Energy and Metals – Part VI

Critical dates

- Tuesday, November 8, 2022 – US midterm election

32nd OPEC and non-OPEC Ministerial Meeting on 5 September 2022We can wait for the EIA monthly data to come out but in order to validate the July data, we would have to wait until the end of September.- China is set to convene a historic meeting on Oct. 16, “We expect the zero Covid policy to be revised after the meeting in Oct, which will help the economy to normalize,” Zhiwei Zhang, president and chief economist, Pinpoint Asset Management, said in a note.

- 09/28/2022

With critical energy infrastructure in the US & EU under direct attack since '21, the best time to bolster defenses and deterrence was years ago.

The next best is right now.

Some ideas for the cyber front: https://t.co/ntLFkudRXs— Bob McNally (@Bob_McNally) September 28, 2022

Last fall, the FAL energy working group designed eight necessary steps to protect U.S. critical energy infrastructure. It’s time to revisit this plan to bolster U.S. and allied energy defense. ➡️ https://t.co/RHMbObndM6 https://t.co/phSL8LD2ym

— Forum for American Leadership (@forum_american) September 28, 2022

https://img1.wsimg.com/blobby/go/1d008308-a2e8-48d3-ac4d-11267653d021/Defense%20Against%20Cyber%20Attacks%20on%20Critical%20Ener.pdf

- 09/27/2022 – be aware that more and more ETFs might get Liquidated. Be prepared for this, save some cash.

Vanguard Is Liquidating a US-Listed ETF for the First Time Ever

The liquidation comes as volatility ripples across asset classes, with central banks around the globe attempting to cool red-hot inflation. That turmoil is showing up in the $6 trillion ETF industry, where 91 funds have shuttered so far this year compared with just 71 closures for all of 2021, Bloomberg data show.

- 09/26/2022 – No secondary sanction for Russian oil price cap, but guideline might still will be published before Dec 5. “Wolfram said the authorities will release full guidance on how the Russian oil price cap will be implemented before European Union sanctions on Russian crude exports take effect on Dec. 5. The price cap will apply to Russian crude oil in every trade, but not refined products that have been produced from Russian crude, Wolfram said. “Once oil is substantially transformed, then price cap no longer applies,” she said.”

U.S. Official Rules Out Secondary Sanctions for Russian Oil Price Cap

SINGAPORE (Reuters) – A U.S. Treasury official has ruled out secondary sanctions to enforce a price cap mechanism on Russian oil exports despite a proposal last week by U.S. senators.

Democratic and Republican senators last week proposed that U.S. President Joe Biden’s administration use secondary sanctions on international banks to strengthen the price cap aimed at capping Russia’s oil revenues while minimising the impact on global markets and prices.

“We don’t think secondary sanctions are needed,” Catherine Wolfram, deputy assistant secretary for climate and energy economics at the U.S. Treasury, told reporters on the sidelines of the APPEC 2022 conference.

“We have all the service providers that are part of the coalition and each country kind of brings in some sanctions.”

The Group of Seven (G7) nations expect companies in the supply chain from brokers to banks, insurers and shipping firms to monitor Russian oil trades and report irregularities. Industry executives and analysts have raised questions about the feasibility of the oil price cap and its enforcement.

Wolfram said the authorities will release full guidance on how the Russian oil price cap will be implemented before European Union sanctions on Russian crude exports take effect on Dec. 5.

U.S. officials have said they will consider Russia’s marginal production cost and historical prices before the Ukraine war when setting the price to encourage Russia to continue production.

The price cap will apply to Russian crude oil in every trade, but not refined products that have been produced from Russian crude, Wolfram said.

“Once oil is substantially transformed, then price cap no longer applies,” she said.

If traders benefit from trading these products, it still means that the revenue does not go to Moscow, she added.

Wolfram added that she does not expect China and India to join the coalition formally at the government level as it would not be in their self interest, but said a number of Indian and Chinese companies would find it in their economic interest to continue using trade services provided by G7 countries after the price cap is in place.

“We have talked to some Indian importers who view using Russian insurance as more costly than using UK or Norwegian insurance,” she said.

“The (U.S.) administration is in close contact with OPEC, who doesn’t like volatility and the idea of big amounts of Russian oil coming off the market, and emphasises that the price cap will only apply to Russia.”

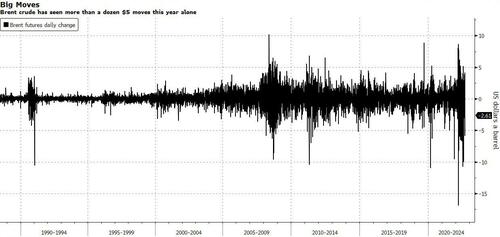

- 09/24/2022 – oil price has the most volatility in 2022 in recent 30 years

This year has swen the most volatile crude #oil prices in more than 30 years pic.twitter.com/9weGHXVtsS

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) September 25, 2022

BRENT calendar spreads are correlated with the global economic cycle (among other things). The six-month spread is still in a strong backwardation but it has eased significantly since June. What happens next depends on whether the economy enters a downturn, and if so, how deep: pic.twitter.com/gwDGIW7olb

— John Kemp (@JKempEnergy) September 24, 2022

- 09/22/2022 – news and comments. RBC Capital Markets previously pegged that number for the U.S. at roughly 315 million barrels. And the DOE will eventually have to replenish the SPR by the same amount that it drew this year, increasing future oil demand. A DOE spokesperson said replenishment won’t likely occur until September 2023.

America Has Lost Its Oil Buffer – WSJ

The U.S. Energy Information Administration said Wednesday that the Strategic Petroleum Reserve declined by nearly 7 million barrels in the week ended Sept. 16, leaving it at roughly 427 million barrels—the lowest since 1984. For the first time since 1983, the SPR now holds less oil than commercial storage.

With so many hazards just around the bend, the U.S. needs a fully functioning air bag. Alas, this one comes with diminished cushioning capacity. Though the president can technically authorize more SPR drawdowns, there will be a limit, given that the IEA has a minimum stockholding obligation for participating members. RBC Capital Markets previously pegged that number for the U.S. at roughly 315 million barrels. And the DOE will eventually have to replenish the SPR by the same amount that it drew this year, increasing future oil demand. A DOE spokesperson said replenishment won’t likely occur until September 2023.

A DOE spokesperson said replenishment won’t likely occur until September 2023.

Besides the short-term political gain, the SPR draw could turn out to have been a losing strategy however the supply-demand balance shakes out. If there is an actual oil shock and not enough oil in the SPR to cushion it, it would be a painful lesson on why the reserve exists in the first place. If there is no such shock, this year’s SPR draw might have set a precedent for politicized use in the future.

- 09/21/2022 – FOMC Press Conference September 21, 2022

- 09/20/2022 – Dr. Yergin thinks the plan of oil cap might have 50% chance of success – US treasury and G7 will send a strong signal to the world on lowering the oil price, plus Fed increases interest rate will suppress the oil price. Oil market will be very volatile. Hard to predict what Russia will react. Fed is working with us (consultant) and many oil companies on this plan.

Part 2 of my wide-ranging discussion w/ @pescami and @pescagist podcast. ⬇️https://t.co/kGOaJpew8E

— Daniel Yergin (@DanielYergin) September 20, 2022

another interesting oppinion

Russia Oil Price Cap: A Lesser Evil or Moral Hazard?

The US-led push by the G7 to impose a price cap on Russian oil exports is a direct result of worries that the European sanctions on Russian exports that are being implemented from Dec. 5 this year may result in a major fall in Russian exports, resulting in a price hike that directly impacts gasoline in the US. The plan has major flaws, but even if it does not work, it is seen as a lesser evil than a major oil price increase. Implementing a price cap on Russian oil is likely to allow its continued flow, but this may also provide a bonanza for those happy not to play by the rules. That could cause a far bigger moral hazard than the infamous 1995 Iraq “oil-for-food” program.

- 09/19/2022 – Powell probably will go Volcker because he does not want to be Burns

Jerome Powell’s Inflation Whisperer: Paul Volcker – WSJ

Jerome Powell’s Inflation Whisperer: Paul Volcker

Aiming to reduce inflation even at the risk of recession, the Fed Chairman draws on a 1980s playbook. ‘We must keep at it until the job is done.’

- 09/18/2022 – Josh’s comments

To be fair, conventional oil production in the US has peaked, and it did so close to their time horizon. Unconventional shale oil is now a large portion of US oil production.

— Josh Young (@Josh_Young_1) September 17, 2022

- 09/14/2022 – Dr. Daniel YerginVice Chairman, S&P Global

Will Putin’s Energy Strategy Backfire?

- 09/14/2022 – news and comments

Gas-to-oil switch to increase German heating oil demand

- 09/12/2022 –

- 09/11/2022 – great interview from Daniel Yergin

This morning, we sit down with #energy icon, @DanielYergin, for a timely conversation on the EU #energycrisis, its impact on our road to #decarbonization, and what’s next now that #WinterIsComing.

Listen Now!https://t.co/w8YhD9kgjP

— Smarter Markets (@Smarter_Markets) September 10, 2022

- EU might be OK if there is a mild winter

- Putin plans to use energy war to change EU leadership. In the end, EU will stay together

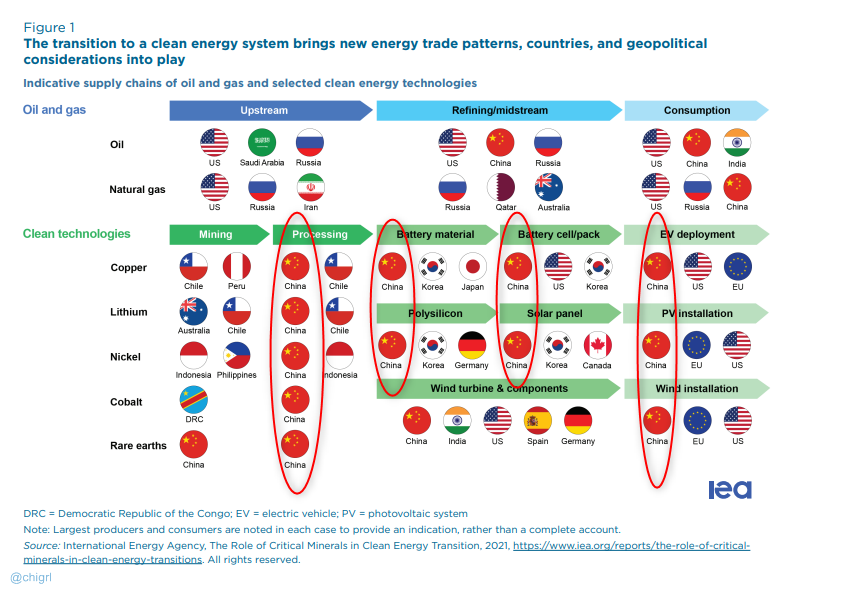

- the transition to low carbon is not feasible because we are very constrained by the mineral (e.g. copper) and oil

- 09/08/2022 –

Yellen repeatedly slams fossil fuels & talks about replacing them with "clean energy". No surprise that US o&g producers aren't in a rush to invest more money to grow their production & that workers aren't rushing back to oilfield jobs! #oil 🧐 @SecYellen https://t.co/vLhU4DHc0n pic.twitter.com/14RWK83m7R

— Josh Young (@Josh_Young_1) September 8, 2022

LIVE: Treasury Secretary Janet Yellen talks about the state of the U.S. economy — 9/08/2022

LIVE: Fed Chair Jerome Powell participates at the Cato Institute 40th Annual Monetary Conference

Cato Institute’s 40th Annual Monetary Conference

The State of Monetary Policy after 40 Year

Fed Chair Powell vows to raise rates to fight inflation ‘until the job is done’

Liz Truss vows ‘never again’ on exorbitant energy bills Prime Minister pledges to ‘revolutionise’ supply as she takes action to ease household fuel crisis

$EOG forecasts US oil production growth this year at a lower level than the EIA and consensus, and expects even slower growth in 2023.

Supply chain challenges & cost inflation cited. Implies well productivity disappointment & possible core exhaustion #oilhttps://t.co/HdaCglpErY

— Josh Young (@Josh_Young_1) September 8, 2022

- 09/06/2022 – news and comments

SAUDI ARABIA LOWERS ALL OIL PRICES FOR EUROPE IN OCTOBER

SAUDI ARAMCO RAISES MOST OIL PRICES FOR US IN OCTOBER

Interesting alongside the OPEC+ production quota cut yesterday. Maybe reflecting weakness in China with continued lockdowns? #oil #opec @aramco pic.twitter.com/u8wYENz5yF

— Josh Young (@Josh_Young_1) September 6, 2022

Saudi Arabia Cuts Oil Prices for Asia and Europe as Demand Cools

State firm Aramco lowers pricing for Asia from record highs

Move follows crude futures dropping 25% in past three months

Oil Rally Fizzles as China Woes and Risk-Off Sentiment Weigh

Chinese authorities order more restrictions as virus spreads

Saudi Arabia cuts oil prices to Asia, signaling cooler demand

Oil dropped as additional Covid-related lockdowns in China heightened risk-off sentiment across markets, halting the rally that followed the OPEC+ meeting earlier this week.

Brent crude dropped 3.04% to settle at $92.83 a barrel Tuesday. West Texas Intermediate was little changed at $86.88 compared to its Friday settlement; markets in New York didn’t register a closing price on Monday due to the US holiday. Saudi Arabia cut oil prices for customers in Asia from a record as Covid-19 restrictions and sagging economies cool energy demand in the region. Virus-related lockdowns in China spread, reigniting fears of a global slowdown.

"Do not believe all the negative narratives about the global energy crisis" – @fbirol, head of the @IEA, which was supposed to have guided policy and analysis to avoid an energy crisis!

"Not my fault"

"don't blame rushing to 'transition' to 'clean' energy"

Impressive. pic.twitter.com/x2d85I7lkN

— Josh Young (@Josh_Young_1) September 6, 2022

On European power and nat gas derivatives trading >

Energy Trade Risks Collapsing Over Margin Calls of $1.5 Trillion https://t.co/eD4foFt2WZ pic.twitter.com/SV4om5kVRO

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) September 6, 2022

South Africa sees offshore sector viable at $70/bl

Or $140 / barrel when factoring in country risk.https://t.co/1sNC1R6lYv

— Josh Young (@Josh_Young_1) September 6, 2022

- 09/06/2022 – oil rig down in Sept, good for oil price

Is Xi Jinping’s trip overseas the beginning of the end for China’s zero-Covid policy?

Most of the country’s leadership has avoided travel abroad since the start of the pandemic two years ago

But face-to-face diplomatic activity appears to be back on the agenda

“Given the systemic risks accumulated to the whole society due to zero-Covid and in the face of less threatening new variants, China will most likely cross the river by feeling the stones,” he said.

“Therefore, it is more likely, in my view, that the party congress marks the start of a major transition, rather than a discontinuity of existing policies,” Huang said.

Thanks @SullyCNBC for having me on to discuss the World Energy War getting underway. Starting in Europe with natural gas, it'll spread globally this winter into oil and impact all energy, while roiling geopolitics and energy/climate policies. #BuckleUp https://t.co/moz5ddydVd

— Bob McNally (@Bob_McNally) September 7, 2022

- 09/06/2022 – interview with Daniel Yergin

Global Energy Expert Daniel Yergin

In this episode of Intelligence Matters, host Michael Morell speaks with Global Energy Expert Daniel Yergin about energy security in the context of deep power rivalries as he provides his analysis of Putin’s energy miscalculations. Yergin details the Biden administration’s efforts to promote more oil production while committing to its long-term climate agenda. He warns against the large impact that any global disturbance can have to tight energy markets.

- Russia’s oil/gas will fully integrated into economy of EU and US, not any more, great disruption to economy. Might be comparable to that of 2018

- China started to leverage its economic power to have more geo-political influence in the world since 2015, oil/gas to miner (e.g Copper), belt-and-silk, China controls 30% copper in South America

- Oil market is very tight, gas price is related to idleness of China refinery. Oil price might be depressed before mid-term, but might jump abruptly due to geo-political risk

- skeptical about oil price cap

- Putin has very deep understanding of energy industry, better than most of Western leaders. His strategy to squeeze out the anti-russia leaders seem to work so far

- Biden admin’s rush to green energy is bad for energy security. Research found that rush will cause economic disruption, like what happens now

- 09/05/2022 – Goldman’s Sam Dart’s viewpoint

Winter is Coming Episode 1 | Samantha Dart, Head of Natural Gas Research, Goldman Sachs

- Asia (mainly China) imports over 70% of LNG normally except this year due to covid lock down, EU is the main importer this year instead and paid premium for this. Next year might be different

- US will be the main LNG exporter and great benefit from this

- Lots of EU companies not willing to sign long term contract for LNG import due to government ESG policy, instead they want 6 year contract. Not long enough for building investment for liquidification facilities. This energy might last longer than people think

- 09/05/2022 – Xi to visit Kaz and later Saudi?

President Xi was supposed to visit Saudi last month but think it got delayed? Now Kaz… I’m sensing a trend here. https://t.co/wut5j1ULLM

— Paulo Macro (@PauloMacro) September 5, 2022

Kazakhstan says China’s Xi to visit, in first foreign trip since pandemic

Chinese President Xi Jinping will visit Kazakhstan on Sept. 14, the Kazakh Foreign Ministry said on Monday, in what would be his first foreign trip since the beginning of the COVID-19 pandemic.

Kazakhstan has close ties with China, supplying minerals, metals and energy to its eastern neighbour and transhipping goods between China and Europe.

- 09/05/2022 – Josh Young’s comments – “The simple tweak shows that we will be attentive, preemptive and pro-active in terms of supporting the stability and the efficient functioning of the market,” bin Salman said.

OPEC+ gives Saudi chairman power to intervene to address market developments

This is as big of a deal as the #OPEC+ #oil production quota cut news, maybe even bigger. Saudi is now running the show, and they have repeatedly promised to "ouch oil shorts" https://t.co/lYXYHZAUT6 https://t.co/2VzYj2xqBh

— Josh Young (@Josh_Young_1) September 5, 2022

OPEC+ gives Saudi chairman power to intervene to address market developments

They scheduled the next OPEC+ meeting for Oct. 5 but the group said it could meet at any time to adjust production before that, essentially giving power to its chairman to address market developments whenever the need arises.

The source told Reuters this flexibility would extend beyond October.

“The members have trusted that the chairman can intervene whenever necessary to bring more stability and this can be beyond October until the end of the (OPEC+) agreement,” the source said.

Another OPEC source said the decision was made to rein in market volatility.

“The price movements up and down is raising concern,” the source said, adding that the group was not looking at a certain price level at which it would meet.

The supply cut is mild but shows OPEC+ is serious about managing global crude markets and willing to take preemptive action, Saudi Energy Minister Prince Abdulaziz bin Salman said Monday.

“The simple tweak shows that we will be attentive, preemptive and pro-active in terms of supporting the stability and the efficient functioning of the market,” bin Salman said.

Russia likely to reduce oil production by 2% this year – TASS cites minister @reuters

I don't think this is voluntary, but their timing announcing this is impeccable. https://t.co/5xEAqzgyeF pic.twitter.com/iX9YCPVhPu

— Josh Young (@Josh_Young_1) September 5, 2022

Russia likely to reduce oil production by 2% this year – TASS cites minister

Russian Energy Minister Nikolai Shulginov said on Monday the country would most likely reduce its oil production by around 2% and lower its gas production by some 7% this year, TASS news agency reported.

FT: Russia switches off Europe’s main gas pipeline until sanctions are lifted

They're finally saying the quiet part out loud.https://t.co/BXyq6DAxfi

— Josh Young (@Josh_Young_1) September 5, 2022

Russia switches off Europe’s main gas pipeline until sanctions are lifted

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

https://www.ft.com/content/2624cc0f-57b9-4142-8bc1-4141833a73dd

Russia’s gas supplies to Europe via the Nord Stream 1 pipeline will not resume in full until the “collective west” lifts sanctions against Moscow over its invasion of Ukraine, the Kremlin has said. Dmitry Peskov, President Vladimir Putin’s spokesman, blamed EU, UK and Canadian sanctions for Russia’s failure to deliver gas through the key pipeline, which pumps gas to Germany from St Petersburg via the Baltic Sea.

Gazprom to Shift Gas Sales to China to Rubles, Yuan From Euro

Gas giant also plans to move 25% of sales to Turkey to rubles

Kremlin seeking to move trade out of ‘unfriendly’ currencies

- 09/04/2022 – Daniel Yergin’s viewpoint of Putin’s energy war

Winter in Europe May Be Springtime for Putin – WSJ

Russia’s energy war deploys high prices to promote social turmoil and empower populist parties.

The second front has opened in the battle for Ukraine—an energy war in Europe. There’s no mystery about Vladimir Putin’s strategy. He laid it out at an economic conference in St. Petersburg in June: high energy prices, which bring hardship as they radiate through the European economy, which will create social turmoil, which will mean that people vote their pained pocketbooks. This in turn will bring to power populist parties that will, to use his own language, change “the elites” in Europe.

The ultimate aim is to bring governments to power in Europe that aren’t committed to supporting Ukraine and thus fracture the Western coalition. The strategy is already at work. Last month a right-wing party pulled out of Italy’s governing coalition, citing “the terrible choice” that Italian families face “of paying their electricity bill or buying food.” This forced the resignation of Prime Minister Mario Draghi, who in June had traveled to Kyiv to affirm Italy’s support for Ukraine.

This energy war is about current prices but also a countdown to winter. Will Europe have enough gas to fill its storage caverns and meet the elevated heating needs that come with cold weather?

- 09/04/2022 – good to listen to Tracy; price cap, possible oil price manupulation

Get the transcript: https://www.completeintel.com/weekahe…

Key themes:

1. European Natgas Stock vs Flow

2. Russian Oil Price Cap Fallout

3. Europe’s Food and Fertilizer Fallout

4. What’s ahead for next week?

Time Stamps

0:00 Start

1:51 European natgas: stocks VS flows – EU has enough NG storage until Feb 2023 when Winter is there.

8:26 What to expect in manufacturing in Europe

9:26 Difficult environment for the German Finance Ministry?

10:27 Fertilizer fallout and impacts on Europe’s food supply

14:19 Is Europe getting relief soon, or will this crisis continue to 2024?

15:33 Russian oil price cap: is it going to come about?

19:12 What’s to stop countries from indirectly buying Russian crude?

22:00 What’s for the week ahead?

on the oil price cap

TS: First, they just announced that they’ve been talking about this for months. Let me give a little bit of background. And they just now say there’s going to be three different kind of price caps, one for crude and two for refined products.

However, if you look at the actual G7 statement that was out today, they were pretty vague on it. Basically, they said, we invite all countries to provide input on the price cap design and to implement this important measure. So in other words, they’ve decided they’re going to do this, but not exactly holiday.

TS: it’s because. They’Re asking all their stakeholders to join in this. And so what I see as the problems with this right now is that there are four specific problems. One, it’s not really enforceable outside of G Seven countries if people don’t sign up for this. Two, Russia already said, again repeating you, that they won’t sell to countries that enact price caps. Three, part of this is the maritime insurance on vessels carrying Russian oil India is already providing safety and notification through IRGC class.

So by Dubai, subsidiary of the Russian shipping group. So I hope I pronounced that right. But anyway, they’ve already kind of gotten their way around this. And four, they’re also thinking about creating their own benchmark.

So right now, Russian crude oil is expressed as a discount to Brent because rent is the benchmark price. They already have an oil trading platform in place via RTS and MYsix. So they could build out this platform, which they’ve been talking about, and go through near Mir, which is basically their version of Swift, and completely by past that and just let market forces work.

I think this price cap is still way off from seeing the light of day. But this actually could turn out much more bullish because this price cap overlooks how Russia could influence global markets.

If they wanted to, they could opt to cut off the EU and NATO, not just G7. G Seven members shut production and raise global crude oil prices through the roof because they would take barrels off the market there by hurting the G7 nation.

I’m not saying that would happen. I’m just saying that’s within the realm of two box. And it’s not surprising after we just saw today, as soon as an oil price cap was announced as a plan, suddenly we just saw gas problem with Nordstream one, therefore I’m off of national gas.

AM: Of course, yeah. A lot of it is for show. This is a political thing right now for scapegoating Russia

for inflation problems. Now they’re just snowballing things and saying Russia’s gas is the problem

for inflation, Russia’s oil is the inflation problem, and other caps. But like I said earlier, and even just Tracy reaffirmed it’s like the moment you mentioned price caps against Russia, Moscow finds an issue, whether it’s gas, prom leak or Belarus problems, or Algeria has problems with Wagner. They create these issues all the time.

Tracy, do you expect, say, energy markets to continue to fall next week?

TS: What I would really look at, and what I’m looking at more, instead of looking at just reprice, which seems highly manipulated right now, especially going into midterms, not suggesting anything, but I think what I would start looking at is in like second and third month spreads or fourth month spreads. Right. So you really want to be looking, I think, just a couple of months down that curve a little bit. And if you start seeing because those curves are still kind of telling us that the market is very tight and curves, you can’t really manipulate as much as you can somewhat of the front line. So I think that’s where you should be looking at. I think we’ll really get a better grasp on these markets and to see what front market is next week is OPEC meeting, right. So they were talking about cuts, right, over the last couple of weeks. That’s right. That’s all. I will be on that. That’s on the fifth.

- 09/04/2022 – Biden against the o/g

Federal Oil Leases Slow to a Trickle Under Biden – WSJ

President, citing climate change, spurns resources his predecessors relied on to boost U.S. energy production

The Biden administration has leased fewer acres for oil-and-gas drilling offshore and on federal land than any other administration in its early stages dating back to the end of World War II, according to a Wall Street Journal analysis.

President Biden’s Interior Department leased 126,228 acres for drilling through Aug. 20, his first 19 months in office, the analysis found. No other president since Richard Nixon in 1969-70 leased out fewer than 4.4 million acres at this stage in his first term.

- 09/04/2022 – OPEC+ likely to freeze output on Sept 5

OPEC+ Likely to Freeze Output at Monday Meeting – @WSJ

Russia Signals Opposition to OPEC+ Production Cut

Russia Concerned Production Cut Tells Buyers Market Is Oversupplied

Russia Worries It Loses Leverage With Buyers in Oversupplied Market

— Josh Young (@Josh_Young_1) September 4, 2022

Russia Signals Opposition to OPEC+ Oil-Production Cut – WSJ

Group of oil producers is expected to keep levels steady at its meeting Monday

- 09/02/2022 – insights from HFI

Me Look at Oil. Me Like What Me See.

- 09/02/2022 – good tweet recommended by Josh

I don’t want to end up categorized as an oil permabull (probably too late!), but taking this head on…🧵

Many of you may recall my harping earlier this year about oil positioning and length.

— Paulo Macro (@PauloMacro) September 2, 2022

- 09/02/2022 – news and comments

U.S. rejects linking Iran nuclear deal, IAEA probes The White House on Friday rejected linking a revival of the 2015 Iran nuclear deal with the closure of investigations by the U.N. nuclear watchdog a day after Iran reopened the issue according to a Western diplomat. Iran on Thursday sent its latest response to a European Union (EU) proposed text to revive the agreement under which it had restrained its nuclear program in exchange for relief from U.S., EU and U.N. economic sanctions. “There should not be any conditionality between re-implementation of the JCPOA and investigations related to Iran’s legal obligations under the Non-proliferation Treaty,” White House press secretary Karine Jean-Pierre said, referring to the deal formally known as the Joint Comprehensive Plan of Action.

I was quoted today in a @Reuters story on Russia shutting off gas to Europe!

""It's revenue maximizing for them (Russia) to have high TTF & JKM prices and high oil prices," he added, referring to European and Asian gas price indexes by the acronyms."https://t.co/Alv8LWfCZ1

— Josh Young (@Josh_Young_1) September 2, 2022

Officials question motives for Russia’s gas pipeline halt

JOSH YOUNG, CHIEF INVESTMENT OFFICER, BISON INTERESTS, HOUSTON

“It seems like Russia is trying to force gas prices high enough that oil is used for power and heat generation” instead of gas, he said. “It’s revenue maximizing for them to have high TTF & JKM prices and high oil prices,” he added, referring to European and Asian gas price indexes by the acronyms.

- 09/02/2022 – G7 oil price cap announcement (downloaded file 2022-09-02-g7-ministers-statement) it is just a draft, detailed plan yet to come

- 09/01/2022 – great discussion on paper/physical market (https://twitter.com/PauloMacro/status/1565224539390447616)

A thread on oil and curve structure.

You may have seen me write before how “the curve always tells the truth” as part of my view going back several months of a growing divergence between physical and derivative commodity markets that has now been widely acknowledged.

1/— Paulo Macro (@PauloMacro) September 1, 2022

- 09/01/2022 – warning from Jeremy Grapham “If the bear market has already ended, the parallels with the three other U.S. superbubbles – so far so strangely in line – would be completely broken. ” all three superbubbles have not broken yet, so we still have plenty of room to go down

ENTERING THE SUPERBUBBLE’S FINAL ACT (articlegmo_entering-the-superbubbles-final-act_8-22)

Prepare for an Epic Finale

Previous superbubbles saw a much worse subsequent economic outlook if they combined multiple asset classes: housing and stocks, as in Japan in 1989 or globally in 2006; or if they combined an inflation surge and rate shock with a stock bubble, as in 1973 in the U.S. and elsewhere. The current superbubble features the most dangerous mix of these factors in modern times: all three major asset classes – housing, stocks, and bonds – were critically historically overvalued at the end of last year. Now we are seeing an inflation surge and rate shock as in the early 1970s as well. And to make matters worse, we have a commodity and energy surge (as painfully seen in 1972 and in 2007) and these commodity shocks have always cast a long growth-suppressing shadow.

Given all these negative factors, it is unsurprising that consumer and business confidence measures are testing historic lows. And in the tech sector, the leading edge of the U.S. (and global) economy, hiring is slowing, layoffs are rising, and CEOs are increasingly bracing for recession. Recently, we have seen a bear market rally. It has so far played out exactly in line with its three historical precedents, the bear market rallies that marked the middle phase of deflating superbubbles. If the bear market has already ended, the parallels with the three other U.S. superbubbles – so far so strangely in line – would be completely broken. This is always possible. Each cycle is different, and each government response is unpredictable. But these few epic events seem to act according to their very own rules, in their own play, which has apparently just paused between the third and final act. If history repeats, the play will once again be a Tragedy. We must hope this time for a minor 7 one.

- 09/01/2022 – news and comments

Oil equities are significantly dislocated from the oil price, from a multi-decade perspective. Even if WTI oil were to go down to $80 and stay there, there would be room for a significant "catch up" in share prices. https://t.co/5pmSnByYnk

— Josh Young (@Josh_Young_1) September 1, 2022

- 08/31/2022 – China is set to convene a historic meeting on Oct. 16, “We expect the zero Covid policy to be revised after the meeting in Oct, which will help the economy to normalize,” Zhiwei Zhang, president and chief economist, Pinpoint Asset Management, said in a note.

Premier Li Keqiang, the second-in-command, said he would end his term as premier in 2022. Other likely changes include leaders on foreign policy.

“The congress will thoroughly examine the current international and domestic situation,” an official English-language release said.

The meeting will “formulate action plans and fundamental policies,” the release said.

However, details on decisions made at the party congress likely won’t be formalized until the so-called “two sessions” annual parliamentary meeting that typically takes place in early March.

The expected mid-October congress puts a tentative date on when China might ease its so-called dynamic zero-Covid policy.

“We expect the zero Covid policy to be revised after the meeting in Oct, which will help the economy to normalize,” Zhiwei Zhang, president and chief economist, Pinpoint Asset Management, said in a note.

While much of the world has relaxed most Covid curbs, Beijing’s attempt to maintain a policy of few to no Covid infections has restricted business activity domestically and kept national borders largely shut for more than two years.

Citi analysts said the ruling party may even “push China’s reconnect[ion] with the world hard as soon as it decides to exit from [dynamic zero-Covid] to earn back the lost political capital.”

- 08/31/2022 – physical and paper oil market

- Oil futures are getting bashed while prices for physical Brent crude have soared to their highest since 2008.

- This dislocation in oil markets is likely a consequence of both demand and supply pressures.

- An analyst says ultimately, the futures market will eventually realign itself with the physical market.

Hansen said if physical crude oil prices stay high, then eventually the market will find the flaw in the bear case for oil futures.

“The physical market always prevails, it is a supply- and demand-driven market. If prices for physical delivery remain elevated, that obviously indicates an underlying strength in the market which the futures might obviously have to reflect as well,” he said.

Explaining The Disconnect Between Physical And Paper Oil Markets

At this juncture, it’s important to make the distinction between the physical market for crude and the crude futures market.

Physical (also known as cash) market prices are determined by the supply and demand for physical crude. Here traders buy oil from the producer and sell it to the refiner for immediate delivery. Physical buyers and sellers have a direct pulse on the market and may feel immediately when it is well supplied, or not.

Futures prices, on the other hand, are determined by the supply and demand for crude futures positions. Futures markets provide traders with a means to bet on crude prices at certain points in the future, and also allows physical market participants to hedge their position and, therefore, minimize risk.

The ongoing disconnect between physical crude and futures markets can mainly be pinned on worsening fears of a serious economic slowdown that might curtail oil demand.

“A growing number of analysts are expecting that many of the world’s leading economies will suffer negative growth in the next few months, and this will drag the U.S. into a recession,” Fawad Razaqzada, market analyst at City Index, has told Bloomberg.

Related: The One Commodity That Won’t Stop Soaring

Months of dwindling liquidity, alongside heavy technical selling as well as hedging activity by oil producers, have all contributed to the oil futures selloff. However, the biggest driver has been concern about a possible recession and an overly hawkish Fed, which have served to undermine the idea of oil prices being a means of hedging against inflation.

“Recession fears likely pushed some investors out of the oil trade as an inflation hedge,” Giovanni Staunovo, analyst at UBS Group AG, has told Bloomberg.

Last month, Federal Reserve officials determined to maintain an aggressive interest rate hike regime in a bid to cool down inflation and prevent it from becoming entrenched, even if that means slowing down the U.S. economy. According to minutes of the Federal Open Market Committee’s June 14-15 policy meeting, the central bank plans to increase rates by either 50 or 75 basis points at its next meeting slated for July 26-27, hot on the heels of a 75-basis points raise in June–the biggest in nearly three decades. Indeed, it’s June’s massive hike that triggered the ongoing oil price selloff, meaning the oil bulls might not get a much-needed reprieve any time soon.

And now, the million-dollar question: will other oil producers take their cues from Saudi Arabia?

- 08/31/2022 – we will see what will happen to oil market after this price cap

U.S., Allies Prepare to Outline Plan to Limit Price of Russian Oil – WSJ

The EU’s sanctions on insurance and financial services for Russian oil are set to go into effect on Dec. 5. Under the price-cap plan, the EU insurance ban would be reversed, allowing Western companies to continue providing financial services for shipment and sales of Russian oil outside the U.S. and Europe at the set price.

Still, important differences persist within the G-7 over the proposal. Officials have differing views over how many countries outside of the G-7 need to sign on to the price cap for it to work.

- 08/31/2022 – warning from Grantham

Jeremy Grantham Warns ‘Super Bubble’ in Stocks Has Yet to Burst

GMO’s co-founder says overvalued equities, bonds and housing will collide with high rates and inflation to cause more pain.

- 08/31/2022 – I need to take advantage of this large volatility. buy LEAPs or stocks in the early morning

— Josh Young (@Josh_Young_1) August 31, 2022

Oil Market “Completely Broken” Says World’s Largest Commodity Hedge Fund Trader

Pierre Andurand, the head of the world’s largest oil hedge fund and the commodities trader known for his bullish calls (and record gains in the past year) tweeted that the oil futures market is now “completely broken” as futures can now move $10 lower a day “for no apparent reason” (just wait until he learns about S&P futures…)

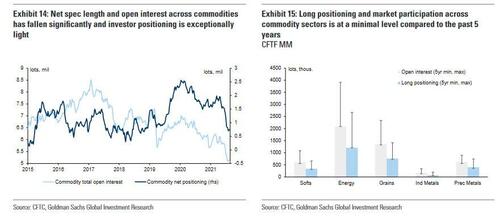

As Goldman explained previously, the financial market for oil is indeed broken due to a total collapse in liquidity and lack of hedging, which has led oil prices to have daily swings of more than $5 over a dozen times this year since Russia’s invasion of Ukraine.

While such moves once would have been considered out of the ordinary one upon a time, with open interest in oil futures at a seven-year low, bigger fluctuations have become the norm. Combined open interest on the four main Brent and WTI contracts fell below 4 billion barrels for the first time since June 2015 last week, Standard Chartered said in a note, while Goldman pointed out yesterday that both net spec length (i.e., outright bulls) and open interest have cratered.

“The market has stopped even asking why we are down $5 in a session or why we are down $2.50 this morning,” said Scott Shelton, energy specialist at ICAP.

Yet while financial markets remain skittish and continue pressing oil prices lower, the fundamental, physical market has become extremely tight, and as Goldman warned most recently yesterday, we may not be too far from an explosive move higher as the collapse in inventory finally spooks all the oil shorts and the same illquidity that has pushed oil lower sends it to all time highs.

- 08/31/2022 – Iran deal?

Nearly 30 US House Democrats have signed onto a draft letter, circulated by @RepJoshG, expressing fresh concerns about the Iran nuclear deal, which appears to be moving toward a conclusion following months of stalled negotiations.

— Iran International English (@IranIntl_En) August 31, 2022

House Democrats Express Concerns About Looming Deal With Iran

- 08/31/2022 – Clean energy depends on China

Clean Energy #SupplyChains …that is a lot of dependence on China pic.twitter.com/8C8D1XQ9tR

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) August 31, 2022

- 08/26/2022 – UAE also supports production cut!

UAE supports Saudi comments on possible oil output cuts – @reuters

This is a big deal because UAE has a little more spare capacity. UAE is showing they care more about OPEC cohesion than maximizing their market share. Bullish #oilhttps://t.co/3v5HUSEatG

— Josh Young (@Josh_Young_1) August 26, 2022

- 08/26/2022 – Powell speech- – Our responsibility to deliver price stability is unconditional. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain.

Monetary Policy and Price Stability (transcript)

Watch Live: Fed Chair Jerome Powell Gives Speech at Jackson Hole (video)

- 08/05/2022 – news and comments

China greenlights $70bn-plus in infrastructure bonds to lift economy

Xi turns focus to spurring growth with eye on third term as Communist Party chief

- 08/25/2022 – OPEC is next set to meet on Sept. 5, but there is no plan at this stage to discuss production cuts at the gathering. Several OPEC members have told the Journal that they might back a reduction in output, particularly if a global recession materializes.

OPEC President Is Open to Cutting Oil Production – WSJ

Consensus is growing for an idea first proposed by Saudi Arabia that it could pump fewer barrels

On Thursday, OPEC President Bruno Jean-Richard Itoua said he could back such action because “economic conditions created by the pandemic in recent years that have led to a slowdown in global economic activity have not yet been entirely stemmed.”

Mr. Itoua, also the Republic of Congo’s oil minister, joins a growing chorus of countries backing the Saudi position, including Iraq and Kuwait—two of OPEC’s biggest producers—and Algeria and Venezuela. Equatorial Guinea, which is set to replace the Republic of Congo as the organization’s president next year, also says it agrees that production cuts should be considered.

OPEC is next set to meet on Sept. 5, but there is no plan at this stage to discuss production cuts at the gathering. Several OPEC members have told the Journal that they might back a reduction in output, particularly if a global recession materializes.

- 08/24/2022 – news and comments

OPEC Nations Line Up Behind Saudi Call to Act If Necessary

Iraq, Kuwait, Venezuela, Eq. Guinea endorse Saudi message

Prince Abdulaziz says OPEC+ may need to reduce production

Big Oil’s Message to Investors: You’re Too Pessimistic – WSJ

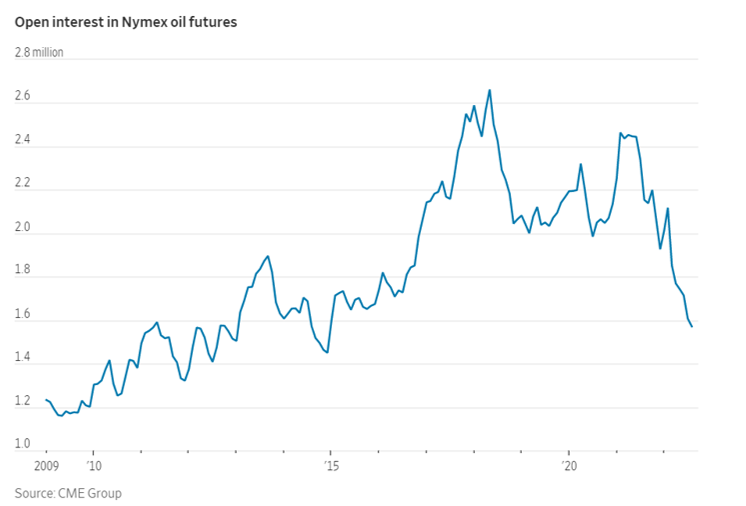

In another sign of fading investor appetite, open interest, or the number of outstanding contracts, in Nymex-traded oil futures declined to the lowest level since December 2014 last week, according to data from CME Group.

Jerome Powell’s Dilemma: What if the Drivers of Inflation Are Here to Stay? – WSJ

Policy makers gathering this week in Jackson Hole are worrying about the emergence of a more volatile world with higher interest rates

“Since the pandemic, we’ve been living in a world where the economy is being driven by very different forces,” Fed Chairman Jerome Powell said on a June panel discussion in Portugal. “What we don’t know is whether we will be going back to something that looks more like, or a little bit like, what we had before.”

• Force 1: Globalization – globalization plateaued

• Force 2: Labor markets. Mr. Goodhart wrote that global labor glut was giving way to an era of worker shortages, and hence higher inflation.

• Force 3: Energy, commodity prices. Energy and commodity firms haven’t heavily invested in new production over the past decade, creating risks of more persistent shortages when global demand is growing. When the Fed broke the back of high inflation in the early 1980s, then-Chairman Paul Volcker enjoyed some helpful tailwinds in the form of decadelong investments in oil.

That was possible when the main threats to the economy were “demand shocks”—pullbacks in hiring, consumer spending and business investment—which slow both inflation and growth, as in the recessions of 2001 and 2007-09.

‘Supply shocks’ – Rather than reducing economic demand, the forces that emerged during the pandemic were what economists call “supply shocks”—events that curtail the economy’s ability to provide goods and services, which in turn hurt growth and spurred inflation. Covid-19 lockdowns and stronger demand for goods disrupted supply chains, as did Russia’s Ukraine invasion and the West’s financial counterassault. Labor shortages emerged across the U.S. With supply shocks, the Fed faces a harder trade-off between growth and inflation, because attacking inflation invariably means damping growth and employment.

Recession risk – The Fed’s aggressive interest-rate increases this year could be the first example of what happens with U.S. monetary policy in this new environment. Faster and bigger rate rises create greater risks of recession and could upend popular investment strategies by leading to more frequent losses for the two main components of traditional asset portfolios—stocks and long-term U.S. Treasury bonds. Several former Fed officials who have worked closely with Mr. Powell say he is likely to err on the side of raising rates too much, rather than too little, because tolerating excessive inflation would represent a much greater institutional failure for the central bank. Mr. Powell has hammered home the primacy of lowering inflation to the Fed’s 2% target. “We can’t fail on this,” Mr. Powell told lawmakers on June 23, describing the Fed’s commitment as “unconditional.”

- 08/23/2022 -news and comments

Saudis, Allies Open Door to Oil-Output Cut to Keep Prices High – WSJ

- 08/22/2022 – news and comments – some factors remain beyond its control

Energy secretary guardedly optimistic about gas prices

Energy Secretary Jennifer Granholm said Sunday that the Biden administration is hopeful gas prices will continue to fall but noted that some factors remain beyond its control.

“If China opens up significantly after Covid, there will be more pressure on demand,” she said. “More pressure on demand means upward pressure on prices. So, we’re watching what happens globally. But we are doing everything possible to try to stabilize supply and demand to keep those prices coming down.”

“As you know, gasoline comes from oil. Oil is traded on a global market. So we are at the whim, if you will, of what happens globally,” the former Michigan governor said.

- 08/22/2022 – could OPEC+ cut production? – this could be very huge!! “The paper and physical markets have become increasingly more disconnected.” -exactly Josh is saying

Riyadh, August 22, 2022, SPA — HRH Prince Abdulaziz bin Salman, Minister of Energy, says volatility and thin liquidity send erroneous signals to markets at times when clarity is most needed.

In an interview with Bloomberg, HRH Prince Abdulaziz pointed out that OPEC+ has the commitment, the flexibility, and the means within the existing mechanisms of the Declaration of Cooperation to deal with such challenges including cutting production at any time and in different forms as has been clearly and repeatedly demonstrated in 2020 and 2021.

How would you describe the current state of the market?

The paper oil market has fallen into a self-perpetuating vicious circle of very thin liquidity and extreme volatility undermining the market’s essential function of efficient price discovery and have made the cost of hedging and managing risks for physical users prohibitive. This has a negative impact on the smooth and efficient operation of oil markets, energy commodities and other commodities creating new types of risks and insecurities. This vicious circle is amplified by the flow of unsubstantiated stories about demand destruction, recurring news about the return of large volumes of supply, and ambiguity and uncertainty about the potential impacts of price caps, embargoes, and sanctions.

How is the current volatility impacting the functioning of markets?

This is detrimental because without sufficient liquidity, markets can’t reflect the realities of the physical fundamentals in a meaningful way and can give a false sense of security at times when spare capacity is severely limited and the risk of severe disruptions remains high. Nowadays one need not look far for evidence of this. The paper and physical markets have become increasingly more disconnected. In a way the market is in a state of schizophrenia, and this is creating a type of a yo-yo market and sending erroneous signals at times when greater visibility and clarity and well-functioning markets are needed more than ever to allow market participants to efficiently hedge and manage the huge risks and uncertainties they face.

How can OPEC+ deal with these challenges?

In OPEC+ we have experienced a much more challenging environment in the past and we have emerged stronger and more cohesive than ever. OPEC+ has the commitment, the flexibility, and the means within the existing mechanisms of the Declaration of Cooperation to deal with such challenges and provide guidance including cutting production at any time and in different forms as has been clearly and repeatedly demonstrated in 2020 and 2021. Soon we will start working on a new agreement beyond 2022 which will build on our previous experiences, achievements, and successes. We are determined to make the new agreement more effective than before. Witnessing this recent harmful volatility disturb the basic functions of the market and undermine the stability of oil markets will only strengthen our resolve.

–SPA

18:33 LOCAL TIME 15:33 GMT

0021

- 08/22/2022 – news and comments

How Occidental Petroleum Captured Warren Buffett’s Eye – WSJ

Occidental has said it generates a profit when oil prices are as low as $40 a barrel. In the second quarter of the year, Brent crude oil prices averaged $114.10 per barrel and U.S. crude prices averaged $109.90 per barrel, according to Scotiabank.

- 08/21/2022

Warren Buffett’s Berkshire Hathaway Cleared to Buy as Much as Half of Occidental’s Shares – WSJ

Private Equity Is Pouring More Money In Oil And Gas

- 08/22/2022 – news and comments

How Occidental Petroleum Captured Warren Buffett’s Eye – WSJ

- 08/20/2022

Iran deal tantalizingly close, but US faces new hurdles

While acknowledging the seriousness of the plots, administration officials contend that they are unrelated to the nuclear issue and do nothing to change their long-held belief that an Iran with a nuclear weapon would be more dangerous and less constrained than an Iran without one.

While deal critics in the current Congress are unlikely to be able to kill a deal, if Republicans win back control of Congress in the midterms, they may be able to nullify any sanctions relief.

“Even if Iran accepts President Biden’s full capitulation and agrees to reenter the Iran nuclear deal, Congress will never vote to remove sanctions,” the GOP minority on the House Armed Services Committee said in a tweet on Wednesday. “In fact, Republicans in Congress will work to strengthen sanctions against Iran.”

China’s Xi Considers Visiting Central Asia, Potential Meeting With Putin Next Month – WSJ

Tentative change in Chinese president’s schedule comes after Pelosi’s trip to Taiwan sparked fear in Beijing of accidental military encounter

- 08/18/2022 – news and comments

OPEC and OPEC+ will be ‘extremely relevant’ if market weakens, says energy consultancy (Bob McNally)

Christmas came early for US solar developers but for EVs the Inflation Reduction Act is more complicated. OPEC+ hunkering down amidst soaring two way oil price risk, including likely return of Iran. @Bob_McNally talking with @_HadleyGamble this week. https://t.co/xQcdpkC2NG

— Rapidan Energy Group (@RapidanEnergy) August 18, 2022

- 08/17/2022 – news and comments

The Current Bear Market w/ Jeremy Grantham (TIP466) 36:29

We have a very special guest today and that is investing legend Jeremy Grantham. Jeremy is the co-founder and Chief Investment Strategist of Grantham, Mayo and van Otterloo or more commonly known as GMO – a Boston based asset-management firm. I last spoke with Jeremy almost exactly a year ago on episode 371 and I highly recommend you revisit it to see how prescient his predictions were at the time. In this episode, I wanted to get Jeremy’s thoughts on how the markets have materialized since we last spoke, but I also wanted to dive deeper into his knowledge around climate change. IN THIS EPISODE, YOU’LL LEARN:

- 00:00:00 – Intro

- 00:00:16 – Where Jeremy thinks we’ll go from here

- 00:05:26 – Why he believes rates will climb higher for longer

- 00:15:52 – How today’s market and economy may start to resemble the stagflation of the 1970’s and 80s

- 00:24:19 – Why important resources are in short supply

- 00:42:13 – The best technologies fighting climate change

- 00:59:52 – The risk in Emerging and other markets outside of the US Jeremy is one of my all time favorite guests to have on this show and I know you will enjoy it as much as I did. So, without further ado, here is my conversation with Jeremy Grantham.

https://www.federalreserve.gov/monetarypolicy/files/fomcminutes20220727.pdf

- 08/15/2022 -news and comments

We expect one more rally in crude oil: Rapidan Energy’s Bob McNally

Crude Volatility: The History and the Future of Boom-Bust Oil Prices

https://mobile.twitter.com/RapidanEnergy/status/1539984275805802499

Rapidan Energy Group’s Bob McNally on oil price volatility: where we’ve been and where we’re going

Bob McNally – the oil price cap mainly intents to keep the Russian oil flow to avoid another price spike; gas price is high mainly caused by the refining spread too high because China is holding back

https://www.axios.com/2022/06/23/biden-gas-prices-disconnect

- 08/08/2022

San Francisco Fed chief Mary Daly says economy seems to be “cooling” amid rate hikes

Hong Kong cuts hotel quarantine for travelers to 3 days, plus 4 days of home medical surveillance

- 08/03/2022 – news and comments

Iran Nuclear Negotiators to Meet in Last-Ditch Effort to Revive Deal – WSJ After 16 months of talks, U.S., EU and Iranian officials to convene in Vienna, but expectations of a pact aren’t high. Iran, the U.S. and the European Union said Wednesday that they would send negotiators to Vienna for what could be make-or-break talks on reviving the 2015 nuclear agreement with Tehran, but expectations of an agreement weren’t high after months of stalled negotiations. A senior Western official said the latest Vienna talks, which will start Thursday, were a chance to agree on the final points of a deal to revive the nuclear pact. That agreement lifted most international sanctions on Iran in exchange for tight but temporary restrictions on its nuclear work. The Western official said that an agreement would need to be found by this weekend.

Beijing Bets the House on Infrastructure – WSJ This time, however, it looks like nearly the entire stimulus effort is being funneled through the formal government bond market—which is essentially controlled by higher-level provincial governments and ultimately, Beijing. Meanwhile, the property market, the linchpin of household savings and local government finances, is being hung out to dry. That may indeed end up creating less waste, but it also seems likely to be far less effective at stimulating growth. Perhaps Beijing will change tack sooner than this Politburo meeting seems to imply. If not, we may all soon find out just how effective this new stimulus model turns out to be.

Oil Prices Fall To $90, But It’s Not Enough For Biden

In an interview with Bloomberg, Amos Hochstein, the White House’s senior adviser for global energy security, has said that gas and oil prices need to go even lower while U.S. producers and OPEC+ need to raise output.

Citi’s Morse Says Brent Will Continue ‘Downward Drift’ to Mid $80s Ed Morse, global head of commodities research at Citigroup, says lack of demand growth and the strong US dollar are behind his firm’s bearish call for crude. “Our base case is for oil to continue to drift downward, seeing Brent in the mid $80s and WTI in the low $80s for year end,” Morse says on “Bloomberg Surveillance.”

US Gasoline Demand Falls Below 2020 But There Are Far More Questions Than Answers

Now there is a way to validate all this, but it will take time. We can wait for the monthly data to come out but in order to validate the July data, we would have to wait until the end of September. The market isn’t going to do that, so in the interim, it’s likely to swing excessively to the low side until demand responds, and then rebound from there.

Sadly, I think that’s where we are headed because without reliable data, there’s no other way for the market to figure it out. So it’s just going to push to both extremes until it gets the answer it wants.

Gas Prices Have Fallen for 50 Straight Days, Approach $4 a Gallon – WSJ

Biden tweeted three times today on gas price. So admin is very determined to lower gas price. Maybe they can do it

I grew up in a family where if the price of gas went up, we felt it.

Gas prices have dropped since mid-June and should continue to come down in the days and weeks ahead. I know those extra dollars and cents mean something.

— Joe Biden (@JoeBiden) July 24, 2022

OPEC, Allies Agree to Modest Increase in Oil Production – WSJ Alliance decides to raise output by 100,000 barrels a day in September, delegates say

FULL STATEMENT: The OPEC+ communiqué is out, confirming the 100,000 b/d hike, and including quite a strong line:

"The Meeting noted that the severely limited availability of excess capacity necessitates utilizing it with great caution in response to severe supply disruptions" pic.twitter.com/i63gqSLWT4

— Javier Blas (@JavierBlas) August 3, 2022

Iranian Official Heads To Vienna To Restart Nuclear Talks

- Iran is sending its chief nuclear negotiator to Vienna to restart talks to save the nuclear accord.

- Iran’s Foreign Ministry told state media on August 3 that the talks will be coordinated by the European Union.

- U.S. President Joe Biden’s administration says it favors a return to the deal, including lifting key sanctions.

- 08/02/2022 – news and comments

Former World Bank Chief Economist Paul Romer: “Is there something different we can do that might be better?”

Romer discusses rising interest rates, higher inflation targets and more https://t.co/8G0Rnt8iRy pic.twitter.com/xqnFj4jVJZ

— Bloomberg TV (@BloombergTV) August 2, 2022

the 2 percent inflation rate may be arbitrary, it should be higher?

Lessons From the Great Inflation of 1973-81 – WSJ

U.S. Factory Growth Slowed in July on Decline in Orders – WSJ Inflation pressures eased last month as commodity price pressures diminished, according to surveys of purchasing managers

Demand for Workers Fell in June to Lowest Level in Nine Months – WSJ Despite decline, total job openings remain well above the number of available workers

Fed Official Says Economy Needs Rate Setting That Slows Economic Growth – WSJ Chicago Fed President Charles Evans hopeful central bank can dial down magnitude of rate increases over remainder of year

BP Profit Surges on High Energy Prices – WSJ Thirst for natural gas, refined products drives bumper cash flows as costs bite consumers

China’s Housing Bust Goes Beyond Steel: Elements by David Fickling

The nation’s current wave of mortgage strikes could ripple through metals.

China’s property distress sours steel sector in warning sign for economy

- Spillover-effect of property slump poses fresh risks to economy

- Steel demand, vital part of industrial engine, suffers blow

- Hit to construction ripples broadly, stings cement, appliances

- Credit constraints, property woes show no signs of easing soon

Oil Not Seeing Normal Recession-Related Declines: Sen

- 08/01/2022 – news and comments

Saudis to Use More Oil to Make Petchems

Saudi Arabia plans to quadruple the volume of oil that it allocates to petrochemicals production to 4 million barrels per day by 2030 in order to add value to its hydrocarbon sales, according to energy ministry data.

The kingdom currently allocates roughly 1 million b/d of oil to petchems, but the plans call for an additional 1.6 million b/d to be allocated to domestic projects and 1.4 million b/d to overseas projects, the data show.

Sources familiar with the matter say that China and India are being considered as target markets for Saudi Arabia’s overseas petchem expansion.

State-controlled Saudi Aramco has emerged as one of the world’s largest petchem producers since its acquisition of Saudi Basic Industries Corp. (Sabic) in 2020.

Investing in petchem capacity abroad would be one way for Aramco to lock in long-term oil demand, while also adding value to its hydrocarbons.

It could also shield Saudi Arabia from a decline in global consumption of transportation fuels in the years ahead as the result of a shift to electric vehicles, biofuels and hydrogen.

These Are The Key Drivers For The Oil Market In our view, these are the most important key drivers of the oil market: China’s oil demand. OECD oil demand. OPEC+ supplies to the market (OPEC+ crude exports). Russian crude exports (whether sanctions are impacting). US oil production.

Biden’s Unforced Energy Errors Are Leading to a Global Oil Crisis | Opinion The SPR releases are slated to end in October, shortly before Europe and Asia start burning oil for power and heat, and shortly after OPEC+ production quotas stop growing by hundreds of thousands of barrels per day, every month.

U.S. Factories Are Far From Recession – WSJ Survey data on Monday showed U.S. manufacturers remain in expansion mode

U.S. Factory Growth Slowed in July on Decline in Orders – WSJ Inflation pressures eased last month as commodity price pressures diminished, according to surveys of purchasing managers

Oil tumbles after weak factory data sparks demand concerns – News | Khaleej Times

Factories across Asia and Europe struggled in July as flagging global demand and China’s strict Covid-19 restrictions slowed production

Oil drops as weak Chinese factory data heightens demand concerns

Factories across Asia and Europe struggled in July as flagging global demand and China’s strict COVID-19 restrictions slowed production, surveys showed on Monday, adding to concerns about economies sliding into recession.

S&P Global’s final manufacturing Purchasing Managers’ Index (PMI) for the euro zone fell to 49.8 in July from June’s 52.1, falling below the 50 mark separating growth from contraction for the first time since June 2020.

The Caixin/Markit PMI eased to 50.4 in July from 51.7 the previous month, well below analyst expectations, data showed on Monday.

″ was already facing an uphill challenge, to put it mildly, with regards to its growth target this year and the fact that manufacturing activity is slowing again doesn’t bode well,” said Oanda analyst Craig Erlam.

An emerging debt crisis (I would take off the question mark -looks like we are there, unless miraculously USD takes a steep dive along with food and energy prices, which likely it will not) pic.twitter.com/eEnVPfZZqS

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) August 1, 2022

U.S. crude oil falls 5% as weak EU, China factory data raises demand fears

S&P 500 Earnings Growth Q2 2022 as of July 29 #energy 🚀🚀 pic.twitter.com/lSy92JlFwK

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) August 1, 2022

arguably 3Q'22 EPS upgrades is more compelling argument to go long #energy … rather than rear-view mirror pic.twitter.com/QJiwHjsk7r

— Τάκης Χριστοδουλόπουλος (@takis2910) August 1, 2022

- 08/01/2022 – saving rate crated, credit card load ballooned, bad sign for economy?

— John Doe (@Zero__edge) August 1, 2022

Opening of am/FX today pic.twitter.com/5xdtQx6KWx

— ʎllǝuuop ʇuǝɹq (@donnelly_brent) August 1, 2022

- 08/01/2022 – news and opinions

Putin Won’t Let OPEC Help Bring Down Oil Prices

The producer group is being asked to pump more oil and help combat soaring inflation. Russia’s not going to let that happen.

- 07/31/2022 – Josh Young

I discussed it in this recent @IdeaBrunchEmail interview. And I bought more recently. No recommendation.https://t.co/qn1S7alxSc

— Josh Young (@Josh_Young_1) July 19, 2022

Idea Brunch #2 with Josh Young of Bison Interests

Josh shares his views on oil and gas investing and his top ideas

- 07/31/2022 – news and comments

Falling Food Prices Ease Upward Pressure on Global Inflation – WSJ

U.S. Eyes Sanctions Against Global Network It Believes Is Shipping Iranian Oil – WSJ Biden administration weighs potential new measures amid plans to restart talks to halt Tehran’s nuclear program

Senate Tax-and-Climate Plan Hinges on Streamlining Energy Projects – WSJ Bill would expedite both clean-energy and fossil-fuel projects, a potential sticking point in Congress

America’s New Energy Crisis – WSJ Fossil fuel plants are closing faster than green alternatives can replace them. Producers of oil and gas can’t keep up with a surge in demand. How did this happen, and what will it take to fix it?

Why Democrats are excited for Biden after a big week Dem might not want the recession before mid-term election?

Elizabeth Warren Accuses Fed Chair of Fomenting ‘Devastating Recession’

The Massachusetts Democrat warned that if Federal Reserve Chair Jerome Powell gets his way, “the resulting recession will be brutal.”

Jerome Powell’s Fed Pursues a Painful and Ineffective Inflation Cure – WSJ

- 07/29/2022 – news

Recession or Not, the Recovery Has Ended – WSJ

The Schumer-Manchin Tax and Subsidy Pact – WSJ

Democrats waiting anxiously for Sinema’s verdict on tax and climate deal

Inside Climate Bill, a Broad Energy Push – WSJ

This is not what a recession looks like

Signs of economic growth are everywhere, says Jurrien Timmer.

- 07/28/2022 – news

LIVE: Treasury Secretary Janet Yellen talks about the state of the U.S. economy — 7/28/2022 Yellen’s comments follow news that the U.S. economy contracted for the second consecutive quarter from April to June, according to an advance estimate from the Bureau of Economic Analysis. Gross domestic product declined 0.9% at an annualized pace for that period. The economy shrank by 1.6% in the first quarter.

Biden speaks on economy and meets with CEOs for an update on economic conditions — 7/28/22

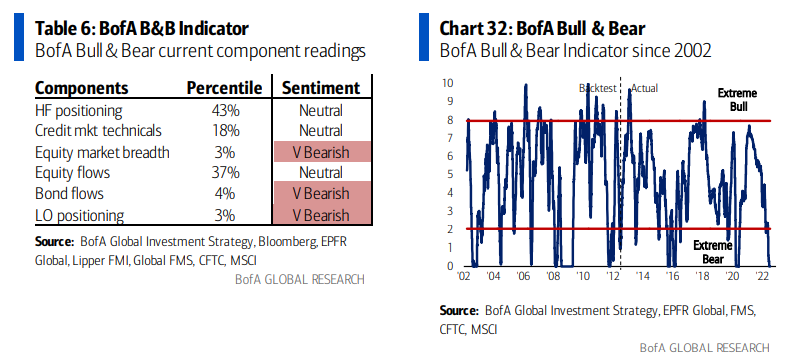

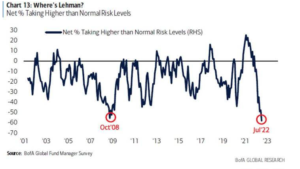

Capitulation??? This recent report, a survey of portfolio manager market psychology, indicates the current environment is worse than 2008 if one can believe its accuracy. 2008 was a significant equity buying opportunity. Today represents an similar opportunity in my experience. When traditional equity mangers favor cash over equities to the extent similar to high levels of pessimism in the past, then being a contrarian individual investor has always, over time, been beneficial to returns. In my experience, insider buying at prices that severely discount the long-term financial performance of skilled management teams is the best methodology. The link provides the story details.

BofA Survey Shows Full Investor Capitulation Amid Pessimism

July 19, 2022 at 4:42 AM EDTUpdated onJuly 19, 2022 at 10:10 AM EDT https://www.bloomberg.com/news/articles/2022-07-19/bofa-survey-shows-full-investor-capitulation-amid-dire-pessimism

Buying Opportunity 07/26/2022 one day before Fed meeting – great comment from Davidson

Having committed all capital to longer-term assets as shown by T-Bills rising to invert high 10yr Treas rates, forces a correction across all assets leading to additional debt defaults from an already high level. A recession ensues no one expected.

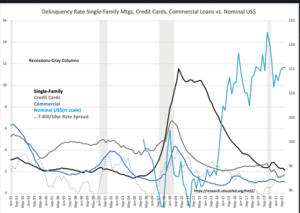

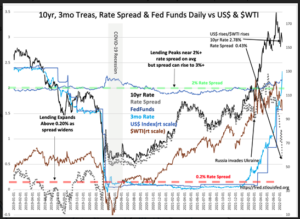

Financial recessions have a rising delinquency pattern well established prior to onset. This is present in every recession. The data is from Jan 1991 and reveals this clear pattern in all areas of credit, home mtgs, credit cards and commercial loans. It is unmistakable. The T-Bill/10yr Treas has in the past always provided a complementary inversion. A rising US$ indicting capital seeking safety in the US has also been a feature. $WTI(West Texas Crude price) declining is part of the response and is now firmly part of algorithmic hedging. This chart uses the revised Nominal US$, a broad currency trade weighted index incepted from 2006, but the same pattern is present in the earlier US$ indices for 75yrs+. What makes this time different is that the consensus call for recession is not supported by any indication of the financial distress present in every prior financial recession. It is important to note that the COVID Recession was self-inflicted when financial conditions were very sanguine. The COVID Recession lasted 1mo, March 2020-April 2020, as a result. Some, even today, declare economic weakness requires stimulus. Headlines rarely proclaim commonsense.

Net/net it looks scary but financial conditions are not risky. This is yet another panic, unique in that there is no precedent, leaving those following past patterns without guidance if they ignore fundamentals.

This mess is an equity buying opportunity!!

- 07/26/2022 – news

China’s Sinopec outbid for Russian ESPO crude in July – traders

‘We can’t be an oil supplier’: Biden’s adviser says oil reserve releases must end

Strong Dollar Fuels Pullback in Commodity Markets – WSJ Prices of raw materials such as oil, coffee and copper have retrenched

Why Inflation Is on the Way Down – WSJ The Fed should ask Milton Friedman. When growth of the money supply slows, so does the increase in prices

China’s Zero-Covid Policy Drags on Vaccination Drive – WSJ Beijing’s containment strategy is proving to be one of the biggest obstacles to ending hesitancy among the elderly

Biden Is Pressed to Declare Emergencies After Climate, Abortion Setbacks – WSJ Some Democrats and activists want president to use executive powers to unlock more authority and funding; declarations would face criticism and legal challenges

Housing Boom Fades World-Wide as Interest Rates Climb – WSJ Prices are falling in some places, raising the risk of market routs and adding to central banks’ challenges

- 07/22/2022 – debate on Recession or not

Predicting the Next Recession – Calculated risk

If the Fed tightening cycle will lead to a recession, we should see housing turn down first (new home sales, single family starts, residential investment). This might be happening, but this usually leads the economy by a year or more. So, we might be looking at a recession in 2023.

There are other indicators too – such as the yield curve and heavy truck sales – but mostly I’ll be watching housing. I’m not currently on recession watch.

Doug Kass on “Why I See a Mild and Brief Recession” – Tilson and Kass

- 07/22/2022 – graphs – extremely bearish positions for oil – a short squeeze is coming?

"energy is too crowded" 🙄 pic.twitter.com/DngZsrszq7

— Josh Young (@Josh_Young_1) July 22, 2022

Bad though this is for China’s economy – and for oil prices – much worse may be to come. “Weakness in the property sector will keep bond defaults rising and a fresh stimulus package is required to offset the deteriorating fiscal balances of local governments,” said Victorino. “[However], at only 2.7 percent of GDP, the possible stimulus package underscores the government’s ambivalence to flood the economy with supportive measures,” she underlined. For Green, a new variant of the Covid Omicron variant – subvariant BA.5 – is of extreme concern. “China is experiencing what could prove an economically devastating wave of the Omicron subvariant BA.5, with the number of areas classified as high and medium risk being 483 [as of 7 July], well above the peak of around 240 in April/May,” he said. “The full extent of spread is as yet unknown, but the outbreak shows no sign of slowing, and until a clear geographical boundary is established, estimating the economic fallout is difficult, and caution is warranted,” he added. “Last week, we downgraded China growth [to 2.5 percent], in the face of market optimism, on our judgment that a significant level of reopening – that is, sufficient to boost mobility/spending/credit demand and so on – was still six to nine months down the road, so in late Q1 2023,” he concluded.

- 07/22/2022 – news

U.S. Hopes For Price Cap On Russian Oil By Year-End

Li Keqiang pledges to do more for stability – Li added that outbound commerce and trade activities, as well as cross-border travel for labor services, would be advanced in an orderly fashion. China would further resume and increase international passenger flights and steadily improve its visa and Covid-testing policies, he said.

Premier Li Keqiang yesterday said it was not easy to achieve 2.5 percent economic growth in the first half of this year and more effort must be put into stabilizing China’s economy.

While signaling flexibility on the growth target, he also reiterated caution on excessive stimulus at a meeting hosted by the World Economic Forum, as the economy shows initial signs of recovery from Covid outbreaks.

The most important thing is to keep employment and prices stable, and slightly higher or lower growth rates were acceptable as long as employment is relatively sufficient, household income grows and prices are stable, Li told global business leaders at the forum on Tuesday, according to reports in state media.

“China won’t roll out massive stimulus, issue an excessive amount of money or overdraw the future for an overly high growth target,” Li was quoted as saying in a report by Xinhua News Agency.

Macroeconomic policies will be targeted, strong and at the same time reasonable and appropriate, according to Li. “China will be practical and realistic, do its best, and aim to achieve a relatively good level of full-year economic growth,” he said.

China’s stimulus rolled out since the pandemic first hit in 2020 has been “reasonable” in scale and this has laid a foundation for preventing inflation, Li said. There’s still a lot of room for the previous round of support measures announced in May to take effect, he added.

Li added that outbound commerce and trade activities, as well as cross-border travel for labor services, would be advanced in an orderly fashion. China would further resume and increase international passenger flights and steadily improve its visa and Covid-testing policies, he said.

Many economists expect China will likely miss its economic growth target of about 5.5 percent this year by a significant margin. That would be the first time: The government didn’t set a target in 2020, during the first wave of the coronavirus outbreak, and only missed it by 0.2 percentage points in 1998.

- 07/22/2022 – Goldman’s viewpoint

Oil prices will rise in coming weeks, sustained high prices likely – Goldman Sachs analyst

Damien Courvalin – Goldman Sachs analyst on Oil-Gas demand outlook 7-22-22

Goldman Sachs analyst Damien Courvalin said Friday that the recent moderation in oil prices “sets the stage for higher prices in coming weeks” as the global supply is still insufficient to meet demand.

In an interview with CNBC, the managing director, head of energy research and senior commodity strategist at Goldman Sachs also outlined a long-term vision of high energy prices, as a lack of supply leads to “sustained, likely record high prices.”

“Demand for oil is still above supply. We’re still depleting record-low inventories,” Courvalin said of the current market, predicting a likely near-term advance.

The Goldman Sachs analyst noted that the main factor that could prevent a renewed rise in oil prices would be an abrupt slowdown in the global economy, which he doesn’t see coming.

Courvalin stressed that commodities operate as “in-the-moment markets,” so the near-term response of oil prices will come from current demand levels, which remain high.

“The issue here is not about future growth rates. It’s about today’s imbalances,” he said.