Study of TSLA and TSLL – Tesla’s annual meeting will be held on June 13, 2024, at 3:30 p.m. Central Time (CT). Shareholders will vote both on moving Tesla’s state of incorporation from Delaware to Texas and Musk’s rescinded pay package. Tesla CEO Elon Musk has announced that the Cybercab robotaxi will be unveiled at an event on August 8, 2024.

If majority of shareholders vote against Musk, Musk might leave and take AI out of Tsla, stock price will tank, then all those shareholders will lose, big time. This is probably a binary event.

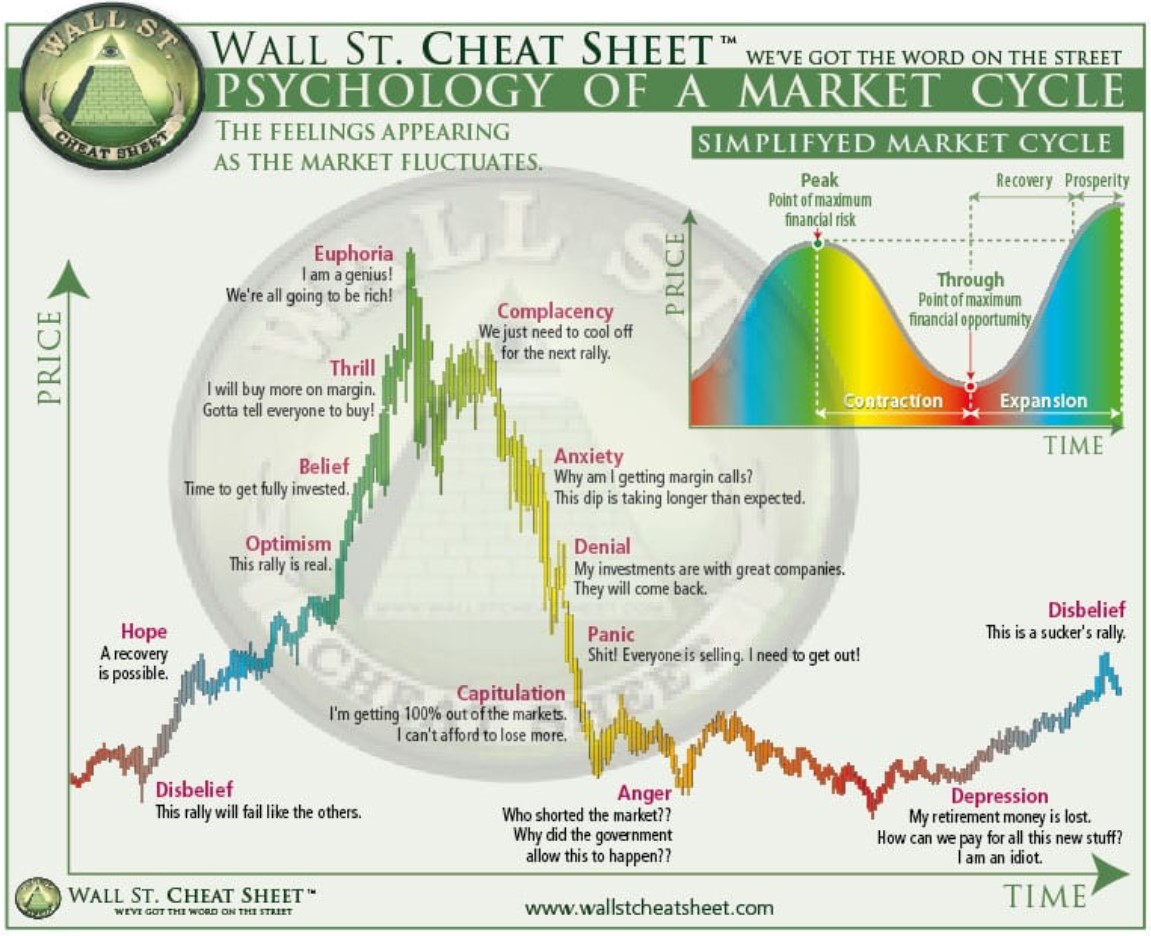

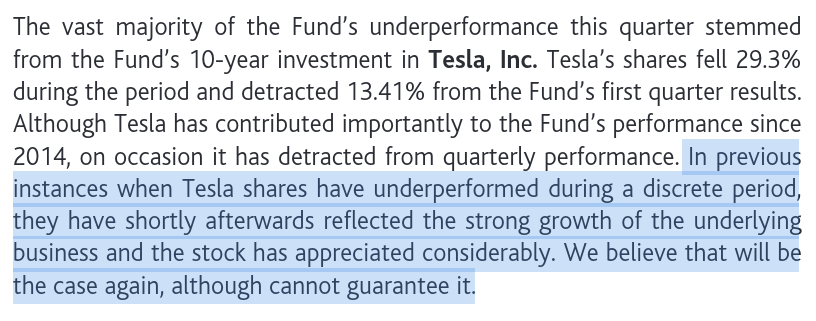

Tesla has set lofty goals amid more recent struggles, but history says Musk and his team will probably achieve their goals, which could bring about a stock recovery and take Tesla to record highs.

Yes, Tesla has struggled in recent years as it has sought to transform itself, and rising competition, lower gross margins, and the lack of clarity on the future of a lower-cost vehicle seemed to disappoint shareholders.

TSLA earning dates

Q2 July 17, 2024

Q3 Oct 16, 2024 (Gift Montage (:15 seconds) (youtube.com) Big money is loading up on Tesla Stock calls)

Q4 Jan 02, 2025

Catalysts

(1) Elon Musk on X: “Tesla Robotaxi unveil on 8/8” / X

06/12/2024 (1) Elon Musk on X: “@WholeMarsBlog Yes” / X

Elon Musk’s 5 manufacturing principles are:

1. **Make your requirements less dumb**: Always question the assumptions and requirements. Don’t assume that the current way of doing things is the best or only way.

2. **Try very hard to delete the part or process**: Look for ways to simplify the process by eliminating unnecessary steps or components.

3. **Simplify or optimize**: After removing unnecessary elements, focus on making the remaining parts of the process as efficient as possible.

4. **Accelerate cycle time**: Once the process is simplified and optimized, look for ways to speed it up without sacrificing quality.

5. **Automate**: Finally, automate the process to the extent possible to reduce human error and increase efficiency.

These principles are based on the idea of constantly challenging and improving the manufacturing process to make it more efficient and effective.

- Big Risk of Tsla Tesla CEO Elon Musk admits ‘two homicidal maniacs tried to kill him’ in past seven months (msn.com)

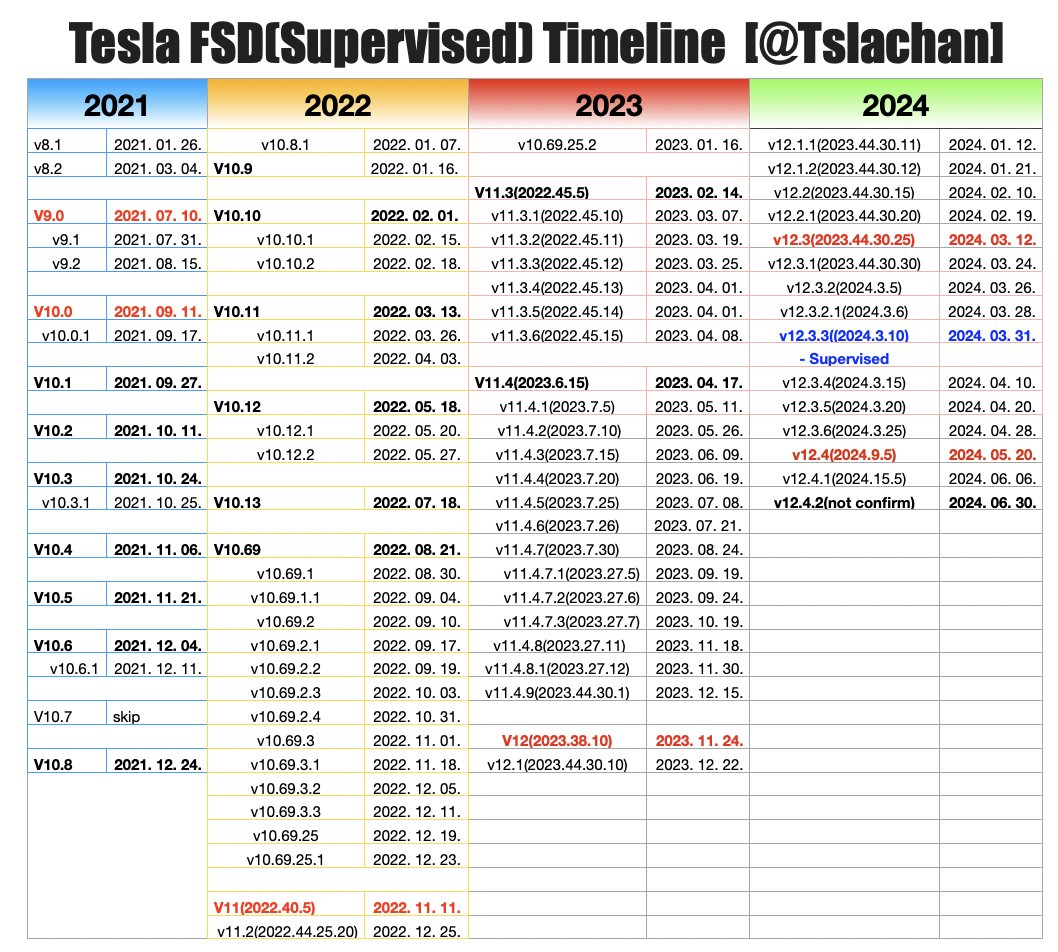

FSD news FSD Community Tracker (teslafsdtracker.com)

FSD REVIEW: during his test drive of FSD V12.3.6 when heading towards Google Headquarters, XPeng ceo can’t help praising how precise and smooth the system is. He even goes so far as to say FSD drives better than someone new to California like himeself most of the time. FSD beats him on smooth drive and handling. Throughout the entire video, clearly there’s no hide of excitement from someone who will compete with Tesla in China pretty soon.

https://x.com/i/status/1806051860576698559

• Shanghai is letting 10 $TSLA cars test their FSD software, a big step towards robotaxis in China. • Tesla’s robotaxi vision involves a hybrid model: Tesla-owned fleet operates like Uber, customer-owned cars join as needed like Airbnb. • Tesla plans to switch to Hardware 4 for training, which will greatly enhance FSD capabilities compared to Hardware 3. • Hardware 5 is expected in about 18 months, with 10X more computing power than Hardware 4. • Elon Musk is confident about nearly eliminating interventions in autonomous driving, possibly in future updates like version 12.5 or 12.6.

06/14/2024 – Tesla’s New Version Of ‘Full Self-Driving’ Is Better, But Flawed (msn.com)

Future of AI – Wise words from a recent interview with @geoffreyhinton, one of the smartest people in the world regarding AI Elon Musk on X: “Wise words from a recent interview with @geoffreyhinton, one of the smartest people in the world regarding AI https://t.co/11A7fJpLcs” / X

Waymo is now available for anyone in San Francisco to fire up the app and hail a robotaxi. The Alphabet-owned company has had government approval to operate paid driverless cars in the city since last August but had been working its way through a waitlist in the months since. Following Cruise’s unceremonious exit from California (after dragging a pedestrian 20 feet and concealing evidence from regulators), Waymo is now the only company with autonomous commercial cars in the state.

Waymo says its cars have logged over 3.8 million driverless miles in San Francisco, and the company claims its vehicles tally “tens of thousands of weekly trips” there. The San Francisco Chronicle reports that Waymo’s fleet in the city has about 300 cars, up from around 250 in January. However, despite the wider availability, it reportedly doesn’t plan to aggressively expand its San Francisco lineup in the near future.

Elon’s master plan 4 – (2) Elon Musk on X: “Working on the Tesla Master Plan 4. It will be epic.” / X

Timestamps:

Part 1: Master Plan 3 02:12 What does it take to convert Earth to sustainable energy generation & use (Elon Musk & Drew Baglino)

Part 2: Executing Master Plan 3 29:04 Vehicle Design (Lars Moravy & Franz von Holzhausen) 41:26 Powertrain (Colin Campbell) 50:07 Electronic Architecture (Pete Bannon & David Lau) 1:09:14 Full Self-Driving (Ashok Elluswamy) 1:19:11 Bot Update (E. Musk & A. Elluswamy) 1:24:21 Charging (Rebecca Tinucci) 1:32:52 Supply Chain (Karn Budhiraj & Roshan Thomas) 1:53:48 Manufacturing (Tom Zhu & D. Baglino) 2:07:11 Energy (D. Baglino & Mike Snyder)

Part 3: Impact at Tesla 2:19:59 Impact (Laurie Shelby & Brandon Ehrheart) 2:26:38 Financials (Zach Kirkhorn) 2:42:00 New Gigafactory Announcement

Q&A 2:44:42 Timeline for new vehicle design 2:47:02 Minining 2:50:32 Involving the rest of the industry 2:52:18 Number of vehicle models, bidirectional charging 2:56:05 Market share in China & political relations with China 2:57:57 Velocity of learning cycles 2:58:48 Demand 3:01:27 Next vehicle models & cannibalizing demand 3:08:45 Cost optimization by region 3:12:51 Capex guidance and Tesla AI 3:16:12 Dry battery electrodes 3:21:29 Managing a large organization & generative AI

PDF presentation: digitalassets.tesla.com/tesla-contents

X does this mean that HW3 is not capable to handle true FSD?

- 06/30/2024 – 特斯拉FSD从0到1入门全解,硬核知识白话说!访谈神秘嘉宾, 投资特斯拉必看! (youtube.com)

- 06/30/2024 – Elon Musk on X: “Some audiobook recommendations: The Story of Civilization by Durant Iliad (Penguin Edition) The Road to Serfdom by Hayek American Caesar by Manchester Masters of Doom by Kushner The Wages of Destruction by Tooze The Storm of Steel by Junger The Guns of August by Tuchman The” / X

Some audiobook recommendations: The Story of Civilization by Durant Iliad (Penguin Edition) The Road to Serfdom by Hayek American Caesar by Manchester Masters of Doom by Kushner The Wages of Destruction by Tooze The Storm of Steel by Junger The Guns of August by Tuchman The Gallic Wars by Caesar Twelve Against the Gods by Bolitho Genghis Khan by Weatherford The first one on the list will take a while to get through, but is very much worthwhile. Admittedly, this is a list that appeals to those who think about Rome every day. I hope someone makes an audiobook of The Encyclopedia of Military History by Dupuy and The Fifteen Decisive Battles of the World by Creasy.

Stalin: Court of the Red Czar by Montefiore (If you want some real nightmares)

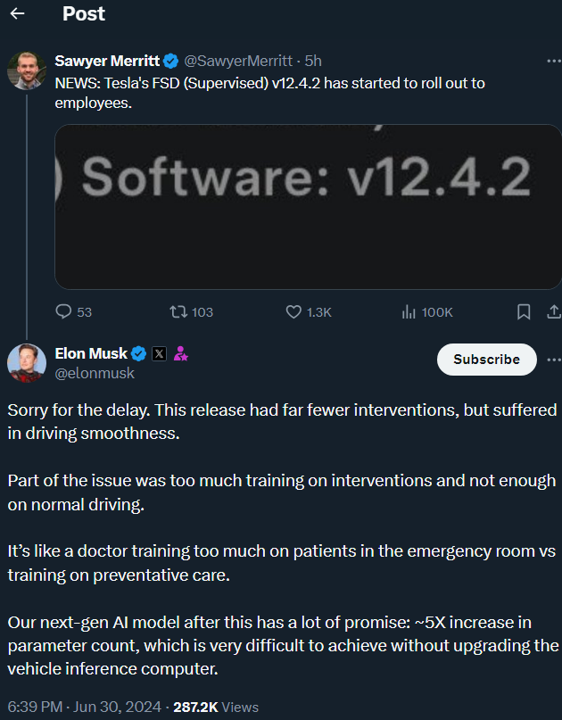

This post confirms many of our previous guesses: 1. The reason for ‘lane dancing’ in v12.4 is that normal driving got ‘filtered out,’ leaving only object avoidance clips, making the model believe more lane changing is better. 2. The ultimate issue is an intelligence issue, because if you have more normal driving clips, then interventions increase. To have both increase without sacrificing the other, you need a larger model, which requires HW4. I cannot say how happy I am because it proves that our understanding of FSD is still valid and sound, and we can anticipate potential risks and solutions before Elon officially announces them. When we, the retail investors, compete with WS whales, we really need this edge to win.

- 06/30/2024 – (1) Sawyer Merritt on X: “Tesla is expected to announce their Q2 delivery numbers this Tuesday between 8AM-9AM ET. Tesla is also expected to share how much energy storage they deployed during the quarter. The company deployed 4,053 MWh in Q1, an all-time record high.” / X

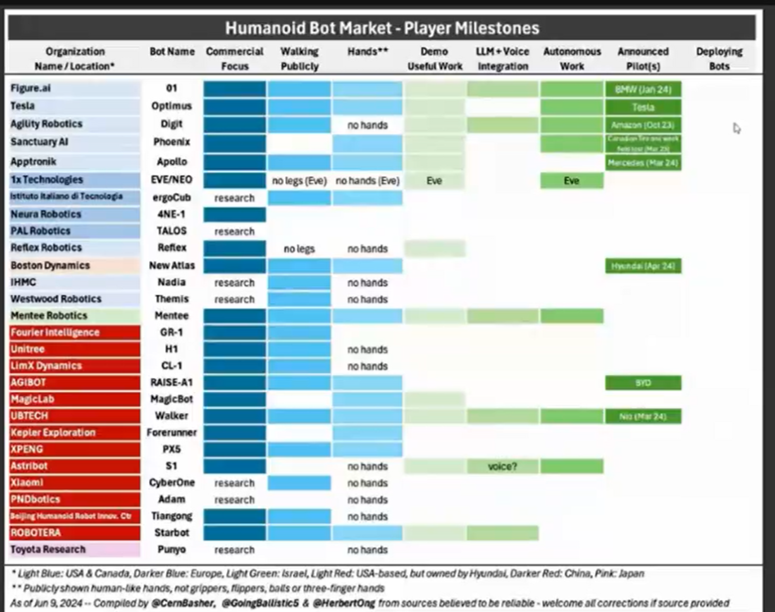

- 06/30/2024 – (2) Pejjy on X: “I finally got to upload this awesome podcast with @CernBasher! Cern explains & breaks down how the $TSLA BOT business is bigger than #Robotaxi business. The numbers get VERY NUTTY! Timestamps: 00:00 Intro: Getting To Know Cern Basher 5:39 #Robotaxis 40:18 $TSLA BOTS https://t.co/2Jqa8gdzkG” / X

in-depth study of Robotaxi and Bot businesses

Figure AI is a private company, so it does not have a public stock price or stock symbol1. However, accredited investors can buy its shares directly from existing shareholders through a marketplace called Hiive1. The most recent funding round in February 2024 was completed at $13.22 per share2.

Must watch Jim’s interview at NBC

• Elon Musk confirmed a new FSD version 12.4 is in testing, focusing on safety and ride comfort. The release of FSD 12.4 to the public was delayed, affecting updates like versions 12.5 and 12.6. • Cruise, a robotaxi company, hired Marc Whitten as CEO and revamped its executive team after some issues. • Tesla is building a huge GPU data center at Giga Texas with cool new cooling systems to save power. The data center will be between 600,000 to 800,000 square feet, making it one of North America’s largest buildings.

Toyota Motor Corp. (NYSE:TM) is reportedly set to introduce its first electric vehicle featuring an advanced autonomous driving system in China next year.

The initiative aims to bolster the Japanese automaker’s market share in China by advancing in hybrid, battery, and intelligent vehicle technologies.

- 06/26/2024 – Battle for the streets: Tesla’s self-driving tech challenges China’s home-grown heroes (msn.com)

China’s autonomous driving landscape consists of two types of players. One group, which includes EV makers like Xpeng and Li Auto and DeepRoute.ai, a tech startup, adopts a technical approach similar to Tesla’s E2E.

They use AI models to process data and directly generate control commands, enabling vehicles to recognize road conditions and pilot themselves. However, unlike Tesla’s camera-based visual solution, Xpeng and Li Auto also equip their cars with lidars, millimeter-wave radars, and cameras to collect data.

The other approach relies on multi-sensor fusion perception technology, with Huawei as a major proponent. Huawei’s autonomous driving system ADS2.0, available in car models like AITO M7 and M9, integrates lidars, millimeter-wave radars, and cameras to enhance perception.

It allows L4 autonomy with low highway takeover rates and includes features like autonomous valet parking.

Huawei bets big on multi-sensor fusion perception because it believes that camera, millimeter-wave radar, and lidar have their shortcomings, making integration necessary.

Tesla itself faces significant hurdles. Musk has lobbied painstakingly to get FSD licensed in China. For FSD to thrive, however, two core issues must be resolved: obtaining geographic data on public roads and ensuring data security compliance.

The first one is easier to fix. Chinese laws require overseas carmakers to work with certified Chinese companies to acquire a mapping license for developing autonomous driving technologies.

Tesla recently solved this by partnering with Baidu to obtain a license and gain access to Baidu’s lane-level navigation system.

The data compliance challenge proves more thorny. In a positive development, an official document indicated early this year that all models produced by Tesla’s Shanghai Gigafactory comply with regulatory requirements in human face and cockpit data collection, storage, and processing.

This finding addressed data security concerns, allowing Tesla cars to enter previously restricted areas like government compounds.

Subsequent reports by international media, such as Reuters, suggest Tesla plans to establish a data center in China to process and train autonomous driving algorithms locally.

This represents a departure from Musk’s earlier stance. Previously, he insisted data collected in China be sent to the US to be processed by its Dojo supercomputer. This is normally how Tesla improves upon its E2E capabilities.

However, this practice is incompatible with China’s national data security law, which has strict requirements for cross-border data flow.

Bloomberg reported that Musk had implored Beijing on a whirlwind trip to China in late April for permission to transfer Tesla’s China-specific data to the stateside, to no avail. Hence, the alternative is to build a data center.

The question is how to obtain the crucial AI chips. Industry insiders told me that Nvidia’s GPU Orin X is a chip of choice for many domestic carmakers and suppliers working on intelligent driving.

One thing is for sure, though. Musk cannot expect the Biden administration to make an exception for Tesla China to import advanced chips from the US.

Which brings me back to what I said earlier. In the short term, Tesla’s FSD is unlikely to crush domestic opponents due to insufficient computing power.

From the regulator’s perspective, Beijing has welcomed Tesla’s FSD entry. Chinese policymakers are known for long-term thinking and should be credited with this.

By allowing FSD into China this time, Beijing appears to be playing its card of “calculated cannibalism” again, using FSD to stimulate competition and drive excellence at home.

Manufacturing prowess and supply strengths still matter, but they alone will not ensure China’s lead in the global EV race. In the new era of autonomous driving, success hinges upon a closer integration of industries like integrated circuits, big data, and AI.

And who else is in a better place than Tesla to help Chinese car companies grow faster and elevate their game?

If things go as planned, Beijing’s latest maneuvers could play out the same way as is often touted in its “win-win” strategy: With Tesla reaping big gains from its FSD business in China, domestic automakers and suppliers are also poised to consolidate their advantages, further outpacing European and Japanese rivals in the autonomous driving race.

Tesla trick: Elon Musk’s plan to train AI in China takes shape (interestingengineering.com) To improve its self-driving technology, Tesla plans to build a data center in China. This center will let Tesla use data from its electric cars in China to train its self-driving systems. This is a big shift from Tesla’s old strategy of sending data out of China for its “Full Self Driving” (FSD) system, as per the report.

Shaping the future of autonomous driving

China, with its status as the world’s largest car market and its vast fleet of sensor-equipped vehicles, provides an ideal environment for Tesla’s data-driven approach. Musk’s plan to use Chinese data to train algorithms aligns with the country’s ambitions to lead in autonomous driving technologies.

Analysts view China as a potential launchpad for self-driving technology, similar to Tesla’s success with its Shanghai Gigafactory. Musk believes Tesla’s Full Self Driving system can adapt well globally, but benefits from country-specific training.

“It would definitely be a milestone for Tesla if it rolls out FSD in China and leverages the China data for algorithm training,” said Yale Zhang of Shanghai-based consultancy Automotive Foresightm, as quoted in the report.

05/30/2024 – Exclusive: Tesla makes push to roll out advanced FSD self-driving in China | Reuters

May 30 (Reuters) – Tesla (TSLA.O), opens new tab is preparing to register its ‘Full Self-Driving’ software with authorities in China in the run up to its planned rollout of the technologically advanced feature this year, three people with knowledge of the matter said.

The U.S. electric vehicle maker is also considering selling the software as a monthly subscription to users of its cars in China, its second-largest market, they said.

Tesla would be joining at least 10 automakers and suppliers including Huawei (HWT.UL) and Xpeng (9868.HK), opens new tab in offering so-called level-two autonomous driving capabilities in China.

And while Tesla will be charging for FSD, Li Auto (2015.HK), opens new tab and Xpeng have offered equivalent driving systems for free on high-end variants of their models, while other automakers such as Nio (9866.HK), opens new tab have offered buyers a trial period without charge.

Huawei and Xpeng also said recently that they had started end-to-end AI model development for autonomous driving that would follow Tesla’s lead.

While Tesla’s rivals can develop algorithms needed to compete with its approach to FSD, it will be challenging for them to catch the U.S. company on the data and the computing power development needs, said Yin Chengliang, professor at the Institute of Intelligent Vehicle of Shanghai Jiao Tong University.

Tesla uses a supercomputer it calls Dojo to train the FSD system using video clips from millions of Tesla EVs. That connected network of vehicles, the world’s largest fleet, and the ability to process the data it generates give it a major advantage over any rival, Yin said.

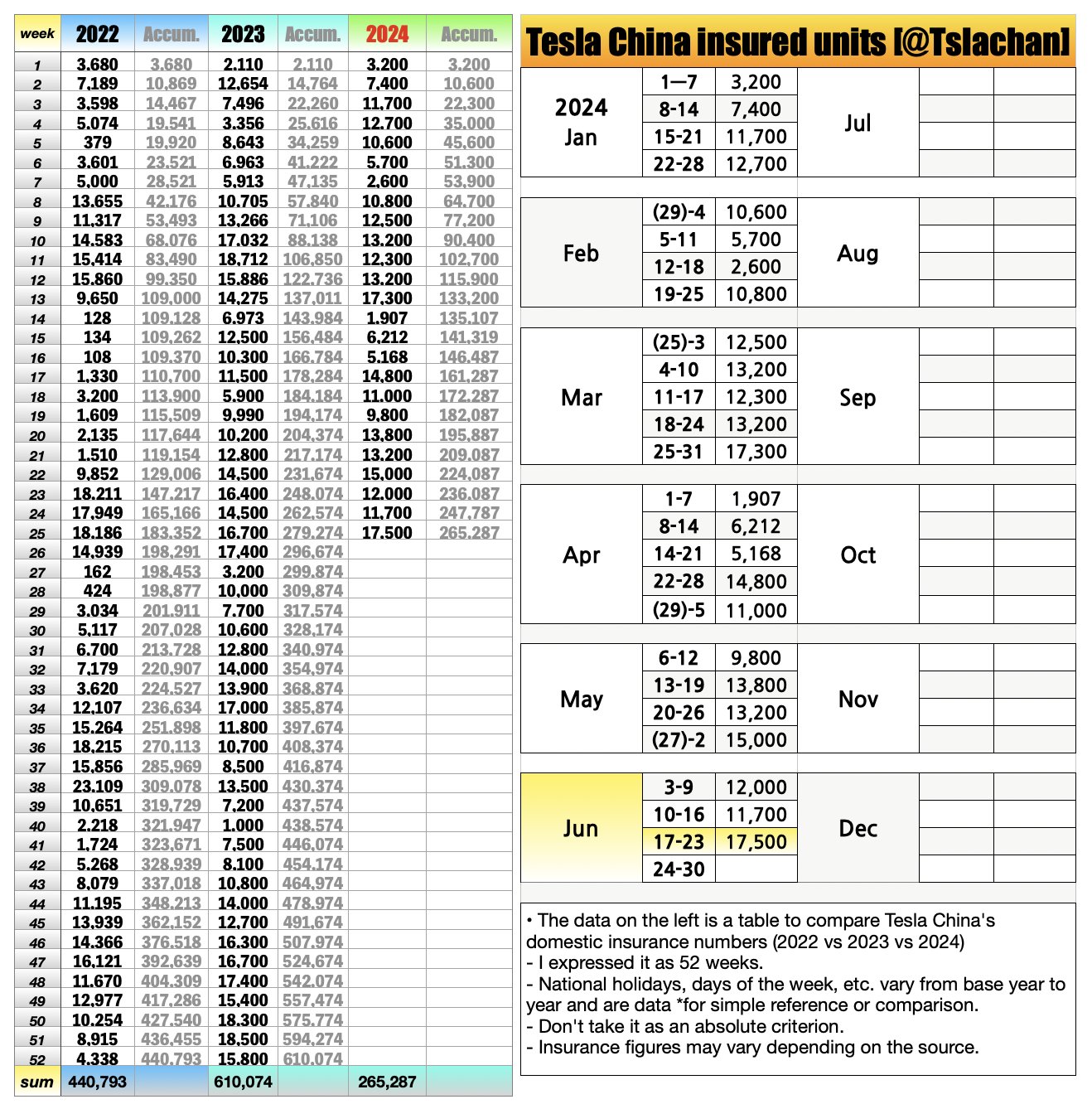

• Tesla’s sales in China for the latest week of 2024 have been the highest this year, totaling 17,500 units, a 14% increase over the previous quarter. • Elon Musk announced at the shareholder meeting that FSD can now be transferred to new vehicle purchases until August 31, stacking with existing incentives. • XPeng Motors CEO praises Tesla’s FSD, predicting it could achieve full autonomy by 2025. • Tesla plans to hire for its Tesla Bot project, aiming to scale up to 1,000 to 2,000 bots next year, with a recent job posting for a project manager indicating readiness for launch. • Elon Musk responded to investor Ron Baron’s prediction on Tesla stock, discussing future growth prospects and strategies.

- 06/14/2024 – 2024 Tesla Shareholder Meeting (1) ELON DOCS on X: “Here’s the full breakdown of Elon’s presentation, including Q&A session, at the 2024 Tesla Shareholder Meeting earlier today. INTRODUCTION 1:36 FSD improving exponentially 4:04 How robotaxi will work 7:08 Autonomy could add $5 trillion value 8:37 Optimus could add $20 trillion https://t.co/ngUJDuVL00” / X

Here’s the full breakdown of Elon’s presentation, including Q&A session, at the 2024 Tesla Shareholder Meeting earlier today

INTRODUCTION

1:36 FSD improving exponentially 4:04 How robotaxi will work 7:08 Autonomy could add $5 trillion value 8:37 Optimus could add $20 trillion value

PRESENTATION 12:54 Tesla’s impact accelerating 15:38 6 millionth vehicle 16:48 Cybertruck 19:11 Updated Model 3 20:02 Model Y bestselling car 20:39 Tesla Semi starting volume prod 22:44 Future products 23:22 Supercharger network 25:44 4680 battery cell production 28:08 Huge energy storage growth 30:39 Software at Tesla 31:56 Real-world AI 32:42 Chips: HW3, HW4, Optimus 37:31: AWS-type opportunity 39:21 FSD getting extremely good 43:50 Optimus progress & perspectives

Q&A 51:08 A thanks to Elon 52:28 Regular free trials for FSD 54:10 Disneyland & statistical FSD risk 56:57 Tesla valuation: 10X by 2029 58:07 Referral program 1:00:37 FSD transfers one more quarter 1:02:03 Elon’s well-being & security 1:05:08 HVAC for homes 1:06:29 Factory tour for kids 1:08:07 Donald Trump fan of Cybertruck 1:09:24 Interventions for unsupervised FSD 1:10:54 Shoutout to@TeslaBoomerMama 1:11:33 Batteries only fraction of car price 1:15:35 Cybertruck could go international next year 1:19:09 Cybertruck Foundation series 1:19:45 Data collection & compute 1:26:47 Optimus to be equipped with LLMs 1:28:17 Optimus will be generalized 1:31:22 Elon helps accelerate Tesla 1:33:49 Parking & charging close to Starbase 1:35:28 Lithium refining 1:38:03 Suggestion: Deliver Teslas at night

- 06/25/2024 – (1) Whole Mars Catalog on X: “On April 17 2024 there were 3,878 Cybertrucks On June 19 2024 there were 11,688 Cybertrucks So 7,810 Cybertrucks delivered in 9 weeks So an average of 867 Cybertruck deliveries a week over the last two months that’s about 11k a quarter extrapolated out… enough to outsell https://t.co/q3IIUt4IGo” / X

- 06/25/2024 – Tesla Adds Mercedes-Benz To Supercharger Network Waitlist, Adjusts Timelines For Rival EV Makers (msn.com)

- 06/25/2024 – (1) Matt Smith on X: “Wow, very solid numbers from Tesla China released this morning!” / X

- 06/25/2024 – Canada to consider surtax on Chinese electric vehicles (msn.com)

- 06/25/2024 – Tesla Opens Up FSD Transfers Yet Again: Here’s How Long You Have To Save Up To $8,000 (msn.com)

No Longer A One-Time Amnesty: In 2023, several Tesla owners raised requests that the company allow for transferring FSD software from their old Teslas to their new ones, citing its high cost. Company CEO Elon Musk acknowledged the requests and in July allowed for transferring it as a “one-time amnesty.” The offer ended in the third quarter.

Since then, Tesla has time and again offered free FSD transfers. The company has also brought down the price of the technology significantly. It was priced at as much as $15,000 last year.

Why It Matters: Tesla has been trying to boost FSD takers in the past few months with incentives including a 30-day free trial of the software for vehicle owners who did not purchase it.

The move is aimed at demonstrating the abilities of the software which the company says will enable fully autonomous driving in due time.

Musk is now relying on vehicle autonomy to be the next big boost for the company amid dwindling EV deliveries and falling share value. As per Musk, doubling down on autonomy is a “blindingly obvious move” for the company with everything else like “variations on a horse carriage.”

- 06/24/2024 – (1) Pejjy on X: “CEO of $UBER sells 50% of his shares… He knows what’s about to happen 👀 $TSLA” / X

- 06/21/2024 – Q3 Oct 16, 2024 (Gift Montage (:15 seconds) (youtube.com) Big money is loading up on Tesla Stock calls)

- 06/21/2024 – CEO Says Ford is ‘Getting Close’ to Level 3 Autonomous Driving with ‘Hands and Eyes Off’ – EconoTimes

Ford CEO Jim Farley announced the company’s progress towards achieving Level 3 autonomous driving, allowing for hands-free and eyes-off-the-road operation, during a recent interview with Bloomberg TV.

Ford CEO Jim Farley Announces Progress Toward Level 3 Autonomous Driving, Enabling Hands-Free and Eyes-Off Operation

In a recent interview (via Electrek), Ford CEO Jim Farley addressed the American automaker’s advancements in autonomous driving. He announced that the company had achieved Level 3 autonomy, allowing drivers to remove their hands from the wheel and their eyes from the road. However, it will be some time before Ford customers can experience it.

If I had to guess, I would assume that the three vehicles are the Tesla Cybercab, the Model 2 (or whatever the cheap car ends up being called), and the long-awaited Tesla Roadster.

- 06/19/2024 – Elon Musk on X: “@WholeMarsBlog Then HW5, which has been renamed to AI5, in the second half of next year. The Tesla AI5 computer has ~10X the capability of HW4 computer and Tesla makes the whole software stack.” / X

- 06/17/2024 – Elon Musk and the SEC Are on a Collision Course Again – WSJ

- 06/13/2024 – Elon Musk wins Tesla shareholder battle to keep his record-breaking pay (yahoo.com)

But Thursday’s results may not spell the end of the corporate governance drama at Tesla.

For one, shareholders unhappy with the result could challenge its legality before the same Delaware court that voided Musk’s pay earlier this year.

One shareholder already filed a lawsuit last week in that state challenging both Tesla’s pay and redomestication proposals, alleging that Musk used “strong-arm, coercive tactics” in his efforts to persuade shareholders to ratify the proposals.

“It is likely Tesla will end up back in Delaware courts defending the package against lawsuits,” Jerry Comizio, a business law professor at American University’s Washington College of Law, told Yahoo Finance.

Comizio said shareholders might claim that the process leading to Thursday’s vote suffered from the same type of disclosure, corporate governance, and fiduciary duty deficiencies that caused a Delaware judge to invalidate the 2018 vote.

That judge, Kathaleen McCormick, ruled that Tesla’s board didn’t act “in the best interests” of Tesla shareholders in approving the $56 billion deal.

The central thrust of McCormick’s decision, according to Case Western Reserve University School of Law corporate law professor Anat Alon-Beck, was that Tesla’s board did not follow proper procedures and disclosures, or address numerous conflicts of interest with Musk.

“They always had the opportunity to do so, but chose not to,” Alon-Beck said. “Instead, they materially failed to comply with disclosure obligations to shareholders that have been central tenants of Delaware law for decades.”

But corporate compensation and governance attorney Bob Lamb said it’s possible the company disclosed enough this time around to insulate itself from added litigation.

“[Y]ou can’t disclose everything,” Lamm said. “At some point, the court’s got to say: ‘Tesla, you’ve done your job.'”

- 06/13/2024 – Unsold Teslas pile up in EV graveyard as Elon Musk’s financial woes deepen (msn.com)

- 06/13/2024 – Chinese Tesla Bots Are HERE! | Watch (msn.com)

Chinese companies are chasing Tesla on humanoid robot since it is the future. This bodes well for the growth of Tesla

- 06/13/2024 – Shareholders are charting Tesla’s future as voting on CEO Elon Musk’s pay package comes to a head (msn.com) Shareholders can still cast votes online Thursday and in person Thursday afternoon at Tesla’s annual shareholders meeting in Austin, Texas. They also can change previously cast votes.

Shares of the company jumped at the opening bell Thursday after the company said in a regulatory filing that stockholders are voting to approve Musk’s pay, valued around $44.9 billion, by a wide margin.

In a filing with the U.S. Securities and Exchange Commission on Thursday, Tesla published Musk’s own posts late Wednesday on X, the social media platform he owns, with charts that appeared to show that shareholders were in favor of his compensation package, as was a measure to move Tesla’s legal home from Delaware to Texas.

Legal experts say that releasing vote totals while balloting is in progress could present problems for Tesla, and that may be why the company made the filing with the SEC, which is likely to look into the matter.

Shareholders can still cast votes online Thursday and in person Thursday afternoon at Tesla’s annual shareholders meeting in Austin, Texas. They also can change previously cast votes.

“Anytime you tell people you’re winning, you’re encouraging others to join you and those who oppose you to pull back,” said Charles Elson, a retired professor and founder of the corporate governance center at the University of Delaware.

Erik Gordon, a law and business professor at the University of Michigan, said Musk’s posts could draw legal scrutiny. “His post had better be accurate or else anyone who bought stock relying on it will have a securities law case against him,” Gordon said in an email.

The SEC declined comment Thursday, and a message was left seeking comment from Tesla.

Elson said posting corporate proxy vote totals before the balloting ends is “highly unusual.”

Social media posts by Musk have drawn scrutiny from the SEC before. He and Tesla were fined a total of $40 million for statements about funding to make Tesla a private company that Musk made on X’s predecessor, Twitter, before he bought the social media platform.

If the pay package is approved, it would almost guarantee that Musk would remain at the company he grew to be the world leader in electric vehicles, shifting to AI and robotics including autonomous vehicles, which Musk says is Tesla’s future.

But if shareholders were to vote against his pay, the CEO could deliver on threats to take artificial intelligence research to one of his other companies. Or he could even walk away from Tesla.

Even with approval, there would be uncertainty. Musk has threatened on X to develop AI elsewhere if he doesn’t get a 25% stake in Tesla (He owns about 13% now). Musk’s xAI recently received $6 billion in funding to develop artificial intelligence.

According to Musk, early indications suggest that shareholders also back a move to relocate Tesla’s legal home to Texas, and out of Delaware.

The move is designed to escape from the Delaware court’s oversight and possibly from McCormick’s ruling. In a January opinion on a shareholder lawsuit, the judge determined that Musk controlled the Tesla board and is not entitled to the landmark pay package.

- 06/13/2024 – Elon Musk’s $46 Billion Pay Package: How Tesla Shareholder Approval Could Play Out in Court – WSJ Renewed support for package is unlikely to end legal challenges

Tesla TSLA 3.15%increase; green up pointing triangle shareholders are set to decide Thursday whether to reinstate a pay package for Elon Musk that was thrown out by a judge. Musk said late Wednesday that so far, shareholders were approving the package by a wide margin.

But a victory for Musk is unlikely to put the issue to rest.

Legal experts say that even with shareholder approval, it is unclear how soon Musk could actually be paid. Here is how the situation could play out.

Will a fresh shareholder approval of the pay deal end the court fight?

Probably not.

While pay packages for typical CEOs require approval from either an independent board or committee or independent shareholders, pay packages for controlling shareholder CEOs usually need signoff from both.

With a fresh shareholder approval, Tesla is hoping it can persuade the Delaware judge to change her ruling. Tesla could point to it as an informed shareholder vote, but it might not address the need for an independent committee’s approval, some lawyers say.

If the Delaware court doesn’t dismiss the case, the company could try arguing on appeal that Musk isn’t a controlling shareholder. If it wins that point on appeal, that—coupled with the new shareholder vote—could be enough to have the case dismissed, said Eric Talley, a law professor at Columbia University.

What might happen to the shareholder who sued Tesla?

Though Tornetta already earned a victory in court, he and his team are waiting for another crucial ruling. His lawyers in January sought some 29 million shares in Tesla, then valued at $5.6 billion, and a further $1 million to cover expenses. That award would result in a record payout for legal fees if approved.

The judge still has to decide how much to award them. A hearing is scheduled for July 8.

Tesla hopes that approval of the pay package by shareholders could limit the fees, which are tied to the benefit provided to Tesla shareholders.

So, would a ‘for’ vote help Musk get paid?

Not so fast, some lawyers say.

Tesla is pursuing two legal avenues at once with the vote. In addition to arguing a new vote addresses the judge’s concerns, Tesla is also betting the vote could ratify the pay package under a provision of Delaware law that allows companies to correct defective corporate actions. Known as Section 204, it is more typically used to address bureaucratic issues such as improper documentation.

If the pay package is ratified, Tornetta’s lawyers are likely to challenge both avenues, especially the unusual application of Section 204.

They could also suggest the new vote was coerced, pointing to recent tweets by Musk. One in particular suggested that unless he can amass roughly 25% voting control in the company, he might focus on projects outside of Tesla. He currently controls a much smaller portion of the vote.

“Mr. Musk seems to be making very thin threats about what he’ll do if they vote against it,” Talley said.

What about the vote to move Tesla to Texas?

Tesla is also asking shareholders to approve the company moving its incorporation to Texas from Delaware. Musk on Wednesday evening said that measure is also poised to pass by a wide margin.

Assuming the move becomes official, a new case could be brought against the pay package in Texas. If that is decided before the Delaware appeal plays out, it could take precedence.

Still, McCormick, who is overseeing the case, seemed to reject this idea recently. She said that she interpreted recent communication by Tesla to mean they “do not plan to litigate any matter related to this action anywhere but Delaware.”

- 06/12/2024 – Tesla shareholders re-approve Elon Musk’s 2018 pay package, Musk says (msn.com) Musk — who remains among the richest people regardless of whether he keeps the pay package — also pledged in a tweet Wednesday night that he would make Tesla the most valuable company on Earth.

Tesla shareholders re-approved Elon Musk’s 2018 pay package by a wide margin, Musk posted on X Wednesday night, appearing to resolve a question that has loomed over his future with the company.

The shareholder vote does not immediately restore Musk’s pay, but it sends a strong signal that the deal has the broad support of Tesla’s investors. In the months leading up to the vote, investors large and small were split on whether to support the package. While some major shareholders criticized him as a distracted leader who doesn’t deserve such a reward, others lauded him for being a generational genius.

“Our answer is clear, loud and unequivocal: Tesla is better with Elon. Tesla is Elon,” said Ron Baron, a billionaire and investor in Tesla, who said Musk was indispensable to Tesla and that his compensation must recognize that fact.

Investors and Musk’s supporters, including X CEO Linda Yaccarino, applauded the preliminary results late Wednesday. Musk — who remains among the richest people regardless of whether he keeps the pay package — also pledged in a tweet Wednesday night that he would make Tesla the most valuable company on Earth.

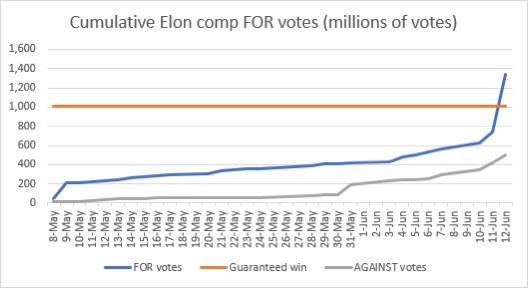

The full results are expected to be revealed Thursday at a Tesla shareholder meeting in Austin. Musk, in his post, indicated that the number of votes in favor of restoring his pay had surpassed a threshold needed to guarantee a victory on his part.

Elon Musk Says Vote on His Pay Winning by ‘Wide Margins’ – WSJ Tesla CEO also says shareholders are backing the company’s reincorporation to Texas

Tesla Chief Executive Elon Musk said late Wednesday on X that preliminary voting results show shareholders currently backing proposals to ratify his pay package and reincorporate the company in Texas by “wide margins.”

In the post, he included line graphs showing the cumulative “for” votes on both resolutions above the line needed for approval. The post came ahead of the company’s annual shareholders meeting Thursday, at which the final results are expected to be announced.

The results provided by Musk are preliminary, and voters can change their votes until the polls close at the meeting on Thursday.

He added in the post: “Thanks for your support!!”

The results had been unclear earlier Wednesday as Tesla waited on the opinions of its biggest outside investors Vanguard and BlackRock, according to people familiar with the tallies.

- 06/12/2024 – Tesla Is Back On The Hiring Train (msn.com)

After the firing spree came a total hiring freeze. There was absolutely no word when the company was going to open its doors, with an internal reshuffle taking place. Then, a trickle of job postings appeared, but interestingly, only related to experts in the fields of AI and robotics. Elon Musk isn’t one to miss a trend, that’s for sure.

Now, the slow trickle has turned into a flood. Job postings are showing up faster than Superchargers at rest stops. Hundreds of openings are available across all departments, clearly showing that Tesla has gone a bit too far with letting people go. Many of those who lost their jobs are now looking to be rehired. It’s never a boring day at Tesla.

ront-line people who sell the dream and fix what needs to be fixed are in high demand. After all, they are the ones keeping Tesla owners happy. Tesla is also looking for engineers with brilliant minds to design the next Cybertruck or finally crack the code for fully autonomous driving.

According to a CNN report on the 10th, Tesla has taken one step closer to launching its Full Self-Driving (FSD) service in China by agreeing to receive upgraded map software from Chinese portal company Baidu.

Baidu announced on the 8th that it would provide Tesla with lane-level navigation services.

While Tesla does offer Autopilot features in China, it has not yet released FSD due to the country’s data regulations. According to Chinese regulations, all self-driving systems must obtain mapping qualifications before operating on public roads, and foreign companies must partner with approved Chinese companies.

If the FSD service is launched in China, Tesla will be positioned to expand its sales in the world’s largest electric vehicle market.

- 06/11/2024 – https://www.barrons.com/articles/tesla-shareholder-vote-stock-options-elon-musk-68fc2488?siteid=yhoof2

TSLA stock options indicate significant concern about the shareholder vote on CEO Elon Musk’s enormous 2018 pay package.

- 06/10/2024- A Huge $1.7 Trillion Stakeholder in Tesla Votes Against CEO Elon Musk’s $56,000,000,000 Compensation Package (msn.com)

- 06/10/2024 – CalSTRS the latest vote against Tesla CEO Musk’s $56 billion pay package, CNBC reports (msn.com)

California State Teachers’ Retirement System (CalSTRS) became the latest investor to say it will vote against Tesla CEO Elon Musk’s $56-billion pay package, the pension fund’s chief investment officer told CNBC on Monday, days ahead of a consequential shareholder meeting.

So far, influential investor advisory groups Glass Lewis and ISS have weighed in against the new pay deal, and several institutions have also said they will vote against it.

Bernstein analysts said in a note on Monday that the package is unlikely to pass, as it would need a large percentage of outstanding votes to win investor approval.

“If the pay package were to be voted down, we believe it could increase uncertainty regarding the future leadership of the company and jeopardize the ‘Musk premium’,” CFRA Research senior equity analyst Garrett Nelson said.

- 06/10/2024 – Tesla’s Game-Changing Move to Revolutionize Vehicle Safety with Cabin Cameras (msn.com)

Tesla, known for its innovative approach to automotive technology, is making headlines again with a significant update to its vehicle safety features. The electric car giant is set to transition from traditional seat sensors to cabin cameras for detecting seat occupancy, marking a pivotal shift in how vehicle safety mechanisms are implemented.

Tesla is one step closer to launching full-self driving (FSD) technology in China after it clinched an agreement with Baidu to upgrade its mapping software.

Partnering with Baidu would allow Tesla to run its full self-driving system on China’s public roads, with its vehicles able to collect surrounding data, such as road layout, traffic signs and buildings.

It could also accelerate Tesla’s global development of its self-driving technology, as data from China could be used to train Tesla’s algorithms needed for fully autonomous vehicles.

The Chinese tech giant said Saturday that it was providing lane-level navigation services for Tesla cars. Baidu (BIDU) says this level of navigation can provide drivers with detailed information, including making lane recommendations ahead of upcoming turns, to enhance safety.

Experts said during Tesla (TSLA) CEO Elon Musk’s surprise visit to China at the end of April that one of his main hurdles in securing government approval to rollout the company’s FSD software was reaching a mapping and navigation deal with Baidu.

“With the support of Baidu’s lane-level map, Tesla’s navigation can accurately render lane changes on the road the user is currently on, upgrading from providing road-level guidance to providing lane-level guidance,” Baidu said in the statement.

According to Chinese regulations, all self-driving systems must obtain mapping qualifications before operating on public roads. Foreign car companies need to partner with licensed Chinese companies to qualify for surveying and mapping.

Car owners have long complained on social media about Tesla’s previous navigation services, which were also provided by Baidu, saying they often have to rely on other maps available on smartphones while driving.

“This time, you can really remove your mobile phone holders (mounted in the car),” Tesla said in its Friday announcement, suggesting drivers no longer need other maps for navigation.

The news went viral on Chinese social media on Monday.

Among the long list of improvements in v12.4 is the elimination of the infamous “steering wheel nag.” The persistent reminder to keep your hands on the wheel with Autopilot engaged is no more. Musk also claims the latest update will allow Tesla vehicles to drive up to ten times more miles per intervention, sometimes driving for as long as an entire year without being corrected.

But here’s the catch – the bold claim of a full year of driving sans-interventions comes with a small print: “once known bugs are fixed.” And as any Tesla owner will attest, those pesky bugs can be more persistent than that annoying mosquito late at night. Take Tesla’s auto wipers, which are known to malfunction with a mind of their own.

Elon Musk Promises Next FSD Update Will Be A Giant Leap – Tesla Tale

Whole Mars Catalog @WholeMarsBlog FSD 12.4.1 shows promise, but needs some polish. Expect 12.4.2 or 12.4.3 to go wide depending on how things go. 12.4.1 isn’t quite ready to replace 12.3.6 yet but will be soon Huge thanks to Tesla for getting this first build out to early access!

Elon Musk: An accurate assessment

- 06/09/2024 – Elon Musk is pitching a daring idea to Tesla shareholders: A vote for Musk is a ticket to the ‘Muskonomy’ (msn.com)

- Tesla shareholders might have another reason to vote for Elon Musk’s pay package this Thursday.

- Musk has been touting the benefits of having Tesla be a part of his business empire.

- The billionaire has touted access to future IPOs and showcased the synergies between his businesses.

- 06/08/2024 – (1) Elon Musk on X: “I’ve mentioned something like this before, but, if any of my companies goes public, we will prioritize other longtime shareholders of my other companies, including Tesla. Loyalty deserves loyalty.” / X

- 06/06/2024 – Cathie Wood Commends Elon Musk’s Dedication to Shareholders, Predicts This Negative Impact If Shareholders Renege On Tesla CEO’s $56B Pay Package (msn.com)

- 06/05/2024 – (162) Ron Baron on supporting Elon Musk’s pay package: He’s created tremendous wealth for people – YouTube

We have another contract going going this point, going forward

- 06/05/2024 – Tesla announces launch dates for long-awaited Semi as construction on manufacturing facility is underway — here’s the official timeline (msn.com)

- 05/31/2024 – 1 Magnificent S&P 500 Stock Down 58% to Buy and Hold Forever (msn.com)

Investors seem to have soured on Tesla (NASDAQ: TSLA), particularly in recent months. The leading electric vehicle stock has suffered from lightened demand for EVs. Also, a perception of changing priorities in some parts of its business may have given investors pause. Consequently, its stock sells at a 58% discount to its high set in 2021.

Tesla’s struggles are probably temporary

Indeed, the slump in EV sales has hurt Tesla, and many investors have worried about competition from Chinese EV maker BYD. Competition and price cuts have compressed gross margins, which has soured some investors on Tesla stock.

- 05/24/2024

- 05/22/2024 – Tesla’s AI Investments and Upcoming Shareholder Vote Would Determine Future Growth: Morgan Stanley Analyst (msn.com)

Morgan Stanley analyst Adam Jonas reiterated an Overweight rating on Tesla Inc (NASDAQ:TSLA) with a price target of $310.

Jonas highlights that the broader collection of Elon Musk’s businesses may collectively invest tens of billions of dollars in AI infrastructure in the coming years.

The analyst points out that the cost of capital is deterministic for AI supremacy.

In his opinion, Tesla’s success lowers Muskonomy’s cost of capital, while Tesla’s failure raises it.

In addition to the cost of capital, Jonas noted that, on a fundamental level, the data, the infrastructure built, and the path to monetization (TAM) within Tesla are critical to Musk’s seemingly ‘adjacent’ AI efforts.

Jonas flagged that the data captured by the car enhances AI learning and development.

The analyst highlighted that the car’s unique attributes (mobile server, compute, thermal, energy storage) may be seen as more critical in the emerging AI-driven hybrid computing ecosystem.

Over time, he expects to see Musk’s efforts within social media/gen-AI, space/communications, and automotive/transportation become more conspicuously linked.

Jonas noted Tesla’s June 13 shareholder vote as significant to the company’s long-term strategic direction. He expects the event could drive material volatility in the stock.

Several photos that show a two-seater without a steering wheel made their way into an official Tesla video.

Interior images of Tesla’s long-rumored self-driving taxi might have been leaked online by the company itself in a short video meant to convince shareholders to vote for Elon Musk’s huge $56 billion compensation package and the relocation of the automaker’s state of incorporation from Delaware to Texas.

Baidu Considers Using Tesla’s Robotaxi Tech In China (insideevs.com)

- 05/20/2024 – FDA okays second patient to receive Neuralink implant: report (NASDAQ:TSLA) | Seeking Alpha another amazing success for Musk

- 05/20/2024 – Tesla Price Cuts Backfiring? European Rental Companies Fume As EV Giant’s Used Car Values Plummet, Service Leaves Bad Taste (msn.com)

Retail price cuts were intended to boost sales amid declining global demand for electric vehicles and rising competition from Chinese EV makers like BYD and Nio. However, these cuts negatively impacted the residual values of Tesla’s fleet customers in Europe, where fleet purchases make up nearly half of auto sales.

Richard Knubben, director general of Leaseurope, said, “Tesla is now actively telling our members: We can give you discounts and compensate you.”

However, he expressed skepticism about whether these discounts would be sufficient.

Tesla is yet to respond to the queries sent by Benzinga.

Tim Albertsen, CEO of Ayvens, noted that while Tesla’s service has improved, the falling resale values have been damaging. Bart Beckers, Deputy CEO of Arval, a unit of BNP Paribas, mentioned that Tesla’s price cuts were detrimental, leading Arval to consider other EV manufacturers.

- 05/20/2024 – Has Tesla’s Autonomous Taxi Been Debuted? Unconventional Model 3 Seen in California (msn.com) Tesla CEO Elon Musk has announced that the Cybercab robotaxi will be unveiled at an event on August 8, 2024.

The vehicle was shared by EV enthusiast Nic Cruz Patane across social media outlet X (formerly known as Twitter). Located in Palo Alto, this alleged Model 3 was not merely mirrorless but also displayed a revised array of cameras compared to the standard model, including new placements by the rear window, on the side repeater, and the trunk. Notably, two cameras were installed on the rear seat windows, an installation that captured significant interest.

Chinese Market to Test FSD for Upcoming Robotaxi Service

Might be the Pioneer for Tesla Robotaxis

Concurrently, Tesla has been pursuing the introduction of a robotaxi network in China. Reports this month from Chinese media revealed that Musk has pitched the idea of deploying a full self-driving system in cars marketed to Chinese customers—a move that positions China as a potential first-runner for experiencing Tesla’s robotaxi concept. At this time, Tesla has not provided an official comment on the unusual Model 3 test vehicle seen in California.

When will Tesla’s robotaxi be announced?

Tesla CEO Elon Musk has announced that the Cybercab robotaxi will be unveiled at an event on August 8, 2024.

- Tesla’s pivot to AI and robotics, rooted in EVs, creates a unique moat in advanced physical products.

- Current financial contractions are seen as temporary, driven by macroeconomic pressures and competitive dynamics in AI, robotics, and EVs.

- Tesla should be valued like a big tech company, reflecting its heavy AI and robotics involvement, making it potentially undervalued over a 10+ year horizon.

Tesla stock is down nearly 60% from its all-time highs, and analysts on Seeking Alpha and elsewhere are expressing negative sentiments more regularly now, putting out frequent Sell ratings. One of the big arguments these analysts commonly make is that Tesla is “just a car company”. To me, that’s naïve and uninformed. Here are the major areas of AI, robotics, and automation that Tesla has in the works:

- Autonomous Vehicles: Tesla’s FSD has the potential to dominate in the field of autonomous taxis because of the scale of Tesla’s operations when compared to smaller outfits like Alphabet’s (GOOGL) Waymo.

- Optimus is a general-purpose humanoid robot designed to perform repetitive and dangerous tasks. It is also known as Tesla Bot.

- Energy Management Systems: Tesla has an AI-powered platform for energy trading. The company also offers virtual power plants to aggregate distributed energy resources to act as a unified power plant.

- Manufacturing Automation: The company employs extensive automation in its Gigafactories, using advanced robotics to assemble vehicles and batteries. The company also uses AI in quality control.

- AI Research and Development: Tesla is developing Dojo, which is a supercomputer optimized for AI machine learning training; this will significantly affect its FSD and other AI-driven features.

- Customer Service and In-Car Experiences: Tesla vehicles incorporate natural language processing and predictive maintenance.

The culture clash between OpenAI and Tesla is significant as it highlights the tension between corporate interests and the initial ethos of OpenAI, which was founded as a non-profit organization. Microsoft is reported to have an equity stake of 49% in OpenAI, based on multiple reports from the time of the extended partnership deal in 2023. However, this specific detail has not been officially disclosed by OpenAI or Microsoft in their public statements.

- 05/17/2024 – Tesla Analyst Sees Annual Shareholder Meeting As Key To Determining Elon Musk-Led Company’s Future Strategy (msn.com) Tesla’s annual meeting will be held on June 13, 2024, at 3:30 p.m. Central Time (CT). Shareholders will vote both on moving Tesla’s state of incorporation from Delaware to Texas and Musk’s rescinded pay package

Morgan Stanley analyst Adam Jonas sees Tesla Inc‘s (NASDAQ:TSLA) upcoming shareholder vote driving material volatility in the stock and determining the company’s long-term strategic direction as company CEO Elon Musk‘s pay package hangs in limbo.

Analyst Recommendation: For the upcoming shareholder meeting scheduled for June, Tesla shareholders will vote again on Musk’s 2018 pay package which was rescinded by a Delaware court earlier this year after deeming it an “unfathomable sum.” The package was worth $56 billion at the time of award.

The outcome of the vote on the package will be key to determining if the CEO gets a 25% voting block within the company, Jonas said in a note on Friday. Musk has previously expressed discomfort with advancing Tesla in the field of AI without having 25% voting. While the approval of the pay package by itself does not assure the CEO of his desired voting block, it would make it “increasingly difficult” for Musk to achieve 25% ownership if the package is rejected, the analyst noted.

Tesla’s AI potential will remain limited and its share price dominated by larger EV market developments until Musk’s voting control issue is resolved, Jonas said. “This is extremely problematic for Tesla investors for a number of reasons, including the inability to quantify the impact,” he said.

Why It Matters: Tesla’s annual meeting will be held on June 13, 2024, at 3:30 p.m. Central Time (CT). Shareholders will vote both on moving Tesla’s state of incorporation from Delaware to Texas and Musk’s rescinded pay package.

Price Action: Tesla shares closed down 2% on Friday at $168.47. The stock is down 32.2% year-to-date, as per data from Benzinga Pro.

- 05/17/2024 – Why Can’t Tesla Just Grant Elon Musk A New Pay Package? Critic And Legal Expert Says CEO ‘Can’t Replicate The Stock-Pumping Feats’ From 2018 (msn.com)

- 05/17/2024 – Elon Musk’s X Completes Rebranding Away From Twitter – WSJ

- 05/17/2024 – Tesla’s largest single investor ‘bites back’ against Elon Musk in bombshell ballot votes (msn.com)

Tesla’s largest single investor, who owns 27.6 million shares worth around $4.8 billion, has posted proof online that he voted against reinstating a $56 billion pay package for the company’s CEO, Elon Musk.

In addition to voting against the lofty compensation a Delaware judge blocked in February, this investor shot down all of Tesla’s other recommended ballot measures, including re-electing Elon Musk’s brother, Kimbal, to the carmaker’s board of directors.

Musk owned about 22% of Tesla when the plan was approved. His interest in the company would grow to about 28% if the company’s market capitalization grew by $600 billion.

In a January post on X, Musk wrote: “I am uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control. Enough to be influential, but not so much that I can’t be overturned.”

- 05/16/2024 – Tesla is going all out to push Elon Musk’s $55 billion pay package through — even spending money on ads (msn.com)

- Tesla is spending money on ads to promote Elon Musk’s $55 billion pay plan.

- The company aims to reapprove Musk’s compensation package after it was voided by a judge.

- Whether the package is reinstated will be voted on by shareholders on June 13.

- 05/15/2024 – Tesla Hits the Road to Persuade Shareholders to Pay Elon Musk $46 Billion – WSJ

- 05/10/2024 – Tesla Analyst Sees Annual Shareholder Meeting As Key To Determining Elon Musk-Led Company’s Future Strategy (msn.com)

Morgan Stanley analyst Adam Jonas sees Tesla Inc‘s (NASDAQ:TSLA) upcoming shareholder vote driving material volatility in the stock and determining the company’s long-term strategic direction as company CEO Elon Musk‘s pay package hangs in limbo.

Analyst Recommendation: For the upcoming shareholder meeting scheduled for June, Tesla shareholders will vote again on Musk’s 2018 pay package which was rescinded by a Delaware court earlier this year after deeming it an “unfathomable sum.” The package was worth $56 billion at the time of award.

- 05/11/2024 – Tesla Turmoil Means Make-or-Break Moment for EV Charging – WSJ

- 04/30/2024 – Why Musk Now Needs China More Than It Needs Him – WSJ Beijing seeks to score political points as it hands Tesla a victory

- 04/29/2024 – Elon Musk Wins China’s Backing for Tesla’s Driver-Assistance Service – WSJ

SINGAPORE—Elon Musk wrapped up a trip to China in less than 24 hours and came away with a crucial victory as he pushes to reignite Tesla’s TSLA 15.31%increase; green up pointing triangle sagging growth.

After his flurry of meetings with top officials in Beijing, China’s government signaled its blessing for Tesla to roll out its advanced driver-assistance service in the carmaker’s second-biggest market. The Tesla chief executive is seeking to expand use of the controversial software feature globally as the company confronts the prospect of lower sales growth this year.

Chinese officials told Tesla that Beijing has tentatively approved the company’s plan to launch its “Full Self-Driving,” or FSD, software feature in the country, people familiar with the matter said Monday.

The U.S. electric-vehicle maker will deploy its autonomous driving services based on mapping and navigation functions provided by Chinese technology giant Baidu, the people said.

Tesla’s stock was up 10% in morning trading Monday.

- 04/30/2024 – Tesla’s Pivot to China Saved Musk. It Also Binds Him to Beijing. – The New York Times (nytimes.com)

- 04/29/2024 – Tesla soul-searching with Adam Jonas (ft.com) (full article is here – Tesla soul-searching with Adam Jonas)

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

https://www.ft.com/content/067b0dce-f34a-4853-8bbe-0ce674e36d04

“The AI brain is searching for its robot ‘body.’ And the body is the vessel of the AI ‘soul’”, writes Adam Jonas in an actual note to clients. Morgan Stanley’s autos analyst has been moved to aphorise by Elon Musk’s surprise visit to Beijing. Less contemplative observers might think Tesla shares are being short-squeezed up ~10 per cent today after Bloomberg reported that the company has received tentative clearance to sell full-self-driving in China — a possibility Musk had flagged during last week’s results conference call. Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

https://www.ft.com/content/067b0dce-f34a-4853-8bbe-0ce674e36d04

More important, says Jonas, is the signal that Musk still loves Tesla . . . Investor concerns around whether Elon Musk was ‘all in’ on Tesla have been weighing heavily on the stock since the compensation package was rejected by Delaware judge. Even the smallest gesture of commitment (an unannounced trip to Beijing) has elevated meaning here, combating concerns over Musk’s commitment to Tesla relative the broader Musk ecosystem of companies (SpaceX/X.AI/etc.). … and that China can still tolerate Musk . . . We would assume that Elon Musk’s US national security clearance is higher than that of the typical American CEO due to his control of SpaceX and the range of missions it conducts with NASA, Space Force and the broader [US Department of Defence]. Achieving a potential detente with the PRC on such areas as autonomous driving/FSD (with its obvious national security sensitivity given its ‘dual purpose’ technology) is surprising and deserves greater research and understanding. For now, Musk winning blessing from the PRC for FSD roll-out in the country seems to address embedded fears of Tesla’s China profit (we estimate China accounts for as much as one half of profit). … so investors can still love Tesla, whatever it might become: The ongoing LLM/Gen AI revolution is in the early days of crossing over into robotics. LLM and robotics were long seen as vastly different areas of science. But there may be far more overlap in how the advancement of LLM accelerates the training and learning of the robot – whether it is a ‘car shaped’ robot or a human shaped one. Titled “He’s Back”, the note reiterates Morgan Stanley’s (recently lowered) $310 share price target on Tesla, of which extant businesses contribute $67: © Morgan Stanley And if all those 2030 forecasts don’t pan out, there may be an opportunity to open an Etsy shop:

WHY IS FSD AVAILABLE ONLY ON A LIMITED BASIS IN CHINA?

Tesla has been offering FSD for subscription in China for four years but with a restricted set of features that limit the system to operations like automated lane changing.

Data security issues have been a key obstacle to a full rollout. Musk is looking to obtain official approval to transfer data collected in the country abroad to train algorithms for its autonomous driving technologies, according to the person with the knowledge of the matter.

Since 2021, Tesla has stored all data collected by its Chinese fleet in the country, as required by Chinese regulators, and has not transferred any back to the United States.

In a sign of progress that may lead to a launch of unrestricted FSD in China, Tesla’s Model Y and 3 cars made it onto a top Chinese auto association’s list of 76 car models found to be compliant with China’s data security requirements.

It remains unclear as to what, if any, other regulatory approvals Tesla will need to obtain or what conditions the company may have before it is able to make FSD fully available in China.

WHAT WOULD AN FSD ROLLOUT IN CHINA MEAN FOR TESLA?

The rollout of FSD in China would allow Tesla to better compete with local rivals in the world’s largest auto market where driver assistance and other connected car features are prized.

Tesla has sold more than 1.7 million cars in China since it entered the market a decade ago and its Shanghai factory is its largest globally.

A rollout of unlimited FSD could turn the Chinese market into a battlefield for cheaper driver assistance features, intensifying a price war that Tesla triggered early last year which has pulled in more than 40 brands in the country.

FSD’s entry into the Chinese market will complement offerings of similar software by local automakers. Smartphone maker Xiaomi (1810.HK), opens new tab, for instance, announced plans for the availability of its Navigate on Autopilot (NOA) driver assistance feature on its first car SU7 at the Beijing auto show.

Enabling FSD in China would provide a buffer to Tesla’s declining EV sales by accelerating its diversification towards autonomous technologies, artificial intelligence and humanoid robots and operating a fleet of millions of autonomous vehicles.

Tesla’s vehicle deliveries in the first quarter fell for the first time in nearly four years. The company began the second quarter announcing lay offs of more than 10% of its global workforce and slashing vehicle prices in major markets including the U.S., China and Europe.

WHAT MIGHT AN FSD ROLLOUT MEAN FOR CHINA?

Beijing’s warm reception of Musk and a potential approval for FSD comes as China’s leaders are grappling with souring foreign investment sentiment towards China, with overseas businesses complaining regulatory tightening over areas such as data have left them confused and concerned.

China has signalled it wants to improve the situation, having last month relaxed rules to facilitate and regulate cross-border data flows and allowing free trade pilot zones to independently formulate lists of data that need to undergo security assessments.

Tesla’s Chinese factory is located in a large Shanghai free trade zone.

Li’s meeting with Musk contrasted with the Chinese premier’s decision not to hold a meeting with visiting foreign CEOs at a key annual Beijing forum last month, which had raised concerns about China’s commitment to attracting investment from abroad.

Approval of Tesla’s FSD would also fit with Chinese authorities’ aim to spur competition and innovation to preserve the country’s leading edge in such technologies. Several Chinese automakers and suppliers such as XPeng and Huawei (HWT.UL) are rolling out similar software to Tesla.

- 04/28/2024 – (1) Elon Musk on X: “Honored to meet with Premier Li Qiang. We have known each other now for many years, since early Shanghai days. https://t.co/JCnv6MbZ6W” / X

- 04/05/2024 – The Inside Tale of Tesla’s Fall to Earth – WSJ

- 03/20/2024 – Elon Musk vs. Everyone: The New Fight in AI – WSJ

he AI wars have begun, and the humans are throwing the first punches.

Elon Musk in the past week or so has been working to make it all about his nascent xAI against the Big Dogs.

The billionaire through tweets and litigation is framing his rivals as fundamentally flawed and unworthy: Google is woke, Microsoft MSFT -1.84%decrease; red down pointing triangle is overreaching and Sam Altman is two-faced.

A 35-page complaint filed in a San Francisco court late Thursday is built on what Musk describes as the hypocrisy of Altman. According to the lawsuit, when Altman and Musk started OpenAI years ago they agreed it would be a not-for-profit entity to counter the greed of Google—only to have OpenAI, under Altman’s control, later pivot toward moneymaking ventures with Microsoft.

Musk has also acknowledged the spending war to fund AI companies’ development, saying recently it will take “at least single digit billions in hardware to have a seat at the adult table rather than the kiddies’ table and next year it’s probably in the tens of billions of hardware to remain at the adults’ table.”

The expense behind creating the technology is what necessitated OpenAI’s evolution as an organization beyond being a simple not-for-profit, Altman has said.

OpenAI concluded it wasn’t equipped to operate as a not-for-profit because it was becoming too costly for the amounts of computer power needed to train the software that mimics the way humans think.

“No one wanted to fund this in any way,” Altman told The Wall Street Journal last year. “It was a really hard time.”

Some executives and board members fear the billionaire’s use of drugs—including LSD, cocaine, ecstasy, mushrooms and ketamine—could harm his companies

Linda Yaccarino understands the assignment.

Or at least that is what her first staff-wide memo as Twitter CEO suggests. In it, she showed she was in tune with a key management philosophy of her new boss, Elon Musk. That is his total embrace of the so-called first principles approach for problem solving, a mixture of physics and philosophical reasoning that breaks issues into their very basics and doesn’t simply rely on what has been done before.

“We need to think big. We need to transform. We need to do it all together,” Yaccarino wrote Monday, a week into her new role at the social-media company after a longcareer in the television advertising industry.

“And we can do it all by starting from first principles—questioning our assumptions and building something new from the ground up.”

“When you want to do something new, you have to apply the physics approach,” Musk said in 2013 during a TED talk. “Good physics is really sort of figuring out how to discover new things that are counterintuitive, like quantum mechanics.”

The challenge, according to Musk, is that it is easier to make decisions by looking at previous experiences, past practices or, as he describes it, analogy. These can be mental shortcuts. That is fine for most things in life. But that approach, he said, can be limiting when it comes to discovering something new.

For breakthroughs, he advocates the first principles approach. In the most basic sense, Musk has described the approach as such: “Boil things down to the most fundamental truths and say, ‘OK, what are we sure is true, or as sure as possible is true?’ And then reason up from there.”

In a telling sign of how much Musk believes in first principles, he insisted his children be educated in its way of thinking, setting up Ad Astra School in 2014 built around that philosophy. “It’s so foundational to Elon,” Joshua Dahn, the school’s co-founder, said in an interview.

Creating the school, which served children ages 8 through 14 at SpaceX headquarters until 2020, required Dahn to deploy first principles thinking at every step.

“Part of the superpower is once you understand the first principles approach—and you expect Elon to question you on it along those lines—then there’s no other path if you’re going to find success other than to sort of operate that way,” Dahn said.

The first principles process involves envisioning what ultimate success looks like and then being open to any path that leads there. Even something so ingrained in traditional schooling, such as accreditation, showed how Musk’s mind applied first principles reasoning in decision making, raising very simple questions: “What’s accreditation? Why does it exist? What’s it for? What’s the cost? What’s the opportunity cost of doing that?”

And the answers can’t simply be: That is what other schools do.

“Reasoning by analogy, especially in the early days, is the thing that’s a total killer,” Dahn said.

Musk’s business successes and his often-stated focus on first principles have sparked interest in others. James Clear, the bestselling self-help author, has written about the approach, writing that while great minds from Aristotle to Johannes Gutenberg have employed such reasoning, “no one embodies the philosophy of first principles thinking more effectively” than Musk.

Ad Astra closed at SpaceX in Hawthorne, Calif., when Musk’s children moved on. Dahn has since spun off his work into Astra Nova School, an online offering for a broader population of students.

Still, it isn’t an easy approach. For Musk’s engineers, the work of unlearning assumptions can be challenging, especially at times when the tried-and-true method would be quicker.

Musk lectured on first principles at his children’s school years ago, diving into his reasoning behind starting SpaceX, including the math behind a rocket and the economics behind its costs.