Study of ibond

- 10/25/2022 – how to buy gift Ibond

Want to stash I Bonds in a ‘gift box’? Do it by Wednesday.

update on the world’s best, safest inflation hedge

- 04/13/2022 – good information on ibond

- The Tax Advantages of Series I Savings Bonds – WSJ

Also: Don’t miss out on the tax benefits of using qualified charitable distributions - Investors Flock to ‘I Savings Bonds’ for Protection Against Inflation – WSJ

- The Safe Investment That Will Soon Yield Almost 10% – WSJ

- Tilson’s recommendation: How to Get High, Risk-Free Returns

To take advantage of I bonds, you will have to go to TreasuryDirect’s website and set up an account… Under the tab “BuyDirect,” you will see an option to purchase Series I savings bonds. From there, it’s easy enough to complete the purchase.

- 06/12/20 – study the details of I bond

Investing in I bonds to beat CDs & Savings with TreasuryDirect

How to Invest in U S Treasury through TreasuryDirect – Better than CDs

Inflation Protected Securities Explained [TIPS & I Bonds]

Inflation Protected Securities Explained! (Protect Your Money From Inflation)

Series I Savings Bonds Rates & Terms: Calculating Interest Rates

Series I Savings Bonds Rates & Terms: Calculating Interest Rates

- 06/09/2021 – learn basic on TIPS

Introduction to Inflation-Protected Securities

What Are Inflation-Protected Securities?

When you purchase a normal bond, you know what your nominal return will be at maturity (assuming there is no default). But you don’t know your real rate of return because you do not know what inflation will be during the life of your bond. The opposite occurs with an IPS. Instead of guaranteeing you a nominal return, the IPS guarantees you a real return. So, you know your real rate of return but not your nominal return. This is again because you do not know the rate of inflation during the life of your IPS.

While inflation-protected securities are structured similarly to normal bonds, the main difference is that the IPS structure of the interest payments is in two parts rather than one. First, the principal accrues with inflation throughout the life of the IPS, and the entire accrued principal is paid out at maturity.

Second, the regular coupon payment is based on a real rate of return. While the coupon on an IPS tends to be materially lower than the coupon on a normal bond, the IPS coupon pays interest on the inflation-accrued principal rather than on the nominal principal. Therefore, both principal and interest are inflation-protected. Here is a chart showing the coupon payments of an IPS.

:max_bytes(150000):strip_icc():format(webp)/dotdash_INV_final-Introduction-to-Inflation-Protected-Securities_Mar_2021-01-6c9fb72cb0d448d8ae2e68a37c58123c.jpg)

Sounds Too Good to Be True?

While the benefits are clear, inflation-protected securities do come with some risk. First, to realize fully the guaranteed real rate of return, you have to hold the IPS to maturity. Otherwise, the short-term swings in the real yield could negatively affect the short-term return of the IPS. For example, some sovereign governments issue a 30-year IPS, and although an IPS of this length can be quite volatile in the short term, it is still not as volatile as a regular 30-year bond from the same issuer.

A second risk associated with inflation-protected securities is that, since the accrued interest on the principal tends to be taxed immediately, inflation-protected securities tend to be better held within tax-sheltered portfolios. Third, they are not well understood and the pricing can be both difficult to understand and calculate.

The Bottom Line

Ironically, inflation-protected securities are one of the easiest asset classes to invest in, but they are also one of the most overlooked. Their poor correlation with other asset classes and unique tax treatment make them a perfect fit for any tax-sheltered, balanced portfolio. Default risk is of little concern as sovereign government issuers dominate the IPS market.

Investors should be aware that this asset class does come with its own sets of risks. Longer-term issues can bring high short-term volatility that jeopardizes the guaranteed rate of return. As well, their complex structure can make them difficult to understand. However, for those who are willing to do their homework, there truly is a nearly “free lunch” out there in the investment world. Dig in!

- 06/06/2021 – Plan to buy I bond (recommended by Tilson)

The Safe, High-Return Trade Hiding in Plain Sight – WSJ

One retirement consultant calls I bonds ‘the best-kept secret in America.’ Right now they’re yielding over 3.5%, nearly risk free.

“I bonds are the best-kept secret in America,” says Mr. Bodie. With a total of just $46.4 billion outstanding, they amount to less than 0.17% of all U.S. debt held by the public, according to the Treasury Department.

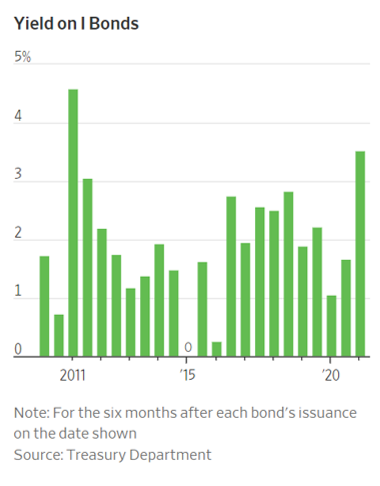

Introduced in 1998, I bonds were conceived to provide primarily small savers with a positive long-term return after inflation. Their yield consists of a fixed rate for the 30-year life of the bond and an inflation rate, which adjusts semiannually. The current 3.54% applies to I bonds issued until Nov. 1, 2021 and will reset every six months unless the official government rate of inflation stays constant.

What if interest rates or inflation head lower? Yes, the yield can decline. But, unlike with Treasury inflation-protected securities, or TIPS, the yield on I bonds can never go below zero. So they protect against both inflation and deflation, which is pretty amazing.

Interest on I bonds is exempt from state and local income tax. In confiscatory states like California, Hawaii, Minnesota, New York and Oregon, a household with $400,000 in taxable income would have to earn roughly 4% on a taxable asset to equal today’s after-tax I-bond return if rates don’t change.

I bonds aren’t as liquid as a bank account, money fund or Treasury bill. You can’t cash out until you’ve held for 12 months. If you redeem within the first five years, you’ll forfeit the last three months of interest. But they’re as liquid as other 30-year bonds—and, if you sell after the first five years, your full recovery of principal and your ability to match or outpace inflation are both guaranteed.

If you buy an I bond at today’s 3.54% rate and sell it one year and a day from now, you’ll earn 2.65% after the penalty (assuming the rate doesn’t change). That’s roughly quadruple what you’d get from a one-year certificate of deposit or ultra-short-term bond fund.

Qs: Solely on my high regard for Mr Zweig I’ve just bought an I bond for the full $10K. Am asking now (yes, I know, I should have asked before) a few questions about what I’ve bought.

1. How long is the bond for? Ten years? Thirty, I’m guessing.

2. I understand the penalties if I cash in early, but looking at it from the opposite point of view, can the Treasury give me back my money early? As, for example, if interest rates stay under 2%, why would they want to keep paying me 3.54?

3. If interest rates go up to, say 5%, do we still keep getting 3.54?

4. What happens if inflation goes up to, say, 5%. Do we keep getting 3.54?

5. In the same way, what if inflation stays below 2 percent? Do we still keep getting 3.54?

Ignorant questions, forgive me.

Answer: You can find answers at treasurydirect.gov under Individual/ Research Center/ Products in depth/ I-Bonds/ Redeem.

This is a good alternative for part of your fixed income personal portfolio. If you’re near the medicare nuisance upcharge re adjusted gross income, you can defer the interest on these until you cash them out.

If you can park some of your fixed income portfolio, this is a good place to be. As Jason pointed out, everything else is paying next to nothing.

I can compliment Jason with a southern expression for writing this column, but I don’t know if it would be printed, so I’ll pass.

1. Buy $10K x 3 = $30K.

2. Use the income reporting option only on the kid, file a tax return for her, and since her tax rate is 0 (as long as her total income is less than $12,400), no tax owed each year. When she’s ready to cash the I Bond, she owes zero tax.

3. Use the tax deferral option on the adults, and pay tax only when cashing the bond out.

4. Cash everything out during the kid’s college years (assuming it’s 5 years or more later), and use the proceeds to pay for school expenses (also assuming you’re below the income threshold).

5. Repeat every year until 1 year prior to the kid’s freshman year. You have to pay 3 months of interest as penalty on the later purchases but who cares, because as Jason pointed out the 3 months interest is a small sacrifice for a much bigger benefit.

6. Congrats! You just made 170X of the MMA yield (assume the comparable ratio stays roughly steady) year after year, tax-free

Wow. Knocking Financial Advisors. Lame.

How about, the Treasury figures out a wat advisors may track these with/for clients.

The online interface is indeed seriously out of date. I’ve just been there. Ouch.

Still, a guaranteed 3.5% today is worth the trouble. Setting up an account and transferring funds for my wife and I took about a half hour.

An easy $700 that pays for my WSJ subscription right there.

What I did do, though, was use my email address for her. Any correspondence from the gov’t will go to me (CFO for investing). (She’s CFO for spending.)

Gave up when they went online only.

I think its a 20 year, zero coupon bond with a floating rate portion that resets up or down every 6 months based on the CPI-U. It’s tied to inflation, not interest rates. Don’t know if its callable by the Treasury, but I think not.

Others are saying it is free of state tax and one can opt to have federal tax deferred. Redeemable by the holder without penalty after 60 months, otherwise there is a penalty of three months interest.

Can others confirm?