Study of SOXL and TQQQ

- 11/19/2024 – Biden Team Races to Deliver Chip Grants Before Trump Takes Over – WSJ Government officials and chip makers like Intel are in talks over billions of dollars aimed at growing domestic manufacturing

The Commerce Department is aiming to finalize as many of them as possible in the next two months ahead of the incoming Trump administration, according to people familiar with the matter. Government and company officials say the legally binding, finalized awards would be impossible to pull back absent an act of Congress.

Donald Trump threw the program’s fate into question on the campaign trail, telling podcast host Joe Rogan that the government should encourage chip production in the U.S. by taxing imported chips rather than offering the grants of the Chips Act.

“That chip deal is so bad,” Trump said in the late-October interview. “When I see us paying a lot of money to have people build chips, that’s not the way. You didn’t have to put up 10 cents. You could have done it with a series of tariffs.”

What will happen under the new administration remains unclear. The Chips Act passed with bipartisan support, and many of the chip projects it is supposed to fund are in the districts of Republican lawmakers. Some industry executives who have spoken to people within Trump’s orbit expect the law to survive the transition of power.

- 11/15/2024 – do you think tensions with China will remain a threat to the semiconductor industry?

Yes, tensions between the US and China are likely to remain a significant threat to the semiconductor industry. The ongoing tech conflict has led to increased export controls and restrictions on advanced semiconductor technologies. These measures aim to limit China’s access to cutting-edge chips and equipment, which are crucial for both commercial and military applications.

China has responded with its own export controls and restrictions, creating a complex and strained supply chain. This situation has forced companies to rethink their strategies and consider diversifying their supply chains to mitigate risks.

While diplomatic efforts continue, the technological rivalry shows no signs of easing, and the semiconductor industry remains a key battleground. It’s a dynamic situation that requires constant monitoring and adaptation from companies and policymakers alike.

Do you have any specific concerns or interests related to this issue?

The negative effects of US-China tensions on the semiconductor industry are significant and multifaceted:

- Supply Chain Disruptions: The trade conflict has led to disruptions in the global supply chain, causing delays and shortages in semiconductor production. This has increased costs and complicated financial operations for companies.

- Increased Costs: Export restrictions and tariffs have driven up the costs of raw materials and manufacturing. Companies are forced to spend more on sourcing materials and navigating the complex trade landscape.

- Reduced Market Access: Restrictions on technology sales to Chinese companies have limited market access for semiconductor firms, impacting their revenue and growth potential.

- Economic Impact: The trade war has had broader economic implications, affecting not only the semiconductor industry but also related sectors such as electronics, automotive, and telecommunications.

- Strategic Realignments: Companies are rethinking their supply chain strategies, seeking to diversify and build resilience to mitigate risks associated with geopolitical tensions.

These challenges highlight the need for companies to adapt and innovate in response to the evolving geopolitical landscape. Do you have any specific concerns or interests related to this issue?

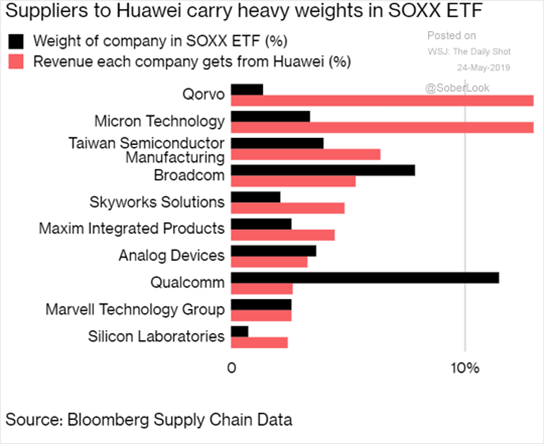

The US-China semiconductor tensions have affected several companies across the globe. Here are some notable ones:

- Intel and Qualcomm: These US-based companies have significant revenue exposure to China, with combined sales of around $45 billion in 2022.

- Taiwan Semiconductor Manufacturing Company (TSMC): As a leading chipmaker, TSMC has had to navigate the complexities of the US-China trade conflict.

- Chinese Chipmakers: Companies like Semiconductor Manufacturing International Corp (SMIC), Hua Hong Semiconductor, and Shanghai Fudan Microelectronics have faced challenges due to export restrictions and increased scrutiny.

- US Defense Contractors: Companies like Raytheon and Lockheed Martin have been impacted by China’s retaliatory measures.

- Global Tech Supply Chains: Companies involved in the production of semiconductors, such as Apple and Qualcomm, could face disruptions if tensions escalate further.

These companies are navigating a complex and evolving geopolitical landscape, which requires constant adaptation and strategic planning.

both ARM and NVIDIA could be negatively affected by the ongoing US-China tensions:

- ARM: As a leading chip design company, ARM’s technology is widely used in various devices, including those manufactured in China. Export restrictions and trade tensions could limit ARM’s market access and impact its revenue from Chinese companies.

- NVIDIA: NVIDIA’s GPUs are crucial for AI applications and data centers. The company has significant exposure to the Chinese market, and trade tensions could disrupt its supply chain and sales in the region. Additionally, NVIDIA’s efforts to expand its presence in China could be hampered by these geopolitical issues.

Both companies are navigating a complex and evolving geopolitical landscape, which requires constant adaptation and strategic planning. Do you have any specific concerns or interests related to ARM or NVIDIA?

- 02/09/2023 –

Powell’s speech triggered record options bets, topping even the meme stock frenzy

CEO Confidence Picked Up in Q1, but CEOs Remain Pessimistic

Biden Puts Semiconductors at the Forefront (wsj.com)

Commerce Officials to Detail Chips Act Application Process This Month – WSJ

U.S. Commerce Secretary presses plan to restrict American companies, and citizens, from making chips for China (cnbc.com)

Secretary Raimondo cnbc – Search (bing.com)

- 11/14/2022 –

Surprise! Warren Buffett Just Bought a Semiconductor Stock

Warren Buffett Just Bought Shares of Apple’s Key Chipmaker — and 7 Other Stocks

- 11/10/2022 –

https://www.gurufocus.com/industry/usa/technology/hardware

- 10/25/2022 – news and comments

Great thread here. Think we are going to see a massive bull market soon. Time to be making your lists up of assets to buy👇👇 https://t.co/DZUXcocyPh

— Kuppy (@hkuppy) October 20, 2022

8/25 This tweet thread by @KennethLFisher and article by @TimothyHerbert1 highlight that the market usually rises after rate hikes. https://t.co/hPNJlwd1llhttps://t.co/AMRUuKzy6c

— Maj Soueidan (@majgeoinvesting) October 20, 2022

- 10/23/2022 – Burry

https://t.co/qFstrVuhA3 pic.twitter.com/HXmmKb2AYp

— Michael Burry Archive (@BurryArchive) October 24, 2022

- 10/05/2022 – Davidson

“Davidson” submits:

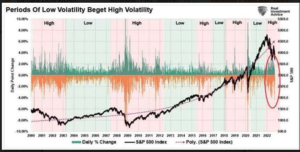

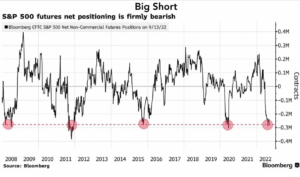

There are multiple approaches to assessing overall market psychology at crucial tuning points. Two relevant correlations, the S&P500 Net Non-Commercial Futures and the S&P 500 Daily Point Change(volatility) have an extensive history and have been reported on multiple sites. These histories from 2008 and 2000 respectively make identical points despite having different perspectives. The first, futures net positions, and the second, daily volatility, indicate high levels of pessimism and uncertainty, i.e., investor confusion on what to do, and have a history of identifying important market lows. Prices are determined by consensus market psychology but also provide feedback as a self-promoting mechanism. Those who rely only on price direction to invest amplify that direction as others join the trend believing the same. This investment activity occurs with near zero attention to any fundamental consideration. There is no off-ramp for many but a change in price trend that forces reconsidering prior assumptions. When headlines are filled with pessimism, the market reflects bearish positioning and high daily volatility. The opposite is true when headlines are optimistic.

The current pessimism is so intense that future positions and volatility equal or exceeds past periods. History is long enough with this data that it becomes a valuable market contrarian signal. Investor sentiment is so bearish that it becomes a bullish signal.

Equities remain favored in the current climate of fear with fixed income to be avoided by my analysis.

https://realinvestmentadvice.com/insights/daily-market-commentary/

- 08/03/2022 – news and comments

SoftBank Raises $22 Billion by Selling Alibaba Derivatives

AMD Should Shine Through Chip Cloud

Pelosi’s Taiwan trip puts the world’s biggest chipmaker back in the spotlight of U.S.-China rivalry

Pelosi meets with Taiwan chip leaders, including Taiwan Semiconductor Chairman: report

Pelosi met with Taiwan Semiconductor (TSM) founder Morris Chang at a lunch hosted by Taiwan’s President, Tsai Ing-Wen. Also at the lunch was Pegatron’s Vice Chairman Jason Cheng, which assembles Apple’s (AAPL) iPhones.

- 08/02/2022 – news and comments

SoftBank Emerges as a Big Loser of the Tech Downturn. Again. – WSJ CEO Masayoshi Son pledged to curb his aggressive investment bets yet plunged into startups last year at the market top

Mr. Son has said he is optimistic the storm will pass, and SoftBank will emerge stronger in the future as the tech sector grows.

For now, SoftBank is cutting back significantly on startup investments. “We would like to pile up lots of cash,” Mr. Son said in a recorded video accompanying the company’s earnings report in May. “We will be much more careful when we invest new money.”

- 07/31/2022 – news and comments

Individual Investors Ramp Up Bets on Tech Stocks – WSJ Shares of Amazon, Alphabet, Meta Platforms and others have suffered double-digit declines, but believers say they expect a rebound

Silicon Valley Lurches Between Deep Cuts and Bold Spending – WSJ Silicon Valley Lurches Between Deep Cuts and Bold Spending

Market correction leaves some startups in crisis as others take employees on vacation

The U.S. Is Investing Big in Chips. So Is the Rest of the World. – WSJ The question is whether semiconductor giants choose America over other locations that have offered incentives and lower costs for years

- 07/27/2022 -news

Senate Approves $280 Billion Bill to Boost U.S. Chip Making, Technology – WSJ

What’s in the Semiconductor Chips Bill That Congress Is Set to Approve? – WSJ

Catalysts for SOXS

- Shorting volatility has become a more and more crowded becoming popular with professional and retail traders alike. The economic outlook by all measures would have been seen as improving during the past one year. Today, the opposite is true. Growth has peaked, fiscal and monetary measures have ended, dollar liquidity is fading, inflation is a real concern, corporate margins are under pressure, a burgeoning energy crisis is underway, and a potential US default still not technically out of the cards.

- Congress has to raise or suspend the debt limit by October 18, otherwise, US debt wil default. Senate Minority Leader Mitch McConnell, R-Ky., later Tuesday blocked Schumer’s motion that would allow Democrats to address the debt limit with a simple majority vote. It needed unanimous support. most economists say such a default would bring about financial calamity that could trigger a broad market sell-off and economic downturn amid a spike in interest rates. “You would expect to see an interest rate spike if the debt ceiling were not raised,” Yellen said during live testimony on Tuesday. “I think there would be a financial crisis and a calamity. Absolutely, it’s true that the interest payments on the government debt would increase.”

- supply chains, rising rates, inflation, declining growth, China, energy crisis, etc.

- Lawmakers first have to try to raise the debt ceiling and avoid the threat of a default on U.S. debt, by about Oct. 18.

- Democrats also aim to pass both pieces of President Joe Biden’s economic agenda by Oct. 31.

- Then, lawmakers will have to approve a funding bill by Dec. 3 to prevent a government shutdown.

Risks

- Bipartisan compromise to raise debt limit

- $1.5 T plan to boost economy and growth rate

- keep interest rate low for long term

- another wave of CV-19

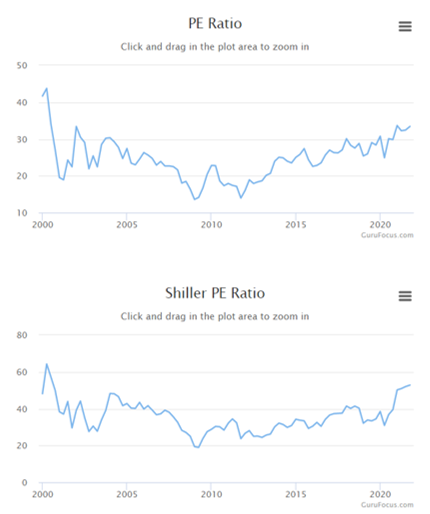

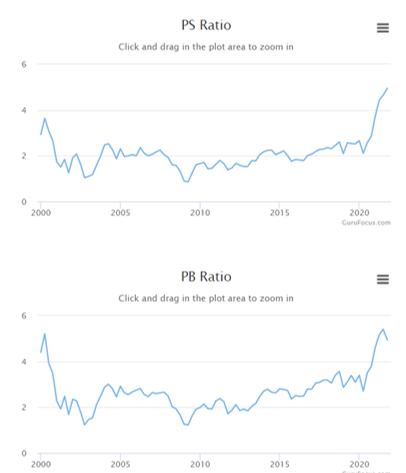

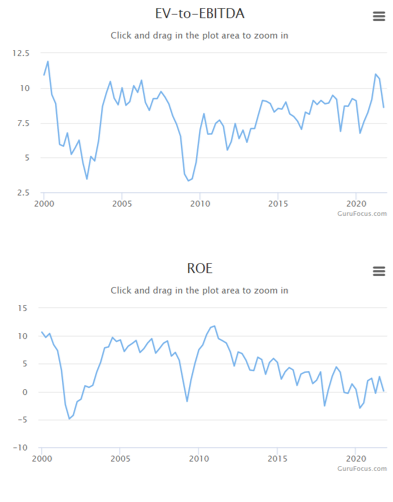

Valuation: price (PS, PB) at historical high, Oper margin at historical relatively low. IYW dropped below SPY after 2000 tech bubble burst, then keep lower until March 2020, then it shot up way above SPY.

- 11/07/2021 – This just underscores (again) why public shorting is a terrible activity in today’s market. – Tilson no long shorts at current market condition

Yesterday reminded me Why I no longer short (In fact, to make sure I don’t fall victim to temptation, I haven’t even set up the capability to do so in my personal account!).

First, biotech firm Cassava Sciences (SAVA) should have been cut in half (or more) after my friend Gabriel Grego’s bombshell report on Tuesday (covered in my last two e-mails).

Instead, the stock soared 49% after releasing an almost-irrelevant piece of news: A journal investigated an article published nine years ago about the company’s only drug, simufilam, and found that there was “no evidence of data manipulation.”

As one of my friends commented:

Yeah, this was a true test of the current market. Insane! And sad that all these “apes” think they are fighting the good fight against these evil short-sellers by going long a piece of crap like SAVA.

But another friend cautioned:

This just underscores (again) why public shorting is a terrible activity in today’s market.

Sadly, I have to agree…

- 10/05/2021 – Congress faces 3 major economic deadlines before the year ends: Debt limit, infrastructure and government funding

- Congress has several high-stakes deadlines ahead of it that could hold implications for the country for years to come.

- Lawmakers first have to try to raise the debt ceiling and avoid the threat of a default on U.S. debt, by about Oct. 18.

- Democrats also aim to pass both pieces of President Joe Biden’s economic agenda by Oct. 31.

- Then, lawmakers will have to approve a funding bill by Dec. 3 to prevent a government shutdown.

There are three main reasons why higher yields are so bad for tech stocks.

First off, they signal that the economic environment is becoming one in which tech stocks may lag value stocks. Higher long-dated bond yields mean that markets expect higher inflation, which is a reflection of strong economic demand. Value stocks, which are often large and mature in their life cycles, rely on strong economic demand for earnings to grow at a fast clip.

Large oil companies, manufacturers, and financial companies are the most economically sensitive value stocks. In order for investors to load up on those stocks, they often sell other stocks. Recently, they have been selling out of tech names and moving into value.

Secondly, the higher yields come as growth stocks had already outpaced value for several months, making growth shares more expensive. Through Thursday’s close, the Vanguard S&P 500 Growth exchange-traded fund (VOOG) had risen 6.1% for the second half of this year, soaring past the Vanguard S&P 500 Value ETF ‘s (VOOV) 1.1% gain. Now value stocks’ performance is catching up, which some on Wall Street have been predicting.

Lastly, higher yields mean a greater discount on future profits. Some growth companies are losing money in the short term, while others are profitable, but all are aggressively investing capital now to create big profits years down the line. The further in the future an earnings stream is expected, the less valuable it becomes compared with the yield on the safest asset—a Treasury bond. Higher bond yields also hurt value names, it’s just that they put a bigger dent into growth valuations.

At some point bond yields will stop surging, but until they do, expect growth stocks to perform poorly.

- 07/07/2019 – Trade Worries Have Eased, But Chip Stocks Aren’t Out of the Woods

Semiconductor stocks are highly sensitive to trade news, and some analysts point to a broader slowdown on the horizon - 05/28/2019 – The Direxion Daily Semiconductor Bull and Bear 3X Shares (SOXL and SOXS) seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the PHLX Semiconductor Sector Index. There is no guarantee the funds will meet their stated investment objectives.These leveraged ETFs (SOXL_Factsheet) seek a return that is 300% or -300% of the return of their benchmark index for a single day. The funds should not be expected to provide three times or negative three times the return of the benchmark’s cumulative return for periods greater than a day.