I have missed 4,000% return on Bitcoin since I firstly heard this idea in Sept 2013 in Value Investing Congress in NYC. Cameron and Tyler Winklevoss presented this idea in the congress, however, I was too stubborn to stick to traditional value investing concept and fully ignored this idea. And I did not spend one minute to think at all. I am so stupid!!! Think about this, are the twin Winklevoss brothers stupid than me? They have committed $11 millions in Bitcoin, why I did not want to spend five minutes to study and understand the basic of it? So stupid I am!!!

I firstly heard this idea in Sept 2013 from Winklevoss’s presentation (presentation agenda Agenda VICNY13_Agenda_Final_Web), however, I chose to fully ignore this idea due to my stubbornness and did not pause-look-think.

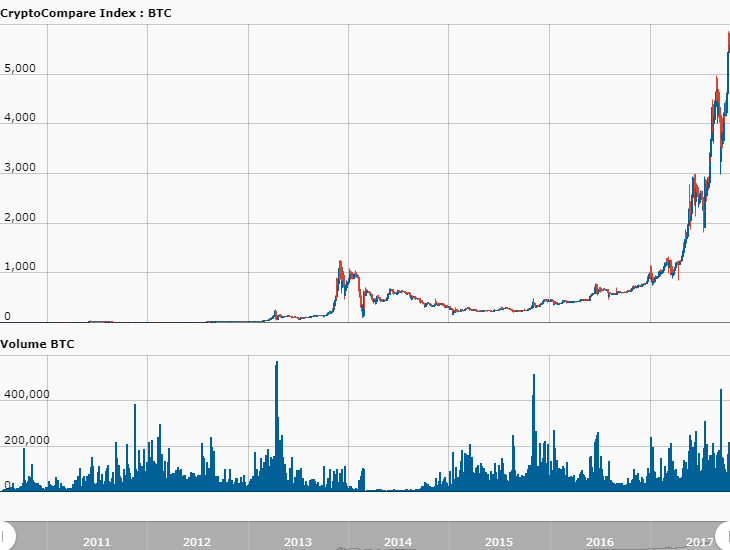

I therefore has missed ~4000 percent of return, see following graph.

The BIG lesson learned for me is always look for value, growth and innovation. Try to have an open and flexible mind to look for all kinds of ideas. Do not stubborn and arrogant. Try to slow down, stop-look-think.

If you’ve seen the movie The Social Network, then you’re familiar with Cameron and Tyler Winklevoss.

They’re the twin brothers who famously claimed to have come up with the idea for Facebook (NASDAQ: FB) only to have it allegedly stolen by Harvard classmate and eventual founder Mark Zuckerberg. The Winklevosses – or is it Winklevi? – subsequently sued Zuckerberg for the rights, eventually settling for a very large sum of money.

Today at the Value Investing Congress, Cameron and Tyler Winklevoss – co-founders of private investment firm Winklevoss Capital – came equipped with their latest idea: an ETF that tracks the price of bitcoin.

What is bitcoin? “A math-based asset that’s a store of value,” according to Tyler (or was it Cameron?). In plain terms, it’s an online form of currency created by a mysterious Japanese inventor Satoshi Nakamoto. His anonymity has something to do with the fact that creating such a currency is illegal on U.S. soil.

Bitcoin is a fixed supply of money – there will never be more than 21 million bitcoins in circulation at any time. The advantages of bitcoin versus, oh, say – a dollar? For one, it’s durable – it can’t fall out of your wallet or disintegrate in a pants pocket during a load of laundry. Because it’s on the Internet, bitcoin is also easy to store.

Can it be hacked? It hasn’t yet, Tyler says.

According to the Winklevosses, bitcoin can also act as a commodity. Like gold, it’s scarce because of the 21 million-bitcoin cap. It’s difficult to counterfeit. And it’s durable.

“A digital gold, or a gold 2.0,” Tyler boldly called it.

Another advantage of bitcoin is that it allows the owner to bypass the banking system, withdrawing money whenever they want and avoiding the risk of having their money stored in a bank that might not be “too big to fail.” Instead, it’s stored on a USB stick or in a digital “wallet” online.

Bitcoin can also be a hedge against inflation, the Winklevi insist. High inflation in Argentina and Zimbabwe have prompted citizens to trade in their money for bitcoin in recent months. With Fed tapering coming soon, bitcoin could also be a “hedge against the Fed,” Cameron says.

It’s especially big in China, which has the highest bitcoin usage of any country. In fact, the Chinese government – through the state-run CCTV station – has quite surprisingly all but promoted bitcoin as a form of currency.

Unlike PayPal, another digital payment system, bitcoin is not tied to the banking system.

So what does all that mean for investors? Cameron and Tyler think they have the answer in the bitcoin exchange-traded fund they invented.

Plain and simple, the ETF makes bitcoin more accessible to mainstream investors. The bitcoin market is currently $1.5 billion – with the potential to grow exponentially as it becomes a more common form of alternative currency.

Like bitcoin itself, the ETF is still in its nascent stages. The jury is still out on both.

One thing’s for sure, though: this time, the Winklevoss twins will DEFINITELY get credit for the invention.

2 Responses to A miss of an idea with 4,000% return due to my lack of pause-look-think