Let us exercise some valuations of stock,

- By using Ben Graham formula,

In the book “The Intelligent Investor”, Benjamin Graham gives a formula to value intrinsic value of stocks. He disregarded complicated calculations and kept his formula simple. The original formula is as follow,

Intrinsic value of stock = EPS * (8.5+2g)

In 1974, Graham revised his formula as follow,

Intrinsic value of stock = EPS * (8.5+2g) * 4.4 / Y

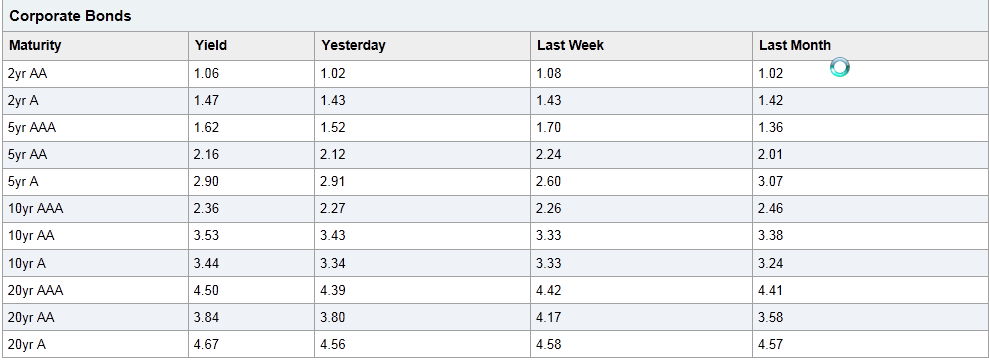

EPS is the trailing 12 month EPS, 8.5 is the PE ratio of a stock with 0% growth and g being the growth rate for the next 7-10 years. Y is 20 yr corporate AAA bond rate.

To give an example on how to use the revised formula, let us calculate the intrinsic value of Bank of America stock (BAC),

Year 2011, EPS = 0.03, g = 7.8, Y = 4.50, thus, IV of BAC is = $0.707

Year 2012, EPS = 0.98, g =7.8, Y = 4.50, thus, IV of BAC is = $23.09

The resources of growth rates and bond rates are from Zacks and Yahoo finance respectively as follow. Please note that in order to be conservative, we assume the growth rate g and bond rate in 2012 are the same as those in 2011.

EPS estimations from Zacks

Corporate Bond rates from Yahoo Finance

- By using relative valuation (multiplier),

Banks and other financial service firms are difficult to value by using popular Discount Cash Flow (DCF) model since the nature of their businesses makes it difficult to define both debt and reinvestment, making the estimation of cash flows much more challenging. Therefore, the most widely used equity multiple for financial firms is relative valuation method – price to book value ratios. The price to book value ratio for a financial service firm is the ratio of the price per share to the book value of equity per share.

Price to Book Ratio =Price per share / book value of equity per share

Higher growth rates in earnings, higher payout ratios, lower costs of equity and higher returns on equity should all result in higher price to book ratios. Therefore, Price to Book Ratio reflects the overall financial health and fair value of equity.

Again, let us take BAC as an example to illustrate this method of valuation,

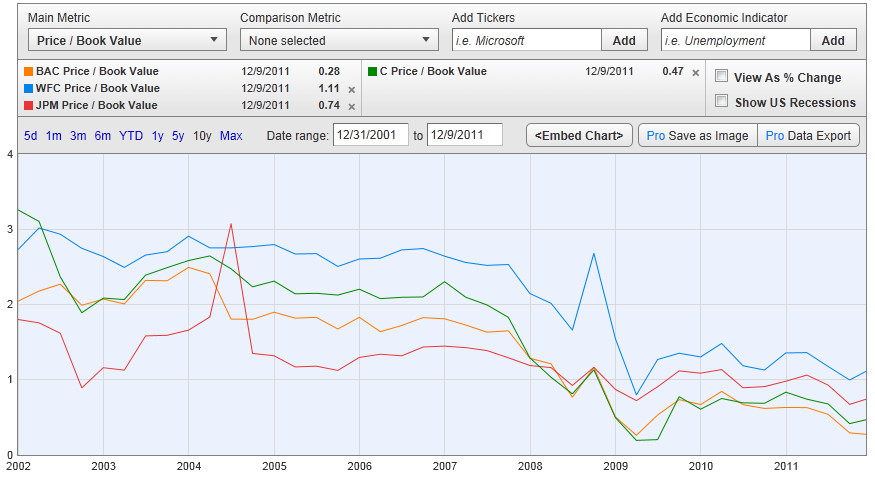

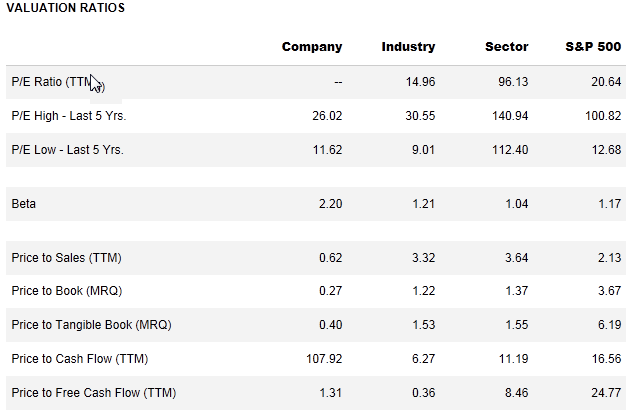

Current BAC price/book price is 0.28, which is exceptionally low compared with its competitors (WFC 1.11, JPM 0.74, C 0.47) and industry (=1.22). It is also quite lower than its historical (from 2002 to 2011) average (~1.5).

Historical P/BV of BAC and competitors (from http://ycharts.com/companies/BAC/price_to_book_value)

BAC P/BV comparison with financial industry, sector and SP500 (from http://www.reuters.com/finance/stocks/financialHighlights?symbol=BAC)

Historical BVPS of BAC (from http://ycharts.com)

Nowadays BAC Book value per share is $20.80. If business of BAC is back to normal and price/book price comes back to average 1.5 in year 2012 and going forward, its stock fair price should be 20.80*1.5 = $31.2 per share.

So in short, once the turmoil of European crisis is gone, once the bank businesses are back to regular (no need to be booming), the price of BAC will be back to its fair value, which is $20 ~ $30 per share. And now BAC is extremely undervalued.

Disclosure: I currently long BAC.

Pingback: Three price-to-book value buys |