Study of FTR

- 04/29/2019 – Frontier Communications: Short Interest Surges And Daily Volume Ebbs As We Approach Q1 2019 Earnings

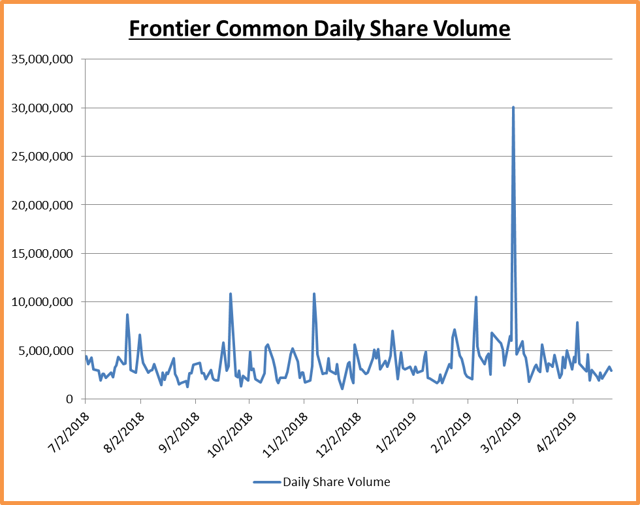

53% short interest and lower daily volume, could this be a big short-squeeze?

Summary

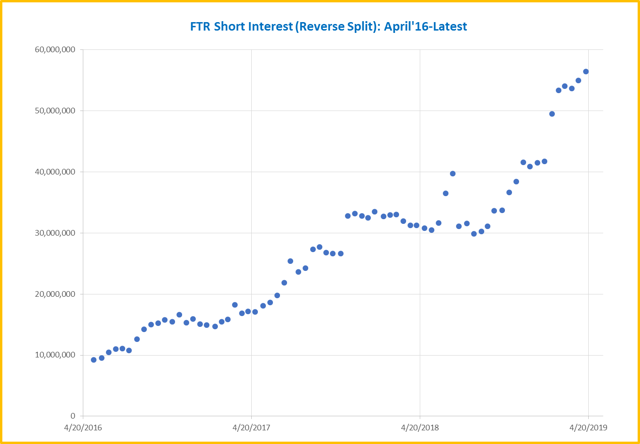

1. Short interest reached yet another all-time high at 54,343,035 shares at the close of trading on April 15th, 2019, a 2.6% increase from the previous report (itself an all-time high).

2. This represents 53% of the outstanding share count at the end of Q4 2018.

3. “Days to cover” metric was reported by Nasdaq to be 15.3 days while I calculate 14.9 days using Yahoo Finance volume report.

4. Short interest continues to surge as average daily volume appears to be ebbing.

5. The 200-day MA, which has represented an upper boundary for market pricing, is declining rapidly towards current pricing, setting up tension on whether the stock will be driven down further or whether it will break out of a three-year constraint.

- 04/28/2019 – Is Frontier Communications a Buy?

It was arguably a smart move at the time. Frontier spent $10.54 billion to purchase Verizon’s (NYSE: VZ) wireline business in California, Texas, and Florida (CTF), doubling the size of the company in a bold move to compete with bigger players in the cable and internet space.

The problem is the deal, which closed in April 2016, happened right around the time that cord cutting began to accelerate. Basically, Frontier bought a declining asset at peak prices. The CTF deal closed as consumers began to not only leave cable, but move to cable-based internet service instead of the phone-based product Frontier had purchased.

Owning the former Verizon properties did allow Frontier to implement over $1 billion in synergy-based cost savings. That’s encouraging, but the company has steadily lost money and subscribers in every quarter since the deal closed.

- 04/21/2019 – CTF markets – California, Texas, Florida

one news: Frontier takes another step toward CTF growth, but legacy challenges remain

04/23/2019 – Frontier Communications (FTR) Expected to Beat Earnings Estimates: Can the Stock Move Higher?

- 04/21/2019 – unsecured debt and secured debt

What is Unsecured Debt

Unsecured debt is a loan that is not backed by an underlying asset. Unsecured debt includes credit card debt, medical bills, utility bills and other types of loans or credit that were extended without a collateral requirement. This type of debt presents a high risk for lenders, also referred to as the creditor, since they may have to sue for repayment if the borrower doesn’t repay the full amount owed.

BREAKING DOWN Unsecured Debt

Unsecured debt can be personal or business debt. As a result of the high risk to the lender, unsecured debt tends to come with high interest rates, which increases the financial burden on the borrower. Borrowers can wipe out unsecured debt by declaring bankruptcy, but taking this dramatic step makes it more difficult to obtain a future unsecured loan.

Secured Debt Vs. Unsecured Debt

Unlike unsecured debt, secured debt is backed by an asset, such as real estate or a vehicle, also known as collateral. Under the terms of a secured loan, the lender is allowed to seize the collateral used to guarantee the loan if the borrower defaults. Examples of secured debt include mortgages, which are secured by real estate, and title loans, which are secured by vehicles. Since the borrower has more to lose by defaulting on a secured loan and the lender has something to gain, this type of debt is less risky for the lender, and therefore comes with lower interest rates when compared to unsecured debt.

Collecting Unsecured Debt

If a person fails to make payments on unsecured debt, the creditor first contacts him to try and receive payment. If the borrower and the creditor cannot reach a repayment agreement, the creditor’s options include reporting the delinquent debt to a credit reporting agency, selling the debt to a collection agency and filing a lawsuit. If the creditor files a lawsuit in state or federal court, a court ruling may force the borrower to use specific assets to repay the unsecured debt.

Corporate Unsecured Debt

Since unsecured debt is risky, in addition to higher interest payments, bond rating agencies usually give the debt a low rating. For example, on June 20, 2016, Kroll Bond Rating Agency (KBRA) assigned a senior unsecured debt rating of BBB+ to a bond issued by Sioux Falls, South Dakota-based Meta Financial Group. The highest rating that the financial group could have received was a AAA rating. A junk bond rating is BB.

Since the debt was not backed by an asset, the BBB rating was based on Meta Financial Group’s robust liquidity profile, strong asset quality metrics and positive risk-weighted capital ratios. If the debt was secured, there is a high likelihood that the bond rating agency would have given a rating of A or higher.

- 04/21/2019 -basic knowledge of revolving loan facility and term loan

What Is a Revolving Loan Facility?

A revolving loan facility is a financial institution that lets the borrower obtain a business or personal loan where the borrower has the flexibility to draw down, repay and redraw loans advanced to it. This type of loan is considered a flexible financing tool due to its repayment and re-borrowing flexibility. It is not considered a term loan because during an allotted period of time the facility allows the borrower to repay the loan or take it out again.

What Is a Term Loan?

A term loan is a loan from a bank for a specific amount that has a specified repayment schedule and either a fixed or floating interest rate. A term loan is often appropriate for an established small business with sound financial statements and the ability to make a substantial down payment to minimize payment amounts and the total cost of the loan.

- 04/21/2019 – basic knowledge of CAF and FTTH

Broadband has gone from being a luxury to a necessity for full participation in our economy and society – for all Americans. For that reason, the FCC has adopted comprehensive reforms of its Universal Service Fund (USF) and Intercarrier Compensation (ICC) systems to accelerate broadband build-out to the approximately 23 million Americans (as of December 31, 2013) who lack access to infrastructure capable of providing 10/1 Mbps fixed broadband. This reform will expand the benefits of high-speed Internet to millions of consumers in every part of the country by transforming the existing USF into a new Connect America Fund focused on broadband.

Consumers everywhere – both urban and rural – will benefit. Reform will not only drive economic growth in rural America, but will expand the online marketplace nationwide, creating jobs and businesses opportunities across the country.

FTTH

Fiber to the home (FTTH), also called “fiber to the premises” (FTTP), is the installation and use of optical fiber from a central point directly to individual buildings such as residences, apartment buildings and businesses to provide unprecedented high-speed Internet access.

04/19/2019 – basic knowledge on 5G backhauls: Can 5G Backhaul Itself?

What is 5g backhaul?

Smart operators and providers are learning all they can about 5G already today. A key requirement to meet 5G service demands is a flexible wireless backhaul infrastructure which meets more stringent performance, reliability, and operational efficiency targets.

Let’s start at the beginning: 5G is all about a new wireless technology that transmits data really fast between a cell tower and a phone, right? That’s true, but equally important to 5G is what that cell tower is connected to — that’s called backhaul. After all, it’s that backhaul connection that plays a big role in how your phone ultimately reaches Facebook’s servers or Netflix’s CDN.

Most of the time, at least in this country, that cell tower routes (backhauls) the traffic it collects within its coverage area through a fiber running between the tower and a nearby switching center. Once the traffic hits that switching center, it’s then routed to its destination along the nation’s core Internet backbone. Think of it like driving around a city until you get onto the interstate.

“We do use microwave in certain special niche conditions. Clearly, fiber is best simply because of its ability to expand, especially when you talk about gigabits coming from the cell. When you have many users using gigabits, fiber is definitely the medium to get that done,” said Mike Haberman, VP of Verizon’s network engineering. He declined to say exactly how much of Verizon’s traffic was backhauled through wireless. “It [fiber] is certainly available in most all places. It’s really come a long way in the last 10 years. We especially like dark fiber, in that way you can expand it and do what you need to do.”

In general, though, analysts’ attitude toward the market potential for wireless backhaul can be described as “meh.”

“We have been tracking wireless backhaul for years, and honestly it has never accelerated because operators prefer to future-proof with fiber,” said Joe Madden of Mobile Experts. “So it has turned out to be a fairly boring segment of the market.”

And that relatively ho-hum view of wireless backhaul is also held by Ericsson’s Hansryd and Mähler, the two executives who are probably the deepest into the Inception-like nature of wireless and wireless backhaul.

“You really need to have multiple backhaul solutions.” Mähler said, explaining that it makes sense to use fiber where it’s available (and it’s readily available in large parts of developed countries like Japan and the United States) and to use wireless where it makes sense (like in developing countries, where it’s really expensive to deploy fiber).

“They are two complementing technologies,” he said.

- 02/15/2019 – churn rate: the annual percentage rate at which customers stop subscribing to a service or employees leave a job.

“the churn rate for cable is much higher than that for satellite services”

Unsecured debt: is a loan that is not backed by an underlying asset. Unsecured debt includes credit card debt, medical bills, utility bills and other types of loans or credit that were extended without a collateral requirement.

Secured Debt Vs. Unsecured Debt: Unlike unsecured debt, secured debt is backed by an asset, such as real estate or a vehicle, also known as collateral. Under the terms of a secured loan, the lender is allowed to seize the collateral used to guarantee the loan if the borrower defaults.

Revolver debt, also known as revolving debt, is a form of credit that can be accessed by corporations and individuals. What separates revolving debt from regular installment loans, then? In a regular loan, the borrower is given access to a fixed sum of money that must then be amortized and paid off over the loan term. For example, a borrower may have been lent $100,000 by a bank to start a business. The term of the loan is two years, and the borrower is required to pay the $100,000 plus interest back over this period.

In revolver debt, the borrower is instead given a line of credit with a maximum limit. The borrower can access any amount up to this limit at any time and does not have a specific term to pay the loan back. However, interest will accrue on any outstanding funds borrowed. For example, a borrower is given a revolving line of credit with a maximum limit of $100,000 by a bank to start a business. The borrower can take out $0, $1,000 or $95,000 tomorrow, depending on his or her needs.

Difference between Revolver Debt and Installment Loans

- In revolver debt, the borrower can re-access any funds that have been paid back. In installment loans, once the loan has been repaid, the borrower must reapply for a second loan if he or she wishes to borrow more.

- In revolver debt, there may not be a fixed payment value or term. In installment loans, the interest and principal payments are fixed.

- Revolver debt will usually come with higher interest rates than installment loans, due to the greater uncertainty with repayments.

02/08/2019 – remember earning date of FTR is 02/26, try to finish study of it before the earning date

02/07/2019 – Frontier says Gfast creates speed equality in Fios footprint

02/06/2019 – If Frontier Can Dodge Its Debt Risk, Its Equity Could Have 25x Upside By 2021

- FTR is down about 97% in the last 5 years as the company’s massive $17B debt load and out of date infrastructure have turned off potential equity investors.

- We examine the company’s debt maturity schedule and free cash flow estimates to arrive at the conclusion that it may not be the bankruptcy story the equity is pricing in.

- If the company can dodge its bankruptcy risk, which we believe is possible, the equity could stand to have massive upside by 2021.

- By the end of 2020, once there is a clearer picture of the Frontier turnaround, net debt levels could be an estimated ~14.776B for a total equity value of $5.084b or just under $50 per share, a return of almost 25x (if using LEAPs, the return can be 50~100x). This level of potential return rarely exists in the market today and often only comes from severely depressed stock prices.

02/04/2019 – Frontier Green Shoots To Consider Approaching Q4 Earnings

- Starting in October, the infrastructure fee doubled from $1.99 to $3.99 across 4.2M customers.

- Q4 and Q1 are the quarters where Frontier makes the majority of its annual cash flow due to lower CapEx.

- There’s a lot of low hanging fruit that the new marketing guy from Bain can circle the wagons around and target as part of the rebrand.

- Having a larger fiber footprint allows for marketing and delivering services that would have previously not been possible.

- The market is not appreciating the quality of their asset base. It is assigning a runoff multiple when it should be growth.