Study of Macro (part III)

- 11/13/2024 – “Freight Recession” Over – ValuePlays

Recession fears have a history of well-defined inventory reduction first seen as severe recession fear built in 2016 and lasted till the COVID shutdown raised trucking use rapidly. The last period of recession fear began roughly Dec 2021 and accelerated into a trucking slowdown beginning March 2022. The retailer response has been to keep tight control on inventories with low inventory to sales ratios. This was the beginning of the strongest prolonged bout of recession fear ever. Only recently have we seen the beginnings of easing the pessimism in sentiment indicators. Freightwaves.com has just declared the end of the trucking recession. The video is part of the story which may be worthwhile passing on to interested parties.

The Freightwaves people are ecstatic in this report and well worth the watch to have them walk you through their presentation.

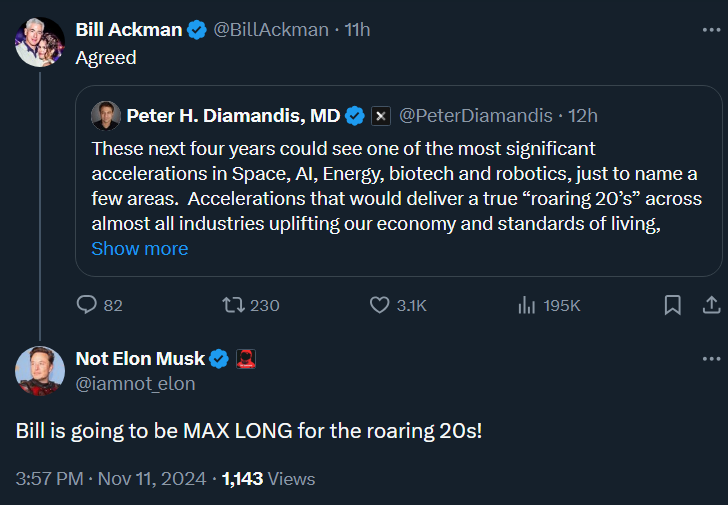

- 11/12/2024 – (1) Not Elon Musk on X: “@BillAckman Bill is going to be MAX LONG for the roaring 20s!” / X

- 11/09/2024 – Charlie Kirk on X: “President Trump released his plan to DISMANTLE the Deep State. Now that he’s President-elect, this is the most important three minutes of video on the internet right now. HUGE 🔥🔥 https://t.co/lhXwDPsv1q” / X

- 11/09/2024 – (1) MJTruthUltra on X: “Trumps Plan to Take a Quantum Leap in Technology and Land Development —Build 10 NEW Cities and Flying Cars The future will be AMAZING! 🙌 • 1/3 of the United States land mass is owned by the Federal Government. – One half of 1% of that land, we should hold a contest to https://t.co/dWTfbKDSV4” / X

Trumps Plan to Take a Quantum Leap in Technology and Land Development —Build 10 NEW Cities and Flying Cars The future will be AMAZING! • 1/3 of the United States land mass is owned by the Federal Government. – One half of 1% of that land, we should hold a contest to charter up to build 10 NEW CITIES “Freedom Cities”. • Transportation- We will lead the way in air & mobility to develop vertical take off & landing vehicles for families. • Forgotten communities will be hives of industry producing goods no longer imported from China! • Cost of Living- Major initiative lowering cost of living, focus on lowering the cost of a new car & building beautiful single family homes. • Congress to support baby bonuses! For young parents to help launch a BABY BOOM! • Launch a modernization & beautification campaign. – Get rid of ugly buildings – Refurbish parks & public spaces – Make cities & towns more livable

Trump Statement Agenda 47: Quantum Leap in the American Standard of Living! Wow!

- 11/07/2024 – The Fed – November 6-7, 2024 FOMC Meeting

Transcript of Chair Powell’s Press Conference November 7, 2024

- 11/06/2024 – The Winners and Losers From the ‘Trump Trade’ Gripping Markets – WSJ Big banks and small-cap stocks surge, while retailers and manufacturers brace for tariffs

Winner: big banks

The S&P 500’s financial sector jumped 6.2% Wednesday, with investors giddy at the prospect of lighter regulations.

Winner: big tech and crypto

Tech leaders including Tesla CEO Elon Musk, a big Trump booster, are hoping for favorable policies from the Trump administration.

Tesla shares surged 15%. Nvidia jumped 4.1% a day after the chip maker surpassed Apple as the world’s most-valuable company. Google-parent Alphabet, which has been under antitrust scrutiny, advanced 4%.

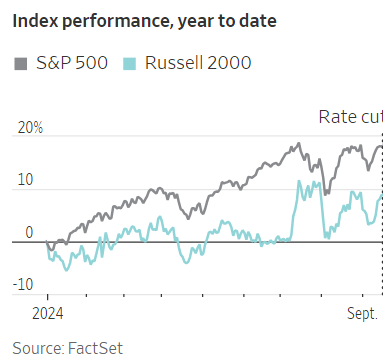

Winner: small caps

The Russell 2000 index of small-cap companies rose 5.8%, reflecting optimism that corporate tax cuts and lighter regulation for small businesses are on the horizon.

The move came despite an increase in bond yields, which often hurts smaller companies that are more reliant on borrowing.

Tariffs and tax cuts are both inflationary forces, hence the bond selloff that’s pushing yields higher, said David Kelly, chief global strategist at J.P. Morgan Asset Management. But corporate tax cuts would be an unequivocal positive for stocks, he added.

Loser: tariff-exposed companies

U.S.-based companies that manufacture goods overseas sold off on worries over tariffs.

Shares of Nike, Target, Best Buy, Williams-Sonoma and Restoration Hardware—all companies that Goldman Sachs analysts have identified as highly exposed to tariffs—traded lower.

Investors don’t like uncertainty, and it isn’t yet known exactly how much the Trump administration might raise tariffs.

- 10/06/2024 – Wall Street Salivates Over a New Trump Boom – WSJ

The enthusiasm is especially heated in a few areas, investors and bankers said. Banks and other financial companies climbed, with the KBW Bank Index rising 11%. Investors expect regulatory scrutiny will ease in a Trump administration.

Some also expect more dealmaking, potentially among smaller and midsize banks. The expected departure of Lina Khan, who leads the Federal Trade Commission and has been a thorn in the side of executives hoping to work out tech acquisitions, was cheered by investors and bankers.

“A lot of these mergers have been thwarted by the current administration,” the activist investor Carl Icahn said in an interview late Tuesday. Given a Trump victory, he said, “That’s going to change.”

Deals boom?

Dealmakers expect mergers and acquisitions to come roaring back, with the installation of business-friendly regulators replacing those backed by Sen. Elizabeth Warren (D., Mass.), a noted dealmaking foe. Goldman Sachs and Morgan Stanley were among the strongest performers on Wednesday; those firms are among the most deal-oriented.

“We’re poised for a potential surge in M&A activity,” Frank Aquila, Sullivan & Cromwell’s senior M&A partner, said Wednesday on LinkedIn.

More room for banks

Among the biggest beneficiaries of a Trump administration are U.S. banks, a group that has been under regulatory scrutiny that is likely to ease in the next four years.

Bank stocks surged Wednesday in a wager that a strong economy, increased dealmaking and lighter regulation will spur higher profits. Some of the firms that have been under the most pressure from their overseers during the Biden administration surged. Wells Fargo jumped 13% to a new high. Goldman Sachs and Morgan Stanley both rose more than 10%.

On Wednesday, the regional lenders KeyCorp, Huntington Bancshares, M&T Bank, Regions Financial and Truist Financial rose 11% or more.

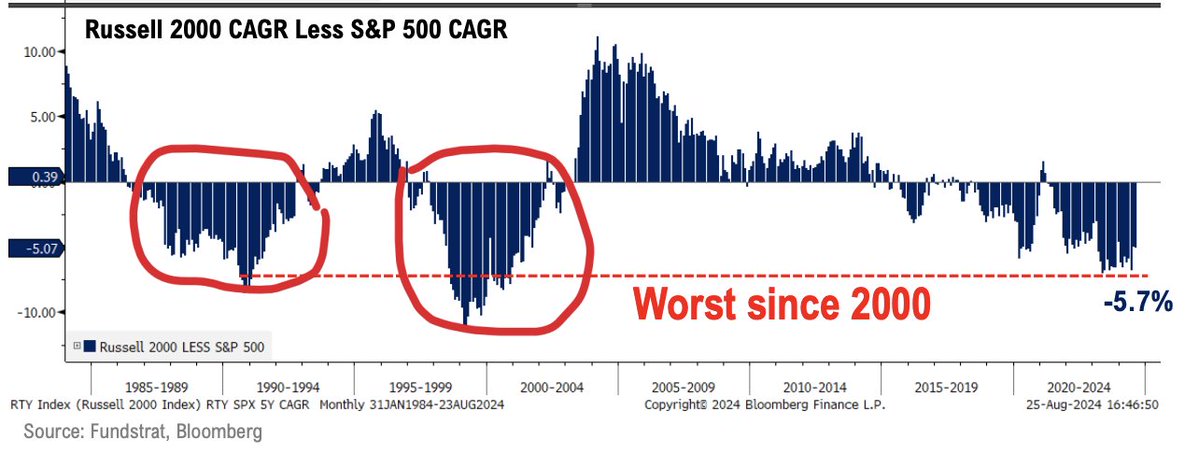

Smaller stocks

Nowhere was the economic optimism more apparent than in small-cap stocks.

The Russell 2000 index marked its best day in nearly two years. Small-caps tend to be more volatile and have trailed large-cap peers this year, partially explaining why they were primed for a big rally.

Investors are hoping that a looser regulatory regime could allow small companies to thrive, while tariffs might help stymie foreign competitors. Shares of Xometry, a software platform that helps product designers and engineers access a network of global manufacturers on demand, has soared around 40% since Monday on expectations that new tariffs could increase demand for its platform.

Small-caps gained momentum in the third quarter thanks to economic strength and rising capital spending from their customers, said Raheel Siddiqui, senior investment strategist at Neuberger Berman.

“The trend was already in place, but Trump’s policies could supercharge it,” Siddiqui said.

The United States is about to become a vastly superior place to do business. We are already the safest and most militarily capable country in the world making us an extremely attractive place to live and raise a family in an increasingly dangerous world. These facts have not gone unnoticed by successful people around the world who are not happy with what their own countries have become, and how their governments have turned against their hardest working and most successful citizens. The problem with our immigration system is that it takes years for the talented, hard-working, successful, law-abiding immigrants to get in, and it takes only days for illegal migrants to cross the border and enter the country. We need to reverse this absurdity. Imagine if we could vet applicants who wanted to bring their talents and resources here in a 45-60 day process as long as they met certain standards for excellence and character. This is not a particularly challenging problem and that’s before comparing it with catching a Super Heavy rocket with chopsticks. We could open the floodgates for entrepreneurs, scientists, engineers, makers, designers and more who could replace the illegal migrants and those who have been consuming resources and bringing crime to our cities and towns. The new immigrants would be force multipliers, bringing and building businesses which will drive our economy and employment. Consider the impact of deporting one criminal migrant and replacing him with a technology engineer and then do the multiplication. The positive impact on our economy and growth rate would be extraordinary. Think Israel after its Russian migration when the best and brightest scientists and engineers left oppression and helped to build start up nation. Think the United States in the 1930s when German scientists came and enabled our rocket, missile and atomic capabilities that helped win the war and build industries thereafter. The time has come.

- 10/04/2024 – Money Movers on X: “Will October be a trick or treat for investors? @fs_insight Managing Director @fundstrat is watching the $VIX as an indicator of how much the market could rally: “It’s hard to say this is a green light into year-end.” https://t.co/J4ht0k1X9o” / X

- 10/04/2024 – U.S. Hiring Accelerated in September, Blowing Past Expectations – WSJ

- September’s outsized payrolls boost takes the U.S. economy out of the shadows of recession and gives the Fed a glide path to a soft landing.

- The big jobs gain virtually eliminated any chance that the central bank would be repeating its half percentage point interest rate cut from September anytime soon.

- The Fed next meets Nov. 6-7, right after the U.S. presidential election and a five-week span during which it will get plenty more to digest.

- stock price is a coin flip next month

- the valuation is high, no much upper trend

- lots of hedge funds are waiting for the election gets over

- investors are talking about recession which is already here

- PCE is coming this Friday

- might be up after election, wait for 3 to 6 months

Typically, the start of a rate-cutting cycle marks a period of uncertainty for companies and investors. As time goes on, it usually becomes clearer whether the economy is going to enter recession or not. That helps explain why the S&P 500 index has historically performed well in a rate-cutting cycle.

Many small companies get an extra benefit because they tend to have more floating-rate debt than their larger peers—meaning that rate cuts directly lower their borrowing costs. As a result, the Russell 2000 index of small and medium-size businesses has often outperformed the S&P 500 after the Fed starts cutting rates.

- 09/18/2024 – Fed Cuts Rates by Half Percentage Point – WSJ Officials are hoping to prevent a gradual cooling in the labor market from turning into a deeper freeze

The Federal Reserve voted to lower interest rates by a half percentage point, opting for a bolder start in making its first reduction since 2020. The long-anticipated pivot followed an all-out fight against inflation the central bank launched two years ago.

Eleven of 12 Fed voters backed the cut, which will bring the benchmark federal-funds rate to a range between 4.75% and 5%. Quarterly projections released Wednesday showed a narrow majority of officials penciled in cuts that would lower rates by at least a quarter point each at meetings in November and December.

- 09/18/2024 – WATCH LIVE: Federal Reserve Chair Powell speaks after Fed announces interest rate cut | PBS News

WASHINGTON (AP) — The Federal Reserve on Wednesday cut its benchmark interest rate by an unusually large half-point, a dramatic shift after more than two years of high rates helped tame inflation but that also made borrowing painfully expensive for American consumers.

The rate cut, the Fed’s first in more than four years, reflects its new focus on bolstering the job market, which has shown clear signs of slowing. Coming just weeks before the presidential election, the Fed’s move also has the potential to scramble the economic landscape just as Americans prepare to vote.

- the tune of FOMC is critical, if it is bearish, then negative for the market

- 25pt or 50 pt cuts are no difference

- both presidential candidates are somewhat good for the market. historically, right after presidential election in one or two months, the market is good

- 09/13/2024 – 25bps or 50 bps Cut? – ValuePlays

I think the Fed does 25bps as they’ve signaled it, and I can’t imagine a justification for 50bps, barring something dramatic before the meeting

“Davidson” submits:

There is tremendous speculation for the Fed to cut 50bps(0.5%) this month. The history of Fed Fund shifts track the T-Bill rate after a couple of weeks leaving Fed Funds at a premium. That premium has hovered around 20bps over last 10yrs+. If this pattern holds, then we need to see T-Bill rates drop to 4.75%-4.8% range for a couple weeks to permit the Fed to act. We are not close yet even though it appeared we might drop below the spot rate 4.96% of a couple of weeks ago. Since then, T-Bill rate has hovered near 5%+/- and is 4.92% today. Unless we see the T-Bill rate below 4.8%, 25bps cut appears out of range and 50bps too far for the Fed to lead that far ahead which it has not done since the early 1980s.

The pressure to lower Fed Funds has been present for ~24mos with the consensus having the European Central Bank already cutting with perhaps another cut just around the corner. That they still face high inflation seems out of character with the recent cut. This does show the pressure traders can put on Central Bankers to alter stated policies.

Friday The 13th: The Cutting Cycle

BY TYLER DURDEN

FRIDAY, SEP 13, 2024 – 11:00 AM https://www.zerohedge.com/markets/friday-13th-cutting-cycle

By Philip Marey, Senior US strategist at Rabobank

Friday The 13th: The Cutting Cycle

Market speculation about a 50 bps rate cut by the Fed next week returned overnight after the Financial Times and the Wall Street Journal called the Fed’s rate choice between 25 and 50 bps a close call and former FOMC member Bill Dudley said there was a strong case for 50.

- 09/11/2024 – A Recession Signal Is Flashing Red. Or Is It? – WSJ

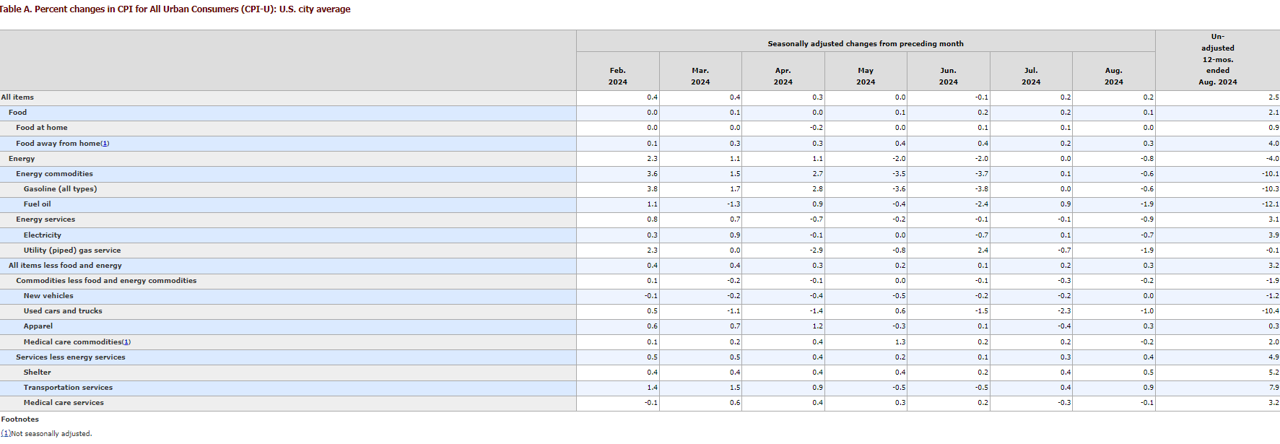

The index for shelter rose 0.5 percent in August and was the main factor in the all items increase. The food index increased 0.1 percent in August, after rising 0.2 percent in July. The index for food away from home rose 0.3 percent over the month, while the index for food at home was unchanged. The energy index fell 0.8 percent over the month, after being unchanged the preceding month.

The shelter index increased 5.2 percent over the last year, accounting for over 70 percent of the total 12-month increase in the all items less food and energy index. Other indexes with notable increases over the last year include motor vehicle insurance (+16.5 percent), medical care (+3.0 percent), recreation (+1.6 percent), and education (+3.1 percent).

- Wall Street is gearing up for one of the most important economic releases of the year Friday.

- The consensus is for the nonfarm payrolls report to show growth of 161,000 for August and a slight decline in the unemployment rate to 4.2%.

- Markets are certain the Fed will start lowering interest rates in a couple weeks, with the possibility of a jumbo cut depending on what Friday’s report shows.

- Companies hired just 99,000 workers last month, less than the downwardly revised 111,000 in July and below the consensus forecast for 140,000, according to payrolls processing firm ADP.

- The report corroborates multiple data points recently that show hiring has slowed considerably from its blistering pace following the Covid outbreak in early 2020.

- The ADP data showed that while hiring has decelerated significantly, only a few sectors reported actual job losses.

- 09/05/2024 – Trump Adopts Elon Musk’s Proposal for Government Efficiency Commission – WSJ Former president also reiterates calls for lower corporate tax rate and steep regulation cuts

Trump Says He Would Ban Mortgages for Undocumented Immigrants – WSJ The Republican nominee said it would help bring down home prices

Former President Donald Trump said he would ban undocumented immigrants from obtaining home mortgages, a move he indicated would help ease home prices even though these buyers account for a tiny fraction of U.S. home sales.

Home loans to undocumented people living in the U.S. are legal but they aren’t especially common. Between 5,000 and 6,000 mortgages of this kind were issued last year, according to estimates from researchers at the Urban Institute in Washington.

Overall, lenders issued more than 3.4 million mortgages to all home purchasers in 2023, federal government data show.

Trump, the Republican presidential nominee, made his comments on Thursday during a policy speech to the Economic Club of New York in Manhattan.

- 09/03/2024 – (1) Thomas (Tom) Lee (not drummer) FSInsight.com on X: “good stuff @SeanMFarrell 👀👀 👇 #tuesdaymusings” / X

The base case for the next 8 weeks is challenging for #stocks and #equities – but an opportunity will emerge to #buythedip This is what we are watching . Great speaking with @JoeSquawk @andrewrsorkin on @SquawkCNBC today.

“I think a 7-10% pullback can happen over the next 8 weeks, but it would be a situation to buy the dip” … “It’s a strong market… Don’t think we’ve seen the tops for 2024.”

- 09/03/2024 – Investors should be cautious for the next 8 weeks, says Fundstrat’s Tom Lee (youtube.com) – what are my action plans for this?

- the stock market could be volatile for the next 8 weeks

- correction of -7% or -10% is not surprising. get ready to buy this deep

- market has been up 7% for the past 6 weeks, expect volatility

- it changes from inflation scare to growth scare, could be continue

- Fundstrat’s viewpoints