Infrastructure

- 11/07/2021 –

How the $1 Trillion Infrastructure Bill Aims to Affect Americans’ Lives

The legislation seeks to ensure fewer blackouts and cleaner water, but in some areas it might fall short of needed upgrades

Congress has voted to pass the largest federal investment in infrastructure in more than a decade, a bipartisan injection of money across vast sections of the U.S. economy.

The $1 trillion package would invest in refurbishing aging roads, bridges and ports; easing transportation bottlenecks; replacing harmful lead pipes; expanding internet access; upgrading the nation’s power grid; and boosting infrastructure resilience amid growing concerns over climate change.

TABLE OF CONTENTS

- How We Commute

- How We Travel

- What Cars We Buy

- How We Transport Goods

- How We Access the Internet

- How We Get Water to Our Homes

- How We Cope With Climate Change

- How We Get Power

- 08/08/2021 – more and more details will come for this infrastructure plan

- Infrastructure Bill’s Boost to Economy Is Likely to Be Limited – WSJ

Economists say the short-term economic lift will be minimal, though bill may generate long-term productivity gains

the infrastructure spending will take place over five to 10 years starting in 2022, a longer timeline than pandemic-era initiatives like stimulus checks, extra unemployment benefits and small-business support programs. That will make its direct effects on employment and demand less noticeable.

2. What’s in the Infrastructure Bill for Roads, Bridges, Broadband and Cryptocurrency – WSJ

Federal spending will be paid for with unused Covid-19 aid funds and unspent jobless aid, among other sources

A bipartisan group of senators unveiled legislative text on Sunday for a roughly $1 trillion infrastructure package, which includes about $550 billion above projected federal spending on roads, bridges, expanded broadband access and more.

The bill includes $110 billion in funding for roads, bridges and major projects, as well as $39 billion to modernize and make public transit more accessible to the disabled and elderly. Significant chunks of that money will go to major city transit systems, like New York City’s, based on federal funding formulas.

The legislation will provide $11 billion in funding for highway and pedestrian safety programs. A total of $7.5 billion will go to implementing a network of electric vehicle chargers, and another $7.5 billion will be used for zero-emission or low-emission buses and ferries. Ports and airports will be boosted with $42 billion in new spending.

The group agreed to spend $50 billion to bolster the country’s infrastructure generally against climate change and cyberattacks. Another $55 billion will go toward clean drinking water and $65 billion will go toward broadband infrastructure and development. The deal invests $21 billion in removing pollution from soil and groundwater, job creation in energy communities and a focus on economic and environmental justice. The legislation will include $73 billion to update and expand the power grid.

3. Cable, Internet Companies Stand to Gain From Broadband Funding in Infrastructure Bill – WSJ

The $1 trillion infrastructure bill includes $65 billion to improve internet access for poor and isolated communities

- 06/03/2021 – White House lower its bid to $1 Tril, the chance of bipartisan approval is rising

Biden Floats New Infrastructure Spending Offer of $1 Trillion – WSJ

President makes legislative proposal in meeting with Republican Sen. Capito; Senate Republicans discuss making a counteroffer

President Biden signaled he could accept a narrower infrastructure package that didn’t include raising the corporate tax rate, telling a top Senate Republican that he wants $1 trillion in new spending and floating alternative ways to pay for the measure, according to people briefed on the matter.

During a Wednesday meeting with Sen. Shelley Moore Capito (R., W.Va.), Mr. Biden put forward the $1 trillion proposal, down from $1.7 trillion previously, and outlined options to pay for the spending that wouldn’t boost the corporate tax rate to 28% from 21%, as he previously proposed. Republicans have called any effort to boost the corporate tax rate or unwind the Republicans’ 2017 tax law a nonstarter.

Under one of Mr. Biden’s suggestions, the biggest companies would pay a minimum corporate tax of 15%, according to people briefed on the matter. Unlike Mr. Biden’s proposed corporate tax-rate increase or changes to taxes on U.S. companies’ foreign income, the minimum tax wouldn’t directly reverse the 2017 law, passed by Republicans with no Democratic support. That law reduced tax bills for most families and businesses, eliminated some breaks and dropped the corporate tax rate to 21% from 35%.

But the minimum corporate tax, already proposed by Mr. Biden as part of his broader agenda, would have some of the same effects by clawing back various tax breaks. More broadly, Republicans argue higher taxes would damp the economic recovery.

- 05/27/2021 – hyperinflation is coming due to unlimited spending? Also, higher tax (including capital gain tax) will crash the stock market and economy? (The corporate tax rate would climb to 28% from 21%, the top capital-gains tax rate would go to 43.4% from 23.8% and unrealized gains would be taxed at death, with a $1 million per-person exemption.)

Biden Expected to Propose $6 Trillion Budget – WSJ

President’s first fiscal plan would boost spending on infrastructure, education, healthcare and social services

The Biden administration’s first budget, for the fiscal year beginning Oct. 1, would put the nation on a path to spend $8.2 trillion annually by the end of 2031, the people said. Under the plan, debt would exceed the record level seen at the end of World War II within a few years and reach 117% of economic output by the end of 2031, up from about 100% this year.

The government was on track to spend $5.7 trillion in fiscal year 2021, according to Congressional Budget Office projections released in February, before Congress enacted Mr. Biden’s $1.9 trillion Covid-19 relief package. The Biden budget plan would boost federal spending by $300 billion, or 5%, above the 2021 projected level.

Biden Budget Said to Assume Capital-Gains Tax Rate Increase Started in Late April – WSJ Leaders of six biggest U.S. banks, testifying to Congress Thursday, each warned against a retroactive change to the capital-gains tax

President Biden’s expected $6 trillion budget assumes that his proposed capital-gains tax rate increase took effect in late April, meaning that it would already be too late for high-income investors to realize gains at the lower tax rates if Congress agrees, according to two people familiar with the proposal.

Mr. Biden’s plan would raise the top tax rate on capital gains to 43.4% from 23.8% for households with income over $1 million. He would also change the tax rules for unrealized capital gains held until death.

The effective date for the capital-gains tax rate increase would be tied to Mr. Biden’s announcement of the tax increase as part of his American Families Plan, which includes an expanded child tax credit and funding for preschool and community college. He detailed the plan April 28, and the budget will be released Friday. White House representatives didn’t immediately comment.

The leaders of the six biggest U.S. banks, testifying to Congress Thursday, each warned that a retroactive change to the capital-gains tax would spook small businesses and investors, likely causing economic damage.

The corporate tax rate would climb to 28% from 21%, the top capital-gains tax rate would go to 43.4% from 23.8% and unrealized gains would be taxed at death, with a $1 million per-person exemption.

- 05/25/2021 – we might will have the infrastructure plan approved in late June or July

Bipartisan infrastructure talks on life support

The White House has said officials want to see progress by Memorial Day, but it’s unclear whether Biden will look past the negotiations and signal support for Democrats to go it alone if there isn’t movement toward a compromise by the end of this week.

In late June or July, Schumer and Speaker Nancy Pelosi (D-Calif.) can move to advance infrastructure through the budget reconciliation process. That would allow them to pass a $2 trillion to $3 trillion measure with a simple-majority vote and bypass a GOP filibuster, assuming sufficient Democratic support in each chamber.

- 04/03/2021 – WSJ’s analysis on Infrastructure Plan

Biden’s Infrastructure Plan Visualized: How the $2.3 Trillion Would Be Allocated – WSJ

Biden’s Infrastructure Plan: Where the Money Is Going – WSJ

Biden’s Infrastructure Plan: Which Sectors Would Benefit? – WSJ

Biden Aims for Universal High-Speed Internet in Infrastructure Plan – WSJ

- 04/01/2021 – start to look for opportunities for the “might” upcoming infrastructure plan

Best stocks for Biden’s infrastructure plan from KeyBanc: Alpha Tactics Part 1

Best stocks for Biden’s infrastructure plan from KeyBanc: Alpha Tactics Part 2

President Biden’s American Job Plan & the ETFs that can be affected

- 04/01/2021 – If tax preference is eliminated for Fossil Fuels, profit of oil companies might suffer

exact details of Infrastructure plan – FACT SHEET: The American Jobs Plan

Eliminate Tax Preferences for Fossil Fuels and Make Sure Polluting Industries Pay for Environmental Clean Up. The current tax code includes billions of dollars in subsidies, loopholes, and special foreign tax credits for the fossil fuel industry. As part of the President’s commitment to put the country on a path to net-zero emissions by 2050, his tax reform proposal will eliminate all these special preferences. The President is also proposing to restore payments from polluters into the Superfund Trust Fund so that polluting industries help fairly cover the cost of cleanups.

- 03/26/2021 – BABs are special municipal bonds that allow states and counties to float debt with interest costs subsidized by the federal government. its rate is 7% which is quite attractive. Might be good to own.

Build America Bonds may be key to financing Biden’s infrastructure plans

- The country’s overall infrastructure needs over the next 10 years total nearly $6 trillion, and lawmakers are split on how to pay for it.

- Citigroup’s head of Citi’s municipal bonds strategy, thinks he has the answer: a resurrection of Build America Bonds.

- The bonds allow states and counties, which manage the majority of U.S. infrastructure, to float debt with interest costs subsidized by the federal government.

The country’s overall infrastructure needs over the next 10 years total nearly $6 trillion, according to a report published earlier in March by the American Society of Civil Engineers. It says there’s a $125 billion backlog on bridge repairs, a $435 billion backlog for roads and a $176 billion backlog for transit systems.

The beauty of subsidizing the interest associated with muni bonds, Rai argues, is that every dollar spent by the federal government works to reinforce the integrity of larger spending projects that, legally, only states and localities have the power to pursue.

The federal government owns less than 10% of the nation’s infrastructure, while the rest is operated by states, cities and the private sector.

BABs are special municipal bonds that allow states and counties to float debt with interest costs subsidized by the federal government. That underwriting not only served to ease jittery investors in the aftermath of the financial crisis, but also made municipal debt even more attractive with rates sometimes north of 7%

- 03/24/2021 – renewal of FAST Act and infrastructure plan are music to construction companies

Road Is Smoother Than Expected for Infrastructure, Biden Plan or Not – WSJ

Traffic and revenue sources for transportation haven’t dried up as much as states expected last year

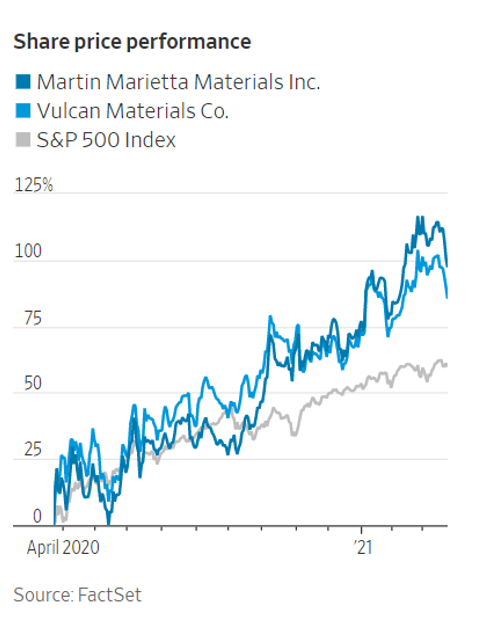

Investors certainly seem to think so. Shares of Martin Marietta MLM +2.65% and Vulcan Materials, which provide building blocks for infrastructure such as concrete, asphalt, sand and gravel, hit record highs this month, soaring 120% and 93%, respectively, over the past year, compared with the S&P 500’s 75% gain.

Both the companies and investors seem bullish about federal support for infrastructure, which is high on President Biden’s agenda. The details of the new administration’s $3 trillion infrastructure plan, which haven’t been finalized, are likely to shift over time—including the sticker price and the parameters of what counts as infrastructure. But there are factors outside the plan that already help brighten prospects.

On a federal level, timing matters. The federal surface transportation funding authorization that passed in 2015, known as FAST Act, is due to expire in September after a one-year extension passed last year. The industry sees an opportunity for a reauthorization and increase in that pool of funding, whether or not it gets folded into the larger infrastructure bill.