Energy and metals – Part V(about GUSH, OXY, etc)

- Potential future catalyst

- FDA approval of Moderna vaccine

- FDA approval of child 5 ~12 yrs old vaccine

- FDA approval of child 0~5 yrs old vaccine

- Delta CV-19 cases bottom

- the antiviral pills could come by the end of the year

- Covid’s ‘pandemic phase’ ending when antiviral pills, kids’ vaccines available

- $3.5 Tril welfare money for huge inflation, US dollar devalued

- oil companies Q3 earning and stock buyback

- US economy fully reopen, US might be back to normal in one year

- stock market rotation due to inflation and interest rate

- record revenue and stock dividend and buybacks

- demand recovery in China, Europe and world wide

- energy crisis in Winter in China and Europe

- supply crunch

- US infrastructure bill approved by end of Sept What the Infrastructure Bill Would Help Fix First – WSJ

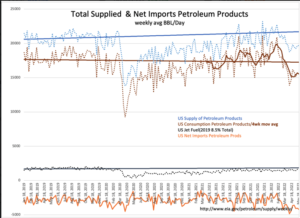

- U.S. crude oil inventories fell more than expected

- middle east war from Taliban

- fall of new energy and EV companies due to China’s RE’s fall and interest rate’s rise

- oil demand is on the rise, as international travel restrictions are starting to be loosened

- Hurricane Ida have continued a month after the hurricane made landfall, with nearly 300,000 daily barrels of oil still offline – short term effect

- U.S. oil/gas companies are still in the early part of an “extended” cyclical rebound with echoes of the mid-2000s. And while valuations have recovered from lows of last year, only a few of the companies are higher vs. their pre-COVID-19 levels.

- the real reason that Big Oil won’t raise production is a matter of simple economics. oil explorers in the United States are making more money now than at any other point in the more-than decade-long history of the nation’s shale revolution. “And this may just be the beginning,” Bloomberg Markets reported this week. “Free cash flow, the key metric watched by investors, probably will increase by 38% next year, presuming oil prices remain elevated.”

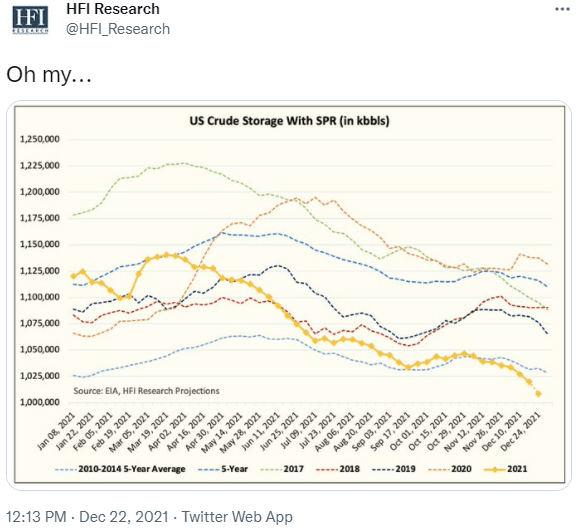

- Dec 23, 2021. This week saw another large oil/oil product inventory draw (NYSEARCA:USO) (CL1:COM) (CO1:COM), bringing the two-week total to ~27mb and resulting in stocks below the 2010 to 2014 average, a period in which Brent oil prices averaged ~$100.

- Rystad reported that oil exploration put up its worst year since the Second World War, as majors like Exxon (NYSE:XOM), Chevron (NYSE:CVX), BP (NYSE:BP), and Total (NYSE:TTE) cut budgets and retrench to short-cycle basins.

- The IEA said in its monthly oil market report that OPEC+ spare capacity could fall to below 4 million barrels per day (bpd) in the fourth quarter of 2022 from 9 million bpd in the first quarter of 2021. It forecast global demand at 99.6 million bpd in 2022, slightly above pre-pandemic levels. OPEC+ Spare Capacity Is Insufficient Amid Global Energy Crisis; The Myth Of OPEC+ Spare Capacity

- Beijing is cutting interest rate to bolster economy, and expediting the rollout of major infrastructure projects

- Because US froze Russia’s Central bank reserves, many other countries are thinking about reducing reserves in US dollar, this might reduce the strength of US dollar. In addition, all currencies are inflated due to worldwide monetary easing, US dollar wil not strengthen too much

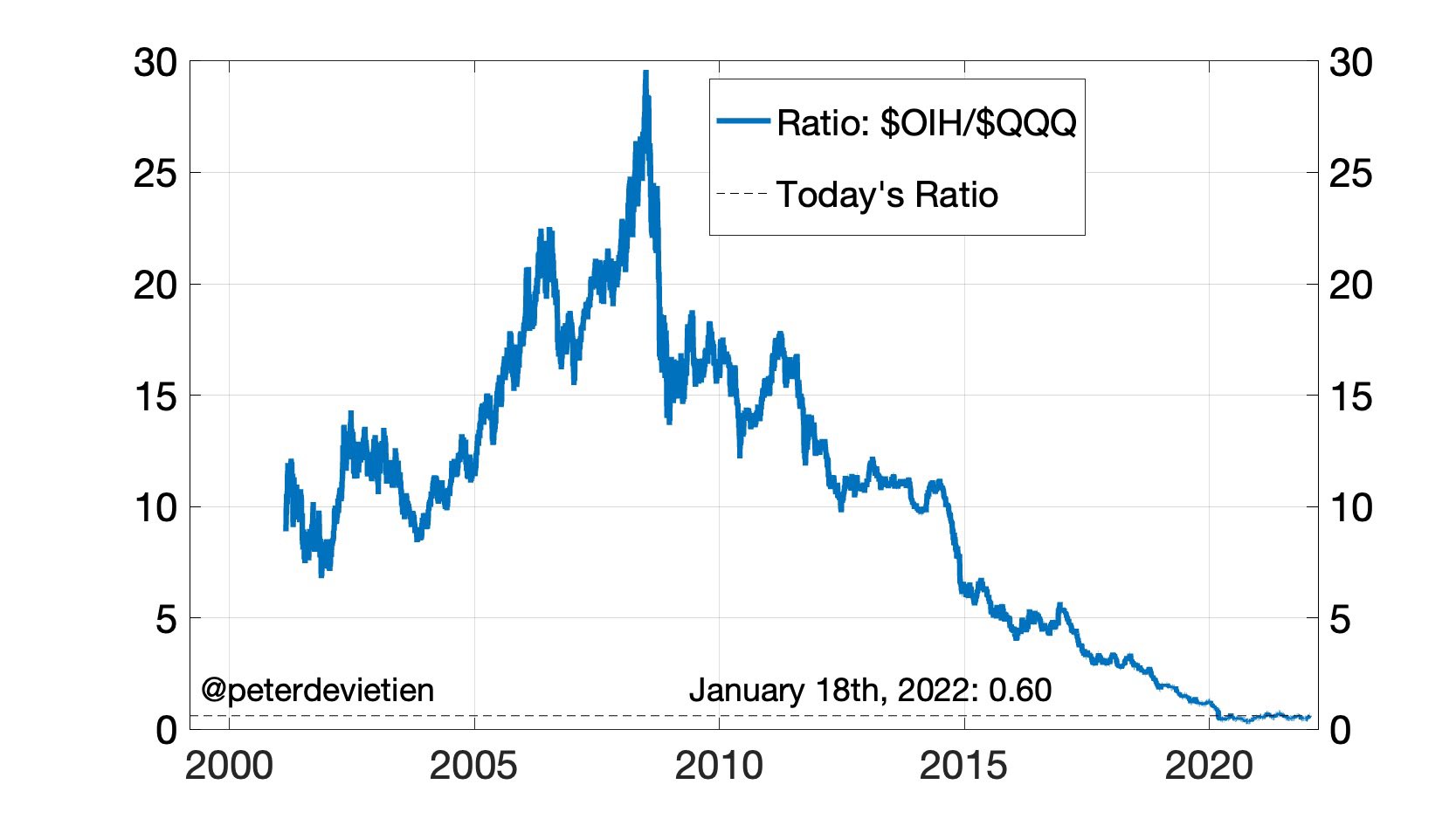

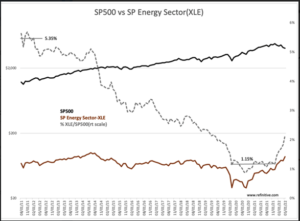

- Huge upside to energy stocks as mean reversion vs the broader market kicks in.

- Simple chart of oil & gas stocks $xop vs #oil futures vs the s&p 500 $spy since September 2014. There is lots of room for oil & gas stocks to recover just to “catch up” with the price of oil and even more to broader market performance

- Perhaps energy is in fact a structural long? I was thinking of it as a multi-year cyclical play.

Perhaps energy is in fact a structural long? I was thinking of it as a multi-year cyclical play. Perhaps it depends on how much capital floods into the space as previous "structural long" sectors like tech and alternative energy roll over after their 18 year bull markets https://t.co/rw5pizKLXd

— Josh Young (@Josh_Young_1) January 23, 2022

Or in chart form: pic.twitter.com/ZsaewEO9IV

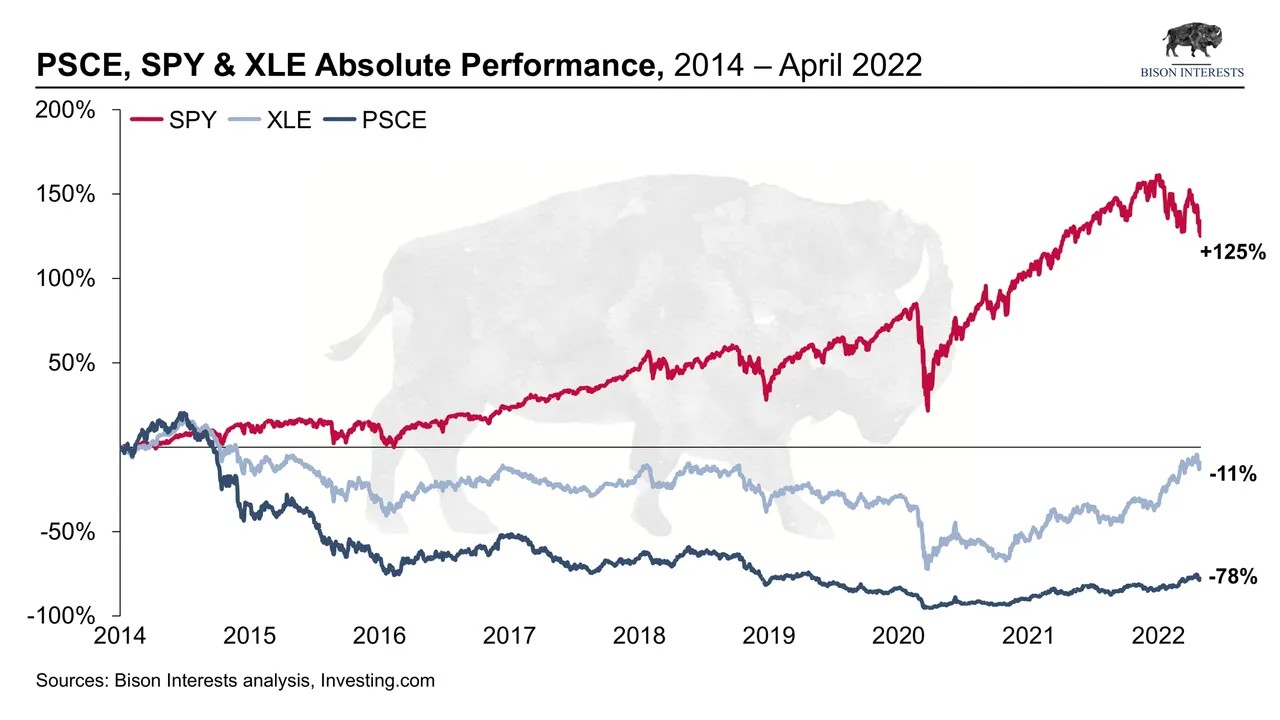

— Josh Young (@Josh_Young_1) January 23, 2022

Another good chart illustrating why "growth investors" may be shocked by the recent market shift and disappointed by it potentially continuing for years. H/t @johnmaher0 https://t.co/2JhIiwkeKR

— Josh Young (@Josh_Young_1) January 23, 2022

33. Josh’s advice: I try to discount short term stuff that’s biased and that’s somewhat unreliable and heavily weight aggregations of that sort of short term information where it starts to become more meaningful signal as well as focusing on sort of medium and longer term effects that. In aggregate, can end up having a real impact even on the short term

The historical share performance vs the broader market argues for this commodities bull market (or "bubble", per Puru) to go much further and continue a lot longer. Impossible to predict the future, but often history "rhymes" pic.twitter.com/fQjqbPdP9D

— Josh Young (@Josh_Young_1) June 5, 2022

Complete opposite of a bubble.

Energy could indeed get short-term frothy and overbought this summer, but it's from a very low base after a long bear market. Not structurally overbought.

The whole complex is ripe for years of growth this decade, after years of underinvestment.

— Lyn Alden (@LynAldenContact) June 5, 2022

34. “People don’t understand how much money you can make in things that people hate,” “It’s like a half-off sale, essentially, for oil and gas stocks,” Young said. – Josh Young

35. XOP, PSCE vs SPY – still have lots of potential for XOP and PSCE

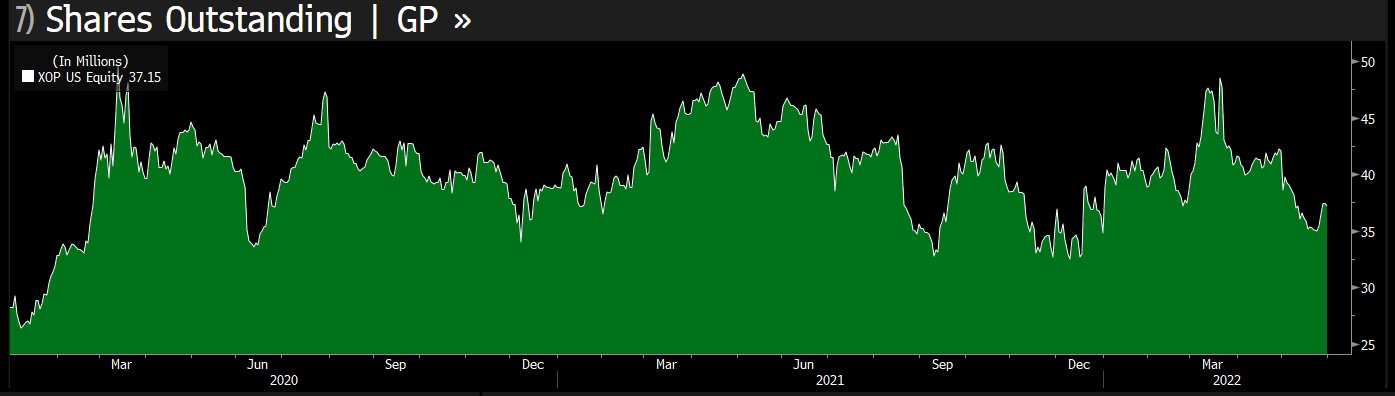

36. Energy is still under-owned. Watch for when units of $USO and $XOP rise – they’ve been flat or down for a while, despite the price increases – Josh Young

1) Kind of funny how the shares outstanding at $USO keep trailing off as the price goes higher. It's almost like no one in retail is long oil, even as it roars… pic.twitter.com/jcxiqFbNjX

— Kuppy (@hkuppy) June 1, 2022

2) Here is $XOP. No increase in 3 years. Just no one cares… pic.twitter.com/XxwOqd3bh6

— Kuppy (@hkuppy) June 1, 2022

Seems like all the key players have maxed out their oil calls… Time for the gamma squeeze?? https://t.co/UbSmNTYLk6

— Kuppy (@hkuppy) June 7, 2022

37. percentage of oil stocks as of June 2022

Energy and Tech as a % of the S&P 500 $qqq $spy $xle pic.twitter.com/OfLZBjXc4p

— Josh Young (@Josh_Young_1) June 10, 2022

38. Could this happens in the future?

This is a great summary of the inflation problem, in my view. https://t.co/6Vo096epAF

— Lyn Alden (@LynAldenContact) June 20, 2022

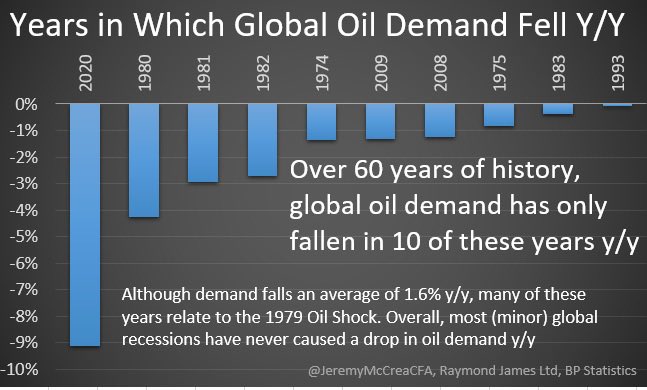

For reference, energy stocks outperformed despite oil demand drops in 1974, 1975, and 1980. And oil demand is currently still rising. pic.twitter.com/Gqd7bnwjzq

— Josh Young (@Josh_Young_1) June 20, 2022

Potential future risks

- new CV-19 variant coming

- another CV-19 cases wave

- OPEC+ and US to significantly increase oil production

- watch out the possible oversupply in 2022

- Oil price and oil demand will be under pressure due to China housing property crisis (i.e EverGrande)

- US and Iran nuclear deal

- OPEC to increase production

- Iran to increase production

- customers do not use oil once price is too high

- oil price tends to reverse to mean once increases too fast.

- Higher rate will strengthen dollar, and reduce oil price

- Russia to invade Ukraine, to strengthen $ and suppress interest rate, the trading algorithm will reduce oil price. World financial market (swift system, oil transfer, sanction of Russia, Russia’s anti-sanction, world economy slow down, etc.) will be in danger – at least in short term, and oil stocks will be dragged down significantly

- Oil Stocks Are Nearing New Heights. It’s Time to Be Careful. A surging oil price might correct itself, as consumers back away from spending on gasoline to protect their wallets. The higher prices go, the more incentive oil companies have to extract barrels from the ground, and the more wells that were once uneconomical can be pumped at a profit. Plus, central banks around the globe are set to lift interest rates to combat high inflation across the board, which could cause oil prices to decline by slowing economic growth.

In general, oil supply and demand are driven by a number of key factors:

- Changes in the value of the U.S. dollar

- Changes in the policies of the Organization of Petroleum Exporting Countries (OPEC)

- Changes in the levels of oil production and inventory

- The health of the global economy

- The implementation (or collapse) of international agreements

- Russian/Ukraine war

- The ongoing energy crisis is the culmination of years of underinvestment across the oil and gas value chain, combined with bad energy policy, ESG activism and divestment. While energy prices have undeniably been lifted by the ongoing crisis in Eastern Europe, underinvestment in energy supply security were bound to lead to shortages and soaring prices eventually. The current conflict is an unexpected, short-term tailwind; oil and gas prices could correct sharply in the event of a negotiated peace, but will likely rise further over time due to longer term factors. While higher energy prices are a major tailwind for oil and gas equities, they are a bad spell for the broader economy: they disproportionately hurt the poor and middle-class, and they stoke already white-hot broader price inflation. However, soaring energy prices are an early manifestation of a larger under-supply issues and are likely to persist. This may drive additional energy market dislocations, along the lines of those that we previously identified and addressed. from Bisoninterests (Important Off-The-Run Metrics Indicate More Oil Opportunity Ahead)

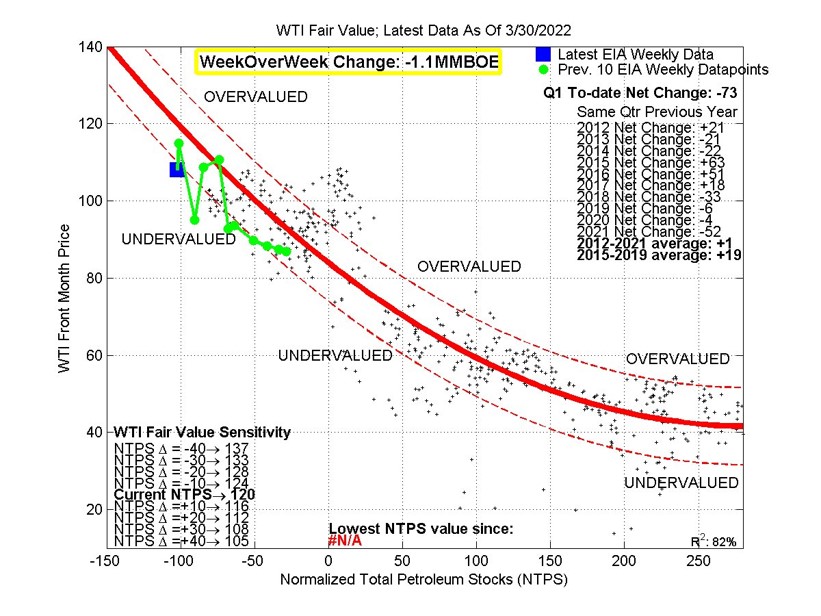

- Interesting analytical approach to implied oil price based on inventory declines. Theoretically SPR releases don’t affect this, and the calculated “fundamental” price for WTI oil is $120. 1Q22 eia data shows largest Q1 total stocks draw since at least ‘12 at -73mmboe or -0.81M b/d. WTI fair value price sits at 120 or $16 undervalued from current levels. SPR release is accounted for in this analysis and shift in strategy will have no impact on this calculation.

-

“look at these people, wandering around with no idea what’s about to happen” – Margin Call – This is a little how it felt with oil in November 2020. Vaccine roll out, Covid reopening, years of under investment in oil exploration and development. Oil was about to go nuts and almost no one knew

Go-to website for oil stock investment

From Josh Young: I find that the best way to get good returns is by really focusing on the best opportunities to compound money and be able to earn multiple times return and so over time. And by doing that I am better on my long investments and I just give up the sort of downside protection associated or the whatever people think they are getting from shorting stocks and sometimes that can be really painful because you get squeezed or whatever and it is a big distraction so I am not doing any direct arbitrage, it is more of a if Canadian oil and gas stocks are generally trading at a big premium to US then I will get sell some of my Canadian stocks and redeploy cheaper in the us and vice versa.

“To achieve exceptional returns you have to accept the kind of volatility that’s considered impolite in the hedge fund industry.” – @Josh_Young_1

Josh Young’s twitter: https://twitter.com/Josh_Young_1

Josh Young’s youtube videos https://www.google.com/search?q=josh+young+oil+youtube&oq=josh+young+oil+youtube&aqs=chrome..69i57.9992j0j7&sourceid=chrome&ie=UTF-8

https://www.youtube.com/results?search_query=josh+young

Bison Interests twitter: https://twitter.com/BisonInterests

Josh Young’s seekingalpha articles: https://seekingalpha.com/author/josh-young

2. study of macro conditions

- Scott Grannis’s macro analysis: http://scottgrannis.blogspot.com/

2) Ray Dalio Reducing Inflation Will Come at a Great Cost: Stagflation

https://www.linkedin.com/pulse/changing-world-order-new-paradigm-ray-dalio/

3. Lyn Alden https://www.lynalden.com/june-2022-newsletter/

- 06/22/2022 – negative news and uncertainty on oil and oil stocks

Senate Democrats propose reinstating the crude oil export ban

- 06/22/2022 – Buffett bought more OXY. pro and con viewpoints.

Headline: BERKSHIRE HATHAWAY BUYS 9.55M OCCIDENTAL SHARES, FILING SHOWS $OXY

For more on #buffett's #oil and #gas investments:https://t.co/M8YIuZQ55g

— Josh Young (@Josh_Young_1) June 22, 2022

Don’t get baited people he bought the top in 2008 and he isn’t a trader so if it nukes to 20 a share he doesn’t care but you will pic.twitter.com/IwZPiGdoYh

— Refurbished BTC Miner For Sale (@HashRate_Cuck) June 22, 2022

- 06/21/2022 – not sure this is feasible or not. Will it kill oil demand?

EU officially bans sale of ICE vehicles from 2035, but that’s still way too late

- 06/21/2022 – Stagflation is “by far and away the most popular description of what the economic backdrop will be in the next 12 months,” according to the report.

80% of economists see ‘stagflation’ as a long-term risk. What it is and how to prepare for it

- Stagflation is a term coined in the 1970s to refer to a combination of high inflation and high unemployment.

- Recent surveys show economists and fund managers see increased risks of stagflation on the horizon.

- There are steps you can take now to get in a better financial position in case stagflation or a recession does happen.

a recent Bank of America global fund manager survey found fears of stagflation are the highest they have been since June 2008. Stagflation is “by far and away the most popular description of what the economic backdrop will be in the next 12 months,” according to the report.

Try to aim for at least six months’ worth of emergency expenses in case a downturn does happen, he said. Also make sure you have prepared a recent budget to see if there are places where you can cut back.

Additionally, take a look at any adjustable-rate debt you may have — credit cards, mortgages, student loans — and see if you can pare those balances down or refinance them. Now that interest rates are poised to go up, those balances will become more expensive.

Moreover, it’s a great time to invest in yourself to be more marketable professionally if layoffs become the norm.

“Make sure you’ve really brushed up on your skills and competencies or education so that if the job market gets tighter, you’re marketable,” Jenkin said.

- 06/21/2022 – Oil demand is still strong – TSA numbers are approaching those of 2019. Even though “Delays, cancellations, long lines and lost baggage are plaguing air travel world-wide, as airlines and airports struggle with soaring summer demand and staff shortfalls.” Flight cancellations have risen this month, according to data compiled by aviation data consultancy Cirium. In the U.S., about 3% of scheduled flights have been scrapped so far this month, compared with a 2% rate in 2019, before Covid. The total number of cancellations rose 16%, to 13,581 fights, from the year-ago period.

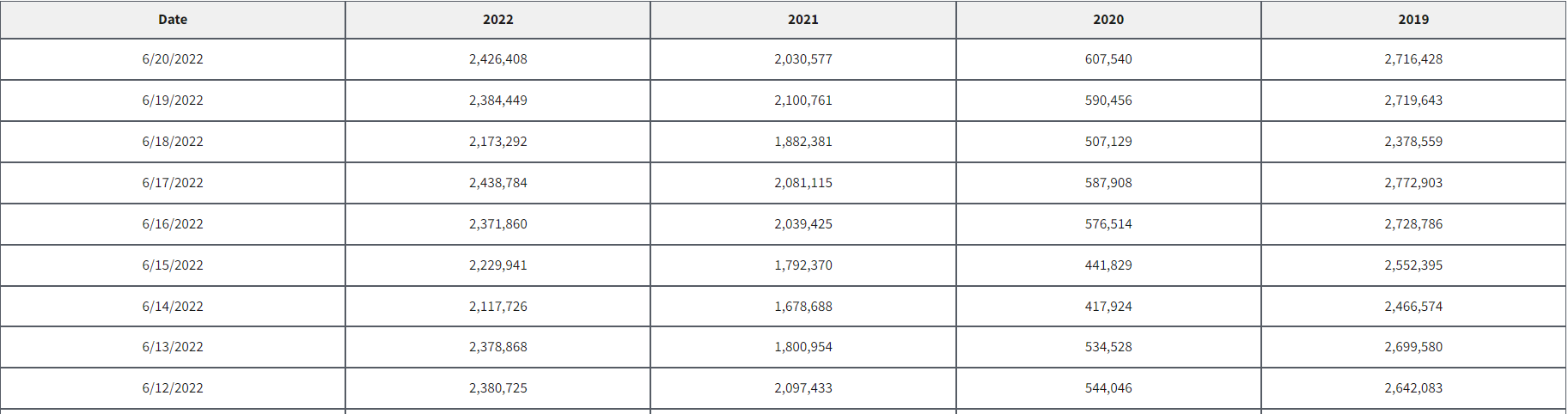

TSA checkpoint travel numbers (current year versus prior year(s)/same weekday)….not bad pic.twitter.com/kVqEqL5tp6

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) June 21, 2022

Airports Around the World Battle Long Lines, Canceled Flights – WSJ

Sydney Airport is helping recruit thousands to fill jobs at Qantas, and McDonald’s, as the aviation industry struggles with surging demand, labor shortages

- 06/20/2022 – A great article on macro and energy market. “Oil got up to $120+/barrel in this cycle. I can imagine a scenario where we push it down to $70 in a recession, then stimulate our way out of the recession and oil goes to $150. So then we try to rein it in again and get it down to $90, and then simulate again and send it to $180. Those are just hypothetical numbers, but the point is, I would expect some sort of zig-zag grind higher during this decade during rounds of tightening, debasement, tightening again, and debasement again. Things are going to be challenging for the US economy, European economy, Chinese economy, and global economy in aggregate, until we get past this energy bottleneck. This involves basically all forms of energy to varying extents, as well as refining infrastructure, pipeline infrastructure, export infrastructure, electrical grid infrastructure, and other related industries.” – really worth my thorough reading and understanding. Think about my strategy going forward. – roll over my 2023 LEAPs to 2024 LEAPs, and wait in cash patiently for the next crashes (due to recession fear and cycles)

June 2022 Newsletter: Demand Destruction

In 1980, the energy supply problems that they had were mostly geopolitical, and were resolved with geopolitical means. There was plenty of global capacity to bring new oil to market, quickly.

Today, energy supply problems are primarily due to a lack of sufficient capex and development over the past several years for oil production, gas production, refineries, pipelines, LNG terminals, electrical grids, and even things like keeping existing nuclear power plants open. Then add a war to the mix to accelerate and magnify the problem. This lack of sufficient capacity will likely take years of capital-intensive work to solve.

Currently, oil is $110 per barrel.

This high price is despite the fact that the US Strategic Petroleum Reserve is actively selling some of its oil into the market to try to suppress prices.

And it’s despite the fact that China has been using rather strict lockdowns, and so their jet fuel usage and gasoline usage throughout this springtime was back down to where it was at the depths of the pandemic in early 2020, which is a multi-year low.

![]()

Chart Source: Circium

So, the two biggest countries are actively contributing excess oil supply to the market and/or destroying oil demand, and yet oil is at $110/barrel.

If inflation is reduced by reducing global energy usage over the next year (a.k.a. severe recession), while the supply-side problems remain mostly unaddressed, then inflation would be ready to return as soon as demand destruction ceases.

Geopolitical Game Theory

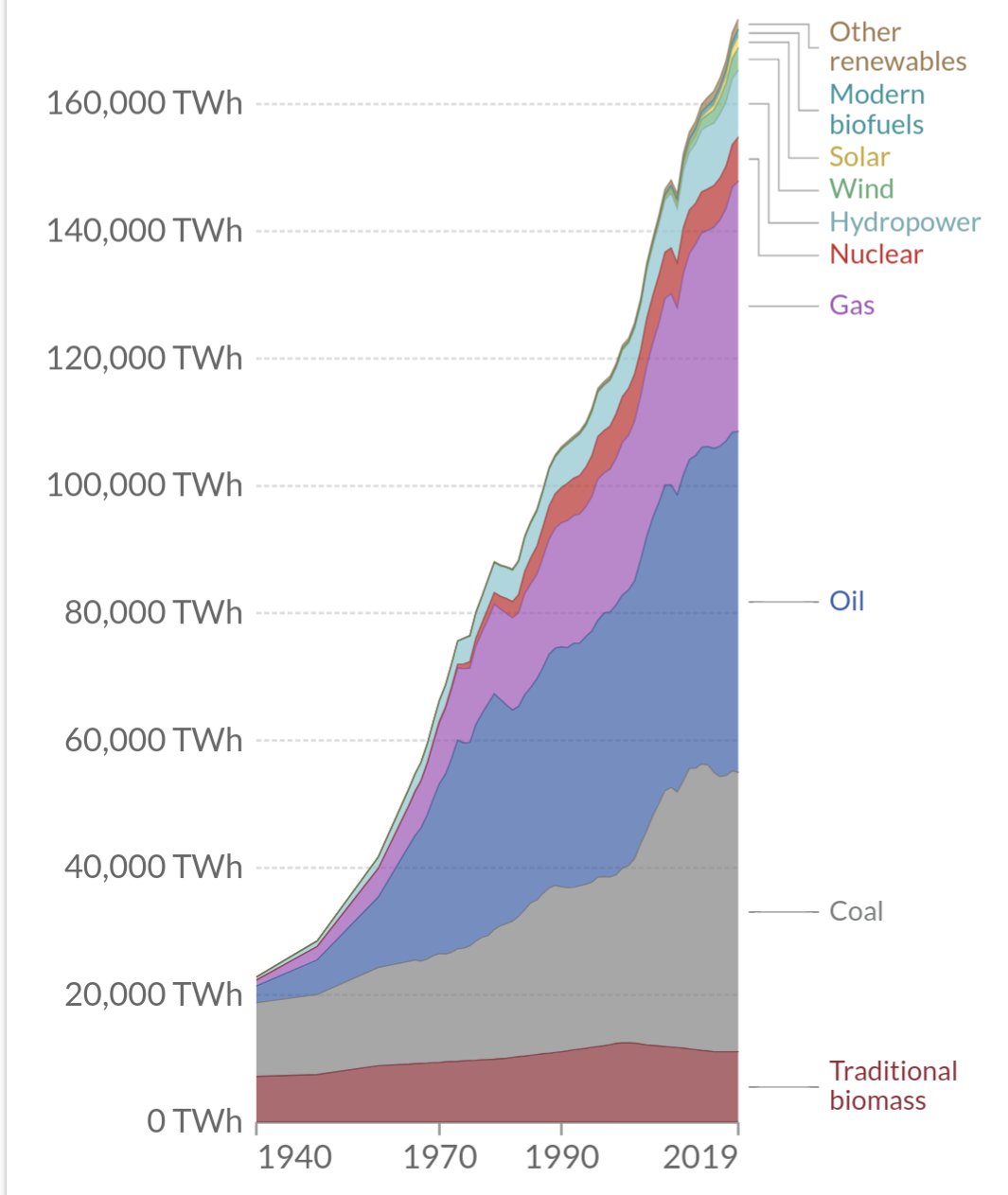

Global energy consumption has increased almost every single year in modern history. The handful of exceptions were extreme periods of global economic weakness:

Chart Source: Our World in Data

Looking at the post-WWII era, global energy consumption dipped for three years from 1980 through 1982 as the US tried to stabilize the flailing dollar, dipped for one year in 2009 during the global financial crisis, and dipped for one year in 2020 due to the pandemic lockdowns (which is not shown on this particular chart, since it ends in 2019). Those are the only times that global energy consumption decreased year-over-year, and these were the three worst economic periods in the post-WWII era.

To the extent that some developed countries have been able to flatten or even slightly shrink their energy consumption, it’s in significant part from a combination of 1) lack of economic growth and 2) sending a large portion of their most energy-intensive manufacturing industries to developing countries. For the world as a whole to shrink energy consumption in a year, means quite a lot of economic devastation is occurring.

US policymakers may be able to tighten fiscal and monetary policy enough, to cause a domestic and global recession significant enough, to reduce energy prices and inflation temporarily. There could be a sharp disruption, or more of a sideways stagnation as they try to give some space for supply to catch up.

However, when the US and other developed countries want to stimulate their way out of that recession again, inflation would likely be quick to resurface. This is because many of the supply constraints would still be there. Destroying demand in the face of supply constraints is like running away and hiding from a monster in a closet, so the monster just sits outside and waits for you to come out again. Until the monster is actually dealt with, it’s still there, waiting.

Oil got up to $120+/barrel in this cycle. I can imagine a scenario where we push it down to $70 in a recession, then stimulate our way out of the recession and oil goes to $150. So then we try to rein it in again and get it down to $90, and then simulate again and send it to $180. Those are just hypothetical numbers, but the point is, I would expect some sort of zig-zag grind higher during this decade during rounds of tightening, debasement, tightening again, and debasement again.

Things are going to be challenging for the US economy, European economy, Chinese economy, and global economy in aggregate, until we get past this energy bottleneck. This involves basically all forms of energy to varying extents, as well as refining infrastructure, pipeline infrastructure, export infrastructure, electrical grid infrastructure, and other related industries.

- 06/20/2022 – so many bankruptcies in the last decade, this might be the real reason there is so much underinvestment in O&G

RE: US O&G

Someone should send the administration this chart as a reference every time they talk about "excess profits" and "price gouging" >>

2015-2021 CUMULATIVE NORTH AMERICAN E&P BANKRUPTCY FILINGS pic.twitter.com/CQNiZ2O7XQ

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) June 20, 2022

BIDEN SAYS HIS TEAM IS MEETING OIL-COMPANY CEOS THIS WEEK, OIL-FIRM CEOS TO BE ASKED TO JUSTIFY THEIR PROFITS.-BBG #OOTT

— CN Wire (@Sino_Market) June 20, 2022

- 06/18/2022 – The main question is not if demand destruction will take place, but when. Signs of demand destruction has emerges, especially when we see the looming of recession. there are signs demand destruction has already started in some areas, mostly cities facing the highest prices. So I need to watch out.

Signs of Demand Destruction Emerge in US

As retail gasoline prices in the US breach the $5 per gallon level nationwide, concerns about demand destruction are growing. Market players from traders to refiners are virtually unanimous that achieving a balance and lowering prices will be a function of consumer behavior. In short, there is almost nothing that can be done to alleviate the high cost of gasoline from the supply perspective, much to the dismay of the Biden administration. The main question is not if demand destruction will take place, but when.

One school of thought is that there is so much pent-up demand that drivers in the world’s largest economy will grit their teeth and bear high pump prices through the summer. After almost three years of living with varying degrees of pandemic protocols, consumers may be prepared to throw fiscal discipline — never a strong suit in the US to begin with — to the winds and follow through on planned vacations and road trips. In addition, many point out that while prices and inflation have increased, so too have savings.

However, the outlook gets much murkier at current price levels and will continue to dim the longer prices remain around $5 per gallon — and especially should they climb, a development some see as virtually inevitable. Indeed, there are signs demand destruction has already started in some areas, mostly cities facing the highest prices. Retailers say much depends on geography.

Meanwhile, with low inventories, strained refining capacity and a tight market globally, the onset of hurricane season could knock out some pipeline or downstream capacity and send prices rocketing even higher, adding to consumers’ pain. In 2021, Hurricane Ida shuttered large swaths of the Gulf Coast’s refining sector for weeks, resulting in over 20 million bbl of gasoline, diesel and other fuels going unproduced.

- 06/13/2022 – Recap of Josh’s interview last year (26Dec2021)

Idea Brunch with Josh Young of Bison Interests

Josh Young shares his approach to oil and gas investing, experience from the boardroom, and his three top ideas

- 06/13/2022 – It wasn’t interest rates that made oil decline, it was government policy on the deregulation side, along with rapid production increases from non-OPEC countries. – Kuppy’s comments

Let’s explore some of the other components that may have contributed to inflation peaking during Volcker’s tenure;

-Oil was one of the primary causes of the 1970s inflation and everyone remembers the oil crisis. During the decade, oil ran all the way from $2 to $39. However, the flipside to this story is that with a lag, high oil prices will eventually incentivize production. The issue was that the US specifically disincentivized US producers and importers. Ronald Reagan signed an Executive Order in January of 1981 to eliminate oil price controls and then removed Jimmy Carter’s idiotic Windfall Profits Tax a few years later. As expected, global production expanded rapidly and with the removal of price controls, that production flooded into the US. By the middle of the decade, despite repeated production cuts by OPEC, there was a global glut of oil and by 1985, oil had collapsed all the way to $7. It wasn’t interest rates that made oil decline, it was government policy on the deregulation side, along with rapid production increases from non-OPEC countries.

-President Reagan’s Economic Recovery Tax Act was signed into law in August of 1981, designed to reduce tax rates and incentivize investment by rewarding risk-taking by businesses. In particular, the Accelerated Cost Recovery System served to accelerate depreciation, reducing taxes for those that invested in productive capacity. Once again, government policy, not interest rates led to an increase in investment and ultimately supply, helping to tame inflation.

-It wasn’t just Reagan working on de-regulation; The Staggers Act of October 1980, deregulated the railroads, The Motor Carrier Act of July 1980, deregulated the trucking industry, and the Airline Deregulation Act of October 1978 effectively deregulated transport industries. The net effect was dramatic price competition, better ability to invest and innovate, and the ability to eliminate unprofitable business that was funded by profitable business. Almost immediately after passage, pricing for transport services collapsed and the ease of transporting goods expanded.

Here’s my alternative view; what if monetary actions mostly serve to impact the price of risk assets, while fiscal mostly impacts the economy’s growth rate, and government policy mostly controls for inflation? As I’ve experienced the interplay of these three factors over more than two decades as an investor, I increasingly think that this is the case. Sure, there is plenty of cross-over. For instance, the S&P wealth effect is increasingly as important for consumer spending as are interest rates, allowing home equity to get tapped. Hence the price of risk assets bleeds into the overall economy. However, I am mostly of the view that these three buckets (monetary, fiscal and policy) control for a substantial percentage of the changes in their respective key categories (risk assets, GDP and inflation), hence why inflation is now accelerating at roughly the rate of government policy mistakes. Meanwhile, the Fed will take interest rates to a level where it nearly detonates the financial system, yet it cannot impact the price of oil.

Coming full circle here, Volcker is still a hero of mine. At the time, he was one of the most hated people in our government, yet he continued forward with his rate plan because he knew it was the right thing to do. He had conviction and didn’t bend to the mob. Ultimately, he was part of the solution. I just think that our collective knowledge has evolved in a way that most people are ignoring many of the other factors that may have had a much greater role in reducing the runaway inflation of the 1970s. If we forget that tax and regulatory policy were the primary factor in reducing inflation, we are bound to repeat Carter’s inflation disaster.

- 06/07/2022 – is there a squeeze coming? What should I do for this?

Seems like all the key players have maxed out their oil calls… Time for the gamma squeeze?? https://t.co/UbSmNTYLk6

— Kuppy (@hkuppy) June 7, 2022

- 06/07/2022 – pend up demand is coming?

Pent up demand ✈️🛢 https://t.co/ualfRSfgH8

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) June 7, 2022

- 06/04/2022 – still no peak coal and oil?

This is a very important chart. We haven't even hit peak coal. The world needs hydrocarbons, particularly the billions of people who use less electricity than my refrigerator. The poorest people can see huge quality of life improvements from more access to reliable energy. https://t.co/DTcpbN3XtT

— Josh Young (@Josh_Young_1) June 4, 2022

- 06/04/2022 – another potential bad policy – bullish for oil?

Headline: WHITE HOUSE'S RAMAMURTI SAYS THEY HAVE LOOKED AT AND ARE CONSIDERING CONGRESSIONAL PROPOSAL TO TAX OIL AND GAS WINDFALL PROFITS -PANEL

Oil prices are going higher. There goes some motivation to drill more wells in the US. Talking about this affects activity @JoeBiden

— Josh Young (@Josh_Young_1) June 4, 2022

"One thing you want to be aware of when you are looking at these types of proposals is how it is going to affect supply as well… I don't think that's an insurmountable hurdle, but it is an important question at a time when there's clearly a supply issue"https://t.co/KU5Sw7RQzx

— Josh Young (@Josh_Young_1) June 4, 2022

White House Weighing Oil Profits Tax to Fund Consumer Rebate

Bharat Ramamurti, the deputy director of President Joe Biden’s National Economic Council, said the administration has been examining U.S. Senate and House of Representative proposals that could hike taxes on energy producers in order to provide a subsidy to consumers.

“We are very much open to any proposal that would provide relief to consumers at the pump,” he said during a panel sponsored by the Roosevelt Institute, a think tank.

“There are a variety of interesting proposals and design choices on a windfall profits tax. We’ve looked carefully at each of them and are engaging in conversations with Congress about design.”

High energy prices have allowed large oil producers to record profits this year. Britain last week announced a 25% windfall tax on oil and gas producers’ profits, alongside a 15 billion pound ($18.9 billion) package of support for households struggling to meet soaring energy bills.

One proposal backed by 15 Democratic-aligned senators and several members in the House would levy a new tax on large oil companies quarterly for crude produced domestically or imported.

The revenue would be paid to consumers under a certain income in the form of a tax rebate that could amount to a few hundred dollars per year, but the bill faces uncertain prospects in Congress.

- 06/03/2022 – And this article. Horrible energy policies driven by energy misconceptions have offered remarkable investment opportunities. Talking about these things has probably limited the growth of my business. Worth it. “People don’t understand how much money you can make in things that people hate,” “It’s like a half-off sale, essentially, for oil and gas stocks,” Young said.

Hedge fund CEO Josh Young is forthright about how he cashed in on climate change activists’ hate for fossil fuels.

“People don’t understand how much money you can make in things that people hate,” Young said in a Financial Times article focused on hedge funds that are profiting on energy equities, including his Bison Interests investment company that reports say saw a more than 300 percent increase in value in 2021.

“Institutional divestment by pension funds, endowments, some billionaires, and others have depleted capital that would have been spent on development, leading to lower production than otherwise,” Young said. “Divestment and associated negative media narrative has suppressed the valuation of public companies and assets by depleting available funds to buy or hold these stocks, with valuations much lower than when oil and gas prices were last at these levels.”

As for Young and his oil and gas investment strategy, he will continue to take advantage of the unintended consequence of climate change activists demonizing fossil fuels.

“It’s like a half-off sale, essentially, for oil and gas stocks,” Young said.

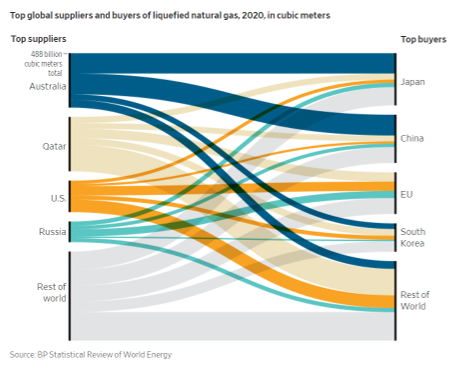

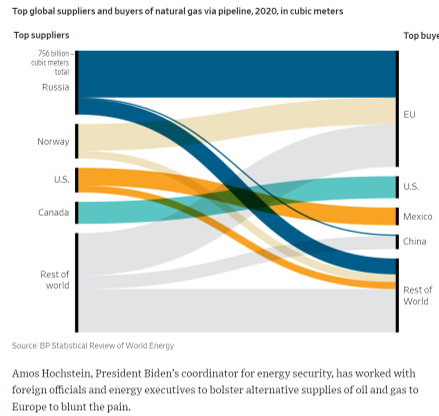

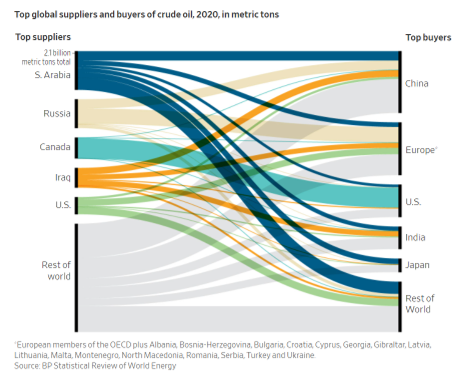

- 06/03/2022 – Over the past half-century, oil and natural gas have moved with relative freedom to the markets where they commanded the highest prices around the world. That ended abruptly when Russian tanks rumbled across the Ukraine border on Feb. 24, triggering a barrage of trade sanctions by the U.S. and Europe targeting Russia that have plunged global commerce into disarray. “We are in a real hinge of history,” said Chas Freeman, a former U.S. ambassador to Saudi Arabia. Mr. Freeman, who is now a senior fellow at Brown University, said Europe can never again trust Russia to be its primary energy provider, and that even if sanctions are lifted, countries are proposing costly new infrastructure and endorsing long-term alternative supply contracts that will lock in the new energy map. The new order promises to make the energy trade less efficient and more expensive, potentially putting commodities at the center of the next global economic crisis

The End of Energy Free Trade – WSJ

Welcome to a new era in oil and gas, prompted by Western sanctions against Russia, that gives geopolitics an edge over market forces

Russia’s attack on Ukraine is redrawing the world’s energy map, ushering in a new era in which the flow of fossil fuels is influenced by geopolitical rivalries as much as supply and demand.

Over the past half-century, oil and natural gas have moved with relative freedom to the markets where they commanded the highest prices around the world. That ended abruptly when Russian tanks rumbled across the Ukraine border on Feb. 24, triggering a barrage of trade sanctions by the U.S. and Europe targeting Russia that have plunged global commerce into disarray.

This week, the European Union agreed to its toughest sanctions yet on Russia, banning imports of its oil and blocking insurers from covering its cargoes of crude.

“We are in a real hinge of history,” said Chas Freeman, a former U.S. ambassador to Saudi Arabia. Mr. Freeman, who is now a senior fellow at Brown University, said Europe can never again trust Russia to be its primary energy provider, and that even if sanctions are lifted, countries are proposing costly new infrastructure and endorsing long-term alternative supply contracts that will lock in the new energy map.

The new order promises to make the energy trade less efficient and more expensive, potentially putting commodities at the center of the next global economic crisis, said Zoltan Pozsar, a former official at the Treasury Department who now heads short-term interest-rate strategy at Credit Suisse Group AG.

- 06/02/2022 – background knowledge of Saudi Oil policy. Oil market fundamentals are very important, but market psychology is equally important,” AlMuhanna writes. “At times of crisis and uncertainty, sentiment overshadows fundamentals and influences the behavior of financial investors in the oil market.” AlMuhanna also reveals the art of deception Saudi oil policy has often employed. He recounts, for example, how a little more than a decade ago the kingdom boosted output by almost a million barrels a day without anyone, including its fellow OPEC producing nations, any the wiser. For months, Riyadh kept its actual production levels secret, making the market believe it was pumping far less than in reality. AlMuhanna also reveals the art of deception Saudi oil policy has often employed. In the process, he reveals not just how Riyadh can move the market via leaks to traders and journalists, but also some of the secret diplomatic maneuvering between the White House and the royal palace. “The first part of the plan was tangible and related to market fundamentals. Saudi Arabia would continue to increase supply to the market,” he writes of events a decade ago. “The second part of the plan was related to market psychology or sentiment. An international campaign was needed to convince the market that the oil price was very high (a policy referred as talking the market down),” he explains, revealing how Saudi officials met “quietly” in London and New York with “analysts, hedge funds, banks and oil companies”.

Saudi Arabia’s Chief Oil Whisperer Spills Some of His Secrets (pdf article Saudi Chief Oil Whisperer Spills Some of His Secrets – The Washington Post) I might can read his book (Oil Leaders: An Insider’s Account of Four Decades of Saudi Arabia and OPEC’s Global Energy Policy (Center on Global Energy Policy Series) Hardcover – May 17, 2022)

Wall Street has Fed-speak – a turgid dialect of English, a mixture of obfuscation and cryptic messaging. The oil market has Saudi-speak – a language of smoke-and-mirrors, a combination of bewildering and byzantine communication typically delivered behind closed doors. A new book provides a lexicon of four decades of verbal intervention in the price of crude by the world’s biggest oil-producing nation. Saudi Arabia has usually delivered clearer signals than the Federal Reserve, but its semaphoring has rarely been public. Instead, one man worked for nearly 40 years in the shadows to shape the kingdom’s oil messaging. Ibrahim AlMuhanna was the power behind the power, the trusted communications advisor to four Saudi oil ministers from the late 1980s until recently, the Deep Throat-type source behind many reports on OPEC’s doings and the man who whispered to many hedge funds and commodity traders. Now retired, he has just published a book that reveals some of the secrets of Saudi-speak. “Oil Leaders” divulges a few bombshells, including the time when British officials in 2008 proposed to Riyadh a “mechanism” to keep oil prices between $60 and $90 a barrel, involving producing and consuming nations. The idea, which AlMuhanna credits to former UK Prime Minister Gordon Brown, would have replaced the invisible hand of supply and demand with government intervention. The author also describes how former Saudi oil minister Ibrahim Al Naimi kept his plan to fight the growth of US shale by flooding the market in 2014 secret even from others in Riyadh. “Neither were the Saudi Ministry of Finance and the Ministry of Economics and Planning consulted nor informed,” AlMuhanna writes. The former Saudi official remains loyal to his master, the king, and his friends, and that puts a limit on his candor. Still, his book, a mix of memoirs and historical analysis, gives away just enough to allow readers a peek behind a curtain that has remained drawn for years. Moreover, with the global economy facing an oil shock akin to those of the 1970s, the timing of the publication is excellent. Oil Leaders demonstrates how Riyadh tries to talk the oil market up and down in much the same way as the Fed steers borrowing costs, influencing prices with words as well as action. “Oil market fundamentals are very important, but market psychology is equally important,” AlMuhanna writes. “At times of crisis and uncertainty, sentiment overshadows fundamentals and influences the behavior of financial investors in the oil market.” AlMuhanna also reveals the art of deception Saudi oil policy has often employed. He recounts, for example, how a little more than a decade ago the kingdom boosted output by almost a million barrels a day without anyone, including its fellow OPEC producing nations, any the wiser. For months, Riyadh kept its actual production levels secret, making the market believe it was pumping far less than in reality. “By mid-2010, Saudi production reached 9m b/d, although some secondary estimates were around 8.2-8.3m b/d,” he says, referring to the consultants that OPEC uses as “secondary sources” to estimate how much its members are pumping. In the crude market, there are lies, damned lies and oil production figures. The former Saudi oil spin master is at his best explaining how the kingdom talked down the market in 2012, revealing a secret plea for help from then-US President Barack Obama, who was facing elections. In the process, he reveals not just how Riyadh can move the market via leaks to traders and journalists, but also some of the secret diplomatic maneuvering between the White House and the royal palace. “The first part of the plan was tangible and related to market fundamentals. Saudi Arabia would continue to increase supply to the market,” he writes of events a decade ago. “The second part of the plan was related to market psychology or sentiment. An international campaign was needed to convince the market that the oil price was very high (a policy referred as talking the market down),” he explains, revealing how Saudi officials met “quietly” in London and New York with “analysts, hedge funds, banks and oil companies”.Is it surprising that Saudi Arabia talked to the market so directly? No. And it’s not the only time Riyadh has done so. But the communication shows how many in the commodity market trade on inside information — a practice that, while illegal in the world of Wall Street, is commonplace in commodities. In the oil casino, many play with marked cards. AlMuhanna describes the 2012 campaign as a success: oil prices fell, and Obama won the election. The book shows that when the White House and the Saudi royal palace are aligned, Riyadh is willing to go to great lengths to talk the market down, even if that means lower revenues. It’s difficult to imagine a similar campaign today, however. In the past two years, Riyadh and Washington have drifted apart.While he avoids commenting on current events, AlMuhanna does provide some nuggets for investors. For one, he makes it clear that Saudi Arabia sees its relationship with Russia as crucial. For Crown Prince Mohammed bin Salman, the future isn’t America, but the emerging world. “The prince is young, dynamic, ambitious, and has clear futuristic goals. He wants to make Saudi Arabia a major international power in many aspects, above all in energy and oil,” the author says, explaining how Prince Mohammed wants to expand “his influence to other major powers such as Russia, China and India.” Oil Leaders is lacking in self criticism about Saudi oil policy, particularly concerning the most recent period. But it still provides useful insights into how Riyadh communicates with the market, suggesting that the kingdom will continue to wield its reserves as both an economic and a political weapon in the years to come.

- 06/02/2022 – Jamie Dimon warns similar to that of Burry. He estimated that some $2 trillion in extra funds are still waiting to be spent. “That fiscal stimulation is still in the pocketbooks of consumers. They are spending it,”

Jamie Dimon Says U.S. Consumers Still Have Six to Nine Months of Spending Power – WSJ

The head of the nation’s biggest bank said the recent drop in Americans’ savings rate hadn’t altered his view that the government’s pandemic stimulus is still padding consumers’ wallets. He estimated that some $2 trillion in extra funds are still waiting to be spent.

“That fiscal stimulation is still in the pocketbooks of consumers. They are spending it,” he said at an investor conference Wednesday.

U.S. households boosted spending for a fourth straight month in April, but the rate at which they were setting aside savings fell to its lowest point in 14 years, according to data released last week. That raised concerns that consumers were tapping into savings to keep up with inflation and that the pandemic stimulus had run out.

Mr. Dimon said the data is heavily distorted by inflation impacts and shifting consumer-spending patterns in goods and services. Lower-income households aren’t quite as healthy, he added.

- 06/01/2022 – Buffett was/is on board on oil investment to fight inflation

Warren Buffett, 1957: "the inflation hedge I like best" Oil & Gas Property Management, Inc!

"Should inflation continue, O&G may well be the vehicle to give the investor the same super-charged performance that highly leveraged investment trusts and warrants did in the early 40s" https://t.co/kvAmOiEYrv pic.twitter.com/72qjBJ2LXP

— Josh Young (@Josh_Young_1) June 2, 2022

- 06/01/2022 – While in theory output will be higher looking forward, OPEC+ has been struggling to meet production quotas. Moreover, the additional barrels slated to hit the market will not make up for the potential loss of more than 1 million barrels per day from Russia

OPEC+ raises output faster than expected as Russia’s war roils global energy markets

- OPEC and its oil-producing allies agreed to hike output in July and August by a larger-than-expected amount as Russia’s invasion of Ukraine wreaks havoc on global energy markets.

- OPEC+ will increase production by 648,000 barrels per day in both July and August.

- The group has been slowly returning the nearly 10 million barrels per day it agreed to pull from the market in April 2020.

- While in theory output will be higher looking forward, OPEC+ has been struggling to meet production quotas. Moreover, the additional barrels slated to hit the market will not make up for the potential loss of more than 1 million barrels per day from Russia as nations around the world ramp up sanctions following the invasion of Ukraine.

- 05/31/2022 – By the end of the year, with Germany and Poland stopping buying oil via pipelines, the embargo would cover 90% of previous Russian oil imports, EU officials said. Russian officials have already forecast that oil production this year could decline by as much as 17% because of Western sanctions. This presents a longer-term issue for Russia since much of its oil infrastructure isn’t geared to quick and deep production cuts. The frigid Siberian climate means pipelines can burst without oil in them, and low-yielding Soviet-era fields are expensive to maintain and restart. Analysts say much of the output that Russia closes now would be permanently lost.

EU Sets Harshest Russian Sanctions, Targeting Oil and Insurance

Crude prices trade at their highest levels in more than two months after EU leaders commit to embargo most Russian oil and ban insuring ships carrying Russian oil

The European Union is set to impose its toughest sanctions yet on Russia, banning imports of its oil and blocking insurers from covering its cargoes of crude, officials and diplomats say, as the West seeks to deprive Moscow of cash it needs to fund the war on Ukraine and keep its economy functioning.

The sanctions, which are expected to be completed in the coming days, are harsher than expected. The ban on insurers will cover tankers carrying Russian oil anywhere in the world. These sanctions could undercut Russia’s efforts to sell its oil in Asia. European companies insure most of the world’s oil trade.

The embargo is a high-risk strategy for the EU, forcing the bloc to break its dependency on cheap Russian energy. It is likely to fuel inflation already running at the highest pace in decades on both sides of the Atlantic.

Leaders of EU member states said late Monday they had agreed in principle to ban Russian crude and refined fuels that arrive on ships, which account for at least two-thirds of imports from Russia. Fuel imported via pipeline was exempted from the deal to get holdout Hungary to agree. The ban will be phased in over several months. By the end of the year, with Germany and Poland stopping buying oil via pipelines, the embargo would cover 90% of previous Russian oil imports, EU officials said.

“Even this partial ban will deal a blow to the Russian budget,” said Maria Shagina, research fellow at the International Institute for Strategic Studies think tank. “Moscow can reroute some of its oil shipments to Asia, but it’s hard to find ways to compensate the whole European market.”

The insurance ban—due to be implemented in six months to mollify concerns of shipping nations including Greece and Cyprus—is the most punishing of the two measures, traders and shipowners say. Few companies are willing to transport oil on uninsured tankers. Such a ban stemmed Iranian oil exports as part of efforts to force Tehran to negotiate its nuclear program a decade ago.

Beyond insurance, traders have struggled to secure bank funding and tankers to transport oil to refiners in China and India. Falling demand at home and abroad has prompted Russian refiners, as well as some crude wells, to cut production.

India has bought record amounts of Russian crude in recent weeks but analysts say that won’t be enough to mop up the barrels the EU is aiming to ban. “In time, Russian storage will fill and production will begin to falter,” strategists at RBC Capital Markets wrote in a note to clients.

Russian officials have already forecast that oil production this year could decline by as much as 17% because of Western sanctions. This presents a longer-term issue for Russia since much of its oil infrastructure isn’t geared to quick and deep production cuts. The frigid Siberian climate means pipelines can burst without oil in them, and low-yielding Soviet-era fields are expensive to maintain and restart. Analysts say much of the output that Russia closes now would be permanently lost.

The hunt for new exporters comes at a price. Europe’s race to stock up on oil from other producers has driven the price of high-quality crudes from West Africa to Azerbaijan to levels not seen for years. With China emerging from Covid-19 shutdowns that have tamed oil demand, Europe will face greater competition for those crudes.

“There’s going to be even higher competition for crude,” said Ms. Sen.

For Europe, replacing Russian diesel will be even more difficult. The fuel, which powers a bigger share of the auto fleet in Europe than in the U.S., will likely arrive from the U.S., the Middle East and India, analysts and traders say. Ms. Sen said diesel will be in short supply globally this winter.

- 06/01/2022 –

There was a great recent article / book review by @JavierBlas that addressed how the Saudis are like the "Fed" of oil, both attempting to "jawbone" the market and to manipulate the actual supply. With limited remaining spare capacity, is the jig be up?https://t.co/ryeerSZZvT

— Josh Young (@Josh_Young_1) June 2, 2022

Saudi Arabia’s Chief Oil Whisperer Spills Some of His Secrets

- 05/31/2022 –

https://www.cnbc.com/2022/05/31/these-charts-show-russias-invasion-of-ukraine-has-changed-global-oil.html

https://www.cnbc.com/2022/05/31/russia-oil-moscow-says-it-will-find-other-importers-after-eu-ban.html

OPEC Weighs Suspending Russia From Oil-Production Deal – WSJ

- 05/30/2022 – Bison oil market update webinar – May 2022

https://www.youtube.com/watch?v=iJaGoyAoFhw&t=2s

Bison Oil Market Update Webinar – May 2022

Energy Stocks Remain Undervalued, Says World’s Best Performing Hedge Fund Manager

- 05/27/2022 – bearish view from Burry: Looming: a consumer recession and more earnings trouble.

— Michael Burry Archive (@BurryArchive) June 2, 2022

https://twitter.com/michaeljburry/status/1530271926567899137

Economists, in this rare instance, are correct. GDP is ~70% consumer spending.https://t.co/foUhCXaNda pic.twitter.com/NYazmUSg6K

— Hassan 👾 (@19hassan48) May 27, 2022

- 05/27/2022 – we have refinery problem! the White House, which has established an interagency “energy markets team” that has been monitoring energy supply and price data for the past several months, has few good options available to tame gasoline prices. More than 1 million barrels a day of the country’s oil refining capacity — or about 5% overall — has shut since the beginning of the pandemic. Elsewhere in the world, capacity has shrunk by 2.13 million additional barrels a day, energy consultancy Turner, Mason & Co. estimates. And with no plans to bring new US plants online, even though refiners are reaping record profits, the supply squeeze is only going to get worse.

1. US has had no new greenfield projects since 1977

2. Brownfield projects added 185% capacity since, but still does'nt offset what has been taken offline

3. You cant just turn refineries off/on

WH Eyes Restarting Idle Refineries to Tame Fuel Priceshttps://t.co/SGKx2UCvJ3

— Tracy Shuchart (𝒞𝒽𝒾 ) (@chigrl) May 26, 2022

White House Eyes Restarting Idle Refineries to Tame Fuel Prices

(Bloomberg) — The Biden administration is reaching out to the oil industry to inquire about restarting shuttered refineries, as the White House scrambles to address record high-gasoline prices that are setting off political alarm bells ahead of the midterm elections.

But the White House, which has established an interagency “energy markets team” that has been monitoring energy supply and price data for the past several months, has few good options available to tame gasoline prices. Pump prices have have sky-rocketing amid Russia’s invasion of Ukraine that sent oil futures north of $100 a barrel.

More than 1 million barrels a day of the country’s oil refining capacity — or about 5% overall — has shut since the beginning of the pandemic. Elsewhere in the world, capacity has shrunk by 2.13 million additional barrels a day, energy consultancy Turner, Mason & Co. estimates. And with no plans to bring new US plants online, even though refiners are reaping record profits, the supply squeeze is only going to get worse.

“They are in a very difficult political situation,” said Mike Sommers, president of the American Petroleum Institute, the oil industry’s top US lobbying group. “They are looking for every option that is out there.”

- 05/27/2022 – Davidson’s bullish view: E&P companies and related industries have a substantial recovery ahead as perceptions shift. Oil stocks are likely to become the next Momentum Issues. in addition, Crude Inventory Decline Accelerates

Everybody Loves Energy Now (from Davidson)

SP500 vs SP Energy Sector(XLE) is a simple price comparison. ETFs are designed to track prices of the underlying securities. The shares outstanding vary, dependent on the ebb and flow of capital in and out of the ETF. The simple price comparison reveals investors are in the early stages of raising commitments to E&P related companies after high pessimism shown March 2020 during the COVID-shutdown. The March 2020 low percentage was 0.88%. The current percentage is 2.14% having surged since Dec 2021 from 1.15% as investors have gradually exited COVID-favored issues for Reopening-favored issues. Media headlines have similarly evolved from suggesting that fossil issues be eliminated for society’s benefit to leaning towards this sector as vital for economic growth as alternative sources fail to meet expectations.

In 2012, XLE represented 5%+ of the SP500 when $WTI was at similar levels as today. Much has changed with society’s overall perceptions of the benefit of fossil fuels shifting to viewing them as the ultimate risk. The past 10yrs has witnessed gross divestment of carbon fuel-based companies from endowments and retirement portfolios and the development of societal benefit scores(ESG) geared to force what has been called our greatest ‘existential risk’ to our climate with rising temperatures melting glaciers and pole ice resulting in flooded cities, failed food sources and a host of other disasters. This perception is peppered with daily commentary of pointing to every disaster anywhere as further evidence. Is it?

Investors, in my opinion, should have fossil fuel related issues as component of portfolios. I visualize not only XLE coming fully back in favor, but likely going to excess as investor perception and price-momentum becomes apparent with Momentum Investors. US markets in particular witnessed a pooling of global capital as global investors became more aware of threats of autocratic governments elsewhere. Much of this capital, is in my opinion, directed by inexperienced investors who rely on price-trends to make decisions i.e., they are Momentum Investors. Markets are in correction today as these investors exit the COVID-favored companies having priced many at incredible valuations, 50x+ Revenue. Outrageous levels of valuation! Many have interpreted the resulting price declines as recessionary signals when economic indicators do not support this conclusion. Underlying economic indicators reveal a post-COVID expansion that is continuing despite corrections in some which COVID had driven well out of historical trends. Normalization continues as government policies drive inflation and energy prices. It becomes less confusing when one’s focus is on data and economic fundamentals and not driven emotionally by the shifting sands in headlines.

In my analysis E&P companies and related industries have a substantial recovery ahead as perceptions shift. Oil stocks are likely to become the next Momentum Issues.

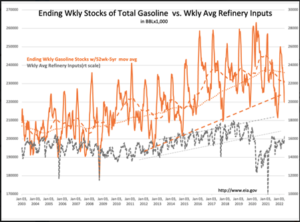

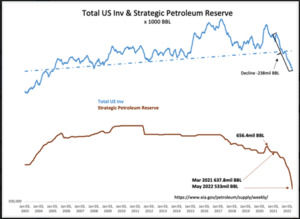

Crude Inventory Decline Accelerates

At every level, US fossil fuel inventories continue to decline. The decline in the SPR has accelerated.

This is not getting better anytime soon…….

“Davidson” submits:

- US Crude Production flat at 11.9mil BBL/Day, Total US Crude Inv fall 7mil BBL(-1mil working inv & -6mil SPR), US Crude Imports decline 0.9mil BBL/Day(6.3mil BBL/Week) Fudge factor 1,225mil BBL/Day(8.57mil BBL/Week)

- US Gasoline Inv decline 0.5mil BBL, US Refining Input rises 0.3mil BBL/Day, US Refined Products Export remain higher at the expense of US inventories

- 05/27/2022 – Both Ray and Jeremy agree that ong is the best defense for inflation environment. If you believe inflation you know that resources do very well, there was little capex for the last 10 years in resource industry even in oil and gas for the last time ( similar to the housing bubble burst and booming?)

Being long real assets (like oil) reduces risk and increases returns (in the current environment) – Ray Dalio @RayDalio

Fascinating conversation worth listening to.https://t.co/tbHBLIU5ok

— Josh Young (@Josh_Young_1) May 27, 2022

Ray Dalio and GMO’s Jeremy Grantham on How They’re Seeing the World Right Now

Great takeaways from Grantham (about 37:00)

1. if you believe inflation you know that resources do very well you also know that in the long run it’s strongly negative correlated (to inflation) and moderately negatively correlated to the rest of your portfolio, as we’re staying today when they do well it puts a burden on the rest of the economy and they do back. so there is a very strong case here for a resource portfolio.

2. there was little capex for the last 10 years in resource industry even in oil and gas for the last time. A resourceful fellow on resources just appointed the last time we had a Super Bubble in Commodities new lines waiting to come online what has happened since 2011 crunch when China’s slowdown in his heavy industrialyzer and the growth rate dropped from double-digit to 0 dead flat for three years in a row by breaking the back off of the resource industry they have not done any 5 to 15 years to bring on a mind they have not been doing their on no great reserves of lithium Koval copper-nickel even I am able to come on line this time and everybody knows if you look at the need for these particular green Metals raining Knuckles the length and breadth of resources they have not been kept CAPEX in oil and gas for the last time

other comments,

- the current bubble burst is like 2000, then morphs into that of 1970’s (profit margin shrinks due to inflation) – another short video (This bubble looks very much like 2000, says GMO’s Jeremy Grantham)

- currently, policy is more dominated than economy incentive

- Dalio says cash is trash during inflation, I am not sure it is 100% right. But inflation does eat away value, I need to think about how to deal with this.

- birth rate drops in western and China, places burden on the labor shortage

- 05/26/2022 – Biden admin’s policy is still negative to oil industry

Biden climate formulas upheld for now by Supreme Court

The U.S. Supreme Court issued an order on Thursday that will allow the Biden administration to continue using its formulas for estimating the social cost of greenhouse gas emissions when regulating energy and infrastructure projects, while legal challenges play out.

The justices rejected calls from 10 Republican-controlled states to reinstate former President Trump’s cost estimation approach while they pursue litigation to block the Biden policy in a lower court.

The Biden metric, based on formulas used in the Obama administration, uses economic models to assign a cost to carbon emissions to help quantify the economic harm caused by climate change, including sea level rise, more destructive hurricanes, extreme wildfire seasons and flooding.

The states filing litigation say the models are “a power grab designed to manipulate America’s entire federal regulatory apparatus through speculative costs and benefits.”

ETFs: (NYSEARCA:XLE), (NYSEARCA:XOP), (VDE), (OIH), (CRAK)

This year’s annual shareholder meetings of major oil companies have seen climate resolutions struggle to win support.

- 05/24/2022 – IEA head said we probably will have the first global energy crisis? and they blame the crisis to Russia, not their poor policy. Does that mean the poor policy will go on? – bullish on oil?

Head of the International Energy Agency blames Putin for the energy crisis 🙄 @iea @fbirol #putin https://t.co/v4wEJENpeS

— Josh Young (@Josh_Young_1) May 24, 2022

And this energy crisis tracker from @BisonInterests has been helpful in understanding the magnitude and trajectory of the crisis. Updated chart as well as link to a Bison thread from last year on the energy crisis https://t.co/LTECDqAc6v pic.twitter.com/VbZLkrjdQc

— Josh Young (@Josh_Young_1) May 24, 2022

- 05/23/2022 – so far no incentive in company compensation plans for Shale Drillers to increase production. “We’re not hearing a lot of management teams talk about growing production or drilling new wells in a significant way,” said Marcus McGregor, head of commodities research at money manager Conning. “They won’t get paid to do so.”

Why Shale Drillers Are Pumping Out Dividends Instead of More Oil and Gas – WSJ

Compensation plans that once paid executives to boost output without regard to energy prices now foster cost cuts and shareholder returns

Executives at firms including Pioneer Natural Resources Co. PXD +2.10% , Occidental Petroleum Corp. OXY +3.46% and Range Resources Corp. RRC +3.89% were once encouraged by compensation plans to produce certain volumes of oil and gas, with little regard for the economics. After years of losses, investors demanded changes to how bonuses are formulated, pushing for more emphasis on profitability. Now, executives who were paid to pump are rewarded more for keeping costs down and returning cash to shareholders, securities filings show.

The shift has contributed to a big turnaround for energy stocks, which have surged through an otherwise down market. Energy shares led 2021’s bull market and this year those included in the S&P 500 are up 46%, compared with an 18% decline in the broader index.

The focus on profitability over growth also helps explain drillers’ muted response to the highest prices for oil and natural gas in more than a decade. Though U.S. oil and gas production has risen from lockdown lows, output remains below prepandemic levels even though crude prices have doubled since then, to about $113 a barrel, and natural gas has quadrupled, to more than $8 per million British thermal units.

“We’re not hearing a lot of management teams talk about growing production or drilling new wells in a significant way,” said Marcus McGregor, head of commodities research at money manager Conning. “They won’t get paid to do so.”

- 05/22/2022 – U.S. oil reserves sink to 35-year low

Energy shares rise with oil futures as U.S. reserves sink to 35-year low

“What remains true across global markets is that inventories are low, particularly for products,” Schneider Electric’s Robbie Fraser said, a challenge that is “likely to persist as northern hemisphere summer travel demand is poised for a boost to gasoline, diesel and jet fuel demand over the weeks and months ahead.”

The U.S. government’s strategic petroleum reserves have sunk to a 35-year-low 538M barrels, after the Biden administration began selling reserves last year in a mostly unsuccessful attempt to tamp down gasoline prices at the pump.

Phil Flynn of Price Futures Group worries the reserves are getting too low ahead of driving season – and hurricane season – telling The Wall Street Journal “it’s like burning out your bullpen early, using your relief pitcher in the second inning and your closer in the third,” also noting U.S. oil consumption is 20% higher than 1987 when reserves were this low.

Rebecca Babin, senior energy trader at CIBC Private Wealth Management, noted the “disconnect between the risk financial markets associate with crude financial assets and the physical market that’s trying to digest SPR releases to meet product demand. This dichotomy keeps markets fragmented and volatile… it could be a cruel summer for energy traders.”