Study of FLG

-

Investors are returning to the U.S. office market, buying premium-quality buildings with too much debt or half-empty towers for low prices.

-

The volume of office building sales increased by 20% in 2024, and is expected to continue to accelerate in 2025, driven by real-estate investors with ample cash.

-

Some buyers are taking chances on buildings with debt and empty space, betting on the potential for value creation through renovations and leasing improvements.

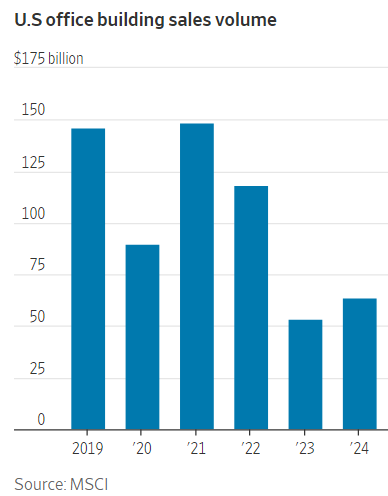

The volume of office building sales increased to $63.6 billion in 2024, up 20% from 2023, according to data firm MSCI. That activity still pales compared with 2015 to 2019, when volume averaged $142.9 billion a year. But it marked the first increase since 2021.

And with a lot of cash sitting on the sidelines, brokers expect sales activity to continue to accelerate in 2025. Opportunistic real-estate funds had $196.8 billion available at the end of last year, up from $179.9 billion at the end of 2020, according to data fund Preqin.

- 12/13/2024 – Flagstar Financial, Inc.’s (NYSE:FLG) recent 4.8% pullback adds to one-year year losses, institutional owners may take drastic measures – 53% by institutes, 13% by individual, 26% by private equity firms

-

Given the large stake in the stock by institutions, Flagstar Financial’s stock price might be vulnerable to their trading decisions

-

53% of the business is held by the top 5 shareholders

-

Ownership research along with analyst forecasts data help provide a good understanding of opportunities in a stock

Every investor in Flagstar Financial, Inc. (NYSE:FLG) should be aware of the most powerful shareholder groups. With 47% stake, institutions possess the maximum shares in the company. Put another way, the group faces the maximum upside potential (or downside risk).

The company’s largest shareholder is Liberty 77 Capital L.P., with ownership of 18%. Hudson Bay Capital Management LP is the second largest shareholder owning 10% of common stock, and BlackRock, Inc. holds about 9.3% of the company stock.

Our research also brought to light the fact that roughly 53% of the company is controlled by the top 5 shareholders suggesting that these owners wield significant influence on the business.

Our data suggests that insiders own under 1% of Flagstar Financial, Inc. in their own names. Keep in mind that it’s a big company, and the insiders own US$46m worth of shares.

The general public, who are usually individual investors, hold a 13% stake in Flagstar Financial. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

With a stake of 26%, private equity firms could influence the Flagstar Financial board.