New Energy

- 06/08/2021 – It take many years for oil/gas company to transition to new energy company. One of its first offshore wind farms had a series of major setbacks—its turbines were damaged by strong winds and corroded by the salt air, and had to be retrofitted with new types of equipment—raising concerns among the public and officials about the viability of offshore wind power. Today, the number of companies in the field has exploded, and analysts say increased competition in auctions could squeeze margins on projects that are typically awarded by governments based on the lowest electricity price a company is willing to sell their power. Financial returns aren’t as good as for oil and gas projects. Traditionally returns of around 15% are targeted for hydrocarbon projects, according to RBC Capital Markets, compared with the 7% to 8% Ørsted targets for some of its projects. Some investors say that while returns are lower on wind projects, they are less volatile and more predictable. That difference has made it tough for investors in large oil companies to buy into the logic of a wholesale shift toward renewables.

One Oil Company’s Rocky Path to Renewable Energy – WSJ

Ørsted spent years transitioning away from oil and gas. Now, it is the world’s largest developer of offshore wind energy. The pivot holds lessons for major oil producers targeting solar and wind power.

For years, Danish Oil and Natural Gas Co. did what many other big oil companies do: pumped hydrocarbons out of the North Sea.

Today, it’s the world’s largest developer of offshore wind energy, and exceeds the market value of oil giants Occidental Petroleum Corp. and Eni SpA.

Renamed Ørsted AS , it’s one of a handful of once-small energy companies that have grown after pivoting from fossil fuels to renewables, including Spain’s Iberdrola SA, Italy’s Enel SpA and America’s NextEra Energy Inc.

As many oil companies now seek to follow suit, Ørsted is a case study on how hard the shift is. It took government intervention, years of subsidies and a wide-open competitive landscape for Ørsted to succeed. Shareholders and board members repeatedly questioned the strategy shift, and the costs ballooned the company’s debt, nearly derailing it.

Today, subsidies are falling, if they exist at all. Competition for new wind and solar projects is fierce. And returns are lower than most big oil developments.

A big reason for Ørsted’s eventual success is that it doubled down on a single industry—offshore wind—where it already had a first-mover advantage. BP PLC and Royal Dutch Shell PLC, two of the big oil companies with the biggest ambitions for going green, are instead investing in a wide array of low-carbon pursuits, from solar and wind to carbon capture. These are technologies they have dabbled in for years, but never pursued with the focus Ørsted applied to offshore wind.

Ørsted said last week it planned to invest $57 billion by 2027 in wind energy.

A big boost that Ørsted and others are now enjoying: a broad government embrace around the world for offshore wind.

For Ørsted, the reinvention over the past decade wasn’t easy. One of its first offshore wind farms had a series of major setbacks—its turbines were damaged by strong winds and corroded by the salt air, and had to be retrofitted with new types of equipment—raising concerns among the public and officials about the viability of offshore wind power.

Today, the number of companies in the field has exploded, and analysts say increased competition in auctions could squeeze margins on projects that are typically awarded by governments based on the lowest electricity price a company is willing to sell their power.

Financial returns aren’t as good as for oil and gas projects. Traditionally returns of around 15% are targeted for hydrocarbon projects, according to RBC Capital Markets, compared with the 7% to 8% Ørsted targets for some of its projects. Some investors say that while returns are lower on wind projects, they are less volatile and more predictable.

That difference has made it tough for investors in large oil companies to buy into the logic of a wholesale shift toward renewables.

“Investors are asking how long will it be before oil majors’ earnings from renewables businesses are big enough to offset the decline in the legacy businesses. My impression is that it’s definitely a few years out,” said Tim Porter, chief investment officer at Reaves Asset Management, which has around a $100 million stake in Ørsted. “The size of the business that’s in decline is far bigger than the size of the business that’s growing for these companies.”

- 06/08/2021 – interesting to see Michael Moore’s view of the “fix” of climate change

Michael Moore Presents: Planet of the Humans | Full Documentary | Directed by Jeff Gibbs – YouTube

Michael Moore presents Planet of the Humans, a documentary that dares to say what no one else will — that we are losing the battle to stop climate change on planet earth because we are following leaders who have taken us down the wrong road — selling out the green movement to wealthy interests and corporate America. This film is the wake-up call to the reality we are afraid to face: that in the midst of a human-caused extinction event, the environmental movement’s answer is to push for techno-fixes and band-aids. It’s too little, too late. Donate: https://www.paypal.com/cgi-bin/webscr… (100% of donations go to translation, further articles and viewing & maintaining wide distribution) Interview with Jeff, Michael, and Ozzie (1hr 16min): https://youtu.be/HBGcEK8FD3w Hill TV Response to critics with Jeff, Michael and Ozzie (17min): https://youtu.be/Bop8x24G_o0 FAQ, Discussion Guide, Media: https://planetofthehumans.com/ Removed from the debate is the only thing that MIGHT save us: getting a grip on our out-of-control human presence and consumption. Why is this not THE issue? Because that would be bad for profits, bad for business. Have we environmentalists fallen for illusions, “green” illusions, that are anything but green, because we’re scared that this is the end—and we’ve pinned all our hopes on biomass, wind turbines, and electric cars? No amount of batteries are going to save us, warns director Jeff Gibbs (lifelong environmentalist and co-producer of “Fahrenheit 9/11” and “Bowling for Columbine”). This urgent, must-see movie, a full-frontal assault on our sacred cows, is guaranteed to generate anger, debate, and, hopefully, a willingness to see our survival in a new way—before it’s too late. Featuring: Al Gore, Bill McKibben, Richard Branson, Robert F Kennedy Jr., Michael Bloomberg, Van Jones, Vinod Khosla, Koch Brothers, Vandana Shiva, General Motors, 350.org, Arnold Schwarzenegger, Sierra Club, the Union of Concerned Scientists, Nature Conservancy, Elon Musk, Tesla. Website: https://planetofthehumans.com/

“green” energy isn’t all that green when you consider what goes into the construction of the infrastructure.

- 06/04/2021 – Mr. Koonin argues not against current climate science but that what the media and politicians and activists say about climate science has drifted so far out of touch with the actual science as to be absurdly, demonstrably false. “I’ve been building models and watching others build models for 45 years,” he says. Climate models “are not to the standard you would trust your life to or even your trillions of dollars to.” – climate change claims are based on computer models which do not converge and have too many uncertainty and variables which can not be fully understood

How a Physicist Became a Climate Truth Teller – WSJ

After a stint at the Obama Energy Department, Steven Koonin reclaims the science of a warming planet from the propaganda peddlers

Barack Obama is one of many who have declared an “epistemological crisis,” in which our society is losing its handle on something called truth.

Thus an interesting experiment will be his and other Democrats’ response to a book by Steven Koonin, who was chief scientist of the Obama Energy Department. Mr. Koonin argues not against current climate science but that what the media and politicians and activists say about climate science has drifted so far out of touch with the actual science as to be absurdly, demonstrably false.

This is not an altogether innocent drifting, he points out in a videoconference interview from his home in Cold Spring, N.Y. In 2019 a report by the presidents of the National Academies of Sciences claimed the “magnitude and frequency of certain extreme events are increasing.” The United Nations Intergovernmental Panel on Climate Change, which is deemed to compile the best science, says all such claims should be treated with “low confidence.”

From deeply examining the world’s energy system, he also became convinced that the real climate crisis was a crisis of political and scientific candor. He went to his boss and said, “John, the world isn’t going to be able to reduce emissions enough to make much difference.”

His book lands at crucial moment. In its first new assessment of climate science in eight years, the U.N. climate panel—sharer of Al Gore’s Nobel Peace Prize in 2007—will rule anew next year on a conundrum that has not advanced in 40 years: How much warming should we expect from a slightly enhanced greenhouse effect?

The panel is expected to consult 40-plus climate computer simulations—testament to its inability to pick out a single trusted one. Worse, the models have been diverging, not coming together as you might hope. Without tweaking, they don’t even agree on current simulated global average surface temperature—varying by 3 degrees Celsius, three times the observed change over the past century. (If you wonder why the IPCC expresses itself in terms of a temperature “anomaly” above a baseline, it’s because the models produce different baselines.)

Yet these models supply most of our insight into how the weather might change when emissions raise the atmosphere’s CO2 component from 0.028% in preindustrial times to 0.056% later in this century. “I’ve been building models and watching others build models for 45 years,” he says. Climate models “are not to the standard you would trust your life to or even your trillions of dollars to.” Younger scientists in particular lose sight of the difference between reality and simulation: “They have grown up with the models. They don’t have the kind of mathematical or physical intuition you get when you have to do things by pencil and paper.”

- 06/04/2021 – It is a dilemma for “greeners”. The Environmentalists’ opposing efforts threatens to significantly slow efforts by the Biden administration and businesses to fight climate change by reducing America’s carbon emissions.

Solar Power’s Land Grab Hits a Snag: Environmentalists – WSJ

Mojave Desert residents say they support clean energy, but not giant projects, citing threat to tortoises and views

These large projects are increasingly drawing opposition from environmental activists and local residents who say they are ardent supporters of clean energy. Their objections range from a desire to keep the land unspoiled to protection for endangered species to concerns that their views would no longer be as beautiful.

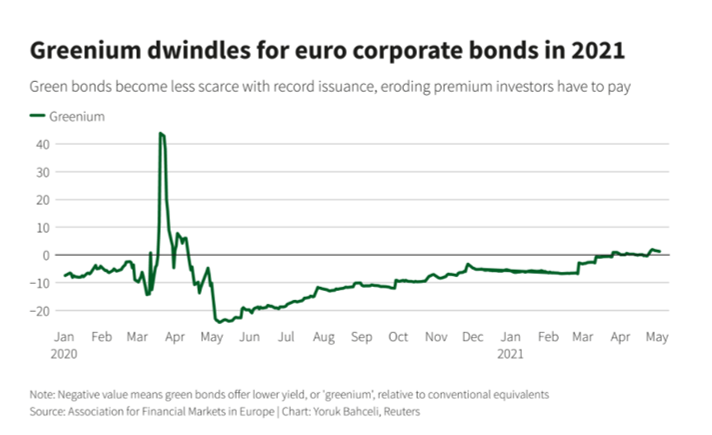

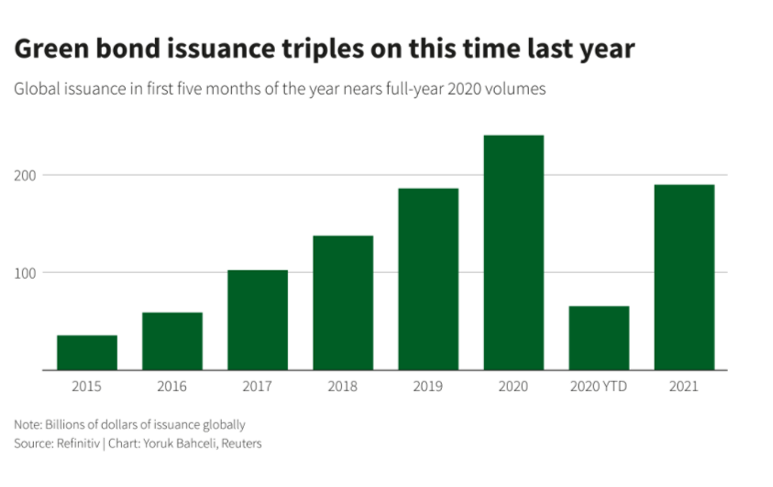

- 06/03/2021 – ‘Greenium’ shrinks as climate bond sales swell to record. Once interest rate hikes, the bonds will be crushed?

Analysis-‘Greenium’ shrinks as climate bond sales swell to record

Investors have long paid a premium to get hold of scarce green bonds, but record issuance might be about to change that.

In government bonds and in corporate sectors where green debt is rare, the greenium still lingers. For instance, Daimler’s green bond offers a credit spread that’s seven basis points tighter than a conventional bond due the same year.

And in the U.S. dollar investment-grade market, with fewer green bonds, green borrowers have commanded a pricing benefit of about 10 bps at issuance since 2020, according to Goldman Sachs, though that is down from 16 bps in 2016-2019.

But on both sides of the Atlantic, the scarcity premium is shifting to social and sustainability bonds, the bank argues.

Social bonds finance expenditures like healthcare or education while sustainability bonds can fund both social and green projects. They are scarcer as issuance really only kicked off after the pandemic erupted last year.

Since last year, such bonds have offered issuers a 20 bp premium on average at issuance in the euro investment-grade market and 36 bps in U.S. dollars, Goldman estimates.

The good news for those who believe in the power of green finance to improve corporate environmental credentials is that the declining greenium has not deterred issuers.

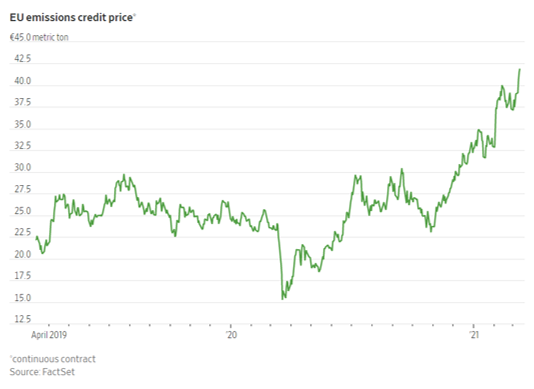

- 05/21/2021 – at least $50 trillion in investment will be needed to reduce fossil-fuel and other greenhouse-gas emissions by 2050 to meet the goals of the Paris climate accord. Where can we get the money? Are they profitable? Some investors say green-energy companies could struggle if interest rates rise and make early-stage investments less attractive. Capex in oil/gas has dropped significantly

Green Finance Goes Mainstream, Lining Up Trillions Behind Global Energy Transition – WSJ

After years of intermittent excitement and fizzled expectations, environmental-oriented investing is no longer just a niche interest

Some of the world’s biggest companies and deepest-pocketed investors are lining up trillions of dollars to finance a shift away from fossil fuels.

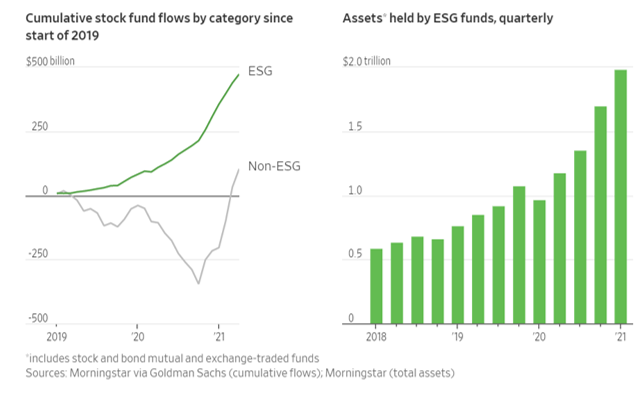

Assets in investment funds focused partly on the environment reached almost $2 trillion globally in the first quarter, more than tripling in three years. Investors are putting $3 billion a day into these funds. More than $5 billion worth of bonds and loans designed to fund green initiatives are now issued every day. The two biggest U.S. banks pledged $4 trillion in climate-oriented financing over the next decade.

“We’ve reached the tipping point and beyond,” said James Chapman, chief financial officer at Dominion Energy Inc., D 1.28% one of the country’s biggest utilities. Dominion, which has begun issuing green bonds, is planning to spend $26 billion or more on clean energy such as wind and solar in the next five years.

Even if investors and governments suffer losses, the inflow of cash could produce innovations in areas like batteries that are needed to significantly reduce carbon emissions. “Wall Street will throw money at this problem,” said David Brown, principal analyst in the energy-transition practice at consulting and research firm Wood Mackenzie. “Some will lose and some will gain, and the net benefit is you will have new industries that will emerge.”

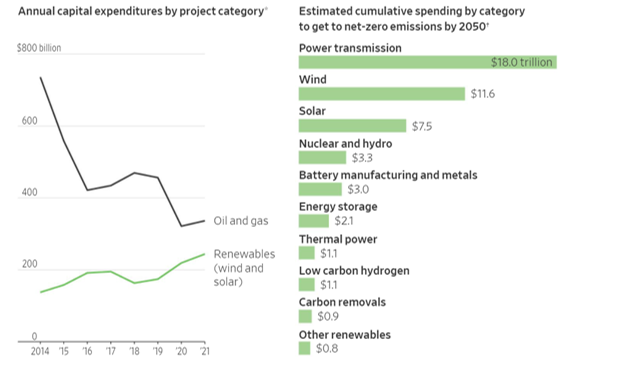

Spending Spree

Energy companies are spending more on renewable projects and less on oil and gas, but analysts say much more is needed to hit global climate goals.

Wood Mackenzie has estimated that at least $50 trillion in investment will be needed to reduce fossil-fuel and other greenhouse-gas emissions by 2050 to meet the goals of the Paris climate accord. The figure is based on the agreement’s targets of the world getting to net-zero emissions in the next 30 years, and limiting the rise in average global temperatures to 1.5 degrees Celsius above preindustrial levels. Wood Mackenzie’s models estimated the amount of wind, solar, battery storage and other projects necessary to meet the temperature goal.

Roughly half of that money, the firm said, needs to go to areas such as wind and solar power and battery storage. Another $18 trillion is needed to modernize the electric grid, in part to transition to cleaner energies such as solar and wind.

Some investors say green-energy companies could struggle if interest rates rise and make early-stage investments less attractive.

- 03/12/2021 – EU’s new Green Investing Standard might help set the bar for US and global. So worth study it

The Green Investing Standard That Could Set the Global Bar – WSJ

Europe’s new rules for institutional investors are woolly, but will be followed by sharper ones that may set the baseline for other countries

The Sustainable Finance Disclosure Regulation requires institutional investors to publish ESG-related risks and impacts and to categorize their products into one of three types, ranging from those that don’t consider sustainability to those for which it is a central objective. Promoters have to explain why a product deserves one of the two greener tags. National regulators will oversee enforcement.

A recent study by the Banque de France found that investors subject to its 2016 sustainability reporting rules cut their financing of fossil fuel companies by nearly 40% compared with domestic and international groups not covered by the rules.

President Biden’s green push hints that this type of disclosure might be on the U.S. agenda too.

- 01/12/2021 – Nuclear power is good new energy with small modular reactors, or SMRs

MINI NUCLEAR REACTORS OFFER PROMISE OF CHEAPER, CLEAN POWER

Reactor makers are pitching smaller, modular systems that produce limitless emissions-free energy—but they may not be an easy sell

Combining new technologies, advanced engineering and a market-friendly approach, reactor manufacturers are developing new systems that produce less power but are much smaller and less costly than existing nuclear reactors.

The pitch: small modular reactors, or SMRs, that can be housed in compact containment structures and operate safely with less shielding and oversight. SMRs could allow power plants to shed their huge hourglass-shaped cooling towers and, in some designs, the reactors would be immersed in water to prevent overheating.

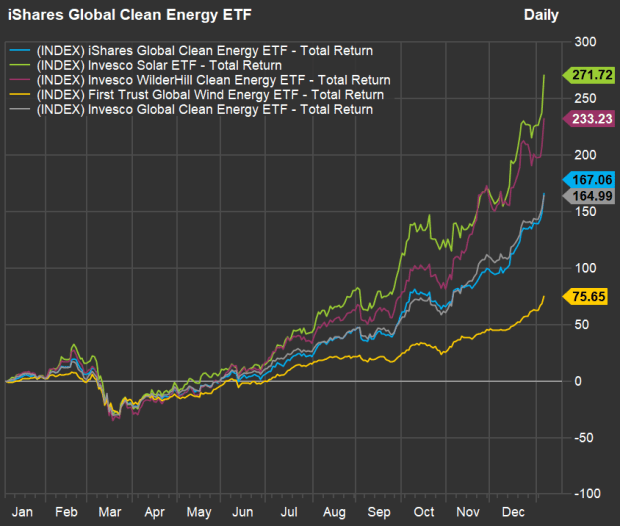

- 01/15/2021 – Bubble? No: solar-generated energy is the “cheapest” electricity source; Biden’s potential Green New Deal; Real technologies. Bubble? Yes: solar and wind power is limited by the laws of nature. Solar generation needs to be coupled with huge battery storage. Hydrogen fuel cells technology needs costly expansion of the hydrogen gas filling station network which barely exists today. – how to play this? review history book of latest Green bubble.

How Sustainable Is the Rally in Renewable Energy Stocks?

Solar and wind power companies have soared in value. Are they in a bubble or in a virtuous upward cycle?

Consider that while the SPDR S&P 500 Exchange-Traded Fund Trust, which tracks the benchmark S&P 500, returned 18.37 percent in 2020, the Invesco Solar E.T.F., which tracks an index of solar energy stocks, soared 233.95 percent, according to Morningstar Direct. The Invesco WilderHill E.T.F., which invests more broadly in alternative energy of various types, rose 204.83 percent.

Returns like those are so strong that they are unlikely to be replicated: It is possible that the stocks of companies engaged in carbon-free energy production are already in a bubble. Jason Bloom, head of fixed income and alternative E.T.F.s for Invesco, describes the sector this way: “I would call it rational optimism in view of improving fundamentals.”

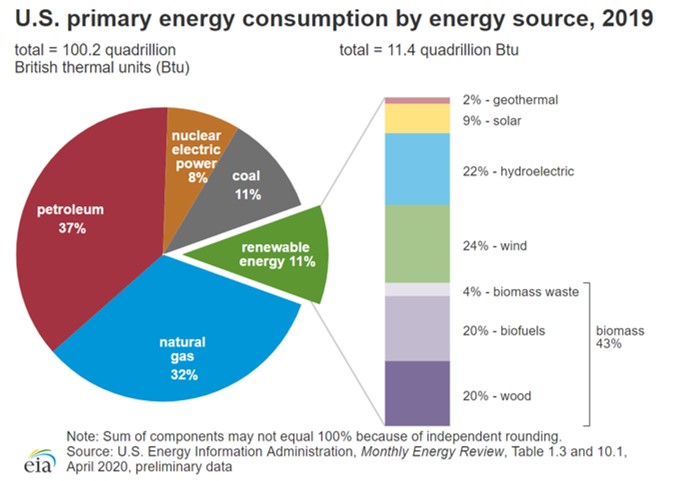

The International Energy Agency recently called solar-generated energy the “cheapest” electricity source in many countries. In the United States, it accounts for just 3 percent of energy output, but it is increasing rapidly. Wind power, which now supplies roughly 8 percent of domestic energy, has also been growing. There is plenty of room for expansion for many renewable energy companies.

Garvin Jabusch, chief investment officer for Green Alpha Advisors, an alternative energy investor, notes that the cost of generating electricity from solar energy is 90 percent lower than 10 years ago. Mr. Jabusch expects alternative energy prices to decline further with expanded demand. Mr. Jabusch favors companies that are “growing production capacity,” like First Solar, which has opened a new plant in Lake Township, Ohio, to expand production of its solar panels.

For all its promise, investment in solar and wind power is limited by the laws of nature: Solar units can produce electricity only when the sun is shining, and wind turbines need wind.

For the most part, Southern California Edison backs up its solar power with electricity generated by natural gas. But the utility recently contracted for nearly 600 megawatts of lithium ion battery storage so it can store excess electricity produced under ideal weather conditions.

“Battery prices are down 90 percent over the last five to eight years,” Ms. Bowman said. “As we transition to a cleaner grid, solar generation coupled with battery storage is the cost-effective solution for California,” she added.

Hydrogen fuel cells, which produce electricity by combining hydrogen and oxygen, have emerged as a possible near-term solution for use in trucking and shipping, says Mr. Bloom. But such applications will require a costly expansion of the hydrogen gas filling station network, said Steve Capanna, director of U.S. climate policy and analysis for the Environmental Defense Fund. Right now, he said, beyond “a handful in California,” there aren’t many such stations.

Paul Coster, a JPMorgan analyst, said that the high prices in the renewables sector are based on solid achievement. “It’s not like the dot-com era,” he said. “These are real actors with real technology.” He added, “We’re living in this wonderful moment in time when virtue and self-interest coincide.”

Perhaps, Mr. Coster mused, there are still good reasons to own some of these stocks. He cited FuelCell Energy, which has negative cash flow and has consistently reported quarterly earnings losses. Mr. Coster said investors may want to project out several years.

By 2025, he said, it’s “feasible” that FuelCell Energy would have $60 million in earnings before interest, taxes, depreciation and amortization, justifying a rich, growth stock valuation. Even so, the company’s shares more than doubled in the last month, and on Jan. 14, Mr. Coster warned that at current prices, the stock was already “richly valued.”

- 01/13/2021 – to understand new energy

What is renewable energy?

Renewable energy is energy from sources that are naturally replenishing but flow-limited; renewable resources are virtually inexhaustible in duration but limited in the amount of energy that is available per unit of time.

The major types of renewable energy sources are

What role does renewable energy play in the United States?

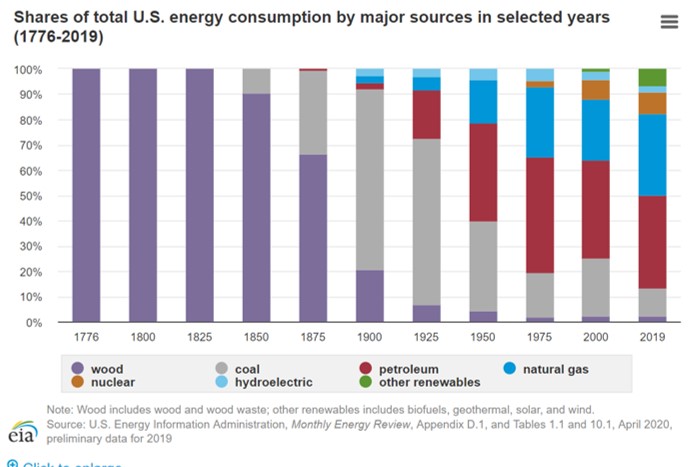

Until the mid-1800s, wood was the source of nearly all of the nation’s energy needs for heating, cooking, and lighting. From the late 1800’s until today, fossil fuels—coal, petroleum, and natural gas—have been the major sources of energy. Hydropower and wood were the most used renewable energy resources until the 1990s. Since then, the amounts and the percentage shares of total U.S. energy consumption from biofuels, geothermal energy, solar energy, and wind energy increased, and in 2019, the combined percentage share of these renewable energy sources was greater than the combined share of wood and hydro energy.

The consumption of biofuels, geothermal, solar, and wind energy in the United States in 2019 was nearly three times greater than in 2000.

In 2019, renewable energy provided about 11.5 quadrillion British thermal units (Btu)—1 quadrillion is the number 1 followed by 15 zeros—equal to 11.4% of total U.S. energy consumption. The electric power sector accounted for about 56% of total U.S. renewable energy consumption in 2019, and about 17% of total U.S. electricity generation was from renewable energy sources.

Renewable energy can play an important role in reducing greenhouse gas emissions. Using renewable energy can reduce the use of fossil fuels, which are the largest sources of U.S. carbon dioxide emissions. The U.S. Energy Information Administration projects that U.S. renewable energy consumption will continue to increase through 2050.

- 01/12/2021 -Biden’s plan on 500,000 charging stations (now there are about 90,000 public charging plugs at 28,000 U.S. stations)

Biden’s Charging Plan Could Sell 25 Million EVs

The president-elect wants to install 500,000 charging stations, but he’ll have to persuade Congress to plug in first.

In a bid to fight climate change and build a stronger, greener economy, Joe Biden is starting with plugs.

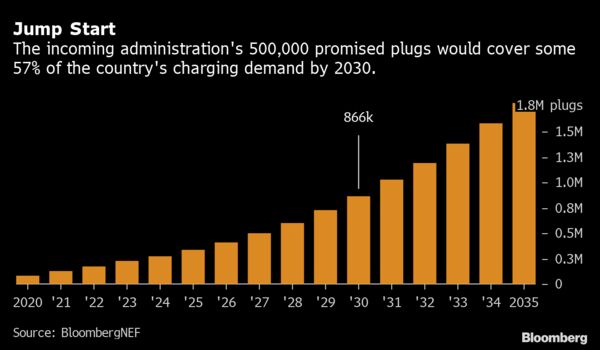

Specifically, the president-elect has a plan to install 500,000 electric vehicle charging cords by 2030, roughly a five-fold increase in the nation’s EV infrastructure that could cost more than $5 billion.

Right now, there are about 90,000 public charging plugs at 28,000 U.S. stations, according to the latest Energy Department tally. However, one in five of those is exclusive to Tesla; of the remainder, only one in 10 tops a car up quickly enough to be useful on a road trip. Most public charging options are still relatively slow—useful for drivers idling at work, for example, or grinding through a long grocery hunt.

Nevertheless, U.S. charging infrastructure is arguably a little ahead of the EV market. At the moment, there are about 20 U.S. electric vehicles for every public plug—the ideal ratio, according to research from BloombergNEF, is about 40 to 50. At that rate, Biden’s charging push would cover 25 million electric vehicles, roughly 9% of the current U.S. vehicle fleet.

“In principle, the (500K) goal is easy to explain—it fits on a postcard—but it’s as complicated as any major construction program in the U.S. at the moment,” Nigro said. “It’s not just ‘Let’s build the electric vehicle charging site of the future and then copycat it all over the country.’”

Biden’s team has yet to detail what form of chargers it hopes for and where they might pop up. Still, private charging networks are cheered by the policy push and hope to help the administration craft its plan—and possibly bid on the business.

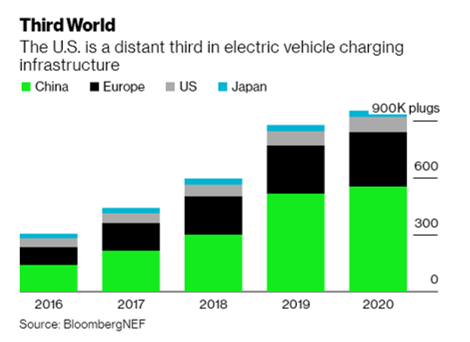

Third World

The U.S. is a distant third in electric vehicle charging infrastructure

Installing 500,000 public chargers at the national level is “feasible”, said Edison International Chief Executive Officer Pedro Pizarro. “It will require a lot of collaboration across utilities, charging companies, charger manufacturers and automakers,” said Pizarro, whose company owns the largest electric utility in Southern California. In addition, there will need to be collaboration with local municipalities to address potential roadblocks with the permitting and citing of the chargers, he said.

EVgo’s internal estimates show that a job is created for every fast-charging station that is installed. With 500,000 new public chargers, that could be 500,000 added jobs.

“Regardless whether you are a Republican or Democrat, you support the job,” she said. “You support clean air. You support economic growth. You support healthy infrastructure in America.”

- 01/12/2021 – The future of electric vehicle charging is bidirectional, understand V1G and V2G

2021 Outlook: The future of electric vehicle charging is bidirectional — but the future isn’t here yet

Within a few years, cars may be able to power homes, participate in energy markets and help businesses lower power bills, experts say.

This approach to managing EV demand — largely reliant on unidirectional power flows that adjust how and when chargers are pulling energy from the grid — is sometimes referred to as level 1 integration (V1G). But there is also interest in using the energy in EV batteries to serve other loads, with what are known as vehicle-to-grid (V2G) capabilities.

While those capabilities are utilized in parts of Europe and Asia, experts say the United States is still years away from widespread use of V2G. There are a few utilities rolling out pilot programs to test the capabilities, including Duke Energy in North Carolina, but there are still safety and engineering concerns to be addressed, technical problems to solve and business cases to study.

- 01/12/2021 – good stocks to study: REGI, FELR, PLUG, ENPH, BE, ICLN

Top Alternative Energy Stocks for Q1 2021

REGI, FSLR, and PLUG are top for value, growth, and momentum, respectively

The alternative energy sector is comprised of companies that engage in the generation, distribution, and sale of renewable and clean energy, as well as related products and services. Examples of alternative energy sources include solar, wind, hydroelectric, and geothermal. The growing list of names in the sector includes companies like Israel-based SolarEdge Technologies Inc. (SEDG), Brazil-based Companhia Energetica de Minas Gerais CEMIG (CIG), and First Solar Inc. (FSLR). Alternative energy stocks, as represented by the iShares Global Clean Energy ETF (ICLN), have dramatically outperformed the broader market, posting a total return of 108.4% compared to the Russell 1000’s total return of 21.8% over the past 12 months.1 These market performance numbers are as of December 7 and the statistics in the tables below are as of December 8.

Here are the top 3 alternative energy stocks with the best value, the fastest earnings growth, and the most momentum.

Best Value Alternative Energy Stocks

These are the alternative energy stocks with the lowest 12-month trailing price-to-earnings (P/E) ratio. Because profits can be returned to shareholders in the form of dividends and buybacks, a low P/E ratio shows you’re paying less for each dollar of profit generated.

-

- Renewable Energy Group Inc.: Renewable Energy Group develops and distributes biofuels, renewable chemicals, and related products. The company works with businesses across the U.S. On December 3, the company announced several executive-level leadership changes, including the movement of Chad Stone, current CFO, to the newly created position of senior vice president of commercial performance. Todd Robinson, previously treasurer and executive director of investor relations, will serve as interim CFO.2

- Canadian Solar Inc.: Canadian Solar is a Canada-based solar power company that designs, manufactures, and sells solar module products that convert sunlight into electricity.

- JinkoSolar Holding Co. Ltd.: JinkoSolar is a China-based energy company that manufactures solar products including silicon wafers, solar cells, and solar modules. The company also offers solar system integration services. In late November, JinkoSolar announced that Dr. Jiun-Hua Allen Guo would be appointed Chief Operating Officer, replacing Zhiqun Xu, who is resigning.

Fastest Growing Alternative Energy Stocks

These are the alternative energy stocks with the highest year-over-year (YOY) earnings per share (EPS) growth for the most recent quarter. Rising earnings show that a company’s business is growing and is generating more money that it can reinvest or return to shareholders.

- First Solar Inc.: First Solar designs and manufactures solar power systems and solar modules. The company utilizes a thin film semiconductor technology to manufacture electricity-producing solar modules. For Q3 2020, First Solar reported YOY net income growth of 406.3% along with YOY net sales growth of 69.6%. Net income was bolstered by sales strength in key product lines, more efficient manufacturing processes, and lower total operating expenses compared to Q3 2019.4

- Daqo New Energy Corp.: Daqo New Energy is a China-based solar energy company that manufactures polysilicon for distribution to manufacturers of solar technology products.

- Ameresco Inc.: Ameresco is an integrated electric energy company. The business supplies energy cogeneration services, hydro electric energy solutions, and renewable energy facilities. On December 7, Ameresco released its first Environmental, Social, and Corporate Governance (ESG) report. The company announced that, in 2019, it delivered a carbon offset equivalent to roughly 11.2 million metric tons of carbon dioxide.

Alternative Energy Stocks with the Most Momentum

These are the alternative energy stocks that had the highest total return over the last 12 months.

| Alternative Energy Stocks with the Most Momentum | |||

|---|---|---|---|

| Price ($) | Market Cap ($B) | 12-Month Trailing Total Return (%) | |

| Plug Power Inc. (PLUG) | 24.75 | 10.3 | 685.7 |

| Enphase Energy Inc. (ENPH) | 129.32 | 16.3 | 436.4 |

| Bloom Energy Corp. (BE) | 27.63 | 4.6 | 423.3 |

| Russell 1000 | N/A | N/A | 21.8 |

| iShares Global Clean Energy ETF (ICLN) | N/A | N/A | 108.4 |

- Plug Power Inc.: Plug Power designs, manufactures, and sells fuel cell systems used in electric lift trucks and other equipment. The company serves customers in retail, grocery, manufacturing, and food distribution worldwide. On November 30, the company announced that it was partnering with hydrogen-powered heavy vehicle maker Gaussin, based in France, to produce a new suite of vehicles for sale in 2021. Hydrogen power is increasingly being used in Western Europe to reduce carbon emissions. McKinsey & Co. forecasts that the global hydrogen economy could grow to $2.5 trillion by 2050, according to Plug Power.

- Enphase Energy Inc.: Enphase Energy provides solar energy cells, monitoring equipment, and microinverters for distributors, large installers, original equipment manufacturers and other customers. For Q3, the company reported 26.6% YOY growth in net income along with a 0.9% YOY decline in revenue. A significantly lower cost of revenue relative to Q3 2019 contributed to strong net income performance for the quarter.7

- Bloom Energy Corp.: Bloom Energy makes equipment used in power generation, including on-site generation systems utilizing fuel cells. The company’s customers represent industries as diverse as health care, banking, media and communication, food and beverage, technology, and utilities, among others.

- 01/12/2021 – Wind stocks to study: FAN,

NPI.TO, NEE, and TPIC are top for value, growth, and momentum

The wind energy industry is comprised of both a small number of pure-play companies and also big corporations that operate their wind energy business as a division or a subsidiary. One example of the latter is General Electric Co.’s (GE) Renewable Energy division. The wind industry has potential for significant growth, with the Global Wind Energy Council forecasting that offshore wind sources will increase dramatically in the coming decades.

Wind stocks, represented by the First Trust Global Wind Energy ETF (FAN), have dramatically outperformed the broader market. FAN has provided a total return of 53.0% over the past 12 months, well above the Russell 1000’s total return of 20.7%, as of December 1, 2020.

- 01/12/2021 – JPM might be right, alt energy might have big runway if Biden admin’s energy policy comes

Alt energy set to extend rally, as JPM sees ‘early innings of adoption’

- The alternative energy industry is “in the early innings of adoption… [with] further upside potential in the stocks as estimates are potentially revised higher,” J.P Morgan analysts say, tapping Sunrun (RUN -6.8%) and Sunnova Energy (NOVA -3.7%) as its top picks.

- Profits at the two solar power firms likely will accelerate in 2021 “owing to installation volume growth, declining customer acquisition costs (digital sales and permitting), declining cost of capital, increasing attach rates of solar+storage, and ramping cash flow from grid services contracts,” JPM says.

- Sunrun also should benefit from synergies from the recently closed acquisition of Vivint Solar, noting the stock has underperformed since the Oct. 8 deal closing, probably due to sales of Sunrun stock inherited by Vivint shareholders.

- But with Vivint Solar’s largest shareholder completely finished selling its position in Sunrun, the analyst believes an overhang on the stock is now removed.

- At the same time, JPM also downgraded Bloom Energy following the stock’s big YTD rally.

- ETF: TAN

- RUN and NOVA shares are losing ground today but have been strong performers over the past five months:

- 01/11/2021 – Solar, wind and natural gas will be the three biggest additions in 2021. Be aware of these three kinds of companies

Solar to be No. 1 in US for new 2021 electricity generating capacity

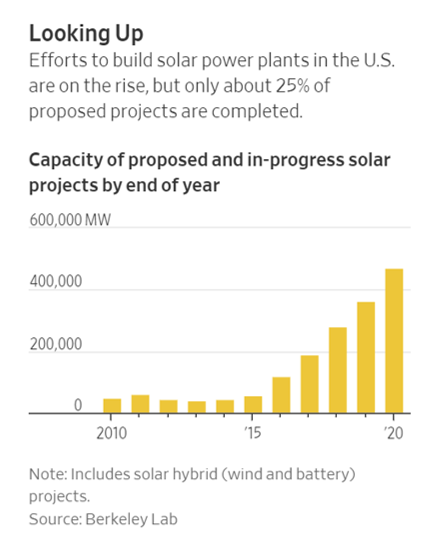

The addition of utility-scale solar capacity is expected to set a new record by adding 15.4 GW of capacity to the US grid in 2021, the US Energy Information Administration (EIA) announced today.

Solar leads the 2021 pack with 39% of total new US electricity generating capacity. It’s followed by wind (31%, or 12.2 GW), natural gas (16%, or 6.6 GW), battery storage (11%, or 4.3 GW), nuclear (3%, or 1.1 GW), and Other, at 0.2 GW.

Renewables account for most new U.S. electricity generating capacity in 2021

According to the U.S. Energy Information Administration’s (EIA) latest inventory of electricity generators, developers and power plant owners plan for 39.7 gigawatts (GW) of new electricity generating capacity to start commercial operation in 2021. Solar will account for the largest share of new capacity at 39%, followed by wind at 31%. About 3% of the new capacity will come from the new nuclear reactor at the Vogtle power plant in Georgia.

Solar photovoltaics. Developers and plant owners expect the addition of utility-scale solar capacity to set a new record by adding 15.4 GW of capacity to the grid in 2021. This new capacity will surpass last year’s nearly 12 GW increase, based on reported additions through October (6.0 GW) and scheduled additions for the last two months of 2020 (5.7 GW). More than half of the new utility-scale solar photovoltaic (PV) capacity is planned for four states: Texas (28%), Nevada (9%), California (9%), and North Carolina (7%). EIA’s Short-Term Energy Outlook forecasts an additional 4.1 GW of small-scale solar PV capacity to enter service by the end of 2021.

Wind. Another 12.2 GW of wind capacity is scheduled to come online in 2021. Last year, 21 GW of wind came online, based on reported additions through October (6.0 GW) and planned additions in November and December (14.9 GW). Texas and Oklahoma account for more than half of the 2021 wind capacity additions. The largest wind project coming online in 2021 will be the 999-megawatt (MW) Traverse wind farm in Oklahoma. The 12-MW Coastal Virginia Offshore Wind (CVOW) pilot project, located 27 miles off the coast of Virginia Beach, is also scheduled to start commercial operation in early 2021.

Natural gas. For 2021, planned natural gas capacity additions are reported at 6.6 GW. Combined-cycle generators account for 3.9 GW, and combustion-turbine generators account for 2.6 GW. More than 70% of these planned additions are in Texas, Ohio, and Pennsylvania.

Battery storage. EIA expects the capacity of utility-scale battery storage to more than quadruple; 4.3 GW of battery power capacity additions are slated to come online by the end of 2021. The rapid growth of renewables, such as wind and solar, is a major driver in the expansion of battery capacity because battery storage systems are increasingly paired with renewables. The world’s largest solar-powered battery (409 MW) is under construction at Manatee Solar Energy Center in Florida; the battery is scheduled to be operational by late 2021.

- 01/11/2021 – JPM might be right, at least, Biden has not yet started the Green New Deal, but these stocks already advanced so much. I can look for one or two to invest.

Alt energy set to extend rally, as JPM sees ‘early innings of adoption’

- Alternative energy stocks and related ETFs are surging today, continuing the outperformance that tracked the likelihood that Democrats would control the White House. Joe Biden’s clinched victory in the Electoral College yesterday is as good of an excuse as any for today’s move.

- Solar stocks are shining brightly: SPWR +12.8%, JKS +12.4%, ENPH +10.2%, CSIQ +8.3%, SEDG +6.1%, FSLR +3.2%.

- Clean energy stocks trade broadly higher: FTEK +15.6%,PLUG +9.6%, BE +8.5%, CLNE +8.1%, BLNK +7.2%, FCEL +4.5%, BLDP +3.8%.

- The Invesco Solar ETF (TAN +6.6%), SPDR S&P Kensho Clean Power ETF (CNRG +5.8%), iShares Global Clean Energy ETF (ICLN +4%) and ALPS Clean Energy ETF (ACES +4.3%) all sport gains of 4% of better.

- The TAN ETF has nearly tripled YTD, while the other related ETFs have more than doubled.

- Last week, JPMorgan said alternative energy is in the “early innings of adoption.”

- 01/08/2021 – need to understand the details of renewable energy

2017 sustainable energy in america factbook

2020-Sustainable-Energy-in-America-Factbook

a great online resource to have a overview of status of renewable energy

- 01/08/2021 – background study of renewable energy

comparison Between Renewable Energy and Fossil Fuels

1. The Difference Between Renewable Energy and Fossil Fuels

The difference between the two isn’t as complicated as you may think. Renewable energy comes from natural resources that can be replenished during an average human lifetime and includes the following types of power:

- Solar

- Wind

- Hydro

- Geothermal

- Biomass

Fossil fuels, on the other hand, can take thousands—or even millions—of years to naturally replenish:

- Natural gas

- Coal

- Oil

These distinctions may seem cut-and-dried, but there are some gray areas. Natural gas is often labeled as “clean power” because it burns cleaner than coal. Folks may even believe that natural gas is a sustainable resource. Don’t be fooled. natural gas is a fossil fuel that emits CO2 when burned. In the case of biomass, things also get a bit more complicated. Burning wood—the most common method of biomass energy generation—sometimes emits more CO2 than burning coal. That said, wood is classified as a renewable resource by a lot of scientists because trees can be replenished.

2. Fossil Fuels Dominate Energy Generation in the US

It’s no surprise that fossil fuels rule the day when it comes to American energy production. But it may surprise you that, in the US, natural gas now accounts for more energy generation than coal. Think about it—remember all that buzz around fracking? The energy industry is hungry for natural gas and will go to great lengths to extract it. Although natural gas currently leads the pack because of increased fracking activity, it still faces a decent amount of competition from other resources. Here’s a breakdown of energy generation by resource type:

Energy Generation in the US

- 34% natural gas

- 30% coal

- 20% nuclear

- 15% renewables

- 1% oil

Looking at the numbers, it might feel like an uphill battle for renewable energy. Why? Because coal is still a close second to natural gas and nuclear power still outpaces renewables by about five percent. But the numbers around renewable energy generation aren’t as disappointing as they may seem.

3. Renewables Are Growing Faster than Fossil Fuels

Even though natural gas increased its market share dramatically over the past decade, renewable energy grew faster than any fossil fuel. In 2016, renewable energy generation in the US grew to a record 22 gigawatts of capacity—burying fossil fuel growth. In Texas, wind power is by far the most dominant renewable resource with nearly triple the megawatt capacity of any other state and a cutting-edge grid that supports the efficient delivery of wind-generated electricity. If an oil-rich state like Texas can sustainably grow renewable energy, it’s reasonable to assume the percentage of renewables will continue to outgrow fossil fuels for the foreseeable future.

4. Renewables Can Cost Less than Fossil Fuels

The old excuse that renewable energy is too expensive is just that: an excuse. These days, the energy produced by renewables is just as affordable as energy produced by fossil fuels, if not cheaper in some cases. Some solar panel projects can even generate power at roughly half the cost of fossil fuels like coal. That’s a lot of potential savings. And, what’s more, renewable energy is only projected to get cheaper over time. PRO TIP: You don’t have to wait. Renewable-energy credits can help you go green at an affordable price today. See how you can go green for only $5 a month.

5. Renewable Energy is Cleaner than Fossil Fuels

Since the start of the Industrial Revolution, the earth’s temperature has increased at an alarming rate, raising oceanic water levels in its wake. Not only do fossil fuels heat the earth, they produce unhealthy by-products like air pollution, which adversely affects your lung health. Even if you’re skeptical about climate change, you can see the effects of fossil fuel combustion all around you in the form of dirty smog—particularly in larger cities like Houston. Renewable energy, on the other hand, typically emits less CO2 than fossil fuels. In fact, renewables like solar and wind power—apart from construction and maintenance—don’t emit any CO2 at all. With renewable energy, you can breathe easier, stay cooler, and create a more comfortable world for generations to come. When comparing renewable energy to fossil fuels, remember that renewable energy generation is cleaner, easier to sustain over time, expanding more rapidly, and sometimes even cheaper than fossil fuels. Visit the Amigo Energy Blog to learn more about renewable energy and see why going green is more important (and easier) than ever.

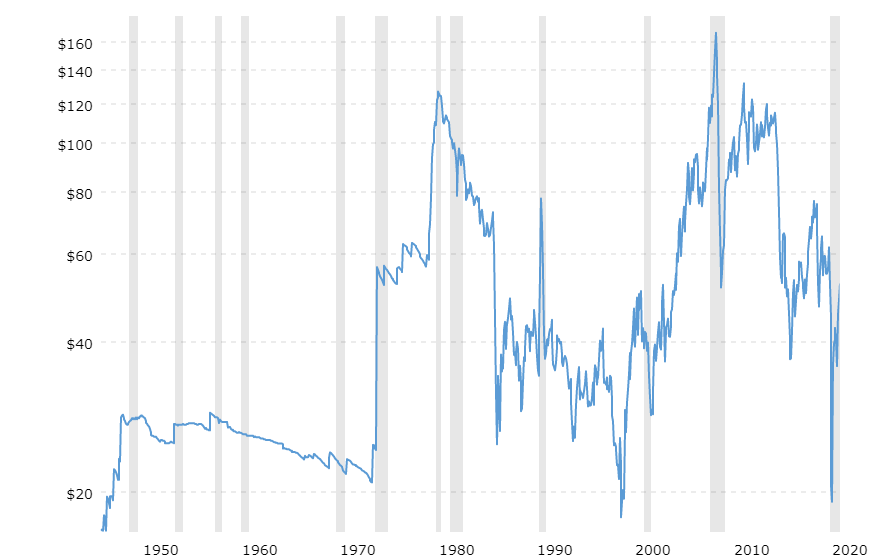

- 01/08/2021 – history study of “Green Bubble”. So current historical low interest rate environment is a great entry point for green energy. – need to understand fully of the history

the famous “green bubble” article

- 1969 ~1973

- 1988 ~1990

- 2006 ~ 2008

comparing with oil price history

The Green Bubble is a theory that the world is facing an over-investment in renewable energy and that the current levels of debts in many clean tech companies are unsustainable. As the interest rate rises many of the projects that are on the market today will go bust, which is claimed to become a big set-back for the renewable energy industry.

The term has been mentioned by several experts and articles and among them are: The book called “The Green Bubble”[1] written by Per Wimmer, a Danish investor, an article written in a magazine called “Wired”[2] that stresses on what happened to the solar energy companies (i.e. Solyndra for example), and the article written by Ted Nordhaus and Michael Shellenberger in 2009, “The Green Bubble: Why Environmentalism Keeps Imploding”.[3]

The article summarizes the history of green technology and the changes in the investments in this domain. In addition, a discussion on whether there is a bubble in green technology or not.

- 01/06/2021 – more capital investment into new energy, less cost, more profitable in the long run. Worth study more

Green Euphoria May Cost Investors, but Planet Says Thank You

Money pouring into Tesla and its ilk speeds up transition to carbon-free energy

Green energy faces obstacles the dot-com boom didn’t. It mostly does what fossil fuels already do—just with less carbon dioxide emissions, a benefit that accrues to the entire world rather than producers or consumers.

Yet renewable energy resembles high technology in one important respect. “The key technologies of renewable energy systems—solar, wind, and batteries—… follow a learning curve: each doubling of their installed capacity leads to the same decline of costs,” wrote Max Roser, founder of Our World in Data, a data aggregation website. Between 2009 and 2019, the cost of photovoltaic solar power fell 89%, of onshore wind by 70%, he said. The cost of gas- and coal-generated power, which depend mostly on the price of the fuel, fell by a third and 2%, respectively.

One of them is Plug Power Inc., a longtime supplier of hydrogen fuel cell power systems for forklifts that is expanding into road trucks, backup power generators for data centers, electrolyzer systems to make hydrogen from water, and hydrogen plants powered by renewables. Funding such plans would ordinarily be tough for a company that has never turned a profit. But as its shares skyrocketed from around $4 to over $30 last year, it issued $1.2 billion of stock and $200 million of debt convertible to shares. With that cash the company can make electrolyzers at “high scale, low cost,” and expand into markets potentially worth $2.5 trillion, according to Morgan Stanley, which underwrote the stock offerings.

Still, when so much capital chases so few companies, valuations can become illogical. Utility NextEra Energy Inc. generates less cash flow than Duke Energy Corp. yet garners twice the market value thanks to its extensive portfolio of renewable power assets. By contrast, BP PLC hasn’t earned any discernible premium for its plans to shift investment from oil and gas to renewable power.

Ultimately, most of the capital needed to transition away from fossil fuels will come not from glamorous green companies such as Tesla but all the others, who produce and consume most energy. More public research and development, a carbon tax or tradable emissions permits would redirect their investments far more effectively. Until and unless those come along, bubbles can help—if they last long enough.

- 01/06/2021 – good list of ETFs and stocks

Here are analysts’ 10 favorite clean-energy stocks to buy now

There is variety in the space. Some ETFs focus on particular industries, such as wind- or solar-power generation, and geographic focuses vary. We looked at five of the largest ETFs in the space:

- iShares Global Clean Energy ETF ICLN, 6.80% — This is the largest clean-energy ETF, with $4.78 billion in assets. It holds a market-capitalization-weighted portfolio of 30 liquid companies involved in the industry. It has annual expenses of 0.46% of assets.

- Invesco Solar ETF TAN, 5.13% — This is a concentrated play with $3.63 billion in assets, holding 30 stocks, also cap-weighted, with 54% of the portfolio in U.S. names. Its annual expense ratio is 0.69%.

- Invesco WilderHill Clean Energy ETF PBW, 6.64% — This ETF has $2.17 billion in assets, holding 32 stocks of companies that are listed in the U.S., with a modified equal-weighting. Its expense ratio is 0.70%.

- First Trust Global Wind Energy ETF FAN, 3.39% — This is another concentrated ETF, with $406 million in assets allocated 60% to “pure-play” wind-industry companies, with the rest of the portfolio made up of diversified companies involved in wind-power generation. That means it holds some large, traditional power companies, such Duke Energy Corp. DUK, -1.04% and NextEra Energy Inc. NEE, 1.33%. The portfolio has 50 stocks weighted by market capitalization. The expense ratio is 0.62%.

- Invesco Global Clean Energy ETF PBD, 5.90% — This ETF has $301 million in assets and it follows what FactSet describes as “more akin to an actively managed strategy than other funds in the segment,” because it follows an index designed to include companies with greater potential for stock-price appreciation. It holds about 100 stocks with a modified equal weighting. Its expense ratio is 0.75%.

One of the challenges in the alternative energy space is how well the stocks have been doing — many companies favored by analysts and investors have gotten well-ahead of consensus price targets.

| COMPANY | TICKER | COUNTRY | SHARE ‘BUY’ RATINGS | CLOSING PRICE – JAN. 5 | CONSENSUS PRICE TARGET | IMPLIED 12-MONTH UPSIDE POTENTIAL |

|---|---|---|---|---|---|---|

| E.ON SE | XE:EOAN | GERMANY | 70% | 8.93 | 11.09 | 24% |

| ENGIE S.A. | FR:ENGI | France | 89% | 12.62 | 15.09 | 20% |

| General Electric Co. | GE | U.S. | 71% | 10.77 | 12.24 | 14% |

| RWE AG | XE:RWE | Germany | 86% | 35.20 | 39.93 | 13% |

| NextEra Energy Inc. | NEE | U.S. | 60% | 74.77 | 83.53 | 12% |

| Enel SpA | IT:ENEL | Italy | 83% | 8.40 | 9.27 | 10% |

| Siemens AG | XE:SIE | Germany | 73% | 117.38 | 127.79 | 9% |

| Terna S.p.A. | IT:TRN | Italy | 53% | 6.16 | 6.71 | 9% |

| Air Products and Chemicals Inc. | APD | U.S. | 60% | 282.39 | 306.75 | 9% |

| Koninklijke DSM N.V. | NL:DSM | Netherlands |

- 12/06/2020 – look for opportunities in new energy companies

top 10 energy storage companies

Top Alternative Energy Stocks for Q4 2020

REGI, JKS, and BE are top for value, growth, and momentum, respectively