Workshop 04/02/2014

- Whitney Tilson’s talk: Ignore the “I miss it” trap. Buy it even though it doubles since it is still value stock.

E.g. Railroad, airline, car rental, Berkshire, Airline just got from horrible to mediocre, not great. But it is good for me to do hedge in my portfolio

HHC is Tilson’s largest stock position

Delta and MU are both business which was terrible, now becomes mediocre. So worth investing.

Stock price normally collapses due to earning, not due to the foundmentals

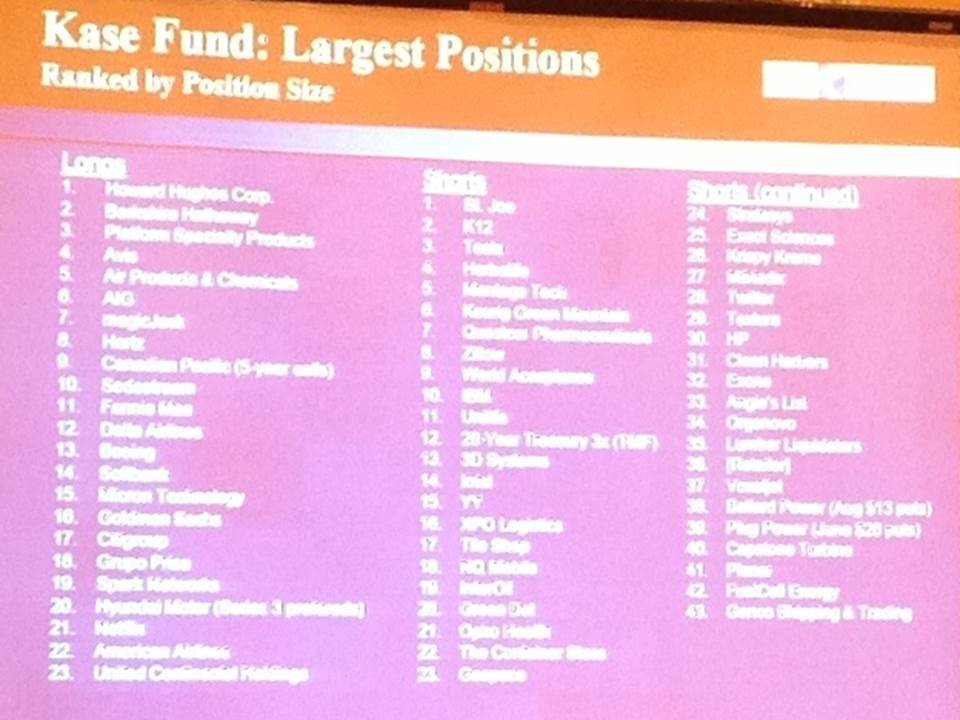

Tilson’s portfolio

Greenmountain lost patent protection one year ago, change the CEO from coca cola, so the stock price should be under pressure.

When you hold a short position, but when something significant change (like management), you need to think about change your position to long. E.g. Magicjack, GGP.

Nettalk is identical to magicjack in terms of technical, however, it is too late and too small.

Questions for tilson

1. Patent protection: it is a very general ip, they can charge loyerty on this in the future

2. Magicjack app

3. Do you think about become the board of director?

Congress

04/03

- 8:30- 9:05 Tim Eriksen, the road less traveled

Book: “the road not taken”

Buffet focused his first decade on investing in micro cap stocks

Idea: Awilco Drilling AWLCF and AWDR

Small cap with large div, ebida, very low ep compared with other competitors

- 9:05 – 9:40 Carlo Cannell, the iron ranch

Good Ideas: PCA, American concrete; “Exciting” ideas: microvision, violin memory, plug power

Boring but great ideas:

Iron ranch; MH industry – manufactured homes; BBW

Tonga partners, LP

Trace Manipulation of stock: follow form 4: to know when the manipulator quits

http://finance.wharton.upenn.edu/~allenf/download/Vita/stock.pdf

Human nature tries to speculation tab analysis, resist it.

- 9:40 – 10:15 Chris Mayer, investing by the CODE

Idea #1 mortgage services companies (e.g. Ocwen, etc) MSRs

CHMI, cherry hill mortgage inv corp

Partnership with Freedom

Idea #2 investing in NPLs in the EU

EU banks sit on $1 tril + in NPLs

Non-performing loan services

The big three: UK, Spain, Ireland

Kennedy Wilson Europe (KWE)

The Kennedy Wilson complex (KW)

- 10:35 – 11:10 Sahm Adrangi, kerrisdale capital’s top equity investment for 2014

Short idea: Bofl Holding Inc. (BOFI), trades at 4x TBV now, 23 PE

It is one of the most expensive publicly traded banks in the US

As its balance sheet grows, and its high- return asset rolls over, it’s profit will significant reduce.

It’s loan portfolio is going roll into lower yield.

It’s historical loan yields are focused on jumbo loan, currently, the competition on jumbo loan is very severe.

BOFI’s depositors are less “sticky”. As more Internet based competition heats up, it’s position is weakening. Organic account growth has stalled.

Large lenders: GE capital, Ally Financial, CIT

Us online banks: everbank, first Internet bank of Indiana

Online division of us banks:

Its NPLs leave investors with very asymmetric risk to the downside

200 basis point increases of interest will become 20% reduction on NPLs return

- 11:10 – 11:45, Tom Russo, global value equity investing

Musings on “perils of Wall Street”

Core investing principles:

Fifty cents dollar bills

Capacity to reinvest: goodwill is the gift that keeps on giving; international, the most promising venue

Capacity to suffer: management matters, family controlled companies

Semper Vic partners, L.P.

Major “global value” equity holdings

Bad ideas on Wall Street typically are not bad ideas at the start, but rather good ideas taken to extreme. – Warren Buffett

Wall street’s mistaken emphasis:

Research and development as a percent of sales

Working capital as a percent of sales

Cash flow conversion ratio

Percent of business from new products (within 3 years)

Percent of business from developing product and emergent markets

Avoid family-owned companies

Invest as though you are a pilot

- 11:45 -12:20 Whitney tilson, sodastream my next deckers

Sodastream

Beaten down stock with High short interest (over 40% of the float), great moat

Short thesis: it is a fad

After my survey of 393 responses, I concluded that it is not a fad

The company has 50 years of history. Integrated into Samsung refrig and kitchenaid

Risk: no much growth since the house hold penetration is already high, not much potential to grow. So maybe the price will not be doubled or more as I expected.

The PE ratio is inline with peers

Competitors: Keurig Cold (it does not exist), Bevyz

Two embedded franchises: Western Europe and the co2 refill business

- 1:40 – 2:15 Eric Anderson, focusing where others aren’t

Market cap less than $500 mil

Under followed companies with little to no sell-side coverage – no one is educating the market

Why are we so lucky to have this investment opportunities?

Ideas #1 forrester (FORR)

Leading technology research and advisory company

Product overview:

Business technology (52% of sales)

Marketing and strategies (47% of sales)

Fair price is 48.19/share

Downside is protected by buy back

Risks:

Sales transition takes longer than expected

Increased competition in marketing & strategy research

Idea #2 OFS Capital (OFS)

Large inside ownership

CEO owns >10%, external manager own 30%

Investment risks:

execution risk – target growing SBIC assets $20-30m per quarter

Idea #3 Hartmann (HART)

Leading egg packaging company

- 2:15 – 2:50 David neuhauser, Livermore partners

Deep value and special situation driven

Our process:

Deeply undervalued and special situation: matrices – DCF, price to book, price to earning, EV to

Bottom-up analysis

Year 2013 portfolio highlights

Volt information Science (VISI)

Trioil resource – activist position in Canadian junior energy company.

New ideas for year 2014

Zargon, grossly undervalued per NVP

- 2:50 – 3:25 Lisa Rapuano, finding your way along the many paths of value

Finding my way

“The most important quality of an investor is temperament” – warren Buffett

Use a probability framework to constantly evaluate business value

Use depth of research and long term view to invest

The ways:

Compounders:

Great company reduces price due to short term problem

Contrarian

Activist or management collaboration candidates

Compounders: what are them?

1 less frequently misprinted

2 sources of undervaluation

Contrarian investment: what are they?

Calibration – wide range outcomes – probabilistic dominates valuation

Temperament requirements:

Patience for the right entry price

Patience with the turnaround

Weirdness

Ability to handle criticism

Ability to stand alone

Resourcefulness

Humility

Contrarian patience and timing illustrated: coco, IL

Activist/engaged investments: what are they?

Contrarian investments with an investor-created catalyst

Opportunity to improve returns

Considerations for engaged investing

Cautions and temperament requirements

Ideas #1 Markel

A compounding machine

Best in class property and casualty (p&c) insurer outperforms peers and the stock market, with much lower volatility (beta =0.6)

Market value Markel on BV, so stock will grow roughly with BV

Idea #2 bed, bath and beyond (BBBY)

Not a declining retailer

Established merchant with a “see-it-before-you-buy-it” assortment

- 3:45 – 4:20 Richard Lashley, a shareholder activist’s perspective on bank stocks

Post financial crisis recovery

There will be m&a boom

Bank stocks are cyclical – downturn is sharp and short, upside is long

Industry fundamentals are almost back to per-crisis level

Despite the rebound since 2009, small and mid cap bank and thrift stock valuations are still historically attractive

Median price/TBV is still 25% lower than historical high

Cost save adjusted M&A are historical attractive which will drive the boom of M&A

PL capital prefers JPM Tarp warrant, JPM.ws

Also the capital one tarp warrant (Coe.ws)

And PNC financial tarp warrants (pnc.ws)

Small cap bank stock

Metro Bancorp, inc (METR)

It lags its peers in proficiency

Despite this, it has a valuable franchise, a lot of potential buyers line up. Likely buy price: $27-30.

Horizon Bancorp (hbnc) – potential deleted from Russel 2000, buy a lot when it is deleted!!!!

Interest Bancshares (IBCA) – potential deleted from Russel 2000, buy a lot when it is deleted!!!!

- 4:20 – 4:55 Richard Pearson, some interesting situation, the sleuth of Wall Street

Focus on small-cap

Dream team group

Media mentions and small cap stocks

The phenomenon

Organovo equity prospectus

Unipixel

Lesson from unipixel

Lot78, stock from $1 to $24 in 2 weeks, then back to $0.5 in six months

Reasons to short ONVO

Breakdown of ONVO assets

A stock in search of a company

ONVO 1.0- selling 3d bio printers

2.0 – selling liver tox assays

3.0 – testing service model

4.0 manufactured human organs

A strong share price, in one year, $3 to $12

Quarterly R&D in perspective: $1-2 mil

Business announcements

Investor conference announcements

Analyst initiation = 50k

JPM is placement agent for it

Independent articles

Motley fool

Seeking alpha, etc

What do these article say?

Rumors, lies

Articles driving the price

Insider selling begins: automatically sell the stocks

Risks: current cash + capacity

$50 mil in cash at present

ONVO 5.0 anything is possible

4:55 – 5:30 Daniel miller, investing with conviction

Overview of Gamco investors (GBL)

Investment process

Open communication with management

Why buy with 60th best idea?

Ideas in sept 2013

realD (RLD), up 63.6%

Guidance software, up 27.7%

Internap, up 7.5%

Two new ideas on April 2014

Idea #1 Bon-ton stores (BONT)

2015 revenue: $2900 mm

2015 ebida: $200mm

X6.5

———————————–

PMV per share $23

Idea #2 Rowan companies (RDC)

2011 transformation

PMV per share = $43.50

04/04 second day of the congress

- 8:10 – 8:50, Eric Sprott, investment opportunity of your lifetime

Manipulation

BaFin, the German equivalent of the SEC, said that precious metal price was manipulated than LIPOR.

gold manipulation

Book “the gold cartel” by Dimitri Speck

Gold fix study by stern business professor shows signs of decade of nabk manipulation (Bloomberg)

Western central banks have no gold left

China net import: 1700 tons

World mine supply: 2300 tons (ex. China & Russia)

- 8:50 – 9:25 issac Schwartz, hidden in plain sight

Kazakh bank system

Loan and credit historical trend

Timeline of Kzakh banks

On the ground floor of global growth

Idea # 1 Company: Tarkett (TKTT)

Deconick family owns 50% of the stock

Globally consolidated

Average PE is 23.1, Tarkett is now 15.8

Two thirds share in most popular category, vinyl

Anticipated margin improvement

North America: if these floors could talk

Mostly residential until 2012

Sports surfaces and other aspects

Guide to naysaying

Russia/CIS is a troubled region deserving a low multiple

USA commercial recovery distant

Sports is a bad business – just look at the last decade

Russian growth can continue

North America

Tarkett’s potential

Multiple paths to 50% ebida growth in five years

Family did not sell in ipo

- 9:25 – 10:00 David Hurwitz, opportunities for activism in Korea

Korea GDP ranks 15th in the world, Total market cap Korean companies, Numerous cheap stocks in Korea, PE is 9.6, p/BV is 1.1, Warren Buffett loves Korean stocks, If I started my partnership now, I will be 100% in Korean stocks, Korea is not Japan, Difficulties of investing in Korea, Few companies report in English, Trading I’d required, Recent accounting change from Korean GAAP, Shareholder activism not yet widely embraced, Rights of minority shareholders in Korea

Companies

Past cases study:

Kukbo design co., ltd; Khomeini corp.

Case study

Samho development (010960); Ktcs corp

- 10:25 -11:00 Michael Kao, the Tao of asymmetric investing

GM distressed bond

GM milque is a 3 bagger

Fnma and Freddie mas pref

Today’s idea

A small-cap E&P common equity

The company is Tag Oil

We think of TAO CN equity as having a profile similar to distressed bond + multiple event options

Profile of a convertible bond

“Distressed bond” component

“Event option” component

Valuation

Base 102% upside; mid 340% upside; high 3040% upside

Recent event, marked with stock price figure

Why is is trading in deep value territory?

Disappointed production numbers in the past few quarters

Apache pull out of JV

Intrinsic and market value divergence creates asymmetry

Risks:

Commodity price risk

Potential environmental opposition to unconventional drilling

11:00-11:35 chan lee and Albert young, in search of hidden champions in South Korea

Macro environments:

Korea has achieved remarkable economic achievements

Strong fiscal position

Korean education

Exceptional infrastructure

Leading Korean companies in the world

Hidden champions from Korea: line; sm entertainment; Orion; amore pacific; hjc

Strong economic outlook

Summary

Korea is no emerging market; is a long term global powerhouse.

Ideas #1

Nexen tire (002350)

Established in 1958, manufacturing automotive tires

It is one of the fastest growing tire company in the world

Tire CP672 ranks third among 20 tires in the US consumer report

Global presence

Production capacity: cagr 13%

State of the art facilities

Growth in global market

Global market share: 0.8%

Financials, income statement

Valuation: $15.35

Nexen highlights

Alternative

Preferred stock, 60% discount to common stock

Idea #2 nexen corp., the holding company of nexen tire (40% holding)

Ticker: 005720:KS

- 11:35-12:10 John Lewis, value: 180 degrees from north to south

Research process:

– Value creation

Low value, growth ability, capital allocation

– quality business model

Porter’s five forces

User experience

High quality attributions

– capital structure and ownership

Strong balance sheet

Ownership mentality

Idea #1 tucows inc. (TCX)

Excellent CEO

Strong capital allocator

No analyst coverage

Opensrs

Godaddy ipo in q314

What is the domain services business worth?

Ting

Us telecom industry ripe for disruption

Significant growth, subscribers are up 380% YOY

Ting’s return on capital

Valuation $9-12

Valuation of TCX: $22

Idea #2 Rosetta Stone

Perception:

– losing market share to free products

– dying cd business

– low margin business

Reality

When will the market recognize value?

Adobe at 8x sales

Rosetta: 0.5x sales

Hidden value: global E&E business

Subscription business is the hidden gem

What is the E&E business worth?

At 3x Enterprice & education 2014 sales alone, RST is worth over $21 per share

Pipeline in place to drive future growth

New institutional and consumer product

Buying strategic assets at good prices

Livermocha (12/11/2013)

Lexia learning (08/01/2013)

Capital allocation

R&D bet

Share repurchase 08-22-2013

Consumer business is transforming

Valuation of RST: $28.90, 150% upside

Idea 2 intersections inc

Big inflection point?

No analyst coverage

New business matrics

Massively misunderstood

Three key business

Valuation $12

Value of identity guard at 15x ebida is $6.5

Value of voyce $0.6 – 2.88

Management has demonstrated a strong ability to achieve guidance

Management expects significant growth

- 1:30-2:05 Zeke Ashton, apples to apples

Anatomy of a bubble

PE, profit margin, sales growth/share, yield

Surviving the bear

Jan 2000 – July 2002, sp500 down -38.6%, Nasdaq -67.2%

Deja vu all over again

Fb to pay $19 bil for whatisapp

Echoes of the past:

Yahoo acquire broadcast for 6.5 bil

What were you thinking?

Subsystem

Perils of paying 10x sales

Bill fleckenstein, thestreet.com

The road to nowhere

What exactly are the implications of paying 10x sales for a group of stocks?

The usual suspects

Opposite ends of the value scale

Tesla – bad apple

BMW – good apple

Tesla vs BMW

Sales outstanding

Price

Sale volume

Sale growth rate

Revenue

Net profit/loss

Gross margin

Operating cash flow

Tesla margin mystery

Operation cash flow excluding regulatory credits is $63 mil; BMW enters the EV market

BMW finances a hidden asset which is better than M&T bank

Capital intensive business

Tesla: likely to be FCF negative for many years as it invests for future growth

Will likely to spend $15b to reach capacity of 300000 cars per year

Buy BMW at 25% discount; BMW is faily controlled; Common stock €92, 2.8 div yield

Preferred €68, high dividend; Can tesla growth into its valuation?

- 2:05-2:40 Daniel ferris, the best royalty investment in the world today

Altius mineral

3000-5000 small mining exploration stocks

1 in 3000 prospects becomes a mine

What is the prospect generator?

Trades intellectual capital for physical capital

Capex lite business model

When it works

Voisey Bay Royalty

Upside potential: Kami project

A transformative deal

Excellent royalty portfolio

Financing

- 2:40-3:15 arnaud Adler, investing in change

Activism: the art of influence

Proxy fight

Negotiated settlement

Public letter

Private letters

Informal communication

Security selection

High free cash flow yield

Multiple ways to win

Operating margins are too low

Poor capital allocation

Idea#1 hill international, inc (HIL)

Global project management firm

Founder and CEO of the company, combined ownership 30%

Why do we like the business?

High barrier to entry

Expense low

Agency model (low risk) vs contractor model (high risk)

Low capex

Hgh ROIC

Valuation:

Why is the stock undervalued?

– Most analysts do not use an appropriate peer group (no good US peer)

Project management firms

Startec

WSP global

Arcadia NV

WS Atkins

tetra tech

– Libyan receivables

– leveraged

Catalyst – time

Potential return 80% in early 2015

Idea generation

Typical multiple based search

Special situations

13D from strategic buyer – o’charley’s (chux)

13D from private equity – Michael Baker (BKR)

Annual meeting delay – J. Alexander’s Corporation (JAX)

What is the upside?

Is it a good risk award situation? $8 today – one year been acquired $13, Two years $19