Study of DPST, KRE and FAS – part II

- 06/13/2024 – Commercial real estate bargain hunters are snagging offices for ‘extreme’ discounts up to 70% (msn.com)

- 06/12/2024 – I’m seeing some parallels with 2000 – but I’m not predicting a meltdown; Too early to buy regional-bank stocks; Renting versus buying in housing | Stansberry Research

Moving on to more charts from Bilello’s latest Week in Charts post…

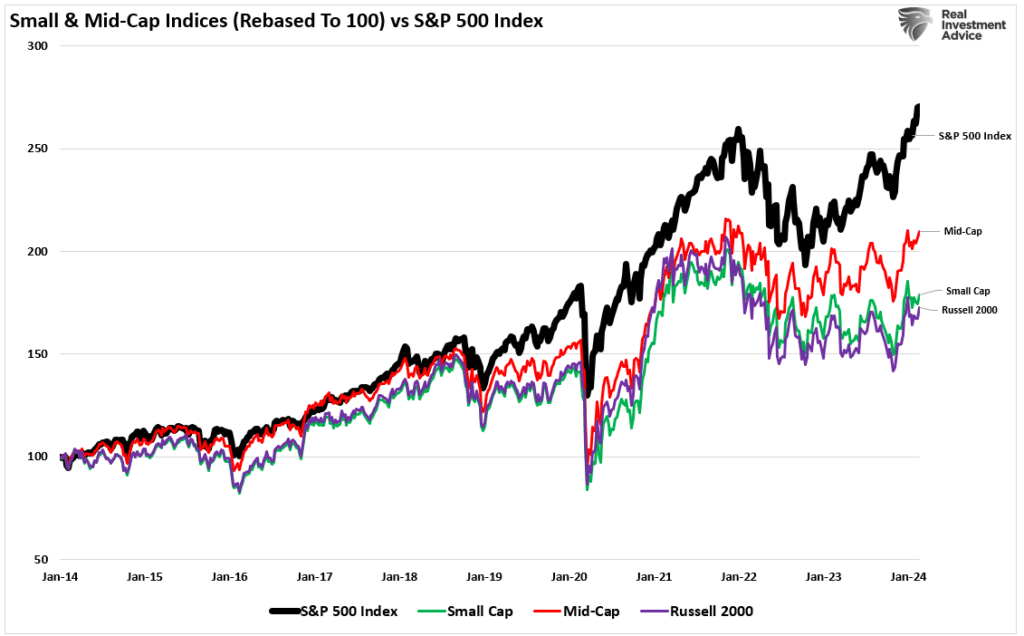

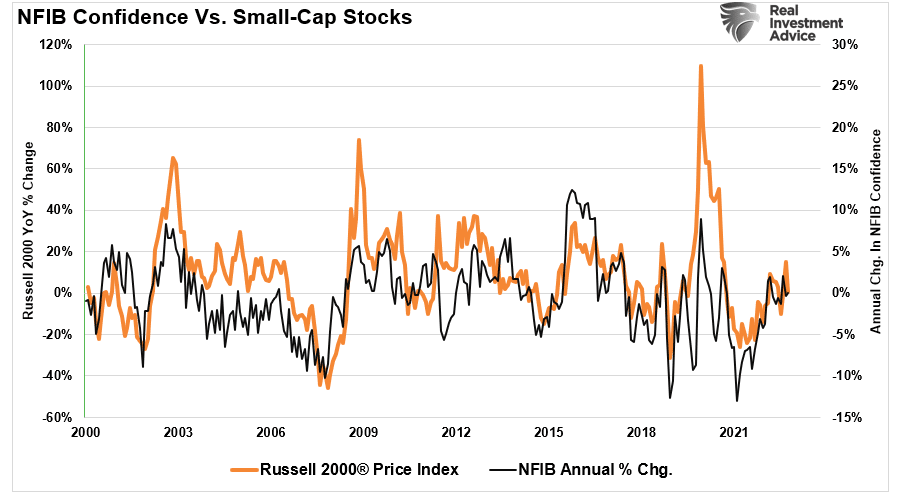

He also included this chart, showing how regional bank stocks, relative to the S&P 500 Index, have traded back down to near their all-time lows from a year ago after Signature Bank and First Republic Bank went under:

Regional-bank stocks are certainly beaten down. But I think it’s too early to start bottom-fishing in this sector, for reasons I outlined in a series of e-mails in which I tapped the expertise of my banking-expert friend in late January and early February (my February 2 and February 8 e-mails have links).

- 05/20/2024 – A $10 Billion Real-Estate Fund Is Bleeding Cash and Running Out of Options – WSJ The Starwood Real Estate Income Trust, known as Sreit, has three choices—none of them appealing – dangerous of commercial real estate

A giant commercial real-estate fund is scrambling to escape a looming cash crunch caused by the long line of investors who want their money back.

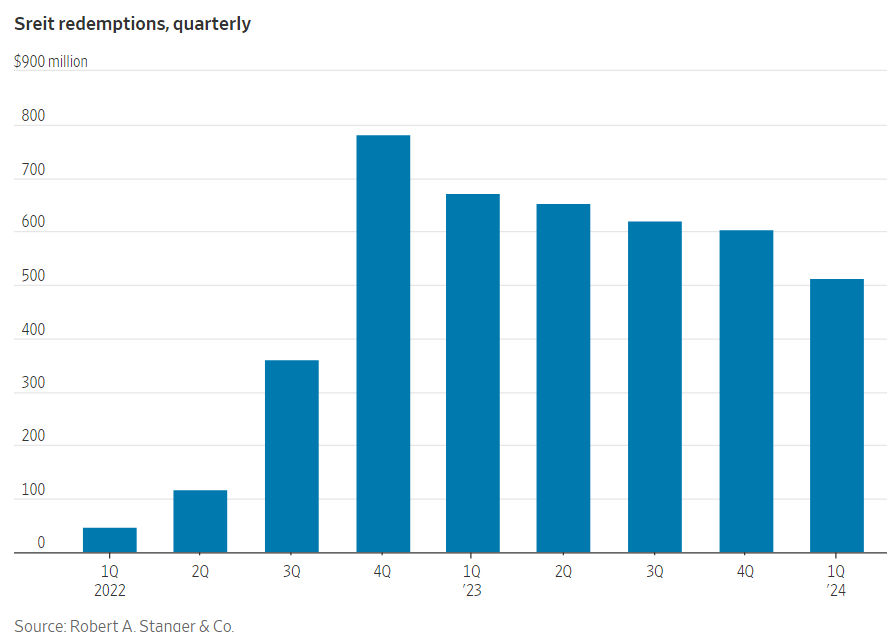

The $10 billion fund from Starwood Capital Group has been trying to preserve its available cash and credit by limiting investor redemptions. In the first quarter, the fund was hit with $1.3 billion in withdrawal requests but satisfied less than $500 million of them, according to regulatory filings.

Even with these limitations, the fund’s liquidity, consisting of cash, marketable securities and a bank line of credit, has been drying up. It totaled $752 million at the end of April, down from $1.1 billion at the end of last year. It was $2.2 billion at the end of 2022, according to filings.

“They don’t have a lot of liquidity left,” said Kevin Gannon, chief executive of Robert A. Stanger, an investment bank that specializes in real-estate funds.

These developments have left the Starwood Real Estate Income Trust, known as Sreit, with three options—none of them appealing. It could take on more debt. It could sell properties into a tough market. Or it could halt completely or limit further redemptions, a move that would greatly impair the fund’s ability to raise new money. Unless it takes one of these three steps, Sreit looks poised to run out of cash and credit before year-end if the current pace of redemptions continues.

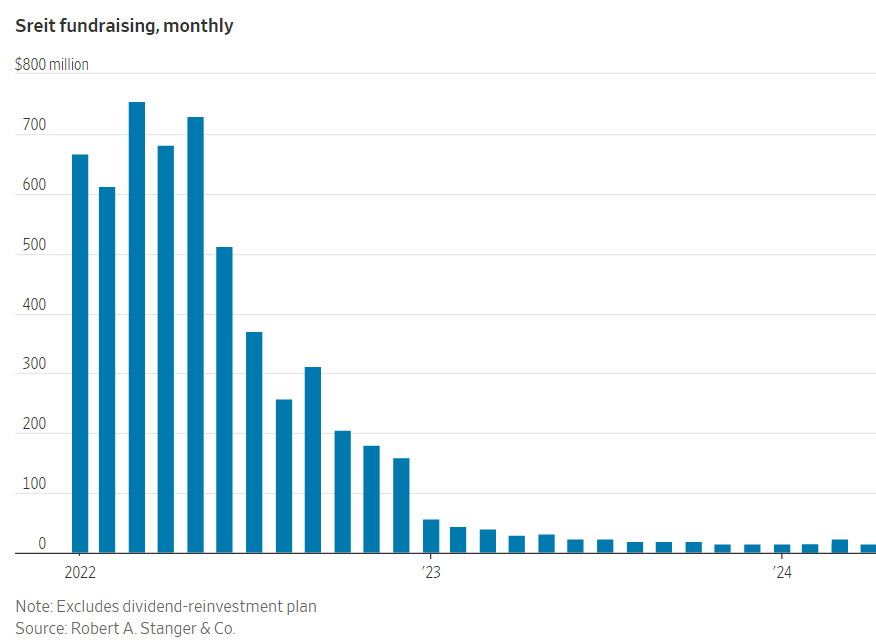

Other real-estate funds are handling the pressure from the long queue of redemptions in varying degrees. The largest of the funds, Blackstone Real Estate Income Trust, or Breit, has $7.5 billion in liquidity and earlier this year was able to fulfill all redemption requests. But withdrawals continue to exceed new fundraising.

The fund could borrow more, but that would be costly at today’s high interest rates. Sreit’s current debt is already equal to 57% of its assets, which is more than many comparable real-estate funds. Sreit’s target leverage is 50% to 65%.

The fund could sell assets. Sreit owns hundreds of properties throughout the country, mostly warehouses and rental apartment buildings in the Sunbelt. But the value of most commercial real estate has been hammered by high interest rates, which drive up costs in the high-leverage business. Rental apartments have also been hurt by overbuilding in many markets.

Most rental-apartment owners who bought in the years just before the interest-rate spike “would prefer not to sell in this market,” said Matthew Werner, managing director with asset manager Chilton Capital Management.

Finally, Sreit could halt or limit further investor redemptions. But analysts believe that would be a last resort because it would make it even harder to raise new money. One of the main selling points of Sreit has been that investors would be able to redeem their shares, subject to the 2% and 5% restrictions.

A redemption halt “would be fatal,” Stanger’s Gannon said. “You wouldn’t be able to raise another dime.”

Sreit was launched in 2018 by Starwood Capital, a private-equity firm headed by Barry Sternlicht, the storied real-estate investor and founder of the Starwood Hotels chain. Sreit raised more than $13.5 billion in equity, which it used to buy more than $25 billion in real-estate assets.

The fund attempted to sell properties last year as the redemption queues began to lengthen. Sreit sold a portfolio of single-family rental homes to Dallas-based Invitation Homes for $650 million, including debt.

But more recently, the fund has slowed sales because of depressed prices. Like other owners, Sreit is hoping prices will rebound later this year, especially if the Federal Reserve begins to cut interest rates.

Instead, Sreit has relied on its line of credit. But that won’t last much longer at the rate the fund is drawing it down. The line has $275 million of capacity, down from its original size of $1.55 billion.

- 05/13/2024 – ETFs with the most sensitivity to CPI surprises – BofA (NYSEARCA:KRE) | Seeking Alpha The SPDR S&P Regional Banking ETF (NYSEARCA:KRE) has the highest squeeze risk on a soft CPI print, the report showed. As a trade recommendation, analysts said to buy the ETF on May 17 51-53 call spread for $0.35, with a 5.7x maximum payout, and ref. 50.35.

The April CPI data — to be released on May 15 — is expected by BofA analysts to show headline and core CPI at 0.3% month-over-month each.

In a BofA Securities Trading Catalysts report, analysts said that “squeeze risks for rate-sensitive laggards on a CPI miss outweigh downside risks on a CPI beat.”

They highlighted ETFs that have been most sensitive to CPI surprises over the past year based on their historical sensitivity and correlation, as well as the short interest at an extreme level.

The SPDR S&P Regional Banking ETF (NYSEARCA:KRE) has the highest squeeze risk on a soft CPI print, the report showed. As a trade recommendation, analysts said to buy the ETF on May 17 51-53 call spread for $0.35, with a 5.7x maximum payout, and ref. 50.35.

These are the top 10 ETFs by beta vs. CPI surprise with more negative correlation to CPI surprises than the S&P 500 (SP500) over the past year:

- ARK Genomic Revolution ETF (ARKG) – Beta: -299; correlation: (88%); average move: 3.6%; short interest: NA

- Invesco Solar ETF (TAN) – Beta: -283; correlation: (88%); average move: 3.3%; short interest: 5%

- SPDR S&P Regional Banking ETF (KRE) – Beta: -210; correlation: (87%); average move: 2.3%; short interest: 101%

- iShares Global Clean Energy (ICLN) – Beta: -198; correlation: (87%); average move: 2.3%; short interest: 2%

- SPDR S&P Bank ETF (KBE) – Beta: -179; correlation: (87%); average move: 1.9%; short interest: 9%

- SPDR S&P Homebuilders ETF (XHB) – Beta: -172; correlation: (84%); average move: 2.0%; short interest: 55%

- SPDR S&P Semiconductor ETF (XSD) – Beta: -169; correlation: (88%); average move: 1.8%; short interest: 1%

- iShares Russell 2000 ETF (IWM) – Beta: -155; correlation: (86%); average move: 1.6%; short interest: 28%

- SPDR S&P Telecom ETF (XTL) – Beta: -143; correlation: (83%); average move: 1.6%; short interest: 1%

- Vanguard Real Estate ETF (VNQ) – Beta: -142; correlation: (83%); average move: 1.5%; short interest: 2%

- 05/10/2024 – SCHW filed 10Q for 1Q2024 on May 09 – so no surprising negative financials as expected?

- Average tangible common equity is $14.105 bil

- As of March 31, 2024, the total remaining unamortized loss on these securities transferred to HTM included in AOCI was $11.0 billion net of tax effect ($14.5 billion pre-tax).

- The provision for credit losses on bank loans was lower in the first quarter of 2024 compared to the same period in 2023, as during the first quarter of 2024, loan loss factors decreased while the total balance of first lien residential real estate mortgage loans (First Mortgages) remained consistent with year-end 2023.

- 05/05/2024 – Property’s Waiting Game Is Getting Harder – WSJ As hopes of interest-rate cuts fade, some commercial real-estate borrowers want to cut loose

Higher-for-longer rates are forcing commercial property owners to rethink their options.

“Restrictive monetary policy needs more time to do its job.” It was the last thing real-estate borrowers wanted to hear from Federal Reserve Chairman Jerome Powell when the central bank held interest rates steady last week.

Last year’s motto in real-estate circles was to “survive until ’25.” Property owners thought the Fed would cut interest rates throughout 2024. If borrowers could just sit tight, it would soon be easier to refinance troubled loans.

Over the past three weeks, borrowers and lenders have both realized this is probably a fantasy. Inflation has been stuck above 3% for three consecutive months. U.S. economic data have remained robust, despite a weaker-than-expected jobs report Friday.

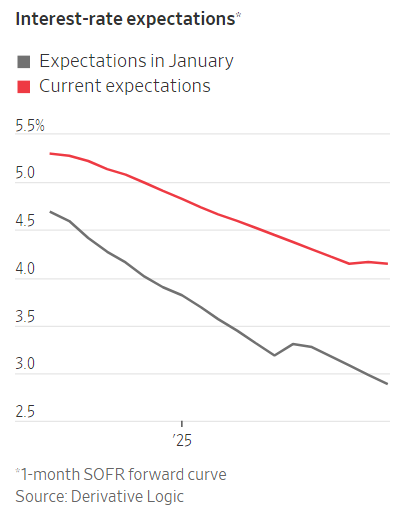

The one-month forward curve shows that investors now think the secured overnight financing rate, or SOFR, which is closely related to the federal-funds rate, will be 4.825% at the start of 2025. This implies up to two small cuts this year. Back in January, six cuts were expected.

One immediate consequence is that the cost of hedging has shot up again. Lenders require borrowers of floating-rate debt to hedge their interest-rate exposure, often through interest-rate caps. These instruments pay out when a benchmark such as SOFR rises above a set strike rate, which reassures lenders that borrowers will be able to meet their repayments even if rates rise.

The cost of these caps has become a major headache for property owners, according to Carol Ng, a managing director at risk-management firm Derivative Logic. The price of a one-year extension for an interest-rate cap on a $100 million mortgage at a 3% strike rate is now $2.1 million. Back in January, when the market expected more rate cuts, the same extension cost $1.3 million.

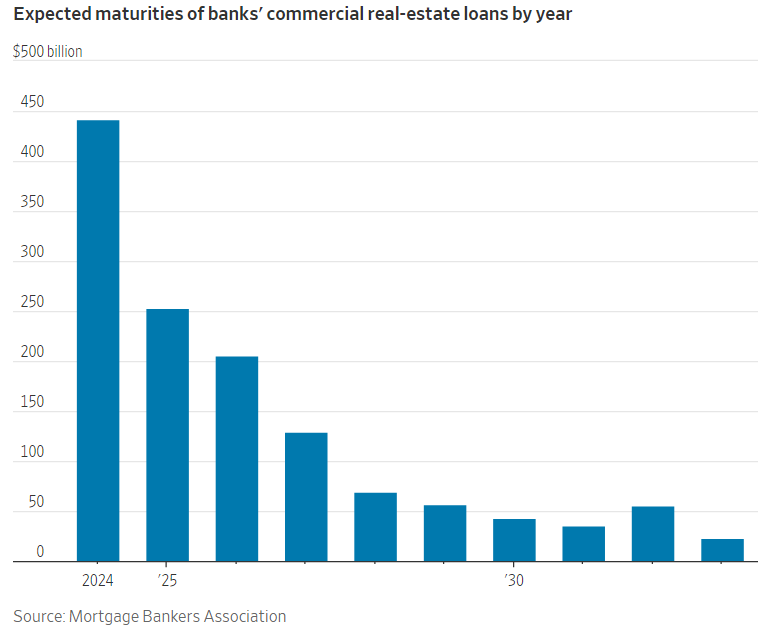

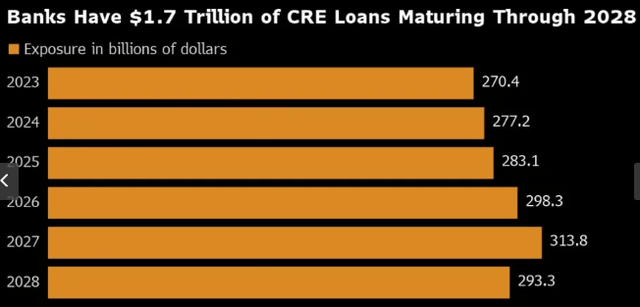

It isn’t just borrowers who are in a tight spot. The longer rates stay high, the greater the weight of unresolved property loans on lenders’ books as commercial real-estate loans get rolled over. According to the Mortgage Bankers Association, $929 billion of outstanding property loans will mature in 2024—a 41% increase on MBA’s earlier estimate. This is because many loans that were due to be paid off in 2023 were extended, adding to this year’s pile of maturities.

The so-called extend-and-pretend strategy worked well after the global financial crisis because the Fed cut rates from roughly 4% at the start of 2008 to close to zero by the end of the year. Ultralow interest rates turbocharged property valuations in the subsequent years, bailing out bad loans.

Higher-for-longer interest rates could also prolong the deep freeze on property deals. Debt costs are so high that it is difficult for buyers to meet lenders’ requirements that the rental income generated by a property cover the debt-service costs by at least 1.25 times. Sellers could capitulate on price to make the math add up, but they are reluctant to take a hit.

Banks Are Extending Office Loans. Are They Also Pretending? – WSJ Many 2023 maturities were pushed into 2024, giving lenders more time for rates to drop and other investors to come in

The looming “maturity wall” for commercial real-estate loans coming due has been moved back, but it has also gotten taller.

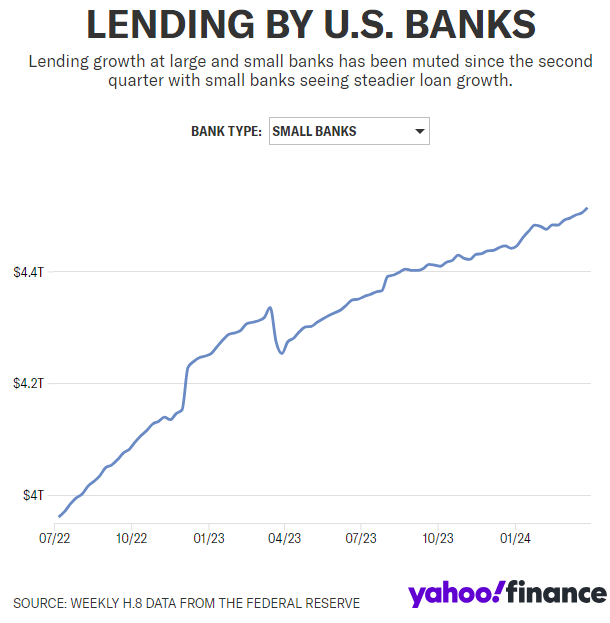

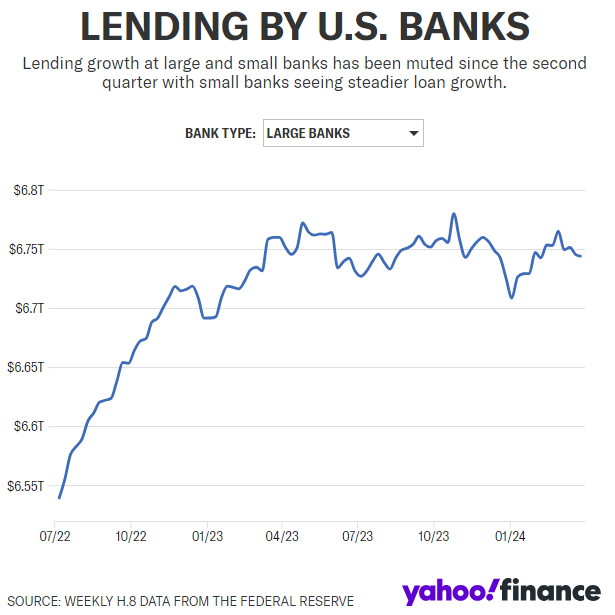

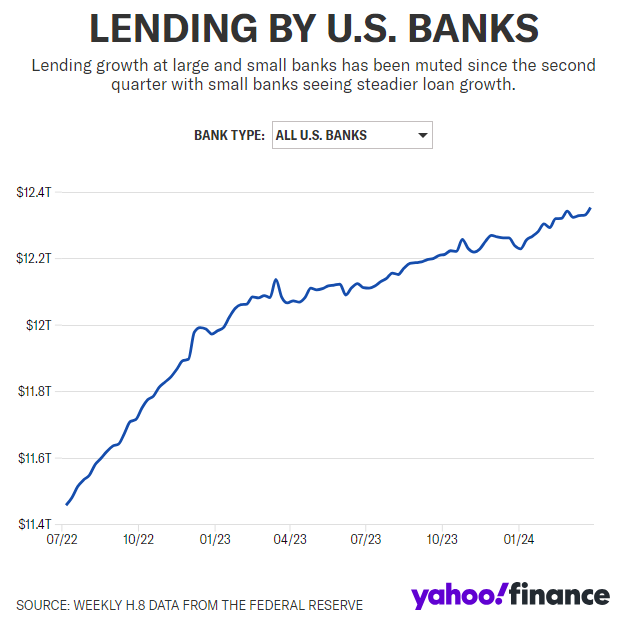

Banks’ commercial real-estate loans are now growing at an accelerating rate. In the first quarter of 2024 they grew sequentially 1.2% on a seasonally adjusted basis, according to Federal Reserve data. This ended a slowdown in growth last year, which had fallen to 0.3% in the fourth quarter.

Investors have been bracing for waves of loan maturities in commercial real estate, which could force a lot of tough choices about whether to restructure or write off mortgages to landlords struggling with occupancy and rental rates.

But it didn’t quite play out as expected last year. MSCI Real Assets noted in a recent report that $214 billion in mortgages slated for maturity in 2023 were, to their knowledge, not refinanced, nor was there a sale of the underlying property. “We believe that these loans have been granted some short-term extension to their maturity date,” MSCI Real Assets wrote.

For banks, this phenomenon—which critics often dub “extend and pretend”—has added significantly to 2024 maturities. PGIM Real Estate, part of Prudential Financial’s asset- management business, in a recent report noted that banks’ expected 2024 commercial real-estate maturities rose 35% from previous estimates.

So for now, despite a sharp slowdown in new commercial mortgage deals being originated last year, longer-lingering loans and prior obligations to lend to projects as they move forward are sustaining banks’ lending volumes.

“Existing commitments keep funding up, and maturing loans have nowhere to go,” wrote Autonomous Research analysts in a recent report. They estimated that about 40% of banks’ CRE loans maturing this year are actually ones that were supposed to mature in 2023.

This is a good news-bad news situation. On the one hand, loans aren’t being written off and losses crystallized. But they also aren’t being paid off and resolved. The issue lingers and forces investors to keep making calls about whether the loans will ultimately perform as banks are anticipating.

How much cushion investors demand will play a major role in whether bank stocks can keep pushing ahead after the KBW Nasdaq Bank Index’s 8% rally in March. Yet investors don’t have much to go on. When it comes to commercial mortgages, trouble doesn’t necessarily manifest in the form of missed payments. Many CRE loans are often structured with “balloon” payments, where most of the principal is due at maturity.

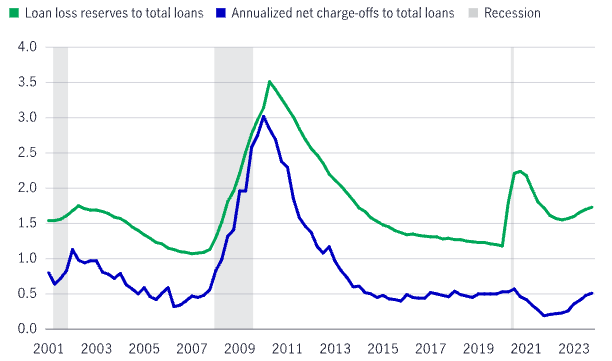

In fact, the rate of delinquencies on banks’ CRE loans had risen to just 1.2% as of the fourth quarter of 2023—still a fraction of the 8%-plus rate touched in the aftermath of the 2008 financial crisis, according to Fed data.

Instead, a key way that banks work through them is to refinance them with new loans when they are due, or when property developers seek out permanent financing from another lender, often a nonbank.

So, as unsatisfying as it may be, pushing out maturities can be the right answer. For one, interest rates are set to fall, which may bring some relief for landlords struggling to raise rents sufficiently to pay for mortgages at today’s high rates.

Plus, it appears that discount-seeking buyers and lenders seeking to jump on opportunities may soon be ready to step up. PGIM Real Estate in its report wrote that there could be an “increasing role for alternative lenders.” This would especially be the case if banks need to be more mindful of their capital and risk levels as new rules come into play.

Fortune Favors Early Movers in America’s Property Crunch – WSJ Investors willing to buy buildings when everyone else is running scared typically get the biggest rewards

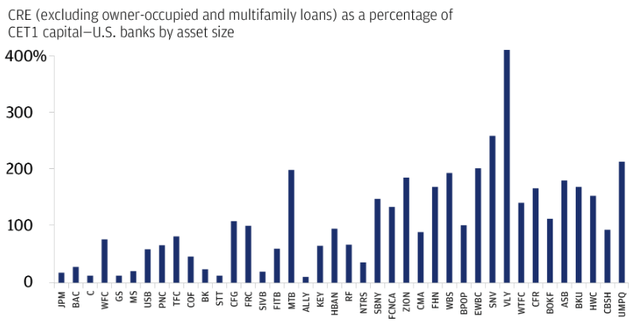

Hundreds of small and regional banks across the U.S. are feeling stressed.

“You could see some banks either fail or at least, you know, dip below their minimum capital requirements,” Christopher Wolfe, managing director and head of North American banks at Fitch Ratings, told CNBC.

Consulting firm Klaros Group analyzed about 4,000 U.S. banks and found 282 banks face the dual threat of commercial real estate loans and potential losses tied to higher interest rates. The majority of those banks are smaller lenders with less than $10 billion in assets.

“Most of these banks aren’t insolvent or even close to insolvent. They’re just stressed,” Brian Graham, co-founder and partner at Klaros Group, told CNBC. “That means there’ll be fewer bank failures. But it doesn’t mean that communities and customers don’t get hurt by that stress.”

Graham noted that communities would likely be affected in ways that are more subtle than closures or failures, but by the banks choosing not to invest in such things as new branches, technological innovations or new staff.

For individuals, the consequences of small bank failures are more indirect.

“Directly, it’s no consequence if they’re below the insured deposit limits, which are quite high now [at] $250,000,” Sheila Bair, former chair of the U.S. Federal Deposit Insurance Corp., told CNBC.

If a failing bank is insured by the FDIC, all depositors will be paid “up to at least $250,000 per depositor, per FDIC-insured bank, per ownership category.”

With rate cuts now on the horizon, real estate watchers are waiting for signs that it is time to pounce. There will be “a six to eight-month window” to find the best deals, according to Doug Middleton, a vice chairman at real-estate firm CBRE.

Private investors, such as high-net-worth individuals and family offices, are already out of the gate. In 2022 and 2023, roughly 60% of all U.S. commercial real estate deals were struck by private investors, according to data from MSCI Real Assets. Normally, they are the buyers in 46% of transactions, based on their record since the global financial crisis.

The field is wide open for anyone brave enough to buy because institutional investors like pension funds have stepped back. They were behind 18% of all U.S. property deals last year, according to MSCI Real Assets, which is a third below their normal share of activity. Real-estate investment trusts have also hit the brakes.

Bold investors made legendary bets after the global financial crisis. In the residential market, which took longer to turn around, Blackstone’s purchase of tens of thousands of foreclosed family homes from 2012 onward turned out to be a masterstroke.

By the time pension fund managers dip their toe back into the property market, early movers will already have the best deals in the bag.

- 05/01/2024 – NYCB Stock Jumps After Earnings (wsj.com), still bad earnings and loss, share jumps ONLY on the outlined strategic plans till the end of 2016. The current short interest of KRE is 48.76/52.35 = 93.14%. The jump on NYCB could cause the short cover of KRE, therefore KRE jumps by >2.0% even though SP500 and Russell2000 drops and FOMC meeting announcement is due in the afternoon. KRE jumped to over 4% then dropped back to 2.57%, it seems like a failed short squeeze today.

New York Community Bancorp shares jumped after new management outlined strategic plans after months of turmoil.

“While this year will be a transitional year,” new CEO Joseph Otting said in a statement, “we have a clear path to profitability over the following two years.”

Shares rose 17% in early trading.

NYCB reported a net loss of $335 million for the first quarter, compared with net income of $2 billion a year earlier. That amounted to a loss of 45 cents a share, worse than the 26-cent loss that analysts polled by FactSet had estimated.

Management said it has been performing reviews of its loan portfolios and would be focusing on working out problem loans and reducing concentrations. NYCB charged off $81 million in loans in the first quarter, compared with zero a year earlier.

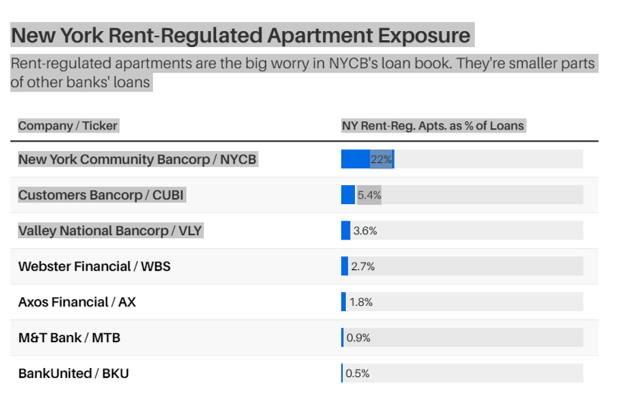

The bank has a large book of loans on rent-stabilized New York properties that have fallen in value in recent years, as well as some in the battered office market. It has also been considering strategic moves, such as selling or running off non-strategic assets.

“We have a lot of work to do in this organization to put the risk structure in place,” Otting said on a call with analysts.

NYCB said it expects charge-offs to increase over the next few quarters and set aside more reserves for potential losses.

The bank had logged a much larger net loss in the fourth quarter as it took hits in those books, setting off panic about its stability. It got a $1 billion rescue infusion in March after its stock plummeted.

Total deposits fell 12% from a year earlier in the first quarter.

NYCB shares jump 30%, CEO gives plan for ‘clear path to profitability’ (cnbc.com)

- New York Community Bank on Wednesday posted a quarterly loss of $335 million on a rising tide of soured commercial loans and higher expenses, but the lender’s stock surged on its new performance targets.

- The first-quarter loss, equal to 45 cents per share, compared to net income of $2.0 billion, or $2.87 per share a year earlier.

- When adjusted for charges including merger-related items, the loss was $182 million, or 25 cents per share, deeper than the estimate of a loss of 15 cents per share from LSEG.

New York Community Bank on Wednesday posted a quarterly loss of $335 million on a rising tide of soured commercial loans and higher expenses, but the lender’s stock surged on its new performance targets.

The first-quarter loss, equal to 45 cents per share, compared to net income of $2.0 billion, or $2.87 per share a year earlier. When adjusted for charges including merger-related items, the loss was $182 million, or 25 cents per share, deeper than the estimate of a loss of 15 cents per share from LSEG.

“Since taking on the CEO role, my focus has been on transforming New York Community Bank into a high-performing, well-diversified regional bank,” CEO Joseph Otting said in the release. “While this year will be a transitional year for the company, we have a clear path to profitability over the following two years.”

The bank will have higher profitability and capital levels by the end of 2026, Otting said. That includes a return on average earning assets of 1% and a targeted common equity tier 1 capital level of 11% to 12%.

Shares of the bank jumped 33% in early trading.

Otting took over at the beleaguered regional bank at the start of April after an investor group led by former Treasury Secretary Steven Mnuchin injected more than $1 billion into the lender. NYCB’s troubles began in late January with a disastrous fourth-quarter earnings report when it shocked analysts with its level of loan loss provisions. The bank’s stock plunged amid multiple management changes and rating agency downgrades.

NYCB has “identified an opportunity” to sell $5 billion in assets to boost the company’s liquidity levels, Otting told analysts during a conference call. That transaction could close within 60 to 70 days and may be announced soon, he added.

The bank had a $315 million provision for credit losses in the quarter, compared with $170 million in the year-earlier period, and said it expected an elevated rate of provisioning for the rest of 2024.

Nonperforming loans surged by $370 million to $798 million in the quarter from the fourth quarter of 2023 as high interest rates took a toll on commercial real estate borrowers.

As it provisioned for future expected loan losses, NYCB assumed that office properties declined 42% in value and multifamily buildings fell roughly 30%, executives said during the analyst call.

“The office market is pretty stressed,” Otting said. “It was a couple of stressed office loans that got to the point where the investors chose to just come to us, and we had to take over the property.”

The bank will seek to reduce exposure to office and multifamily loans over time by managing client relationships, dropping those who do not keep deposits at NYCB, Otting said.

The results and targets were a relief to analysts concerned that NYCB could miss its window to report results. The bank did not announce its Wednesday earnings release until late Tuesday.

“Overall, we believe results are better than worst-case fears” on a “reasonable” amount of reserve builds, analysts led by Ken Usdin of Jefferies wrote in a note.

After taking a number of actions to shore up its balance sheet and business, the company now targets significantly higher profitability and higher capital levels by the end of 2026, including a return on average earnings assets of 1%, a return on average tangible common equity of 11% to 12%, supported by a common equity tier 1 capital target in the range of 11% to 12%, CEO Joseph Otting said.

The company, now calling itself NYCB Flagstar, introduced a base forecast for 2024 EPS of -$0.50 to -$0.55, CET1 ratio of 10.0%-10.25%, and an efficiency ratio of 80%-85%. At March 31, CET1 ratio was 9.45% and its efficiency ratio was 82.47%.

Q1 adjusted EPS of -$0.25, vs. the -$0.13 consensus estimate, compared with -$0.27 in Q4 2023 and $0.23 in Q1 2023.

Net interest income of $624M, vs. the $636M Visible Alpha consensus, declined from $740M in the previous quarter and increased from $555M a year ago.

Provision for credit losses totaled $315M vs. $552M in Q4 2023 and $170M in Q1 2023.

Total revenue of $633M, vs. the $795M consensus, increased/declined from $887M in the prior quarter and $2.65B a year ago.

Adjusted preprovision net revenue was $98M vs. $284M in Q4 and $263M in Q1 2023.

Total loans held for investment were $82.3B vs. $84.6B in Q4. Deposits fell to $74.9B from $81.4B in Q4.

- 04/30/2024 – Office-Loan Defaults Near Historic Levels With Billions on the Line – WSJ Over $38 billion of U.S. office buildings face loan defaults, foreclosures or other forms of distress, the highest amount since 2012

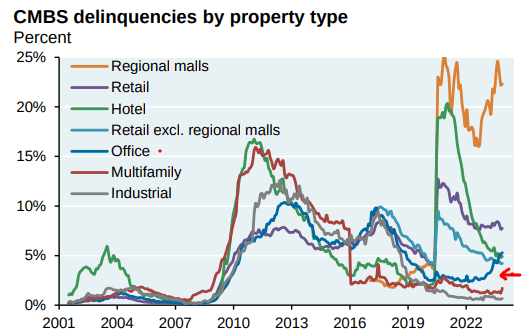

Defaults are reaching historic levels in the office market, as a growing number of owners capitulate to persistently high interest rates and weak demand.

More than $38 billion of U.S. office buildings are threatened by defaults, foreclosures or other forms of distress, according to data firm MSCI. That is the highest amount since the fourth quarter of 2012 in the aftermath of the 2008-2009 financial crisis.

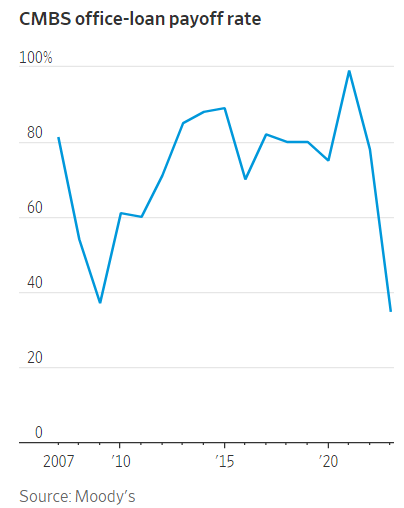

Office owners are paying back their loans at a much slower rate. As recently as 2021, more than 90% of office loans that were converted into commercial-mortgage-backed securities were paid off when they became due, according to Moody’s. Last year, that figure fell to 35%, the worst payoff rate in the history of the data, which goes back to 2007.

“It’s a pretty stark change,” said Matt Reidy, director of Moody’s commercial real estate economics.

Today’s high interest rates are particularly problematic because commercial-property owners typically borrow at least half of a building’s cost. Most of the mortgages that are coming due now were made when interest rates were much lower than now.

In a normal office market, many landlords would be able to pay the higher rates. But since Covid-19, the office market has been far from normal. Demand has nosedived as many businesses allowed employees to work from home and reconsidered the amount of workspace they need.

Tenants signing new leases are closely scrutinizing their landlords’ financial health. They want to be sure the owner isn’t going to lose its property to creditors and has the money to add promised amenities.

“Tenants are very focused on landlords who can put additional capital into the buildings because they want to get their employees back,” said Adam Edwards, managing director at real-estate investment banking firm Eastdil Secured.

Tenants have good reason to be wary. In the next 12 months, $18 billion of office loans converted into securities will mature—more than double the volume in 2023. Moody’s projects that 73% of loans will be difficult to refinance because of the properties’ income, debt levels, vacancy and approaching lease expirations.

Earlier this year, industry hopes were high that the Federal Reserve would begin cutting its interest rates this year. But in recent weeks, those hopes have faded as inflation concerns have persisted.

The U.S. office vacancy rate currently is at a record 13.8%, compared with 9.4% at the end of 2019, according to data service CoStar Group. In the first quarter of 2024, tenants signed leases for about 102 million square feet, about 10% below the 2019 average, CoStar said.

The financial upheaval in the office market is pressuring U.S. banks, insurance companies and other lenders. Commercial real estate losses in the fourth quarter at New York Community Bancorp sent shock waves down Wall Street evoking memories of bank failures last year.

Regional banks in recent weeks have been reporting high net charge-offs due to commercial-property exposure. At PNC Financial Services, for example, they were more than $50 million in the first quarter, slightly less than $54 million in the fourth quarter of last year but much higher than about $10 million one year earlier.

Office loans were a contributing factor. “The problem you have in office is, in many instances, there is no cash flow at all,” PNC Chief Executive Bill Demchak said on an earnings call. “It is really a unique animal at the moment.”

Regulators seized the troubled Philadelphia bank Republic First Bancorp FRBK -60.00%decrease; red down pointing triangle and sold it to fellow regional lender Fulton Financial FULT 0.39%increase; green up pointing triangle, the fourth high-profile bank failure since last spring.

The bank was closed by the Pennsylvania state regulator on Friday and sold after an auction run by the Federal Deposit Insurance Corp., confirming an earlier report by The Wall Street Journal.

Republic First faced some of the same problems as the three regional banks that failed last year: paper losses on bonds that lost value as interest rates rose, and high proportions of uninsured deposits that can quickly flee.

A relatively orderly deal should prevent the failure from sparking a wider crisis in confidence.

But regional banks are still on shaky ground. Two years of higher rates have forced them to pay more interest on deposits, which has increasingly eaten into profits. It will be harder for them to absorb the costs of potentially stricter regulatory requirements and technology updates, compared with megabanks like JPMorgan Chase. And some hold high concentrations of loans on offices and other commercial real estate that are under pressure.

A larger regional bank, New York Community Bancorp, fanned concerns about commercial real estate earlier this year after it revealed problems in its multifamily loan book. Those loans are concentrated in a niche area of the market: rent-stabilized buildings in New York that have dropped in value. NYCB got a rescue infusion from investors in March.

FDIC says Republic First Bank is closed by Pennsylvania regulators | CNN Business

The Federal Deposit Insurance Corporation on Friday said that Republic First Bank has been closed by Pennsylvania state regulators, in what the FDIC said was the first US bank failure this year.

“Philadelphia-based Republic First Bank (doing business as Republic Bank) was closed today by the Pennsylvania Department of Banking and Securities, which appointed the Federal Deposit Insurance Corporation (FDIC) as receiver. To protect depositors, the FDIC entered into an agreement with Fulton Bank, National Association of Lancaster, Pennsylvania to assume substantially all of the deposits and purchase substantially all of the assets of Republic Bank,” the FDIC said in a statement.

The bank had about $6 billion in total assets and $4 billion in total deposits at the end of January, the FDIC said in its release.

- 04/25/2024 – Main Street Banking Model Is Being Squeezed – WSJ, First-quarter results at regional banks show the uneven toll of higher interest rates

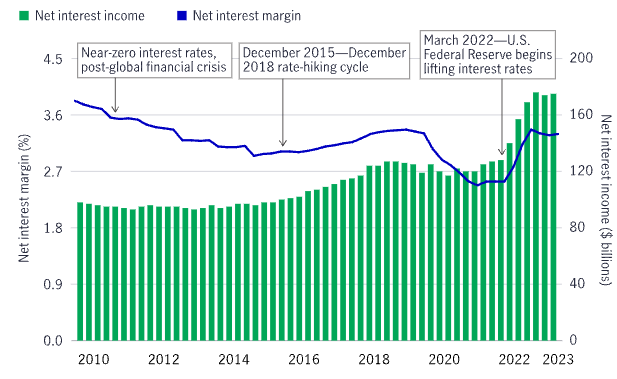

Higher-for-longer interest rates are continuing to weigh on Main Street banks.

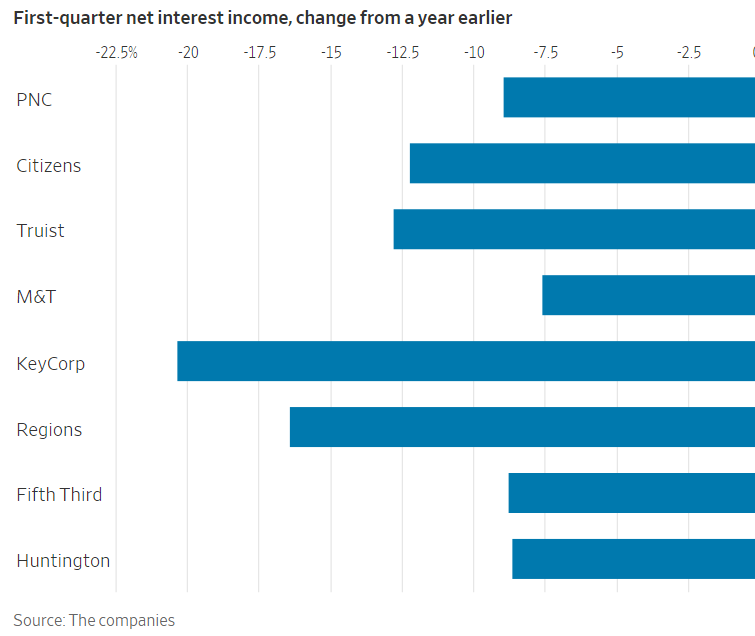

Regional banks posted steep profit declines in the first quarter and predicted more pain ahead. The results underscore the uneven toll that two years of higher interest rates have taken on regional banks, which tend to have plain-vanilla businesses taking in deposits and making loans. That model has become less profitable because of the pressure to pay up on deposits.

Profit fell by more than a fifth from a year earlier at U.S. Bancorp USB -1.78%decrease; red down pointing triangle, Truist Financial TFC -2.64%decrease; red down pointing triangle and M&T Bank MTB -0.93%decrease; red down pointing triangle and by around a third or more at Citizens Financial Group CFG -1.87%decrease; red down pointing triangle, KeyCorp KEY -2.75%decrease; red down pointing triangle and Huntington Bancshares HBAN -1.64%decrease; red down pointing triangle. At Comerica CMA -2.42%decrease; red down pointing triangle, profit declined by more than half.

At the biggest banks this quarter, rate pressure began to emerge, but profits were down much less overall.

One bright spot for some regional banks: a rebound in fee businesses such as wealth management, treasury management and investment banking. Noninterest income rose 8% at U.S. Bancorp, 7% at Citizens and 6% at Key. Even select smaller banks enjoyed a boost. At the holding company for First National Bank of Pennsylvania FNB -0.55%decrease; red down pointing triangle, F.N.B. FNB -0.55%decrease; red down pointing triangle, noninterest income rose 11%.

“The more diversified the revenue this quarter, the better the results,” said RBC analyst Gerard Cassidy.

Significant fee businesses are few and far between across the nation’s more than 4,500 regional and community banks. And compared with the giant fee businesses of megabanks such as JPMorgan Chase, those that exist are tiny.

The Federal Reserve recently signaled that stubborn inflation may force it to keep rates at their current high levels for longer than expected, a particular problem for banks without much diversity and scale. In the first quarter, most of the larger regional banks forecast that net interest income, the difference between what they earn on loans and pay out on deposits, would fall for the full year.

Bank shares have risen broadly this week. The KBW Nasdaq Bank Index and the SPDR S&P Regional Banking ETF are each around 3% higher. But many bank stocks have yet to fully recover from a year punctuated by selloffs.

“People are still on nervous footing,” Zach Wasserman, chief financial officer at Huntington, said. “But I think now there is a recognition that some firms really weathered that and proved the resilience of their models.”

Banks have in recent quarters piled away reserves for losses in commercial real estate books, especially for loans on offices that have emptied since the pandemic. Regulators, bankers and analysts have said those issues would play out over a number of quarters, without risks to the broader financial system.

“I’m sure there will be more surprises,” U.S. Bancorp Chief Financial Officer John Stern said, referring to commercial real estate across the industry. “There may be one-off banks here and there, but there won’t be a sector-wide thing.”

Commercial real estate losses in the fourth quarter at New York Community Bancorp NYCB -0.82%decrease; red down pointing triangle had sparked a moment of panic earlier this year. But those losses were tied to a uniquely large portfolio of loans for rent-stabilized New York apartments. NYCB, which got a rescue infusion from investors in March, hasn’t said when it will report first-quarter results.

At PNC Financial Services PNC -1.95%decrease; red down pointing triangle, net charge-offs in commercial real estate rose to more than $50 million in the first quarter from around $10 million a year earlier. The bank expects more stress in that space, especially for office loans.

“The problem you have in office is, in many instances, there is no cash flow at all,” PNC Chief Executive Bill Demchak said on a call with analysts. “It is really a unique animal at the moment.”

For signs that the turbulent commercial real-estate market is beginning to stabilize, look at Blackstone’s largest real-estate fund, known as Breit.

The firm was able to fulfill all investor redemption requests in February and March for the first time since late 2022, when a flurry of withdrawals compelled it to limit how much it could pay out.

“We believe commercial real estate is at an inflection point, with real estate values bottoming,” Blackstone said in an April letter to Breit shareholders, who are mostly individual investors.

But that is only part of the story. Breit fundraising hasn’t returned to its previous robust levels. Investor withdrawals continue to greatly exceed new cash coming in, a sign of lingering worries about the backdrop for commercial properties.

Breit turned a corner in one respect this year. In February and March, redemption requests declined to $961 million and $799 million, respectively, low enough for Breit to pay all of them. In January 2023, redemption requests exceeded $5 billion.

- 04/23/2024 – KRE | SPDR S&P Regional Banking ETF Stock Price, Quotes and News – WSJ to read the earning transcripts of these companies and understand their conditions (https://seekingalpha.com/account/people)

TOP 10 HOLDINGS KRE

| Name | % of Total Portfolio |

|---|---|

Regions Financial Corp. |

2.55% |

Western Alliance Bancorp. |

2.54% |

Citizens Financial Group Inc. |

2.53% |

Truist Financial Corp. |

2.49% |

Webster Financial Corp. |

2.48% |

Huntington Bancshares Inc. |

2.46% |

Bank OZK |

2.46% |

First Horizon Corp. |

2.46% |

East West Bancorp Inc. |

2.45% |

Zions Bancorp N.A. |

2.45% |

Federal Reserve Chair Jay Powell is making the rest of 2024 more complicated for regional banks.

This past week 12 of the nation’s best-known midsize lenders reported sizable drops in first quarter profits thanks largely to the effect elevated interest rates are having on their operations.

Many of these banks are paying higher costs for deposits as customers continue to seek out higher yields, and those costs are eating into a key revenue source known as net interest income.

That pressure is not likely to abate anytime soon as the Fed dials back its expectations for rate cuts in 2024, a move that was cemented by Powell this past Tuesday just as many regional banks prepared to release their first quarter results.

Most reaffirmed that they expect the money they make from lending to drop as rates remain elevated.

Some, however, predicted that if rates stay high, their banks will eventually be able to make more from lending or the repricing of their securities, perhaps during the second half of this year.

Minneapolis-based US Bancorp now expects to make between $200 million and $500 million less in net interest income than it forecast in January, driven by lower loan growth and more expense pressure from deposit costs.

“The outlook for potential rate cuts in 2024 has meaningfully changed,” Andy Cecere, US Bancorp CEO, told analysts Wednesday. “We now expect our net interest income for the full year to be lower than anticipated.”

Pittsburgh-based PNC, however, said it expects improvement in the last two quarters of the year thanks to the repricing of its under-earning securities portfolio. That will help even out any rise in deposit costs, the bank’s CEO said.

“It would be a bit of a heroic assumption for anybody to say that deposit costs won’t continue to creep up in the face of a steady Fed,” PNC CEO Bill Demchak told analysts Tuesday.

First Horizon (FHN) CFO Hope Dmuchowski told analysts Wednesday that forecasting how much the bank can make from its net interest income “in this environment is very, very hard, even within a 3% range, with as many moving parts as we have.”

The Memphis-based lender kept its previous guidance for net interest income to grow between 1% and 4%, assuming three rate cuts. It also bucked an industry-wide trend in the quarter, with costs for interest-bearing deposits declining from the previous quarter while overall levels were stable.

At Buffalo, N.Y.-based M&T Bank (MTB), executives bumped the bank’s net interest income guidance up to $6.8 billion, the top of its previous range. But that is an estimate based on two rate cuts.

As long as rates remain where they are, Spence said, the key for banks is “the race between your ability to reprice fixed-rate assets and your ability to manage deposit costs.”

Fifth Third’s interest-bearing deposit costs rose by 0.01% in the first quarter compared with the previous quarter, a much lower rise than some rivals.

“For all banks in an environment like this one, your ability to continue to control interest expense is going to be a big driver of your ability to hit your outlook,” Spence said.

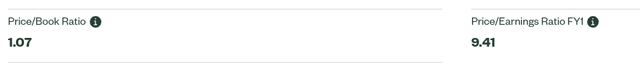

Regional banks have started to report first-quarter earnings, and investors are worried that more Warbasses will be revealed. Shares of these small and midsize banks, which are stuffed with loans for office buildings, apartment complexes and other commercial properties, are near their lowest level in five months.

My banking-expert friend, whom I quoted extensively in many e-mails in early February (archive here), thinks that what Schwab is doing is likely to catch up with it… which is one of the reasons his fund is short SCHW.

He sent me a detailed e-mail with his thoughts, which he kindly gave me permission to share with my readers here. As he says:

I saw your write-up on SCHW today and thought I’d pass along a few comments as I think the stock is incredibly overvalued – and one of the primary reasons is exactly the dynamic that you pointed out. Great job exposing this topic!

Schwab has $269.5 billion of deposits with an average cost of only 1.35%! I am dumbfounded at the fact they have kept the cost of these deposits so low given their customers should be of an investor mindset, and even if a customer is primarily trading stocks they should still be focused on what their cash is earning.

As you point out, I’ve heard from others that it isn’t so clear to see or know what your cash is earning (or not earning in this case!). My sister-in-law was getting hosed on a decent cash balance and said she couldn’t find the rate anywhere, so she eventually called to have her cash moved into a money market but, like you, it sat in their low-yielding product for way too long.

Now that we are in a “higher-for-longer” environment, it is just a matter of time before those deposit costs move meaningfully higher, particularly as more people like you start realizing you’ve been taken advantage of. The average cost of deposits in the banking industry is likely going to be near 2.5% after all the Q1 reports are filed, and I would say the banking industry should have a lower cost of deposits than Schwab given traditional banks have more non-interest bearing/transaction deposits.

To put this into perspective, Schwab – the entire company – is expected to earn around $6.2 billion in 2024. The management is very promotional and acts like their cost of deposits could potentially decline if there are rate cuts, which I strongly disagree with. You can easily do the math… if their cost of deposits only goes up by only 1%, that is a pre-tax cost of $2.7 billion! (And if the higher-for-longer environment persists for several years, it wouldn’t surprise me to see the Schwab deposits move materially higher than a 1% increase.)

Even if SCHW can achieve these earnings estimates, the stock is trading at over 21 times earnings. And analysts are expecting earnings to grow 28% in 2025 to $4.37/share. I really struggle to see how they can grow earnings at all amidst this dynamic.

As he continues, the cost of deposits is just one of the issues caused by the higher-for-longer environment: (The 10-Q filing deadline for The Charles Schwab Corporation is due on Monday, June 10, 2024. This report covers the quarterly period ended April 30, 2024 – watch out before this date)

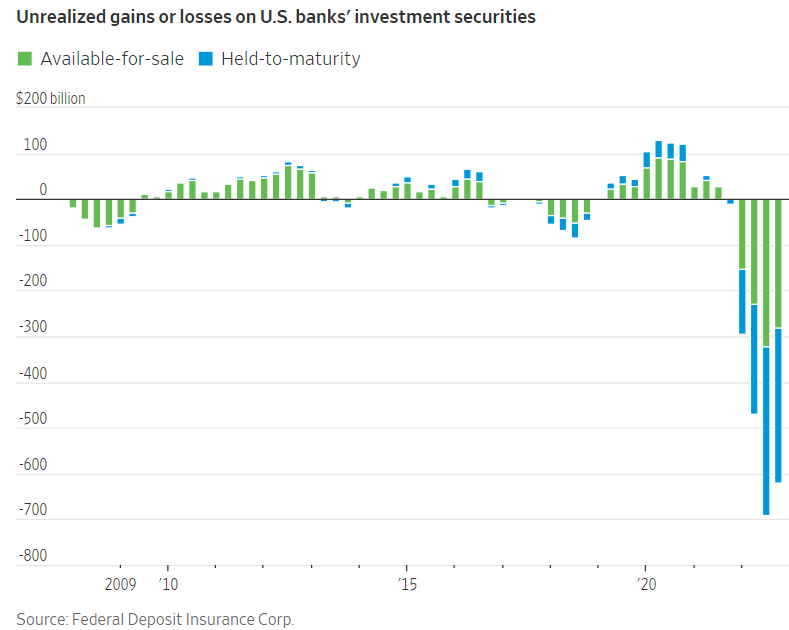

Schwab’s bank is one of the worst in the industry when it comes to fair value marks. They have not filed their 10Q and bank call report yet for Q1, but I estimate that their held-to-maturity securities mark is roughly $14.6 billion and their loan portfolio mark is roughly $1.9 billion (both tax-adjusted), which would leave them with negative tangible common equity of over $3.7 billion (they currently have stated tangible common equity of only $12.8 billion)!

If the regulators (or investors) decide to refocus on the fair value issues that sunk Silicon Valley Bank and First Republic, then it would be impossible for Schwab to avoid scrutiny as it is the 11th largest bank in the country. If I were the regulator, I would force Schwab Bank to immediately raise a significant amount of capital.

If you are wondering why they have these massive interest rate marks, they basically took in large amounts of low-cost deposits that they thought would be cheap forever, so like most banks they went out and bought securities (primarily RMBS [residential mortgage-backed securities] and CMBS [commercial mortgage-backed securities]) to capture some spread. Schwab’s securities portfolio yields less than 2%, so as their deposit costs rise they could have a big portion of their balance sheet with a negative spread.

Here is the bank call report data from 12/31/23 (note that the $11.2 billion held-to-maturity loss was at 12/31). I am estimating the securities are worth 88 cents on the dollar in coming up with my current $14.6 billion mark.

In addition to buying the low-yielding securities, Schwab took on $9.35 billion of 1-4 family mortgages that are yielding in the 3% range! That is the driver of the nearly $2 billion tax-adjusted loan mark.

For sake of full disclosure, I am short the stock, but regardless thought you would find this summary interesting given I would say it is just a matter of time before more people like you wake up to the fact that as you put it: “Schwab is screwing you over in the same way banks are screwing their customers who are holding cash in their savings accounts.”

Not only will Schwab’s interest expense skyrocket, but I think they have reputational risk as customers could easily be soured after learning they’ve been burglarized by the company over the past couple of years.

I’d like to give a huge thank you to my friends and readers for taking the time to share your thoughts!

When it comes to Schwab’s stock, I agree that it looks like one to avoid.

- 04/16/2024 – Investment Banking Bounceback Powers Big U.S. Lenders – WSJ Top banks post better-than-expected results, helped by strong consumer spending and flurry of Wall Street activity

America’s biggest banks reported stronger-than-expected earnings in the first quarter, highlighting how a resilient economy is helping power everything from Main Street to Wall Street.

JPMorgan JPM 2.51%increase; green up pointing triangle Chase, Bank of America BAC 3.35%increase; green up pointing triangle, Citigroup C 1.41%increase; green up pointing triangle, Wells Fargo, Goldman Sachs GS 0.22%increase; green up pointing triangle and Morgan Stanley MS 0.44%increase; green up pointing triangle all reported revenue and earnings that beat or met analysts’ expectations. Consumer spending remained robust. Pent-up demand for dealmaking, stock and bond sales lifted earnings at the Wall Street-heavy banks. A market rally continued in early 2024, boosting fees the banks collect on money they manage for clients.

But the results were tempered by rising pressure from interest rates, which squeezed profit margins. Banks are warning that the recovery in capital markets is fragile. And many said they don’t expect much revenue and profit growth this year.

As a group, the six big banks reported $35.63 billion in profits, down 3% from a year ago, with half of the banks reporting a decrease in profit and half of them reporting an increase. Combined revenue rose 4% to $139.07 billion.

- Financial technology has already helped level the playing field for smaller banks competing against giants like Wells Fargo and Chase, and AI is being viewed as the next tech arms race for Main Street in keeping up with Wall Street.

- “The teller line, as we see it today, will eventually die,” says one community bank CEO, who tells CNBC that the future branch will look more like “a wall of screens.”

- JPMorgan CEO Jamie Dimon wrote in his annual letter to shareholders this week that AI will have vast implications for bank worker roles across its more than 300,000 employees.

- 04/12/2024 – High Rates Have Been a Profit Machine for Banks. Not Anymore. – WSJ JPMorgan, Wells Fargo and Citigroup post better-than-expected first-quarter results, but their forecasts are muted

But the still-strong economy is also keeping inflation higher than hoped, forcing the Fed to hold interest rates up. Data this week seemed to remove expectations of a Fed rate cut in June, and the markets are reconciling with the likelihood that elevated rates are here to stay. Bankers said Friday that customers are moving more money around to chase those rates, which is going to eat into margins for the year.

A key profitability metric called net interest income—which measures the difference between what banks pay out on deposits and charge on loans—shrank on a quarterly basis at JPMorgan for the first time since 2021. It also fell from the last quarter at both Wells Fargo and Citigroup.

For the full year, JPMorgan expects that measure to be roughly flat. Wells Fargo and Citi expect it to fall.

“Rates might be higher than what people expected a week ago,” Wells Fargo Chief Financial Officer Mike Santomassimo said on a call with analysts. “We do have to wait and see how clients are going to react.”

Commercial real estate continues to be a point of stress for the banking system, although it is a proportionally larger problem for some smaller banks, which have invested a lot more into office and retail loans than big banks. JPMorgan Chief Financial Officer Jeremy Barnum said that the bank’s book of commercial real-estate loans wasn’t getting significantly worse, but still faced challenges.

“There’s no light at the end of the tunnel yet,” Barnum said.

The scale and diversity of the megabanks help them navigate good times and bad. But regional and community banks could reveal a deeper toll from higher interest rates next week, when they start to report first-quarter results.

Smaller banks are highly dependent on interest income. They are also under more scrutiny after the high-profile failures of three regional banks last year. In the fourth quarter, surprise losses at New York Community Bancorp revived concerns that commercial real estate could kick up another crisis.

In the first quarter, the biggest U.S. banks were hit again with special fees owed to the Federal Deposit Insurance Corp. for their share of the government’s response to last year’s regional-bank crisis. The banks had paid large bills last quarter too.

- 04/08/2024 – Jamie Dimon Warns U.S. Might See Interest-Rate Spike – WSJ, The head of JPMorgan Chase questions the ‘soft landing’ talk but says his bank is ready no matter what

- 03/24/2024 – NYCB and Meridian Rode the Property Boom Together. Now They’re Struggling. – WSJ The bank got many of its loans from a broker now blacklisted by Fannie Mae and Freddie Mac

The turmoil at both companies comes at a difficult time for the commercial real-estate market and the banks that lend to it. Investors and regulators are wary of a coming crush of soured loans—and what it might do to the still-fragile regional banking system. Fannie Mae, Freddie Mac and federal housing regulators are launching wider looks into the opaque market, according to people familiar with the probes. Federal prosecutors are investigating landlords and suspected mortgage fraud, according to people familiar with those efforts.

Freddie Mac issued new guidelines effectively suspending Meridian. The lender has sent letters to other Meridian brokers telling them they are blacklisted even if they go to a different firm, according to people familiar with the matter. Fannie Mae told lenders it would no longer accept Meridian-brokered loans starting March 4, 2024.

The government-backed lenders are now starting to sift through the financials of numerous borrowers and brokers, looking to weed out fabricated numbers, according to people familiar with the matter. Freddie Mac recently told borrowers to submit their numbers directly, effectively going around brokers altogether.

Earlier this month, NYCB got a lifeline with an investment of more than $1 billion from former Treasury Secretary Steven Mnuchin and others. Carpenter and other longtime NYCB directors departed. Former Comptroller of the Currency Joseph Otting took over as CEO.

Life at Regional and Small Banks, One Year After SVB Failed – WSJ

The banking industry’s middle class is shrinking. It has been one year since Silicon Valley Bank failed and kicked off a crisis among the nation’s regional banks, and the recent disruption at NYCB shows they remain under pressure.

Most regional banks are too small to reap the benefits of scale, diversification and implicit government support enjoyed by megabanks such as JPMorgan Chase and Bank of America. Yet they are too big to escape the scrutiny of investors and regulators. They now face difficult questions on profitability, business models and even their traditional role as the intermediary between depositors and borrowers.

“It has been a year, but it feels a lot longer,” said Chris McGratty, an analyst with KBW.

A New York real-estate bind

At Valley National, Robbins believes his message will eventually click.

“Patience,” Robbins said, has emerged as the watchword for this most-unsettling year. “When they see our first-quarter results, then things will begin to shift.”

Regional lenders are each trying their own approaches to survive, changing business focus, getting bigger, staying smaller. One future most agree on: There are too many of them.

Investor and customer panic has eased significantly since then, but regional and community banks still have a confidence problem. Some customers remain hesitant to keep large uninsured balances anyplace other than the largest banks.

Banc of California made it through the crisis with a handful of wins and then acquired PacWest, a much larger competitor where Wolff used to work. The $1 billion deal, and capital raise that went along with it, allowed Banc of California to roughly quadruple in size.

“There certainly was the sense that the crisis is over because it was a recognition that there was an outcome for banks that might be unstable or perceived to be unstable,” Wolff said, referring to PacWest.

Soon after the announcement, Wolff watched rumors continue to spread on social media about his bank. Posters thought regulators or shareholders would reject the deal. “Both will head into FDIC receivership given their obvious solvency issues,” one Reddit user wrote in August. The rumors weren’t true. The deal won approval and closed in a matter of months.

“We focus on what we can control,” Wolff said. “And I think the results speak louder than anything.”

Private Equity Cautiously Steps In to Back Troubled Banks – WSJ Distress at regional banks has spurred some buyout firms to invest in a sector they typically ignore

Some of those deals worked out, while others ranged from mediocre to disastrous, investors and analysts say. The private equity-backed rescues of IndyMac and BankUnited

yielded strong returns and spurred other firms to go shopping for banks. Others, like TPG’s 2008 investment of $1.35 billion in Washington Mutual shortly before its collapse, showed the dangers of betting on troubled institutions.

“Most people stay away from the [banking] sector because they haven’t lived through the cycles, they don’t have the regulatory or sector expertise, and they don’t know how to achieve what they want,” Berlinski said.

The challenge is finding banks whose value is depressed enough to be bought inexpensively, but not so distressed they go bust. Private equity’s relatively high return targets are also a barrier to investment. Firms generally seek to generate at least a 20% profit on their deals, while the banking industry typically posts profit margins of around 13% to 15%.

“If you’re buying into a bank that’s reasonably healthy and looking for 20% [returns], that’s hard,” said Mike Brown, an analyst at research firm Keefe, Bruyette & Woods. The banking tremors of the past year have “created interesting opportunities for private equity to consider banks, a space that wasn’t traditionally the most attractive spot to deploy capital,” he added.

The scale of private-equity investment has so far been modest, and far below that of the last financial crisis. Investors are skeptical the post-SVB straits will yield much more in the way of private-equity deals unless conditions deteriorate.

The banking sector appears to be stabilizing after last year’s upheaval. The KBW Nasdaq Bank Index, which tracks bank stocks, has recovered to less than 10% below its peak prior to SVB’s collapse.

Adams of Wellington Management says he doesn’t expect to see mass-scale private-equity buying opportunities in banking unless interest rates remain at their current levels for a long spell or go even higher.

Warburg’s Zilberman expects to keep seeing one-off deals, but not a full-blown meltdown.

“I don’t believe we have a distressed sector on our hands,” he said. “I don’t think commercial real estate will blow up, but I think there will be idiosyncratic situations like SVB and NYCB. There will be banks that run into trouble, and when that happens private equity will certainly have opportunities.”

The Problem Isn’t Big Banks—It’s Banks Getting Bigger – WSJ Going from a midsize lender to a larger one comes with regulatory and other challenges

A Federal Reserve review of SVB’s supervision and regulation, published last April, noted that the bank’s “core risk-management capacity failed to keep up with rapid asset growth.” The bank’s growth also changed how it was supervised. The report noted that supervision of the company was “complicated by the transition” from what is known as a Regional Banking Organization, or RBO, to a Large and Foreign Banking Organization, or LFBO, as it crossed $100 billion in assets.

So how could you get to bigger banks without these problems? The Federal Reserve’s latest capital rule proposal would bring some standards to a wider range of banks, though regulatory approaches must also be “tailored” to a bank’s size under current laws. There could also be a preference for already giant banks buying smaller ones. But that can raise other thorny competition issues.

- 03/09/2024 – A Year After Silicon Valley Bank’s Collapse, the Rules Are Still Catching Up – WSJ, New proposed regulations won’t address some root causes of regional banking malaise

Last March, Silicon Valley Bank collapsed and kicked off the most significant U.S. banking crisis in years. A few months later, the Federal Reserve proposed a series of major changes to how big lenders are regulated. Those events are less related than you might think.

The Fed proposals are known as the “Basel III endgame,” in reference to completing the implementation of global banking reforms first outlined well over a decade ago, following the 2008 financial meltdown. These reforms have substantially raised banks’ capital levels and constrained many behaviors that were at the heart of that crisis, like bets on risky mortgages.

A larger group of banks would face some tougher standards under the proposal, including those the size of SVB SIVBQ 0.00%increase; green up pointing triangle. Yet this final batch of rules won’t directly address some of the most salient causes of the collapses of SVB, Signature Bank SBNY 15.67%increase; green up pointing triangle or First Republic. After all, some of SVB’s most troublesome assets were low-risk U.S. Treasurys. At First Republic, a big problem was mortgages for low-risk superprime borrowers—not shaky subprime ones.

And in all three cases, a problematic funding source was their deposits via core customer relationships. This was the exact sort of thing a lot of people said banks needed to refocus on after the 2008 crashes of trading firms like Bear Stearns and Lehman Brothers.

Here is a short recap of what sparked last year’s failures: During the pandemic, banks were flush with deposits and bought bonds, or made loans, at low, fixed interest rates. Then when the Fed started aggressively raising rates in 2022, the market value of those assets fell. That became a problem as banks faced higher deposit costs or increasing withdrawals as customers sought higher yields elsewhere.

But if that crisis was fundamentally about credit risk, then 2023 was about interest-rate risk. And addressing that may require some different ideas.

- 03/08/2024 – Moody’s review on New York Community Bancorp shifts to possible upgrade (NYSE:NYCB) | Seeking Alpha

Moody’s switched the direction of its review on New York Bancorp (NYSE:NYCB) to a possible upgrade from a possible downgrade, following the announcement that NYCB has secured $1.05B in capital commitments from several institutional investors, named a new CEO, and is reconstituting its board, the ratings firm said late Thursday.

The ratings under review include NYCB’s long-term issuer rating of B3, its lead bank, Flagstar Bank, NA’s long-term deposits of Ba3, Flagstar’s baseline credit assessment of b2, Flagstar Bancorp Inc.’s B3 subordinate debt rating, and New York Community Capital Trust V’s backed preferred stock rating of Caa1. All of the ratings are below investment grade.

The capital raise will increase NYCB’s common equity tier 1 ratio to 10.3% on a pro forma basis, assuming full conversion of the preferred equity to common, from 9.2% reported at Dec. 31, 2023.

“The involvement of private equity investors in the bank is helpful to stabilize its capital in the short-term, but creates long-term uncertainties around the bank’s governance and long-run strategy that now also will be explored during the ratings review,” Moody’s said.

The ratings firm also continues to believe that NYCB may have to increase its provisions for credit losses. The company had $992M allowance for credit losses, or 1.26% of total loans excluding loans with government guarantees and warehouse loans, as of Dec. 31, 2023.

Moody’s will pay particular attention to New York Community Bancorp’s (NYCB) Q1 results, noting that its weighted average coupon on its office portfolio is 4.7%; $313M of office loans are maturing in 2024 and $237M are maturing in 2025. NYCB’s reserve coverage is ~8% on its $3.4B of office loans. Meanwhile, ~54% of its office loans are in Manhattan, where office vacancy is ~15%, and its office loans are mostly class B properties, a lower quality than class A properties.

“The review will focus on the outlook for NYCB’s CRE portfolio, plans regarding its ACL, earnings, capitalization, liquid assets and use of wholesale funding,” Moody’s said.

- 03/07/2024 – NYCB lost 7% of deposits in past month, slashes dividend to 1 cent (cnbc.com) – great to view Steven Mnuchin’s interview

- New York Community Bank said Thursday it lost 7% of its deposits in the turbulent month before announcing a $1 billion-plus capital injection from investors led by former Treasury Secretary Steven Mnuchin’s Liberty Strategic Capital.

- The bank had $77.2 billion in deposits as of March 5, NYCB said in an investor presentation tied to the capital raise, down from $83 billion it had as of Feb. 5.

- NYCB also said it’s slashing its quarterly dividend for the second time this year, to 1 cent per share from 5 cents, an 80% drop.

New York Community Bank said Thursday it lost 7% of its deposits in the turbulent month before announcing a $1 billion-plus capital injection from investors led by former Treasury Secretary Steven Mnuchin’s Liberty Strategic Capital.

The bank had $77.2 billion in deposits as of March 5, NYCB said in an investor presentation tied to the capital raise. That was down from $83 billion it had as of Feb. 5, the day before Moody’s Investors Service cut the bank’s credit ratings to junk.

Before announcing a crucial lifeline Wednesday from a group of private equity investors led by Mnuchin’s Liberty Strategic Capital, NYCB’s stock was in a tailspin over concerns about the bank’s loan book and deposit base. In a little more than a month, the bank changed its CEO twice, saw two rounds of rating agency downgrades and announced deepening losses.

At its nadir, NYCB’s stock sank below $2 per share Wednesday, down more than 40%, before ultimately rebounding and ending the day higher. The shares climbed 10% in Thursday morning trading.

The capital injection announced Wednesday has raised hopes that the bank now has enough time to resolve lingering questions about its exposure to New York-area multifamily apartment loans, as well as the “material weaknesses” around loan review that the bank disclosed last week.

‘Very attractive’ bank

Mnuchin puts 15% of his fund into NYCB

- he started looking at NYCB “a long time ago. it is one of the 20 biggest banks in US

- buy of Signatures bank is a great deal. They left the bad loans to the government, smart deal

- 80% deposits are insured

- Joseph Otting be the CEO is good

- multifamily real estates are still cash flow even though are NYC regulated, suboptimal. He thinks it is one-off situation. Interest rate will be lower in the future. Work out the multifamily Real estate for the next two years. Rebuild the business

- rate B or lower of office loans are eliminated from balance sheet, 3.5 bil office loans in NYC is the problem, we will work out the quickest

- agree that the regional banks sector has problem and opportunities now, look for acquisition and merge opportunities

- TBV is $6.60, the price of stock is only $3.30

Mnuchin told CNBC in an interview Thursday that he started looking at NYCB “a long time ago.” “The issue was really around perceived risks in the loans, and with putting billion dollars of capital into the balance sheet, it really strengthens the franchise and whatever issues there are in the loans we’ll be able to work through,” Mnuchin told CNBC’s “Squawk on the Street.” “I think there’s a great opportunity to turn this into a very attractive regional commercial bank,” he added. Mnuchin said that he did “extensive diligence” on NYCB’s loan portfolio and that the “biggest problem” he found was its New York office loans, though he expected the bank to build reserves over time. “I don’t see the New York office working out or getting better in the future,” Mnuchin said.

is getting more than a $1 billion investment, according to people familiar with the matter.

Liberty Strategic, Citadel Securities and NYCB management are participating in the capital investment, the people said.

Former Secretary Steven Mnuchin, Joseph Otting, Allen Puwalski and Milton Berlinski to Join NYCB Board of Directors

Joseph Otting to Become CEO and Alessandro DiNello to be Named as Non-Executive Chairman

Investment is Strong Endorsement of New Management Team; Creates Strong Balance Sheet

Reconstituted Board and Management Team Positioned to Deliver Well Capitalized $100+ Billion National Bank with a Diversified, De-Risked Business Model

HICKSVILLE, N.Y., March 6, 2024 /PRNewswire/ — New York Community Bancorp, Inc. (NYCB) (“NYCB” or the “Company”) today announced that Liberty Strategic Capital (“Liberty”), Hudson Bay Capital (“Hudson Bay”), Reverence Capital Partners (“Reverence Capital”), Citadel Securities (“Citadel”), other institutional investors and certain members of the Company’s management (collectively, the “Investors”) will make a combined over $1 billion investment in the Company, subject to finalization of definitive documentation and receipt of applicable regulatory approvals. Liberty is expected to invest $450 million, Hudson Bay will invest $250 million, and Reverence will invest $200 million as part of the transaction.

Transaction Details

In connection with the equity capital raise transaction, NYCB will sell and issue, in the aggregate, to the Investors shares of common stock of the Company at a price per share of $2.00 and a series of convertible preferred stock with a conversion price of $2.00, for an aggregate investment amount of $1.05 billion. In addition, investors will receive 60% warrant coverage to purchase non-voting, common-equivalent stock with an exercise price of $2.50 per share, a 25% premium to the price paid on common stock.

Holders of the preferred stock will not have voting rights and will be entitled to quarterly non-cumulative cash dividends, as and if declared by the Board. Each share of preferred stock is convertible into common stock on a 1 preferred share – 1,000 common shares basis. Series B preferred stock will automatically convert upon certain transfers permitted by federal banking regulations and stockholder approval of a charter amendment to increase the Company’s authorized common stock, while Series C preferred stock will automatically convert upon the achievement of certain trigger events related to receipt of antitrust clearance under the Hart Scott Rodino Act and the charter amendment. The Company will provide customary shelf and piggyback registration rights to each of the Investors. Additionally, Liberty will also have the ability to request an underwritten shelf take-down and block trade rights.

Timing and Approvals

The transaction is expected to close on or around Monday, March 11, 2024, subject to the satisfaction of certain closing conditions, receipt of any regulatory approvals required in connection with the new roles of Mr. Otting and Mr. DiNello, and the filing of a supplemental listing application required to authorize for listing on the New York Stock Exchange the shares of common stock issued under each investment agreement and to be issued upon the conversion of shares of the preferred stock issued under the investment agreements.

New York Community Bancorp gets $1B investment from Mnuchin-led investor group NYCB) | Seeking Alpha

/C O R R E C T I O N — New York Community Bancorp, Inc./ | Seeking Alpha

- 03/06/2024 – Jerome Powell Says Fed on Track to Cut Interest Rates This Year – WSJ

Fed chair characterizes last year’s inflation slowdown as notable and widespread

Brisk inflation and hiring data in January haven’t altered the Federal Reserve’s expectation that it will be appropriate to cut interest rates later this year, but Chair Jerome Powell said officials want more evidence that inflation is slowing.

Rate cuts won’t be warranted until officials have “gained greater confidence that inflation is moving sustainably” toward the central bank’s 2% goal, Powell told the House Financial Services Committee on Wednesday during the start of two days of testimony on Capitol Hill.

“We want to see a little bit more data so that we can become confident,” Powell said. “We’re not looking for better inflation readings than we’ve had. We’re just looking for more of them.”

Powell told lawmakers the central bank was focused on supporting economic conditions that would keep bringing inflation down while maintaining solid growth and a healthy labor market, achieving what is called a soft landing.

“We are on a good path so far to be able to get there,” he said. Powell also said he saw “no reason to think” that the U.S. economy faces an immediate risk of falling into a recession.

On Wednesday, Powell characterized the recent slowdown in inflation as both notable and widespread, an indication the rise in January prices hadn’t changed the Fed’s outlook that inflation will continue to slow this year.

Soft Landing Achieved? Don’t Ask the Pilot (wsj.com)

If the Fed somehow lands this plane, don’t expect the captain to make an announcement.

“We’re just going to keep our heads down and do our jobs. We wouldn’t be declaring victory like that,” Fed Chair Jerome Powell said Wednesday under questioning from a Democratic lawmaker who encouraged the central bank to come out and say it had achieved a soft landing—if and when the economy might achieve such a state.

“Will there be some announcement at some point that we’ve had a soft landing?” said Rep. Al Green (D., Texas).

“I don’t think by us, no,” replied Powell, who waded through a delicate series of election-year questions during three hours of testimony before the House Financial Services Committee without making much news on monetary policy. Powell is set to return to Capitol Hill tomorrow to answer questions before the Senate Banking Committee.

Transcript: Fed Chief Jerome Powell’s Postmeeting Press Conference – WSJ

Transcript_ Fed Chief Jerome Powell’s Postmeeting Press Conference – WSJ- pdf file

- 03/05/2024 – The Problem Isn’t Big Banks—It’s Banks Getting Bigger – WSJ, Going from a midsize lender to a larger one comes with regulatory and other challenges

NYCB doesn’t share key characteristics of banks that were at the heart of last year’s crisis sparked by Silicon Valley Bank’s collapse, such as huge potential losses on bonds and reliance on uninsured, and thus more skittish, deposits. NYCB, as of the third quarter last year, reported no “held-to-maturity” securities in its portfolio, and as of an early February update, said nearly three-quarters of its deposits were insured or collateralized

But it did make recent jumps in asset size and is facing accompanying changes in its regulatory status. NYCB went from $90 billion in assets at the end of 2022 to over $110 billion as of its latest report. Last year it took on some of the assets and liabilities of seized Signature Bank from the Federal Deposit Insurance Corp.

With this growth, it crossed the threshold to become what is known in regulatory terms as a Category IV banking institution. Toward the end of 2022 it had completed its acquisition of Flagstar Bancorp, which brought its total assets up to $90 billion at the end of 2022 from $63 billion in the third quarter of that year.

NYCB said in January that a jump in loan-loss reserve levels in the fourth quarter of 2023 made it better aligned with “relevant bank peers, including Category IV banks.” The bank also said the cut to its dividend announced in January would “accelerate the building of capital to support our balance sheet as a Category IV bank.”

explanation on hold-to-maturity

As Interest Rates Rose, Banks Did a Balance-Sheet Switcheroo – WSJ (Lenders pledged to hold on to money-losing bonds, allowing them to avoid reporting losses)

The Wall Street Journal identified six large U.S. banks including Charles Schwab Corp. SCHW 0.71%increase; green up pointing triangle and PNC Financial Services Group Inc. PNC 2.07%increase; green up pointing triangle that together switched the classifications on more than $500 billion of their bond investments last year. For some banks, excluding the unrealized losses from their balance sheets allowed them to report robust levels of capital when in reality their assets were worth much less.

- 03/05/2024 – These Are the 6 Bank Stocks in Warren Buffett’s Portfolio: Should You Invest? (msn.com)

Warren Buffett’s Berkshire Hathaway released its much-anticipated earnings and annual letter to shareholders on February 24. The conglomerate’s earnings were a record, reporting $37.4 billion full-year operating profit, and the conglomerate is now sitting on an all-time high of $167.6 billion in cash and equivalents.

Of note, Berkshire significantly increased its weighting in financial services stock, which could indicate a view that interest rates have hit their highs for this cycle and that the Federal Reserve will lower rates sooner rather than later, as GOBankingRates previously reported.

And Berkshire’s 10Q filing for the third quarter of 2023 indicated an unexplained purchase of $1.2 billion of “banks, insurance, finance” stocks, according to David Kass, Clinical Professor of Finance at University of Maryland, Robert H. Smith School of Business.

1. American Express: 20.6% stake

2. Ally Financial: 9.6% Stake

3. Bank of America: 13% Stake

4. Capital One: 3.3% Stake

5. Citigroup: 2.9% Stake

As we were sitting around the pool on Saturday, one of the guys said he thinks that banks adopting blockchain technology will lead to lower costs and higher margins over time.

That’s an interesting theory… so I immediately e-mailed my banking expert friend (about whom I wrote extensively recently – see my e-mails from January 30, January 31, February 1, February 2, February 6, February 7, and February 8) to ask for his opinion.

He was kind enough to allow me to share it – here’s what he e-mailed back to me:

I’d say there can be modest benefits in terms of operational efficiencies with record keeping, compliance/fraud prevention, and potentially benefits with the speed and cost of certain types of payments.

There are some industries related to banking where blockchain could be a massive disruptor – take title insurance for example. This is a large cost in a home purchase that could be virtually eliminated with blockchain record keeping and tracking of historical data. Auto purchases (and associated title transfers) are another area that could be significantly improved.

However, at the end of the day, margins in the banking sector are going to be predominantly driven by interest rates, credit losses, and competition. The more efficient technology makes the banking sector, the more competitive it could get. For example, think how easy it is now to move money from one bank to the next – this has led to the massive increase in deposit competition which is likely to continue, causing bank funding costs to go higher.

As he concluded:

There are definitely some benefits of blockchain and related technologies, but I’m not sure it is a significant game changer for the banking sector given the competitive dynamics and other major factors (like interest rates) that will drive the sector’s performance.

The downgrade could trigger contractual obligations from business clients of NYCB who require the bank to maintain an investment grade deposit rating, according to analysts who track the company. Consumer deposits at FDIC-insured banks are covered up to $250,000.

New York Community Bancorp’s credit grade was cut to junk by Fitch Ratings, and Moody’s Investors Service lowered its rating even further, a day after the commercial real estate lender said it discovered “material weaknesses” in how it tracks loan risks.