Study of REIT stocks

- 05/11/2024 – Real estate stocks continue to outperform broader markets with higher chances of rate cut | Seeking Alpha

Real estate stocks outperformed broader markets for the second straight week as the incoming economic data pointed to increased chances of a rate cut in 2024.

The Real Estate Select Sector SPDR ETF (NYSEARCA:XLRE) rose 2.13% during the course of the week to close at 37.81 on Friday, posting gains in three out of five sessions.

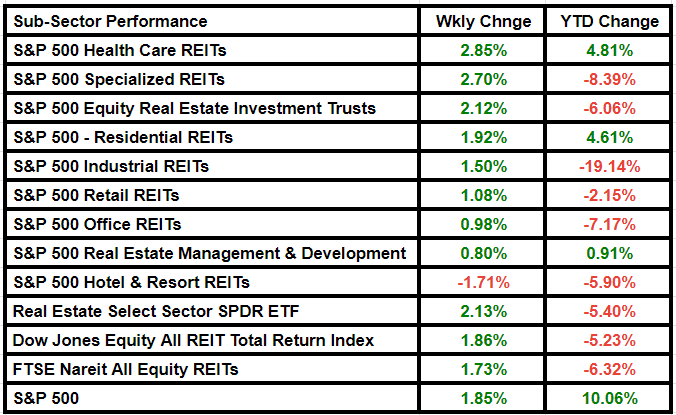

Here is a look at the subsector performance for the week:

While some banks have experienced an increase in commercial real estate (“CRE”) loan delinquencies, the rates generally remain low, Federal Reserve Governor Michelle Bowman said in a speech addressing financial stability on Friday.

But should the post-pandemic trend of lower demand for certain property types, such as offices, continue, “we could see declines in property values, reduced rental income cash flows, or other conditions that could lead to impairment of some banks’ CRE loans or portfolios, especially if those loans mature and are refinanced at higher interest rates,” Bowman said.

That’s why CRE continues to be an area of focus for both banks and regulators, she noted.

“I expect we will continue to see material differences in the performance of CRE across the various types of commercial property and in specific geographic regions,” due to variations in regional return-to-office patterns and shifting demand for different types of CRE properties.

Bank supervision by regulators can “be an effective tool to mitigate vulnerabilities,” she said. For example, underwriting standards and loan-to-value ratios have improved significantly since the 2008-09 financial crisis. In addition, credit conditions for CRE lending have tightened even as loan demand softened. “I see this as reflecting both better management of these loans and portfolios, and more proactive supervision of material risk.”

Bowman also acknowledged the role that monetary policy can “heighten short-term stresses” in the banking system. “Our supervisory activities should reflect an awareness of these effects on bank management decision-making as we rely on regulation and supervision to promote resilience in the regulated banking system, with the goal of helping banks as they navigate an evolving macroeconomic environment and adjust to major shifts in the stance of monetary policy,” Bowman said.