Energy and Metals – Summary

- Potential future catalyst

- FDA approval of Moderna vaccine

- FDA approval of child 5 ~12 yrs old vaccine

- FDA approval of child 0~5 yrs old vaccine

- Delta CV-19 cases bottom

- the antiviral pills could come by the end of the year

- Covid’s ‘pandemic phase’ ending when antiviral pills, kids’ vaccines available

- $3.5 Tril welfare money for huge inflation, US dollar devalued

- oil companies Q3 earning and stock buyback

- US economy fully reopen, US might be back to normal in one year

- stock market rotation due to inflation and interest rate

- record revenue and stock dividend and buybacks

- demand recovery in China, Europe and world wide

- energy crisis in Winter in China and Europe

- supply crunch

- US infrastructure bill approved by end of Sept What the Infrastructure Bill Would Help Fix First – WSJ

- U.S. crude oil inventories fell more than expected

- middle east war from Taliban

- fall of new energy and EV companies due to China’s RE’s fall and interest rate’s rise

- oil demand is on the rise, as international travel restrictions are starting to be loosened

- Hurricane Ida have continued a month after the hurricane made landfall, with nearly 300,000 daily barrels of oil still offline – short term effect

- U.S. oil/gas companies are still in the early part of an “extended” cyclical rebound with echoes of the mid-2000s. And while valuations have recovered from lows of last year, only a few of the companies are higher vs. their pre-COVID-19 levels.

- the real reason that Big Oil won’t raise production is a matter of simple economics. oil explorers in the United States are making more money now than at any other point in the more-than decade-long history of the nation’s shale revolution. “And this may just be the beginning,” Bloomberg Markets reported this week. “Free cash flow, the key metric watched by investors, probably will increase by 38% next year, presuming oil prices remain elevated.”

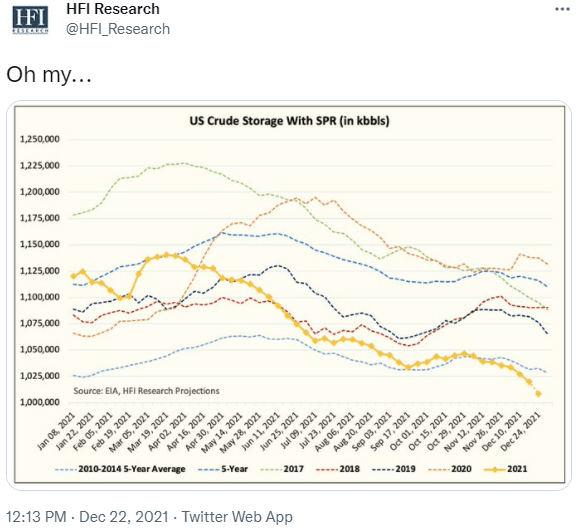

- Dec 23, 2021. This week saw another large oil/oil product inventory draw (NYSEARCA:USO) (CL1:COM) (CO1:COM), bringing the two-week total to ~27mb and resulting in stocks below the 2010 to 2014 average, a period in which Brent oil prices averaged ~$100.

- Rystad reported that oil exploration put up its worst year since the Second World War, as majors like Exxon (NYSE:XOM), Chevron (NYSE:CVX), BP (NYSE:BP), and Total (NYSE:TTE) cut budgets and retrench to short-cycle basins.

- The IEA said in its monthly oil market report that OPEC+ spare capacity could fall to below 4 million barrels per day (bpd) in the fourth quarter of 2022 from 9 million bpd in the first quarter of 2021. It forecast global demand at 99.6 million bpd in 2022, slightly above pre-pandemic levels. OPEC+ Spare Capacity Is Insufficient Amid Global Energy Crisis; The Myth Of OPEC+ Spare Capacity

- Beijing is cutting interest rate to bolster economy, and expediting the rollout of major infrastructure projects

- Because US froze Russia’s Central bank reserves, many other countries are thinking about reducing reserves in US dollar, this might reduce the strength of US dollar. In addition, all currencies are inflated due to worldwide monetary easing, US dollar wil not strengthen too much

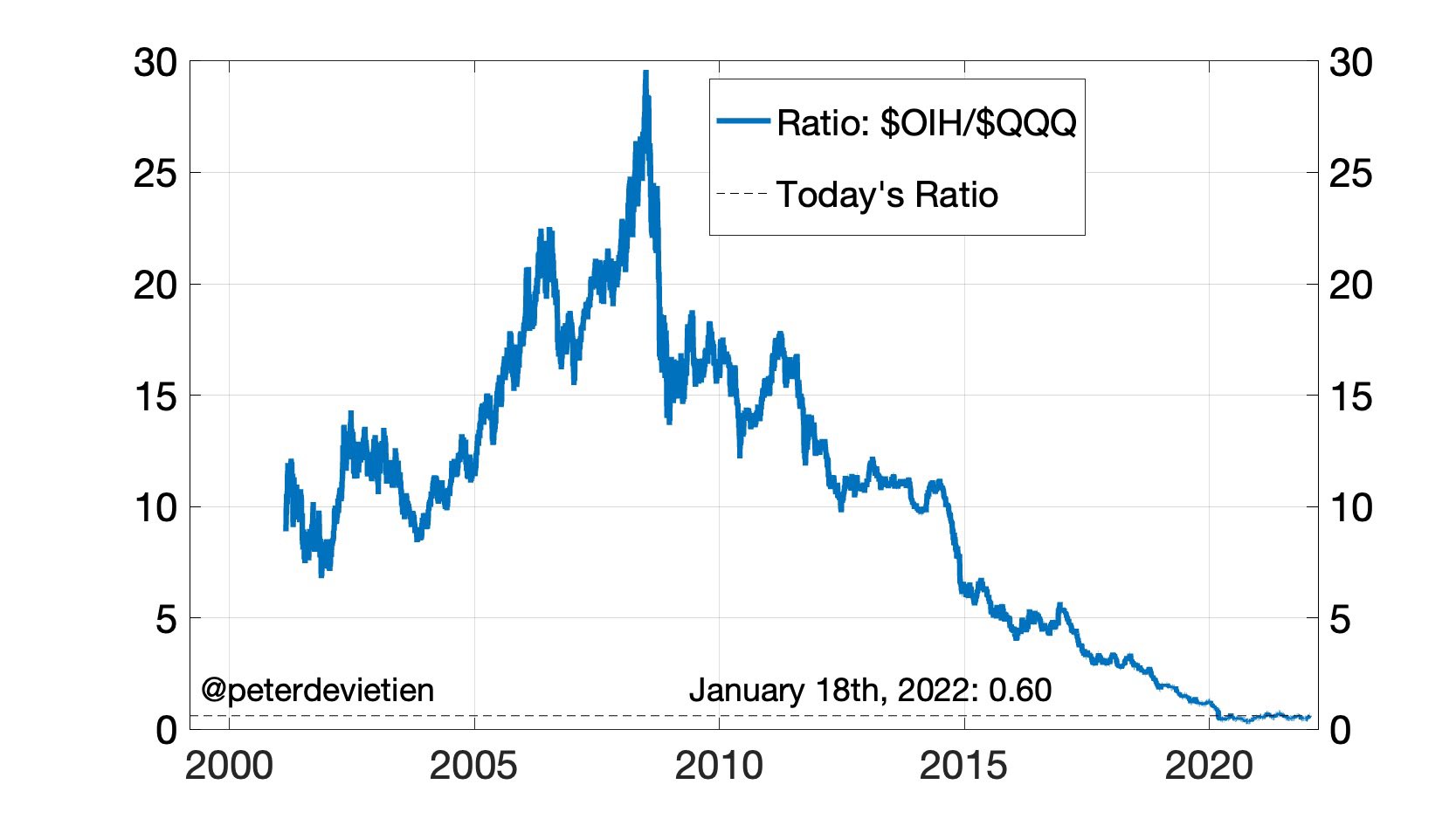

- Huge upside to energy stocks as mean reversion vs the broader market kicks in.

- Simple chart of oil & gas stocks $xop vs #oil futures vs the s&p 500 $spy since September 2014. There is lots of room for oil & gas stocks to recover just to “catch up” with the price of oil and even more to broader market performance

- Perhaps energy is in fact a structural long? I was thinking of it as a multi-year cyclical play.

Perhaps energy is in fact a structural long? I was thinking of it as a multi-year cyclical play. Perhaps it depends on how much capital floods into the space as previous "structural long" sectors like tech and alternative energy roll over after their 18 year bull markets https://t.co/rw5pizKLXd

— Josh Young (@Josh_Young_1) January 23, 2022

Or in chart form: pic.twitter.com/ZsaewEO9IV

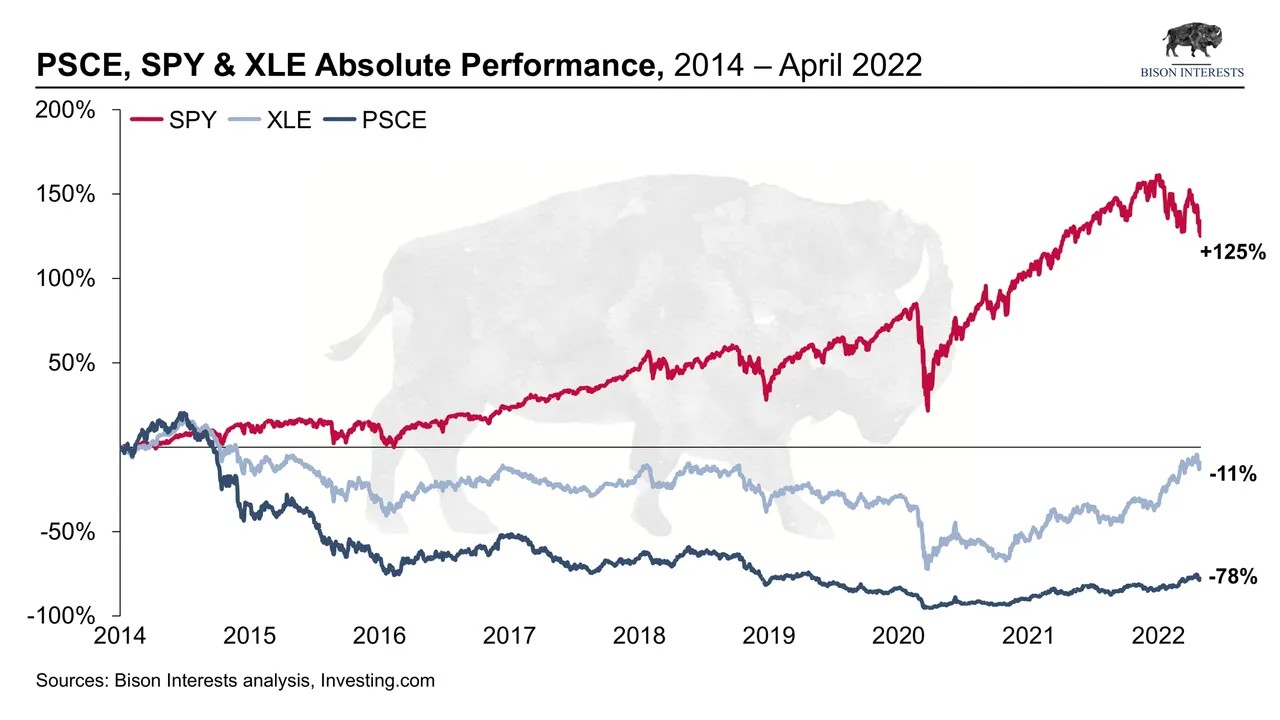

— Josh Young (@Josh_Young_1) January 23, 2022

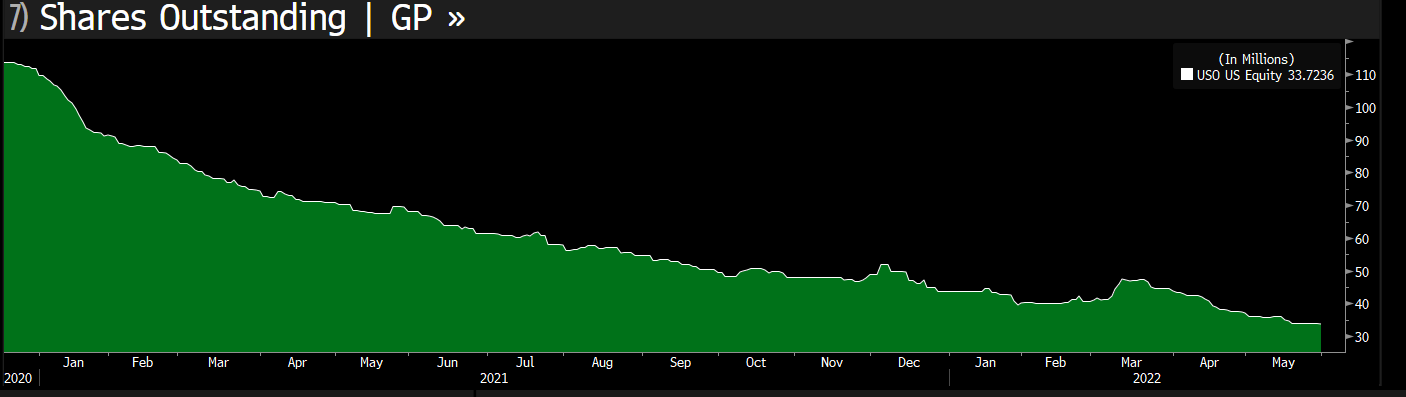

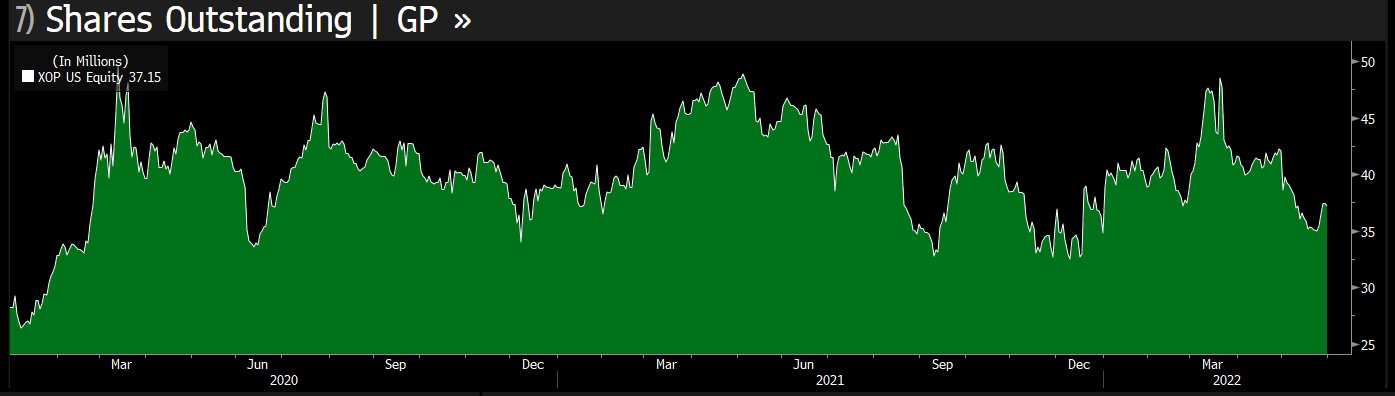

Another good chart illustrating why "growth investors" may be shocked by the recent market shift and disappointed by it potentially continuing for years. H/t @johnmaher0 https://t.co/2JhIiwkeKR

— Josh Young (@Josh_Young_1) January 23, 2022

33. Josh’s advice: I try to discount short term stuff that’s biased and that’s somewhat unreliable and heavily weight aggregations of that sort of short term information where it starts to become more meaningful signal as well as focusing on sort of medium and longer term effects that. In aggregate, can end up having a real impact even on the short term

The historical share performance vs the broader market argues for this commodities bull market (or "bubble", per Puru) to go much further and continue a lot longer. Impossible to predict the future, but often history "rhymes" pic.twitter.com/fQjqbPdP9D

— Josh Young (@Josh_Young_1) June 5, 2022

Complete opposite of a bubble.

Energy could indeed get short-term frothy and overbought this summer, but it's from a very low base after a long bear market. Not structurally overbought.

The whole complex is ripe for years of growth this decade, after years of underinvestment.

— Lyn Alden (@LynAldenContact) June 5, 2022

34. “People don’t understand how much money you can make in things that people hate,” “It’s like a half-off sale, essentially, for oil and gas stocks,” Young said. – Josh Young

35. XOP, PSCE vs SPY – still have lots of potential for XOP and PSCE

36. Energy is still under-owned. Watch for when units of $USO and $XOP rise – they’ve been flat or down for a while, despite the price increases – Josh Young

1) Kind of funny how the shares outstanding at $USO keep trailing off as the price goes higher. It's almost like no one in retail is long oil, even as it roars… pic.twitter.com/jcxiqFbNjX

— Kuppy (@hkuppy) June 1, 2022

2) Here is $XOP. No increase in 3 years. Just no one cares… pic.twitter.com/XxwOqd3bh6

— Kuppy (@hkuppy) June 1, 2022

Seems like all the key players have maxed out their oil calls… Time for the gamma squeeze?? https://t.co/UbSmNTYLk6

— Kuppy (@hkuppy) June 7, 2022

37. percentage of oil stocks as of June 2022

Energy and Tech as a % of the S&P 500 $qqq $spy $xle pic.twitter.com/OfLZBjXc4p

— Josh Young (@Josh_Young_1) June 10, 2022

38. Could this happens in the future?

This is a great summary of the inflation problem, in my view. https://t.co/6Vo096epAF

— Lyn Alden (@LynAldenContact) June 20, 2022

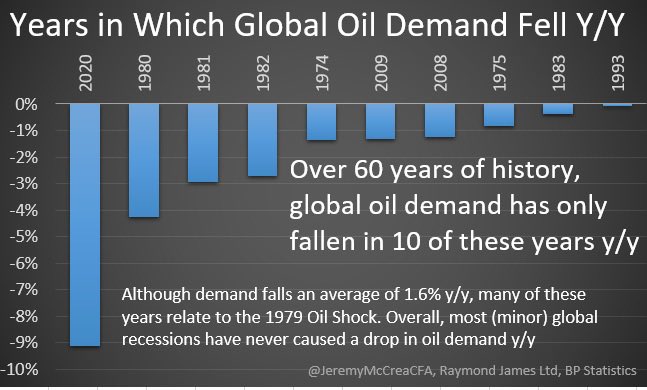

For reference, energy stocks outperformed despite oil demand drops in 1974, 1975, and 1980. And oil demand is currently still rising. pic.twitter.com/Gqd7bnwjzq

— Josh Young (@Josh_Young_1) June 20, 2022

Potential future risks

- new CV-19 variant coming

- another CV-19 cases wave

- OPEC+ and US to significantly increase oil production

- watch out the possible oversupply in 2022

- Oil price and oil demand will be under pressure due to China housing property crisis (i.e EverGrande)

- US and Iran nuclear deal

- OPEC to increase production

- Iran to increase production

- customers do not use oil once price is too high

- oil price tends to reverse to mean once increases too fast.

- Higher rate will strengthen dollar, and reduce oil price

- Russia to invade Ukraine, to strengthen $ and suppress interest rate, the trading algorithm will reduce oil price. World financial market (swift system, oil transfer, sanction of Russia, Russia’s anti-sanction, world economy slow down, etc.) will be in danger – at least in short term, and oil stocks will be dragged down significantly

- Oil Stocks Are Nearing New Heights. It’s Time to Be Careful. A surging oil price might correct itself, as consumers back away from spending on gasoline to protect their wallets. The higher prices go, the more incentive oil companies have to extract barrels from the ground, and the more wells that were once uneconomical can be pumped at a profit. Plus, central banks around the globe are set to lift interest rates to combat high inflation across the board, which could cause oil prices to decline by slowing economic growth.

In general, oil supply and demand are driven by a number of key factors:

- Changes in the value of the U.S. dollar

- Changes in the policies of the Organization of Petroleum Exporting Countries (OPEC)

- Changes in the levels of oil production and inventory

- The health of the global economy

- The implementation (or collapse) of international agreements

- Russian/Ukraine war

- The ongoing energy crisis is the culmination of years of underinvestment across the oil and gas value chain, combined with bad energy policy, ESG activism and divestment. While energy prices have undeniably been lifted by the ongoing crisis in Eastern Europe, underinvestment in energy supply security were bound to lead to shortages and soaring prices eventually. The current conflict is an unexpected, short-term tailwind; oil and gas prices could correct sharply in the event of a negotiated peace, but will likely rise further over time due to longer term factors. While higher energy prices are a major tailwind for oil and gas equities, they are a bad spell for the broader economy: they disproportionately hurt the poor and middle-class, and they stoke already white-hot broader price inflation. However, soaring energy prices are an early manifestation of a larger under-supply issues and are likely to persist. This may drive additional energy market dislocations, along the lines of those that we previously identified and addressed. from Bisoninterests (Important Off-The-Run Metrics Indicate More Oil Opportunity Ahead)

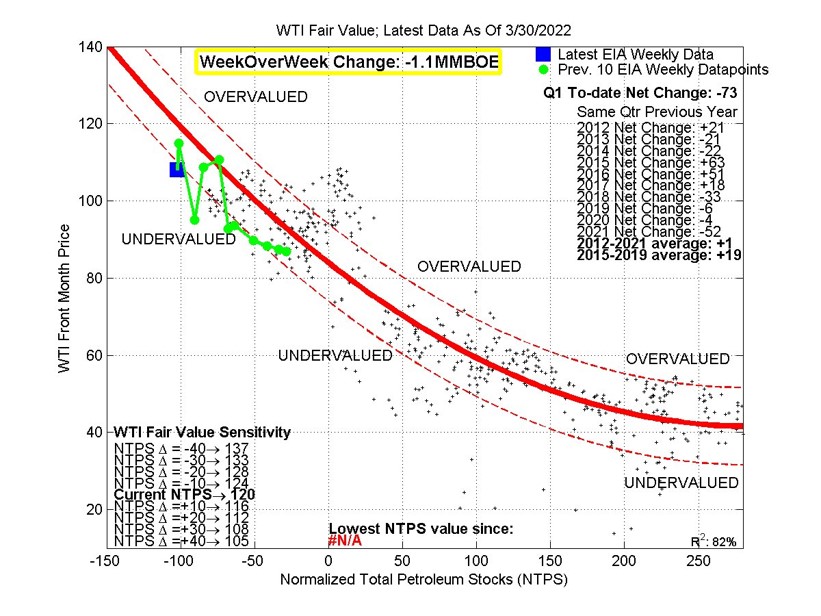

- Interesting analytical approach to implied oil price based on inventory declines. Theoretically SPR releases don’t affect this, and the calculated “fundamental” price for WTI oil is $120. 1Q22 eia data shows largest Q1 total stocks draw since at least ‘12 at -73mmboe or -0.81M b/d. WTI fair value price sits at 120 or $16 undervalued from current levels. SPR release is accounted for in this analysis and shift in strategy will have no impact on this calculation.

-

“look at these people, wandering around with no idea what’s about to happen” – Margin Call – This is a little how it felt with oil in November 2020. Vaccine roll out, Covid reopening, years of under investment in oil exploration and development. Oil was about to go nuts and almost no one knew

Go-to website for oil stock investment

From Josh Young: I find that the best way to get good returns is by really focusing on the best opportunities to compound money and be able to earn multiple times return and so over time. And by doing that I am better on my long investments and I just give up the sort of downside protection associated or the whatever people think they are getting from shorting stocks and sometimes that can be really painful because you get squeezed or whatever and it is a big distraction so I am not doing any direct arbitrage, it is more of a if Canadian oil and gas stocks are generally trading at a big premium to US then I will get sell some of my Canadian stocks and redeploy cheaper in the us and vice versa.

“To achieve exceptional returns you have to accept the kind of volatility that’s considered impolite in the hedge fund industry.” – @Josh_Young_1

Josh Young’s twitter: https://twitter.com/Josh_Young_1

Josh Young’s youtube videos https://www.google.com/search?q=josh+young+oil+youtube&oq=josh+young+oil+youtube&aqs=chrome..69i57.9992j0j7&sourceid=chrome&ie=UTF-8

https://www.youtube.com/results?search_query=josh+young

Bison Interests twitter: https://twitter.com/BisonInterests

Josh Young’s seekingalpha articles: https://seekingalpha.com/author/josh-young

2. study of macro conditions

- Scott Grannis’s macro analysis: http://scottgrannis.blogspot.com/

2) Ray Dalio Reducing Inflation Will Come at a Great Cost: Stagflation

https://www.linkedin.com/pulse/changing-world-order-new-paradigm-ray-dalio/

3. Lyn Alden https://www.lynalden.com/june-2022-newsletter/