Guru watch – Cathie Wood

- 02/24/2021 – same story like ARK? Years from now we may be asking the question… “Remember ARK?” just as we do the same today with Gerry Tsai’s Manhattan Fund, Tom Marsico’s Janus, Ryan Jacob’s Internet Fund, and Kevin Landis’ The Firsthand Funds.

- 02/09/2021 – Michael Burry on Cathie Wood – learn from history book

Shades of Gary Pilgrim and PBHG Growth from the 1990s, or Gerald Tsai and the Manhattan Fund in the 1960s. @ARKInvest is defining an era. If you know your history, there is a pattern here that can help you. If you don’t, you’re doomed to repeat it.

background on Gary Pilgrim

Pilgrim is considered an innovator in growth stock investing. Early in his career, he developed an aggressive style which utilized an unusually systematic method of identifying small, rapidly growing companies with the potential to beat quarterly earnings expectations, which would result in sharp upward movement of their stock price. He also exhibited little concern over high P/E ratios, and very little tolerance for companies that missed earnings estimates, resulting in relatively high portfolio turnover. This style, sometimes referred to as “earnings momentum”, is characterized by high volatility, with a tendency toward dramatic gains or losses.

Meanwhile, the fund’s assets under management had increased from about US$8 million in 1993 to US$5 billion in mid-1996. During Pilgrim’s peak popularity in 1996, Sheldon Jacobs, the editor in chief of The No-Load Fund Investor, stated “I have never seen a group that has done so consistently well.”[4] The October 1996 Kiplinger’s Personal Finance Magazine gave him the following review: “Forget Peter Lynch: Gary Pilgrim is the best stock picker of the past five years and the past ten.”[5]

Unfortunately for many investors who, in response to massive media attention, bought into the fund at this time, late-1996 to early-1999 was a difficult period for PBHG Growth as market trends turned against small growth stocks, even as the economy at large flourished. During this 10-quarter period, the fund struggled to break even, while the S&P 500 returned 95%.[6]

As the internet technology boom took off, however, PBHG Growth’s performance skyrocketed, returning 93% in 1999.[6] But with the economic downturn which began in early 2000, the fund, true to its volatile nature, began to fall precipitously, losing 34% in 2001 and 30% in 2002.

On November 20, 2003, both the Securities and Exchange Commission and New York Attorney General Eliot Spitzer filed charges against Gary L. Pilgrim, Harold J. Baxter, and PBA for civil securities fraud and breach of fiduciary duties.[9][10] Pilgrim was accused of allowing one of his friends, Michael Christiani, the manager of a hedge fund called Appalachian Trails L.P., to use a market timing strategy which rapidly traded shares of, among other funds, the PBHG Growth Fund. Though market timing is a legal and legitimate practice still in widespread use, it had begun to be considered potentially deleterious to buy-and-hold investors. In fact, at the time charges were brought in 2003, PBA had already expelled all market timers from its funds and had allowed no such activity since December 2001. There were no accusations or evidence of the illegal late trading which factored in other cases of the 2003 mutual fund scandal.

On November 17, 2004, the S.E.C. announced a settlement which forbade Pilgrim and Baxter from publicly denying wrongdoing, and required each to personally pay US$80 million while PBA would pay US$90 million, for a total of US$250 million. In addition, both Pilgrim and Baxter were permanently forbidden from employment in an investment-advisory capacity.[11]

Despite attempts to recover, the PBHG Funds brand was too badly damaged by the incident to remain viable. In 2004, PBA was renamed Liberty Ridge Capital by parent company Old Mutual. The PBHG Funds were absorbed into the Old Mutual Funds group, and Liberty Ridge Capital ceased operating in 2009.

- 02/08/2021 – warnings on ARK fund. if investors sold enough shares of ARK Innovation ETF to cause a $1 billion redemption, that would require 14.5% of the recent trading volume of its underlying holdings, on average, to change hands. Given ARK Innovation’s massive $25 billion in assets, “it is reasonable to worry about the market impact of $1 billion exiting the fund in a single day,” says Ms. Kashner. If a redemption of that size occurred, she says, “downward pressure on the fund constituents would be nearly inevitable.”

Cathie Wood Has Wall Street’s Hottest Hand. Maybe Too Hot.

ARK Investment’s money under management grew more than fivefold from March to the end of last year. But when funds get too big, too fast, they often can’t sustain their performance.

According to FactSet, 43.5% of ARK’s total equity holdings are in stocks of which the firm owns at least a tenth of all shares outstanding. At Vanguard Group, by contrast, only 9.7% of total equity positions are in such concentrated holdings.

If ARK ever needs to sell any of those holdings, who will buy in enough bulk to keep prices from collapsing?

At my request, Elisabeth Kashner, director of funds research at FactSet, analyzed the liquidity of ARK’s holdings. She calculates that if investors sold enough shares of ARK Innovation ETF to cause a $1 billion redemption, that would require 14.5% of the recent trading volume of its underlying holdings, on average, to change hands. For Vanguard Total World Stock ETF, by comparison, a $1 billion block sale would involve an average of only 0.6% of total trading volume in that fund’s stocks.

“Any selling of this kind is likely to be on a significantly higher-than-average volume day” in ARK’s holdings, says the firm’s chief operating officer, Tom Staudt. So ARK’s trades would likely be less of the resulting market-wide total than FactSet’s numbers imply, he says.

Given ARK Innovation’s massive $25 billion in assets, “it is reasonable to worry about the market impact of $1 billion exiting the fund in a single day,” says Ms. Kashner. If a redemption of that size occurred, she says, “downward pressure on the fund constituents would be nearly inevitable.”

- 02/04/2021 – great takes from Cathie Wood: EV market will grow from 20 millions sales in 2020 to 400 millions sales in 2025, big jump. US (Tesla) will lead EV market, following by China. Baidu will be China’s EV platform. BYD does well, ARK owns it. Bitcoin (the most secured crypto currency) is only $600 b so far, but this idea of digital currency is much bigger than Apple and Google, so market should be higher. Bitcoin is going to institutions and regulation will play a role on this, might be ease on this. We always look for Google trend on Bitcoin and found lots of searches in recent year.

Ark’s Cathie Wood breaks down her outlook on Tesla, the EV market, bitcoin, and crypto

- 12/31/2020 – Big ideas 2020 from ARK

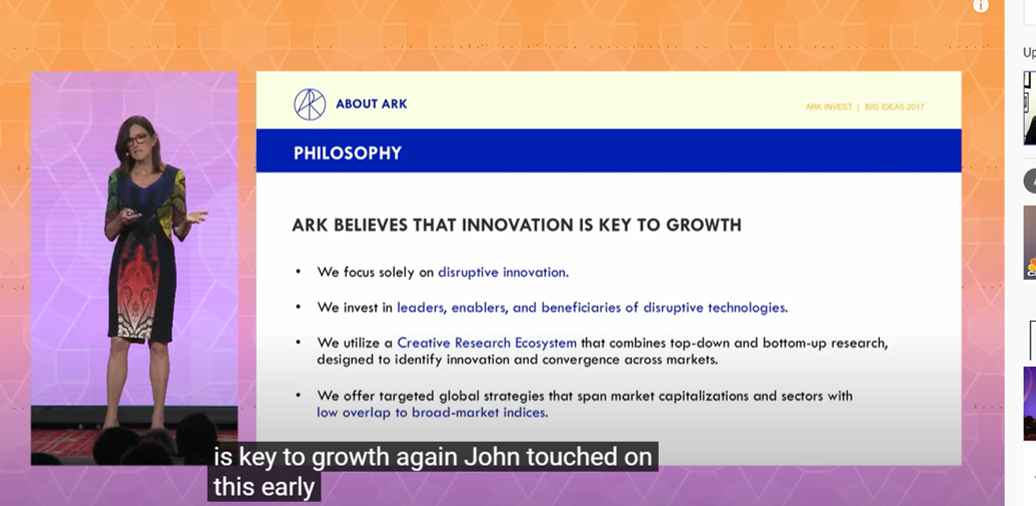

- 12/31/2020 – great to hear what she said in 2017, prophetic

Investing in Disruptive Innovation | Catherine Wood | Exponential Finance

5 big platforms: Genomic sequencing, robotic and automation, energy storage (battery technology), next generation internet (AI) and blockchain technologies

7 details technology areas:

How ARK invests?

- 12/30/2020 – great to know this outstanding lady

ARK Invest’s Cathie Wood Reveals Her Successful Playbook

“If you are buying into a vacuum of conventional wisdom … the potential to capitalize is enormous,” Wood told Investor’s Business Daily.

Follow Cathie Wood’s Winning Template At ARK Invest

Over her 40-year career, Wood, now in her 60s, rose to the top in the male-dominated world of Wall Street. ARK Invest upended the exchange traded fund (ETF) world.

Wood’s firm, which launched the first actively managed ETF six years ago, now offers seven ETFs. After crossing $5 billion in assets in June 2018, the firm now manages nearly $19 billion, according to ETF.com.

Its flagship fund, ARK Innovation ETF (ARKK), posted a 94% return this year, through Oct. 26, topping 99% of funds in its category, according to Morningstar. ARK Invest looks for big stock success stories in cutting-edge tech areas: DNA sequencing, robotics, artificial intelligence, energy storage and blockchain technology. The whole asset management industry is trying to catch up.

Hold Your Ideas With Conviction Like Cathie Wood

To be successful, Wood says, you need conviction in your ideas. Be proud of your work, even amid criticism like she got with her sky-high Tesla price target. “People would say, ‘Oh, my gosh, you were made fun of, you were ridiculed, they treated your research with derision,'” Wood said. “Those were the most exciting times for me because I always believe truth wins out.”

Drowning out naysayers and staying focused is a prerequisite for success, she says.

Brainstorm Your Way To Success Like Ark Invest

Finding emerging technologies and budding inventors who will change the world takes vision. Wood spends her days thinking about events that haven’t happened yet.

“I love figuring out how the world is going to work,” Wood said. “I think I understand how it works now. But how is it going to change? That is really exciting.”

Wood looks forward to every Friday at 10:30 a.m. That’s when Wood and her team of analysts — some half her age — assemble for a brainstorming meeting. She’s looking to gain an edge. And learn about things from her team that others don’t know.

“They are bringing the most interesting, provocative or controversial ideas they’ve heard all week,” Wood said.

Cathie Wood: Channel Your Curiosity

Wood emits boundless curiosity. As a kid, she never lived in one place long. Her dad, an Air Force design engineer, moved from base to base. And the family came along. By 12, she had moved 10 times. Wood spent time in England, Ireland (where both her parents are from), and Alabama, upstate New York, and California.

Adapting to change and embracing new things powers her. “You know how kids ask, ‘Why? Why? Why?’ I was probably one of those kids,” Wood said.

Like many young girls, Wood dreamed of being a ballerina. And curing cancer. “I didn’t do either,” she said. But what she did do was start a money-management firm that invests in companies with therapies that “will potentially cure cancer.”

Ark Invest Tip: Collaborate With Game Changers

You need to spend time with innovators to be on the cutting-edge yourself, Wood says.

Fostering new ideas is a core tenet at ARK Invest. To help spark innovative dialogue, ARK Invest gives its research to anybody who wants it. Wood treats research like “open-source software.” Not like top-secret dossiers. She posted her firm’s Tesla valuation analysis online.

“In the sharing economy world and the networking world, if you don’t give, you don’t get,” Wood said. You can’t succeed on your own, Wood says.

Wood vows by a team-focused management style. “You have to have a very collegial and collaborative group,” Wood said. “That’s the key from a cultural point of view. You don’t see any turf warfare at ARK. Putting the pieces of the puzzle together with each other is going to get us to the truth faster.”

Surround yourself with people trying to shape the future, she says. In fact, betting your future on old-line companies is riskier than joining with entrepreneurs and startups.

“What we’re doing is sizing up the opportunities innovators are going after,” Wood said. “Trying to figure how big they are. They’re reaching for the stars. But they don’t know how big the market is going to be. That’s what we do.”

Make Your Own Breaks Like Cathie Wood Did

In the first three years after opening ARK Invest, business was tough. Wood