study of XLU and UTSL

- 05/17/2024 – Why Utilities Are Lighting Up the Stock Market – WSJ Utility stocks are suddenly white hot, thanks largely to artificial intelligence’s thirst for electricity. Investors accustomed to thinking of the sector as sleepy and safe need to realize the game has changed.

AI isn’t the only reason utilities have heated up so fast. The rapid increase in demand for electricity nationwide comes from three main sources, says Maria Pope, CEO of Portland General Electric, Oregon’s biggest utility. One is the revival of domestic manufacturing after decades of moving offshore. Another is the boom in semiconductor production, boosted by government support. But the expansion of data centers, “driven by the insatiable appetite of AI,” is the fastest-growing source of industrial demand, says Pope. Jay Rhame, chief executive of Reaves Asset Management, which manages about $3 billion in utility stocks, thinks the only historical parallel is the boom in electricity generation that followed the widespread adoption of air conditioning in the 1960s and 1970s. To be fair, utility stocks have still barely caught up to where they were at the end of 2021. They were beaten up so badly last year that they’re still considerably cheaper, on average, than the stock market overall. The Dow Jones U.S. Utilities Index trades at 17 times expected earnings over the next year; the S&P 500 is at 20 times projected earnings. So this isn’t a bubble—not yet, anyway. But income-oriented investors accustomed to thinking of power companies as the sleepiest and safest of industries should realize the game has changed.

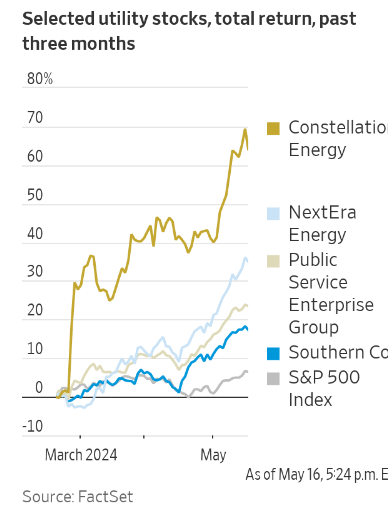

In the past few months, though, utilities have left the rest of the market in the dust. These dullest of all stocks have suddenly become a bet on the single flashiest area of the market: artificial intelligence. AI requires a lot of computing power, and computers use a lot of electricity.

That has introduced a new risk to an old bet on safety. Investors looking for income and value may now find themselves holding stocks that bang around a lot more than they did in the past.

This spring, “AI caught the market by storm,” says Douglas Simmons, portfolio manager of the $1.2 billion Fidelity Select Utilities mutual fund. “It became recognized more broadly among generalist investors that utilities have become a play on AI.”

As Bespoke Investment Group, a research firm, pointed out this week, three of this year’s five best-performing stocks in the S&P 500 are utilities: Vistra, Constellation Energy and NRG Energy. Vistra, up 143%, has even outperformed the king of AI itself, Nvidia; Constellation, up 85%, is barely behind it.

For utility investors, this is like night and day.

Last year was a total blackout. The Dow Jones Utility Index lost 7.2%, while the S&P 500 gained 26.3%; both figures include dividends. That was the worst annual underperformance by utilities since 1999.

Higher interest rates were part of the problem. Rising yields not only increased borrowing costs for utilities, but made their shares less attractive relative to bonds.

And 2023 wasn’t the only recent off year. The spectacular implosion of PG&E in 2017 and 2018 had investors worrying that power companies face growing risks in a warming world.

Utilities inched up only an average of 6.6% annually over the five years ended last Dec. 31; the S&P 500 gained 15.7% annually.

The business of providing electricity hasn’t grown in the past couple of decades as conservation and more-efficient technology have reduced consumption. The U.S. generated slightly less electricity in 2021 than it had in 2007, according to the federal Energy Information Administration—even though the economy grew more than 3% annually over that period.

Now, however, the need for energy is finally expanding. On their April 23 earnings-announcement call, executives at NextEra estimated that electricity demand from data centers alone would grow 15% a year through the end of the decade.

AI isn’t the only reason utilities have heated up so fast. The rapid increase in demand for electricity nationwide comes from three main sources, says Maria Pope, CEO of Portland General Electric, Oregon’s biggest utility.

One is the revival of domestic manufacturing after decades of moving offshore. Another is the boom in semiconductor production, boosted by government support. But the expansion of data centers, “driven by the insatiable appetite of AI,” is the fastest-growing source of industrial demand, says Pope.

Jay Rhame, chief executive of Reaves Asset Management, which manages about $3 billion in utility stocks, thinks the only historical parallel is the boom in electricity generation that followed the widespread adoption of air conditioning in the 1960s and 1970s.

To be fair, utility stocks have still barely caught up to where they were at the end of 2021. They were beaten up so badly last year that they’re still considerably cheaper, on average, than the stock market overall.

The Dow Jones U.S. Utilities Index trades at 17 times expected earnings over the next year; the S&P 500 is at 20 times projected earnings.

So this isn’t a bubble—not yet, anyway. But income-oriented investors accustomed to thinking of power companies as the sleepiest and safest of industries should realize the game has changed.

Hot money always follows hot performance. Remarkably, investors have yanked about $4 billion out of utility ETFs over the past year. That outflow will surely turn into a flood of new money if the stocks stay hot.

And stocks that can go up 15% or more in a month, as many power companies have done since mid-April, can also go down 15% or more in a month—something that utilities never used to do unless they were on the verge of going bust.

Just as bonds have delivered startling volatility in the past few years, income-oriented utility investors should make sure they’re ready for some shocks along the way.