Burry’s twitters

I look for value where it can be found. – MB

“The lesson of Buffett was: To succeed in a spectacular fashion you had to be spectacularly unusual” – MB

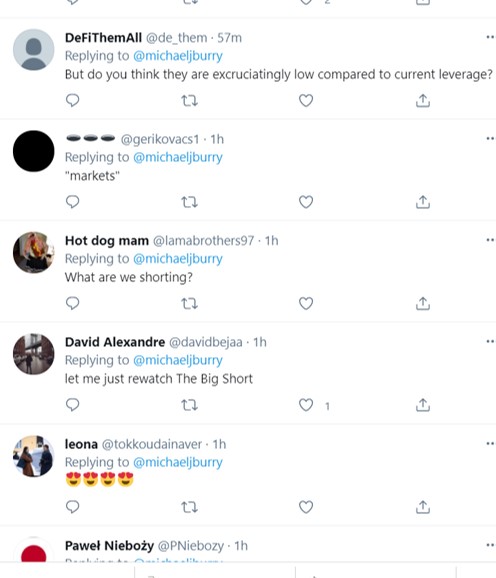

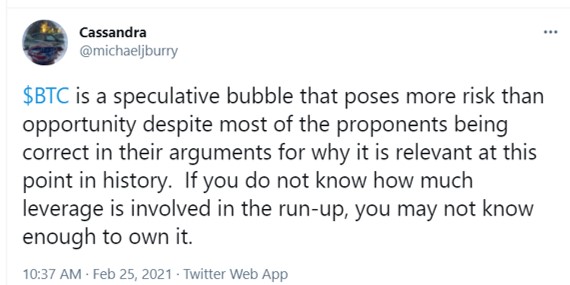

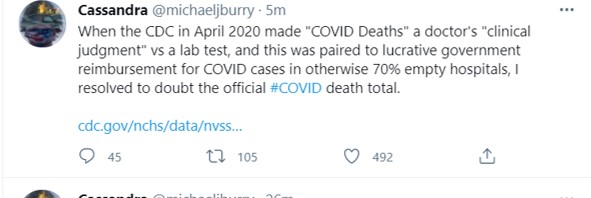

- 02/25/2021 – CV impact on education, economy, inflation, BTC, CDC, CV death report, interest rate, dem party, yield curve?

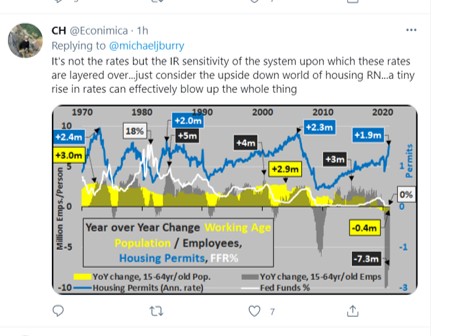

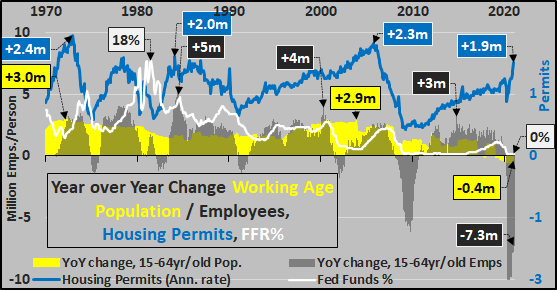

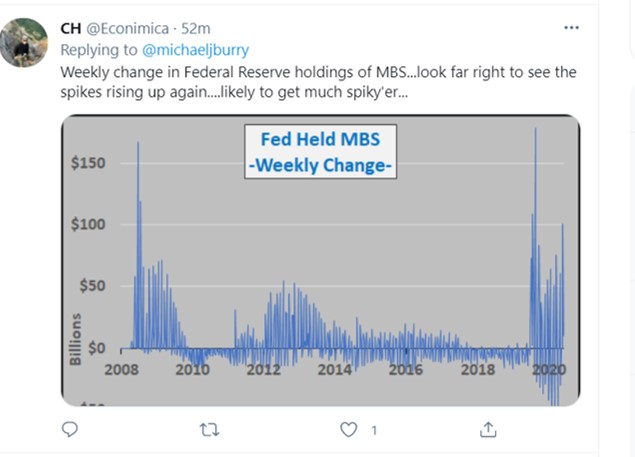

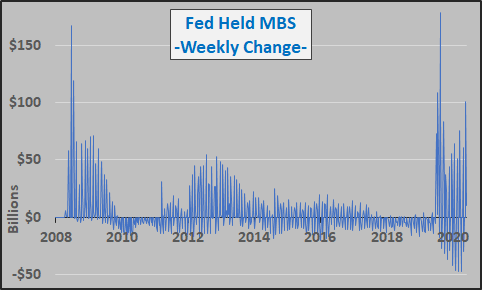

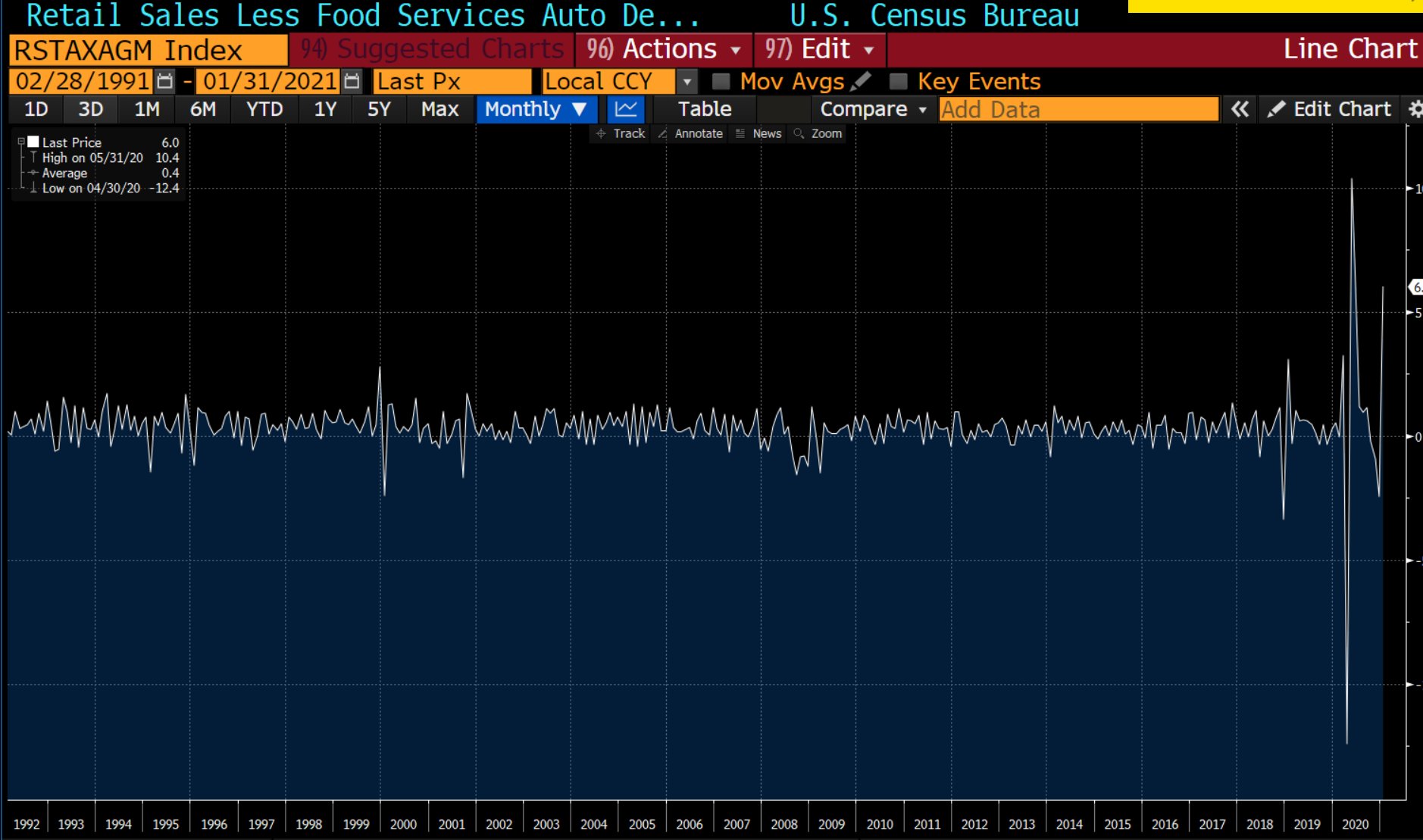

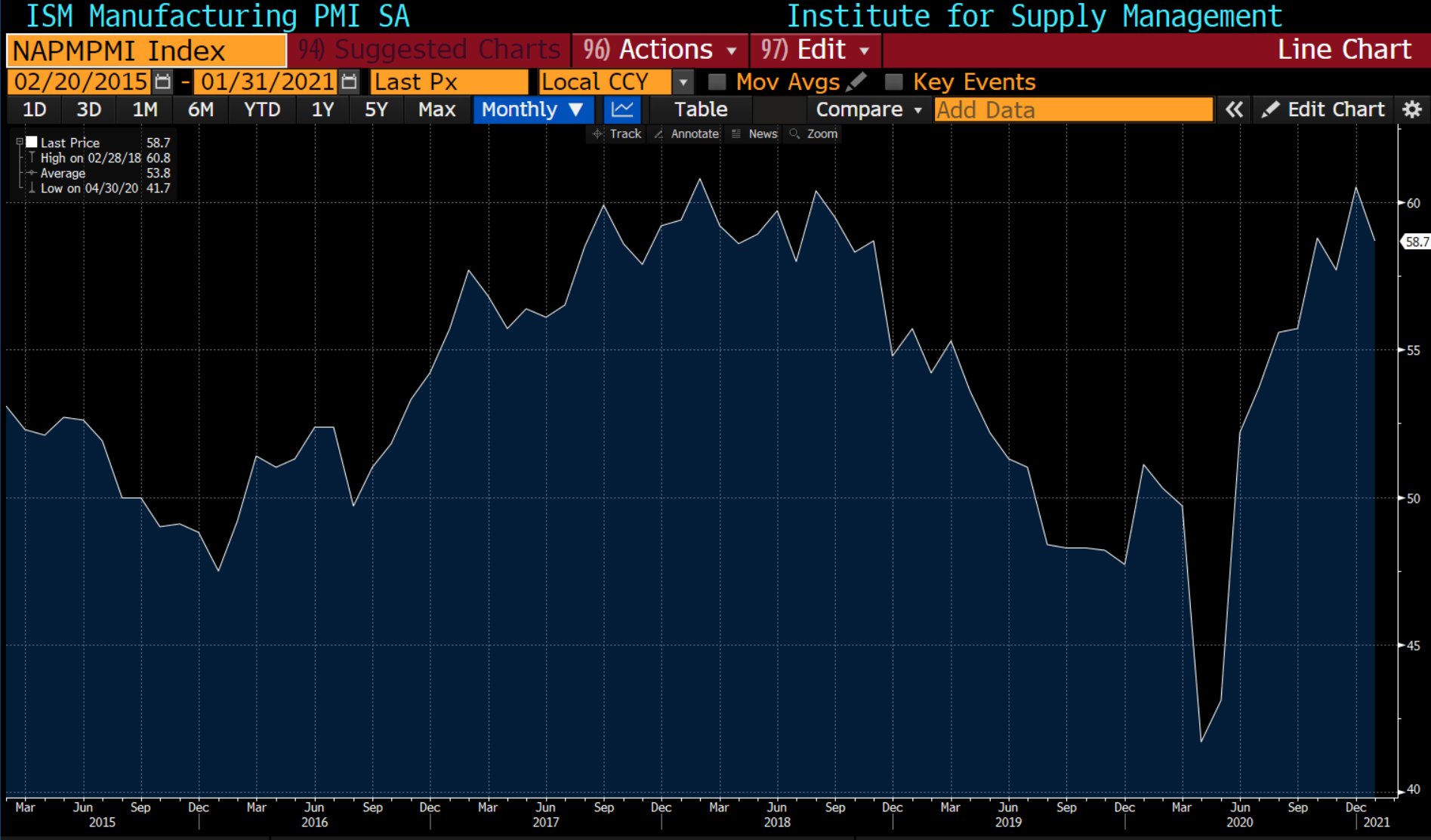

Burry has no detailed explanation on the above yield curve, here are my own understanding from following WSJ article

Key Short-Term Bond Spread Hits Lowest Level in Nearly a Year – WSJ

Treasury prices rally, but traders worry about a reversal if inflation picks up

https://www.cdc.gov/nchs/covid19/coding-and-reporting.htm

https://www.vice.com/en/article/qjp57d/democrats-ask-biden-to-give-up-his-unilateral-power-to-launch-nukes

https://www.cdc.gov/nchs/data/nvss/vsrg/vsrg03-508.pdf

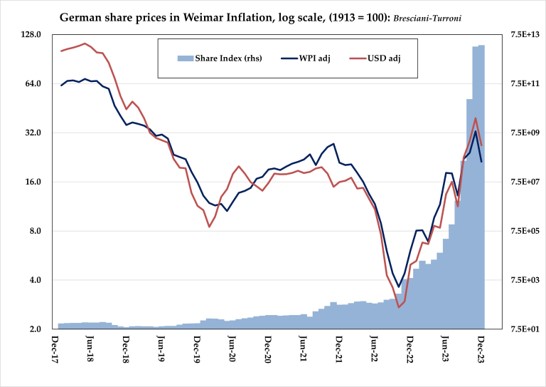

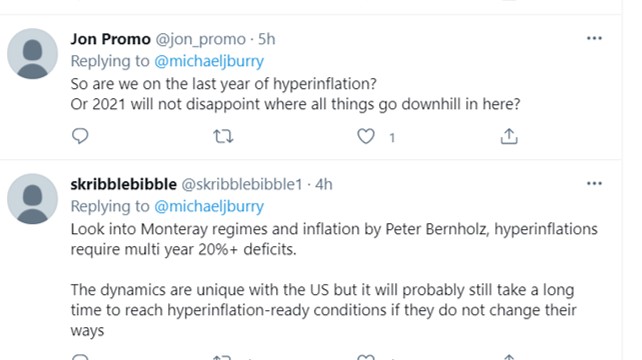

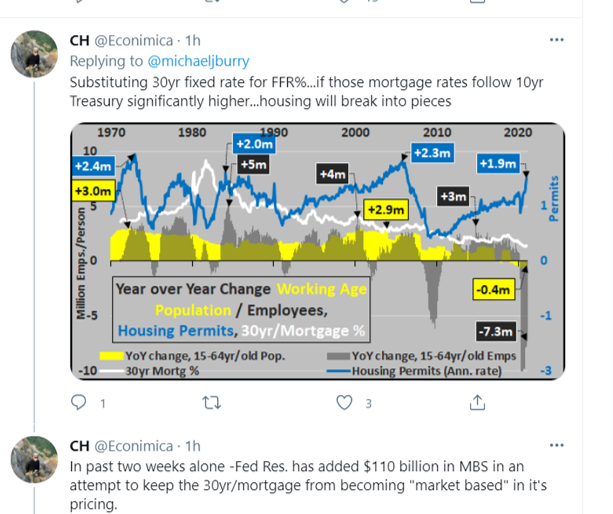

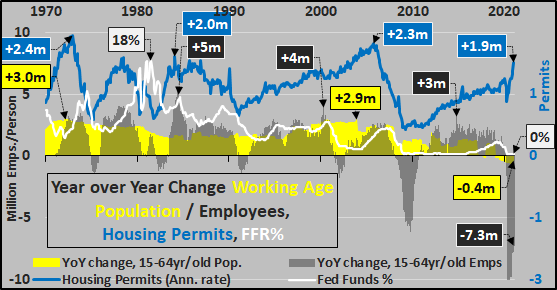

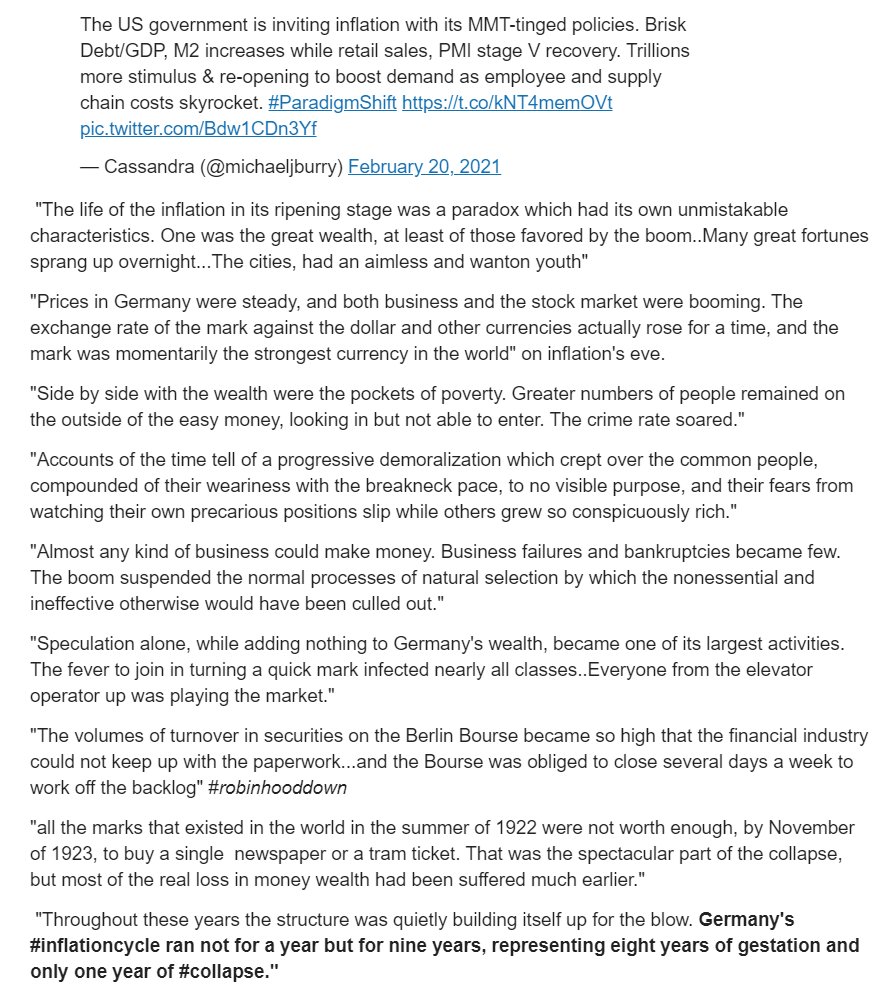

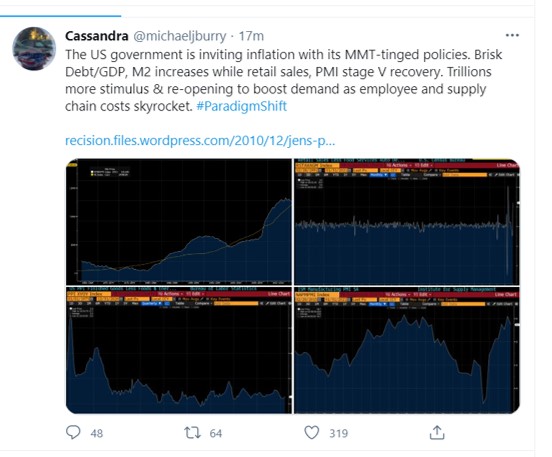

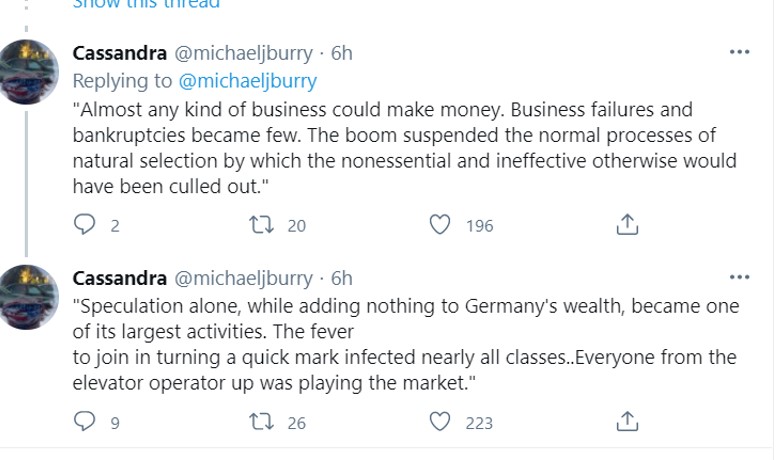

https://www.zerohedge.com/markets/michael-burry-warns-weimar-hyperinflation-coming

https://www.zerohedge.com/markets/michael-burry-warns-weimar-hyperinflation-coming

https://www.fa-mag.com/news/michael-burry-of–the-big-short–slams-virus-lockdowns-in-tweetstorm-55066.html?section=3&page=2

School Closures Have Failed America’s Children

As many as three million children have gotten no education for nearly a year.

I wrote recently about my old buddy Mike Stepp, who dropped out of high school, couldn’t get a good job, self-medicated with alcohol and meth, and recently died homeless. I fear that our educational failures during this pandemic will produce countless more tragedies like Mike’s.

“The blunt fact is that it is Democrats — including those who run the West Coast, from California through Oregon to Washington State — who have presided over one of the worst blows to the education of disadvantaged Americans in history.” –@NYT

ok to say out loud now Trump’s gone?

https://www.theguardian.com/society/2017/mar/28/children-missing-out-on-education-at-risk-of-abuse-and-exploitation

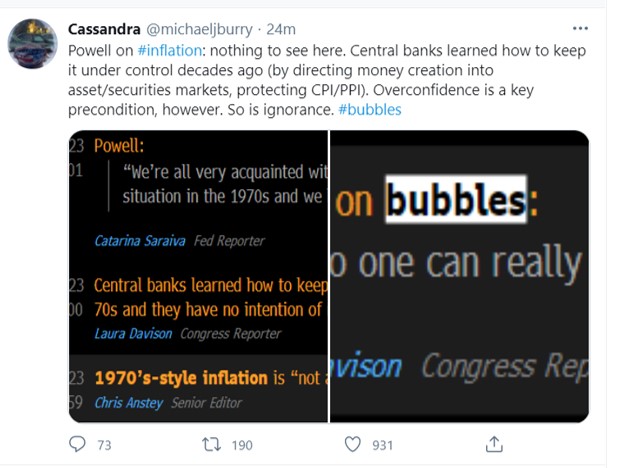

- 02/24/2021 – markets forget Powell, NFTs

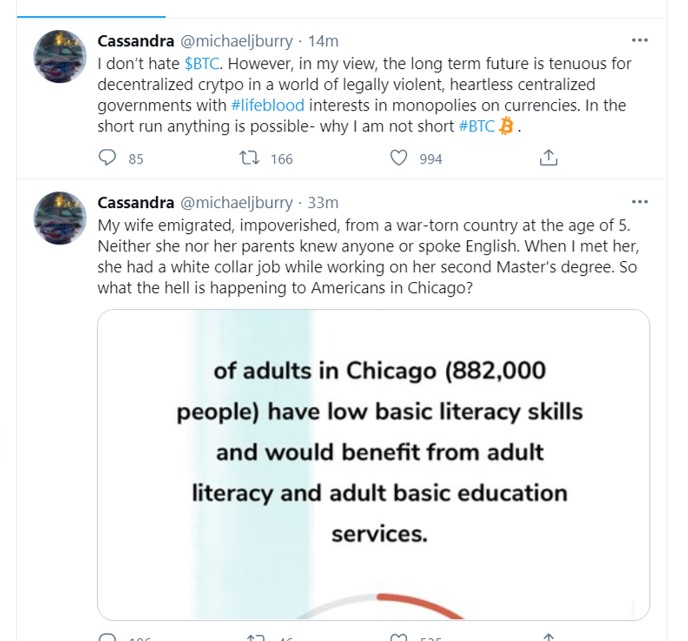

Charlie Munger doesn’t know what’s worse: Tesla at $1 trillion or bitcoin at $50,000

- Charlie Munger, vice chairman of Berkshire Hathaway and Warren Buffett’s longtime business partner, on Wednesday dismissed the rocketing share price of Tesla and the recent bitcoin frenzy.

- “I don’t think bitcoin is going to end up the medium of exchange for the world. It’s too volatile to serve well as a medium of exchange,” he said.

- Asked about Bitcoin’s price and Tesla’s market cap, Munger said: “I don’t know which is worse.”

Munger was also asked what the biggest threat to banking is, and whether it was bitcoin or digital wallets like Apple Pay and Square.

“I don’t think I know what the future of banking is, and I don’t think I know how the payment system will evolve,” he said. “I do think that a properly run bank is a great contributor to civilization and that the central banks of the world like controlling their own banking system and their own money supplies.

“So I don’t think bitcoin is going to end up the medium of exchange for the world. It’s too volatile to serve well as a medium of exchange. And it’s really kind of an artificial substitute for gold. And since I never buy any gold, I never buy any bitcoin.”

You can watch the full interview below.

how much money should be thrown in the right tail @CathieWood

Francisco mercado @franciscocapde8

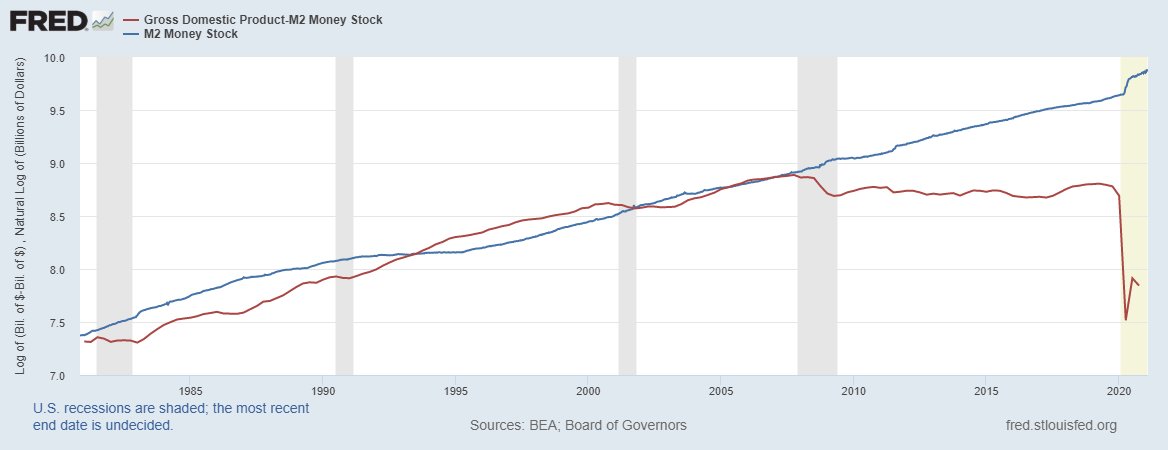

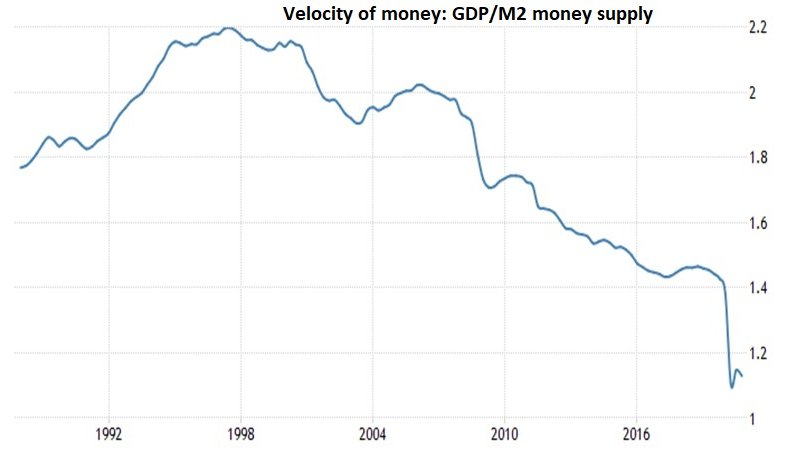

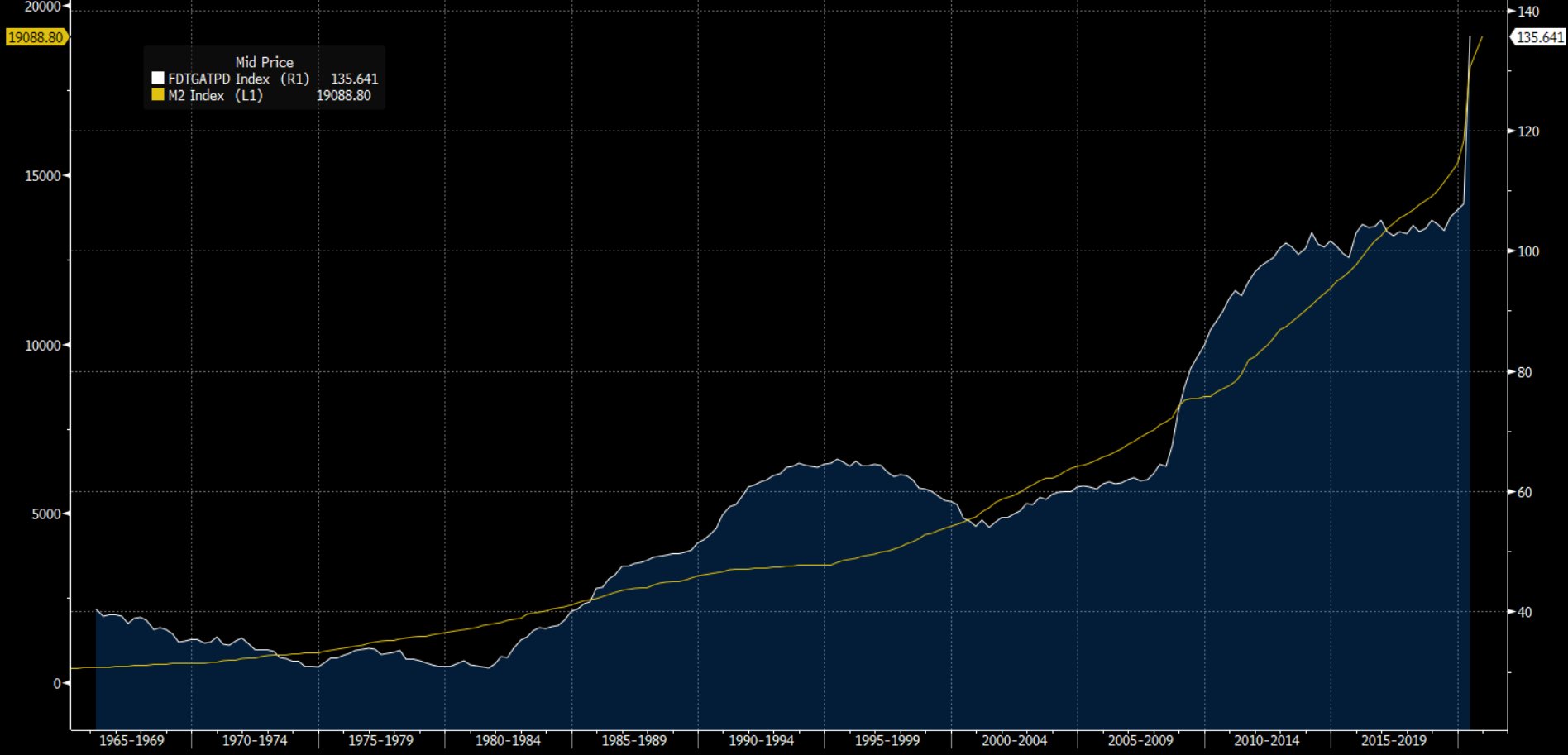

THREAD1-gdp measured against m2 is the velocity of money. This measures inflation or deflation, velocity spikes when gdp grow faster than m2, people run off money because rising prices, we are going to apply this comparison against other asset (btc, gold,dow j.) instead of GDP

Francisco mercado @franciscocapde8 thread1-2008 broke the trendline, this means that money supply increase faster and higher than gdp can grow. You can also see brown line entering in a down patern with lower highs. this is because money isnt going to real economy but going to bonds and stocks and other spec. as.

background knowledge about NFTs

A non-fungible token (NFT) is a special type of cryptographic token which represents something unique; non-fungible tokens are thus not mutually interchangeable.[1] This is in contrast to cryptocurrencies like bitcoin, and many network or utility tokens that are fungible in nature.[2]

What Are NFTs and How Do They Work?

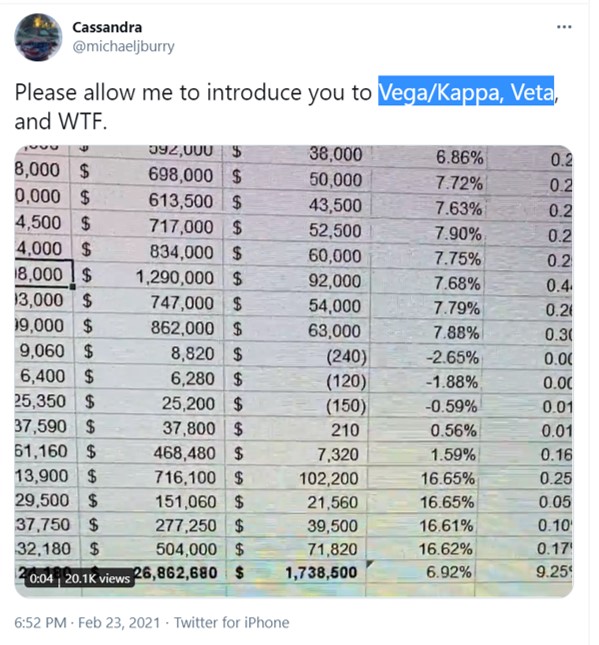

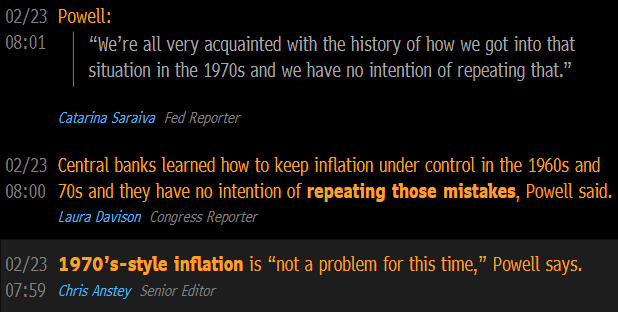

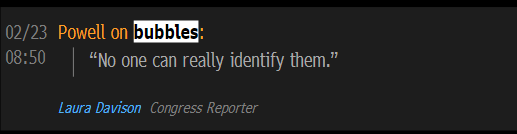

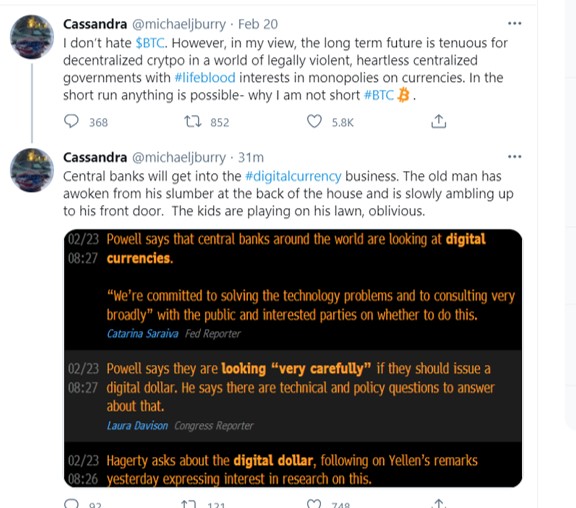

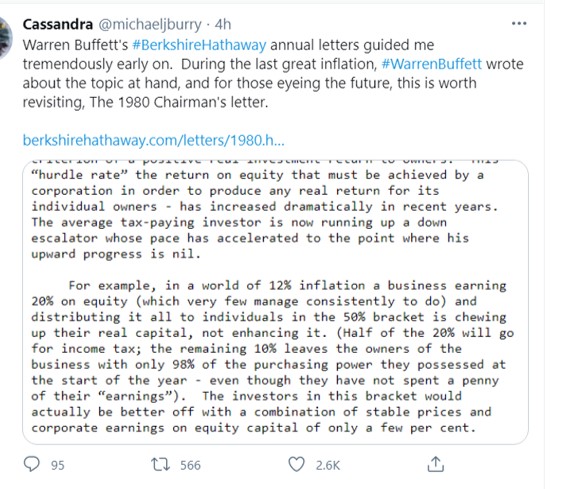

- 02/23/2021 – Powell, inflation, digital currency, BTC, Buffett letter on inflation, vega/Kappa and Veta, make big impact

Contents

BMW will now use aluminum that’s been made with solar power

jodi @1chubbychicken1 Replying to @michaeljburry

jodi @1chubbychicken1 Replying to @michaeljburry

https://www.forbes.com/sites/jasonbrett/2020/03/24/digital-dollar-and-digital-wallet-legislation-surfaces-in-the-us-senate/?sh=7856c5543866

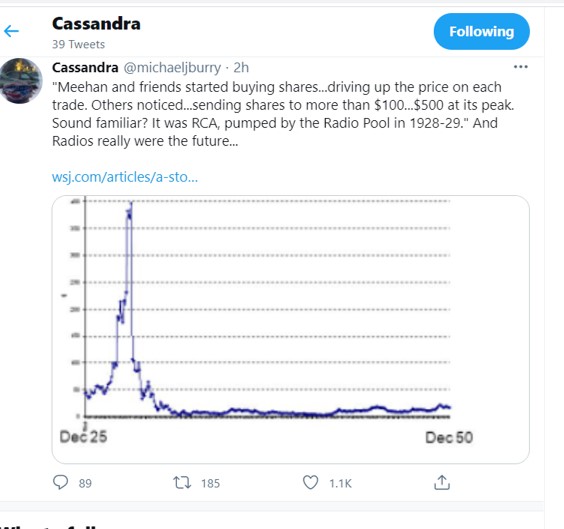

https://www.wsj.com/articles/a-stock-trading-dupe-is-born-every-minute-11613933258?mod=hp_opin_pos_3

https://www.berkshirehathaway.com/letters/1980.html

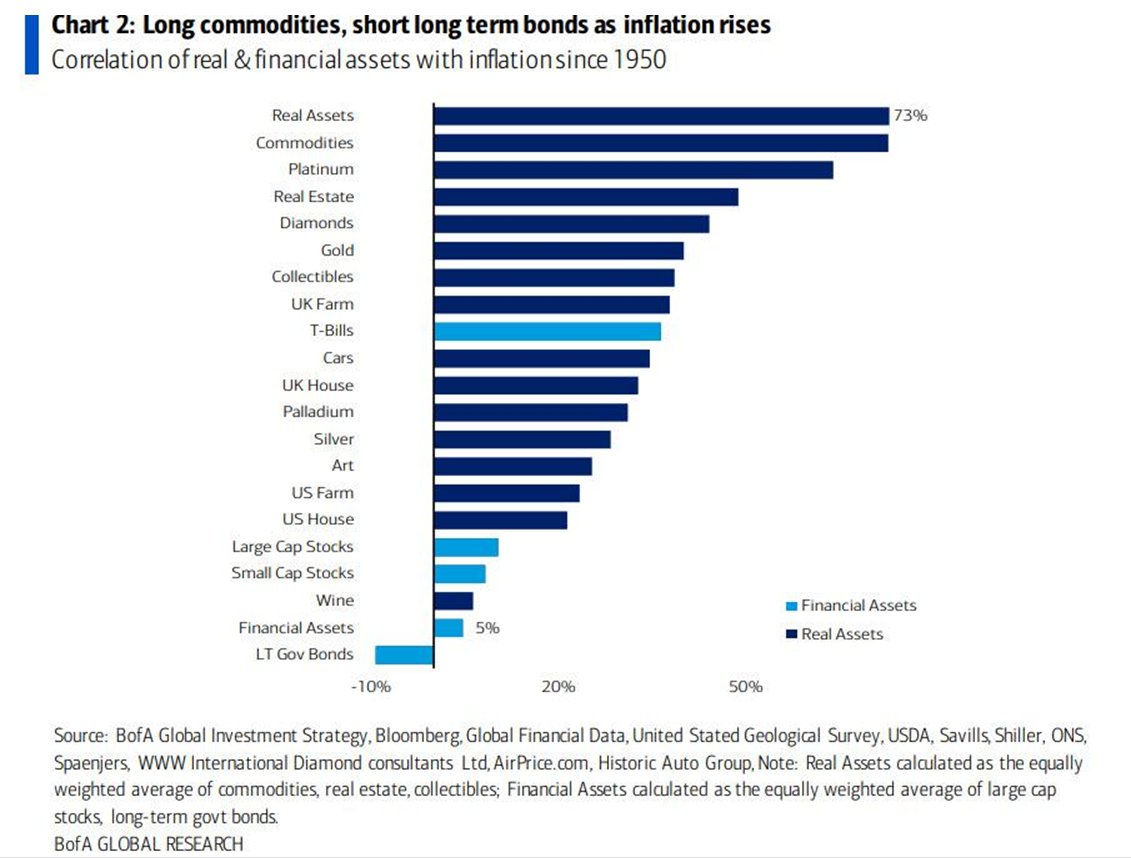

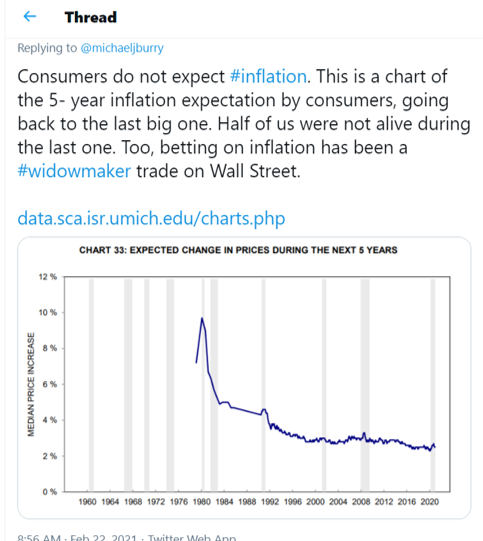

- 02/22/2021 – inflation, investments in inflation conditions

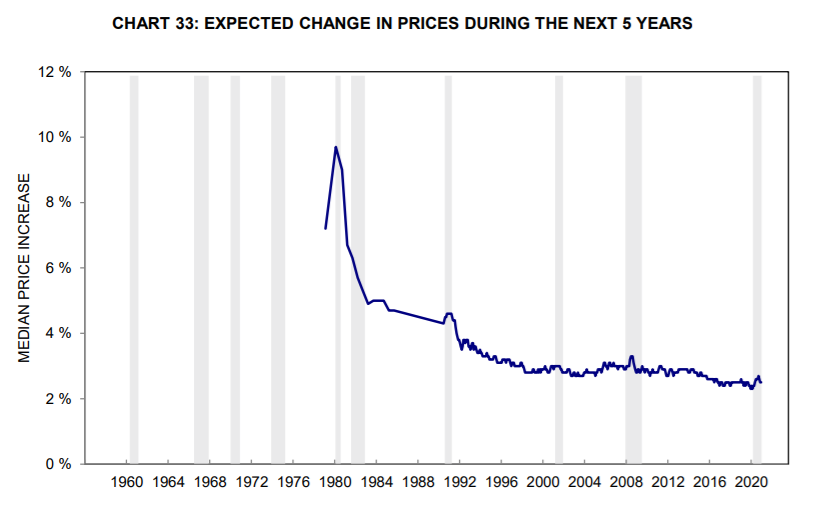

https://data.sca.isr.umich.edu/charts.php

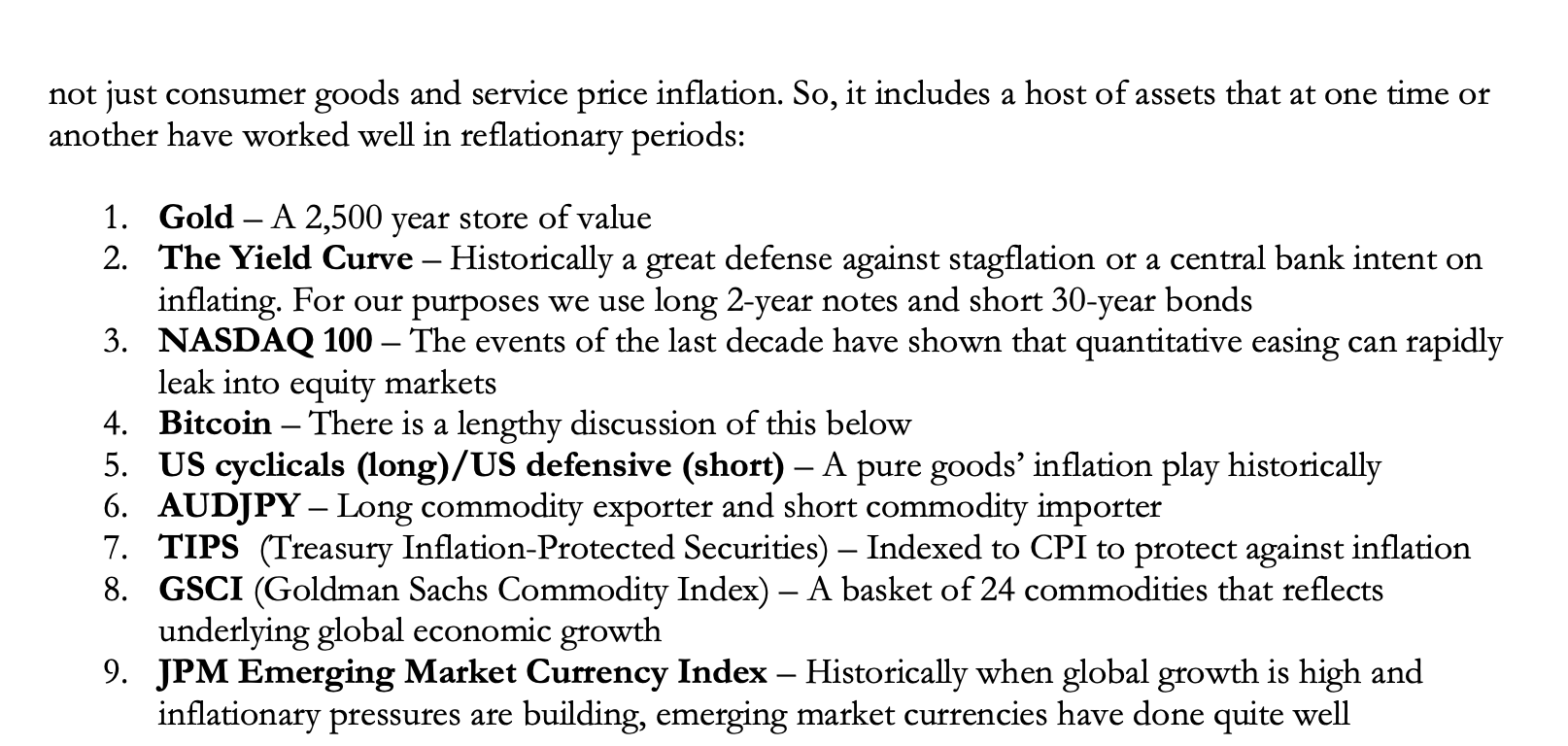

Here is a link to a similar analysis that Paul Tudor Jones published a few months ago called “The Great Monetary Inflation”. This topic is hugely important for all investors.

lopp.net/pdf/BVI-Macro-

https://financialpost.com/news/economy/canada-hastily-revises-core-inflation-on-methodology-concerns

Statistics Canada revised its measures of core inflation less than a week after receiving negative feedback over its methodological changes.

Revisions published Monday show price pressures are stronger than initially reported. They pushed the average of the Bank of Canada’s preferred measures of core inflation to a yearly increase of 1.77 per cent in January, from 1.5 per cent in the statistics agency’s initial release.

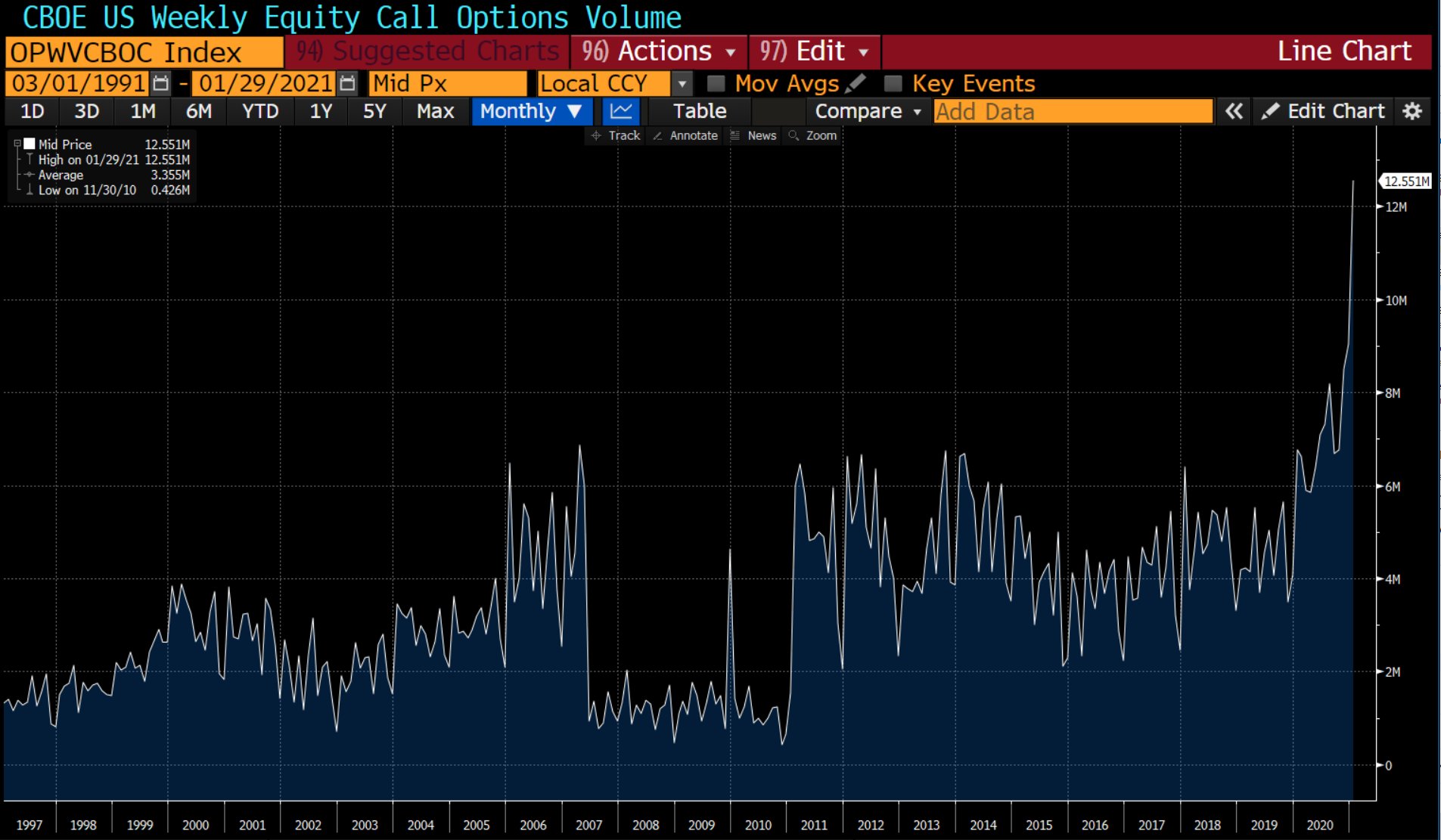

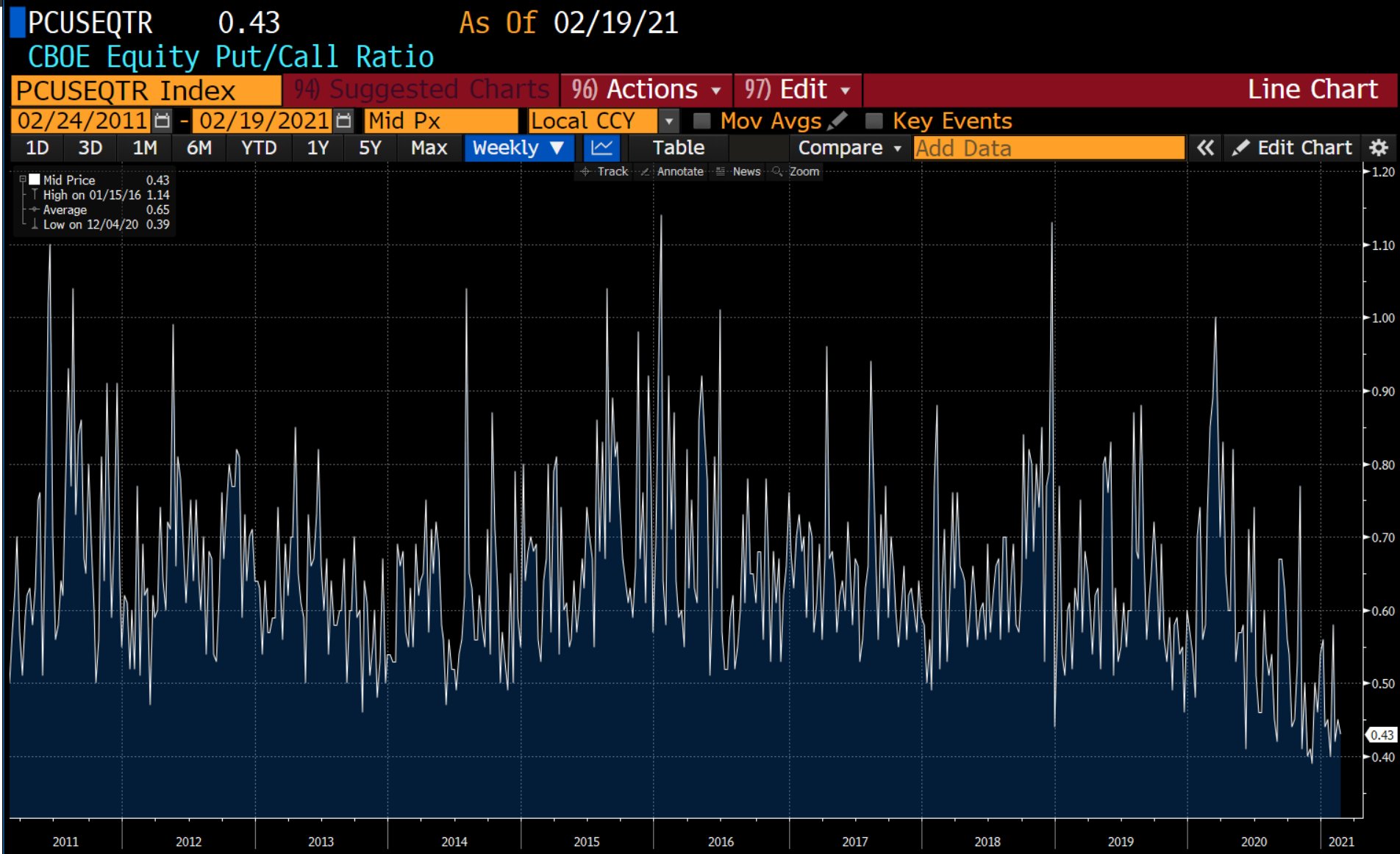

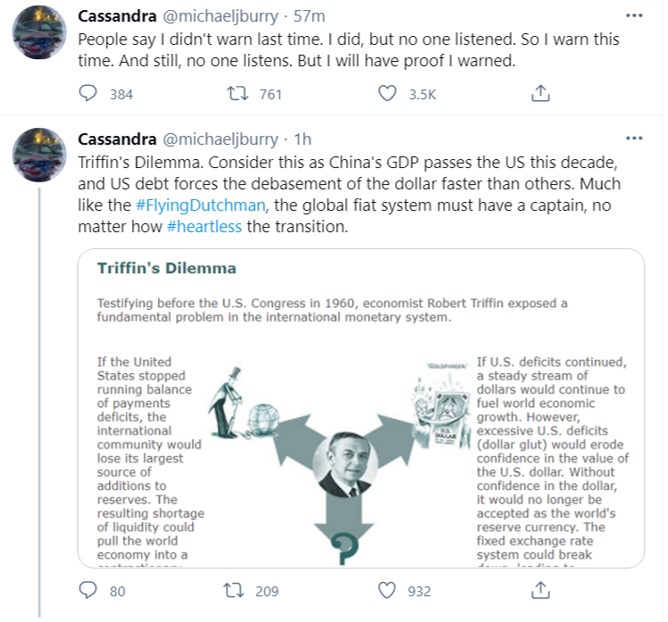

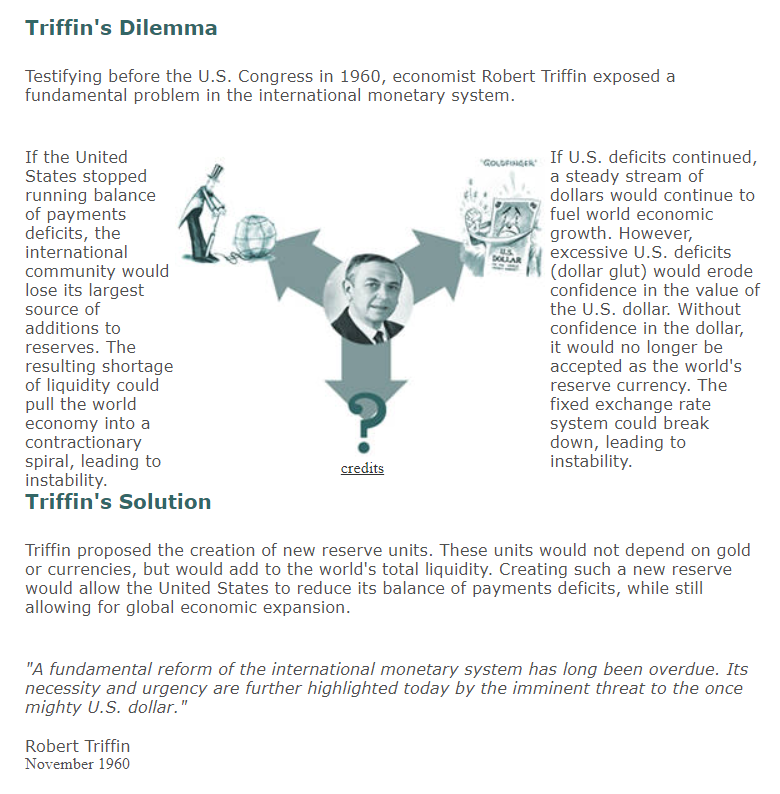

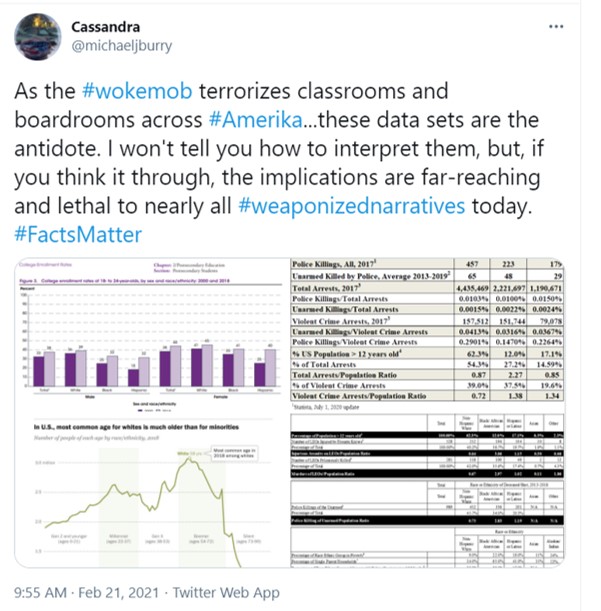

- 02/21/2021 – race, inflation and company bonds, call volume, put/call ratio, Triffin’s Dilemma on currency reserves

https://www.wsj.com/articles/companies-arent-saving-their-pennies-as-markets-turn-bubbly-11613750438?mod=markets_lead_pos12

“When dollars might as well be falling from the sky…management teams get creative and ultimately take more risk.. paying out debt-financed dividends to investors or investing in risky growth opportunities has beaten a frugal mentality hands down.”

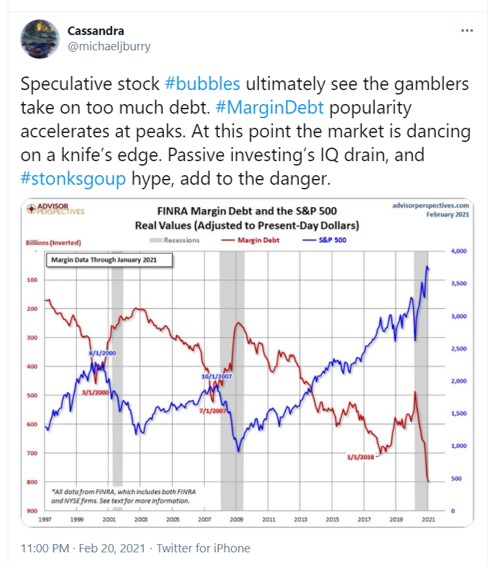

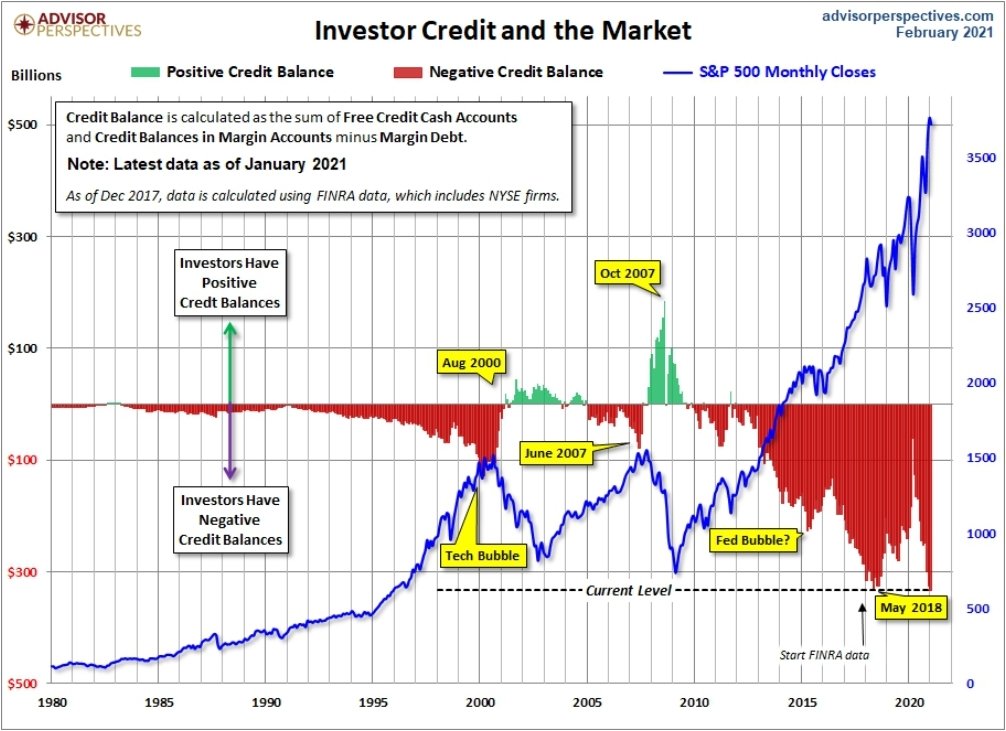

- 02/20/2021 – BTC, education in US, interest rate, inflation, human rights, margin debt

one follower’s comment:

Larry Feldman @LarryFeldmanNYC Replying to@michaeljburry

Larry Feldman @LarryFeldmanNYC Replying to@michaeljburry

Total margin debt is around 2% of the Wilshire 5000, lowest reading since 2008, but the spike from last year is noticeable as lockdowns encouraged retail trading of options, etc… Not sure if that just shows the larger impact of valuations vs history yardeni.com/pub/stmkteqmar

https://www.bbc.com/news/uk-55973215

https://www.bis.org/publ/work338.pdf

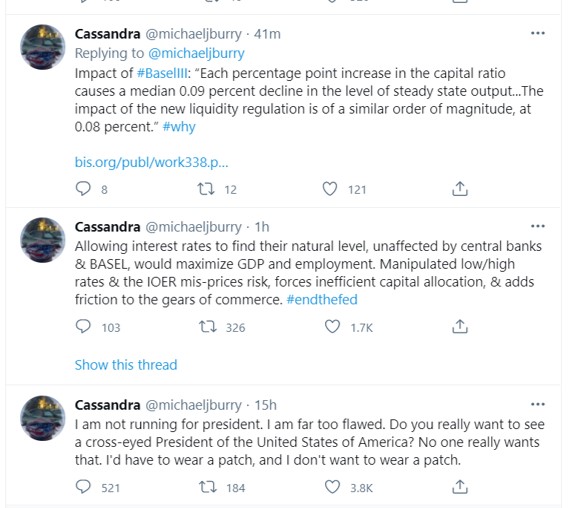

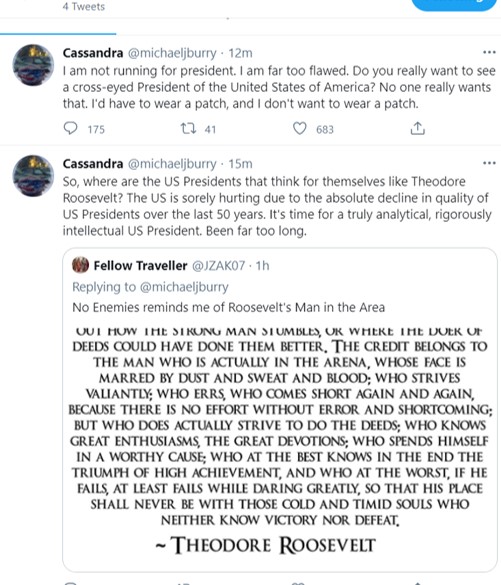

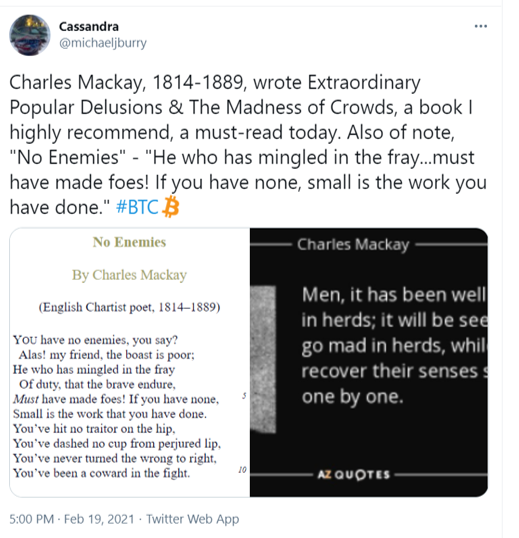

- 02/19/2021 – about US president, market madness and digital currencies

here is the book: https://www.gutenberg.org/files/24518/24518-h/24518-h.htm

The Rising Tide of Digital Currencies:

- The shift into online spending has been both massive and global.

- Current players in the payment space are taking action in the digital currency space as well. Following in the footsteps of Paypal (PYPL) and Square (SQ), Visa (V) is launching a pilot program to provide banks with crypto APIs that will allow their customers to purchase, hold and trade digital assets. Mastercard (MA) and the fintech company Island Pay

The pandemic accelerated the shift away from the physical world and into the digital world, and that digital world is rather poorly served by traditional payment systems like cash and checks, opening the door for digital payment solutions and digital currency alternatives. Last year stands in stark contrast to 2019, which saw global payment revenues grow by nearly 5%, bringing the total to just shy of $2 trillion, according to McKinsey & Co. In the first six months of 2020, online consumer spending was 30% higher than the same period in 2019, six times the annualized 2019 pace for the growth of online retail. The steep decline of in-person purchases and cash transactions saw ATM usage drop by nearly 50% in India in April 2020 and by 46% in the UK from March to July 2020. McKinsey estimates that cash transactions in the U.S. will have dropped from 51% of all transactions in 2010 to 28% in 2020.

The shift into online spending has been both massive and global.

Current players in the payment space are taking action in the digital currency space as well. Following in the footsteps of Paypal (PYPL) and Square (SQ), Visa (V) is launching a pilot program to provide banks with crypto APIs that will allow their customers to purchase, hold and trade digital assets. Mastercard (MA) and the fintech company Island Pay recently announced the introduction of a prepaid card that can instantly convert the Bahamas Sand Dollar CBDC to traditional Bahamian dollars to use in transactions.

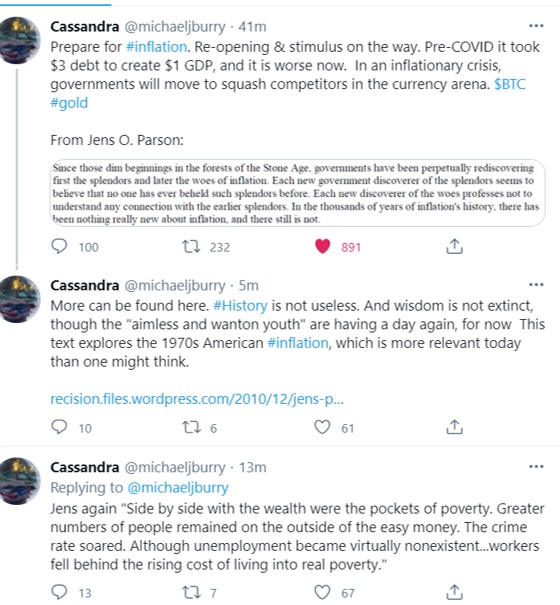

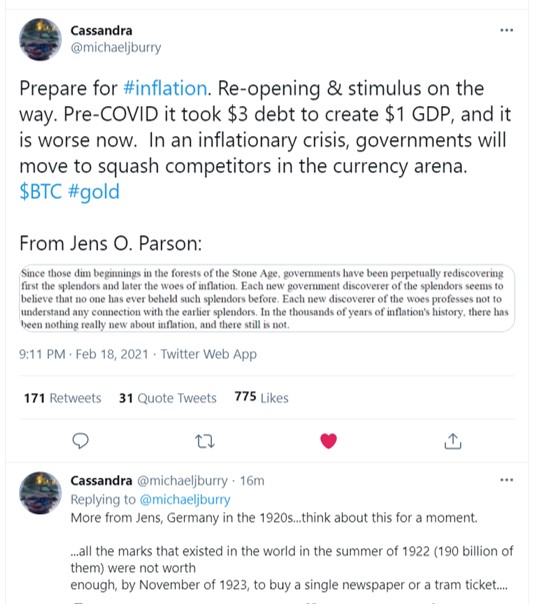

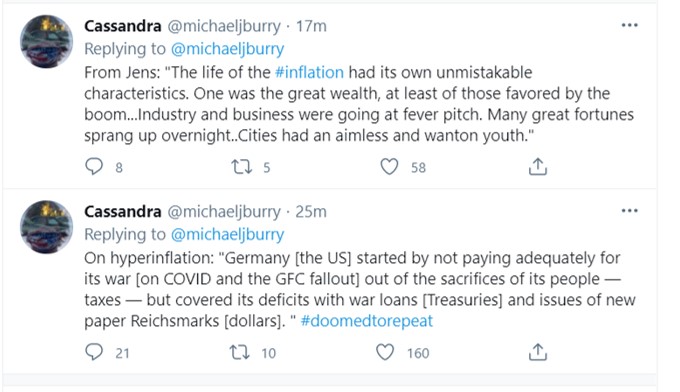

- 02/18/2021 – what should I prepare for the potential upcoming inflation? study history