Study of Macro (part III)

- 12/20/2024 – PCE inflation November 2024: Key Fed inflation measure shows 2.4% rate in November, lower than expected

- The PCE price index, the Fed’s preferred inflation gauge, showed an increase of just 0.1% from October and a 2.4% annual rate, both below expectations.

- Excluding food and energy, core PCE also increased 0.1% monthly and was 2.8% higher from a year ago, with both readings being 0.1 percentage point below the forecast.

- Personal income rose 0.3%, short of the 0.4% estimate. Personal expenditures increased 0.4%, one-tenth of a percentage point below the forecast

- 12/19/2024 – Pejjy on X: “Here’s why $TSLA stock is selling off so hard: 1. Less interest rate cuts in 2025 (not a big deal). 2. Expiration of equity options, index options & index futures. 3. Monthly Options Expiration Date. 4. S&P Indexes Rebalance. 5. Nasdaq 100 and Nasdaq Biotechnology Index” / X

- 12/19/2024 – The Next Big Fed Debate: Has the Era of Very Low Rates Ended? – WSJ Fed officials trying to figure out just-right interest rate and some think they might be close to that destination

Trump Isn’t President Yet. He’s Already Spooking the Fed. – WSJ Inflation risks from the incoming administration’s agenda can’t be ignored any longer

The Federal Reserve can no longer deny that it is beginning to think about what Donald Trump will do as president. That in turn likely means fewer rate cuts on the horizon.

The Fed’s economic projections, and Chair Jerome Powell’s press conference, spooked the stock market into a sharp selloff. One undeniable takeaway was concern over the president-elect’s policy proposals. This sets up what could become a contentious and destabilizing relationship between the chief executive and the central bank.

- 12/19/2024 – Trump Sinks Bipartisan Spending Deal, Demands Streamlined Bill – WSJ President-elect floats idea of pairing revised legislation with raising debt ceiling

- 12/18/2024 – (1) Jesse Morgan on X: “BREAKING: Senator Rand Paul announces he will delay the passage of the massive Omnibus Spending Bill if it clears the House, potentially leading to a government shutdown if not passed by Friday. https://t.co/v7MfkvWF5o” / X – stock market tanks partially cause by the potential shutdown?

Elon Musk Says Spending Bill ‘Should Not Pass,’ Stirring Up Republican Infighting – WSJ

- 12/18/2024 – Fed Signals Intent to Slow Interest-Rate Cuts After Approving Quarter-Point Reduction – WSJ Having lowered rates by a full percentage point since September, officials penciled in just two cuts next year

Stocks fell after the Fed’s decision, and Treasury yields rose. The Dow Jones Industrial Average fell more than 500 points, or 1.3%, in afternoon trading.

New projections released Wednesday show officials expect inflation to be somewhat stickier next year than previously anticipated, possibly because of policy changes by President-elect Donald Trump. The projections show officials expect to make fewer rate reductions, with most penciling in two cuts for 2025, down from four at their meeting in September.

- 12/16/2024 – What’s Behind SoftBank CEO Masayoshi Son’s $100 Billion Pledge to Trump – WSJ Following through will require some combination of a massive fundraising effort, new debt or selling chunks of his company’s holdings to raise cash, Left unmentioned: Son, the chief executive of tech conglomerate SoftBank Group 9984 4.42%increase; green up pointing triangle, doesn’t have $100 billion. Following through will require Son to embark on some combination of a massive fundraising effort, a huge amount of new debt or selling chunks of the company’s holdings to raise cash.

- 12/15/2024 – this is great for our nation – DOGE

(1) Elon Musk on X: “https://t.co/gd1PutFWok” / X

- 12/13/2024 – be cautious more selling than buying from insiders Insider Trends: Historical Buy to Sell Ratio – GuruFocus.com

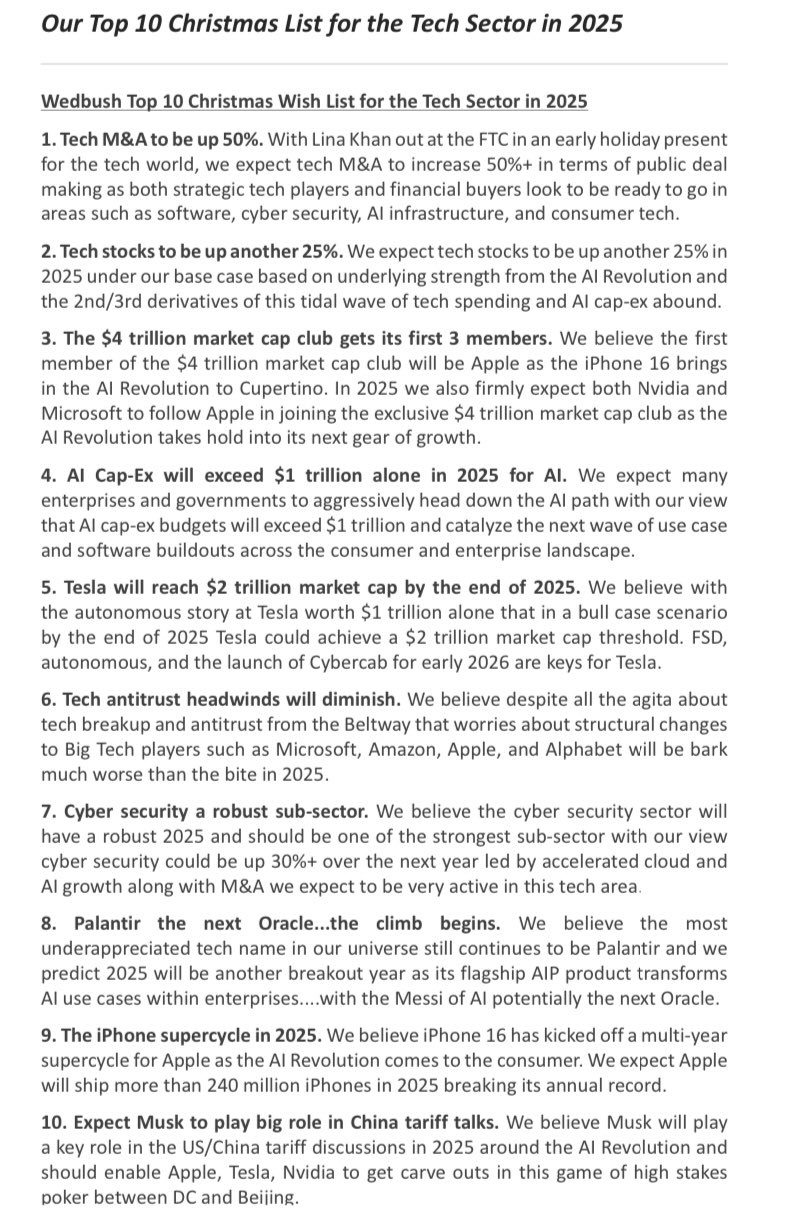

- 12/13/2024 – Tech will be in a bull market for the next 2-3 years, says Wedbush Securities’ Dan Ives | Watch

- Regarding Techs, we started the AI revolution at 9:00pm, now it is only 10:00pm.

- buy the drops on Adobe, Oracle and others

- Meta, Appl, Goog and Tsla will get stronger and stronger

Tech will be in a bull market for the next 2-3 years, says Wedbush Securities’ Dan Ives | Watch

- 12/12/2024 – Bill Ackman: Stepping into the most pro-growth, pro-business administration in my adult lifetime | Watch

Trump policies are good for all sectors, except energy?

- 12/09/2024 – macro warning

Grantham_ We’re In One Of The Greatest Bubbles In Financial History

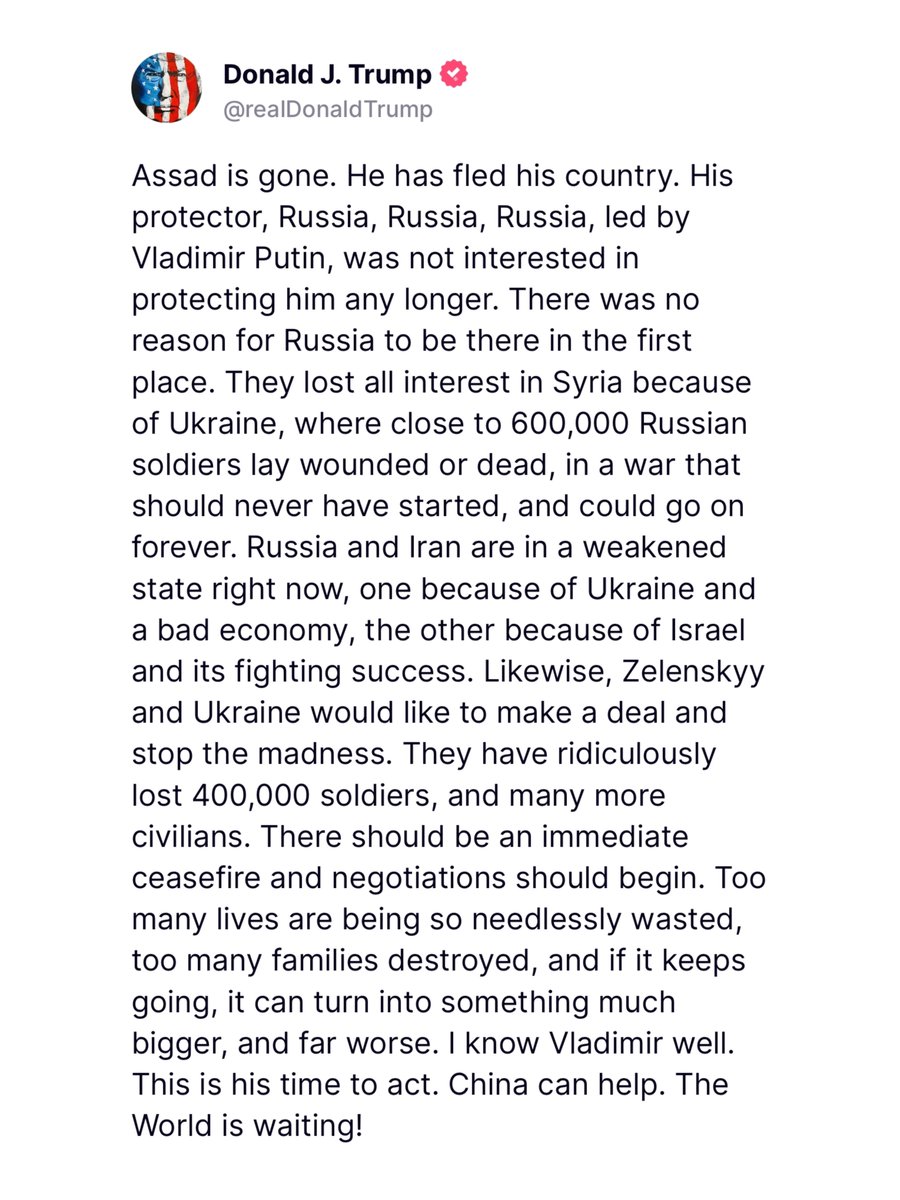

- 12/08/2024 – what will happen when the war is ended?

- 12/06/2024 – Trump to Nominate Former Georgia Sen. David Perdue as Ambassador to China – WSJ President-elect has threatened steep tariffs on products from Beijing

Some commentators in China have described Perdue as a hawk on Beijing, citing perceived “anti-China” remarks he made as a senator. Even so, his corporate record and close ties with Trump suggest that Perdue could serve as a pragmatic voice on China policy with a direct line to the White House, Chinese experts say.

At home, Perdue styled himself as being tough on Beijing amid bilateral tensions, while playing down his connections to China.

“China will need to deal with Sen. Perdue very seriously,” given his standing with Trump and understanding of U.S.-China trade dynamics, said Victor Gao, vice president of the Center for China and Globalization, a Beijing-based think tank.

Gao said choosing Perdue signals a willingness to engage Beijing in a pragmatic manner. “China should welcome this nomination,” he said.

- 12/05/2024 – Brad from Altimeter also recommended software companies (Index IGV)

Marc Andreessen @pmarca on JRE was absolute . The man is so fundamentally optimistic. And he’s quite willing to change his mind over time – his story of going from horrified and confused that Trump won in 2016 to why he supports him now is so obviously genuine. True national treasure. Worth the 3 hours. There’s 30 seconds or so around 1:25 where he talks about his optimism for the future that was just perfect. I’ll link below. I’m totally pumped up now.

Joe Rogan Experience #2234 – Marc Andreessen – YouTube

- 11/27/2024 – ChatGpt on Trump trade

The term “Trump trade” refers to a set of investment strategies and market moves that were popular during and after Donald Trump’s 2016 presidential election campaign and his tenure in office. These trades were based on market expectations about the policies and actions that Trump’s administration might take, particularly in terms of fiscal stimulus, tax cuts, deregulation, and trade policies. Investors tried to capitalize on these potential market impacts by focusing on certain sectors and stocks that were expected to benefit from Trump’s policies.

Here are some of the key Trump trade suggestions:

1. Infrastructure Spending and Construction

- Reasoning: One of Trump’s campaign promises was significant spending on infrastructure, including bridges, roads, and other public works projects.

- Sector Impact: Companies involved in construction, materials, and engineering were expected to benefit from increased infrastructure spending.

- Example Stocks: Companies like Caterpillar (construction machinery), United Rentals (equipment rental), and Martin Marietta (construction materials) were considered good investments.

2. Tax Cuts and Corporate Profits

- Reasoning: Trump pushed for substantial tax cuts, including corporate tax reductions, which were anticipated to boost profits for large companies.

- Sector Impact: Companies with large domestic operations were expected to benefit from the tax cuts, as well as those with significant overseas earnings, which could be repatriated at lower tax rates.

- Example Stocks: Large-cap companies like Apple, Microsoft, General Electric, and JPMorgan Chase were seen as beneficiaries of these tax changes.

3. Financials and Banks

- Reasoning: Trump’s administration was expected to loosen financial regulations, which would benefit the banking and financial sectors.

- Sector Impact: With the potential repeal of the Dodd-Frank Act (which imposed stringent regulations on banks), investors anticipated greater profitability for banks and financial institutions.

- Example Stocks: Stocks like Goldman Sachs, Citigroup, and Bank of America were seen as beneficiaries of deregulation.

4. Energy Sector (Especially Fossil Fuels)

- Reasoning: Trump was a strong proponent of deregulation in the energy sector, particularly concerning fossil fuels. He also aimed to increase U.S. energy independence by promoting oil, gas, and coal production.

- Sector Impact: Energy companies, particularly those in the oil and gas industry, were expected to see growth from deregulation and new drilling opportunities.

- Example Stocks: ExxonMobil, Chevron, and Halliburton were among the stocks considered strong performers under Trump’s energy policies.

5. Defense and Aerospace

- Reasoning: Trump called for increased military spending and a more robust defense posture, which was expected to benefit defense contractors.

- Sector Impact: Companies in the defense and aerospace industries were expected to see rising demand for military equipment, technology, and services.

- Example Stocks: Companies like Lockheed Martin, Northrop Grumman, and General Dynamics were expected to benefit from increased defense budgets.

6. American Manufacturing and Tariffs

- Reasoning: Trump’s focus on “America First” and his stance on imposing tariffs on foreign imports, especially from China, was expected to benefit U.S.-based manufacturers.

- Sector Impact: U.S. companies that would benefit from tariffs on imports (especially Chinese goods) were seen as stronger investments, particularly in manufacturing and steel production.

- Example Stocks: U.S. Steel, Nucor, and Caterpillar were among the companies that stood to gain from protectionist trade policies.

7. Healthcare (Insurance and Pharma)

- Reasoning: Trump’s stance on healthcare reform, including attempts to repeal and replace the Affordable Care Act, was expected to create opportunities in the healthcare sector.

- Sector Impact: Insurance companies, pharma, and healthcare providers were expected to be impacted by changes in healthcare laws, including reduced government spending on health programs.

- Example Stocks: Companies like UnitedHealth, Cigna, and CVS Health were suggested as potential beneficiaries of healthcare changes.

8. Technology and Innovation

- Reasoning: While the Trump administration did not have a clear focus on supporting the tech sector, companies in emerging technologies like artificial intelligence, robotics, and cybersecurity were still seen as long-term growth areas.

- Sector Impact: These sectors continued to grow, and stocks in these industries were generally seen as strong investments, regardless of specific political outcomes.

- Example Stocks: NVIDIA, Alphabet (Google), and Amazon were popular tech stocks that were expected to benefit from continued innovation.

9. Banking on the U.S. Dollar

- Reasoning: Trump’s policies were expected to have significant effects on the value of the U.S. dollar, depending on his fiscal policy and trade stance. A stronger dollar was seen as beneficial for U.S. companies with global exposure.

- Sector Impact: A stronger dollar was expected to negatively impact U.S. exports but benefit companies that sourced goods or services from overseas.

- Example Stocks: Stocks like Apple (which generates significant revenues overseas) were thought to be resilient in a strong dollar environment.

Conclusion:

The Trump trade was a reflection of market optimism around his administration’s policy priorities, particularly tax cuts, deregulation, infrastructure spending, and a more protectionist trade stance. Investors who aligned their portfolios with these expectations often focused on sectors like energy, financials, defense, manufacturing, and infrastructure, hoping to capitalize on the anticipated policy changes.

These sectors experienced volatility as Trump’s policies evolved, but many of these themes continued to influence market decisions even after his presidency.

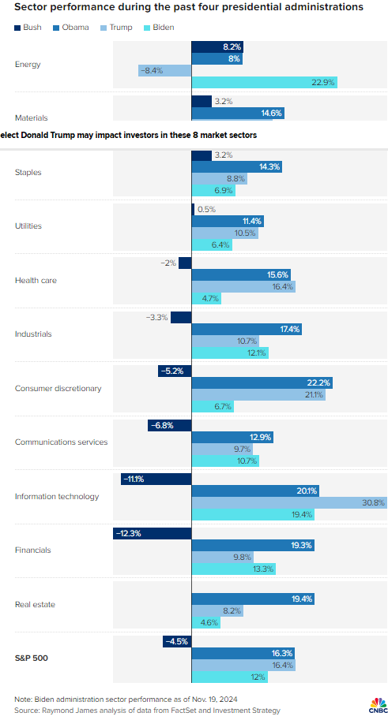

- President-elect Donald Trump’s policy agenda, from tariffs to deregulation, carries risks and rewards for different investment sectors, market experts said.

- Here are the big factors that may impact autos, banks, building materials and construction, crypto, energy, health care, retail and technology.

the biggest boost sectors in Trump 1.0 (descent order) – consumer discretionary, IT, financials, real estate, health care, materials, staples, utilities, energy

Banks

Trump’s first administration eased certain regulations for banking rules, fintech firms and financial startups.

Likewise, Trump’s second term is expected to usher in lighter financial regulations.

That may help bolster profitability in the sector, and therefore stock prices, said Brian Spinelli, co-chief investment officer at Halbert Hargrove in Long Beach, Calif., which is No. 54 on the 2024 CNBC FA 100 list.

“The larger banks probably benefit more from that,” Spinelli said.

Less regulation — combined with the prospect that interest rates could stay higher — will provide a net positive for the bank industry, since they may be able to lend out more risk-based capital, said David Rea, president of Salem Investment Counselors in Winston-Salem, North Carolina, which is No. 8 on the 2024 CNBC FA 100 list.

One issue that emerged this year that could resurface is concern about regional banks’ exposures to commercial real estate, Spinelli said.

“It wasn’t that long ago, and I don’t think those problems disappeared,” Spinelli said. “So you question, is that still looming out there?”

Retail

Tax cuts may boost consumers’ discretionary income, which would be a boon for companies selling consumer electronics, clothes, luxury goods and other items, Goldberg said.

Then again, there’s a “high probability” of tariffs, Weinstein said.

Retailers would likely pass on at least some of that additional cost to consumers, experts said.

All physical goods from apparel to footwear, tools and appliances are at risk from tariffs, Weinstein said. Tariff impact would depend on how the policies are structured.

The Home Depot (HD), Lowe’s (LOW) and Walmart (WMT), for example, source a relatively big chunk of their goods from abroad, Weinstein said.

Home Depot sources more than half its goods from the U.S. and North America, but “there certainly will be an impact,” CEO and president Ted Decker said Nov. 12 during the firm’s Q3 earnings call.

“Whatever happens in tariffs will be an industry-wide impact,” Decker said. “It won’t discriminate against different retailers and distributors who are importing goods.”

It’s a good idea for investors to own “high quality” retailers without a lot of debt and with diversified inventory sources, Goldberg said. He cited TJX Companies (TJX), which owns stores like TJ Maxx, Marshalls and HomeGoods, as an example.

“Direct imports are a small portion of [its] business and TJX sources from a variety of countries outside of China,” Lorraine Hutchinson, a Bank of America Securities research analyst, wrote in a Nov. 21 note.

Deregulation may be positive for smaller retailers and franchises, which tend to be more sensitive to labor laws and environmental and compliance costs, Goldberg said.

Technology

The technology sector continued its strong run in 2024, thanks in large part to the Magnificent Seven — Amazon, Apple, Alphabet, Meta, Microsoft, Nvidia and Tesla.

Even broadly diversified investors may find it difficult to escape those names, as they are among the top weighted companies in the S&P 500 index.

Information technology — which includes all those stocks except for Amazon and Google parent Alphabet — comprises the largest sector in the S&P 500 index, with more than 31%.

Trump is poised to have an influence on looming antitrust issues, amid considerations as to whether Google’s influence on online search should be limited.

Any tariffs put in place may also prompt some sales to decline or the cost of raw materials to go up, said Rea of Salem Investment Counselors.

Nevertheless, Rea said his firm continues to have a “pretty heavy” tech allocation, with strong expectations for generative artificial intelligence. However, the firm does not own Tesla, due to its expensive valuation, and has recently been selling software company Palantir, a winning stock that may have gotten ahead of itself, he said.

Technology valuations are trading well into the high double digits on a price to earnings basis, which often signals forward returns will decline, according to Halbert Hargrove’s Spinelli.

Consequently, prospective investors who come in now would basically be buying high, he said.

“If you think you’re going to get the same double digit returns in the next five years, sure it could happen on a one-year basis,” Spinelli said. “But your chances historically have been that your returns come down.”

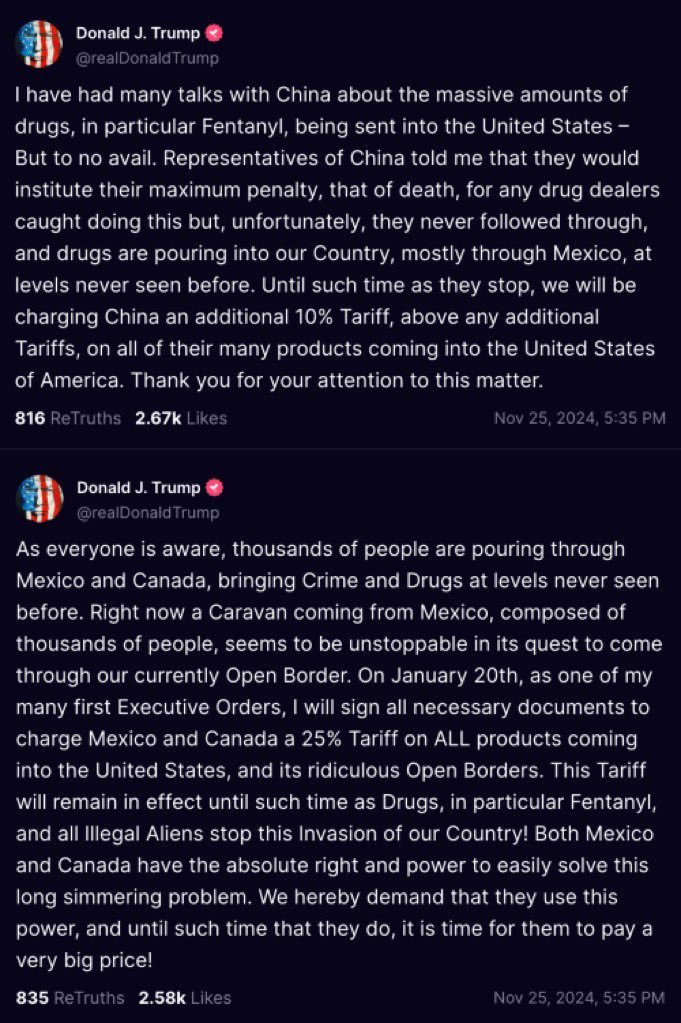

- 11/26/2024 – Trump vows an additional 10% tariff on China, 25% tariffs on Canada and Mexico – it seems like a bargain tool for Trump on China tariff

- President-elect Donald Trump plans to raise tariffs by an additional 10% on all Chinese goods coming into the U.S., according to a post Monday on his social media platform Truth Social.

- The post immediately followed one in which Trump said his first of “many” executive orders on Jan. 20 would impose tariffs of 25% on all products from Mexico and Canada.

- Trump had threatened tariffs of 60% on Chinese goods while campaigning for president.

“Drugs are pouring into our Country, mostly through Mexico, at levels never seen before,” Trump said. “Until such time as they stop, we will be charging China an additional 10% Tariff, above any additional Tariffs, on all of their many products coming into the United States of America.”

Trump had threatened tariffs of 60% on Chinese goods while campaigning for president.

A 10% tariff on China is lower than the 20% to 30% that markets expected, Kinger Lau, chief China equity strategist at Goldman Sachs, said Tuesday on CNBC’s “Squawk Box Asia.” He expects China will cut rates, increase fiscal stimulus and moderately depreciate its currency in order to counter the economic impact of increased duties.

- 11/26/2024 – China Looks to Musk as Conduit to Trump, Seeking to Ward Off Harsh Policies – WSJ With billions invested in Shanghai, Tesla chief has much at stake in next administration’s plans

Elon Musk has showed off a Tesla to China’s premier inside Beijing’s walled leadership compound and dined with Donald Trump at Mar-a-Lago.

If there is anyone with the connections to work things out between the world’s two feuding superpowers, it just might be Musk—or so many in Beijing are hoping.

Chinese leaders enjoy some leverage over the Tesla chief executive, who has poured billions of dollars into investments in Shanghai. He has said Chinese leaders “really actually seem to care a lot about the well-being of the people.”

That contrasts with the many China hawks in Trump’s orbit including Treasury secretary nominee Scott Bessent, who recently called Beijing a “despotic regime” that needs to be hit with high tariffs to protect American jobs.

To be clear, according to Trump the 25% tariffs will not be implemented, or if implemented will be removed, once Mexico and Canada stop the flow of illegal immigrants and fentanyl into the U.S. In other words, @realDonaldTrump is going to use tariffs as a weapon to achieve economic and political outcomes which are in the best interest of America, fulfilling his America first policy. This is a great way for Trump to effect foreign policy changes even before he takes office.

- 11/25/2024 – Scott Bessent Sees a Coming ‘Global Economic Reordering.’ He Wants to Be Part of It. – WSJ Trump’s pick for Treasury secretary is a fierce defender of his activist approach to trade

Three arrows

Bessent, should he be confirmed as Treasury secretary, will oversee the sale of trillions of dollars of U.S. government bonds of the type he used to trade. His other responsibilities will include advising on fiscal policy, handling tax collection, enforcing sanctions and more.

Bessent has long been worried about the U.S.’s heavy debt and thinks the main way it can be reduced is by boosting growth, which increases tax revenues.

He has advised Trump to pursue a policy he calls 3-3-3, inspired by former Japanese Prime Minister Shinzo Abe, who revitalized the Japanese economy in the 2010s with his “three-arrow” economic policy. Bessent’s “three arrows” include cutting the budget deficit to 3% of gross domestic product by 2028, spurring GDP growth of 3% through deregulation and producing an additional 3 million barrels of oil or its equivalent a day.

To get government spending under control, Bessent has advocated extending the 2017 Tax Cuts and Jobs Act but with what are called pay-fors to lower its cost. That would involve either reducing spending or increasing revenue elsewhere to offset the impact. He also proposed freezing nondefense discretionary spending and overhauling the subsidies for electric vehicles and other parts of the Inflation Reduction Act.

Earlier this year, Bessent thought about tariffs as a negotiating tool, telling investors in a letter that the “tariff gun will always be loaded and on the table but rarely discharged.” He has since argued for them more forcefully, especially as a source of tax revenue.

In a speech last month titled “Make the International Economic System Great Again,” Bessent argued for increasing tariffs on national-security grounds and for inducing other countries to lower trade barriers with the U.S. He criticized trade policy with China for enriching Wall Street, weakening domestic industrial might and failing to lead to Chinese economic overhauls.

Bessent called for tariffs to resemble the Treasury Department’s sanctions program as a tool to promote U.S. interests abroad. He was open to removing tariffs from countries that undertake structural overhauls and voiced support for a fair-trade block for allies with common security interests and reciprocal approaches to tariffs.

“President Trump is right that actual free trade is desirable,” Bessent said in prepared remarks at the time. “It might seem counterintuitive from a free market perspective, but he is also right that in order to actually create a freer and more extensive trading system over the long term, we need a more activist approach internationally.”

[Peter Thiel] I didn’t want to believe Elon when he said this, and I texted him a few weeks before the election and told him, you know, I hadn’t believed you when you said this at first, but I think it’s because psychologically I don’t want to believe that. I don’t want to believe that the country’s so far gone that you have to leave the country or something. But then it was the sense in which I felt that he was correct was that if Trump, with what I think much better substance, much better on so many things, could not win in 2024 against the machine, the machine would always win. And if the machine always wins, you no longer have a democracy. You certainly no longer have a democratic process within the Democratic Party. We always debate the election shenanigans in November of 2020. The far more extraordinary thing was March of 2020, where Biden comes in fourth place, fifth place in Iowa, New Hampshire, and then somehow gets rammed through South Carolina. All the other candidates drop off. So, it’s an extremely non-democratic primary in the Democratic Party in 2020. And then an even less democratic process by which Biden was replaced with Harris. And yeah, it was going to be this. And if the machine could defeat Trump, I thought it was reasonable that it would gain even more power and somehow be unbeatable and the country would become California, become a one-party state. And it would be far worse than California because the constraint on California is people can leave California. It’s much harder to leave the U.S.

- 11/17/2024 – How Joe Biden’s Gamble on Inflation Backfired – WSJ In avoiding the missteps that followed the 2008-09 financial crisis, officials made new mistakes that led to political defeat

Key Points What’s This?

-

Biden’s $1.9 trillion stimulus package in 2021 was intended to avoid the mistakes of the 2009 recovery.

-

The Biden administration’s belief that inflation was transitory led to a delay in addressing the issue.

-

Critics say that the White House’s reluctance to reduce tariffs, cut deficits, or curb demand left the Federal Reserve with the primary responsibility for combating inflation.

- 11/16/2024 – Republican Euphoria Punctured by Tough Math in the House – WSJ political uncertainty will show up

- 11/16/2024 – December Interest Rate Cut Isn’t a ‘Done Deal,’ Says Boston Fed President – WSJ Boston Fed President Susan Collins says a December rate cut isn’t a ‘done deal’

- 11/15/2024 – Beijing is already preparing to retaliate in a second Trump era

In the first trade war, China quickly retaliated with $100 billion in tariffs on U.S. goods, particularly agricultural products like soybeans and corn.

To retaliate against any new measures, China would probably turn back to this agricultural tariff playbook, in part because it targets the livelihoods of U.S. farmers, a politically important constituency for Trump in swing states like Ohio and Iowa.

“If what happens in the first couple of years of the Trump administration really disrupts the business of farming, you can imagine the U.S. midterm elections going a different direction,” said Even Pay, an agricultural analyst at Trivium China, a Beijing-based research firm.

- 11/14/2024 – Bill Ackman tells Megyn Kelly that Trump is picking ‘the dream team’

- 11/13/2024 – “Freight Recession” Over – ValuePlays

Recession fears have a history of well-defined inventory reduction first seen as severe recession fear built in 2016 and lasted till the COVID shutdown raised trucking use rapidly. The last period of recession fear began roughly Dec 2021 and accelerated into a trucking slowdown beginning March 2022. The retailer response has been to keep tight control on inventories with low inventory to sales ratios. This was the beginning of the strongest prolonged bout of recession fear ever. Only recently have we seen the beginnings of easing the pessimism in sentiment indicators. Freightwaves.com has just declared the end of the trucking recession. The video is part of the story which may be worthwhile passing on to interested parties.

The Freightwaves people are ecstatic in this report and well worth the watch to have them walk you through their presentation.

- 11/12/2024 – (1) Not Elon Musk on X: “@BillAckman Bill is going to be MAX LONG for the roaring 20s!” / X

- 11/09/2024 – Charlie Kirk on X: “President Trump released his plan to DISMANTLE the Deep State. Now that he’s President-elect, this is the most important three minutes of video on the internet right now. HUGE 🔥🔥 https://t.co/lhXwDPsv1q” / X

- 11/09/2024 – (1) MJTruthUltra on X: “Trumps Plan to Take a Quantum Leap in Technology and Land Development —Build 10 NEW Cities and Flying Cars The future will be AMAZING! 🙌 • 1/3 of the United States land mass is owned by the Federal Government. – One half of 1% of that land, we should hold a contest to https://t.co/dWTfbKDSV4” / X

Trumps Plan to Take a Quantum Leap in Technology and Land Development —Build 10 NEW Cities and Flying Cars The future will be AMAZING! • 1/3 of the United States land mass is owned by the Federal Government. – One half of 1% of that land, we should hold a contest to charter up to build 10 NEW CITIES “Freedom Cities”. • Transportation- We will lead the way in air & mobility to develop vertical take off & landing vehicles for families. • Forgotten communities will be hives of industry producing goods no longer imported from China! • Cost of Living- Major initiative lowering cost of living, focus on lowering the cost of a new car & building beautiful single family homes. • Congress to support baby bonuses! For young parents to help launch a BABY BOOM! • Launch a modernization & beautification campaign. – Get rid of ugly buildings – Refurbish parks & public spaces – Make cities & towns more livable

Trump Statement Agenda 47: Quantum Leap in the American Standard of Living! Wow!

- 11/07/2024 – The Fed – November 6-7, 2024 FOMC Meeting

Transcript of Chair Powell’s Press Conference November 7, 2024

- 11/06/2024 – The Winners and Losers From the ‘Trump Trade’ Gripping Markets – WSJ Big banks and small-cap stocks surge, while retailers and manufacturers brace for tariffs

Winner: big banks

The S&P 500’s financial sector jumped 6.2% Wednesday, with investors giddy at the prospect of lighter regulations.

Winner: big tech and crypto

Tech leaders including Tesla CEO Elon Musk, a big Trump booster, are hoping for favorable policies from the Trump administration.

Tesla shares surged 15%. Nvidia jumped 4.1% a day after the chip maker surpassed Apple as the world’s most-valuable company. Google-parent Alphabet, which has been under antitrust scrutiny, advanced 4%.

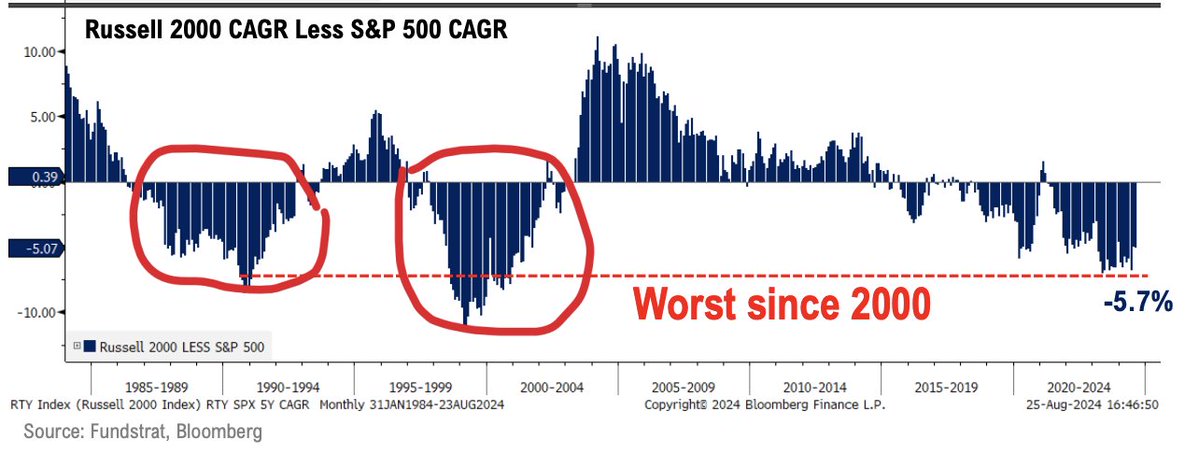

Winner: small caps

The Russell 2000 index of small-cap companies rose 5.8%, reflecting optimism that corporate tax cuts and lighter regulation for small businesses are on the horizon.

The move came despite an increase in bond yields, which often hurts smaller companies that are more reliant on borrowing.

Tariffs and tax cuts are both inflationary forces, hence the bond selloff that’s pushing yields higher, said David Kelly, chief global strategist at J.P. Morgan Asset Management. But corporate tax cuts would be an unequivocal positive for stocks, he added.

Loser: tariff-exposed companies

U.S.-based companies that manufacture goods overseas sold off on worries over tariffs.

Shares of Nike, Target, Best Buy, Williams-Sonoma and Restoration Hardware—all companies that Goldman Sachs analysts have identified as highly exposed to tariffs—traded lower.

Investors don’t like uncertainty, and it isn’t yet known exactly how much the Trump administration might raise tariffs.

- 10/06/2024 – Wall Street Salivates Over a New Trump Boom – WSJ

The enthusiasm is especially heated in a few areas, investors and bankers said. Banks and other financial companies climbed, with the KBW Bank Index rising 11%. Investors expect regulatory scrutiny will ease in a Trump administration.

Some also expect more dealmaking, potentially among smaller and midsize banks. The expected departure of Lina Khan, who leads the Federal Trade Commission and has been a thorn in the side of executives hoping to work out tech acquisitions, was cheered by investors and bankers.

“A lot of these mergers have been thwarted by the current administration,” the activist investor Carl Icahn said in an interview late Tuesday. Given a Trump victory, he said, “That’s going to change.”

Deals boom?

Dealmakers expect mergers and acquisitions to come roaring back, with the installation of business-friendly regulators replacing those backed by Sen. Elizabeth Warren (D., Mass.), a noted dealmaking foe. Goldman Sachs and Morgan Stanley were among the strongest performers on Wednesday; those firms are among the most deal-oriented.

“We’re poised for a potential surge in M&A activity,” Frank Aquila, Sullivan & Cromwell’s senior M&A partner, said Wednesday on LinkedIn.

More room for banks

Among the biggest beneficiaries of a Trump administration are U.S. banks, a group that has been under regulatory scrutiny that is likely to ease in the next four years.

Bank stocks surged Wednesday in a wager that a strong economy, increased dealmaking and lighter regulation will spur higher profits. Some of the firms that have been under the most pressure from their overseers during the Biden administration surged. Wells Fargo jumped 13% to a new high. Goldman Sachs and Morgan Stanley both rose more than 10%.

On Wednesday, the regional lenders KeyCorp, Huntington Bancshares, M&T Bank, Regions Financial and Truist Financial rose 11% or more.

Smaller stocks

Nowhere was the economic optimism more apparent than in small-cap stocks.

The Russell 2000 index marked its best day in nearly two years. Small-caps tend to be more volatile and have trailed large-cap peers this year, partially explaining why they were primed for a big rally.

Investors are hoping that a looser regulatory regime could allow small companies to thrive, while tariffs might help stymie foreign competitors. Shares of Xometry, a software platform that helps product designers and engineers access a network of global manufacturers on demand, has soared around 40% since Monday on expectations that new tariffs could increase demand for its platform.

Small-caps gained momentum in the third quarter thanks to economic strength and rising capital spending from their customers, said Raheel Siddiqui, senior investment strategist at Neuberger Berman.

“The trend was already in place, but Trump’s policies could supercharge it,” Siddiqui said.

The United States is about to become a vastly superior place to do business. We are already the safest and most militarily capable country in the world making us an extremely attractive place to live and raise a family in an increasingly dangerous world. These facts have not gone unnoticed by successful people around the world who are not happy with what their own countries have become, and how their governments have turned against their hardest working and most successful citizens. The problem with our immigration system is that it takes years for the talented, hard-working, successful, law-abiding immigrants to get in, and it takes only days for illegal migrants to cross the border and enter the country. We need to reverse this absurdity. Imagine if we could vet applicants who wanted to bring their talents and resources here in a 45-60 day process as long as they met certain standards for excellence and character. This is not a particularly challenging problem and that’s before comparing it with catching a Super Heavy rocket with chopsticks. We could open the floodgates for entrepreneurs, scientists, engineers, makers, designers and more who could replace the illegal migrants and those who have been consuming resources and bringing crime to our cities and towns. The new immigrants would be force multipliers, bringing and building businesses which will drive our economy and employment. Consider the impact of deporting one criminal migrant and replacing him with a technology engineer and then do the multiplication. The positive impact on our economy and growth rate would be extraordinary. Think Israel after its Russian migration when the best and brightest scientists and engineers left oppression and helped to build start up nation. Think the United States in the 1930s when German scientists came and enabled our rocket, missile and atomic capabilities that helped win the war and build industries thereafter. The time has come.

- 10/04/2024 – Money Movers on X: “Will October be a trick or treat for investors? @fs_insight Managing Director @fundstrat is watching the $VIX as an indicator of how much the market could rally: “It’s hard to say this is a green light into year-end.” https://t.co/J4ht0k1X9o” / X

- 10/04/2024 – U.S. Hiring Accelerated in September, Blowing Past Expectations – WSJ

- September’s outsized payrolls boost takes the U.S. economy out of the shadows of recession and gives the Fed a glide path to a soft landing.

- The big jobs gain virtually eliminated any chance that the central bank would be repeating its half percentage point interest rate cut from September anytime soon.

- The Fed next meets Nov. 6-7, right after the U.S. presidential election and a five-week span during which it will get plenty more to digest.

- stock price is a coin flip next month

- the valuation is high, no much upper trend

- lots of hedge funds are waiting for the election gets over

- investors are talking about recession which is already here

- PCE is coming this Friday

- might be up after election, wait for 3 to 6 months

Typically, the start of a rate-cutting cycle marks a period of uncertainty for companies and investors. As time goes on, it usually becomes clearer whether the economy is going to enter recession or not. That helps explain why the S&P 500 index has historically performed well in a rate-cutting cycle.

Many small companies get an extra benefit because they tend to have more floating-rate debt than their larger peers—meaning that rate cuts directly lower their borrowing costs. As a result, the Russell 2000 index of small and medium-size businesses has often outperformed the S&P 500 after the Fed starts cutting rates.

- 09/18/2024 – Fed Cuts Rates by Half Percentage Point – WSJ Officials are hoping to prevent a gradual cooling in the labor market from turning into a deeper freeze

The Federal Reserve voted to lower interest rates by a half percentage point, opting for a bolder start in making its first reduction since 2020. The long-anticipated pivot followed an all-out fight against inflation the central bank launched two years ago.

Eleven of 12 Fed voters backed the cut, which will bring the benchmark federal-funds rate to a range between 4.75% and 5%. Quarterly projections released Wednesday showed a narrow majority of officials penciled in cuts that would lower rates by at least a quarter point each at meetings in November and December.

- 09/18/2024 – WATCH LIVE: Federal Reserve Chair Powell speaks after Fed announces interest rate cut | PBS News

WASHINGTON (AP) — The Federal Reserve on Wednesday cut its benchmark interest rate by an unusually large half-point, a dramatic shift after more than two years of high rates helped tame inflation but that also made borrowing painfully expensive for American consumers.

The rate cut, the Fed’s first in more than four years, reflects its new focus on bolstering the job market, which has shown clear signs of slowing. Coming just weeks before the presidential election, the Fed’s move also has the potential to scramble the economic landscape just as Americans prepare to vote.

- the tune of FOMC is critical, if it is bearish, then negative for the market

- 25pt or 50 pt cuts are no difference

- both presidential candidates are somewhat good for the market. historically, right after presidential election in one or two months, the market is good

- 09/13/2024 – 25bps or 50 bps Cut? – ValuePlays

I think the Fed does 25bps as they’ve signaled it, and I can’t imagine a justification for 50bps, barring something dramatic before the meeting

“Davidson” submits:

There is tremendous speculation for the Fed to cut 50bps(0.5%) this month. The history of Fed Fund shifts track the T-Bill rate after a couple of weeks leaving Fed Funds at a premium. That premium has hovered around 20bps over last 10yrs+. If this pattern holds, then we need to see T-Bill rates drop to 4.75%-4.8% range for a couple weeks to permit the Fed to act. We are not close yet even though it appeared we might drop below the spot rate 4.96% of a couple of weeks ago. Since then, T-Bill rate has hovered near 5%+/- and is 4.92% today. Unless we see the T-Bill rate below 4.8%, 25bps cut appears out of range and 50bps too far for the Fed to lead that far ahead which it has not done since the early 1980s.

The pressure to lower Fed Funds has been present for ~24mos with the consensus having the European Central Bank already cutting with perhaps another cut just around the corner. That they still face high inflation seems out of character with the recent cut. This does show the pressure traders can put on Central Bankers to alter stated policies.

Friday The 13th: The Cutting Cycle

BY TYLER DURDEN

FRIDAY, SEP 13, 2024 – 11:00 AM https://www.zerohedge.com/markets/friday-13th-cutting-cycle

By Philip Marey, Senior US strategist at Rabobank

Friday The 13th: The Cutting Cycle

Market speculation about a 50 bps rate cut by the Fed next week returned overnight after the Financial Times and the Wall Street Journal called the Fed’s rate choice between 25 and 50 bps a close call and former FOMC member Bill Dudley said there was a strong case for 50.

- 09/11/2024 – A Recession Signal Is Flashing Red. Or Is It? – WSJ

The index for shelter rose 0.5 percent in August and was the main factor in the all items increase. The food index increased 0.1 percent in August, after rising 0.2 percent in July. The index for food away from home rose 0.3 percent over the month, while the index for food at home was unchanged. The energy index fell 0.8 percent over the month, after being unchanged the preceding month.

The shelter index increased 5.2 percent over the last year, accounting for over 70 percent of the total 12-month increase in the all items less food and energy index. Other indexes with notable increases over the last year include motor vehicle insurance (+16.5 percent), medical care (+3.0 percent), recreation (+1.6 percent), and education (+3.1 percent).

- Wall Street is gearing up for one of the most important economic releases of the year Friday.

- The consensus is for the nonfarm payrolls report to show growth of 161,000 for August and a slight decline in the unemployment rate to 4.2%.

- Markets are certain the Fed will start lowering interest rates in a couple weeks, with the possibility of a jumbo cut depending on what Friday’s report shows.

- Companies hired just 99,000 workers last month, less than the downwardly revised 111,000 in July and below the consensus forecast for 140,000, according to payrolls processing firm ADP.

- The report corroborates multiple data points recently that show hiring has slowed considerably from its blistering pace following the Covid outbreak in early 2020.

- The ADP data showed that while hiring has decelerated significantly, only a few sectors reported actual job losses.

- 09/05/2024 – Trump Adopts Elon Musk’s Proposal for Government Efficiency Commission – WSJ Former president also reiterates calls for lower corporate tax rate and steep regulation cuts

Trump Says He Would Ban Mortgages for Undocumented Immigrants – WSJ The Republican nominee said it would help bring down home prices

Former President Donald Trump said he would ban undocumented immigrants from obtaining home mortgages, a move he indicated would help ease home prices even though these buyers account for a tiny fraction of U.S. home sales.

Home loans to undocumented people living in the U.S. are legal but they aren’t especially common. Between 5,000 and 6,000 mortgages of this kind were issued last year, according to estimates from researchers at the Urban Institute in Washington.

Overall, lenders issued more than 3.4 million mortgages to all home purchasers in 2023, federal government data show.

Trump, the Republican presidential nominee, made his comments on Thursday during a policy speech to the Economic Club of New York in Manhattan.

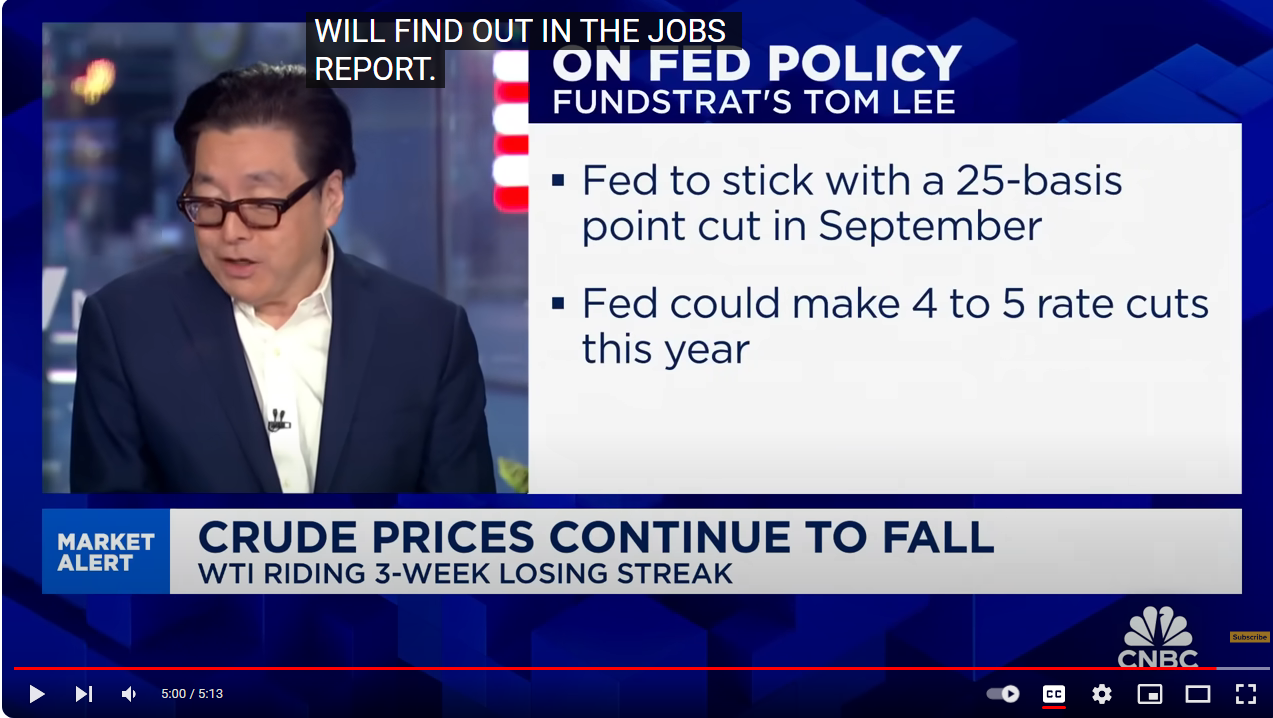

- 09/03/2024 – (1) Thomas (Tom) Lee (not drummer) FSInsight.com on X: “good stuff @SeanMFarrell 👀👀 👇 #tuesdaymusings” / X

The base case for the next 8 weeks is challenging for #stocks and #equities – but an opportunity will emerge to #buythedip This is what we are watching . Great speaking with @JoeSquawk @andrewrsorkin on @SquawkCNBC today.

“I think a 7-10% pullback can happen over the next 8 weeks, but it would be a situation to buy the dip” … “It’s a strong market… Don’t think we’ve seen the tops for 2024.”

- 09/03/2024 – Investors should be cautious for the next 8 weeks, says Fundstrat’s Tom Lee (youtube.com) – what are my action plans for this?

- the stock market could be volatile for the next 8 weeks

- correction of -7% or -10% is not surprising. get ready to buy this deep

- market has been up 7% for the past 6 weeks, expect volatility

- it changes from inflation scare to growth scare, could be continue

- Fundstrat’s viewpoints