High tech

- 01/11/2021 – section 230 is critical for high tech media companies and airbnb too. We will see how Biden admin will revoke it

Airbnb’s Section 230 Use Underscores Law’s Reach Beyond Facebook

Home-rental site is caught up in political push to change internet shield even as its efforts to use law haven’t always worked

- 01/10/2021 – pay special attention to these guys: paypal mafia

PayPal’s founders & first employees also helped to launch and/or fund: SpaceX YouTube Facebook LinkedIn Uber Tesla Square Airbnb Reddit Yelp Lyft Pinterest Tumblr Twilio Quora Postmates Eventbrite Palantir Zynga

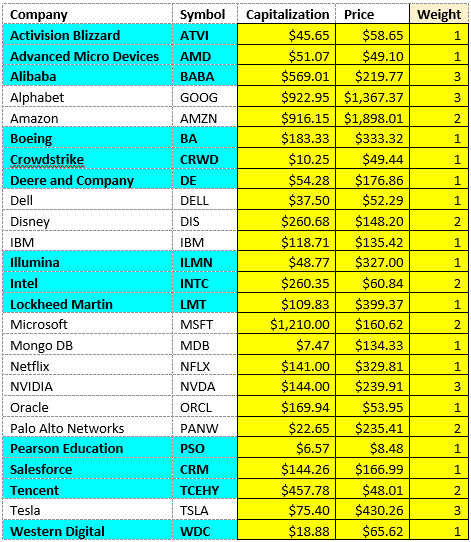

- 01/07/2021 – good to study AI companies, also Cathie Wood’s portfolio

The AI Portfolio: 99% YoY Profit, Review, And Adjustments

- The AI Portfolio of 25 companies achieved a 99%, which is 600% better than the S&P and 1,600% better than the Dow Jones in 2020.

- COVID-19 had a very positive impact on AI technology and resulted in AI models that are less reliant on historical data.

- For its third year, a few changes were made to the AI Portfolio, and it will now have 31 companies.

- For 2021, I expect the AI Portfolio to have a much better performance compared to the market indices.

- This article discloses the unique portfolio management method adopted for the AI Portfolio.

What are the industries?

The industries that were included in the AI Portfolio are basically the same except for the addition of “Retail” as a new industry addressing both e-commerce and traditional retail, and combining the two software categories into one. Here is the list of industries:

- Agriculture

- Cybersecurity

- Education

- Financial Services

- Gaming

- Hardware – Disk Storage

- Hardware – Processor Development

- Healthcare

- Military and Defense

- Retail (New)

- Software (Combined)

- Transportation and Self-Driving Vehicles

- Video Streaming, Entertainment and Original Content

Each one of these industries deserves an article of its own to properly address, so we will focus here instead on the specific companies within each industry.

- 01/06/2021 – For the first time ever, unmanned aircrafts will be able to both fly over people and operate at night under new rules cemented by the U.S. Federal Aviation Administration. – I need to watch out these Drone companies. This is the future of post office.

Drones set to deliver packages ‘everywhere’ in country in near future

Unmanned aircrafts will be able to fly over people and operate at night under new rules cemented by FAA

Instant delivery of packages, groceries and restaurant meals are one step closer to a reality under new commercial drone regulations.

For the first time ever, unmanned aircrafts will be able to both fly over people and operate at night under new rules cemented by the U.S. Federal Aviation Administration. The changes will bring a boost to the future landscape of the commercial drone industry, which is sending more companies to produce drone fleets to expedite deliveries.

One startup in Chicago, Valqari, has found a way to integrate landing pads into home design. The company, founded in 2017, is developing drone-delivery mailboxes that can accommodate any type of shipment, ranging from perishable foods to consumer goods to prescription drugs. Once the package is inserted into the mailbox door, an elevator raises it to a retractable door, activated by the drone. The aircraft can then latch onto the parcel and take off for transport. Similarly, the destination tower can receive packages that are dropped off and delivered straight to the mailbox.

- 12/21/2020 – it is worthwhile to study these two companies

Lidar stocks soar after report that Apple is working on a car for 2024

- Reuters reported on Monday that Apple is aiming to start production of an Apple-branded car for consumers as soon as 2024.

- That boosted the stocks of two companies that make lidar sensors, a core component for self-driving cars that allows their computers to take a 3D image of the world around them.

- Velodyne stock rose nearly 23% on Monday. Luminar rose over 27%.

- 02/17/2020 – US is planning to limit China’s access to chip equipment. Might hurt Applied Materials and Lam research profit in the short term. Might benefit NOK and ERIC.

U.S. Weighs New Move to Limit China’s Access to Chip Technology

Trump administration targets Huawei with proposed changes to restrict use of American chip-making equipment

The Trump administration is weighing new trade restrictions on China that would limit the use of American chip-making equipment, as it seeks to cut off Chinese access to key semiconductor technology, according to people familiar with the plan.

The Commerce Department is drafting changes to the so-called foreign direct product rule, which restricts foreign companies’ use of U.S. technology for military or national-security products. The changes could allow the agency to require chip factories world-wide to get licenses if they intend to use American equipment to produce chips for Huawei Technologies Co., according to the people familiar with the discussions. Chinese companies are bound to see the action as a threat to them too, which is a goal of the proposed rule, said the people briefed on the effort.

The move is aimed at slowing China’s technological advancement but could risk disrupting the global supply chain for semiconductors and dent growth for many U.S. companies, U.S. industry participants said.

U.S. chip-manufacturing tool makers, such as Applied Materials Inc. and Lam Research Corp., are among the biggest in the industry. The equipment they make is some of the most expensive machinery in the world. Setting up a modern chip factory typically costs many billions of dollars, and new restrictions on U.S. equipment could drive customers toward alternatives.

“It would be a huge disincentive for any fab to use U.S. equipment because there would be a limitation on that versus Japanese or Chinese equipment,” one of the people said.

The restrictions, if enacted, could reverberate to semiconductor-design companies, many of them American, that don’t produce their own hardware but rely on contract chip manufacturers.

…

The restrictions also could hit earnings for Applied Materials, Lam Research and other U.S. chip-manufacturing machinery companies. The companies didn’t immediately respond to requests for comment.

5G

- 02/20/2020 – a great website to study all 5G stocks

Top 5G Stocks for Q1 2020 Quarter

- 02/19/2020 – I need to dig into each one of them to find the gem

7 5G Stocks to Buy Now for the Future

These 5G names are great for investors hoping to ride the trend’s growth wave

Top 5G Growth Stocks With Highest EPS Fundamentals

- 02/18/2020 – 5G tower is the future of 5G REIT

Three Cell Tower Companies Become the Hottest Play in Real Estate

With rollout of 5G networks and promise of self-driving cars, the value of towers is expected to rise

The three publicly listed cell-tower companies all rallied last week after a federal judge cleared the merger of mobile carriers T-Mobile and Sprint Corp. Shares of American Tower Corp., Crown Castle International Corp. and SBA Communications Corp. each gained more than 4% on Feb. 11, the day of the judge’s ruling.

- 02/17/2020 – amazing 5G download speed!

Huawei 5G millmimeter wave speed record broken by Ericsson with 4.3Gbps Download speed

In recent times, technological advancements have been significant in many areas, especially in information and data infrastructures. It is now viable to stream 4K videos and movies at home all in part due to faster data rates and download speeds. Now, the record for the fastest download speeds has been broken after Ericsson said its latest 5G hardware is capable of 4.3Gbps.

According to Ericsson, its latest network infrastructure for 5G has enabled a full hour long 4K video to be transferred in just 14 seconds, which is great news considering this will be available to the general consumers. The company’s engineers in Stockholm have apparently hit a download speed of a whopping 4.3Gbps. This breaks the previously held record which was set by Huawei in October 2019 with a download speed of 3.67Gbps.

- 02/15/2020 – The start of roll out is unexpected slow. But the long term perspective is very bright.

Superfast 5G Rollout Hits Slow Patch, Some Equipment Suppliers Say

Ericsson, Xilinx and Juniper are among 5G suppliers seeing lull

The rollout of new 5G wireless networks is showing signs of slowing, denting near-term sales prospects for some networking equipment makers and potentially delaying access for some consumers to the lightning-fast data speeds the technology promises.

Industry officials say there is no common cause for the slowdown seen across multiple markets, with various countries affected by different dynamics. In some cases, the equipment makers say, telecom providers want certainty that the investments made will reap returns before plowing more money into further infrastructure.

- 02/12/2020 – Good argument on why not investing in capital intensive companies like NOK and ERIC. “For the moment (10/29/2019 -article time), investors should steer clear of telecommunications companies and focus on component manufactures of equipment that will be necessary for the new 5G-capable smartphones.” so it is better to invest in MU and QCOM because of its .

Has the 5G Wireless Revolution Been Overhyped?

At present, only a small group of companies have a clear path for capitalizing on the new networking technology

The difficulty carriers must surmount is finding a way to monetize or extract revenue from the new higher-speed devices. The 5G build out for telecommunications companies is a monumental capital equipment and labor-intensive undertaking. In a recent report, Craig Moffett , a telecom analyst with MoffettNathanson, calculated that over the past nine years, data consumed per wireless device has increased 89-fold, while average revenue per device has dropped 12.6%. “The carriers have failed at extracting additional revenue from additional data consumption,” he wrote.

Moffet further contended that: “Most of the use cases we’ve heard don’t make sense, yet the capital requirements for densifying networks are very real.”

But what about the return for the carriers supplying the higher speeds? As Moffett noted: “Simply using more data at higher speeds— we’ve all heard about the dream of downloading a full season of ‘Game of Thrones’ in seconds before boarding a plane—has up to now been a dry well for wireless revenue generation.” The dilemma for the carriers is, given the enormous expense associated with building out the 5G network, what strategic plan is in place to profit from the enterprise?

For the moment, investors should steer clear of telecommunications companies and focus on component manufactures of equipment that will be necessary for the new 5G-capable smartphones. Chipmakers will be among those in the tech sector that will stand to profit in the immediate future from the dramatically increased memory requirements the architecture of the new 5G phones requires.

The advantage for investors is that regardless of the enhanced benefits to consumers from 5G-capable wireless networks, new handsets will need more memory and other newly engineered components in great quantities.

Consider the quantum increase in memory chips that will be needed to handle the new, faster 5G networking demands. According to Sumit Sadana, chief business officer at memory maker Micron Technology (NASDAQ:MU), an average midrange 5G phone will need six gigabytes of DRAM, an increase from the four gigabytes design in current phones. Higher-end handsets will need eight to 12 gigabytes of DRAM, an increase from that current configuration of six gigabytes.

Qualcomm (NASDAQ:QCOM) is another company that stands to profit, given its core markets for mobile phone chips. The company is well positioned to gain more revenue with the demand for increased components as well as increased licensing fees. CEO Steve Mollenkopf says that the company, on average, gets approximately 1.5 times as much revenue from a 5G phone as from a 4G handset.

Investors need to be prudent and selective concerning the companies that can leverage their existing products to take advantage of the 5G rollout. For the moment, that universe, to an extent, is limited to chip manufactures, who can respond to the dramatically increased demand for the necessary memory configurations required.

- 02/12/2020 – U.S. can help with both NOK’s costs and customer financing to counteract Huawei

The U.S. Already Has a $60 Billion Huawei Solution

(Bloomberg Opinion) — It might be the first workplace tip I was ever given: Always propose a solution when pointing out a problem.

The U.S. seems finally to have taken the adage to heart for its approach to China’s Huawei Technologies Co. Attorney General William Barr suggested on Friday that the U.S., either directly or in a consortium with private American or “allied” companies, consider taking a controlling stake in Huawei’s biggest telecommunications-equipment rivals: the European companies Ericsson AB and Nokia Oyj.

Sure, the proposed solution might be ill-considered — in this context there is such a thing as a bad idea — but let’s keep things upbeat and try to find a way to make it workable. Where there’s a will, there’s a way, and all that.

Having a positive cross-Atlantic proposal on the table is a refreshing change from the U.S.’s general tone over the past 14 months, characterized as it has been by sniping and threats toward nations considering Huawei kit for the fifth-generation mobile networks that are crucial to making the Internet of Things a reality. (As early as 2009, the U.S. found so-called “back doors” in Huawei’s mobile-phone networks and has been telling allies such as the U.K. and Germany about them since late last year, the Wall Street Journal reported on Tuesday.)

The U.K., which has been actively managing the role of Huawei’s gear in its network for a decade, has plowed ahead irrespective, albeit with some important checks and balances which seem a sensible way of limiting malicious actors’ access. As Barr himself said on Friday, “It’s all very well to tell our friends and allies that they shouldn’t install Huawei, but whose infrastructure are they going to install?”

QuicktakeHow Huawei Landed at the Center of Global Tech Tussle

The proposal was welcomed by some, not least by Cevian Capital AB, the activist fund that’s Stockholm-based Ericsson’s biggest shareholder. No surprise there. Takeover talk helps a share price, and both Ericsson and Helsinki-based Nokia have been among the five worst-performing stocks in the MSCI World Information Technology Index in the past decade.

To find a workable solution, a good place to start is to identify the problem. Barr stated it thus:

The question is whether, within this window, the United States and our allies can mount sufficient competition to Huawei to retain and capture enough market share to sustain the kind of long-term and robust competitive position necessary to avoid surrendering dominance to the Chinese.

That makes it seem like a question of capital. But if cash is what Nokia and Ericsson need, the solution is not simply to acquire them. Were Ericsson to become the target, the buyers would likely need to spend $40 billion on the deal — money that would go straight into the pockets of existing investors before a cent was injected into the firm’s operations. That seems a shoddy allocation of taxpayers’ money. If equity was indeed the means by which to invest, then perhaps a capital increase would be the best option? But for shareholders to stomach the sort of dilution involved, there would have to be a clear way for the firm to benefit from the proceeds and translate them into more value.

QuicktakeThe 70-Year-Old Spy Alliance the U.S. Says It May Cut Off

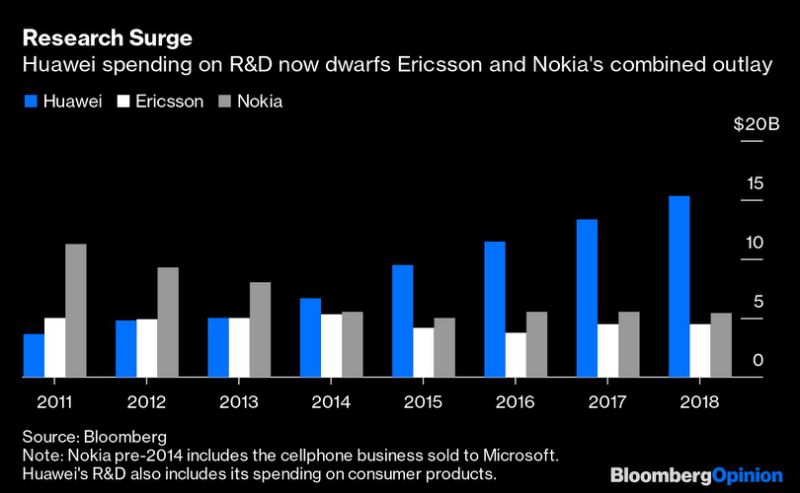

Why would either firm need the capital? Their disadvantage to Huawei in recent years has been their inability, first, to invest in research and development at the same pace, and second, to see their customers’ network costs subsidized with generous financing offers. Huawei has benefited from as much as $75 billion in state-backed financial assistance over the years, the Wall Street Journal reported in December. That helped it charge about 30% less than rivals for its gear. It’s all very well seeking a market-based solution, but China has been leaning on the scales.

Being undercut by Huawei has made it harder for Nokia and Ericsson to foot the massive R&D expense that’s needed while they’re having to compete more viciously on price. That’s left them lagging in key technologies related to 5G such as network slicing, a much sought-after technique that will let carriers allocate their capacity more efficiently. Catching up could cost each firm $5 billion, a significant sum similar to what they’re each already spending annually, which already represents an eye-watering 20% of sales. The companies probably have three years before carriers start seeking such capabilities with gusto.

The best approach from the U.S. would therefore be to help with both those costs and customer financing. Investing in R&D would have the corollary benefit of creating well-paying American jobs, adding to the combined 24,000 people that the two Nordic companies already employ in North America.

Interestingly, on the financing side, the U.S. already has just the mechanism in place — with the U.S. International Development Finance Corporation, which will have a budget of $60 billion to help developing countries and businesses purchase equipment. The agency’s chief has intimated it plans to help counteract Huawei. It started operations in December. Ensuring it has the necessary budget scope also to help firms in developed economies will be essential.

Barr’s suggestion may not be a practical one — Larry Kudlow, an adviser to President Donald Trump, acknowledged as much by saying that the U.S. would not be buying either firm — but hopefully it signals a change in American thinking that could lead to workable solutions.

- 02/11/2020 – good for ERIC and NOK, bad for Huawei

U.S. Officials Say Huawei Can Covertly Access Telecom Networks

Trump administration ramps up push for allies to block Chinese company

- 02/04/2020 – US pushing advanced software for 5G networks

U.S. Pushing Effort to Develop 5G Alternative to Huawei

Companies including Dell, Microsoft and AT&T are part of the effort, White House economic advisor Larry Kudlow says

WASHINGTON—Seeking to blunt the dominance of China’s Huawei Technologies Co., the White House is working with U.S. technology companies to create advanced software for next-generation 5G telecommunications networks.

The plan would build on efforts by some U.S. telecom and technology companies to agree on common engineering standards that would allow 5G software developers to run code on machines that come from nearly any hardware manufacturer. That would reduce, if not eliminate, reliance on Huawei equipment.

Companies including Microsoft Corp., Dell Inc. and AT&T Inc. are part of the effort, White House economic adviser Larry Kudlow said.

“The big-picture concept is to have all of the U.S. 5G architecture and infrastructure done by American firms, principally,” Mr. Kudlow said in an interview. “That also could include Nokia and Ericsson because they have big U.S. presences.”

- 01/19/2020 – 5G will impact 6 industries significantly, but the road might be long and many obstacles stand

How 5G Will Change So Much More Than Your Phone

New wireless technology promises to make everything connected. Here’s a sample of what that could mean.

Here’s a rundown of how this new telecom technology could transform six industries, how long those changes might take and what obstacles stand in the way.

- Flexibility in the factory

- Cars get fueled up with data

- A new angle on sports

- More immersive movies and games

- A new doctor-patient relationship

- Making surveillance more precise

- 01/19/2020 – Government collaboration and deregulation will help catch up the 5G race. To release the spectrum by giving agencies a larger cut of auction proceeds will help.

How the U.S. Can Catch Up in the 5G Race

Government collaboration is much more important in building out the network than it was for 4G

A winning formula

The U.S. isn’t starting from scratch, however. Indeed, in one important way it has a head start: The country is covered by the most extensive web of 4G networks in the world. Those networks can be upgraded to the world’s most extensive 5G coverage if cities and counties can expedite the permits needed for network updates and resist charging excessive fees and lease terms for cells on public property.

Congress also should address the spectrum bottleneck that wireless carriers face. Federal agencies possess nearly half of the premium spectrum but have few incentives to release it for commercial operations. Congress should consider giving these agencies a larger cut of auction proceeds to encourage them to release underused spectrum.

American regulators, government and industry are playing catch-up on 5G. But with a combination of responsible use of public assets and light-touch regulation of 5G services, we can still win this race.

- 01/06/2020 – Good intro for 5G – What’s Ahead for 5G This Year

CIOs say the technology is overhyped, but the infrastructure is improving

In the global race for 5G, U.S. telecom firms have a unique disadvantage: limited access to the “goldilocks” band of radio frequencies. That’s pushing U.S. firms toward a less practical version of 5G. WSJ explains the science and its implications. Illustration by Carlos Waters / The Wall Street Journal