Study of TPL

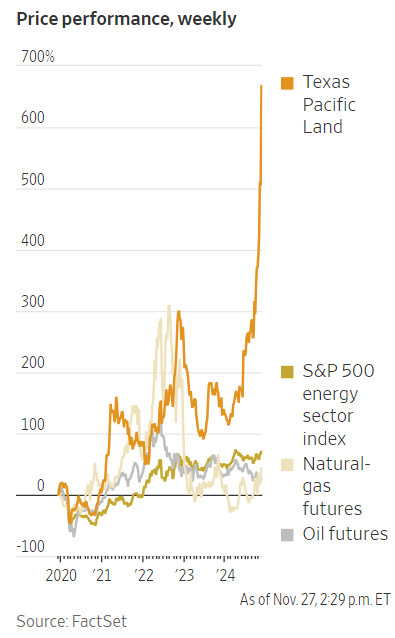

- 11/26/2024 – This Hot Texas Oil Stock Is a Defunct 19th-Century Railroad – WSJ A new approach to wringing cash from its swath of desert has Texas Pacific Land shares soaring – lots of revenue streams boosted the stock price significantly.

A big lesson learned for me on how to find the 7 baggers investment

The success has sparked imitators. Shares of LandBridge, another big Permian property owner, have more than tripled since their initial public offering in late June. LandBridge said earlier this month that it would pay $245 million for the 46,000-acre Wolf Bone Ranch in West Texas, giving it a total of 272,000 acres.

While oil production has propelled Texas Pacific’s rise, investors are looking for natural gas to fuel further growth.

- 09/30/2021 – a buying point?

Texas Pacific Land tumbles as Credit Suisse slaps with Sell-equivalent rating

- Texas Pacific Land (TPL -7.3%) plunges after Credit Suisse initiates coverage with an Underperform rating and an $800 price target, which would represent a 40% drop from yesterday’s closing price.

- TPL is trading at an outsized premium “despite moderating growth and lack of visibility on surface option value,” Credit Suisse’s Chris Baker says.

- “As moderating growth and recently enhanced disclosures are better understood, we believe TPL will continue to be viewed as having an enviable asset position but one that deserves a more modest premium to royalty peers given similar production growth and volatile commodity exposure,” the analyst writes.

- 03/21/2021 – it is possible TPL will be in SP500 and ETF ownership

The Texas Pacific Land Trust Investor

- 11/24/2020 – the reorg of TPL is anticipated to be the first half of January 2021. Get ready for it.

Provides Update on Corporate Reorganization

DALLAS–(BUSINESS WIRE)– Texas Pacific Land Trust (TPL) (“the Trust”) announced today that its Trustees have declared a special cash dividend of $10.00 per sub-share certificate. The special cash dividend, which will be payable on December 17, 2020 to sub-shareholders of record as of the close of business on December 11, 2020, increases the Trust’s cumulative 2020 regular and special dividend offerings to $26.00 per share and represents $201.7 million returned to shareholders this year.

Additionally, the Trust today provided an update on its previously announced corporate reorganization efforts. On March 23, 2020, following a comprehensive review led by a Conversion Exploration Committee that included shareholder representation, the Trustees approved a plan to reorganize the Trust from its current structure to a corporation formed under Delaware law. On June 15, 2020, the Trust announced the name of the new corporation, Texas Pacific Land Corporation (“TPL Corp”), as well as the prospective members of its Board of Directors. A draft registration statement on Form 10 has also been submitted to the Securities and Exchange Commission (the “SEC”) for review on a non-public basis. The Trust continues to make significant progress toward effecting its planned corporate reorganization and now anticipates that it will occur during the first half of January 2021.

- 02/13/2020 – great recap of TPL

Texas Pacific Land Trust: The Century-Old Share Buyback Story

Little competition, capital-light, simple and boring operations facing an existing future