Due to the augmentation of economic globalization, US economy growth pathway seems to be largely and easily affected by global effects. How does eurozone market influence US market? Can US sustain the financial turmoil ongoing in Europe?

First of all, let us get an idea what eurozone is. The eurozone is an economic and monetary union (EMU) of 17 European Union (EU) member states that have adopted the euro as their common currency and sole legal tender. The eurozone currently consists of Austria, Belgium, Cyprus, Estonia, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Malta, the Netherlands, Portugal, Slovakia, Slovenia, and Spain. Basically, EU represents “western world” except northern america.

Secondly, let us take a look at what eurozone market index is. Euro Stoxx 50 index is a stock index of Eurozone stocks designed by Stoxx Ltd aimed to provide a blue-chip representation of Supersector leaders in the Eurozone. The EURO STOXX 50 (Price) Index is a free-float market capitalization-weighted index of 50 European blue-chip stocks from those countries participating in the Economic and Monetary Union (EMU). Essentially, EURO STOXX 50 to Europe is like S&P 500 to US.

Lastly, let us look at US vs eurozone equity market,

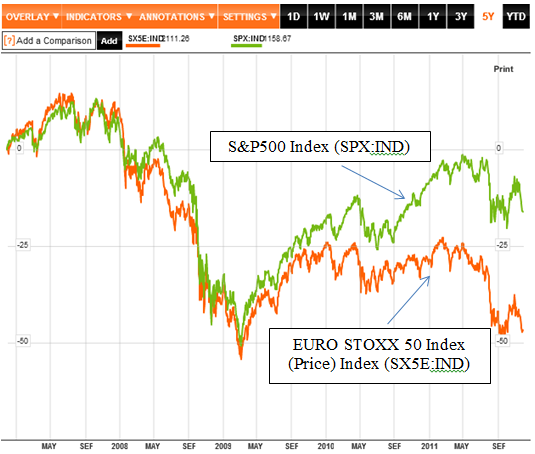

Figure 5. 5 year history of US vs Eurozone Equities (Source: http://www.bloomberg.com/apps/quote?ticker=SX5E:IND#chart)

As this above figure shows, there are two dips in the equities and the equity price movements of US vs Eurozone are evidently very closely correlated from 2008 till now. The first dip in stocks was in early 2009, S&P 500 plunged 50% (compared with the equity level in January 2008), while EURO STOXX 50 dropped ~53%. The big slump in equities was mainly due to the subprime mortgage crisis in US. In this case, US stocks “dragged” the whole world, includeing eurozone equities, significantly down.

The second “dip” is now, EURO STOXX 50 declined 48% which is close to 2009 level, however, US stocks only downswinged 15%. As we all know, the freefall of EURO STOXX 50 is caused by European Sovereign debt crisis and there is no near sight when this crisis will be resolved. Since the economy of US and Eurozone is so interwined nowadays and the equity price movements of US vs Eurozone are closely interlocked, we have to wonder whether the “perfect storm” in eurozone will spread to US and derail the lackluster recovery of US economy or not.

Will US equity further drop to the same level as that of Eurozone? In other word, will US go double dip?

I will continue this topic in my future posts.