Energy and Metals

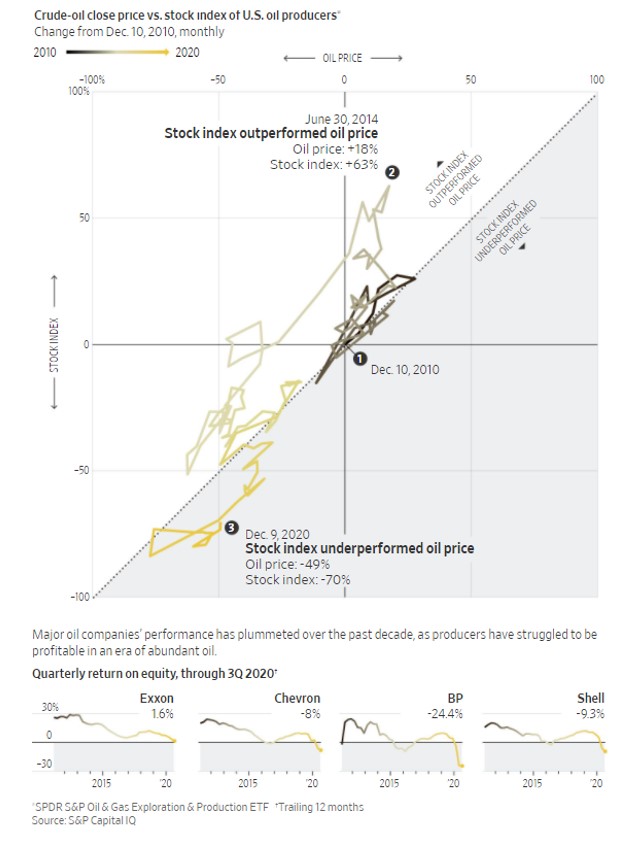

- 03/16/2021 – If this is true, then it is not good to invest in oil industry; or, is it article just a propagadar for renewable energy? I need to investigate it

Fossil Fuels Are Wildly More Expensive Than Previously Thought, Study Says

Overinflated fossil fuel investments might be a ‘worthless’ bubble waiting to trigger the next crash, while renewables seem more appealing than ever.

A new study finds that conventional electric power plants powered by fossil fuels and hydro are massively overvalued by the world’s leading analyst organizations. The report says they are overvalued to such a degree that the trillions of dollars of investment in these industries could amount to a “bubble” similar to the subprime mortgage housing bubble whose collapse triggered the 2008 financial crash.

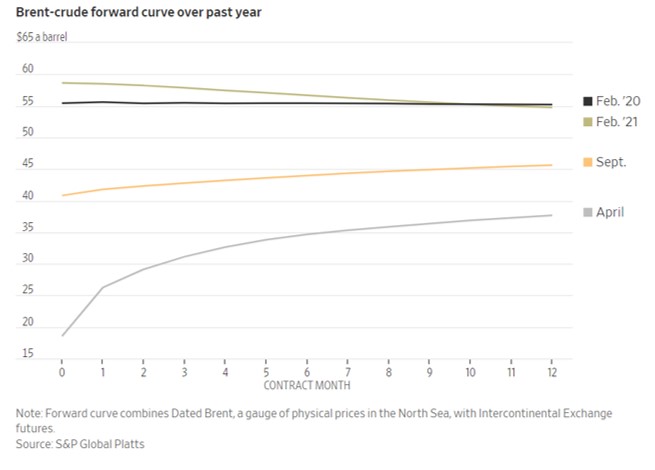

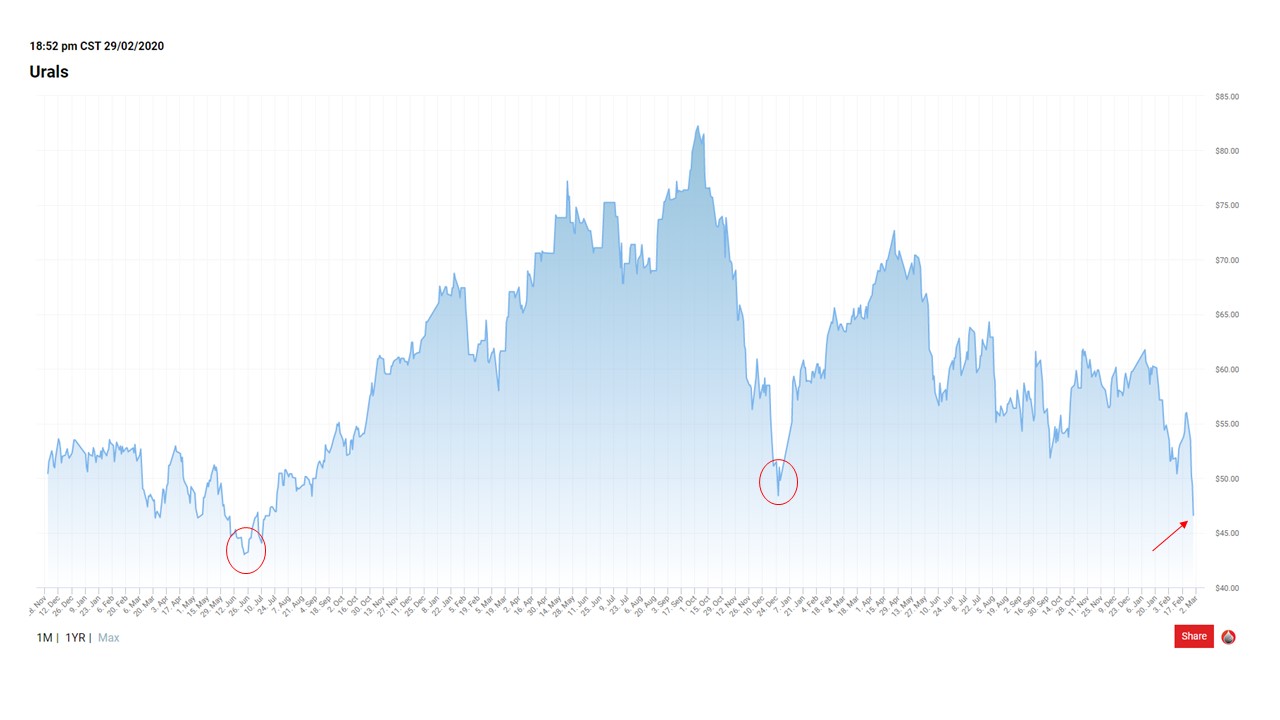

- 03/16/2021 – watch out the future price calculation method change in Brent crude

Crude-Oil Price Overhaul Hits Delay Amid Shipping-Cost Uproar – WSJ

Platts defers plan to include West Texas oil prices in its basket of international crudes following pushback from industry

Prices of Texas oil were going to be included in assessments of Brent crude, the benchmark price underpinning the world’s most important commodity market, starting in July 2022. That has been delayed by data provider S&P Global Platts after the energy industry pushed back on key details, in particular who would pay for freight costs.

The proposed change was meant to reflect the growing importance of U.S. exports in global energy markets.

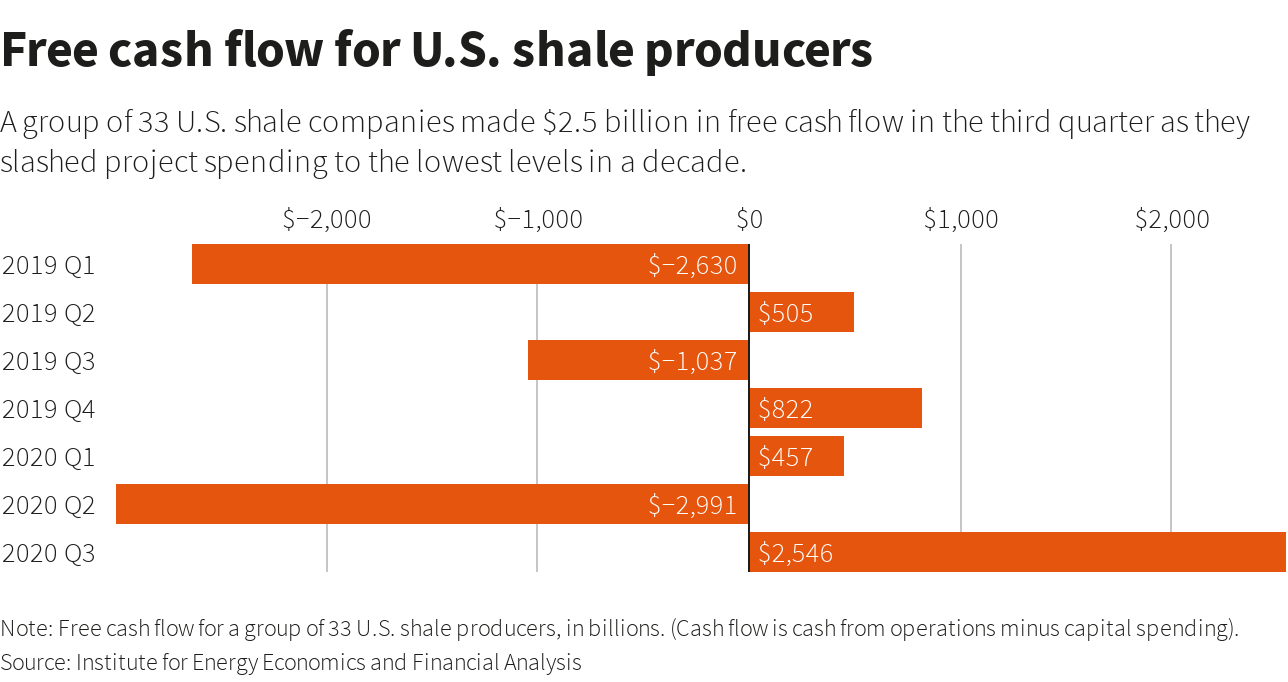

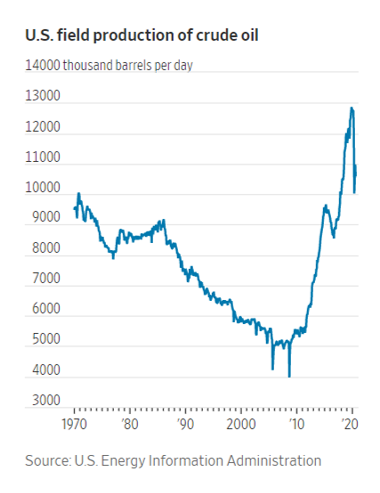

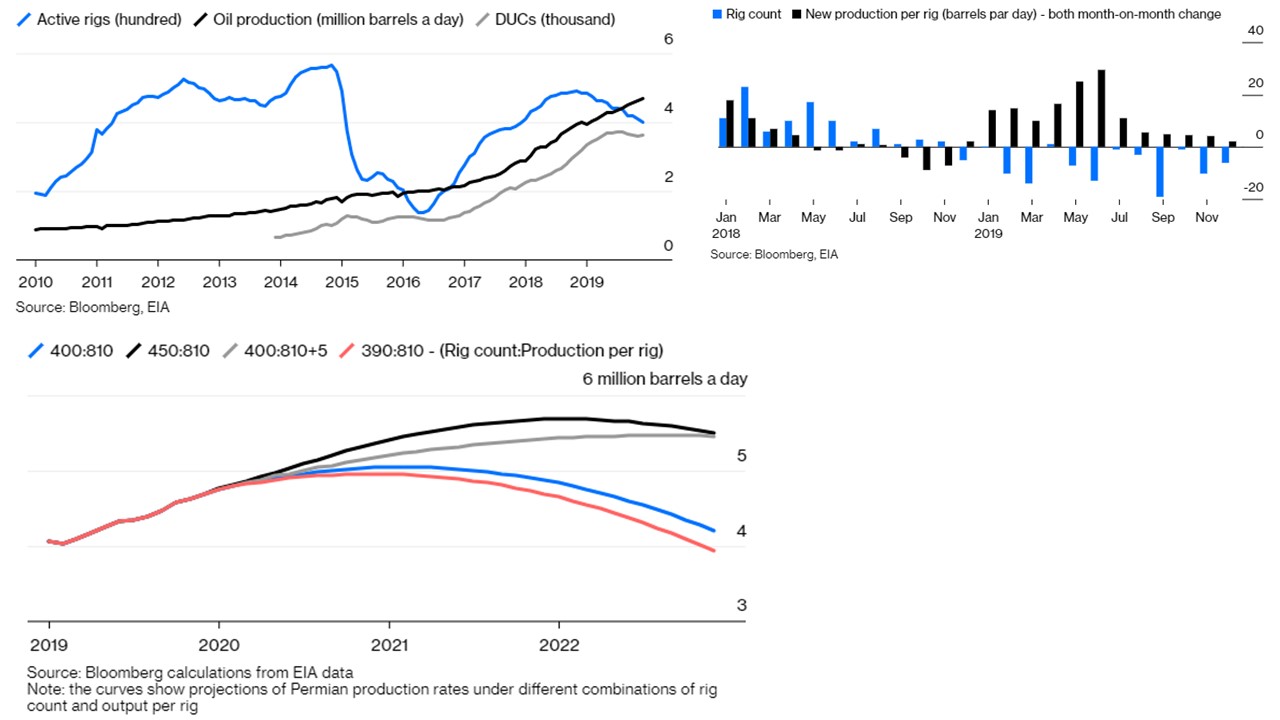

- 03/15/2021 – U.S. shale firms vow to strict capital discipline and only small increase of production (from 6.5 million barrels per day (bpd) in 2020 to 7.2 million bpd in 2021), although oil prices have rallied this year. EIA expects U.S. production in 2022 at 12.0 million bpd, up by 500,000 bpd compared to the February STEO forecast because of higher expected crude oil prices.

The Big OPEC+ Gamble Appears To Be Paying Off

U.S. oil firms focused exclusively on the shale patch are expected to only marginally increase their combined production this year compared to 2020, according to Bloomberg Intelligence data of listed companies—a sign that OPEC+ could be right, at least for now, that $70 oil would not unleash a massive production increase from the United States.

According to Bloomberg Intelligence data, the largest listed U.S. shale firms who have no production outside America are set to raise their production from 6.5 million barrels per day (bpd) in 2020 to 7.2 million bpd in 2021—a modest increase compared to the previous two boom-and-bust cycles.

Most public U.S. shale firms continue to vow strict capital discipline, although oil prices have rallied this year and WTI Crude is currently trading at over $65 per barrel. Major listed companies promise that any excess cash flow will go to additional payouts to shareholders, who have seen years of meager returns while the shale patch was chasing drilling and production records.

However, smaller privately held oil firms are benefiting from higher oil prices as their primary way of generating cash is increased production. This could spoil the oil management policy of the OPEC+ group again. The plans of smaller shale drillers remain “an open-ended question,”

Current oil prices are high enough to warrant increased U.S. shale activity in the second half of the year if prices hold around these levels, JP Morgan said last week.

“At current prices, most U.S. onshore operators are economic, leaving a vast group of operators, from large public companies to private players, in good position to ramp up activity in 2H21 and build solid momentum for higher volumes in 2022,” analysts at JP Morgan said in a weekly note as carried by Reuters.

The EIA still sees U.S. crude oil production this year slightly down from last year, at 11.1 million bpd in 2021 compared to 11.3 million bpd in 2020. However, in its latest Short-Term Energy Outlook published last week, EIA expects U.S. production in 2022 at 12.0 million bpd, up by 500,000 bpd compared to the February STEO forecast because of higher expected crude oil prices.

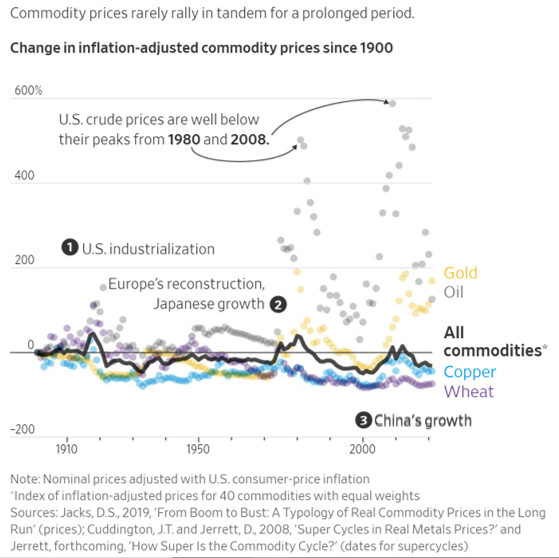

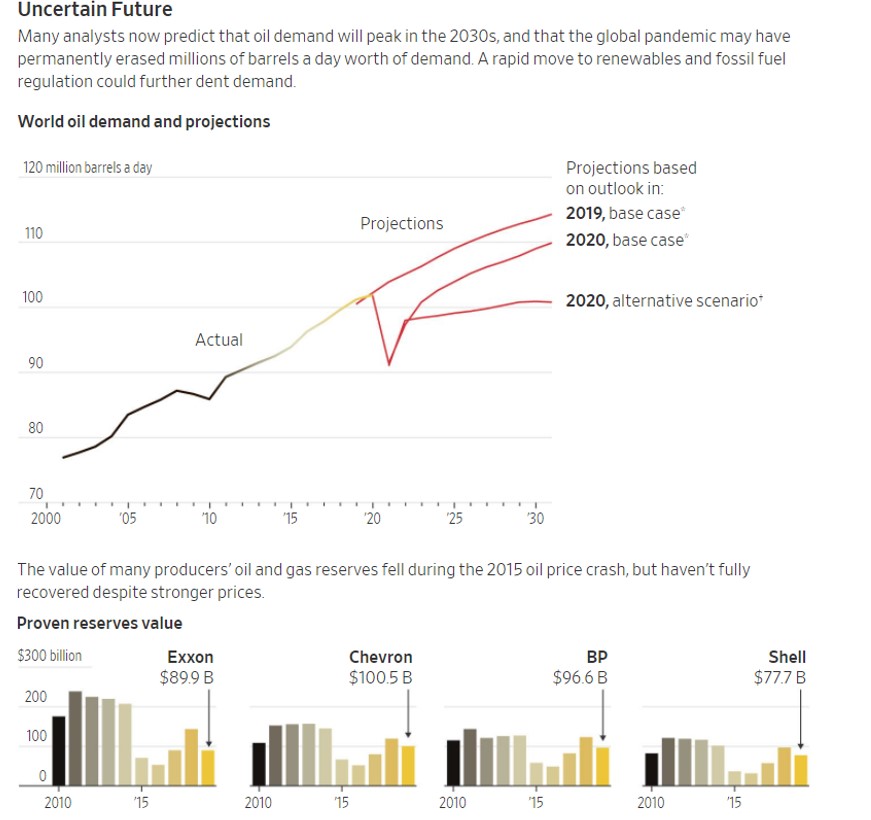

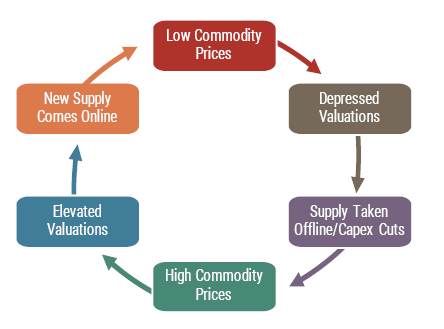

- 03/14/2021 – the oil and commodity supercycle might only occur when a major economy such as the U.S. or China undergoes rapid industrialization or urbanization, creating demand for raw materials that existing supplies struggle to meet. If there is no new US infrustructure plan, it is very difficult to have this supercycle. Even though there might be supercycle, it might not prolonged since When resources’ prices swing higher for an extended period, one of three things happens. The first is an economic shock, such as the recession in the 1970s, caused in part by the Arab oil embargo. The second is a rush of supply as miners, energy producers and farmers seek to cash in. Over time, people switch to cheaper alternatives. – does this mean that if oil and commodity price shoot up too fast, I might need to think about getting out fast? Also, please note that Adjusting for inflation, U.S. crude prices in 2020 were well below their peaks from 2008 and 1980, though they were more than double the 1945 level. – so there might still be quite some room for oil/commodity to run up? The current outlook for commodity prices is especially complicated because of a number of competing forces. The production cuts and a recovery in demand in China and India have helped oil prices rebound since crashing last spring. Brent crude futures have gained a third this year to about $69 a barrel. Some investors are betting they could surpass their all-time high of $148 a barrel in 2008. U.S. production won’t keep up with the recovery in consumption due to restrictions on drilling on federal lands and belt-tightening by producers, said Christyan Malek, head of oil and gas research at JPMorgan Chase & Co. Cutting emissions at wells will boost production costs, and big oil companies are investing in renewable-energy sources instead of crude, he added. The world’s biggest independent oil trader doesn’t see an imminent supply crunch. “We have plenty of reserves in the ground, we have plenty of refining capacity and we have plenty of ships to move oil,” – A number of competing forces to affect the oil price, hard to predict. Some investors are betting they could surpass their all-time high of $148 a barrel in 2008.

Commodities Supercycle Looks Like a Stretch – WSJ

Some investors are betting prices will surge over a long period, but history suggests the conditions aren’t right

Commodity markets are roaring, stirring a debate about whether prices are headed for an extended upswing. The history of booms and busts in raw materials suggests the conditions aren’t right.

A prolonged upturn would present investors with an opportunity to make money from long-term bets on exchange-traded products that track commodity prices. Such vehicles bloomed in popularity when commodity markets soared in the 2000s and early 2010s, only to fall out of favor when prices tanked in 2014.

But the chances of commodity prices rising in tandem over a long period are slim. Such cycles are rare. They have occurred when a major economy such as the U.S. or China undergoes rapid industrialization or urbanization, creating demand for raw materials that existing supplies struggle to meet.

When resources’ prices swing higher for an extended period, one of three things happens. The first is an economic shock, such as the recession in the 1970s, caused in part by the Arab oil embargo. The second is a rush of supply as miners, energy producers and farmers seek to cash in. Over time, people switch to cheaper alternatives.

Adjusting for inflation, U.S. crude prices in 2020 were well below their peaks from 2008 and 1980, though they were more than double the 1945 level, according to data compiled by Mr. Jacks. Inflation-adjusted grain prices have dropped since World War II due to advances in crop science, Mr. Jacks said.

“Is there anything out there like that now? I don’t see it,” Mr. Jerrett said.

The China-led supercycle kicked off with crude-oil and copper prices at their lowest level in more than a decade. That isn’t the case now: Copper prices, for instance, are close to record highs.

The current outlook for commodity prices is especially complicated because of a number of competing forces.

A big unknown is how the drive to cut carbon emissions shifts supply and demand for different commodities. Switching to cleaner sources of energy will likely turbocharge purchases of materials such as copper and nickel, bulls contend. Before those efforts choke off demand for gasoline and diesel, a dearth of investment in the oil industry could buoy crude prices, too.

For now, however, the oil market remains on life support from members of the Organization of the Petroleum Exporting Countries and Russia, which are holding millions of barrels of crude in the ground each day to bolster prices.

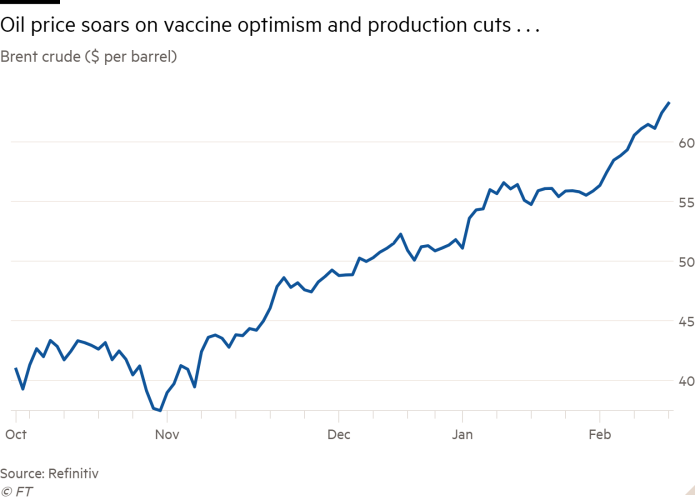

The production cuts and a recovery in demand in China and India have helped oil prices rebound since crashing last spring. Brent crude futures have gained a third this year to about $69 a barrel. Some investors are betting they could surpass their all-time high of $148 a barrel in 2008.

U.S. production won’t keep up with the recovery in consumption due to restrictions on drilling on federal lands and belt-tightening by producers, said Christyan Malek, head of oil and gas research at JPMorgan Chase & Co. Cutting emissions at wells will boost production costs, and big oil companies are investing in renewable-energy sources instead of crude, he added.

The world’s biggest independent oil trader doesn’t see an imminent supply crunch. “We have plenty of reserves in the ground, we have plenty of refining capacity and we have plenty of ships to move oil,” said Giovanni Serio, head of research at Vitol.

- 03/10/2021 – Tepper adds some energy companies: OXY (2%),XLE (1.77%), XOP, KMI, ET on Q4 2020

Tracking David Tepper’s Appaloosa Management Portfolio – Q4 2020 Update

This quarter, Tepper’s 13F portfolio value increased ~18% from $5.66B to $6.69B. The number of holdings increased from 31 to 44. The top five positions are T-Mobile US, Amazon, Micron Technology, Facebook, and PG&E Corp. They add up ~45% of the portfolio.

New Stakes:

Occidental Petroleum (OXY): OXY is a ~2% of the portfolio stake established this quarter at prices between ~$8.90 and ~$21.30 and the stock currently trades well above that range at $31.23.

Qualcomm (QCOM) and SPDR Energy ETF (XLE): QCOM is a 1.37% of the portfolio position established this quarter at prices between ~$116 and ~$159 and the stock currently trades at ~$130. The 1.77% XLE stake was purchased at prices between $27.70 and $41.60 and it is now at $52.95.

Note: Qualcomm is back in the portfolio after a quarter’s gap. It is a frequently traded stock in Tepper’s portfolio.

Macy’s Inc. (M), CarMax Inc. (KMX), Kohl’s Corp (KSS), Enterprise Products Partners (EPD), SPDR S&P Oil & Gas ETF (XOP), and iShares MSCI South Korea ETF (EWY): These are very small (less than ~1% of the portfolio each) new stakes purchased this quarter.

Alliance Data Systems (ADS), EQT Corp (EQT), Freeport-McMoRan (FCX), MPLX LP (MPLX), Magellan Midstream (MMP), Dragoneer Growth Opportunities (DGNR), and Kinder Morgan (KMI): These are minutely small (less than ~0.5% of the portfolio each) new positions established this quarter.

Energy Transfer LP (ET): Energy Transfer Partners merged with Energy Transfer Equity and the resulting entity was renamed Energy Transfer LP (ET). The transaction closed last January, and terms were 1.28 shares of ETE for each ETP. Tepper held shares in both and those got converted to ET shares. There was a stake doubling in Q4 2019 at prices between $11 and $13. Next quarter saw another ~45% stake increase at prices between $4.55 and $13.75. Last two quarters also saw a ~60% stake increase at prices between $5.11 and $7.15. The stock is now at $8.15 and the stake is at 2.22% of the portfolio.

- 03/10/2021 – should I look at some individual oil companies for possible better return?

Crude oil prices close higher on economic outlook, plunging fuel inventories

- All 11 S&P sectors trade higher today, with energy (XLE +2.7%) taking the lead and extending its YTD gain to 38%, as the outlook continues to brighten for the pandemic-hit global economy.

- Gains in oil and gas names accelerated following a modest turnaround in crude oil prices after the latest weekly inventory report showed a big build; April WTI crude (CL1:COM) closed +0.7% to $64.44/bbl, while May Brent (CO1:COM) settled +0.6% to $67.90/bbl.

- Among today’s noteworthy stock winners in the sector: RIG +19.1%, HFC +6.2%, VLO +6%, MPC +4.4%, PSX +4.2%, KMI +3.9%, XOM +3.2%, COP +3%.

- Gains in gas E&Ps are particularly striking, including SWN +13.9%, AR +12.2%, RRC +9.1%, COG +3.8%.

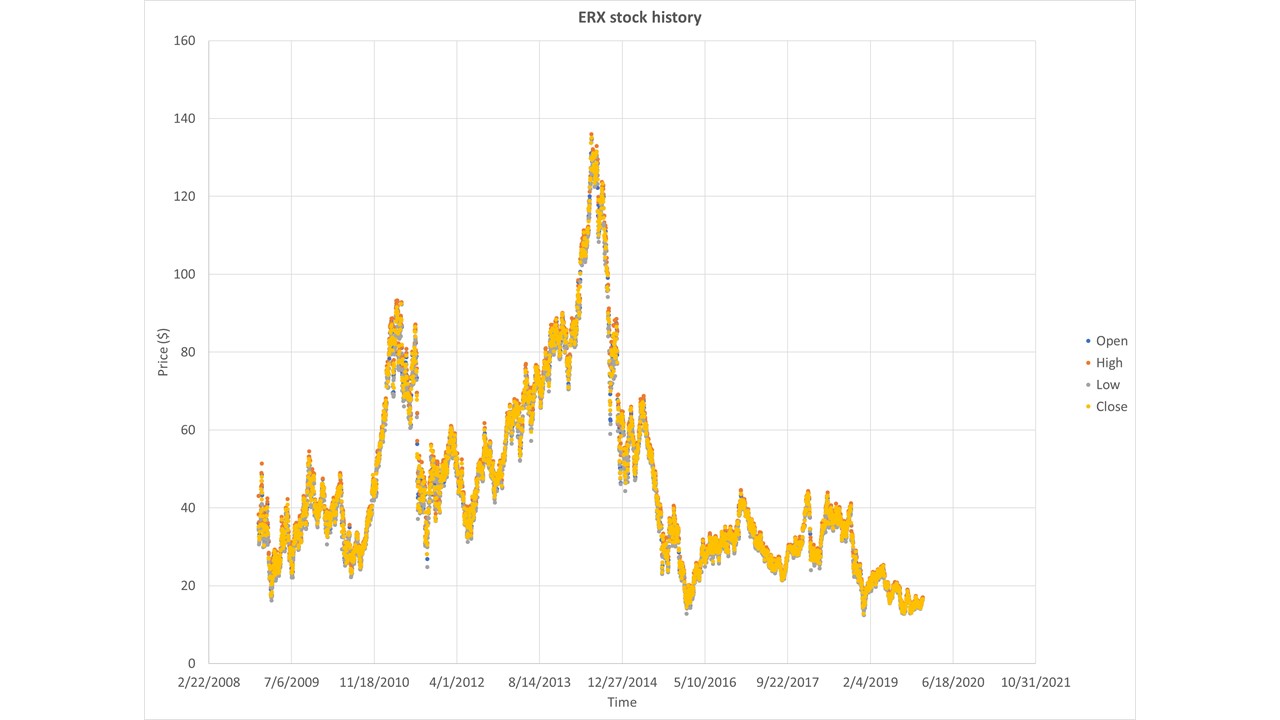

- ETFs: USO, XLE, UCO, XOP, VDE, GUSH, OIH, ERX, BGR, BNO

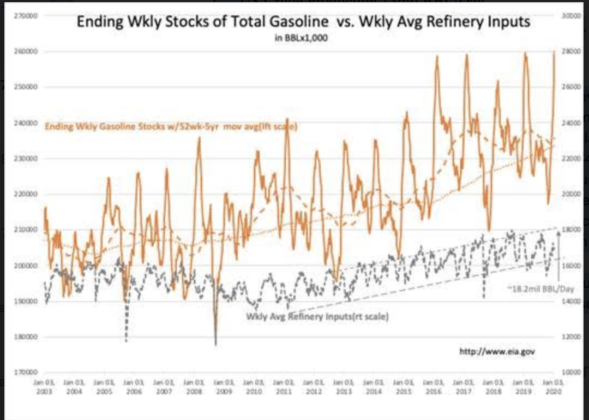

- The U.S. Energy Information Administration reported that U.S. gasoline stocks fell by a much more than expected 11.9M barrels last week, and distillates fell 5.5M barrels, but crude oil stockpiles jumped 13.8M barrels, far exceeding forecasts for a 816K-barrel increase.

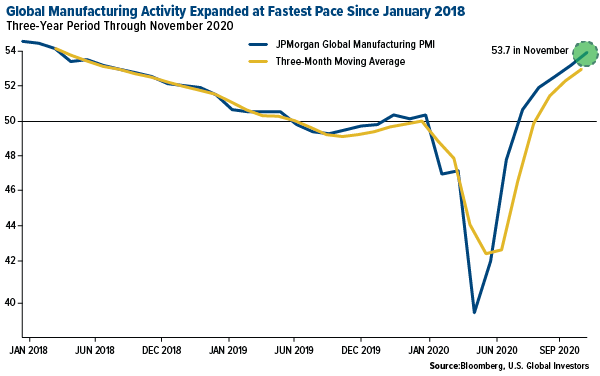

- The OECD raised its outlook for global economic growth to 5.6% for this year and 4% for next year, after previously forecasting 2021 growth of 4.2%.

- “When it comes to lifting market sentiment, there is very little that can rival an upgrade to the post-COVID economic recovery,” says PVM’s Stephen Brennock.

- 03/09/2021 – large inventory build is not good, even though with large draw

Oil Prices Slide On Yet Another Surprise Inventory Build

The American Petroleum Institute (API) reported on Tuesday a build in crude oil inventories of 12.792 million barrels for the week ending March 5.

Analysts had predicted an inventory build of 816,000 barrels for the week.

In the previous week, the API reported a major build in oil inventories of 7.356-million barrels after analysts had predicted a 928,000-barrel draw. But that was nothing compared to the EIA’s report a day later of a 21.6 million barrel build.

It is unclear whether today’s reported stock build is part of EIA’s large build reported last week, or whether we will see another large build from the EIA tomorrow.

The API reported another large draw in gasoline inventories of 8.499 million barrels for the week ending March 5—on top of the previous week’s 9.933-million-barrel draw. Analysts had expected a 3.467-million-barrel draw for the week.

Distillate stocks saw a large decrease as well, of 4.796 million barrels for the week, after last week’s 9.053-million-barrel decrease.

Cushing inventories rose by 295,000 barrels. Last week, inventories at the Cushing oil hub increased by 732,000 barrels.

- 03/09/2021 – he might have some good points on oil

I think oil is the play for a couple months…

As states begin to open up we use more oil. Last week it was Texas and Idaho, on the weekend it was Arizona and West Virginia more states open on the weekly. More traveling more spending.

Schools are opening up. The work from home families are gonna be driving to drop the kids off.

Airlines are announcing more flights are being scheduled for an increase in demand.

Construction projects start in spring and go through summer.

Cruises announced they’ll be starting trips with fully vaccinated travelers.

Speaking of vaccinated. Vaccines are rolling out ahead of schedule, so move the opening up times sooner.

We also started droning the middle east again. The military runs on oil.

But the biggest indicator of an oil boom. Is oil literally going boom. Saudi Arabia was attacked, and we all know SA is a US ally.

on top of alllllllll this. The biggest case for an oil boom, is, inflation of the petro-dollar. The US with all its military power has bestowed upon itself the currency in which oil is traded. We take out anyone who tries to trade using other currency *cough cough Gaddafi *

As the next stimulus package is about to be passed, The US Dollar is sure to inflate. The US dollar is no longer on the gold standard, but because the dollar is so tied to oil, it’s essentially on the oil standard. As the US dollar inflates, so must the petro-dollar.

- 03/09/2021 – will we have more demand than supply going forward? hard to predict

How Oil Could Go To $100 Per Barrel

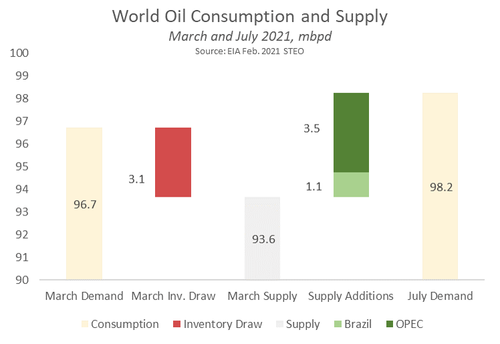

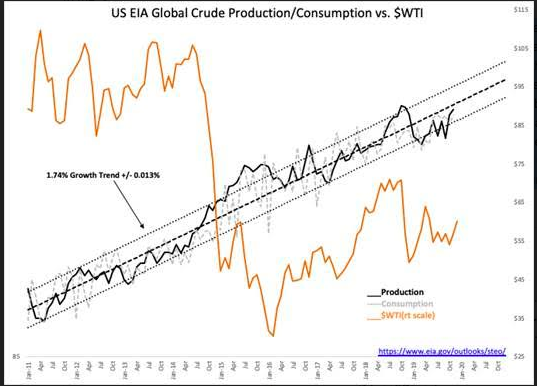

In its February Short Term Energy Outlook (STEO), the EIA forecasts this month’s world oil consumption at 96.7 million barrels per day (mbpd). The oil supply, however, is much lower, only 93.6 mbpd, with the difference of 3.1 mbpd of necessity being drawn from crude oil and refined product inventories. By historical standards, a sustained draw of 3 mbpd is large, and we would expect prices to be rising under such circumstances.

The EIA sees demand continuing to recover at a good pace to mid-year, with July world oil consumption forecast at 98.2 mbpd (but still about 4 mbpd below ‘normal’). This incremental demand is being materially supplied by two sources, Brazil and OPEC. We might accept Brazil’s crude oil production growth as given, allowing that the timing might be off by a month or two. The pivotal question is instead OPEC’s intentions.

The EIA uses a volume (or demand) driven model, implying that OPEC will passively increase production to meet demand, and thereby keep oil prices low. But why would OPEC do this? If OPEC simply maintained current production levels, the world would be 3.5 mbpd short of supply by mid-year. A shortfall of 3.5 mbpd — 3.6% of global consumption — is a lot. It would rapidly drain remaining excess inventories, leaving only oil prices to mediate between supply and demand just as the world economy is showing both strength and momentum as the pandemic ends. In other words, in the coming months consumers will be prepared to compete for the available barrels of oil, and that should push oil prices up sharply.

Middle East politics are convoluted. The complex interplay of Iran, Saudi Arabia and the United States can produce unexpected results. Were Iran more collected, it could probably bring the US back toward some sort of deal in short order, thereby freeing Tehran to increase oil exports and push down oil prices. On the other hand, the Houthi attack on Saudi oil facilities at the loading port of Ras Tanura may push the Saudis back into the US embrace and motivate the Kingdom to keep oil prices lower to curry favor with the Biden administration.

It is hard to know where the balance comes out. Nevertheless, now is OPEC’s best opportunity to make real money in the short to medium term. They would be fools to let the opportunity slip by.

- 03/09/2021 – almost 5 million bpd of OPEC production has been off the markets since May last year. Bringing any of these barrels back could have triggered prices to fall below $60, reducing cash flows for its members, and resulting in losing the opportunity to compensate for losses made during the pandemic. Now we have two drivers, the OPEC+ cuts and equally important the Saudi voluntary cuts. Generally, we would expect suppliers to be willing to increase production as prices continue to grow, yet when OPEC suppliers will be convinced to do so remains highly uncertain. Statements from the Saudi Energy Minister did confirm that at the last press conference, suggesting that these cuts may continue throughout Q-2 2021, and that these barrels will be brought back in a phased manner. This suggests that prices will be supported by not only the OPEC+ cuts, but also by Saudi voluntary cuts during Q-2 2021. – hard to predict the future move

Saudi Surprise Cut May Have Lasting Effect On Oil Prices

almost 5 million bpd of OPEC production has been off the markets since May last year. Bringing any of these barrels back could have triggered prices to fall below $60, reducing cash flows for its members, and resulting in losing the opportunity to compensate for losses made during the pandemic.

One of the key pillars of support is the rollover of the Saudi million bpd surprise cut in April, and the exemption of Russia to raise production by 130,000 bpd which may have supported the group to reach a consensus.

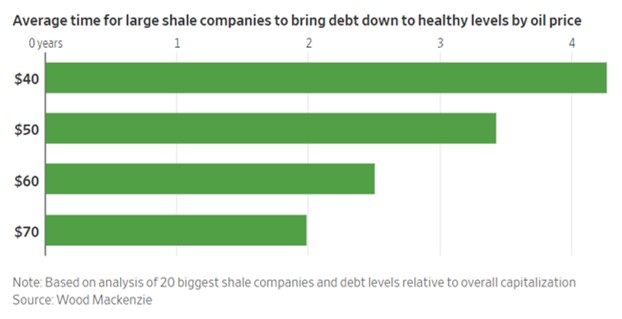

Furthermore, OPEC+ is not expecting US shale to boost production as prices continue to rise, giving producers an opportunity to compensate for lost revenues while preserving their market share. For shale oil to come back we need (1) to have oil demand returning to pre-pandemic levels, and (2) a sustained level of current prices over an extended period of time. This will be essential to restoring confidence in investing into the shale industry while minimizing risks. Last week’s EIA report showed the US production at 10 million bpd, 3.1 million bpd below its level a year ago. Under the current production scenarios, prices are expected to trade above $70 in March supported by prospects of market over-tightening, the increasing rate of global vaccination, and the increasing likelihood of certain countries returning to pre-crisis normality. Fuel demand in the US is currently improving, especially gasoline and kerosene whose demand rose by 942,000 bpd and 305,000 bpd w/w, respectively, to stand at 8.15 million bpd and 1.29 million bpd, respectively.

Last week, the OPEC+ meeting saw some unexpected results, and it is very hard to predict the next move in April and beyond. Now we have two drivers, the OPEC+ cuts and equally important the Saudi voluntary cuts. Generally, we would expect suppliers to be willing to increase production as prices continue to grow, yet when OPEC suppliers will be convinced to do so remains highly uncertain.

Even if OPEC+ agrees on a production hike in April, Saudi Arabia will likely still not be in a hurry to ease Its voluntary cuts immediately. Statements from the Saudi Energy Minister did confirm that at the last press conference, suggesting that these cuts may continue throughout Q-2 2021, and that these barrels will be brought back in a phased manner. This suggests that prices will be supported by not only the OPEC+ cuts, but also by Saudi voluntary cuts during Q-2 2021.

- 03/09/2021 – Biden government is really pushing on energy trasition, how will it impact oil industry?

Biden’s Energy Secretary To Oil Industry: Adapt Or Die

“I’m not going to sugarcoat how hard transitions are,” new United States Energy Secretary Jennifer Granholm stated on Wednesday. Her comment, made during IHS Markit’s annual CERAWeek conference, was in reference to the clean energy transition that serves as one of the cornerstones of President Biden’s platform, but she could just as easily be talking, in grander terms, about the administrative changeover that she is part of. The new presidential administration has hit the ground running on climate change, with a demonstrative focus on bringing the United States up to speed with the rest of the developed world in terms of leaning into the global green energy transition. While this proactive approach has been lauded as essential and far overdue in some circles, it also has its fair share of critics. Biden’s relatively tough stance on the United States’ massive shale oil and gas industry has stirred up a groundswell of anxiety in many parts of the country that depend on fossil fuel to keep their economies running.

Now, just when oil prices are stabilizing and the shale industry is adjusting to the new normal, the last thing those dependent on the fossil fuel sector want is more adversity. But for Granholm, this view–that the Biden administration is leaving oil and gas workers behind–is a shortsighted one. Instead, she says that oil and gas companies should be jumping at the chance to grow and innovate to stay relevant in the new, increasingly decarbonized global economy. It’s not the Biden administration that’s leaving oil and gas workers behind, the thinking goes–it’s stubborn oil and gas execs. “The bottom line is this particular growth of clean energy and reduction of carbon provides a huge opportunity and I’m extending a hand of partnership,” Granholm said at the CERAWeek conference on Wednesday.

- 03/09/2021 – is OPEC+ playing oil cartel again?

OPEC’s sneaky oil move may leave energy markets thirsty

OPEC has always been ultra-competitive but the cartel’s latest move is downright sneaky and may leave global energy markets thirsty.

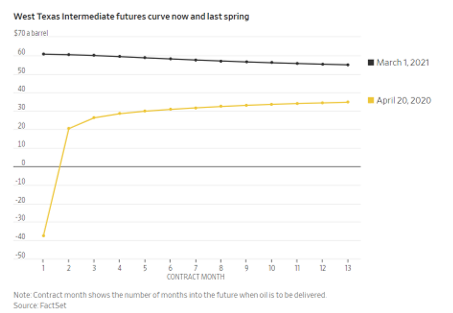

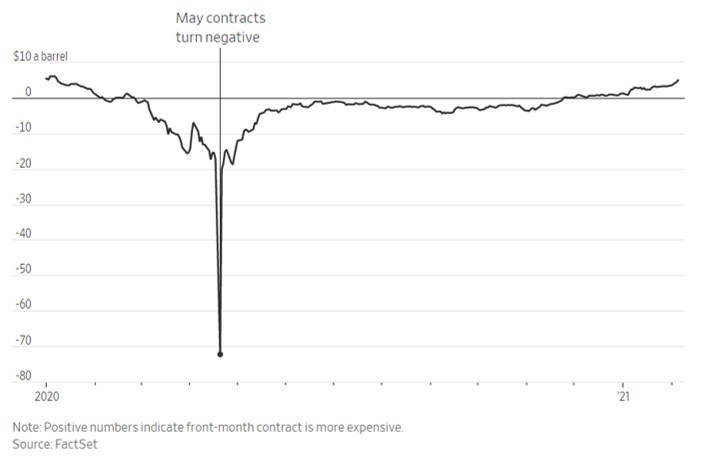

The market structure in oil is in what is known as “backwardation,” where nearby futures contracts trade at higher prices than crude in the future, suggest that the oil supply is tight and needs more supply. Right now the backwardation discrepancy is so wide it almost like the market is screaming out for help.

What Is Backwardation?

Backwardation is when the current price—spot—price of an underlying asset is higher than prices trading in the futures market. Backwardation is sometimes confused with an inverted futures curve. In essence, a futures market expects higher prices at longer maturities and lower prices as you move closer to the present day when you converge at the present spot price. The opposite of backwardation is contango, where the futures contract price is higher than the expected price at some future expiration. Backwardation can occur as a result of a higher demand for an asset currently than the contracts maturing in the future through the futures market.

- 03/07/2021 – transient news, no real impact on oil

Brent crude breaks $70 after Saudi Arabia’s oil facilities attacked by Yemen’s Houthis

- 03/07/2021 – great SA articles on oil industry in year 2021

Forget Tech, Forget Renewables, Oil & Gas Run The Show In 2021

OPEC Maintains Cuts, Oil Price Surges, Buy These 8 Stocks Now

Nobody Owns Oil And Gas Stocks Anymore, But Maybe You Should

Clean Energy Vs. Oil & Gas: The Biggest Lie Of 2020

GUSH: Global Energy’s Rebound Likely To Produce Returns In 2021

Drilling Down Oil-Focused Trading Strategies With GUSH

- 03/07/2021 – China is aggresively pursuing LNG

China’s Pursuit of Natural Gas Jolts Markets and Drains Neighbors – WSJ

Beijing’s quest to run world’s second-largest economy on cleaner energy is reshaping global trade in the fossil fuel

China’s quest to anchor its industrial growth to cleaner energy is whiplashing global prices of liquefied natural gas, reshaping trade in the world’s fastest-growing fossil fuel and raising fears of power blackouts in neighboring economies competing for the resource.

A sudden confluence of global supply outages and an unusually cold winter tripled LNG prices in mid-January to a record $32.50 a million British thermal units from early December—and brought into focus China’s increasingly outsize role.

Underpinned by its economic boom and rising presence in LNG spot markets, Beijing’s efforts to shift from coal to gas as a fuel over the longer term has drawn ever-larger LNG imports in recent years, tightening supplies available to gas-dependent neighbors Japan and South Korea. The three economies account for 60% of the world’s LNG consumption.

- 03/05/2021 – Major oil sands producers in Western Canada will idle almost half a million barrels a day of production next month due to major overhaul and maintenance. In addition, Canada’s oil industry is being shunned by some investors such as Norway’s $1.3 trillion wealth fund amid concern that the higher carbon emissions. Both will help increase oil price.

Oil Sands Give OPEC a Boost With Half-Million-Barrel Output Cut

Major oil sands producers in Western Canada will idle almost half a million barrels a day of production next month, helping tighten global supplies as oil prices surge.

Suncor Energy Inc. plans a major overhaul of its U2 crude upgrader, cutting output by 130,000 barrels a day over the entire second quarter. Syncrude Canada Ltd. will curb 70,000 barrels a day during the quarter because of maintenance in a unit.

The supply cuts out of Northern Alberta, following a surprise OPEC+ decision to not increase output next month, could add more support to the recent rally in crude prices.

Adding to its struggles, Canada’s oil industry is being shunned by some investors such as Norway’s $1.3 trillion wealth fund amid concern that the higher carbon emissions associated with oil sands extraction will worsen climate change. These forces help make future growth in the oil sands unlikely, said McKay, whose company is among the largest producers in the country.

- 03/04/2021 – surprise move by OPEC+ to keep lid on oil output, positive for oil

OPEC-Plus Keeps Lid on Oil Output, and Prices Rise – WSJ

Saudi Arabia and Russia have careened between optimism and dire warnings amid pandemic’s ebb and flow

Under the agreement reached Thursday, most members of what is known as the OPEC-plus alliance agreed to keep their output unchanged, with small exceptions for Russia and Kazakhstan, amounting to about 150,000 barrels a day combined. That brings the group’s overall agreed cuts to 6.9 million barrels a day, down from more than nine million barrels a day at the start of the crisis.

The move is a victory for Saudi Energy Minister Abdulaziz bin Salman, who has consistently urged caution on the pace of a global recovery from the pandemic, while also periodically accommodating Russia’s eagerness to open taps wider on any sign of recovery.

- 03/04/2021 – watch out the outcome of this meeting

Saudis, Russia Discuss Joint Oil Output Raise Ahead of OPEC Meeting – WSJ

Two sides are discussing combining forces to supply the world with more crude as prices rise

Ahead of a planned meeting Thursday of the OPEC-plus alliance, Saudi Arabia and Russia have started to narrow the contours of a deal that will be closely watched by oil markets.

The proposal under discussion would commit Saudi Arabia to restoring about 500,000 barrels a day of unilateral cuts it has previously made, the people said. OPEC-plus members would then restore collectively another 500,000 barrels a day, including 125,000 from Russia.

Saudi Arabia and Russia have discussed another scenario for the broader group, these people said, which would call for OPEC-plus to keep production mostly throttled back.

The added production under discussion is less than some market watchers had hoped

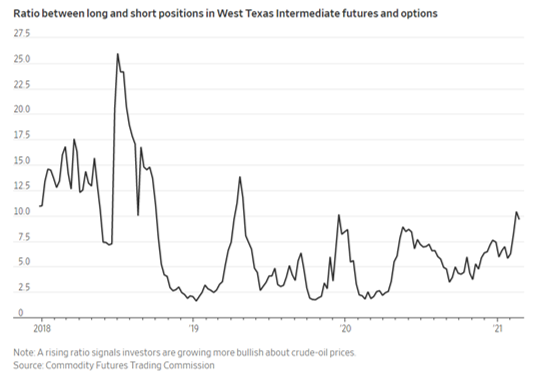

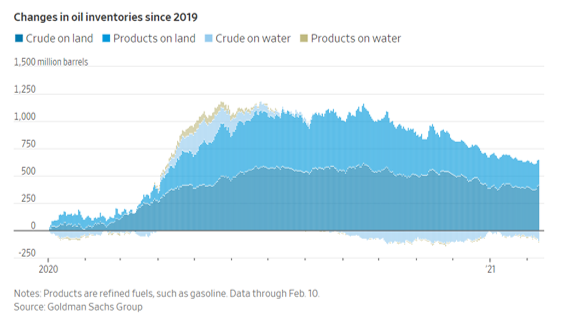

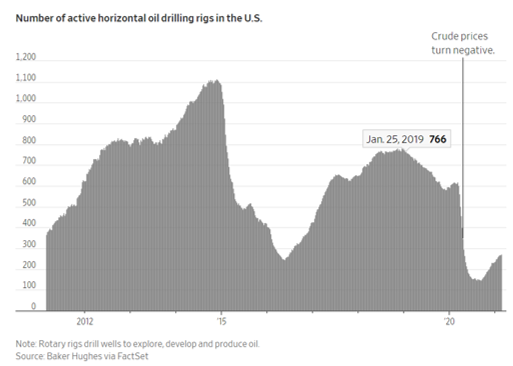

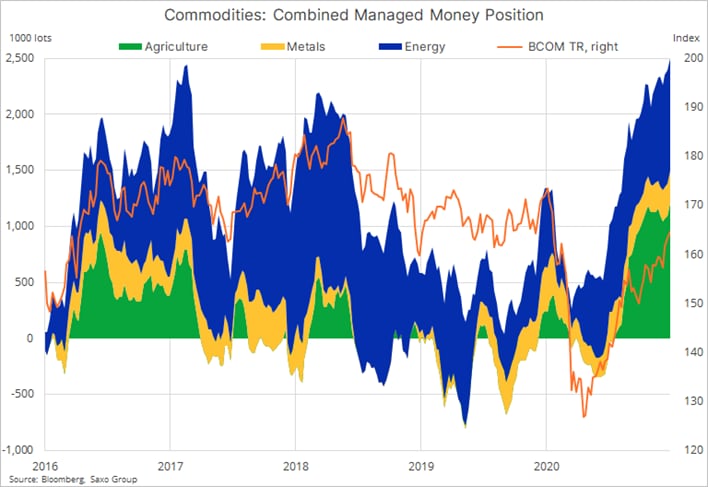

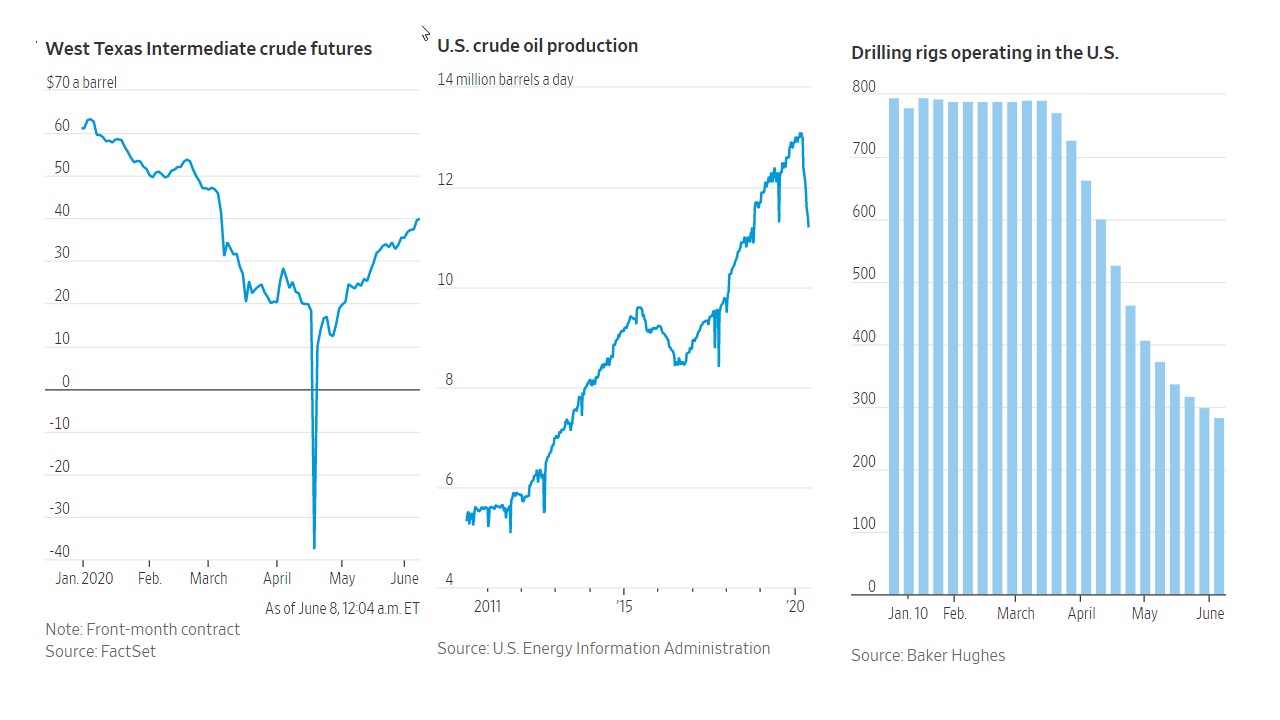

- 03/03/2021 – oil might have more room to rise since (1) low long/short ratio; (2) shrunk supply and inventories (3) downward forward curve; (4) demand on the rise due to economic recovery; (5) numbers of drill rig is less than half of year 2020. However, there is a possible short term headwind: OPEC+ might unwind some of its production cuts on March 4- could this be my another entry point?

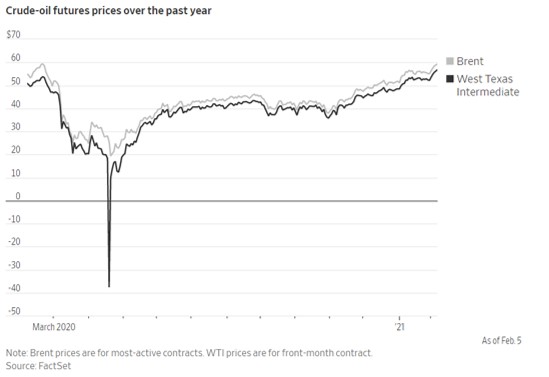

How the Oil Market Bounced Back From a Year of Crisis – WSJ

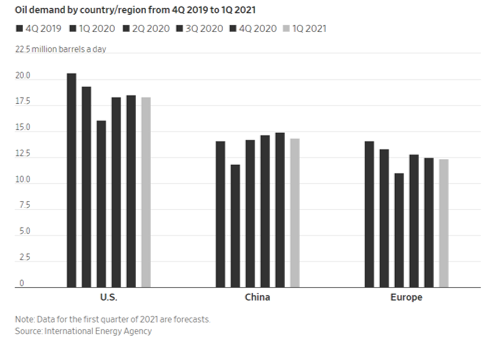

A fall in stockpiles, restraint among U.S. producers and the speedy recovery in Asian demand have driven the rally

Traders and analysts say supply and demand, rather than speculation, have underpinned the rally so far. The ratio of positions held by money managers in WTI futures and options contracts who expect oil prices to rise, versus those who expect them to fall, is below levels seen during the last big run-up in oil prices in 2018. That suggests investors aren’t in the driving seat.

Analysts say that may change if money managers pile into the oil market to bet on the reopening of economic activity.

- 03/02/2021 – activists are pushing oil companies to lock more value

Exxon Adds New Board Members Amid Activist Pressure – WSJ

Oil giant says Jeffrey Ubben and Michael Angelakis would join its board, but Engine No. 1 plans to continue proxy fight

Exxon Mobil Corp. XOM -0.24% added two new directors to its board Monday, as the beleaguered energy company tries to fend off calls for change from a pair of activist investors.

The Texas oil company said activist investor Jeffrey Ubben would join its board, along with Michael Angelakis, the chief executive officer of Atairos Group and former chief financial officer of Comcast Corp.

Exxon CEO Darren Woods said the new directors were part of a continuing effort to refresh the company’s board and reflected ongoing talks it is having with investors

- 03/02/2021 – The downside risk that the energy transition can bring to oil prices is calculated to as much as $10 per barrel in the long term

- The biggest oil firms cut thousands of jobs each

- Big Oil also slashed capital expenditure (capex) plans and continues to vow spending discipline. Many of the companies have accelerated the high-grading of their portfolios, selling non-core businesses and assets,

- Sales of non-core assets are likely to accelerate as companies would look to focus operations on the regions they have identified as key to their cash flow and return on investment generation. Such sales could also accelerate debt reduction, which has ballooned over the past year, according to Wood Mackenzie.

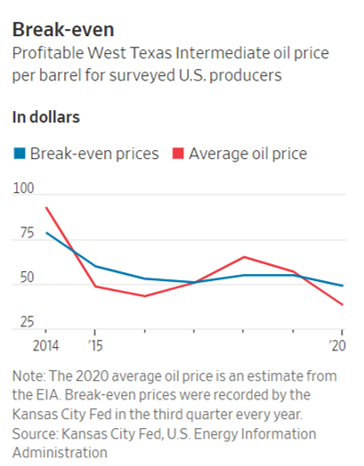

- he ultra-conservative capital spending plans and the huge cost cuts have allowed international oil companies (IOCs) to materially lower their cash flow breakevens

- easy monetary policies from governments to boost economies, and oil as a hedge against inflation for investors would lead to oil prices averaging around $60 a barrel this year, with possible spikes to $70 and even $75 before or during the summer.

Energy Transition Could Cut Oil Prices By $10 Per Barrel

The back-to-back downturns that exploration and production companies (E&Ps) have faced during the past decade have accelerated the energy transition, adding to growing social and regulatory demands for greener energy solutions. This is putting the resilience of global upstream portfolios under pressure. Energy transition experts on Rystad Energy’s upstream team have now quantified the long-term risk of this change to oil prices and to the net present value (NPV) of global oil and gas portfolios.

In an analysis marathon that has generated a series of three commentaries and a report to its clients, Rystad Energy has assessed the way E&Ps are navigating the energy transition, based on energy diversification, portfolio resilience and decarbonization. While the full in-depth findings are not going to be made public outside our client portal, in this press release we are offering a glimpse of our portfolio resilience findings.

The downside risk that the energy transition can bring to oil prices is calculated to as much as $10 per barrel in the long term, meaning oil prices could end up $10 lower in the future than they otherwise would if the transition to cleaner energy speeds up.

- 02/28/2021 – oil price is inverse to dollar price

Oil prices fall as strengthening dollar impacts commodities

Oil fell the most since November with a stronger dollar and concerns surrounding inflation weighing on crude’s best start to the year on record.

Futures in New York declined 3.2% on Friday, with a rising dollar reducing the appeal of commodities priced in the currency. Yet, the U.S. crude benchmark still managed to post a nearly 18% gain this month as inventories worldwide tighten and pockets of demand return. Domestic crude production dropped in 2020 for the first time in four years, according to the U.S. government.

“Prices have a little bit more risk to the downside from the recent run that we’ve seen,” said Tariq Zahir, managing member of the global macro program at Tyche Capital Advisors LLC. “To continue going higher from here, demand has to come back pretty substantially.”

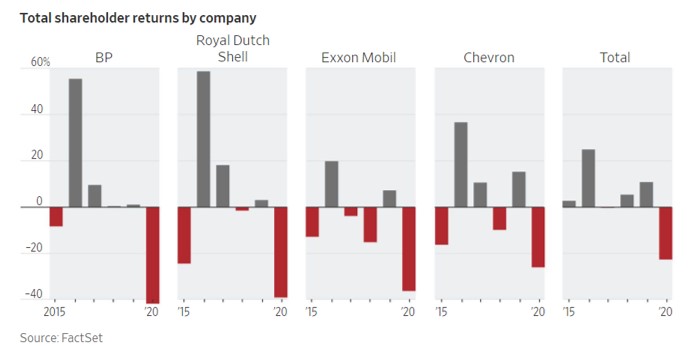

- 02/28/2021 – “The scale of the financial reset has primed the sector for a recovery in free cash flow. At an average price of US$55/bbl, we estimate free cash flow generation could top US$140 billion in 2021 – exceeding any previous year since 2006. If oil prices reach US$70/bbl, free cash flow would be double the previous peak,”

Why Big Oil Expects Record Cash Flow In 2021

The world’s largest oil companies are set for a cash flow bonanza this year, probably at record levels, as massive cost cuts in the wake of the 2020 oil price and oil demand collapse have significantly lowered the corporate cash flow breakevens for many firms.

After posting record losses in 2020, a year which company executives described as one with “the most challenging market conditions,” Big Oil is looking at 2021 with increased optimism, mostly because oil prices have rallied in recent weeks. Moreover, the ultra-conservative capital spending plans and the huge cost cuts have allowed international oil companies (IOCs) to materially lower their cash flow breakevens.

These factors are set to result in a record cash flow for the biggest oil firms this year if oil prices average $55 per barrel, Wood Mackenzie said in new research.

Currently, investment banks largely believe that a tightening oil market, easy monetary policies from governments to boost economies, and oil as a hedge against inflation for investors would lead to oil prices averaging around $60 a barrel this year, with possible spikes to $70 and even $75 before or during the summer.

“The scale of the financial reset has primed the sector for a recovery in free cash flow. At an average price of US$55/bbl, we estimate free cash flow generation could top US$140 billion in 2021 – exceeding any previous year since 2006. If oil prices reach US$70/bbl, free cash flow would be double the previous peak,” Ellacott says.

- 02/24/2021 – The Texas Freeze knocked out as much as 4 million bpd of U.S. oil production and 6 million bpd of refining capacity last week, IHS Markit said.

How Hard Did The Texas Freeze Hit U.S. Shale Production?

U.S. shale oil production in the first quarter will be lower than previously expected because of the sub-zero temperatures and snowstorms that put Texas in the spotlight last week and pushed oil prices higher.

Reuters cites several shale oil producers, including Occidental and Diamondback Energy, which expect a slow recovery in production as frozen pipelines and well equipment removed some 2 million bpd from the U.S. total.

What’s more, some of the lost production may never return because it would be too expensive to restart some smaller wells, analysts said. The wells that will be restarted will need about two weeks, according to the oil companies Reuters talked to.

The news of lower output for longer pushed oil prices up by $1 on Tuesday in Asian and European trading, helped by continuing vaccine optimism.

“The positive momentum continues in the oil complex, with investors unabashedly predisposed to a bullish view,” Reuters quoted the chief global markets strategist of Axi, Steven Innes, as saying.

Refineries along the Texas Gulf Coast are also restarting after the outages that took more than two million barrels in daily refining capacity offline.

Saudi-owned Motiva, the largest refinery in the U.S., notified the Texas Commission on Environmental Quality that it would begin a 17-day restart process on Monday.

Marathon Petroleum also began restarting the shut down units of its refinery in Galveston, and Exxon is also preparing to bring its shut down facilities back online.

The Texas Freeze knocked out as much as 4 million bpd of U.S. oil production and 6 million bpd of refining capacity last week, IHS Markit said. The production outages have created a tighter supply situation that has been absent for most of the pandemic, boosting prices.

Yet even before the Freeze, OPEC and U.S. oil industry insiders expected shale production to be slow to rebound from the pandemic lows as companies remain cautious with their spending plans.

- 02/23/2021 – BofA is bullish on oil companies: factors including continuing capital restraint from U.S. shale producers against the backdrop of positive commodity pricing, stable production, rising cash margins and low reinvestment are supportive of positive free cash flow profiles. But there’s still volatility ahead, not only from commodity prices but also headwinds on the political/regulatory front. Recommended stocks: FANG, OVV, CNQ, SU, ENB

BofA eyes beta as its sees more room for energy rally to run

- A strong energy rally from last quarter still has legs, BofA says, pointing to factors including continuing capital restraint from U.S. shale producers against the backdrop of positive commodity pricing.

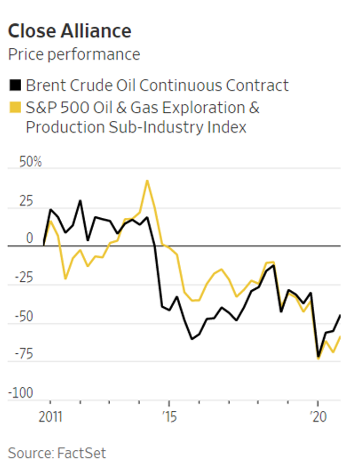

- The Exploration and Production SPDR ETF (NYSEARCA:XOP) is over 70% vs. the market since early November, the analysts note. But hearing company strategy outlooks in fourth-quarter earnings calls so far is boosting the feeling that there’s more upside.

- There’s an emerging “rate of change” story driven by commodity tailwinds and efficiency gains, BofA says – and stable production, rising cash margins and low reinvestment are supportive of positive free cash flow profiles.

- But there’s still volatility ahead, not only from commodity prices but also headwinds on the political/regulatory front (though it says impacts there will vary widely across basins/operators, calling for an increased focus on stock selection).

- BofA is changing up the deck and its strategy for the sector. “Given a more positive backdrop (versus last year), we continue to suggest more ‘beta’ in our stock-specific barbell investment strategy involving (1) beaten up rebound names with low breakeven/oil torque and (2) defensive names with dividend visibility.”

- Its Commodity team now sees an average Brent crude price of $60/barrel in 2021, with a top at $70/bbl, after an originally bullish view of $60 Brent largely played out. The new view incorporates OPEC Plus extending its supply cut deal (pulling an extra 180M barrels out of the market) as well as the Texas freeze, which should pull an additional 50M barrels out.

- In the current environment, it prefers five names: Diamondback Energy (FANG; “oil torque, step change in capital efficiency following recent acquisitions with increasing Midland pivot, zero federal land exposure”); Ovintiv (OVV; “oil torque, clear progress in debt pay down, well defined capital allocation framework, <1% federal land exposure”); Canadian Natural Resources Ltd. (CNQ; “oil torque, sector-leading FCF breakeven, FCF/EV >10%); Suncor (SU; a “2021 turnaround story”); and Enbridge (ENB; “beneficiary of underappreciated heavy oil demand pull”).

- A price target of $87 on Diamondback implies 22.5% upside from current pricing.

- 02/22/2021 – Goldman predicts oil at $75 due to the following reasons

- OPEC+ will fall behind the market rebalancing, especially as the pace of global drawdowns of stockpiles has accelerated

- There are no signs of more activity from most non-OPEC+ producers outside of North America, creating a risk supply will fall 900,000 barrels a day short of the bank’s estimates in the coming year

- The U.S. earnings season confirms that big explorers and producers, the key drivers of U.S. shale output, remain focused on returning cash to shareholders

- Indications from the U.S. government suggest Iranian output likely won’t increase in the short term

Goldman Sees Brent Oil at $75 as Supply Response Trails Demand

Oil prices will rally sooner and higher than previously thought as the global energy demand recovery outpaces the supply response from the OPEC+ alliance, shale and Iran, according to Goldman Sachs Group Inc.

Consumption will get back to pre-virus levels by late July, while output from major producers is likely to remain “highly inelastic” to the rising prices, the bank said in a note. Goldman raised its Brent forecasts by $10 a barrel, to $70 next quarter and $75 in the following three months.

“This faster re-balancing during what was expected to be the dark days of winter will be followed by a widening deficit this spring as the ramp-up in OPEC+ production lags our above-consensus demand recovery forecast,” bank analysts including Damien Courvalin said in the note.

Oil’s rebound to levels last seen before Covid-19 wreaked havoc on the global economy has been driven by Saudi Arabia’s unilateral output cuts together with the improving demand outlook. The rally has also been supported by investors using crude to position for a reflationary environment, Goldman said. Brent oil traded above $63 a barrel on Monday and is up around 22% this year.

Supply will keep lagging behind demand for several reasons, the bank said:

- OPEC+ will fall behind the market rebalancing, especially as the pace of global drawdowns of stockpiles has accelerated

- There are no signs of more activity from most non-OPEC+ producers outside of North America, creating a risk supply will fall 900,000 barrels a day short of the bank’s estimates in the coming year

- The U.S. earnings season confirms that big explorers and producers, the key drivers of U.S. shale output, remain focused on returning cash to shareholders

- Indications from the U.S. government suggest Iranian output likely won’t increase in the short term

- 02/22/2021 – Saudi wants more constraint to pruduction, but Russia opposes. Watch out this meeting: When Opec+ gathers on March 4, it will discuss whether to provide more crude to the market in April

Saudi, Russia differ on oil strategy before meeting

Riyadh wants to hold output steady while Moscow is pushing for supply increase ahead of Opec+ session

SAUDI Arabia and Russia are once again heading into an Opec+ meeting on opposite sides of a crucial debate about the oil market.

Riyadh is publicly urging fellow members to be “extremely cautious”, despite prices rebounding to a one-year high. In private, the kingdom has signalled it would prefer that the group broadly holds output steady, delegates said. Moscow, on the other hand, is indicating that it still wants to proceed with a supply increase.

The positions mirror those taken at recent meetings, but this time the Saudis have a new bargaining chip – one million barrels a day of voluntary cuts. The kingdom pledged to make these extra curbs only in February and March, but some see signs that could change as the negotiations get underway.

When Opec+ gathers on March 4, it will discuss whether to provide more crude to the market in April. There will be two crucial decisions.

First, the group as a whole must choose whether to restore as much as 500,000 barrels a day, the next step in a gradual revival of production that was agreed on in December, but paused at the January meeting.

Second, Saudi Arabia must determine the fate of the extra one million barrels a day of extra voluntary cuts it is making this month and next to help clear surplus inventories even more quickly.

The kingdom initially announced this reduction would be reversed in April, but their latest thinking is fluid and the next move has not been finalised, delegates said. Offering to maintain some part of this voluntary cut in April could give Riyadh a useful bargaining chip if it is seeking to limit the group’s overall output increase.

Global inventories are falling “very fast” and are set to diminish sharply later this year, according to the International Energy Agency (IEA). Demand for petroleum products that cater to societies working and consuming at home is booming.

After freezing storms in Texas shuttered as much as 40 per cent of US crude production in the past week, the clamour for barrels from refiners in some regions has grown stronger. There is also the risk for Opec+ that, once the weather-related disruption in the shale heartlands abates, high prices would provoke a new flood of supply.

But at the same time, inventories remain significantly above average levels; and the IEA forecasts they could pile up again next quarter. The supply disruption from the US freeze will not last long enough to cause a shortage, according to Opec+ delegates, who asked not to be identified because the information is not public.

Even after the rally, prices are still below the levels most Opec members need to cover government spending, giving Riyadh extra leverage.

“The elephant in the room is Saudi Arabia’s gift of one million barrels a day in extra cuts,” said Bjornar Tonhuagen, an analyst at consultants Rystad Energy AS. “If the gift is snatched back, prices cannot do else but decline.” BLOOMBERG

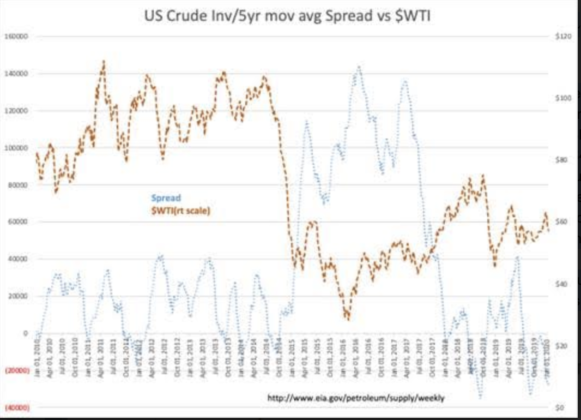

- 02/21/2021 – Crude oil has been rising since the business cycle signaled solid economic growth

Crude Oil And Energy Stocks: It’s Not The Cold Weather, It’s The Business Cycle

- Cold weather is causing price volatility in crude oil.

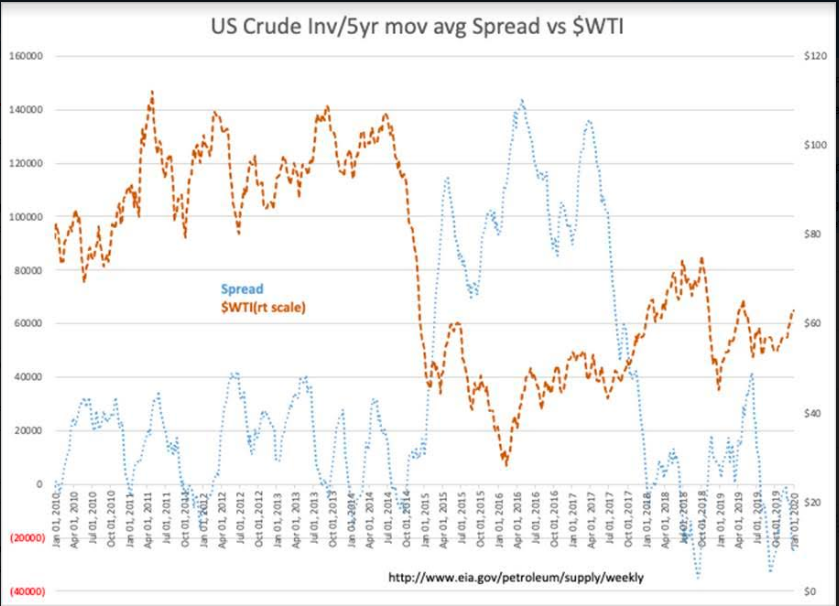

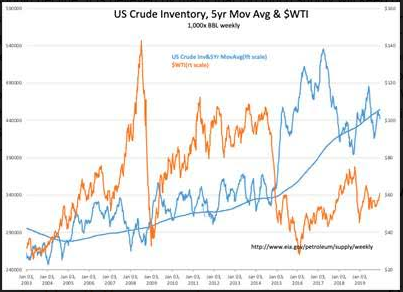

- The inventory cycle, as expected, is fueling a strong business cycle.

- Crude oil has been rising since the business cycle signaled solid economic growth

- 02/19/2021 – Oil supercycle is “seriously flawed”. there is is not a firm basis for an impending supercycle. – I need to study what happened in 1970s oil shocks and the 2004-14

Oil Price Supercycle is a Meme

Analysts at Standard Chartered have noted that the recent rise in crude oil prices has been accompanied by mounting levels of discussion of a crude oil price supercycle. These analysts, however, think the concept of an oil supercycle is “seriously flawed”.

In the report, the analysts said comparisons with post-Second World War economic stimulus, the 1970s oil shocks and the 2004-14 period have all been made recently as a basis for a supercycle. They noted, however, that they thought none of them serve as a suitable parallel for present conditions.

“The supercycle in our view involves extreme demand optimism combined with extreme supply pessimism,” the analysts said in the report.

“We think it is too soon for another extreme upswing, and prices have not been low enough, in our view, to generate extreme supply side shortfalls,” the analysts added.

The analysts outlined that, over the past six years, WTI crude oil has averaged about $51 per barrel and noted that current front-month prices are not low in terms of the post-2014 market. They conceded that back-end prices are relatively low but highlighted that a $3 per barrel year on year fall “is not a firm basis for an impending supercycle”

- 02/18/2021 – history

Background: What caused the 1970s oil price shock?

This article is more than 9 years old

The 1970s oil crisis knocked the wind out of the global economy and helped trigger a stock market crash, soaring inflation and high unemployment – ultimately leading to the fall of a UK government

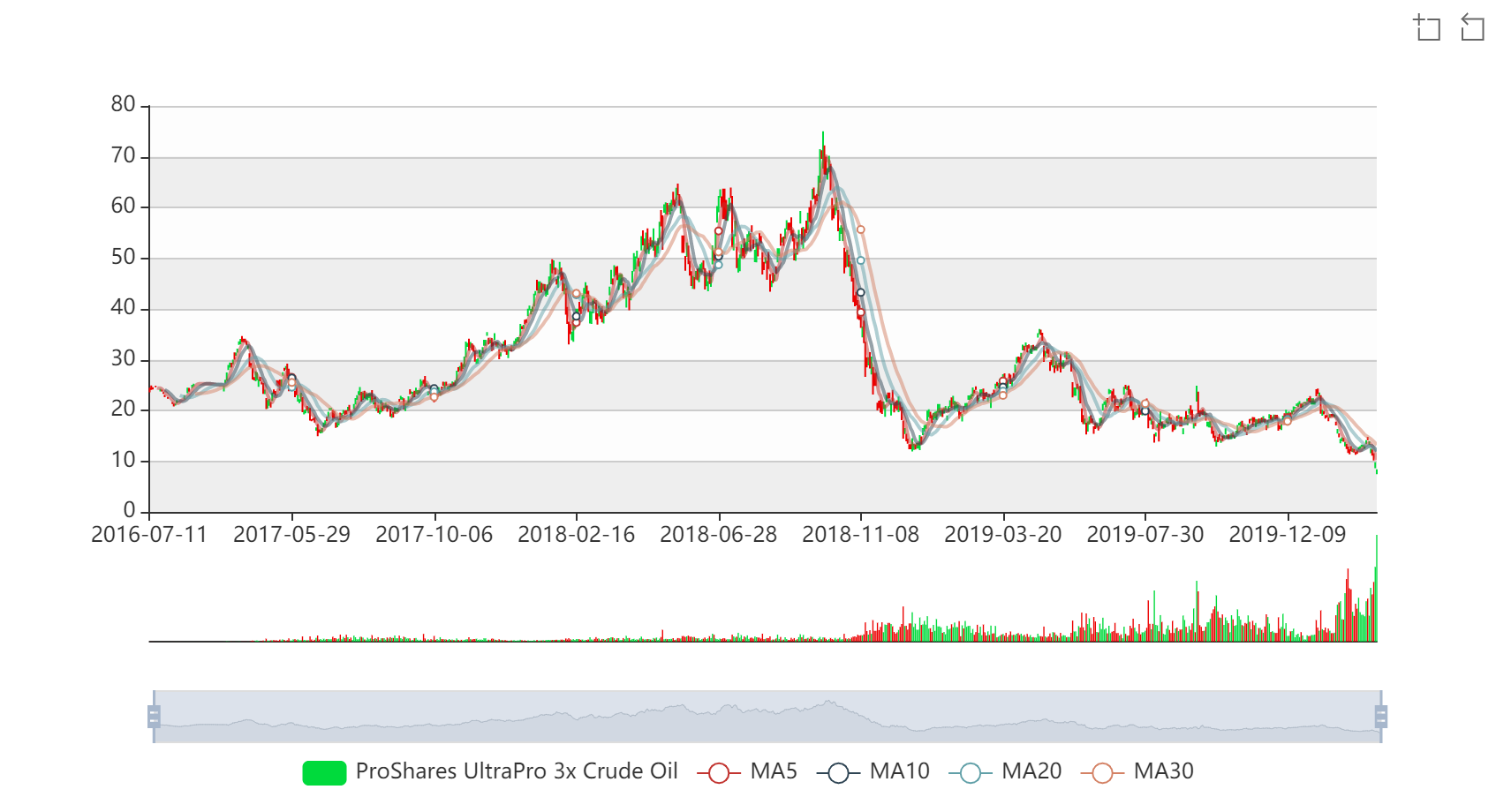

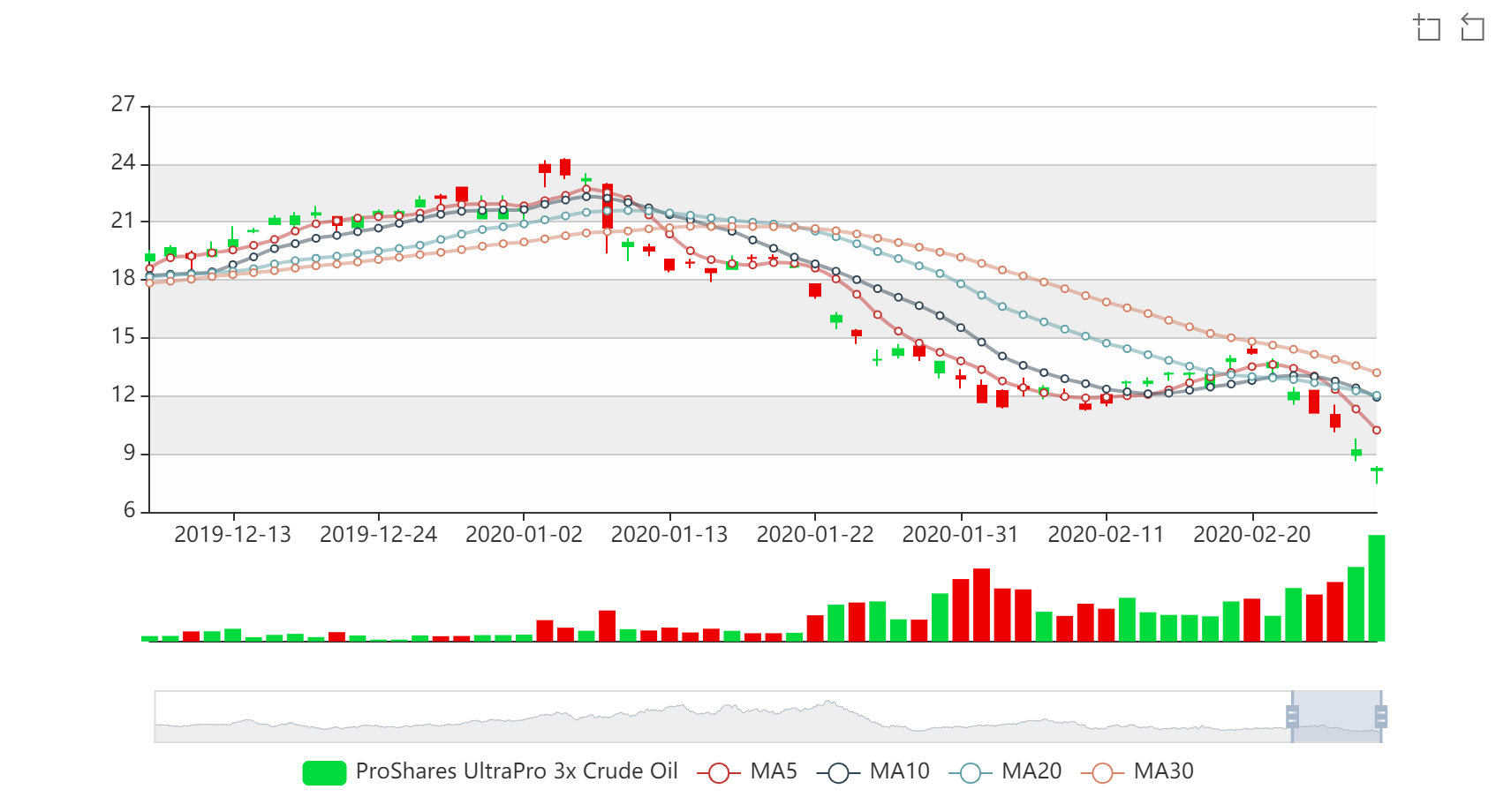

I need to study more details on this graph

- 02/18/2021 – need to read the details

The Big Oil Stocks That Goldman Says Have up to 50% Upside Ahead of a Global Recovery | Barron’s

European Big Oil stocks exposed to the recovery in transportation have a 20% to 50% upside potential in the next 12 months, according to Goldman Sachs analysts.

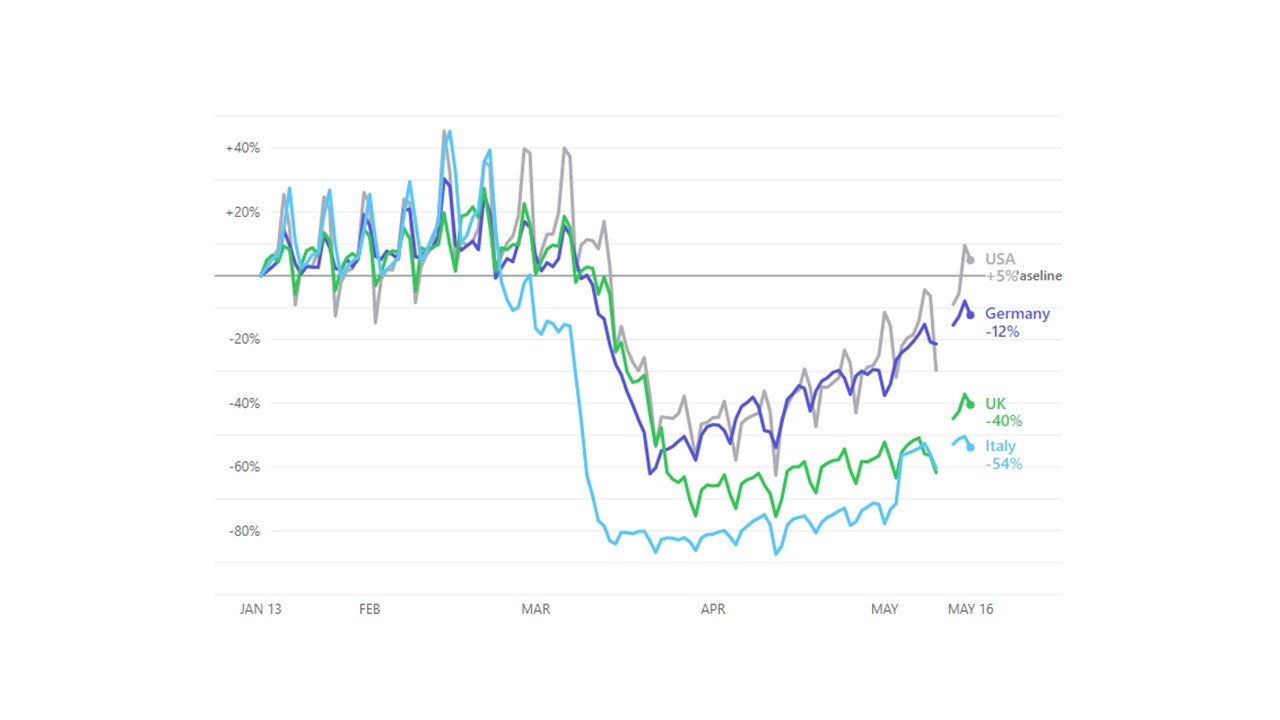

Transport-led oil demand has suffered a severe hit due to the Covid-19 pandemic, but the investment bank’s analysts said that the continuing vaccine rollout and gross domestic product forecasts can support a recovery in 2021. On average, around two-thirds of European Big Oil companies’ earnings comes from transport-led oil demand, with Galp, BP, Total and Repsol the most exposed.

The sector has climbed around 40% from the lows of October 2020, but has underperformed both the wider market and Brent’s recovery, following a weak set of fourth-quarter earnings, they noted.

- 02/18/2021 – Texas’ freeze has shut in about one-fifth of the nation’s refining capacity and closed oil and natural gas production across the state. “The temporary outage will help to accelerate U.S. oil inventories down towards the five-year average quicker than expected,”

Brent gives up gains after rising above $65 on Texas freeze

Oil prices steadied on Thursday, with Brent edging back from a 13-month high, after a sharp drop in U.S. crude inventories supported prices, while buying spurred by a cold snap in the largest U.S. energy-producing state petered out.

Brent crude rose 3 cents to $64.37 a barrel by 11:40 a.m. EST (1640 GMT), after increasing to $65.52 earlier in the session, its highest since Jan. 20, 2020.

U.S. crude stockpiles fell by 7.3 million barrels in the week to Feb. 12, the Energy Information Administration said on Thursday, compared with analysts’ expectations for an decrease of 2.4 million barrels.

Crude exports rose to 3.9 million barrels per day, the highest since March, EIA said.

“The big nugget was the big jump in exports of crude oil,” said John Kilduff, partner at Again Capital in New York. “We’ll have to see what happens with that next week weather in Texas, but I have been looking for a pick up there for a while.”

Texas’ freeze entered a sixth day on Thursday, as the largest energy-producing state in the United States grappled with refining outages and oil and gas shut-ins that rippled beyond its borders into neighbouring Mexico.

The deep freeze has shut in about one-fifth of the nation’s refining capacity and closed oil and natural gas production across the state.

“The temporary outage will help to accelerate U.S. oil inventories down towards the five-year average quicker than expected,” SEB chief commodities analyst Bjarne Schieldrop said.

Oil’s rally in recent months has also been supported by a tightening of global supplies, due largely to production cuts from the Organization of the Petroleum Exporting Countries (OPEC) and allied producers in the OPEC+ grouping, which includes Russia.

OPEC+ sources told Reuters the group’s producers are likely to ease curbs on supply after April given the recovery in prices.

What the Texas Deep Freeze Means for Oil, Natural Gas: we might lost 3 mil barrels of oil, 3 millions of barrels of refining oil and 10 bcf gas. Huge disaster!

- 02/18/2021 – Gurus who invested in oil at 4Q20, stamp of approval

- Tepper purchased 3.125 million shares of Energy Select Sector SPDR Fund (XLE), giving the position 1.77% equity portfolio weight. Shares averaged $34.68 during the fourth quarter.

- Burry invested in Hollyfrontier $6m, DNOW $11m

- Buffett invested in Chevron Corp (CVX) $4.1 bil

- 02/17/2021 – watch out the reversal of production cut from OPEC, may be in April. The plans could still be reversed. Even with the reversal of production cut, IEA said that a recovery in demand would outstrip production in the second half of the year

Saudi Arabia Set to Raise Oil Output Amid Recovery in Prices – WSJ

World’s largest oil exporter plans to reverse recent unilateral production cut, while OPEC-plus seen likely to roll over curbs

The world’s largest oil exporter surprised oil markets last month when it said it would unilaterally slash 1 million barrels a day of crude production in February and March in an effort to raise prices.

But the kingdom plans to announce a reversal of those cuts when a coalition of oil producers meets next month, the advisers said, in light of the recent recovery in prices. The output rise won’t kick in until April, given the Saudis have already committed to stick to cuts through March.

The advisers cautioned the plans could still be reversed if circumstances change, and the Saudis’ intention hasn’t yet been communicated to the Organization of the Petroleum Exporting Countries, said the people and OPEC delegates.

In its monthly market report Feb. 11, the International Energy Agency said that a recovery in demand would outstrip production in the second half of the year, prompting “a rapid stock draw” of the glut of crude that has built up since the pandemic began.

- 02/16/2021 – Oil suprecycle prediction: The expected surge is predicated on the belief that fiscal stimulus will boost consumption just as investment in new production has been sucked out of the industry. Such a disconnect between demand and supply, fuelling a lasting surge in prices, are the basic conditions of a so-called supercycle. “We’re going to be short of oil before we don’t need it in the years to come.” Potential risks prevent oil to go up: the return of Iranian oil, the pace of producers’ supply increases, and the risk that Covid-19 vaccines struggle against variants of the disease. Skeptical view: The oil and gas industry is in “terminal decline”, he said. “Perhaps this dead cat can bounce a few more times. But would that be a supercycle?

Oil ‘supercycle’ predictions divide veteran traders

full article is here (Oil ‘supercycle’ predictions divide veteran traders _ Financial Times)

Two of the biggest banks on Wall Street are calling a new “supercycle” in oil, with JPMorgan Chase and Goldman Sachs both predicting prices will soar when the pandemic abates. The most bullish forecast has international crude prices staging a comeback towards the $100-a-barrel region — a level not reached since 2014. The expected surge is predicated on the belief that fiscal stimulus will boost consumption just as investment in new production has been sucked out of the industry. Such a disconnect between demand and supply, fuelling a lasting surge in prices, are the basic conditions of a so-called supercycle. It would transform conditions in the oil sector, which was hammered last year by the Covid-19 hit to demand and doom-laden predictions about what the widespread embrace of electric vehicles will mean for the market. “We’re going to be short of oil before we don’t need it in the years to come,” JPMorgan’s head of oil and gas, Christyan Malek, told clients on a conference call last week. “We could see oil overshoot towards, or even above, $100 a barrel.” Brent crude, the international benchmark, is up more than two-thirds since the end of October to $63 a barrel, driven by vaccine optimism and production cuts by leading exporters.

But this time it is not the emergence of an energy-hungry China that he predicts will boost consumption, but stimulus spending by governments around the world, such as the $1.9tn proposed in the US by the Biden administration — including for “green” infrastructure.

Veteran Goldman Sachs analyst Jeffrey Currie, who was a key voice in oil’s last supercycle between 2003 and 2014, told the Financial Times he believes there are real risks that oil trades in the $80 range “or even higher this year”. But this time it is not the emergence of an energy-hungry China that he predicts will boost consumption, but stimulus spending by governments around the world, such as the $1.9tn proposed in the US by the Biden administration — including for “green” infrastructure.

“This type of stimulus aimed at middle and lower class income [households] creates significant, commodity-intensive consumption, as they have a much higher propensity to consume,” Currie said. “These people don’t drive Teslas. They drive SUVs.”

He draws a parallel with President Lyndon Johnson’s “Great Society” initiative in the 1960s, arguing that the boost it gave to the US middle class — and the accompanying growth in oil consumption — helped set the stage for the oil price spikes of the 1970s, when Middle Eastern oil producers were able to squeeze supplies to the US.

“I believe the path of oil prices is likely to be upward for 2021 and the following years, but there are also many elements that could derail that move up,” he added, citing the return of Iranian oil, the pace of producers’ supply increases, and the risk that Covid-19 vaccines struggle against variants of the disease.

Sceptics include Andy Hall, one of the most successful oil traders of the last supercycle — and now retired from day-to-day trading. The oil and gas industry is in “terminal decline”, he said. “Perhaps this dead cat can bounce a few more times. But would that be a supercycle?”

- 02/15/2021 – watch out the OPEC+ meeting at March to see whether they will relax the oil production cuts or not.

Oil Prices Rally as Cold Blast Hits Texas – WSJ

Freezing weather boosts demand for fuel and power, while threatening oil-and-gas output in key production state

For oil prices, the cold snap helped to extend a monthslong recovery powered by production curbs by OPEC and its partners, led by Russia.

A key question for oil traders now is whether the cartel opts to relax the cuts at a meeting in March. Saudi Arabia will likely resume production of the million barrels a day it decided to take off the market in January, boosting global supplies, according to Ms. Nakhle.

“They are likely to stop that, now that prices are above $60 a barrel,” she said.

- 02/15/2021 – interesting history review from NOV CEO: The reason is that all (wind, solar, geothermal, biomass, hydrogen and fusion) are at best imperfect substitutes for the status quo, at least for now, in all categories except greenhouse gas emissions

National Oilwell Varco, Inc. (NOV) CEO Clay Williams on Q4 2020 Results – Earnings Call Transcript

Most renewables technologies are not new. You may be surprised to learn that robust serious technical economic discussions about transitioning to new forms of energy actually began more than 40 years ago, following the Iranian hostage crisis and the second big oil shock of the 1970s. The economic vulnerability of the West during the Cold War, exposed by the tenfold increase in oil price throughout the 1970s, led to some serious hand wringing about diversifying away from oil, particularly foreign imports.

Strikingly, the list of potential green energy sources from that era is essentially unchanged from today’s list of candidates: wind, solar, geothermal, biomass, hydrogen and fusion. In the past four decades, all have seen their respective technologies progress incrementally and some have seen significant industrialization. So why then haven’t we transitioned to something different yet? The reason is that all are at best imperfect substitutes for the status quo, at least for now, in all categories except greenhouse gas emissions.

Solar and wind face intermittency challenges, land use issues and not-in-my-backyard political opposition. Hydrogen faces storage and transportation challenges from metallurgical hydrogen embrittlement. Biomass faces land use and efficiency challenges. Fusion continues to face technical challenges. And geothermal really only works in geologic hotspots with shallow magma. All face infrastructure hurdles.

- 02/15/2021 – oil might go higher due to demand/supply, pandemic eases and inflation

Why Oil Is Likely Headed Much Higher From Here

- Oil’s supply demand dynamic illustrates that higher prices are probable.

- OPEC+ nations led by Russia and Saudi Arabia are likely to continue to create artificial supply constraints in the market.

- On the other side of the equation, oil demand is likely to rise notably as the coronavirus pandemic eases into H2 and 2022.

- Finally, there is the inflation factor that is likely to enable oil prices to appreciate notably into year-end and next year.

- Some companies that we like going forward.

- 02/14/2021 – Oil prices soared as fears of heightened tensions in the Middle East , while hopes that a U.S. stimulus and an easing of lockdowns will buoy fuel demand provided support

Oil hits 13-months highs on fears of Middle East tensions

Oil prices soared on Monday to their highest in about 13 months as fears of heightened tensions in the Middle East prompted fresh buying, while hopes that a U.S. stimulus and an easing of lockdowns will buoy fuel demand provided support.

The Saudi-led coalition fighting in Yemen said late on Sunday it intercepted and destroyed an explosive-laden drone fired by the Iran-aligned Houthi group toward the kingdom, state TV reported, raising fears of fresh Middle East tensions.

- 02/12/2021 -Gas price might continue to be higher, more pipeline projects might get cancelled, therefore, gas price might be even higher.

Gas hits highest price in 12 months as progressives, celebrities pressure Biden to cancel more pipelines

Gas Buddy analyst: ‘Prices are likely to continue rising in the weeks and months ahead’

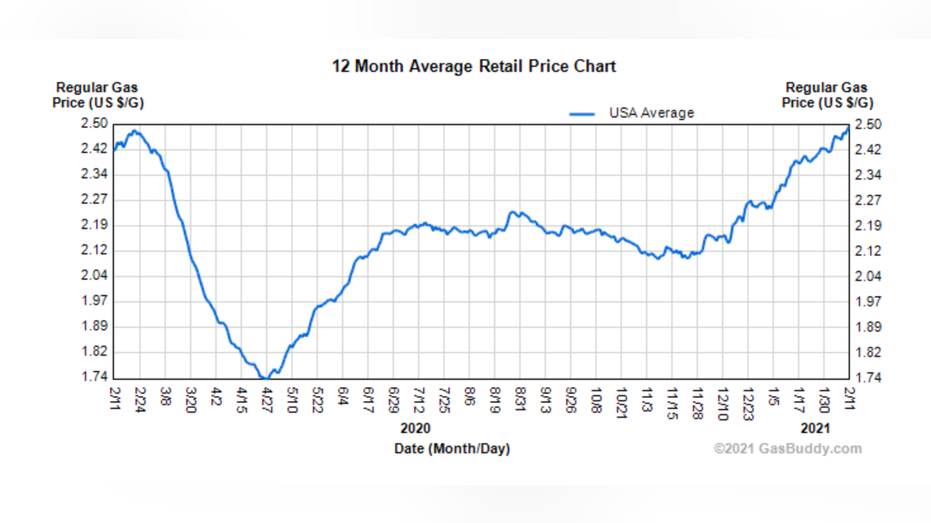

The average price of gas in the United States has hit a 12-month high, according to new data Thursday from Gas Buddy.

The average retail gas price in the United States is now $2.50 per gallon after soaring from an average price of $1.74 per gallon in April 2020. In February of last year, Gas Buddy’s chart shows gas prices were about $2.42 per gallon and proceeded to rise slightly before plummeting as the coronavirus pandemic spread across the country.

12 Month Average U.S. Gas Retail Price (Chart courtesy of Gas Buddy)

Gas Buddy senior petroleum analyst Patrick De Haan told FOX Business that a significant contribution to the increase is related to the recovery from COVID-19 as well as rising oil demand globally against the Organization of Petroleum Exporting Countries’ (OPEC) decision to cut production.

“Unfortunately prices are likely to continue rising in the weeks and months ahead so long as we continue to see improvement in the pandemic,” De Haan added, “They could rise another 15 to 35 cents a gallon by summer, [it’s] all really contingent on what happens in the months ahead with COVID.”

The new data comes as President Biden is facing pressure from progressive Rep. Ilhan Omar, D-Minn., to cancel the Enbridge Line 3 pipeline project as well as a letter signed by dozens of celebrities to shut down the Dakota Access Pipeline for good.

- 02/12/2021 – natural gas soaring on cold weather. Texas is about to be barreled over by snow, ice and cold, and that has shaken energy markets. Is there energy shock coming? should I play it? how can I play it very profitably and safely?

Arctic Blast Grips U.S., Upending Markets, Setting Records

The Arctic blast sweeping the U.S. has unleashed winter weather from coast to coast, spawned deadly ice storms as far south as Houston and sent natural gas and power prices soaring to record levels. Conditions are set to get even worse. Storm warnings and advisories stretch from Washington state in the west, south to Texas and up the East Coast to New Jersey. Across the central U.S., wind chill warnings and advisories cover most of the Great Plains and upper Midwest. Temperatures in Chicago could drop to -2 degrees Fahrenheit (-19 Celsius) Saturday and Sunday but the wind will make it feel closer to -25. After this system clears out, another will arrive by the middle of next week.

“It is not just the magnitude of the cold, it is also how persistent it is also how persistent it is,” said Marc Chenard, a senior branch forecaster with the U.S. Weather Prediction Center. “We have about another week of this. There is another system behind this one impacting similar areas.”

While winter lashes the nation, it’s even reaching into areas that are usually spared the season’s worst. Texas is about to be barreled over by snow, ice and cold, and that has shaken energy markets.

Gas processing plants across Texas are shutting as liquids freeze inside pipes, disrupting output just as demand for the heating fuel jumps. Prices have surged more than 4,000% in two days in Oklahoma. Electricity in some parts of Texas have topped $5,000 a megawatt-hour. Meanwhile oil output in the Permian Basin, the biggest U.S. shale play, is moderating as wells slow down or halt completely.

Deep freeze sends natural gas soaring to record $600 in Oklahoma

Heating and power plant fuel traded for as much as $195 per mmBtu in Southern California

- 02/12/2021 – Shell, BP and Total are cutting oil output – good for oil price?

Shell Hits Its Own Peak Oil, Plans to Reduce Output

Energy giant joins peers it pledging to reduce its dependence on fossil fuels while tapping the growing electricity market

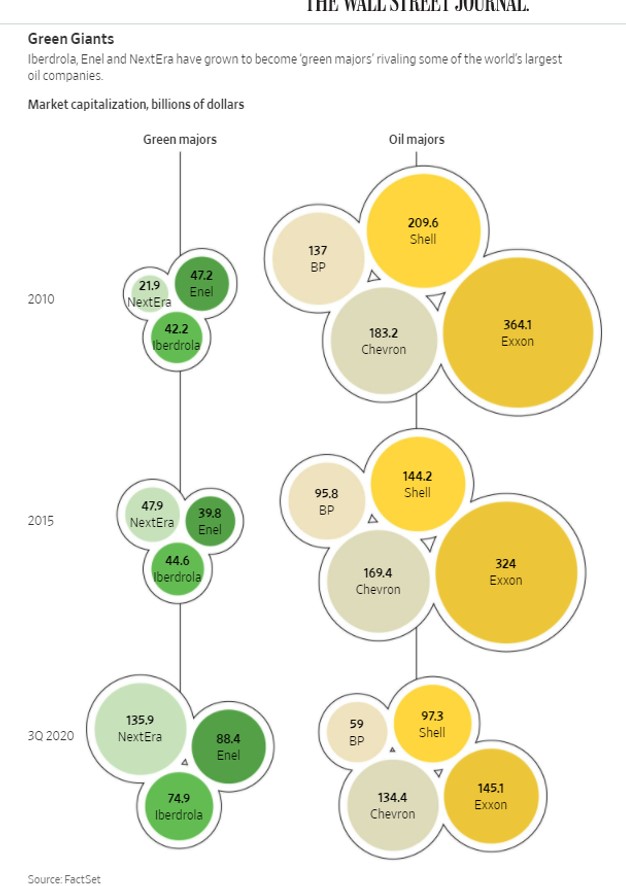

The strategy follows similar plans from rivals BP PLC and Total SE to reduce their dependence on fossil fuels while expanding in renewable power such as wind and solar, partly in response to growth in regulatory and investor pressure. By contrast, U.S. companies Exxon Mobil Corp. and Chevron Corp. don’t plan to invest substantially in electricity and both say the world will need vast amounts of fossil fuels for decades to come. Exxon does, though, plan to invest in technology to reduce carbon emissions.

However, the pivot to low-carbon energy is seen by analysts as challenging because it requires investments in areas where major oil companies don’t necessarily have a competitive advantage and that have lower returns. Renewables projects typically generate returns of around 10%, compared with the traditional 15% targeted on oil-and-gas projects.

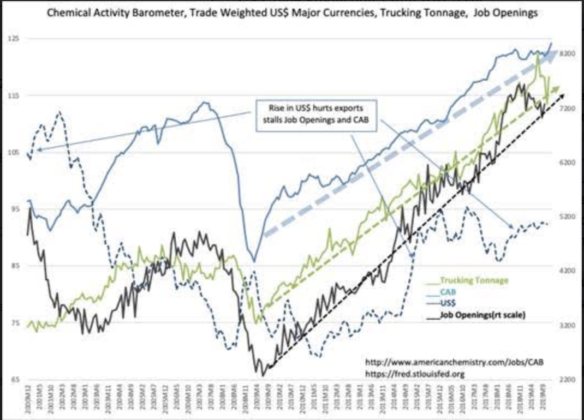

- 02/10/2021 – supercycle of copper will charge the supercycle of oil. Massive green spending stimulus will have an indirect pull on oil demand. However, he added that it may be “a little early to declare a full supercycle.” US drilling and completion activity continuing to rise with the improvement in oil prices over recent months. “Still, we do not see major changes to US supply expectations because operators will maintain capital discipline in 2021,” it said in a research note.

INTERVIEW: Hang on for wild oil, copper ride in commodity supercycle: Goldman’s Currie

Oil has a ‘lot of upside’, copper prices already at supercycle levels, Supercycle reminiscent of 1970s spike rather than 2000s bull run, Supply crunch could play into shale, core OPEC+ hands

The oil market is being swept up in a commodity supercycle, with huge upside risk to a target price of $65/b, according to Jeff Currie, head of commodity research at Goldman Sachs, who added key metals such as copper are already at supercycle levels and that the story has only just begun.

“I want to be long oil and hang on for the ride,” Currie said in an interview with S&P Global Platts on Feb. 5, warning “there is a lot of upside here.”

Currie, who called the supercycle in the early 2000s, highlighted the importance of the interconnections between the key commodities like oil and industrial metals in driving prices higher, arguing that oil prices cannot be considered in isolation.

“This is why I jump up and down and pound the table that people don’t keep talking about iron ore with your oil outlook. Well, it’s really important to your oil outlook. So is the dollar, so is copper, and grains… So is everything else out there,” Currie said.

He noted that copper is crucial to the oil outlook. While Goldman has a copper target of $10,000/mt, which is consistent with its $65/b oil price, Currie speculated as to whether copper could actually reach $40,000/mt at some point.

“We have no copper, copper inventories just drew their largest observable draw we’ve seen in the last five weeks, prices are already back to supercycle levels and we have not even started the energy transition story of electrifying the world,” Currie said. “Copper is the only thing we know that can conduct electricity at the rate needed, so I’m really curious as to how high some of these markets can go,” he added.

Supercycle origins

Currie explained that we are seeing a supercycle emerge because of a “structural upward shift in demand.” He emphasized that energy transition is at the heart of this transformation because of all the green capital expenditure that is required to be able to create the electrification the globe needs.

Currie noted the shift in demand has three elements, which he termed “REV” — standing for redistribution policies, environmental policies and versatility in supply chain initiatives.

He also suggested that this supercycle is more akin to the one seen in the 1970s rather than the start of the century. Tensions around poverty and social unrest that led to redistribution efforts and the war on acid rain back then compares to the climate change pressures today. Meanwhile, regarding supply chains, Currie said the US Cold War with Russia can be viewed with a similar eye to the issues between China and US.

“Last summer it was the Chinese buying strategic reserves of grains, copper, oil. And when we think about when did the Europeans and the Americans build all those strategic reserves, it was built in the 1970s, under very similar circumstances,” Currie said of the parallels.

Talking specifically on oil, Currie noted perhaps counterintuitively that the massive green spending stimulus will have an indirect pull on oil demand given the energy needs surrounding the whole enterprise.

“And let’s remember, what’s unique about this is everybody everywhere in the world is doing the exact same thing at the exact same time, which is why you get that immediate impact on demand,” he added.

Chris Midgley, head of analytics at S&P Global Platts, has also noted that “the market certainly feels like it is moving into a supercycle — commodities across the board including coal have risen over 20% since the end of Q3… demand is recovering but still lags well behind 2019 levels and headwinds remain with high infection rates, new strains of the virus and further lockdowns.”

However, he added that it may be “a little early to declare a full supercycle.”

OPEC, shale

Currie warned that demand concerns for oil longer-term will deter investment in long life cycle production paving the way for key OPEC and US producers.

This “hostile environment to attract capital” will mean the “only investment that’s going to go into this space is going to be very short cycle production in places like the Middle East, as well as the United States in the shale patch,” Currie said.

Currie added that these conditions are going to push up the cost of capital in these areas too.

Taking the example of shale, Currie said these producers over the last decade have been spending “130% of cash flow, because of access through debt and equity markets,” but noted that “they’re going to be lucky if they could spend 70% of cash flow,” with reduced access.

“This means that the hurdle rate of which they can actually now begin to drill is at a much higher price, instead of being at $55/b, we think it’s closer to $65/b, which is why we’re sitting… in an environment where we have not seen an uptick in drilling — historically, by the time we got to $55/b that would have already happened,” Currie said.

Platts Analytics sees US drilling and completion activity continuing to rise with the improvement in oil prices over recent months. “Still, we do not see major changes to US supply expectations because operators will maintain capital discipline in 2021,” it said in a research note.

But Currie was also keen to point out that the outlook for non-core OPEC+, namely those outside the core Gulf countries and Russia, is less assured.

Once the demand recovery really takes off, Currie believes the “dynamic that’s keeping that cohesion between Russia and OPEC is likely to disappear. I would tend to think that it’s going to be a free for all.”

And any return to pump-at-will by the OPEC+ participants would likely see US shale’s role as the marginal supplier resume.

- 02/10/2021 – be cautious on the change of oil supply/demand and oil price. US oil companies need to be very discipline in order to maintain the oil price. Among the names that analysts say are more sensitive to price changes are MEG Energy (MEG), Centennial Resource Development (CDEV), Marathon Oil (MRO), and Occidental Petroleum (OXY).

Oil’s Rally Was Just Heating Up. Why a Government Agency Says Prices Will Fall.

But the U.S. government agency that tracks energy markets thinks those gains may be ephemeral. The Energy Information Administration put out a forecast on Tuesday that predicts Brent crude prices will average $56 in the first quarter and then average $52 the rest of the year.

The EIA expects West Texas Intermediate crude, the U.S. benchmark, to average $50.31 this year, versus current prices around $58.

The EIA expects prices to slide because operators will start producing more oil, causing supplies to start to build up. In addition, oil production far outpaced demand in 2020, and the high levels of oil in storage could keep a lid on prices.

“EIA expects lower oil prices later in 2021 as a result of rising oil supply that will slow the pace of global oil inventory withdrawals,” the EIA report says. “EIA also expects that high global oil inventory levels and spare production capacity will limit upward price pressures.”

The EIA isn’t alone. Rystad Energy analyst Louise Dickson wrote on Tuesday that “the continuous rise in oil prices feels like a bubble inflating daily. We don’t expect a ground-breaking correction, but the bubble has to break at some point, it’s just market physics.”

So far, U.S. producers have held the line and kept production low, despite rising prices. Chris Wright, the CEO of shale-drilling company Liberty Oilfield Services (LBRT) said late last week that operators didn’t appear to be bringing production back online.

The latest price increase has led to a boom in oil stocks, which gain considerable operating leverage at prices over $50. Given the high fixed costs to produce oil, every dollar over $50 has a big impact on the bottom line. Stocks that are particularly sensitive to oil price changes could slump if oil prices reverse. Among the names that analysts say are more sensitive to price changes are MEG Energy (MEG), Centennial Resource Development (CDEV), Marathon Oil (MRO), and Occidental Petroleum (OXY).

- 02/10/2021 – supply cut, demand increase, inflation, and reflation trades might drive oil higher to $60 ~ $70

from oilprice.com Tuesday, February 9th, 2021

- The EIA sees U.S. oil production returning to 2019 levels by 2023 and then remaining between 13 and 14 mb/d through 2050.

- The agency sees Brent prices rising from an average of $42 per barrel in 2020 to as high as $73 per barrel by 2030 and $95 per barrel by 2050.

- The Permian remains the dominant source of new production in the years ahead.

Brent topped $60 per barrel on Monday, hitting a fresh high. OPEC+ cuts combined with enhanced expectations of U.S. economic stimulus pushed crude oil up. The market continues to tighten. “Support seems robust and the narrative sees the oil market swiftly burning through the remaining crisis-surplus, potentially running into tightness later this year,” Norbert Rücker, an analyst at Swiss bank Julius Baer, told Reuters.

Could oil hit $100? Oil prices could go as high as $100 a barrel next year on the back of “very easy monetary policy” and reflation trade, Amrita Sen, chief oil analyst at Energy Aspects, told Bloomberg in an interview.