Since August 3, 2009 when Robert H. Benmosche was elected by AIG board to be President and Chief Executive Officer, Mr. Benmosche has promised to revive AIG. He said “when I first came on board as AIG’s CEO in August, I held a series of meetings with our management and employees throughout the company. I told them that I was a builder, not a liquidator. I also noted that I believed that AIG was too big, too diverse, and not too transparent enough, and that we were going to have to create more discrete businesses. This is the only way we can create fair value for what are indisputably outstanding businesses, with strong, often unique franchises, distribution networks, product offerings, and experienced staff built up over many years.”

So how is AIG doing so far? To answer this question, let us look back what did the CEO of AIG promise to accomplish and what are the current outcomes?

Here is the going forward plan laid out in March 2010:

http://www.aigcorporate.com/aboutaig/march2009_present.html

Highlights from the plan (italic texts are the progresses/outcomes as of today)

1. We will be a smaller and more focused company than in the past. The only way we can repay taxpayers is to divest parts of the organization, and we are.

Below is a list of announced business sales agreements, closings and other developments since September 2008:

- 03.26.12: ILFC ANNOUNCES PROPOSED $550 MILLION SENIOR SECURED TERM LOAN

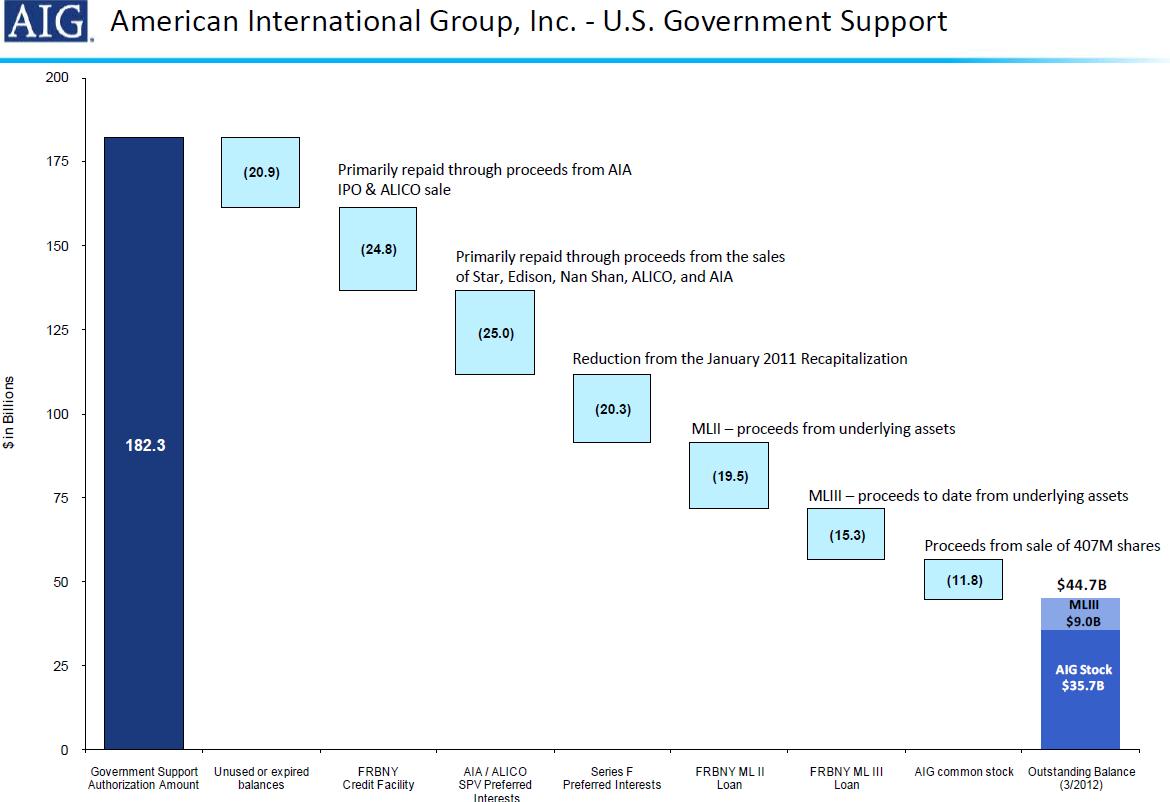

- 03.22.12: AIG PAYS DOWN IN FULL PREFERRED INTERESTS IN AIA SPV; TOTAL U.S. GOVERNMENT INVESTMENT IN AIG CUT BY 75 PERCENT SINCE 2008

- 03.07.12: AIG ANNOUNCES U.S. DEPARTMENT OF THE TREASURY LAUNCH OF OFFERING TO SELL UP TO $6 BILLION OF AIG COMMON STOCK

- 03.05.12: AIG ANNOUNCES PRICING OF SALE OF ORDINARY SHARES OF AIA GROUP LIMITED

- 11.07.11: AIG ANNOUNCES INTEREST RATES OF NEW SENIOR NOTES OFFERED IN EXCHANGE FOR OUTSTANDING JUNIOR SUBORDINATED DEBENTURES

- 11.03.11: AIG Board of Directors Authorizes Repurchase of up to $1 Billion of AIG Common Stock

- …….

- Recapitalization: AIG executed on January 14, 2011 the first part of its recapitalization plan with the U.S. government to repay all its obligations to American taxpayers, including repaying the Federal Reserve Bank of New York Credit Facility, applying proceeds from the AIA IPO and ALICO sale to the government’s ownership interest, and converting U.S. Treasury Department’s holdings to AIG common stock. COMPLETED January 14, 2011

- ALICO: On November 1, 2010, AIG completed its sale of ALICO to MetLife for approximately $16.2 billion ($7.2 billion in cash and the remainder in securities of MetLife). CLOSED November 1, 2010

- AIA IPO: On October 29, 2010, AIG sold, in an initial public offering, 8.08 billion shares (or 67%) of AIA for approximately $20.51 billion. IPO COMPLETED October 29, 2010

- Nan Shan: AIG announced on January 12, 2011 an agreement to sell its 97.57 percent interest in Nan Shan Life Insurance Company, Ltd. to Taiwan-based Ruen Chen Investment Holding Co., Ltd. for $2.16 billion in cash (subject to regulatory approval).

- Star and Edison: AIG announced on September 30, 2010 a definitive agreement to sell its Japan-based life insurance subsidiaries, AIG Star Life Insurance Co., Ltd. and AIG Edison Life Insurance Company, to Prudential Financial, Inc., for

a total purchase price of $4.8 billion, comprising $4.2 billion in cash and $0.6 billion in the assumption of third-party debt. AIG will retain and continue to grow its general insurance business in Japan. AIG expects the sales to close prior to the end of the first quarter of 2011. CLOSED February 1, 2011 - American General Finance: On November 30, 2010, certain funds managed by Fortress

Investment Group LLC and affiliates acquired 80 percent of American General Finance Inc. (AGF), a leading provider of consumer credit, from AIG. AIG retained a 20% interest in the AGF business. CLOSED November 30, 2010 - PineBridge Investments: AIG announced on September 5, 2009 that it had entered into an

agreement to sell a portion of its investment advisory and asset management business to Bridge Partners, L.P., a company owned by Pacific Century Group (PCG), the Hong Kong-based private investment firm. PCG paid $277 million at

closing, and AIG expects to receive additional future consideration that includes a performance note and a continuing share of carried interest. AIG is retaining its in-house investment operation that oversees approximately $509 billion of assets under management. CLOSED March 26, 2010 - AIG (Finance) Hong Kong Limited: On August 12, 2009 AIG announced that it had entered into an agreement to sell 100 percent of its shares of AIG Finance (Hong Kong) Limited (“AIG Finance”) to China Construction Bank Asia for $70 million in cash, subject to typical closing adjustments, plus the repayment of intra-group indebtedness and deposits of approximately US$557 million. CLOSED October 29, 2009

- AIGFP Completes Disposition of Energy and Infrastructure Portfolio: On August 11, 2009

AIG Financial Products announced that it had completed the sale of its energy and infrastructure investment assets, realizing aggregate net proceeds in excess of $1.9 billion. This disposition effort, which began during the fall of 2008, concluded with AIGFP’s sale of its lease equity interest in the Bruce Mansfield power generation plant operated by FirstEnergy Corp. The Mansfield sale follows recent closings of three other sales: a tax equity interest in the Stanton wind farm in west Texas and two lease equity interests in portfolios of rail cars operated by BNSF Railway Company. CLOSED August 11, 2009 - AIG Consumer Finance Operations in Poland: On July 29, 2009, AIG announced that it had entered into an agreement under which it will combine its consumer finance business in Poland, conducted through AIG Bank Polska S.A., into the Polish consumer finance business of Santander Consumer Finance S.A., which is conducted through Santander Consumer Bank, S.A. (SCB). In exchange, AIG will receive a 30% equity interest in SCB. At closing, all of the AIG intercompany debt facilities related to these entities will be repaid, and AIG will not be responsible for the future funding of the combined consumer finance businesses.The acquisition of 99.92% of AIG Bank Polska was completed on June 8, 2010. CLOSED June 8, 2010

- U.S. Life Insurance Premium Finance Portfolio: On July 28, 2009 AIG announced that it had completed the sale of a majority of the U.S. life insurance premium finance business of AIG Credit Corp. and A.I. Credit Consumer Discount Company (A.I.Credit) to First Insurance Funding Corp. (FIFC), a subsidiary of Wintrust Financial Corporation of Lake Forest, Illinois, for approximately $679.5 million in cash. If certain conditions are met, FIFC will purchase certain

specified additional life insurance premium finance assets for $61.2 million. CLOSED July 28, 2009 - AIG consumer finance operations in Colombia: AIG announced on July 1, 2009 that it had agreed to sell its consumer finance operations in Colombia, consisting of Inversora Pichincha S.A. and Interdinco S.A., to Banco Pinchincha C.A. of

Ecuador and other parties. CLOSED March 24, 2010 - AIG Credit Card Company (Taiwan) Limited: AIG announced on June 30, 2009 that it had entered into an agreement to sell the assets of AIG Credit Card Company (Taiwan) Limited to Far Eastern International Bank. CLOSED August 31, 2009

- AIG consumer finance operations in Russia: AIG announced on June 29, 2009 that it had entered into an agreement to sell its consumer finance operations in Russia, consisting of OOO AIG Bank (RUS), to Banque PSA Finance SA, a 100 percent-owned subsidiary of PSA Peugeot Citroën Group. The transaction is subject to the satisfaction of certain conditions, including approval by the Central Bank of Russia. CLOSED September 11, 2009

- AIG consumer finance operations in Mexico: AIG announced on June 24, 2009 that it had entered into an agreement to sell its consumer finance operations in Mexico, consisting of AIG Universal, S.A. de C.V., SOFOM E.N.R. and Markcenter Services, S. de R.L. de C.V., to Desarrollo de Negocios Integrados, S.A. de

C.V. and Inversiones DNI, S.A. de C.V., companies related to Afirme Groupe Financiero and Consorcio Villacero. CLOSED July 17, 2009 - Transatlantic Holdings, Inc.: AIG announced on June 10, 2009 that it had closed the

previously announced public offering of 29.9 million shares of Transatlantic Holdings, Inc. (TRH) common stock owned by AIG and its subsidiaries in an underwritten offering for gross proceeds of $1.136 billion. On March 15, 2010,

AIG announced that had closed a secondary public offering of 8,466,693 shares of TRH common stock owned by American Home Assurance Company (AHAC), a subsidiary of AIG, for gross proceeds of approximately $452 million. - AIG consumer finance operations in Argentina: AIG announced on June 2, 2009 that it had entered into an agreement to sell 100 percent of its shares in its consumer finance operations in Argentina, consisting of Compañía Financiera Argentina S.A. (CFA), Cobranzas y Servicios S.A. and AIG Universal Processing Center S.A., to Banco de Galicia y Buenos Aires S.A. and an investment group arranged by Grupo Pegasus. The transaction is subject to the satisfaction of certain

conditions, including approvals by the Argentine Central Bank and the Argentine National Commission for the Defense of Competition. CLOSED June 24, 2010 - AIG Otemachi Building in Tokyo: AIG announced on May 11, 2009 an agreement to sell its prime real estate holding in Tokyo , The AIG Otemachi Building, for approximately

$1.2 billion in cash (¥115,500mm) to Nippon Life Insurance Company. The property includes approximately one acre of land on which the building is situated. CLOSED May 28, 2009 - 21st Century Insurance Group: AIG and Zurich Financial Services Group (Zurich) announced on April 16, 2009 an agreement to sell 21st Century Insurance Group, the wholly owned subsidiaries comprising AIG’s U.S. personal auto insurance business, to Farmers Group, Inc. (FGI), a subsidiary of Zurich . Under the terms of the transaction, FGI paid AIG $1.9 billion, consisting of $1.7 billion in cash and $200 million in face amount of subordinated, euro-denominated capital notes backed by Zurich Insurance Company, Zurich ‘s principal operating unit. FGI also assumed 21st Century’s outstanding debt of $100 million. CLOSED July 1, 2009

- Interests in Spanish solar photovoltaic plants: AIG Financial Products Corp. (AIGFP), an AIG company, reported in March 2009 that it closed the sale of its interests in three operating Spanish solar photovoltaic plants from its energy and infrastructure book. The plants have a combined capacity of 35.4MWp. HG Capital, a London-based private equity firm focused on renewable energy, acquired AIGFP’s interests. CLOSED March 18, 2009

- Assets from AIGFP’s energy and infrastructure book: AIG Financial

Products Corp. reported on Feb. 13, 2009 that it closed the sale of its interests in two transactions and related commodity hedges from its energy and

infrastructure book of business for total net proceeds of $60.5 million. CLOSED

February 13, 2009 - AIG Retail Bank and AIG Card Thailand: Bank of Ayudhya Public Company Limited (BAY) and AIG announced an agreement on February 5, 2009 under which BAY would acquire AIG Retail Bank Public Company Limited and AIG Card (Thailand) Company Limited. Under the terms

of the agreement, BAY acquired 99.5% of shares of AIG Retail Bank and 100% of AIG Card (Thailand) for a total consideration of Baht 2.055 billion or $58.7 million (subject to closing valuation adjustment). In addition, inter-company

loans totaling $477 million from AIG were repaid at closing. CLOSED April 8, 2009 - AIG PhilAm Savings Bank, Inc. (AIGPASB), PhilAm Auto Finance & Leasing, Inc. and PFL Holdings, Inc: East West Banking Corporation (EastWest Bank) and AIG announced on January 23, 2009 that they and certain of AIG’s subsidiaries, including Philippine American

Life and General Insurance Company (Philamlife) and AIG Consumer Finance Group, Inc., entered into a Share Sale Agreement for EastWest Bank to acquire all of the shares of AIG PhilAm Savings Bank, Inc. (AIGPASB), PhilAm Auto Finance

& Leasing, Inc. and PFL Holdings, Inc. CLOSED March 16, 2009 - AIGFP’s commodities index business: UBS Investment Bank announced in January 2009 that it entered into a binding agreement to purchase the commodity index business of AIG Financial Products Corp., including AIG’s rights to the DJ-AIG Commodity Index. This commodity index business is comprised of a product platform of commodity index swaps and funded notes based on the benchmark Dow Jones-AIG Commodity

Index (DJ-AIGCI). $15 million of the purchase price was paid upon closing, with additional payments of up to $135 million payable over the following 18 months based upon future earnings of the purchased business. CLOSED May 7, 2009 - AIG Life of Canada: AIG announced in January 2009 an agreement to sell AIG Life Insurance Company of Canada to BMO Financial Group. AIG Life of Canada, headquartered in Toronto , Canada , offered a wide range of insurance and wealth products, including universal life and term life insurance plans, critical illness plans, permanent plans and immediate annuities. Under the terms of the transaction, BMO acquired AIG Life of Canada for approximately C$375 million (or approximately US $308 million) in cash, subject to any change in net worth between September 30, 2008 and closing. CLOSED April 1, 2009

- HSB Group: AIG announced in December 2008 the sale of its wholly owned subsidiary HSB

Group, Inc. (HSB) to the Munich Re Group. Under the terms of the transaction, Munich Re acquired 100% of the outstanding shares of HSB Group, a leading worldwide provider of equipment breakdown and engineered lines insurance and

reinsurance, for $742 million in cash and assumed $76 million of outstanding HSB capital securities. CLOSED March 31, 2009 - AIG Private Bank: AIG announced in December 2008 an agreement to sell AIG Private Bank Ltd. to Aabar Investments PJSC, a global investment company based in Abu Dhabi. Under the terms of the agreement, Aabar paid AIG approximately $253 million for the entire share capital of AIG Private Bank, and purchased and assumed approximately $55 million of intra-company loans outstanding to AIG Private Bank. CLOSED April 16, 2009

- Tenaska: AIG and Tenaska, Inc., announced in December 2008 that Tenaska would repurchase the 50% interest in Tenaska Marketing Ventures, Tenaska Gas Storage and Tenaska Marketing Canada (collectively, TMV) owned by affiliates of AIG Financial Products Corp. (AIGFP). CLOSED December 31, 2008

- Unibanco: União de Bancos Brasileiros S.A. (Unibanco) and AIG announced in November 2008 an agreement to repurchase each other’s shares in two Brazil joint ventures: Unibanco AIG Seguros S.A. (UASEG) and AIG Brasil Companhia de Seguros (AIG Brasil). CLOSED November 26, 2008

In sum, AIG has made significant progress in its plan to meet its obligations to the U.S. government.

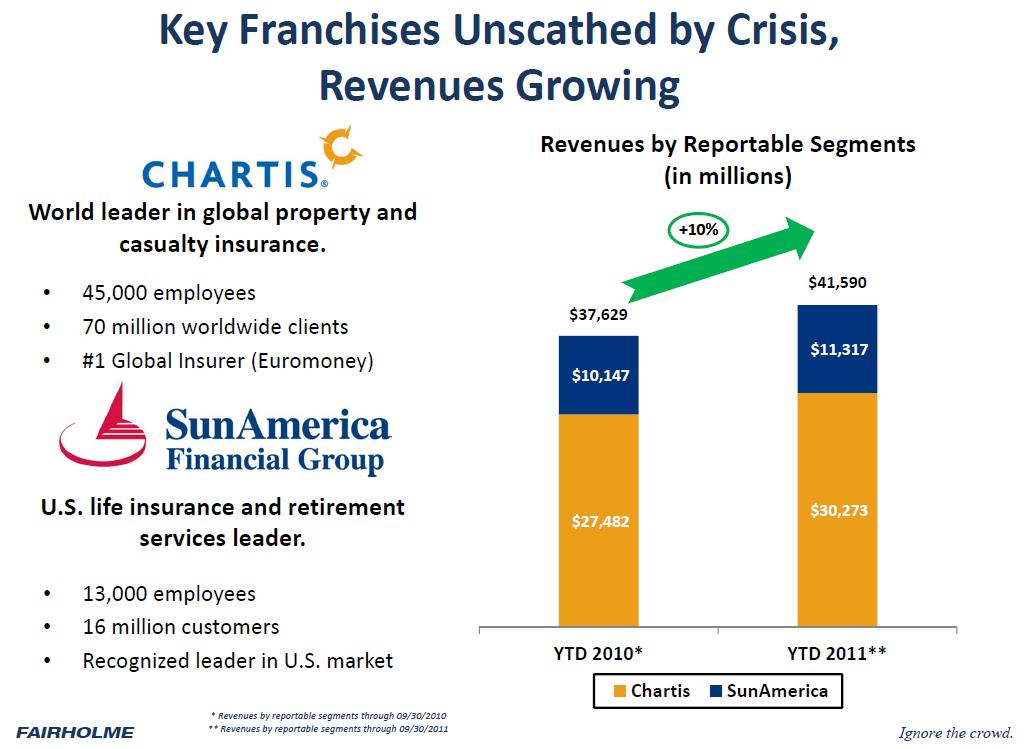

2. Our plan for each of our major businesses to contribute to our future success, and our company-wide strategy is to focused on repaying taxpayers, achieving growth, and balancing risks.

By re-focusing on core business, AIG has maintained the insurance industry leadership.

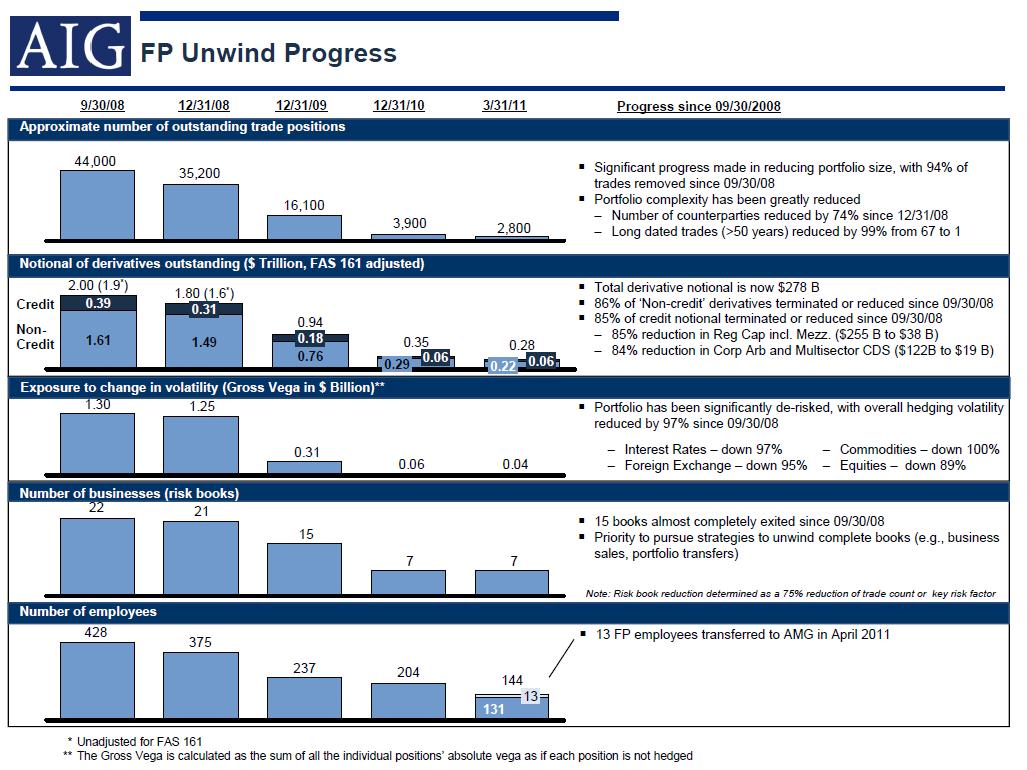

3. Our strategy remains to exit the vast majority of the risk at AIGFP by the end of 2010. Any remaining positions, which will be largely de-risked and not require active management, will either be managed by AIG or third parties.

AIG has been executing a clear, methodical, and orderly wind-down of AIG Financial Products Corp. (AIGFP), which is the business that wrote the credit default swaps that were a significant source of AIG’s liquidity issues in 2008. AIGFP reduced the notional amount of its derivative portfolio by 46 percent from $940.7 billion at December 31, 2009, to $505.8 billion at September 30, 2010.

AIG has also reduced its exposure to its Securities Lending program, as described below.

Securities Lending Solution: Maiden Lane II

Multi-Sector Credit Default Swap Solution: Maiden Lane III

3. One thing I’ve learned in my career is that people count. Too often we underestimate the power of people and take them for granted.

AIG has implemented compensation and reward programs that will recognize employee contributions. Compensation at AIG reflects on-the-job performance, and AIG has

implemented strong performance management systems that differentiate performance.

So all in all, AIG is doing exactly or better/faster than it promised to deliver. Nevertheless Mr. Market has not waked up on this. And I think it is a good time to buy AIG (I bought AIG.WS).

16 Responses to How does AIG execute its restructuring plan?