 million barrels after analysts had predicted build of 2.964 million barrels.

After oil prices fell last week, they fell even further on Tuesday ahead of today’s data.

At 4:00 p.m. ET, before Tuesday’s data release, WTI had fallen by $3.91 on the day (-6.35%) to $57.48—a $7 per barrel decrease from last week as new EU lockdowns threaten to further dampen oil demand and as speculators look to liquidate their long positions.

The Brent crude benchmark had also fallen on the day $4.13 at that time (-6.39%) to $60.49—about $8 per barrel down on the week.

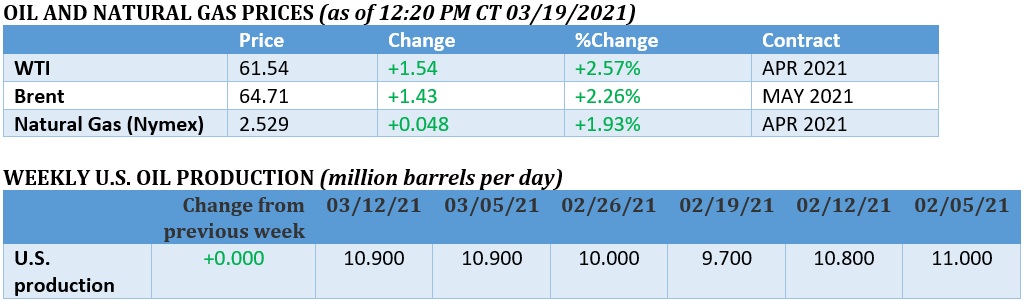

U.S. oil production stayed the same for the week ending March 12 at 10.9 million bpd, according to the latest data from the Energy Information Administration.

- 03/22/2021 – the road to dominating alternative energy might be a at least a decade long

Fossil Fuels Will Continue To Dominate For Decades To Come

The Biden administration has promised to set aside $2 trillion for decarbonization and plans to rejoin the Paris Agreement. All of these commitments are certainly impressive in theory, but in reality, they are going to run into two major problems. The first is achieving the adoption of renewable energy at an incredibly unrealistic speed, the second is ensuring that the system that we are transitioning to does what it needs to do. It is important to note that we do not currently have many of the technologies that we will need if we are to reduce carbon emissions by the levels set out in the Paris Climate Agreement.

- 03/21/2021 – Saudi might be cautious on increase production

Saudi Aramco profit slumps 44% after Covid-battered year, but maintains dividend

- Saudi Aramco reported a 44% collapse in full year earnings, as the coronavirus punched the global economy, oil prices, volumes and refining margins.

- Aramco still declared a dividend of $75 billion and remains the world’s most profitable company.

- “We remain confident that we will emerge on the other side of this pandemic in a position of strength,” said Saudi Aramco CEO Amin Nasser.

The firm also said it expects to cut capital expenditure in the year ahead, and lowered its guidance for spending to around $35 billion from a range of $40 billion to $45 billion previously.

- 03/20/2021 – oil, copper and lithium might boom this year

Three Commodities Set To Boom As The Global Economy Recovers

Wall Street is now predicting a new commodity bull market that will rival the oil price spikes of the 1970s or the China-driven boom of the 2000s. Market experts, including Goldman Sachs, believe the commodity boom could rival the last “supercycle” in the early 2000s that powered emerging BRIC economies (Brazil, Russia, India and China).

Here are 3 key commodities that can act as an inflation hedge and also as a nice play in the emerging commodity supercycle.

Bloomberg Commodity Index 12-Month Change

Source: Bloomberg

- oil

- copper

- lithium

- 03/19/2021 – Vaccine hiccups and TX refinery stalls might prevent the oil price rally

The Oil Price Rally Is Officially Over

|

The recent aggressive oil price rally appears to have officially come to an end, with WTI having lost more than $7 in one week. Prices began to bounce back on Friday morning.

|

Crude oil plunged by more than 7% on Thursday, the worst single-day loss since April 2020, and is set to close out the week down by the most since October. The decline is the result of a combination of bearish factors – profit-taking by overly long speculators, a stronger dollar, and diminished hopes surrounding vaccinations in Europe. “There have been some bearish headlines over the last two weeks,” Helge Andre Martinsen, senior oil analyst at DNB Bank ASA, told Bloomberg. “But it’s surprising that it happened in just one day.”

Vaccine hiccups could prevent 1 mb/d of oil demand. According to Rystad Energy, a lengthier vaccine campaign in Europe – due to delays and increased hesitancy – could delay the recovery of 1 mb/d of oil demand this year.

U.S. refining capacity still not fully restored. U.S. refining capacity is sitting at about 80% of levels seen before the Texas grid crisis in February. An estimated 1.2 mb/d of refining capacity remains offline, according to IHS Markit, due to spring maintenance and ongoing repairs.

- 03/18/2021 – oil falls due to dollar rises, vaccine rollout stalls in EU and British, inventory build up in US due to severe cold weather in Texas and the central part of the country in February forced shutdowns at refineries. IAE does not expect oil supercycle (or an extended period where prices rise well above their long-run trend). WTI on March 12 switched from backwardation to contango, where front-month is cheaper than the second-month. – Are these three negative contributors temporary or long term trend?

Oil falls 4% as dollar rises and vaccine rollout stalls

Oil prices sunk for a fifth day in a row on Thursday to their lowest in two weeks on a stronger dollar, a further increase in U.S. crude and fuel inventories and the weight of the ever-present COVID-19 pandemic.

The International Energy Agency said on Wednesday that the Paris-based energy watchdog does not expect oil prices to enter a supercycle, or an extended period where prices rise well above their long-run trend.

U.S. government data on Wednesday showed crude inventories have risen for four straight weeks after severe cold weather in Texas and the central part of the country in February forced shutdowns at refineries.

U.S. crude inventories rose by 2.4 million barrels last week, the U.S. Energy Information Administration (EIA) said on Wednesday. [EIA/S]

Traders said those stockpiles could grow further now that WTI on March 12 switched from backwardation to contango, where front-month is cheaper than the second-month.

“Contango is bearish because it encourages (firms to) store crude oil and sell it further down the curve at a profit,” said Bob Yawger, director of energy futures at Mizuho in New York.

The premium of the Brent front-month over its second-month, meanwhile, was the lowest since early February.

another similar news here

Oil Plunges On A Wave Of Bearish News

Oil prices plummeted by 4 percent on Thursday morning, as a rising U.S. dollar, rising U.S. crude inventories, and fresh setbacks in vaccination programs in Europe weighed on the market.

As of 11:45 a.m. EDT, WTI Crude prices were dropping by 4.20 percent at $61.89, and Brent Crude was plunging by 3.91 percent at $65.34.

Adding to the bearish sentiment, the Energy Information Administration reported on Wednesday a crude oil inventory build of 2.4 million barrels for the week to March 12.

The EIA inventory report showed that U.S. commercial crude oil inventories rose above 500 million barrels for the first time this year, ING analysts commented.

- 03/18/2021 – CV-19 wave is back to EU, could they control it? this might reduce the demand of oil because of lockdown

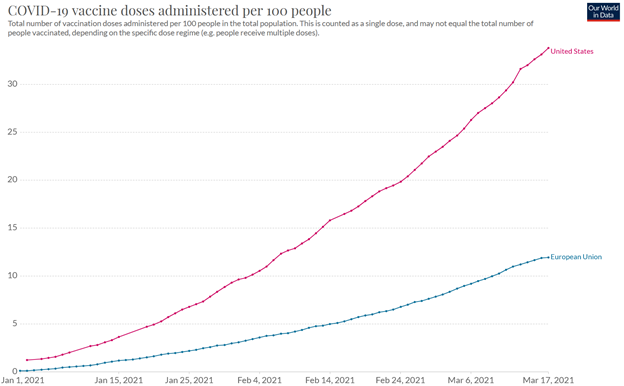

from Tilson’s daily: the European Union is a mess, with vaccinations per capita reaching barely one-third that of the U.S. (source):

|

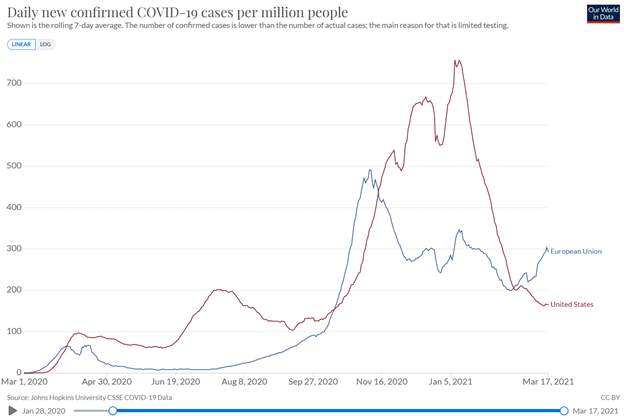

Not surprisingly, daily new cases are on the rise in the European Union and now exceed the U.S. level on a per-capita basis (source):

|

Here are three articles about the disaster in Europe:

- Italy imposes lockdown measures as cases spike across Europe

- Germany, France, Spain, and Italy are the latest to suspend use of AstraZeneca’s vaccine

- Halting a key vaccine across Europe weakens an already faltering rollout

That said, Europe will figure this out – its incompetence just means the continent will be a few months behind the U.S…

- 03/17/2021 – Oil prices fell for the third day in a row on Tuesday as the third wave of coronavirus infections in Europe and slowing vaccine rollouts in the EU added to a stronger U.S. dollar to weigh on the market.

Oil Extends Losses On Renewed Demand Concerns

As of 10:23 a.m. EDT on Tuesday, WTI Crude prices had dropped below the $65 a barrel mark and were trading at $63.87, down by 2.29 percent on the day. The prompt Brent Crude price was also down, by 1.93 percent at $67.61.

While data from Asia and the United States point to a rebound in fuel demand, some major economies in Europe are headed toward a third wave of COVID-19 infections and new restrictions. Italy has announced in recent days a new nationwide lockdown through Easter weekend, while Germany admitted that it was in a third wave of rising cases.

Adding to those concerns about major European economies and oil demand in Europe, several EU nations, including the biggest—Germany, France, and Italy—suspended vaccinations with the AstraZeneca vaccine amid concerns of blood clots as potential side effects. Those concerns have yet to be reviewed by regulators, while the World Health Organization (WHO) says that there is no proven link between blood clots and the AstraZeneca shot.

Brent prices continue to trade in a relatively tight range of $67 to $70, which “highlights the short-term risk of the market having reached a level from where current fundamentals are not yet strong enough to support further short-term strength,” Saxo Bank analysts said on Tuesday.

“While rising US bond yields and the stronger dollar has lowered investment appetite, these developments may also signal a stronger recovery in global demand is needed to justify even higher prices,” the analysts noted.

- 03/17/2021 – IEA does not expect oil to enter a “supercycle,” or extended period during which prices rise well above their long-run trend. The IEA expects the cuts carried out by OPEC+ will reduce inventories. But not just yet. “The prospect of stronger demand and continued OPEC+ production restraint point to a sharp decline in inventories during the second half of the year. For now, however, there is more than enough oil in tanks and under the ground to keep global oil markets adequately supplied,”

Why an oil price ‘supercycle’ is unlikely

The International Energy Agency said Wednesday that it does not expect oil to enter a “supercycle,” or extended period during which prices rise well above their long-run trend.

“Oil’s sharp rally to near $70 per barrel has spurred talk of a new supercycle and a looming supply shortfall. Our data and analysis suggest otherwise,” the IEA said in its latest monthly report.

Some analysts are expecting crude prices to surge near $100 per barrel as coronavirus lockdowns end and travel resumes. But the IEA, which monitors energy market trends for the world’s richest countries, thinks there is too much oil sloshing around global markets for a supercycle to take hold.

“For a start, oil inventories still look ample compared with historical levels despite a steady decline from a massive overhang that piled up during [the second quarter of 2020],” it said.

The IEA expects the cuts carried out by OPEC+ will reduce inventories. But not just yet.

“The prospect of stronger demand and continued OPEC+ production restraint point to a sharp decline in inventories during the second half of the year. For now, however, there is more than enough oil in tanks and under the ground to keep global oil markets adequately supplied,” the IEA said in its report.

- 03/16/2021 – Biden’s energy agenda to reduce oil production and boost price

Biden’s Energy Agenda To Reduce Oil Production And Boost Prices

Joe Biden had a neat, nine-point plan for energy when he campaigned for president. He started putting this plan into action on his first day in the White House with the cancellation of the notorious Keystone XL pipeline and has since then continued with his tough stance on fossil fuels.

The argument that this tough stance will, in fact, benefit oil producers has been made since the campaign trail. It went like this: Biden’s fight for less oil and gas and more renewable energy will hurt U.S. oil and gas producers, but it will not reduce American demand for oil and gas, hence it will benefit the industry, just not the U.S. industry.

The argument makes sense, and there is plenty of proof: after canceling the Keystone XL, Alberta oil producers increased the amount of oil they sent to U.S. refineries by rail—a less safe method of transporting crude, by the way. Biden’s moratorium on new oil and gas leases on federal land was one of the factors that pushed oil prices higher earlier this year. And the Biden administration’s attitude to Saudi Arabia may have contributed to the Kingdom’s decision to extend its voluntary oil production cuts that contributed to the latest price rally.

That last point was recently made by Schork Group principal Stephen Schork to Fox News. Schork said that in addition to making it clear that oil and gas were no longer a priority for the government (except in negative terms), Biden’s treatment of Saudi Arabia had resulted in higher prices.