Study of interest rate

- 03/31/2022 –

MARKET INSIDER

2-year Treasury yield tops 10-year rate, a ‘yield curve’ inversion that could signal a recession

The 2-year and 10-year Treasury yields inverted for the first time since 2019 on Thursday, sending a possible warning signal that a recession could be on the horizon.

The bond market phenomenon means the rate of the 2-year note is now higher than the 10-year note yield.

Strategists say the 2-year yield has climbed most rapidly since it is the part of the curve most reflective of Fed rate hikes. The 10-year has also moved higher on the Fed, but it has also been held back by flight-to-quality trades as investors keep an eye on the Ukraine war. Yields move opposite price.

Some market pros believe the 3-month yield to the 10-year yield is a more accurate recession forecaster, and that curve has not flattened at all. That spread has been widening, a signal for better economic growth.

- 02/16/2022 – 2022 FOMC Meeting Feb 16, 2022

Statement:

PDF | HTML

Implementation Note

Minutes:

PDF | HTML

(Released February 16, 2022)

- 02/16/2022 – There had been some expectation ahead of the minutes’ release that they could signal a more hawkish outlook among central bank officials about the path forward for monetary policy tightening, including support from some participants for an increase of half a percentage point, or 50 basis points, in March, rather than the standard 25 basis points. Some investors were also braced for indications of when the Fed might begin to shrink its balance sheet. But with no explicit mention of a 50 basis-point increase and no details on when the balance sheet might start to shrink, ” the minutes are on the less-hawkish side of expectations,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote afterwards.

Fed Eyeing Potential for Faster Rate Increases to Ease Inflation – WSJ

Officials also stepped up deliberations last month over how to shrink central bank’s $9 trillion asset portfolio, January minutes show

Federal Reserve officials at their meeting last month discussed an accelerated timetable for raising interest rates, beginning with an anticipated increase in March amid greater discomfort with high inflation.

They agreed that “if inflation does not move down as they expect, it would be appropriate for the committee to remove policy accommodation at a faster pace than they currently anticipate,” said the minutes of the Jan. 25-26 meeting, which were released Wednesday.

When the Fed raised interest rates between 2015 and 2018, it did so gradually—and never more than once every quarter. Under the economic outlook they judged most likely last month, most officials last month “suggested that a faster pace of increases…than in the post-2015 period would likely be warranted,” the minutes said.

The discussion indicated officials were prepared to raise interest rates at consecutive policy meetings, which occur roughly every six weeks, something they haven’t done since 2006. That could set up a series of rate increases in March, May and June.

The minutes also showed officials continued their deliberations over how aggressively to shrink their $9 trillion asset portfolio, but provided few new clues about how that might happen later this year. The move is another way for the Fed to tighten financial conditions to cool the economy.

Fed Signals Openness to Faster Interest-Rate Increases to Curb Inflation

There had been some expectation ahead of the minutes’ release that they could signal a more hawkish outlook among central bank officials about the path forward for monetary policy tightening, including support from some participants for an increase of half a percentage point, or 50 basis points, in March, rather than the standard 25 basis points. Some investors were also braced for indications of when the Fed might begin to shrink its balance sheet.

But with no explicit mention of a 50 basis-point increase and no details on when the balance sheet might start to shrink, ” the minutes are on the less-hawkish side of expectations,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, wrote afterwards.

- 01/26/2022 – FOMC statement from Powell

- Fed Chair Powell press conference video here starting at 2:30 PM ET.FOMC Statement:

Indicators of economic activity and employment have continued to strengthen. The sectors most adversely affected by the pandemic have improved in recent months but are being affected by the recent sharp rise in COVID-19 cases. Job gains have been solid in recent months, and the unemployment rate has declined substantially. Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation. Overall financial conditions remain accommodative, in part reflecting policy measures to support the economy and the flow of credit to U.S. households and businesses.

The path of the economy continues to depend on the course of the virus. Progress on vaccinations and an easing of supply constraints are expected to support continued gains in economic activity and employment as well as a reduction in inflation. Risks to the economic outlook remain, including from new variants of the virus.

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent. With inflation well above 2 percent and a strong labor market, the Committee expects it will soon be appropriate to raise the target range for the federal funds rate. The Committee decided to continue to reduce the monthly pace of its net asset purchases, bringing them to an end in early March. Beginning in February, the Committee will increase its holdings of Treasury securities by at least $20 billion per month and of agency mortgage‑backed securities by at least $10 billion per month. The Federal Reserve’s ongoing purchases and holdings of securities will continue to foster smooth market functioning and accommodative financial conditions, thereby supporting the flow of credit to households and businesses.

In assessing the appropriate stance of monetary policy, the Committee will continue to monitor the implications of incoming information for the economic outlook. The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals. The Committee’s assessments will take into account a wide range of information, including readings on public health, labor market conditions, inflation pressures and inflation expectations, and financial and international developments.

Voting for the monetary policy action were Jerome H. Powell, Chair; John C. Williams, Vice Chair; Michelle W. Bowman; Lael Brainard; James Bullard; Esther L. George; Patrick Harker; Loretta J. Mester; and Christopher J. Waller. Patrick Harker voted as an alternate member at this meeting.

- Fed Interest-Rate Decision Tees Up March Increase – WSJ

- Stock Market Today: January 27, 2022 – it was confirmation from Chairman Powell that the central bank will act aggressively to reduce prices and bring inflation closer to the Fed’s revised near-term target range of 2.6% to 2.8% that has investors skittish. The lead bank’s plan will include the conclusion of its monthly bond-buying program by early spring, the likely start of interest hikes at its March monetary policy meeting, and the commencement the of the reduction of the central bank’s $9 trillion balance sheet (possibly as early as this summer). The latter was revealed in a “Statement of Principles” that accompanied the Fed’s monetary policy statement.Chairman Powell also went on to say that with the U.S. economy showing signs of strength and near full employment, the central bank can focus more on the other half of its dual mandate, which is to promote stable prices. We think investors took this as a sign that the upcoming era of monetary tightening may be far more aggressive than what we saw in the past (particularly in the second half of 2018) when inflation was quite benign. It also is worth noting that when questioned by reporters, Mr. Powell did not shoot down the possibility that the first increase in interest rates could be more than 25 basis points and that the central bank is not wedded to just raising rates during every other Federal Open Market Committee meeting, which was the prevailing expectation leading into this week’s FOMC meeting.

- The Fed’s Road To Full Normalization

- Fed officials signaled an earlier start to wind down the central bank’s balance sheet.

- Inflation is still expected to moderate over the coming quarters, likely reducing the need for an abrupt adjustment at the March meeting.

- The Fed reiterated its preference for a passive reduction, instead of outright sales in the secondary market.

- 12/28/2021 – It might take very long time for interest rate to rise. Therefore, it is not best idea to invest in TMV, TBT and SOXS yet

Stock Market Today: December 28, 2021

Adam Rosner | December 28, 2021

The Federal Reserve will most likely have to take action to curb inflationary pressures, but Wall Street seems to be speculating that the central bank will take a measured approach to the problem.

- 11/28/2021 – Interest rate might not raise in 2022: Powell’s second term is less likely to become Volcker 2.0 even though it cannot be dismissed. The second scenario, more likely especially in light of renewed Covid concerns, suggests that Powell will not have too much policy action. The Fed might be about to become even more dovish, as Governor Lael Brainard is installed as vice chair and as Biden fills three vacant seats on the seven-member policy-setting board. Powell has repeatedly said the path of the economy and monetary policy depends on the path of the pandemic, which isn’t over. If the Fed resists raising rates in 2022 by enough to douse inflation, Yardeni says officials will have to move the goal post. In that case, he expects Powell will raise interest rates no more than twice in the second half of 2022, and predicts the Fed will change its longstanding inflation target to 3% from 2%. Doing so would be more than semantics, with businesses, consumers, and investors all having to adjust to a new normal. The stock market and the housing market are each about 15% overvalued. “If we get mean-reversion in equities and housing, which are where they are because of interest rates, you’re going to have some humdinger of an asset deflation,” he says. He suspects the Fed won’t tolerate the carnage. Several recent data points support Rosenberg’s view that the economy isn’t exactly on fire. In addition, don’t forget that 27 trillion of National debt…not so bad to finance at these rates. Therefore, Fed strategy might be simple here: do nothing and do it for a long time!

Will Interest Rates Go Up in 2022? Don’t Bet on It.

Under the less likely scenario, Powell’s second term will become Volcker 2.0, says Ed Yardeni, president of Yardeni Research. That’s a reference, of course, to former Fed Chairman Paul Volcker, who effectively hit the economy over the head with a two-by-four in the late 1970s and early 1980s as he raised interest rates to an unprecedented 20% to curb inflation. Yardeni pegs the odds of Powell channeling Volcker at 25%. It isn’t his base case, but he calls it a risk scenario that investors shouldn’t dismiss. Moreover, the Fed might have tied its own hands, the U.S. economy is more sensitive than ever to asset prices

The second scenario, more likely especially in light of renewed Covid concerns, suggests that investors are assuming too much policy action. For all of Powell’s talk of tools to deal with inflation, there is really only one: raising interest rates. Tightening monetary policy didn’t go so well the last time it was tried, before the pandemic. Powell quickly had to reverse the rate increases he’d initiated. And the Fed might be about to become even more dovish, as Governor Lael Brainard is installed as vice chair and as Biden fills three vacant seats on the seven-member policy-setting board.

Powell has repeatedly said the path of the economy and monetary policy depends on the path of the pandemic, which isn’t over. News over the Thanksgiving holiday of a new fast-spreading virus variant gives the Fed reasonable cover to demur on tightening.

If the Fed resists raising rates in 2022 by enough to douse inflation, Yardeni says officials will have to move the goal post. In that case, he expects Powell will raise interest rates no more than twice in the second half of 2022, and predicts the Fed will change its longstanding inflation target to 3% from 2%. Doing so would be more than semantics, with businesses, consumers, and investors all having to adjust to a new normal.

David Rosenberg, chief economist at Rosenberg Research & Associates, goes a step further. The longtime bear and ardent defender of the inflation-is-transitory argument also thinks interest rates won’t rise much, if at all, for a different reason. Rosenberg says the fragility of the U.S. economy is underappreciated.

Moreover, the Fed might have tied its own hands, Rosenberg suggests, making the debate over inflation effectively moot. The U.S. economy is more sensitive than ever to asset prices, and, in his view, the stock market and the housing market are each about 15% overvalued. “If we get mean-reversion in equities and housing, which are where they are because of interest rates, you’re going to have some humdinger of an asset deflation,” he says.

He suspects the Fed won’t tolerate the carnage.

Several recent data points support Rosenberg’s view that the economy isn’t exactly on fire. Digging into the October retail sales report, one finds that about half of the better-than-expected increase was because of higher prices. Drop the seasonal adjustment that gets wacky around the holidays and first-time claims for unemployment insurance rose to a six-week high in the latest week, a very different headline than hitting the 1969 low for seasonally adjusted claims.

- 10/28/2021 – ECB will keep short-term rates the same until March 2022. We will see what Fed Reserve will do

Stock Market Today: October 28, 2021

the European Central Bank announced this morning that it will keep short-term interest rates the same and will continue its current pace of bond buying until March, 2022. This comes ahead of the Federal Reserve’s two-day monetary policy meeting, which commences next Tuesday. The central bank’s monetary policy decision, which many pundits think may include the start of the monthly bond-buying tapering, will be closely watched by market participants and may have a big impact on the direction of trading. However, there is a sense that the expectation of a tapering announcement next week may already be priced into the market.

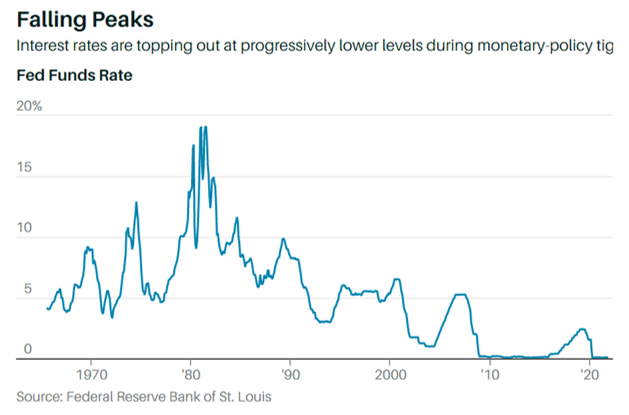

- 10/14/2021 – Great comments from Davidson: Inflation is not transitory when M2 having expanded 30% and threatening to expand more is matched with Real Private GDP ~3% annually. T-bill rate correlates with inflation, Fed Fund rate follows T-bill rate (therefore, Fed will not lead the rate hike, just follow the T-bill rate increases). One should not expect the Fed to act any different with the current bout of inflation. The history of the 1970s inflation is coupled strongly to govt spending of the period with the Fed following rates till Volcker finally acted.

Is Bitcoin The Answer To Inflation??? Absolutely Not

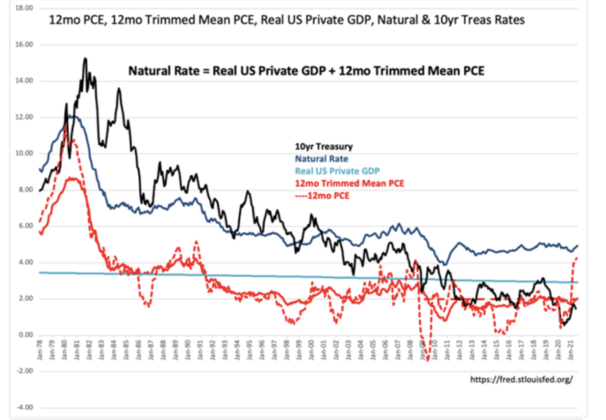

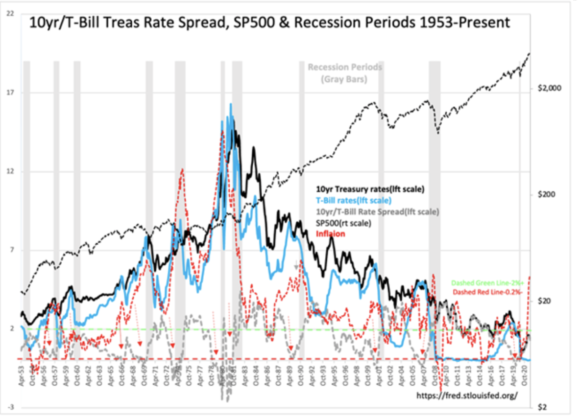

The first chart shows the difference 12mo PCE and the less volatile 12mo Trimmed Mean PCE the Fed prefers. These are compared with the 10yr Treas rate and the Real Private GDP which are used to calculate the Natural Rate, a valuation indicator for the SP500 called The Value Investor Index(not shown here). The second chart shows the monthly history of the T-Bill/10yr Treas rates and rate spread vs SP500, recession periods and inflation using the historic CPI(Consumer Price Index from 1947). CPI just reported 5.38%. One can see that rates and inflation have a generally strong correlation. When examined in detail, every recession begins with an inverted yield curve with T-Bill rates exceeding 10yr Treas rates. Wall Street has long believed that the Fed raises rates in response to inflation. The facts do not support this perception.

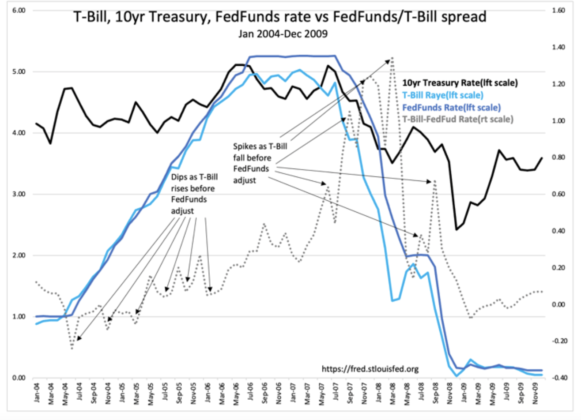

The third chart provides a closer look using the Jan-2004-Dec-2009 period. The T-Bill, 10yr Treas and Fed Funds rates are compared with an added element i.e., the rate spread representing Fed Funds and T-Bills. The reason for examining the Fed Funds/T-Bill rate spread is to detect the timing of Fed actions. If the Fed moves first when rates are rising with inflation then we should see a narrowing of this rate spread as the Fed acts preemptively to raise rates to slow inflation. Similarly, coming out of recession if the Fed is acting to stimulate economic activity, then the Fed should preemptively cut rates forcing T-Bill rates to follow lower. This should be reflected in the rate spread widening during the process. The pattern reveals the opposite with the Fed catching up to both rising rates and falling rates. The Fed follows. It does not lead. One sees this as rates rise throughout the expanding business cycle in the T-Bill/Fed Funds rate spread. The spread dips as T-Bill rates rise just prior to Fed Funds adjusting higher. This is the pattern of following not leading. The Fed works to keep Fed Funds higher than T-Bills at all time. Once rates fall as recessionary activity panic investors, T-Bill rates fall faster than Fed Funds which widens the rate spread till the Fed catches up again following rates lower with a lag in time.

Over decades it has become ‘common knowledge’ that the Fed controls rates. With rate history available to any amateur analyst, the data reveals an entirely opposite picture. One should not expect the Fed to act any different with the current bout of inflation. The history of the 1970s inflation is coupled strongly to govt spending of the period with the Fed following rates till Volcker finally acted. Basically M2(money supply) expanded faster than the economy could replace it with profits(another term to use for profits is equity, as in shareholder equity from the corporate world).

Central bank prepares to begin reducing asset purchases next month and eyes end to stimulus program by mid-2022

Under plans discussed last month, the Fed would reduce its purchases by $15 billion a month, divided proportionally between Treasury and mortgage bonds. Officials discussed starting the taper in mid-November; if they follow the schedule penciled out last month, purchases would conclude by June.

- 10/06/2021 – South Korea, Norway, Czech Republic and New Zealand started to increase interest rate. Other countries are also expected to hike interest rates in the coming months. – the rate hike might starts

New Zealand raises interest rates for first time in seven years

New Zealand’s central bank has raised interest rates for the first time in seven years as it tries to rein in property prices and inflation.

The Reserve Bank of New Zealand (RBNZ) increased its cash rate by a quarter of a percentage point to 0.5%.

Economists had expected the hike last month but the bank held off due to an outbreak of the Covid-19 Delta variant.

The hike puts New Zealand amongst a handful of developed economies that have raised borrowing costs in recent weeks as central banks look to wind back those emergency measures.

In August, South Korea became the first major Asian economy to raise interest rates since the coronavirus pandemic began.

The Bank of Korea increased its base rate of interest from a record low of 0.5% to 0.75%.

The move was aimed at helping curb the country’s household debt and home prices, which soared in recent months.

Norway and the Czech Republic have also raised their borrowing costs in the last month.

Other countries are also expected to hike interest rates in the coming months.

- 09/25/2021 – If interest rate increases steadily, Russell 2000 have better access to capital when the economy is growing. And regardless of size, companies in economically-sensitive sectors—such as banking and oil—can benefit, too. However, too fast a rise in bond yields could dent all stocks, though the most economically-sensitive ones could still outperform.

Bond Yields Are Surging and Could Keep Rising. What That Means for Stocks.

many central banks around the globe have signaled confidence in the economy as well. The Federal Reserve has suggested that the reduction of its bond buying program—a pillar of economic support since the pandemic began—could come as soon as November. Market-based inflation expectations for the next 10 years currently stand at 2.34%, according to St. Louis Fed data, another reason the 10-year Treasury yield likely could edge up further.

Small-cap companies can especially benefit in this environment. Those firms’ earnings typically rely much more heavily on growth in the domestic economy, and they have better access to capital when the economy is growing. And regardless of size, companies in economically-sensitive sectors—such as banking and oil—can benefit, too.

Since the 10-year yield began surging this week, the Russell 2000 index of small-cap stocks has risen 3%, outpacing the S&P 500’s 2.2% gain. Cyclical sectors on the S&P 500 have also beaten the broader index. The SPDR S&P Bank Exchange-Traded Fund (ticker: KBE) and the Energy Select Sector SPDR Fund (XLE), for example, have risen 5.6% and 7.7%, respectively in the same time frame.

However, too fast a rise in bond yields could dent all stocks, though the most economically-sensitive ones could still outperform. If bond yields suddenly spike to nosebleed levels, stock valuations could fall hard, as higher, long-dated bond yields make future profits less valuable. “The other variable to the answer is the speed with which rates rise,” says Hank Smith, head of investment strategy at Haverford Trust. “If that 10 year hits 2% by year-end, either the economy better be booming like it was in the second quarter or the equity markets are not going to take that very well.”

- 09/24/2021 – Rising inflation expectations could cause the Federal Reserve to change policy course quickerly

Costco, Nike and FedEx are warning there’s more inflation set to hit consumers as holidays approach

- A slew of factors including rising shipping cost and supply chain bottlenecks are persisting and should last through the upcoming holiday season.

- One issue is that the cost to ship containers overseas has soared in recent months.

- Many companies have indicated that consumers at least for now are willing to take on higher prices.

- Rising inflation expectations could cause the Federal Reserve to change policy course.

- 09/23/2021 – Norway hikes rates. Rate hike will strengthen currency. May not be good for oil. In addition, Bank of Canada, Bank of Korea and the Bank of England are planning to take the first steps toward normalizing policy in the wake of the pandemic

Norway hikes rates, becoming the first central bank in the developed world to do so

- “A normalising economy now suggests that it is appropriate to begin a gradual normalisation of the policy rate,” said Governor Oystein Olsen in a statement Thursday.

- Norway’s currency rallied to its highest levels since June against the euro, according to Reuters, and gained 0.7% against the U.S. dollar. The bank also said that another hike is likely in December.

The rate hike comes as many central banks consider similar moves amid solid growth and surging inflation. In the United States, Federal Reserve officials reiterated Wednesday that a tapering of bond buying is coming “soon.” The European Central Bank recently slowed its bond buying, but an actual rate move is expected to be still some way off for both banks.

Fed takes a hawkish turn and markets hold up, for now

- The Federal Reserve avoided a shock to equities in an already weak September, but will investors remain comfortable with the hawkish tilt?

- As expected from its decision yesterday, members pulled forward rate-hike expectations on the dot plot. And Fed chief Jay Powell telegraphed a tapering announcement at the next meeting in November.

- Tapering is expected to end around mid-2022 and liftoff could occur after that, although 2023 still seems the most likely timing for the start of rate hikes for now.

- 08/27/2021 – it is a dovish taper. The interest rate might take long time to raise significantly

Powell could see taper start this year, stays cool on rate hikes: Jackson Hole

- The U.S. economy is making progress toward the Federal Reserve’s twin goals of full employment and price stability, meaning the central bank is considering reducing its purchases of Treasury bonds and mortgage-backed securities, Federal Reserve Chair Jerome Powell said in an online speech at the Jackson Hole Economic Policy Symposium.

- Specifically, he said, “substantial further progress” test has been met for inflation. And there has been “clear progress” toward maximum employment, he said.

- “At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year,” he said in the prepared text of his speech.

- Since that meeting, the July employment report showed more progress, but there’s also further spread of the Delta variant, he noted (added 10:19 AM ET).

- “We will be carefully assessing incoming data and the evolving risks. Even after our asset purchases end, our elevated holdings of longer-term securities will continue to support accommodative financial conditions.”

- Update at 10:15 AM ET: Powell continues to make the case that inflationary pressures are “transitory.” Long-term inflation expectation measures “today are at levels broadly consistent with our 2 percent objective,” he said That suggest that “that households, businesses, and market participants also believe that current high inflation readings are likely to prove transitory.”

- 10:19 AM ET: For now policy is well positioned, he said.

- The timing and the pace of the coming reduction in asset purchases won’t be a direct signal for the timing of an interest rate liftoff, he said. That will require a more stringent test.

- “We have said that we will continue to hold the target range for the federal funds rate at its current level until the economy reaches conditions consistent with maximum employment, and inflation has reached 2 percent and is on track to moderately exceed 2 percent for some time.”

- 10:21 AM ET: “We have much ground to cover to reach maximum employment, and inflation has reached 2% and is on track to reach maximum employment, and time will tell whether we have reached 2% inflation on a sustainable basis.”

Powell sees taper by the end of the year, but says there’s ‘much ground to cover’ before rate hikes

video is here

- 08/23/2021 – Powell is baffled in the rate decision.

Fed Chairman Powell Navigates the Inflation Debate – WSJ

The Federal Reserve confers this week, and Mr. Powell is expected to clarify the central bank’s position. He battles internal dissension over how to proceed, and a haywire economic recovery hampered by the Delta variant.

At stake is the fate of an economic recovery that has been far stronger than Fed officials forecast, with output exceeding its pre-pandemic level by the spring, but unemployment still higher and jobs far fewer than before the coronavirus prompted large swaths of business and social activity to shut down last year.

If Mr. Powell gets Fed policy right—reversing its easy money policies at just the right pace—inflation should recede over time, the economy will continue growing and the labor market can fully heal. If he gets it wrong, pulling back too slowly or too quickly, Americans could struggle for years with higher inflation or a sharp economic downturn.

First, bottlenecks have been more severe than anticipated. New waves of Covid-19 cases around the world due to the Delta variant, along with uneven vaccine distribution, threaten to disrupt supply chains for longer than hoped.

Second, Fed officials didn’t expect Congress and the White House to pump so much federal aid into the economy this year, which supercharged consumer demand as U.S. vaccination rates and business reopenings were taking off. Last December, the outgoing Trump administration and Congress approved $900 billion in new aid. Then in March, President Biden and Congress agreed to a $1.9 trillion assistance package.

Higher inflation that results from supply-chain bottlenecks won’t be a serious problem for the Fed if it eases on its own. But decisions could become thornier if inflation stays high.

When higher inflation results from restricted supply, raising rates doesn’t solve the problem, as the European Central Bank discovered after raising rates in 2008 and 2011 because of higher oil prices. The move curbed demand rather than increasing supply, ultimately worsening economic damage and making inflation too low in the ensuing years.

“There’s a question of whether you want the Fed tightening into a supply-side shock. Destroying demand isn’t the way to do it,” said Diane Swonk, chief economist at accounting firm Grant Thornton.

The Delta variant also threatens to delay a rebound in travel and leisure spending. The Kansas City Fed last week scrapped plans for this week’s conference, the Jackson Hole Economic Policy Symposium, normally conducted in Wyoming’s Grand Teton National Park, to be held in person.

Mr. Powell is betting that more workers will return to the labor market as schools reopen, vaccinations make people less risk-averse and more-generous unemployment benefits expire. That should help ease some price pressures by moderating wage growth.

- 08/21/2021 – Burry raises bearish bet on treasuries, should I?

Michael Burry’s Pretty Big Short Hinges on Treasuries Sinking

Michael Burry, whose huge, wildly profitable bets against the housing bubble were made famous in “The Big Short,” is wagering that long-term U.S. Treasuries will fall.

His Scion Asset Management held $280 million of puts on the iShares 20+ Year Treasury Bond ETF at the end of June, according to a regulatory filing released this week, an increase from $172 million three months earlier.

- 08/21/2021 – will taper come in Sept? Almost 60 percent of respondents anticipated the first reduction in the pace of net asset purchases to come in January, though, on average, respondents placed somewhat more weight than in the June surveys on the possibility of tapering beginning somewhat earlier.

Minutes of the Federal Open Market Committee

With respect to the path of net asset purchases, respondents to the Open Market Desk’s surveys of primary dealers and market participants expected communications on asset purchases to evolve gradually, with signals anticipated over coming months regarding both the Committee’s assessment of conditions constituting “substantial further progress” and details on tapering plans. Almost 60 percent of respondents anticipated the first reduction in the pace of net asset purchases to come in January, though, on average, respondents placed somewhat more weight than in the June surveys on the possibility of tapering beginning somewhat earlier. With respect to the pace of tapering, respondents continued to anticipate that the Committee would take a gradual approach. While market participants discussed the possibility of an earlier or faster-than-proportional reduction in the pace of net purchases of agency mortgage-backed securities (MBS), most survey respondents appeared to expect the timing and pace of tapering of net purchases of agency MBS and Treasury securities to be similar.

- 08/09/2021 – it is hard to predict the short term move of interest rate even though I might get fundamentals right

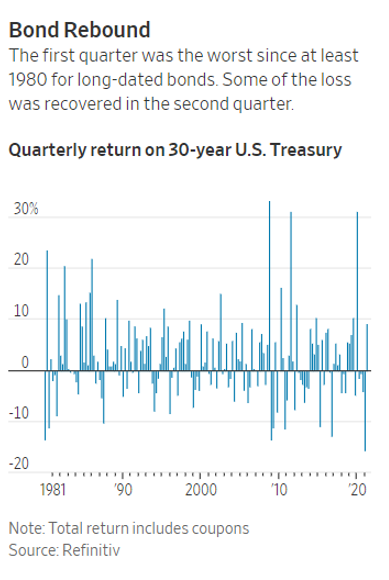

Treasurys’ Big Rally Gets Help From Skeptics of Low Rates – WSJ

Partial unwinding of crowded trade helps drive yields down to levels few thought they would see at time of strong growth, inflation

So many investors have been betting against Treasurys that the conditions were in place for yields to fall significantly with just a modest nudge from those who actively wanted to buy bonds, some analysts say. When investors moved to cover their shorts—the act of buying Treasurys to close out bets that their price would fall—they helped advance the rally and compelled others to do the same.

“There is always risk, since trying to predict the direction of interest rates over the short term is very difficult,” he said. “But we have conviction that the 40-year bull market for bonds is over, inflation risks will prove more than transitory, and rates will be higher by the end of the year.”

- 08/06/2021 -negative global yields serving to drag U.S. yields lower. So unless we see global yield increases, we will not see US treasury yield to increase too much.

What the world’s rising pile of negative-yielding debt means for U.S. Treasurys

The search for yield is still a struggle.

The pile of debt around the world that offers a negative nominal yield — meaning that investors would effectively have to pay for the privilege of parking their money — is on the rise again.

According to the Financial Times, a Barclays index shows the amount of debt offering negative yields now stands at $16.5 trillion, a six-month high.

It’s no surprise to see negative global yields serving to drag U.S. yields lower.

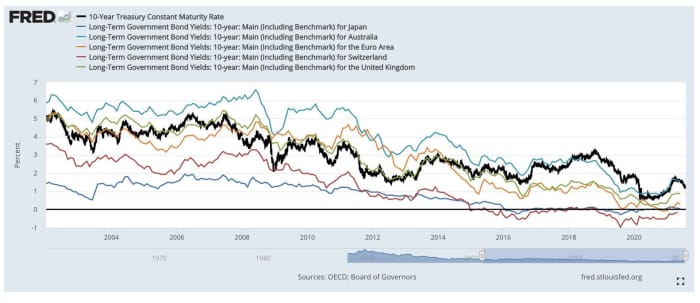

Nicholas Colas, co-founder of DataTrek Research, pointed to the chart below in a Thursday note, observing that the trend to ever-lower sovereign debt yields started after the financial crisis of 2008. That’s not just the result of bond buying by central banks, but also to a slow recovery from the 2007-09 recession and aging demographics across much of the developed world.

The chart above tracks the 10-year Treasury yield, the bold black line, versus the 10-year yields for Japan (light blue line), Australia (dark blue), the eurozone (orange), Switzerland (red) and the U.K. (green). Over time, the Treasury yield goes from middle of the pack to the top, Colas noted.

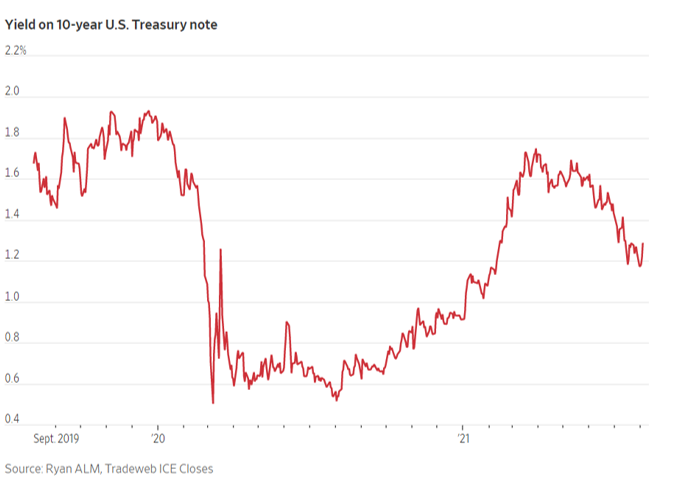

While there are other reasons for the retreat by the 10-year yield from its March high just shy of 1.80%, the realization the pandemic is still taking a toll on global economic growth is toward the top of the list, he said, leaving global asset allocators little choice.

Some yield “is better than nothing, so capital is flowing to Treasurys,” he said.

- 07/15/2021 – listen to this when I have time

LIVE: Fed Chair Jerome Powell testifies before Congress on monetary policy

- 07/12/2021 – Fed reserve tapering bond purchases might push down bond yield – which is counter-intuitive. I think there is more risk of inflation in the long run than there was, as politics, globalization and the labor market shift, and bond yields so low are deeply unappealing.

How to Solve the Mystery of Falling Bond Yields – WSJ

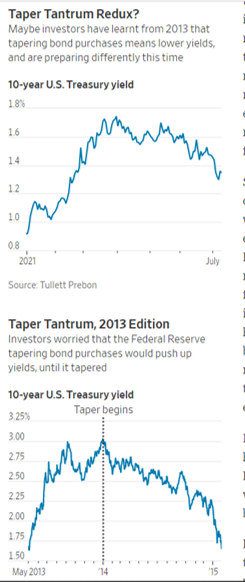

When the Fed signals it will taper bond buying, yields drop. If this sounds counterintuitive, don’t worry.

That probably sounds odd, since back in 2013 the taper tantrum—a bond-market panic about the Federal Reserve cutting its Treasury purchases—prompted the exact opposite reaction, and 10-year yields soared from 1.6% in May of that year to above 3% by the end of December.

But bear with me: What happened when the taper actually began was that yields dropped back, eventually falling all the way down to 1.6% again.

So here is a possibility: Investors have learned their lesson. The Fed is again readying the markets for the tapering of its bond purchases, but instead of a repeat of 2013’s tantrum, there has been a rush to buy bonds, and a big drop in yields.

I think there is more risk of inflation in the long run than there was, as politics, globalization and the labor market shift, and bond yields so low are deeply unappealing. But if the drop in yields is correctly anticipating a Fed more willing to raise rates, that takes away the biggest reason to worry that the current bout of inflation will be allowed to feed on itself.

- 06/18/2021 – Fed’s Bullard Pencils In Rate Increase in 2022

Fed’s Bullard Pencils In Rate Increase in 2022 – WSJ

St. Louis Fed President questions continued mortgage-bond purchases amid robust housing market

The Federal Reserve Bank of St. Louis President James Bullard said the economy is seeing more inflation than he and his colleagues had expected, and noted that while there is substantial uncertainty about the outlook, it could lead to a rate increase next year.

Speaking Friday on CNBC, Mr. Bullard said that when he submitted forecasts at this week’s Federal Open Market Committee meeting, “I put us starting in late 2022” with the first move up from what are now near-zero short-term interest rates.

- 06/17/2021 – Fed bank also raised the overnight repo rate for banks by 50 basis points, which is one under-the-radar way of slowing the pace of lending and trying to keep the economy from overheating. Repo transactions temporarily increase the quantity of reserve balances in the banking system. Reverse repo transactions temporarily reduce the quantity of reserve balances in the banking system.

Stock Market Today: June 17, 2021

Looking at yesterday’s developments more closely, the Federal Reserve made no short-term changes at its two-day meeting. It kept interest rates near zero and announced that the $120 billion-a-month asset purchasing program will remain in place for the time being. Those decisions were not surprising, but what unnerved investors was the aforementioned inflation outlook and the perception that the lead bank is becoming a bit more hawkish on monetary policy. In fact, the Fed statement showed that seven District governors now foresee an interest-rate hike in 2022, up from three at the prior meeting. The bank also raised the overnight repo rate for banks by 50 basis points, which is one under-the-radar way of slowing the pace of lending and trying to keep the economy from overheating.

June 17, 2021: Conduct overnight reverse repurchase agreement operations at an offering rate of 0.05 percent and with a per-counterparty limit of $80 billion per day; the per-counterparty limit can be temporarily increased at the discretion of the Chair.

from Implementation Note issued June 16, 2021

March 17, 2021: Conduct overnight reverse repurchase agreement operations at an offering rate of 0.00 percent and with a per-counterparty limit of $80 billion per day; the per-counterparty limit can be temporarily increased at the discretion of the Chair.

from Implementation Note issued March 17, 2021

definition of Reverse Repurchase Agreement: A reverse repurchase agreement, or “reverse repo”, is the purchase of securities with the agreement to sell them at a higher price at a specific future date. For the party selling the security (and agreeing to repurchase it in the future) it is a repurchase agreement (RP) or repo; for the party on the other end of the transaction (buying the security and agreeing to sell in the future) it is a reverse repurchase agreement (RRP) or reverse repo.

definition of Federal Funds Rate

- Federal funds rate is the target interest rate set by the FOMC at which commercial banks borrow and lend their excess reserves to each other overnight.

- FOMC sets a target federal funds rate eight times a year, based on prevailing economic conditions.

- The federal funds rate can influence short-term rates on consumer loans and credit cards as well as impact the stock market.

Information from newyorkfed

Repo and Reverse Repo Agreements

The New York Fed is authorized by the Federal Open Market Committee (FOMC) to conduct repo and reverse repo operations for the System Open Market Account (SOMA) to the extent necessary to carry out the most recent FOMC directive. The New York Fed’s Open Market Trading Desk (the Desk) executes these repo and reverse repo operations in the tri-party repo market.

Repurchase agreements (also known as repos) are conducted only with primary dealers; reverse repurchase agreements (also known as reverse repos) are conducted with both primary dealers and with an expanded set of reverse repo counterparties that includes banks, government-sponsored enterprises, and money market funds.

In a repo transaction, the Desk purchases Treasury, agency debt, or agency mortgage-backed securities (MBS) from a counterparty subject to an agreement to resell the securities at a later date. It is economically similar to a loan collateralized by securities having a value higher than the loan to protect the Desk against market and credit risk. Repo transactions temporarily increase the quantity of reserve balances in the banking system.

In a reverse repo transaction, the opposite occurs: the Desk sells securities to a counterparty subject to an agreement to repurchase the securities at a later date at a higher repurchase price. Reverse repo transactions temporarily reduce the quantity of reserve balances in the banking system.

Repo Operations

Prior to the 2008 financial crisis, repo operations were used to fine-tune the supply of reserves in the banking system and keep the federal funds rate around the fed funds target established by the FOMC. Currently, the Desk conducts repo operations to support effective policy implementation and the smooth functioning of short-term U.S. dollar funding markets. Repo operations are conducted with Primary Dealer counterparties at a pre-announced offered amount, minimum bid rate, and maximum individual proposition limit, all of which are available on the Operational Details page.

Overnight Reverse Repo Operations

The Desk has conducted overnight reverse repo operations daily since 2013. The ON RRP is used as a means to help keep the effective federal funds rate from falling below the target range set by the FOMC. The overnight reverse repo program (ON RRP) is used to supplement the Federal Reserve’s primary monetary policy tool, interest on excess reserves (IOER) for depository institutions, to help control short-term interest rates. ON RRP operations support interest rate control by setting a floor on wholesale short-term interest rates, beneath which financial institutions with access to these facilities should be unwilling to lend funds. ON RRP operations are conducted at a pre-announced offering rate, against Treasury securities collateral, and are open to a wide range of financial firms, including some that are not eligible to earn interest on balances at the Federal Reserve.

- 06/16/2021 – Fed members worry that if inflation exceeds 2% by too much or for too long, it might lead businesses and consumers to anticipate more inflation in the future, which can become self-fulfilling. In their forecast, they continue to move toward more and more tightening as one quarter after another.

Fed Pencils In Earlier Interest-Rate Increase – WSJ

Most officials now expect to raise rates by the end of 2023, rather than hold them near zero

Federal Reserve officials signaled they expect to raise interest rates by late 2023, sooner than they anticipated in March, as the economy recovers rapidly from the effects of the pandemic and inflation heats up.

That inflation rate, the highest since 2008, makes the Fed uncomfortable, even if officials continued to stress Wednesday that they think it mostly reflects temporary factors that should fade later this year. They worry that if inflation exceeds 2% by too much or for too long, it might lead businesses and consumers to anticipate more inflation in the future, which can become self-fulfilling. Evidence of rising inflation expectations would likely require the Fed to tighten policy sooner or more aggressively than planned to re-anchor those expectations around 2%.

detailed documents from FOMC

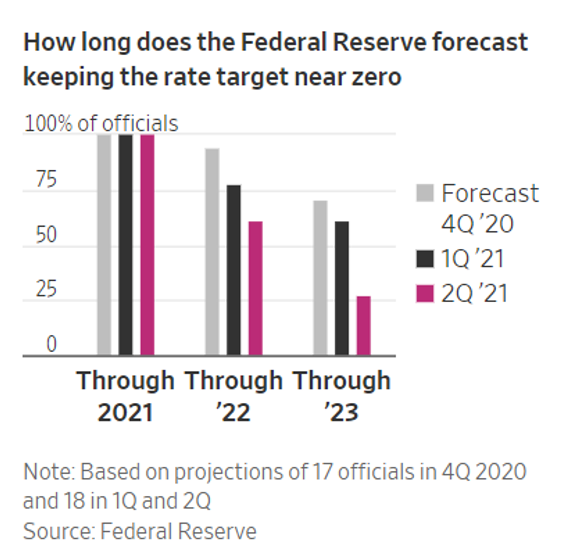

Expectations for 2023 interest rate hike grow within Fed, dot-plot shows

- Most of the top Federal Reserve officials now expect a rate hike sometime in 2023, moving up the likely timeline for an interest-rate move following recent signs of a strong economy and higher inflation.

- This change in outlook comes according to the central bank’s so-called dot-plot, a closely watched summary of the Fed’s expectations for the future. The dot-plot outlines the projections held by the 18 members of the Federal Open Market Committee, the central bank’s rate-setting body.

- Of the 18 FOMC members, 13 now predict that at least one rate hike will take place in 2023. In its last projection, released in March, the Fed said seven members forecast a tightening that year.

- Wednesday’s dot-plot also showed that seven members thought a rate increase would be needed next year.

- In March, four members predicted a 2022 hike. This in itself marked a more hawkish sentiment compared to the December meeting, when only one FOMC member projected that the central bank would have to make a move that early.

- Looking to Fed members’ outlook for the economy, the median projection for GDP growth stood at 7.0% in Wednesday’s release. In March, the Fed’s median expectation called for 6.5% growth in real GDP for 2021.

- Turning to inflation, the median forecast for core PCE inflation came in at 3.0% on Wednesday. March’s projections pointed to a 2.2% median growth rate prediction for core PCE inflation.

- 06/13/2021 – Fed might announce QE taper in Aug or Sept or later this year on rising inflation concerns; Fed might start taper QE in the Q4 2021 or 2022; Fed might start to lift interest rate by 2023 or 2024. Since Powell has said the central bank will give advance notice of when it plans to taper asset purchases, so as not to repeat the 2013 “taper tantrum”, when markets were caught by surprise by the Fed’s change in policy. I think Powell might announce QE taper at least one quarter or half a year earlier.

Here’s what to expect from the Federal Reserve’s meeting this week

- Federal Reserve officials meet again on Tuesday and Wednesday to consider the path for the country’s monetary policy — chiefly the federal funds rate target range (now at 0.0%-0.25%) and asset purchases.

- Again, it’s widely expected that no tightening will occur this time, but investors will be watching closely for any signals that the Fed is setting the stage to become less accommodative.

- More than half of 51 economists surveyed by Bloomberg expect the median of 18 officials expecting an interest rate hike during 2023, in contrast to the March dot-plot where the median expectation was for a 2024 liftoff.

- Now that the economy seems to be recovering at a rapid pace, the timing of the Fed’s pivot to remove its ultra-accommodative measures is at issue. Powell has said the central bank will give advance notice of when it plans to taper asset purchases, so as not to repeat the 2013 “taper tantrum”, when markets were caught by surprise by the Fed’s change in policy.

- Some 40% of economists in the Bloomberg survey expect the Fed to indicate in late August its intention to start tapering its current $120B/month bond purchasing rate. Some 24% of the economists expect that signal to come in September.

- A Reuters poll of economists had similar results — most expected the Fed to announce in August or September a strategy for paring its bond buying program, with actual reduction of purchases likely to start in early 2023.

- Recall that many Fed officials have commented that they’re willing to let inflation run hot for a period of time after the measure has lagged its 2% target for years.

- if inflation turns out to be more persistent than expected, the Fed may be forced to slam on the brakes, potentially risking a recession.

Fed to announce QE taper in Aug or Sept on rising inflation concerns

The Federal Reserve is likely to announce in August or September a strategy for reducing its massive bond buying program, but won’t start cutting monthly purchases until early next year, a Reuters poll of economists found.

A significant number of Fed watchers also said the central bank would wait until later in the year before announcing a taper, now the main focus for markets fretting over rising inflation as an end to the pandemic in the United States is in sight.

Booming demand with the U.S. economy reopening is expected to continue and push up consumer prices this year, with the June 4-10 Reuters poll of over 100 economists showing an upgrade to both growth and inflation forecasts.

Nearly 60% of economists, or 29 of 50, who responded to an additional question said a much-anticipated taper announcement from the central bank will come next quarter, despite a patchy recovery in the job market in recent months.

That included 13 predicting it to come at the Jackson Hole symposium in August, an annual conference where central bankers have often dropped important policy hints.

The remaining 21 forecast a taper announcement for the quantitative easing (QE) programme after the third quarter.

“We expect to hear clear hints at the Jackson Hole Conference that the Fed is now discussing the merits of QE tapering and this will be developed further at the September FOMC which is just four weeks later,” said James Knightley, chief international economist at ING.

Driven by massive government spending and a rapid inoculation drive, the U.S. economy was expected to grow at a seasonally adjusted annualized rate of 10.0%, 7.0% and 5.0% in the current, next and the fourth quarter, respectively.

That compared to 9.5%, 6.7% and 4.7%, respectively, forecast in the previous poll.

“The U.S. is on track to have recovered all its lost output in the current quarter and end the year with a larger economy than if there had been no pandemic and growth had merely continued at its 2014-19 trend,” added ING’s Knightley.

The U.S. unemployment rate was forecast to gradually fall through to the end of next year, averaging over 5% this year and more than 4% in 2022. That is still above its pre-crisis level of 3.5%.

The Fed’s preferred inflation gauge, the core personal consumption expenditures price index, jumped in April to 3.1%, its highest annual rate since July 1992. It was expected to average 2.5% this year and 2.2% next, according to the poll, above the central bank’s 2% target.

- 06/10/2021 – cheap dollar and relatively higher bold yield attract European investors to buy US treasury. In addition, pension funds move cash into bonds in riskier assets, stocks due to rally of stock market. Will these be temporary? and treasury yield will eventually jump?

Cheap Dollars Attract Foreign Investors to Treasurys – WSJ

Pension funds have also become big buyers of Treasury bonds

The cheapest dollars in years are spurring a rise in foreign investment in U.S. government bonds at the same time that pension funds are boosting their holdings—and that demand pickup could weigh on Treasury rates even as the economy strengthens.

The WSJ Dollar Index, which measures the greenback against a basket of currencies, is down 2.9% this quarter so far and hovering close to the lowest level in about five months. The price of hedging dollars through forward rates also was the cheapest in at least six years last week and remains close by, according to analysis from Deutsche Bank.

“If I were to buy a bond market, which is the case for a lot of investors, I would buy the U.S. Treasury,” said Laurent Crosnier, chief investment officer of Amundi’s London branch, Europe’s largest asset manager. The positive yield and low hedging cost “makes the U.S. Treasury attractive relative to others.”

“If you take a 10-year U.S. Treasury and you hedge with a three-month forward, the yield you get is around 0.9%,” said Althea Spinozzi, a fixed-income strategist at Saxo Bank.

That is higher than all European government bonds of the same maturity. Italy’s 10-year bond yield was 0.755% on Thursday. Japan’s equivalent bond yielded 0.659%.

Another source of money flowing into Treasurys has been pension funds. Strong rallies in riskier assets, like stocks, in recent months helped to close the shortfall many funds have between the value of their assets and their liabilities, allowing them to move cash into safer assets, like bonds.

U.S. pension funds shifted nearly $90 billion of funds out of stocks and into fixed income during the first quarter of this year, $41 billion of which went into Treasurys, according to analysts at Bank of America.

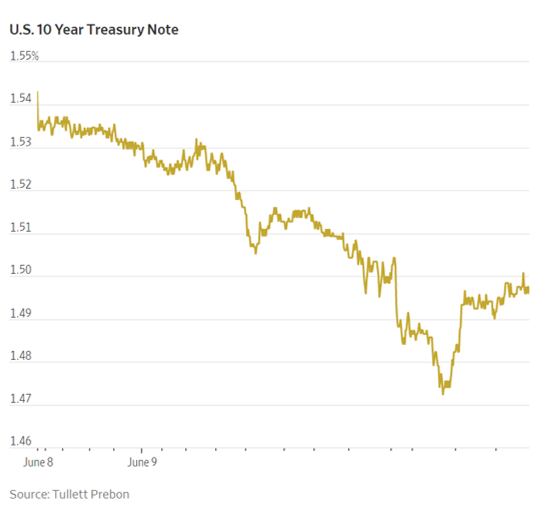

- 06/09/2021 – this might be the reason why CPI is up but interest rate is down yesterday and today: investors and pension plan fund managers may be seeing an avenue to preserve these gains by adding more fixed-income to their portfolios, which offer more safety than equities, especially with valuations looking quite frothy these days

Stock Market Today: June 10, 2021

So what drove yesterday’s rotation? The catalyst was the drop in the yield of the 10-year Treasury note, which settled yesterday at 1.489% (it has since rebounded to around 1.53% this morning following the economic data). As noted, this pushed investors into the growth areas, but we don’t think this is a sign that inflation is not an issue. Our sense is it was investors recognizing the underperformance of bonds versus the S&P 500 stocks so far this year and wanting to increase their fixed-income exposure at a rather inexpensive price. It also should be noted that with the sharp run-up in the U.S. stock market since its 2020 coronavirus-driven nadir, many of the pension plans at now fully funded. Plan managers may be seeing an avenue to preserve these gains by adding more fixed-income to their portfolios, which offer more safety than equities, especially with valuations looking quite frothy these days; the S&P 500 Index came within a few points of establishing another record high yesterday.

- 06/09/2021 – Mixed signals around the U.S. economic recovery left the 10-year yield trading in a range around 1.6% for months. In addition, high demand from investors have pulled yields lower in recent sessions: Japanese investors have added about $19 billion in Treasurys this year through March, the last month for which data are available. Federal Reserve holdings of U.S. securities on behalf of foreign central banks has increased by $40 billion, according to NatWest. Hedge funds that shift stock and bondholdings based on volatility in markets are snapping up Treasurys. Analysts said other factors are driving lower yields, including a weaker dollar, which has lifted demand for Treasurys from foreign investors. Foreign investors tend to hold more Treasurys when the dollar declines and reduces the costs of protecting against swings in currencies.

10-Year Treasury Yield Dips Below 1.5% – WSJ

Tepid economic data and high demand from investors have pulled yields lower in recent sessions

The yield on the benchmark 10-year Treasury note dipped below 1.5% for the first time in a month, dragged down in recent sessions by tepid economic data and high demand from investors both in the U.S. and elsewhere.

The yield on the 10-year Treasury note, which helps set borrowing costs on everything from corporate debt to mortgages, fell near 1.47% before recovering to trade at a recent 1.501%, according to Tradeweb. That is down from 1.527% Tuesday and the first intraday fall below 1.5% since May 7.

Mixed signals around the U.S. economic recovery left the 10-year yield trading in a range around 1.6% for months, ending an early-year climb spurred by investors’ bets that a stimulus-powered recovery would fuel inflation. A key measure of investors’ expectations for average annual inflation over the next 10 years, known as the 10-year break-even rate, slipped last week.

Analysts said other factors are driving lower yields, including a weaker dollar, which has lifted demand for Treasurys from foreign investors. Foreign investors tend to hold more Treasurys when the dollar declines and reduces the costs of protecting against swings in currencies.

Japanese investors have added about $19 billion in Treasurys this year through March, the last month for which data are available.

Federal Reserve holdings of U.S. securities on behalf of foreign central banks has increased by $40 billion, according to NatWest.

Hedge funds that shift stock and bondholdings based on volatility in markets are snapping up Treasurys. John Briggs, head of strategy for Americas at NatWest, said so-called risk parity funds, which seek to produce market-beating gains with lower risk by using futures or other derivatives to increase their returns on safer assets such as bonds, have also moved money from stocks into bonds in recent weeks.

“Fixed income allocations currently stand at 75.6%, the largest since November of 2020,” Mr. Briggs said in an email. “With the overall fixed income allocation rising, this suggests additional demand for U.S. Treasurys.”

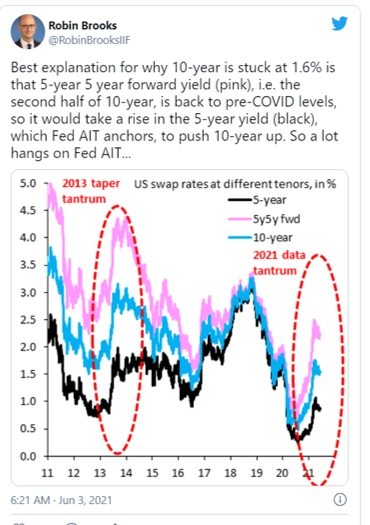

- 06/06/2021 – Taper tantrum happened somewhat in Feb and March, then subdued. It needs Fed AIT to life up the 10 year yield. Yields in the eurozone have been on the rise, which might help push US int rate higher.

Taper tantrum? Only if somebody wakes the U.S. bond market – MarketWatch

In February and March , as the U.S. economy began to recover from the coronavirus pandemic, a selloff in U.S. Treasurys sent yields up sharply, with the 10-year benchmark TMUBMUSD10Y, 1.569% coming within a whisker of 1.8%. Partly as a result investors began to rotate away from technology and other growth stocks that are sensitive to higher interest rates which had performed well during the pandemic, limiting further gains in the major stock indexes.

Since then the bond market has been subdued, with yields falling back below 1.6% even as fears of a surge in inflation have mounted as businesses have reopened and consumer demand has ramped up. The market calm seems to fly in the face of talk of a repeat of the 2013-14 “taper tantrum” that left bond traders with psychological scars after yields rose sharply when the Federal Reserve began to slow its purchase of bonds as the economy recovered from the 2008 financial crisis.

“We’ve had a big move already,” said Kathy Jones, chief fixed-income strategist at the Schwab Center for Financial Research, in a phone interview, referring to the rise of over one percentage point in the 10-year yield from just above 0.5% last summer. And that move occurred without the Federal Reserve fiddling with its $120 billion-a-month bond purchase program, she noted.

Economists at the Institute of International Finance, meanwhile, said the 10-year’s sideways yield action over the last two months is likely a product of the Fed’s average-inflation targeting stance, in which it has vowed to allow inflation to run above its 2% target for a spell to make up for past undershoots and allow the labor market to fully heal.

“It is notable how few hikes are priced into front-end interest rates compared to the tantrum in 2013, even as rapid progress on vaccinations and prospects of a rapid recovery would warrant such a risk premium,” they said, in a June 3 note.

Yields in the eurozone have been on the rise. And investors have noted that the stockpile of global debt sporting negative yields — meaning investors were paying for the privilege of lending money — has started to shrink significantly. The chart below tracks the percentage of European and Japanese government bond yields that remain negative.

- 06/05/2021 – need to read

Warren Buffett on Interest Rates and Why Stocks are Cheap

Stocks appear incredibly cheap when interest rates are considered.

- 06/02/2021 – yield curve steepest in a week. rate hike pressure is gradually building up

TREASURIES-Yield curve steepest in a week after manufacturing data

The U.S. Treasury yield curve hit its steepest level in a week on Tuesday morning after manufacturing data showed strong demand, even as industry faced labor and raw material shortages. The steeper yield curve on Tuesday reflected expectations that the Federal Reserve would hold interest rates low for now, even as the economy recovers. The benchmark 10-year yield , a proxy for the market’s view on the health of the economy, was last 3.7 basis points higher on the day to 1.630%. The two-year yield, which reflects expectations of interest-rate rises, was marginally higher, last up less than half a basis point on the day to 0.149%. The Institute for Supply Management (ISM) said on Tuesday its index of national factory activity increased in May as pent-up demand, driven by a reopening economy and fiscal stimulus, boosted orders. But strong demand has strained supply chains. And the coronavirus has disrupted labor at manufacturers and their suppliers, leading to raw material shortages across industries. The spread between the two- and 10-year yields , the most common measure of the yield curve, rose to 148.8 basis points, the highest since May 21, just prior to the release of the data, and then hit those levels again after the release. The spread between the five- and 30-year yields , another closely watched measure, rose to 150.6 basis points, also the highest since May 21.

- 06/02/2021 – Fed starts to sell corporate bonds and ETFs acquired during CV, it is a prelude of interest rate hike? even though the size is only $14 bil.

Fed to Sell Corporate Bonds and ETFs Acquired During Covid-19 Crisis – WSJ

The Federal Reserve will soon begin selling off the corporate bonds and exchange-traded funds it amassed last year through an emergency-lending vehicle set up to contain the Covid-19 pandemic’s economic fallout.

The vehicle, known as the Secondary Market Corporate Credit Facility, or SMCCF, held $5.21 billion of bonds from companies including Whirlpool Corp. , Walmart Inc. and Visa Inc. as of April 30. In addition, it held $8.56 billion of exchange-traded funds that hold corporate debt, such as the Vanguard Short-Term Corporate Bond ETF.

The sales, which should be completed by the end of this year, are unrelated to monetary policy, a Fed official said. Net proceeds will be remitted to the Treasury Department, which funded the facility’s creation.

The SMCCF’s corporate-debt holdings are distinct fr