KWEB, CWEB and BABA

Risks

- Risk to Chinese Internet Stocks CWEB: Set For Re-Rating Once Deflation Stabilizes (NYSEARCA:CWEB) | Seeking Alpha

Potential traffic hike if Trump won the White House would be an event risk. While China has moved some of the assembly lines to ASEAN countries, the remaining amount of direct exports to the US remained to be quite significant at $500 bn. UBS economists estimate that China’s GDP growth could be halved if Trump imposes 60% tariffs on all Chinese goods.

Moreover, tariff s could reignite the US inflation due to supply shortages, as import s from China includes not only consumer products but also many inter mediate products and machinery for US domestic production. If inflation rose again, the Fed may alter its course of monetary easing. This shift would be detrimental to the global equity market. – this could also be bad for IWM and KRE. However, Trump might force to lower the interest rate more which will be good for both of them.

2. Risk for Investing in Leveraged ETF

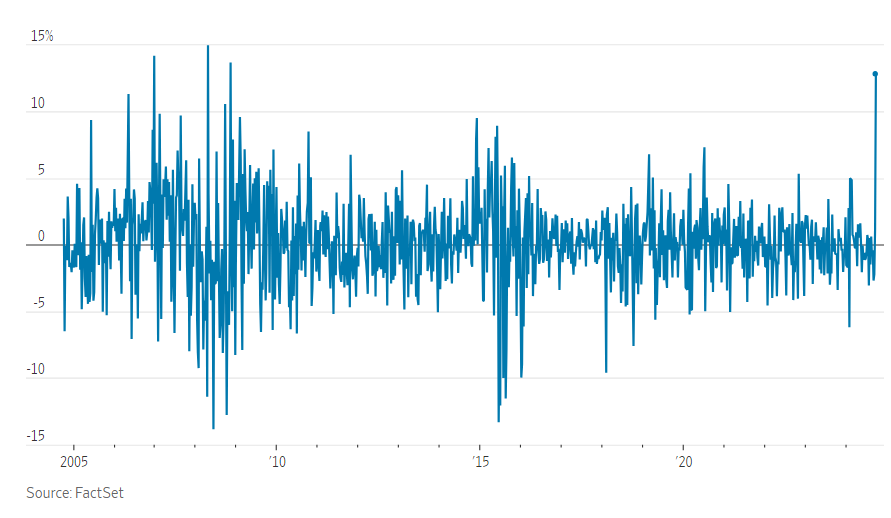

The key risk of investing in a 2x daily return fund, such as CWBE, is the potential value erosion during high volatility periods. For example, if the underlying asset rises 5% in a day and loses 5% the next day, the underlying asset will be 99.75% of its original value (105% * 95% = 99.75%). The 2x daily return fund will end up being only 99% of the original value (110% * 90% = 99%).

In the fund prospectus of CWBE, Direxion has provided the table below for investors to see how high volatility will hurt the fund value. In an extreme case, if the gold price has a 100% annual volatility, the fund will lose 63% of its value, even if the index ends up flat by the year-end. Therefore, investors must be mindful that leveraged ETFs are not for long-term holdings.

3. The PBOC’s monetary stimulus is considered insufficient to boost consumer spendings, as the decline in the housing market significantly reduces household net worth.

4. While fiscal stimulus may be welcomed, consumers might still choose to save rather than spend, as improving consumer confidence takes time.

5. Despite attractive valuations, KWEB faces negative sentiment from geopolitical tensions, particularly from upcoming U.S. election volatility and potentially Trump’s Tariff War 2.0.

6. Top Six Economic Consequences of the Refugee Crisis (managementstudyguide.com)

Potential upcoming catalysts

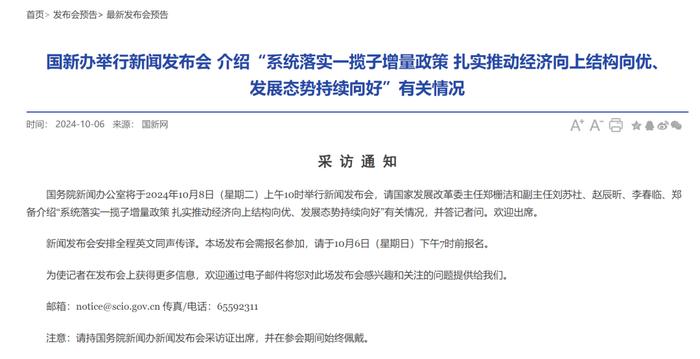

- Fiscal plan could come as early as Tuesday, when the country’s top economic planning agency, the National Development Reform Commission, holds a press briefing to announce a package of policies to boost the economy.

Sina finance

港股|港股行情|港股新闻_新浪港股_新浪财经_新浪网 (sina.com.cn)

涨疯了!有人急了,直奔香港排队_新浪新闻 (sina.com.cn)

************************************************************************************

- 11/15/2024 – Michael Burry Cautiously Ups Alibaba, JD.com, Baidu Bets With Offsetting Hedges: Retail Doesn’t Share Big Short Investor’s Optimism

- 11/14/2024 – (1) Hedge Vision on X: “Michael Burry files his Q3 13F with big China bets as well as hedges Top 5 Positions, 11 total: 1. $BABA, 16.36% 2. $JD, 15.41% 3. $JD puts, 15.41% 4. $BABA puts, 13.81% 5. $FOUR, 10.24% -Top Buys: $JD puts, $BABA puts, $JD, $BIDU puts, $BIDU -Top Sales: $HPP $BCAB $ACIC https://t.co/9Gh8L0p8zq” / X

Michael Burry files his Q3 13F with big China bets as well as hedges Top 5 Positions, 11 total: 1. $BABA, 16.36% 2. $JD, 15.41% 3. $JD puts, 15.41% 4. $BABA puts, 13.81% 5. $FOUR, 10.24% -Top Buys: $JD puts, $BABA puts, $JD, $BIDU puts, $BIDU -Top Sales: $HPP $BCAB $ACIC $REAL -New Positions: $JD puts, $BABA puts, $BIDU puts

- 11/14/2024 – How Beijing Took Control of Hong Kong’s Financial Hub—and Left the West Behind – WSJ The world’s pre-eminent East-meets-West investment hub has become more Chinese as international financial institutions, corporations, and expatriates retreat. the changes seem more structural than cyclical.

Some of the shift in Hong Kong reflects the reality that the market for deals is weak, given China’s economic problems. New listings on Hong Kong’s stock exchange dropped to the lowest total in more than 20 years in 2023. In recent months, momentum picked up a notch after Chinese appliance maker Midea Group’s $4 billion listing fueled optimism among bankers and investors.

Even so, the changes seem more structural than cyclical.

- 11/08/2024 – China’s Incredibly Out-Of-Touch Stimulus Policy, From not-so-urgent to out-of-touch. How to think about China’s fiscal stimulus policies.

HFI Research

I am officially changing my stance on China’s fiscal stimulus policy. Instead of calling it the “not-so-urgent” fiscal stimulus policy, I’m changing it to the “out-of-touch” stimulus policy.

From an economic standpoint, China’s recent fiscal stimulus announcement centers around debt management and risk mitigation rather than spurring economic and consumption growth. To me, this is just backward thinking.

Take a step back and imagine that we are in the middle of COVID-19, and instead of the crazy stimulus package the US announced ($3.58 trillion or ~17% of 2020 GDP) to spur growth again, we focused on “reducing” the Federal deficit and containing our borrowing. US economic growth would have likely suffered for years to come and the unemployment rate would have remain elevated. Millions would be out of jobs still and families would still be fighting to claw their way back.

Just look around the globe. Every other country that didn’t respond in the same speed and manner the US did is still suffering the aftereffects. China is no different, and if you visit Shanghai today and talk to some of the people who reside there, they still bring up the trauma that happened in March/April 2022 as a sign of distrust of the government.

The Shanghai lockdown still lingers in many people’s minds. After nearly 15 months of the Pfizer vaccine announcement, the fact that China still pursued a zero-COVID policy was not only asinine but stupendously preposterous. Some might call it illogical, I will just call it out-of-touch.

And when it comes to stimulating the economy, the policy announcements so far are no different. Instead of tackling the major issue (the property market) all at once with clear objectives and strict deadlines, policymakers are going the route of “responding to market dynamics”. The wishy-washy approach almost guarantees an early failure followed by desperate policy measures in the end. What the Chinese fail to realize in this case is that this is a confidence game, and without a bazooka, it’s going to fail 100 out of 100 times.

Waiting for the Obvious

To many world leaders, the zero-COVID policy was nonsense from the start. For some, anchoring bias prevented them from seeing that inevitable, and for others like China and Australia, protests on the streets needed to happen for them to act urgently.

In my recent meeting with Investing In China, he pointed out to me that if you lived in China (in 2022), the zero-COVID policy ended overnight. It was as if a magic switch flipped in the minds of the policymakers, and everyone realized how stupid of a policy it was.

So in many ways, China is not stubborn, but why did it have to wait until it was so disgustingly obvious to change its ways?

I suspect that the fiscal stimulus route will be no different. Right now, policymakers continue to look at stabilizing growth as opposed to promoting one. This is the wrong approach and economic figures will pay the price for that.

- 11/08/2024 – China Moves to Ease Debt Concerns—but Again Holds Off on Stimulus Measures – WSJ Investors’ hopes for large-scale support for the economy were dashed after an anticipatory stock-market surge in recent weeks

China’s top legislative body approved a $1.4 trillion package to help local governments swap some of their mounting off-balance-sheet debts. But lawmakers disappointed many investors by not revealing new fiscal stimulus to revive an economy poised to face new headwinds with the impending return of Donald Trump.

Analysis-China’s looming fiscal package set to stabilize rather than boost growth

Asia shares stumble on China anxiety; gold and bitcoin rally

It’s the biggest question in the global economy: How many hundreds of billions of dollars will Beijing plow into pumping up China’s wobbling economy?

And the next biggest: How much of that will go to consumers?

Chinese Finance Minister Lan Fo’an didn’t offer detailed answers to either question when he hosted a hotly anticipated news conference on Saturday. Lan’s silence on both fronts risks disappointing investors when stock markets open in mainland China and Hong Kong on Monday after some of the choppiest trading in years.

Still, Lan did outline a laundry list of high-priority challenges that he vowed to tackle, signaling that he would spend some $300 billion of funds that have been earmarked for this year but haven’t yet been deployed.

China Says It Has a Big Stimulus Coming—But Still Won’t Say How Big – WSJ

- 10/11/2024 – China’s Stimulus Barrage Draws Out Cautious House Hunters – WSJ

- 10/11/2024 – High Hopes for China Stimulus Ahead of Weekend’s Briefing – WSJ Expectations are high heading into the event, which could introduce the fiscal stimulus analysts say has been missing

The pressure is on for China’s Finance Ministry to deliver more fiscal stimulus at a press conference on Saturday. Market sentiment has been swinging from hope to dismay as officials roll out a wave of measures to boost the economy and shore up confidence—with mixed results. A briefing from China’s top economic planner this week met with disappointment. Still, expectations are high heading into the ministry event, as it has the power to announce the fiscal stimulus analysts say is missing from the policy package.

The focus is on where the ministry will direct funds. Many are hoping for a sharpened focus on reviving consumption, an essential step toward high-quality economic growth. High on the wish list is improving the social safety net. Issuing more debt is nothing new, and the market will look for more support for lower-income communities, ANZ’s Xing said.

Beijing may also increase fiscal transfers to local governments and give them a large borrowing quota to help those struggling under big piles of debt, Nomura economists led by Ting Lu said in a note.

A fiscal package including transfers to local governments and subsidies to encourage consumption among low-income households and families with several children could temporarily lift economic growth over the next quarters

Regardless of what the Finance Ministry announces, markets will inevitable ask what’s next. Clear guidance about the path of fiscal policy next year—particularly on any potential widening of the de-facto deficit—would be a positive surprise, Morgan Stanley economists said.

And since additional budgetary measures and bond issuance require approval from China’s top legislature, investors likely need to wait for the National People’s Congress Standing Committee meeting, due at the end of the month, for details on any extra policy measures.

China Could Detail Stimulus Plans This Weekend. Here’s What the Stock Market Needs. (msn.com)

No matter what, policymakers will want to avoid a repeat of 2015, analysts say. That year, the government initially promoted investment in the stock market as it tried to reduce reliance on exports. But that led to a speculative surge in the market, forcing Beijing to intervene to curb excess margin trading. That sent stocks tumbling. And in a bid to boost export growth, the People’s Bank of China also devalued the yuan, adding to market turmoil and contributing to an economic slump.

Beijing seems to be managing expectations already: Chinese stocks fell 13% in the past week as the country’s economic planning agency offered little in new stimulus, cooling the market euphoria. It’s up to Saturday’s briefing for China to show it can truly deliver.

In a bold move to support its struggling economy, China’s central bank has introduced a substantial liquidity initiative, opening a $71bn “swap facility” aimed at enabling firms to purchase stocks. This announcement, made on October 10, follows a series of measures intended to rejuvenate the economy, which has faced ongoing challenges since the lifting of Covid-19 restrictions, as reported by The Inquirer.

Now, with the introduction of the swap facility, firms can leverage equities, bonds, and other assets as collateral for access to cash in the form of high-grade liquid assets, including treasury bonds and central bank bills. The People’s Bank of China (PBoC) has indicated that this program could be expanded in response to market conditions. Early market reactions were positive, with Shanghai shares climbing over one per cent and Hong Kong stocks rising by more than two per cent.

Despite these efforts, analysts caution that more direct state support is essential to stimulate consumption and meet the government’s growth target of around 5% for the year. As anticipation builds for a fiscal policy briefing from Finance Minister Lan Fo’an on October 12, traders are eager for a concrete action plan that could further boost economic sentiment.

- 10/09/2024 – China’s Stock Market Tumbles on Doubts About Government Stimulus – WSJ Index has worst day since February 2020, Finance Ministry calls press briefing for Saturday

After a late-September burst of policy announcements about economic revival and a news conference Tuesday to tout them, the Chinese stock-market roller coaster took a plunge on Wednesday. Beijing’s answer: plans for another news conference.

- 10/08/2024 – China’s Stock Market Fever Breaks as Authorities Disappoint – WSJ

Expectations for a flood of stimulus had run high before a Tuesday morning press conference by Beijing’s economic planner. the HSBC analysts wrote, details of any government spending package are more likely to come from China’s cabinet and the Ministry of Finance—neither of which has yet scheduled any coming news conferences. “More patience, please,” Liu and Xin wrote.

HONG KONG—An epic Chinese stock market rally lost steam Tuesday after a press conference by the country’s economic planning agency disappointed hopes for more fiscal stimulus measures and raised questions about whether Beijing has more to offer the ailing economy.

Some investment bank analysts, offering some comfort on Tuesday, said investors shouldn’t have expected too much from the economic-planning agency, whose main duty is to formulate and implement strategies on economic and social development—and which doesn’t ordinarily announce bold fiscal measures, HSBC economists Jing Liu and Erin Xin wrote in a note after the Tuesday morning letdown.

Instead, the HSBC analysts wrote, details of any government spending package are more likely to come from China’s cabinet and the Ministry of Finance—neither of which has yet scheduled any coming news conferences. “More patience, please,” Liu and Xin wrote.

- 10/07/2024 – Chinese Semiconductor Stocks Extend Rally on China’s Stimulus Measures – WSJ the strength in chip stocks is leading a broader market rally in Hong Kong

Some think Beijing could unveil additional fiscal measures in the near term, as the country returns from a weeklong National Day holidays, and investors will be closely monitoring the press conference by its top economic planner, the National Development and Reform Commission, on Tuesday.

China could unveil a modest fiscal package of up 1.5 trillion yuan to 2 trillion yuan, the equivalent of $212.8 billion to $283.7 billion, in the near term, UBS economists said in a research note.

They added that the package could be split between supporting households and corporates, and reducing local governments’ financing gap.

- 10/07/2024 – China’s economy is in bad shape. Can its ‘whatever-it-takes’ stimulus effort turn things around? (msn.com) That could come as early as Tuesday, when the country’s top economic planning agency, the National Development Reform Commission, holds a press briefing to announce a package of policies to boost the economy.

“The elephant in the room seems to be a lack of consumer confidence,” economists at Nikko Asset Management wrote in a research note on Thursday. “What is really needed is for the authorities to deploy the proverbial ‘big guns’ to push out more fiscal policies. Such a move could address this crisis of confidence, improve risk appetite and reflate the economy.”

Ray Dalio, founder of the world’s biggest hedge fund Bridgewater Associates, said in a social media post last week that this could be China’s “whatever it takes” moment, if its leaders end up doing “a lot more” than what’s already been announced.

That could come as early as Tuesday, when the country’s top economic planning agency, the National Development Reform Commission, holds a press briefing to announce a package of policies to boost the economy.

“This time is different,” HSBC economists led by Jing Liu said last week in an investor note, which called the press conference unusual. “Everything seems like it’s happening all at once. But it’s still just the beginning.”

The investment bank is expecting Beijing to announce one trillion yuan ($142 million) worth of fiscal spending on consumer products or large construction projects, which will directly stimulate the economy.

Another one trillion yuan may be set aside for recapitalizing banks or helping indebted local governments to issue bonds. The latter won’t give a direct boost to the economy but could help avoid financial risk, HSBC added.

Any meaningful stimulus measures must tackle the problem of oversupply in the property market, experts said.

“The policy pivot … is serious. It has already led to an encouragingly sharp rally in Chinese stocks that could run further in the short term,” Chi Lo of BNP Paribas Asset Management said last week. “But conviction for a turnaround is still needed to sustain the recovery in the Chinese economy and asset markets.”

- 10/06/2024 – Despite Geopolitical Tensions, China Is Big Business for Western Consulting Firms – WSJ Deloitte, Ernst & Young, others have signed thousands of contracts across China as Washington and Beijing seek to untangle economies

- 10/06/2024 – Tilson’s email on China

This is beyond outrageous – the US needs to expel a bunch of these people, especially the Chinese diplomats involved…

How China extended its repression into an American city. Excerpt:

The Post investigation found:

- While there was aggression from both sides, the most extreme violence was instigated by pro-CCP activists and carried out by coordinated groups of young men embedded among them, verified videos show. Anti-Xi protesters were attacked with extended flagpoles and chemical spray, punched, kicked and had fistfuls of sand thrown in their faces.

- The Chinese Consulate in Los Angeles paid for supporters’ hotels and meals as an incentive to participate, according to messages shared in WeChat groups reviewed by The Post. At least 35 pro-CCP Chinese diaspora groups showed up to the APEC summit protests — including groups from New York, Pennsylvania and Washington state.

- Videos show at least four Chinese diplomats from the consulates in Los Angeles and San Francisco among the crowd of pro-CCP protesters, sometimes directly interacting with aggressive actors over four days of protests from Nov. 14-17. Some Chinese diaspora group leaders with ties to the Chinese state participated in some of the violence, the videos show.

- Chinese diplomats hired at least 60 private security guards to “protect” Chinese diaspora groups gathered to welcome Xi, according to seven people involved in the arrangement.

2) An insightful WSJ article: There’s a China-Shaped Hole in the Global Economy. The sources of this underconsumption are deeply embedded in both China’s fiscal systems and its policy choices. – is this the reason China now changing its fiscal systems nd policy choices?

Excerpt:

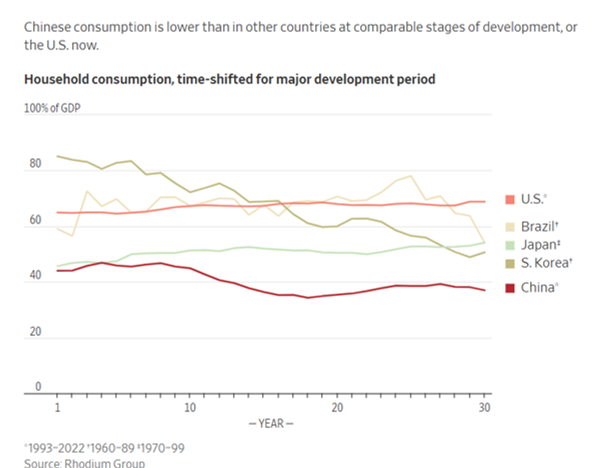

China’s economy is unusual. Whereas consumers contribute 50% to 75% of gross domestic product in other major economies, in China they account for 40%. Investment, such as in property, infrastructure and factories, and exports provide most of the rest.

Lately, that low consumption has become a headwind to China’s growth because property investment, once a major component of demand, has collapsed.

This isn’t just a problem for China; it’s a problem for the whole world. What Chinese companies can’t sell to Chinese consumers, they export. The result: an annual trade surplus in goods now of almost $900 billion, or 0.8% of global gross domestic product. That surplus effectively requires other countries to run trade deficits.

China’s surplus, long a sore spot in the U.S., increasingly is one elsewhere, too. While China’s 12-month trade balance with the U.S. has risen by $49 billion since 2019, it’s up $72 billion with the European Union, $74 billion with Japan and Asia’s newly industrialized economies, and about $240 billion with the rest of the world, according to data compiled by Brad Setser of the Council on Foreign Relations.

Logan Wright, head of China research at Rhodium Group, a U.S. research firm, said China accounts for just 13% of the world’s consumption but 28% of its investment. That investment only makes sense if China takes market share away from other countries, rendering their own manufacturing investment unviable, he said.

“China’s growth model is dependent at this point on a more confrontational approach with the rest of the world,” he said.

Logan Wright, head of China research at Rhodium Group, a U.S. research firm, said China accounts for just 13% of the world’s consumption but 28% of its investment. That investment only makes sense if China takes market share away from other countries, rendering their own manufacturing investment unviable, he said.

“China’s growth model is dependent at this point on a more confrontational approach with the rest of the world,” he said.

While many developing countries relied on investment and exports to fuel early growth, China is an outlier for how low its consumption is, and its sheer size. In a report, Rhodium estimates that if China’s consumption share equaled that of the European Union or Japan, its annual household spending would be $9 trillion instead of $6.7 trillion. That $2.3 trillion difference—roughly the GDP of Italy—is equal to a 2% hole in global demand.

The sources of this underconsumption are deeply embedded in both China’s fiscal systems and its policy choices.

3) Other China-related articles:

- From Fortune: Temu’s woes are fresh signs of the doom loop headed for China’s economy (full text below)

- NYTimes: ‘Twilight Love’: Shanghai’s Lonely and Retired Are Looking for Love

- About Thailand: Chinese E.V. Makers Rush In and Upend a Country’s Entire Auto Market

- 10/06/2024 – China officials to brief on economic policy implementation Tuesday (msn.com) will fiscal policies coming?

Senior officials from China’s top economic planning agency will brief reporters on Tuesday on steps to implement policies to promote economic growth, the State Council Information Office said in a notice.

It said five officials, including the chairman of the National Development and Reform Commission, Zheng Shanjie, would attend the news conference.

The topic will be: “systematically implementing a package of incremental policies to solidly promote economic growth, structural optimisation and sustained momentum of development”. The statement gave no further details.

Tuesday is the first working day in China after a run of holidays over the past week, including National Day.

Before the break, China’s central bank lowered interest rates and injected liquidity into the banking system while regulators eased some property curbs in a package of stimulus measures that sent stocks soaring.

刚刚,重磅消息!利好来了!事关A股__财经头条 (sina.com.cn)

据国新办网站6日消息,国务院新闻办公室将于2024年10月8日(星期二)上午10时举行新闻发布会,请国家发展改革委主任郑栅洁和副主任刘苏社、赵辰昕、李春临、郑备介绍“系统落实一揽子增量政策扎实推动经济向上结构向优、发展态势持续向好”有关情况,并答记者问。

此前,2024年9月24日(星期二)上午9时国新办举行新闻发布会,中国人民银行行长潘功胜、国家金融监督管理总局局长李云泽、中国证券监督管理委员会主席吴清介绍了金融支持经济高质量发展有关情况,并答记者问。

“924”国新会推出多项重磅政策,包括降准、政策利率下调、存量房贷降息、降二套首付比例、提高再贷款中央资金支持比例、续期“金融16条”等。从9月24日以来,A股、港股疯狂上涨。

- 10/06/2024 – 外资狂买!摩根大通又出手了__财经头条 (sina.com.cn)

外资正在“加仓中国”。

今日,港股低开高走,截至收盘,恒指涨2.82%,恒生科技指数涨4.99%。在近期连续大涨之后,恒指今年累计涨幅高达33.37%,恒生科技指数更是高达38.9%,超越COMEX黄金,成为表现最佳的全球大类资产。

最新数据显示,摩根大通正在港股市场加大买入中企的力度。在经历了近期大幅上涨后,中国资产的吸引力仍然十分巨大。

EPFR Global的卡梅隆·布兰德(Cameron Brandt)在接受媒体采访时表示,流入中国股市的外国资金已达到“惊人”的水平。布兰德强调,中国目前仍然是全球“唯一的游戏”,但流入中国股票基金的大部分资金仍来自中国国内投资者,他们一直在从其他资产的资金转回股票。

布兰德预计中国股市的上涨仍将持续一段时间,“中国已经明确表示,他们希望股市上涨,而且这种情况可能会持续一段时间”。

- Ray Dalio is again promoting the idea that China urgently needs to start a “beautiful deleveraging.”

- The country is sitting on massive debt levels, and it’s making businesses and people hold on to cash.

- To get the economy moving, Dalio said Beijing must free up indebted businesses and get them to borrow again.

Dalio wrote that Chinese leader Xi Jinping’s unprecedented stimulus sparked a “big week” for economic optimism, but it won’t be enough.

If China wants its big week to go down in the history books as a turning point to success, then Beijing has to “do what it takes, which will require a lot more than what was announced,” Dalio said.

Dalio emphasized that China is at a crossroads. If Beijing doesn’t start a “beautiful deleveraging,” he said, it risks allowing its crisis to drag on and create an “economic and psychological malaise like Japan experienced.”

China’s debt crisis is just one of five challenges that Dalio believes the country faces in a coming “100-year storm.” The others include the climate crisis, the US-China tech war, its souring ties with Washington, and growing wealth inequality.

The investor has long styled himself as bullish on China, but regularly speaks out on fiscal decisions the country should make to avoid catastrophe.

Top Five Challenges Facing the Chinese Economy (managementstudyguide.com)

中国资产大反攻,外资继续积极看多!达利欧:本轮刺激经济举措将成为历史性转折|资产_新浪财经_新浪网 (sina.com.cn)

假期心痒想开户?60多家券商表态国庆假期不休息!五大服务举措到位|券商_新浪财经_新浪网 (sina.com.cn)

- 10/06/2024 – 史上首次!期货投资者可在“十一”长假期间办理开户手续_新浪新闻 (sina.com.cn) 对于个人投资者而言,10月7日网上开户只需要准备银行卡和身份证,相当于提前一天上传个人信息和进行视频验证。而由于交易所编码假期期间无法申请,所以最早要等到8日夜盘才能正常交易,但总体流程相较往年更快

这两天,多家期货公司提供的信息显示,因期货预约开户人数较多,中国期货市场监控中心(简称“中国期货监控”)拟于10月7日(周一)8:30-17:30临时开放期货网开系统,投资者可以在10月7日完成网开手续。

如这一操作正式落地,这将是史上首次期货投资者可在“十一”长假期间办理开户手续。

对于个人投资者而言,10月7日网上开户只需要准备银行卡和身份证,相当于提前一天上传个人信息和进行视频验证。而由于交易所编码假期期间无法申请,所以最早要等到8日夜盘才能正常交易,但总体流程相较往年更快。

对于投资者关注度较高的股指期货。期货公司提醒,股指期货开户门槛较高,需要连续5个交易日保证金账户可用资金余额不低于50万元;需要最近3年内具有10笔及以上的境内交易所期货交易记录,或者累计10个交易日且20笔及以上的境内期货交易所的期货仿真交易经历;此外还需要中期协知识测试成绩合格(80分以上)。

- 10/04/2024 – Chinese stocks could rally 15% as more stimulus spurs a GDP growth spurt next year, SocGen says (msn.com) the stimulus package could be announced as soon as October, potentially at the next Standing Committee of the National People’s Conference at the end of the month.

- Chinese stocks could climb as much as 15% on the nation’s expected fiscal stimulus package, SocGen said.

- The package could be announced in October, potentially reaching 3 trillion yuan, the bank estimated.

- The stimulus measures could push China’s GDP to grow as much as 5% next year, strategist said.

Strategists estimated that the stimulus package could be announced as soon as October, potentially at the next Standing Committee of the National People’s Conference at the end of the month. The package could amount to as much as 3 trillion yuan, or $427 billion, and include an “open-ended commitment” for a bigger stimulus package the following year.

Those measures could push GDP growth to 5% next year, the strategists said, up from the bank’s original estimates of 4.5% growth.

“The undervaluation of China equities is something that we observe across different benchmark indices and sectors. Most markets are trading well below or within their 10-year history,” the bank said, adding that they also expected the policy to boost corporate earnings growth to as much as 15%.

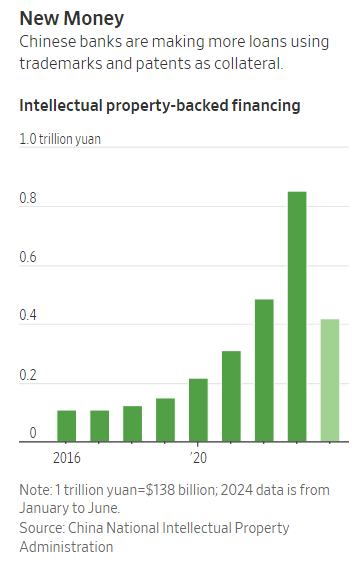

- 10/04/2024 – For Chinese Tech Startups, Beijing Fills a Funding Void Left by VCs – WSJ Previous efforts to inject state money into favored industries have yielded mixed results – it seems like Chinese government has lots of incentives to boost the stock market. On the contrary, the drop of company stock and loss of money in company will be penalized : The loss of state-owned assets in China could be considered a crime, punishable by up to seven years in jail. Officials at state funds could lose their jobs for incurring investment losses. Some state investors attach more strings to protect their investments, such as requiring company founders to guarantee loans personally.

A sharp drop in venture-capital funding for Chinese startups is leading Beijing to be more involved in grooming the country’s tech industry, a strategy that threatens to handicap China’s efforts to catch up with Western technologies in the long run.

The Chinese state is now gradually taking over funding—and even exits—of tech startups.

In April, the People’s Bank of China set up a roughly $70 billion relending facility to encourage banks to lend to science and technology companies, with a fifth of the amount set aside for startups and growth-tech companies.

Chinese banks are framing their efforts as a public duty. Bank of China, one of the country’s largest banks, said in its annual report that it granted more than $200 billion in credit lines last year to about 68,000 enterprises to “promote major technological breakthroughs.” A bank in southwestern China has said it went as far as helping a small tech company register patents to obtain an intellectual-property loan.

State-owned companies with minimal tech connections are joining the push. Kweichow Moutai, a leading producer of baijiu, a liquor served at state banquets, and its smaller rival Luzhou Laojiao recently made investments in chip-related companies.

Uneasy partnerships

Chinese state funds often have priorities—such as boosting employment or aligning with other government objectives—that are different from those of private investors and startups. Additionally, Chinese state funds generally have shorter investment horizons and have a much lower tolerance for losses.

The loss of state-owned assets in China could be considered a crime, punishable by up to seven years in jail. Officials at state funds could lose their jobs for incurring investment losses. Some state investors attach more strings to protect their investments, such as requiring company founders to guarantee loans personally.

BEIJING (Reuters) -China’s home sales rose during the National Day holiday after a string of property stimulus measures to boost the country’s beleaguered real estate market since late September, state media said on Saturday.

During the week-long holiday period that started on Tuesday, the number of house visits, which reflects a willingness to buy a home, increased significantly while sales of homes in many places rose to “varying degrees”, state broadcaster CCTV reported.

More than 50 cities introduced policies to boost the real estate market, while nearly 2,000 developments from more than 1,000 property companies participated in promotions, CCTV said, citing the Ministry of Housing and Urban-Rural Development.

The number of visits to most of the projects participating in the promotions increased by more than 50% year-on-year, it added.

假期,楼市热了!10余省份、50余城出台优化政策_新浪新闻 (sina.com.cn)

- 10/04/2024 – SHANGHAI STOCK EXCHANGE (sse.com.cn) Shanghai Stock Exchange are closed for China National Day

October 1 (Tuesday) – October 7(Monday), plus September 29 (Sunday) and October 12 (Saturday) – will there be a big jump in stock right after this close? should I do short term LEAPs? Shanghai market will be closed on Monday, good time for me to invest?

SSE Trading Hours & Market Holidays [2024]

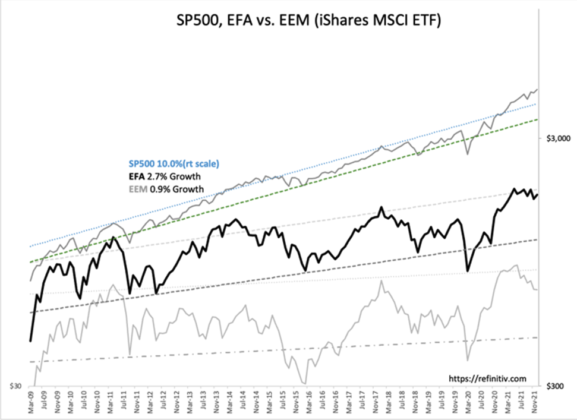

- china stocks dropped 70%, so they have large room to come back

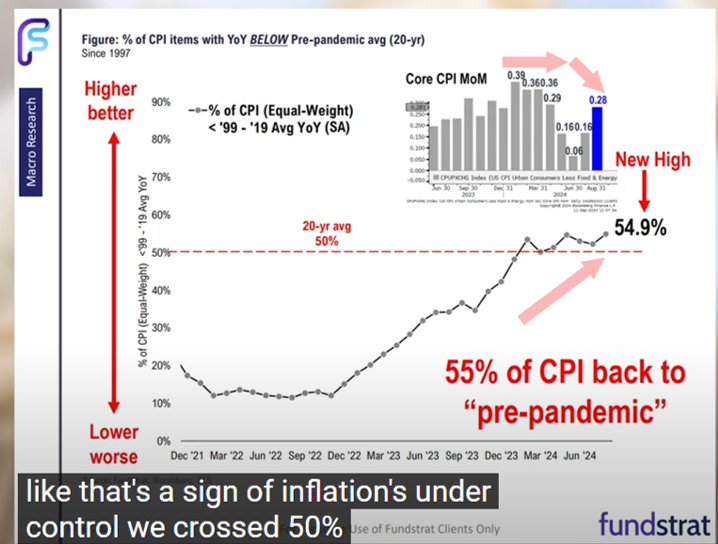

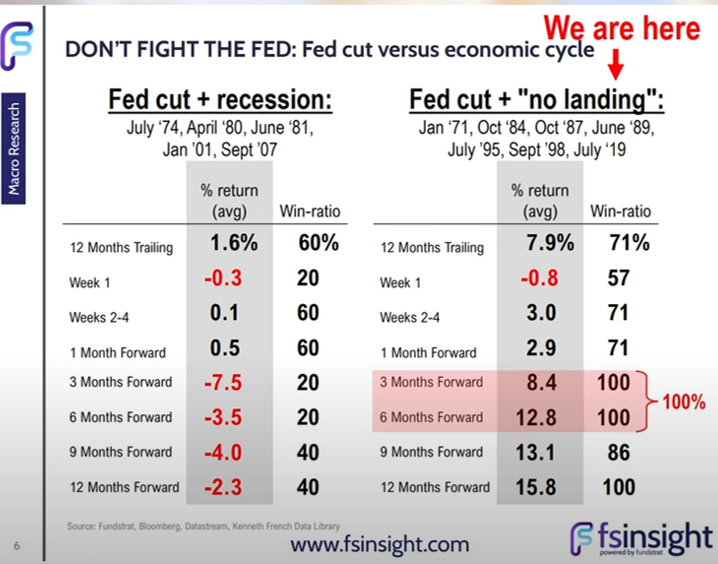

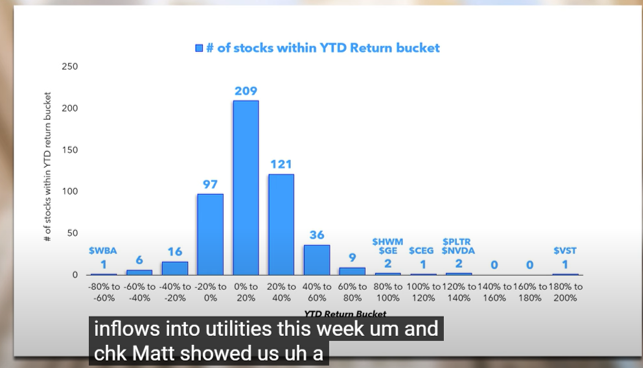

- lots of tailwinds for us stocks, might rally after election

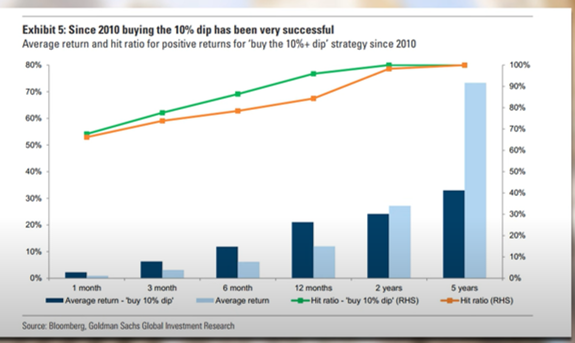

- investors will buy the dips like they did in all of 2024

- stocks to be strong into year-end; Sp to reach 6000 by year end

- upside is bigger for iwm

- 10/01/2024 – ‘No challenges can stop China’s progress,’ Xi Jinping says in 75th anniversary speech (nbcnews.com) The Chinese leader also reiterated Beijing’s aims for reunification with the self-governing island of Taiwan as he marked the 75th anniversary of the People’s Republic of China

The Beijing leader added that China would “spur” the development of Hong Kong and Macao — both self-governed regions that are ruled by Beijing under the “one country, two systems” principle.

In a 2019 speech commemorating the PRC’s 70th anniversary, Xi had said that no force could sway China’s development, amid festivities involving a military parade and large-scale celebrations. Events for the 65th anniversary were more subdued.

Xi’s speech comes at a time of uptick in Chinese markets in recent weeks, with major mainland Chinese and Hong Kong stock indexes recently surging to their highest in more than a year after authorities announced plans to support economic growth. On Thursday, a high-level meeting led by Xi called for halting the real estate decline, and for strengthening fiscal and monetary policy.

Xi Calls for Forging Mighty Force to Build Strong China (youtube.com)

- 10/04/2024 – 涨疯了!有人急了,直奔香港排队_新浪新闻 (sina.com.cn)

港股“涨疯了”。近期内地陆续推出的利好政策不但刺激了A股,也给港股市场带来一轮新的增长。

近日,A股暴涨却遇国庆休市,“因为A股第一次不想放假”一度冲上热搜。随着国庆假期A股的休市,不愿错过这轮行情的投资者将目光瞄准了港股。

港股10月4日重回上涨态势,恒生指数尾盘突破10月2日所创的阶段高点,站上22700点,最终报22736.87点,创2022年3月以来的新高,收涨2.82%。

恒生科技指数收涨4.99%。半导体股飙涨,宏光半导体涨超285%,晶门半导体大涨70%,华虹半导体、中芯国际涨近30%。

中资券商股延续强势表现,中州证券涨逾29%,申万宏源涨逾25%,国联证券涨超27%

十一”小长假开启,此前几天“疯涨”的A股却被突然按下了7天的暂停键。微信群聊中,有股民迫不及待地等待开盘。于是,“国庆不放假”的港股,成了不少股民新的选择。

据香港媒体报道,香港本地的最大券商之一辉立证券开设账户的业务出现巨大增长,许多客服员工取消了假期,全天24小时待命。老虎证券上周的开户数量激增了73.4%,移动应用的活跃用户数也同比增长了10%。

香港最大的在线券商之一富途控股表示,上周开户咨询量比平时高出了40%,富途在线平台的股票交易量比前一周增长了95%,投资者数量增加了60%。

- 09/30/2024 – 受权发布丨习近平:在庆祝中华人民共和国成立75周年招待会上的讲话_新浪新闻 (sina.com.cn)新华社北京9月30日电在庆祝中华人民共和国成立75周年招待会上的讲话(2024年9月30日,下午)习近平女士们,先生们,同志们,朋友们:今天,我们欢聚一堂,共同庆祝中华人民共和国成立75周年。75年前,中华人民共和国成立,标志着中国人民站起来了,开启了中华民族伟大复兴的历史新纪元。75年来,我们党团结带领全国各族人民不懈奋斗,创造了经济快速发展和社会长期稳定两大奇迹,中国发生沧海桑田的巨大变化,中华民族伟大复兴进入了不可逆转的历史进程。在这里,我代表党中央和国务院,向全国各族人民,向中国人民解放军指战员和武警部队官兵,向各民主党派和无党派人士,致以崇高敬意!向香港特别行政区同胞、澳门特别行政区同胞、台湾同胞和海外侨胞,致以诚挚问候!向关心和支持新中国建设事业的友好国家和国际友人,致以衷心感谢!此时此刻,我们更加怀念为新中国成立和发展建立卓越功勋的老一辈领导人,更加怀念为新中国建立和走向富强献出生命的革命先烈和英雄模范。可以告慰他们的是,他们追求的理想正在实现,他们开创的事业薪火相传、欣欣向荣!同志们、朋友们!以中国式现代化全面推进强国建设、民族复兴,是新时代新征程党和国家的中心任务。今天,我们庆祝共和国华诞的最好行动,就是把这一前无古人的伟大事业不断推向前进。——推进中国式现代化,必须坚持中国共产党领导。我们要始终坚持党总揽全局、协调各方的领导核心作用,坚决维护党中央权威和集中统一领导,持之以恒推进全面从严治党,努力以党的自我革命引领伟大社会革命。——推进中国式现代化,必须坚持中国特色社会主义道路。我们要始终坚定道不变、志不改的决心和意志,深入贯彻党的基本理论、基本路线、基本方略,进一步全面深化改革、扩大开放,着力推动高质量发展,努力把国家发展进步的命运牢牢掌握在中国人民手中。——推进中国式现代化,必须坚持以人民为中心。我们要始终牢记党的根本宗旨和国家性质,牢记人民至上,一切为了人民,一切依靠人民,努力让全体人民在共同奋斗中共享改革发展成果。——推进中国式现代化,必须坚持走和平发展道路。我们要始终坚定站在历史正确的一边、站在人类文明进步的一边,高举和平、发展、合作、共赢旗帜,努力促进世界和平安宁和人类共同进步。同志们、朋友们!实现中华民族伟大复兴,是包括香港同胞、澳门同胞、台湾同胞在内的全体中华儿女的共同愿望。我们将全面准确、坚定不移贯彻“一国两制”、“港人治港”、“澳人治澳”、高度自治的方针,坚定不移维护和促进香港、澳门长期繁荣稳定。有伟大祖国作坚强后盾,香港同胞、澳门同胞一定能够创造更加美好的未来!台湾是中国的神圣领土,两岸人民血脉相连、血浓于水。我们要坚持一个中国原则和“九二共识”,深化两岸经济文化交流合作,促进两岸同胞心灵契合,坚决反对“台独”分裂活动。实现祖国完全统一,是海内外中华儿女的共同心愿,是大势所趋、大义所在、民心所向,历史的车轮谁都无法阻挡!人类共处一个地球,各国人民命运与共。我们将始终坚持维护世界和平、促进共同发展的外交政策宗旨,弘扬全人类共同价值,倡导平等有序的世界多极化、普惠包容的经济全球化,推动落实全球发展倡议、全球安全倡议、全球文明倡议,积极参与全球治理体系改革和建设,推动构建人类命运共同体。同志们、朋友们!经过75年的艰苦奋斗,中国式现代化已经展开壮美画卷并呈现出无比光明灿烂的前景。同时,前进道路不可能一马平川,必定会有艰难险阻,可能遇到风高浪急甚至惊涛骇浪的重大考验。南岳衡山有副对联说得好:“遵道而行,但到半途须努力;会心不远,要登绝顶莫辞劳”。我们要居安思危、未雨绸缪,紧紧依靠全党全军全国各族人民,坚决战胜一切不确定难预料的风险挑战。任何困难都无法阻挡中国人民前进的步伐!我们坚信,创造了五千多年辉煌文明的中华民族,必将在新时代新征程上创造出新的更大辉煌,必将为人类和平和发展的崇高事业作出新的更大贡献!现在,我提议:为中华人民共和国成立75周年,为中国繁荣富强和全国各族人民幸福安康,为中国人民同世界各国人民的友谊和合作,为在座各位来宾、各位同志、各位朋友的健康,干杯!

- 09/30/2024 – Chinese Property Stocks Surge as Barrage of Stimulus Continues – WSJ

Two major Chinese cities lifted key curbs on buying homes to boost demand

Opinion | Easing fear of making mistakes can help boost China economy | South China Morning Post (scmp.com)

-

09/30/2024 – A Week of Shock and Awe Ignites China’s Stock Markets – WSJ While hopes are high, the wider economy—in particular its languishing property market—will take longer to recover

The stock-market frenzy follows an extraordinary week for the Chinese economy. After months of drip-feeding tiny doses of policy support into an ailing economy crying out for major surgery, China’s top leadership relented. Volley after volley of growth-friendly pledges were announced in a daily staccato, with officials pledging more to come if needed. The blast of stimulus—and the epic rally it set off—came on the eve of a seven-day holiday marking the 75th anniversary of the founding of the People’s Republic.

Though officials pledged more fiscal spending, they haven’t yet put a number on it, or offered much in the way of specifics. They promised to stabilize the property sector, but analysts say the details announced so far don’t come close to achieving that.

The measures kept coming. On Sunday evening, the government said it would lower down payments for second homes and allow existing homeowners to refinance their mortgages at lower interest rates, which although common in the U.S. is difficult in China.

Some big cities followed up with their own real-estate measures. The southern manufacturing hub of Guangzhou said Sunday that it would remove all remaining restrictions on home purchases, while Shanghai and Shenzhen, two of China’s biggest and wealthiest cities, said they would allow more people to buy homes and relax quotas on purchases in suburban areas.

The result of this policy blitz: Trading in stocks exploded, again, on Monday, while in Shenzhen, the local housing bureau pointed to apartments in a new affordable-housing project selling out in eight hours.

By the end of the day Monday, the value of stocks traded in China’s domestic stock market had reached $372 billion, the highest single-day total ever.

Property stocks were some of the biggest gainers. Hong Kong-listed shares of Kaisa Group, Sunac China Holdings, and Fantasia Holdings, all of which have defaulted on their debts, surged 83%, 55% and 38%, respectively. More than a dozen other defaulted developers also saw their shares climb by 10% or more, according to data provider Wind.

The euphoria around bank stocks was much more restrained, as fresh policies such as lowering mortgage rates and cutting interest rates threaten to further erode profit margins. Shanghai-listed shares of the country’s largest four banks edged up by between 2% and 4%.

Then, there are the remaining concerns around China’s economic fundamentals. In addition to the fifth straight month of manufacturing-sector contraction, the official purchasing managers index also showed export orders weakening and surveyed firms signaling continued caution on hiring.

Beijing’s main response to the slowdown so far has been to funnel investment into factories. The resulting pickup in production has hammered prices and profits and fueled trade tensions overseas, where many countries are growing alarmed at a wave of cut-price Chinese imports squeezing homegrown industries.

And even after the latest announcements on real estate, the sector remains a severe drag on China’s economy. Economists say Beijing still needs to do more to clear a backlog of unfinished homes that have already been paid for if consumer confidence is to return.

- 09/30/2024 – A Wild Week for China’s Markets, in Charts (wsj.com)

A major injection of stimulus from China’s central bank—and promises of more government support from top leaders—mark the beginning of a more muscular approach from Beijing to righting the economy, our correspondents report.

Here’s a look at how the broadside jolted markets:

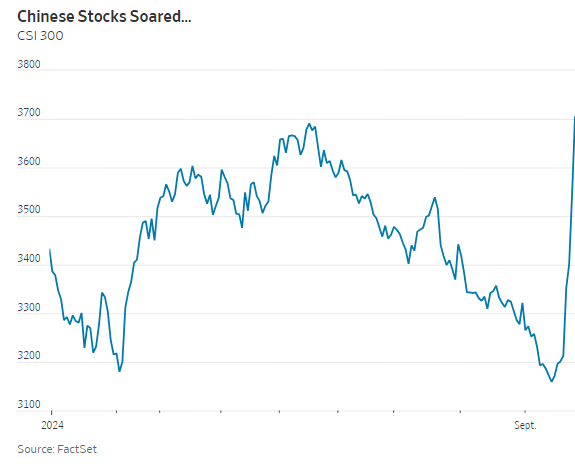

The Shanghai Composite Index rose 13%, its biggest weekly gain since November 2008. That erased several months’ losses for the index.

The Shanghai Composite Index rose 13%, its biggest weekly gain since November 2008. That erased several months’ losses for the index.

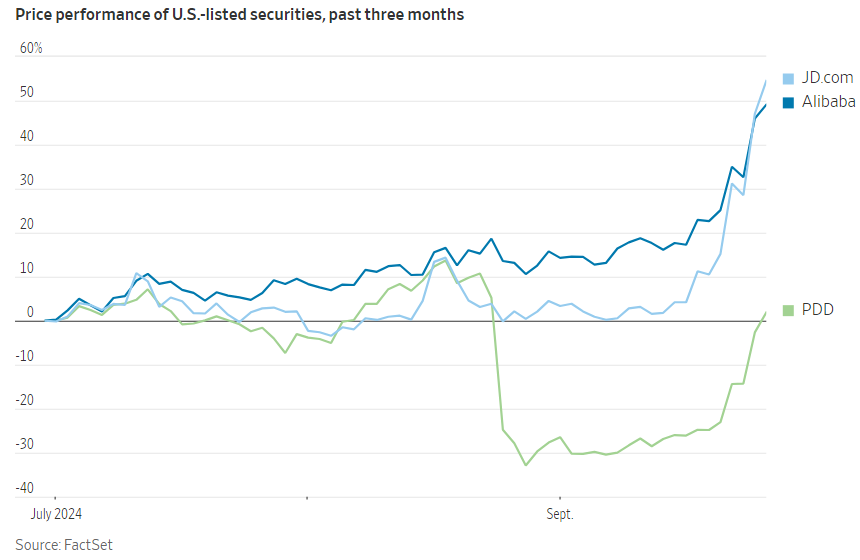

In the U.S., securities of Chinese ecommerce companies Nio, Alibaba, Pinduoduo and JD.com zipped up. The Nasdaq Golden Dragon Index rallied hard.

In Hong Kong, the Hang Seng Index also jumped 13%, its best week since 1998.

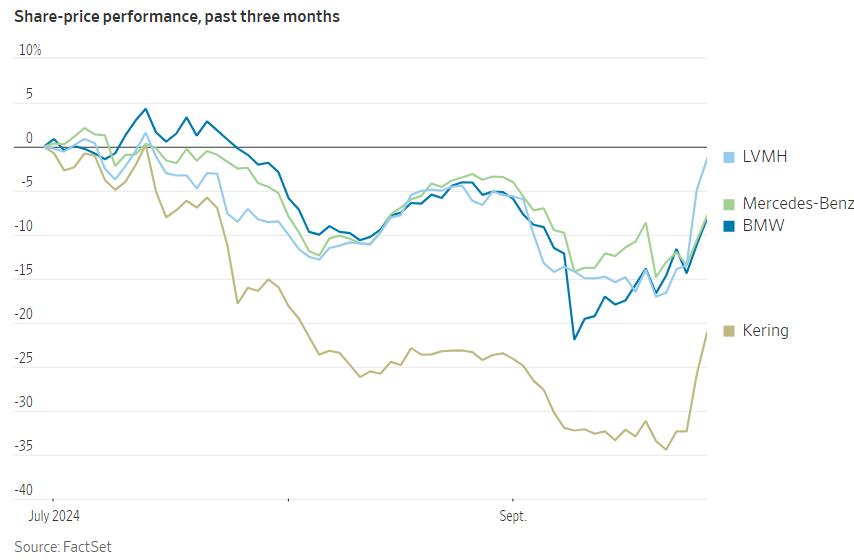

In Europe, companies that have suffered from weak Chinese sales in recent months perked up. Purveyors of luxury goods, such as LVMH, Kering and Christian Dior, have all seen their stocks pop. So have German carmakers Mercedes-Benz and BMW.

Investors thought the Chinese authorities had dealt casino companies with big Macau operations a good hand.

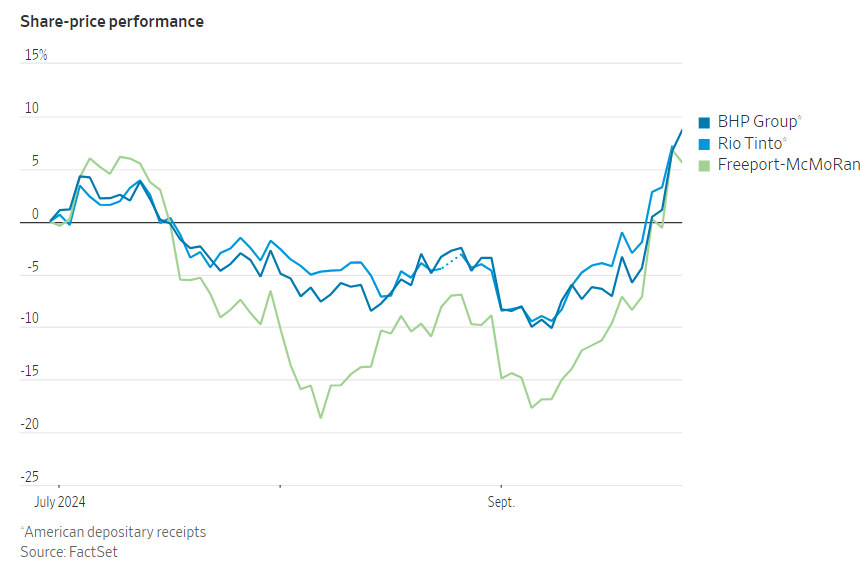

Shares of miners that shovel iron ore, copper and other commodities into China’s huge industrial economy jumped.

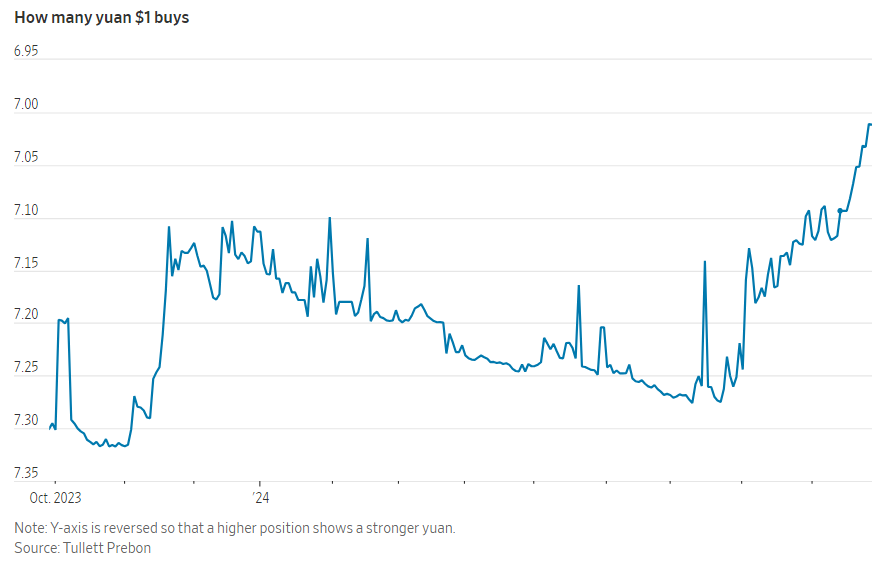

And China’s currency strengthened to a more-than-one-year high.

- 09/29/2024 – Will China’s Surprise Stimulus Work? – WSJ Getting out of the deflationary hole China dug itself is vital, and in the short run all stimulus will help. But for the long term, the form that state support takes matters.

The best week in 16 years for China’s stock market was built on hope. Worse, it was built on hope for more state intervention, one of the reasons its economy is in such trouble to start with.

Start with the hope. China went for a triple boost last week: cuts to interest rates and other easing, loans to investors and to companies to buy back their stock, and a promise of something “fiscal” in yet-to-be-defined size.

Investors loved the idea of central bank support for share buying, not surprisingly. No need to rely on the “national team” of state-directed buyers that stepped in after the 2015 bubble popped if the central bank will support prices directly.

But it was the politburo’s use of the word “fiscal,” and its surprise decision to focus its September meeting on the economy, that really fired up the hopes. If China starts doling out trillion-yuan ($140 billion) stimulus here and there, could it get the economy out of its housing-induced slowdown?

The parallel for investors is 2008, when China was the first to launch massive stimulus in response to the global financial crisis. It worked, and investors remember. But the stimulus also left China with a legacy of huge local government debt, overcapacity and excess housing, worsened by the country’s subsequent failure to shift from state-directed investment to household consumption.

The last stimulus mattered hugely to investors outside China too, as the country sucked in resources for its infrastructure binge and helped support global demand. Smaller stimulus means it almost certainly won’t have such a grandiose effect this time (though copper and other industrial metals had a very good week). If it turns out to be really big, it will be a bane rather than a boon: China has been exporting deflation, and turning that into a source of global inflation would be unhelpful for the rest of the world.

We still don’t know exactly what China will do. What it needs are three things, only one of which it has addressed, and in a weird way, so far:

Change sentiment. Chinese consumers and investors have been in a dismal mood since the housing bubble began to deflate. Before the People’s Bank of China announced its rate cuts and stock-support program, shares were trading at just over 10 times estimates of earnings over the next 12 months—the biggest discount to the S&P 500 in data back to 2010.

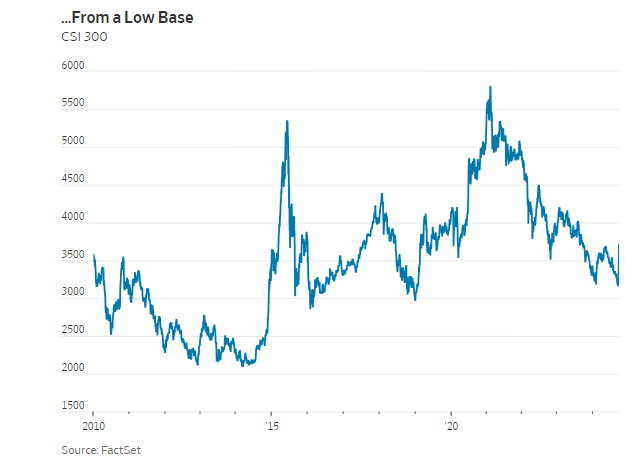

Such cheapness helps explain why the new policy and politburo comments led to such an extraordinary gain, with the CSI 300 index of the largest companies up 15.7% in the week. After all, even the most bullish economists don’t expect support on the scale of November 2008—when the weekly gain was 15.8%.

Clearly investor sentiment changed. It isn’t obvious that this will feed through into household willingness to borrow and spend, though. Chinese households have much less invested in the stock market than Americans, and rely instead on housing and cash savings. To the extent that the market is a signal of wider sentiment, even more manipulation by the government could make its information even less useful. On the other hand, pushing it up certainly makes investors wealthier, and that will make them, at least, feel better.

00:00 – Cold Open

10:43 – Intro

12:55 – Market Setup and China Stimulus

- David Tepper said to buy everything from China on CNBC

- KWEB might go all time high, could be self-reinforced movement

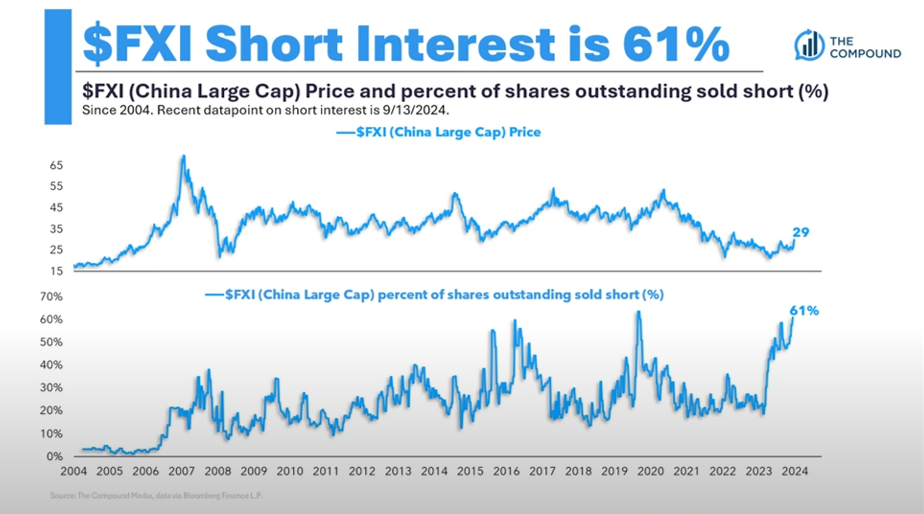

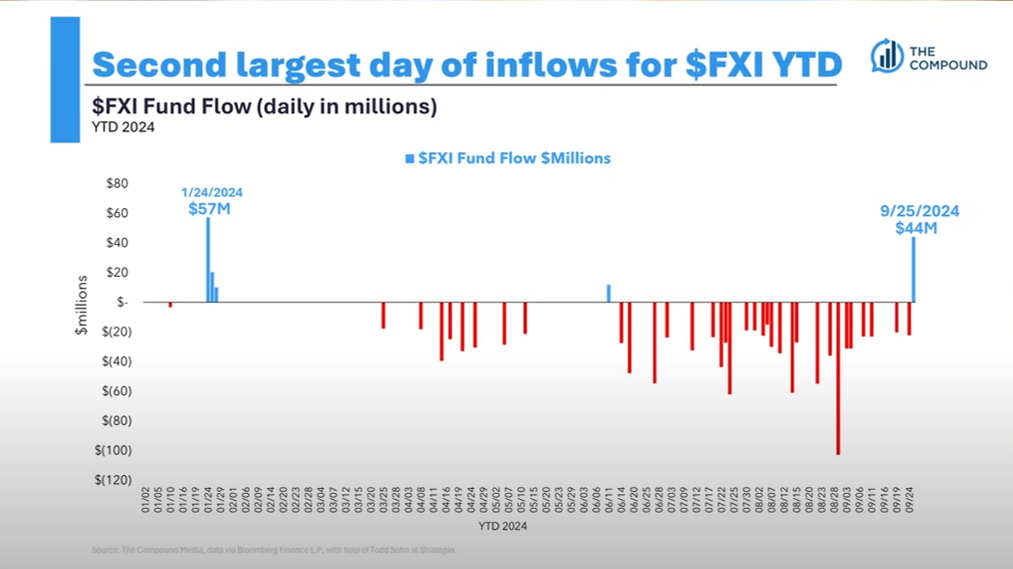

- China stocks are cheap in valuation, second largest day inflow for FXI

4. it might be like 2010 Dragi, it might retrace all time high

5. it is a good opportunity for US investors with record high savings to buy FXI

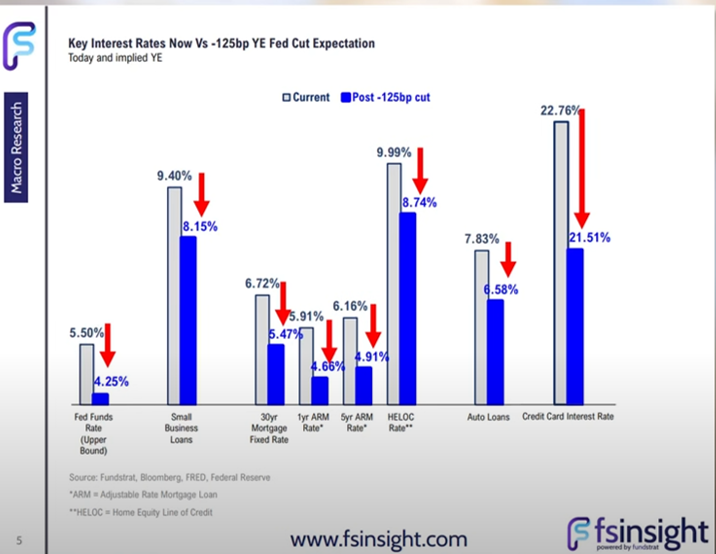

6. fed rate cut and mortgage rate

24:11 – The Labor Market

29:56 – The Fed Cuts and Current Risks

risks: geopolitics, election

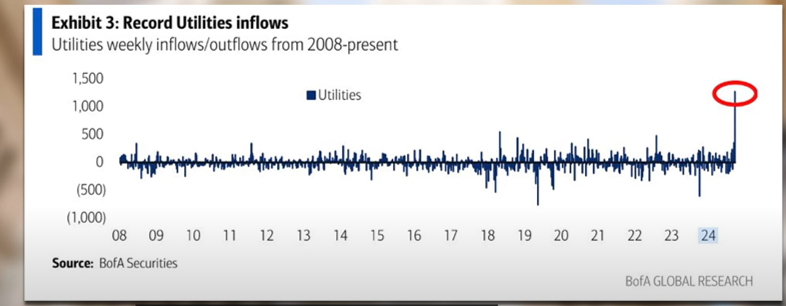

35:52 – Utilities

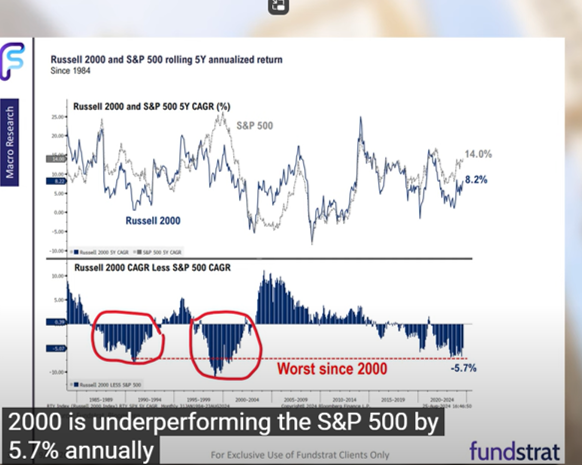

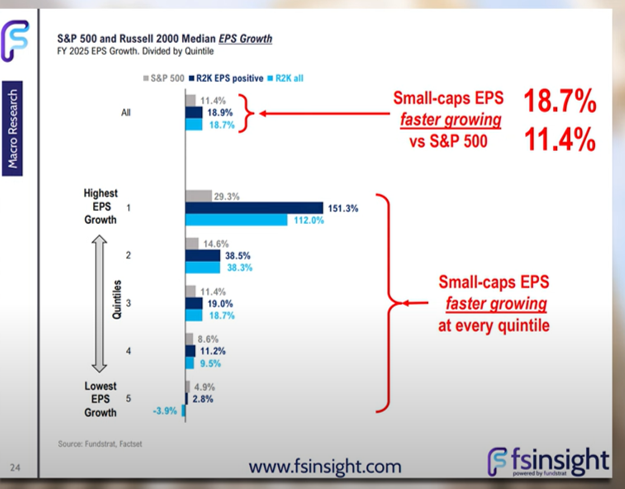

39:47 – Small Caps

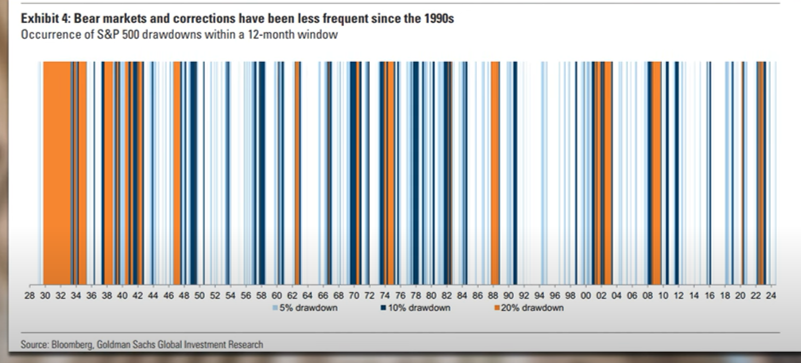

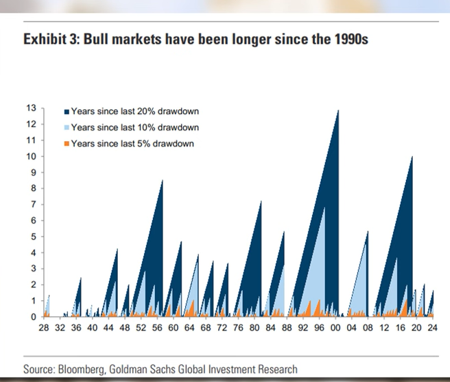

51:41 – History of Drawdowns

01:00:50 – The Election

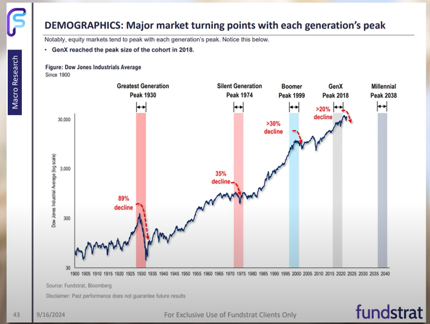

01:02:54 – Demographics

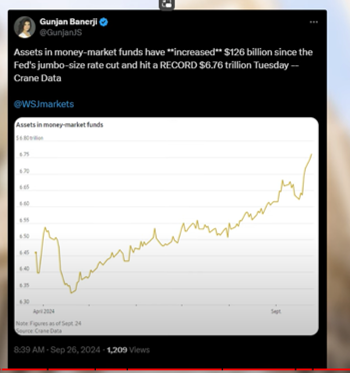

01:09:38 – Money Market Inflows?

inflation might have second wave. 40% of people might vote second wave will come

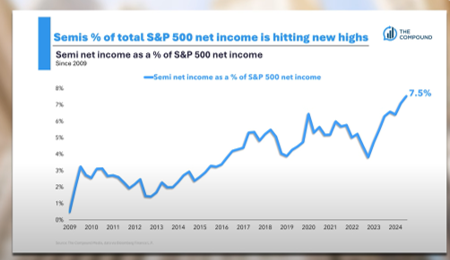

01:12:52 – AI and Semiconductors

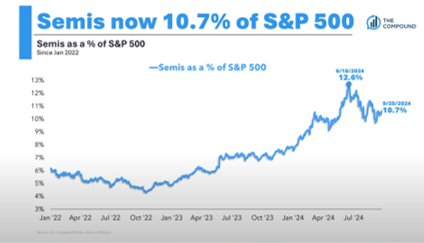

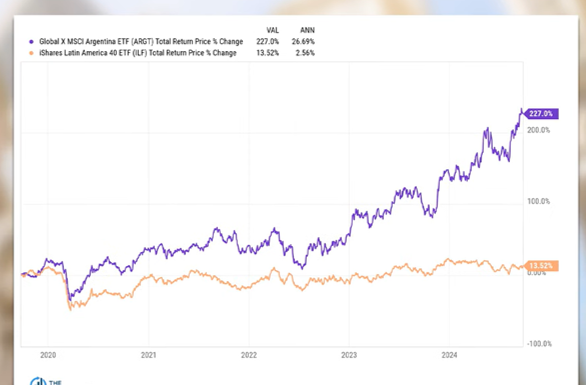

01:19:21 – What’s going on in Argentina?

01:22:25 – Favorites

work during his travel in Asia, but with less time. Great time to have a set back to stay away from noise and clear mind, like reentering my job.

- 09/27/2024 – David Tepper on Chinese stocks

240419A 16×9 full (youtube.com)

格隆汇9月26日|受中国政策组合拳利好提振,中国资产ETF美股高开高走,3倍做多富时中国ETF-Direxion涨25%,2倍做多沪深中国互联网股票ETF-Direxion涨超24%,2倍做多沪深300ETF-Direxion、2倍做多富时中国50ETF-ProShares涨近17%,kraneshares中国海外互联网ETF涨12%,中国大盘股ETF-iShares涨超8%。

- 09/26/2024 – China’s Stimulus Measures Are Part of an Economic Bazooka, Assembled Piece by Piece – WSJ China’s central bank and top political leaders appear to be abandoning a reluctance to act forcefully on the economy

China’s leaders have been drip-feeding support into their ailing economy for three years. This week, they jacked up the dose.

A major injection of stimulus from the central bank—and promises of more government support from the Communist Party’s top decision-making body—mark the beginning of a more muscular approach from Beijing to righting the economy after months of hesitancy, economists say.

It electrified the markets, sparking a seventh straight day of gains on Shanghai’s stock market that has pushed the benchmark index up 11%—its biggest such run in four years—and into positive territory for the year.

The new urgency from policymakers in Beijing follows a torrent of economic warning signals: shrinking tax revenues, tumbling prices for homes and industrial goods, slowing retail sales and sputtering factory output and investment.

“After the pandemic, we’ve felt that making money isn’t that easy,” said Liu Ailing, a 47-year-old homemaker in Beijing. Liu said she is heartened by some of the measures rolled out this week, especially a planned reduction in mortgage rates for homeowners, which she hopes will counter the rising cost of educating her third-grade daughter.

Yet tempering the stimulus hopes are still-unanswered questions about how much Beijing is willing to spend—and especially how much it is prepared to put in the pockets of China’s beaten-down consumers.

- 09/26/2024 – KWEB: 5 Reasons Why I’m Cautious About The Recent Rally (NYSEARCA:KWEB) | Seeking Alpha

- KWEB’s recent rally is driven by optimism surrounding China’s stimulus, but it may not be sustainable due to the market’s “buy the news” mentality before the holiday and overbought conditions.

- The PBOC’s monetary stimulus is considered insufficient to boost consumer spendings, as the decline in the housing market significantly reduces household net worth.

- While fiscal stimulus may be welcomed, consumers might still choose to save rather than spend, as improving consumer confidence takes time.

- Despite attractive valuations, KWEB faces negative sentiment from geopolitical tensions, particularly from upcoming U.S. election volatility and potentially Trump’s Tariff War 2.0.

- Investors should consider selling options to capitalize on high implied volatility, as KWEB’s price action is driven more by headline news than fundamentals.

- 09/26/2024 – China’s Politburo Supercharges Stimulus With Housing, Rates Vows (yahoo.com)

President Xi Jinping’s huddle of the 24-man Politburo concluded with a promise to strive to achieve the country’s annual economic goals, the official Xinhua News Agency reported Thursday. Officials pledged action to make the real estate market “stop declining,” their strongest vow yet to stabilize the crucial sector after new-home prices fell in August at the fastest pace since 2014.

The government will also strictly limit the construction of new-home projects, the Politburo said, as part of efforts to ease residential oversupply — although such building has ground to a near-halt.

While the Politburo offered no specifics on fiscal spending, Reuters reported late Thursday that the Ministry of Finance is planning to issue 2 trillion yuan ($284 billion) of special sovereign bonds this year. That funding will be evenly split between stimulating consumption and helping local governments tackle debt problems, Reuters said, citing two people familiar with the matter.

- 09/26/2024 – David Tepper is uber bullish on China: It’s a ‘buy everything moment’ (msn.com)

David Tepper, founder of Appaloosa Management, said he is going “all-in on China” after announcements of huge stimulus measures to boost the country’s economy.

In a CNBC interview, the billionaire hedge-fund manager said he is bullish on all things China (NASDAQ:MCHI), (FXI), (GXC).

He also recommended stock buybacks if the Chinese currency (USD:CNY) proves strong, and said he does not care about the proposed U.S. tariffs on China imported goods, since it is the internal stimulus that is benefiting the Chinese markets.

“You can’t be short the U.S.; you can’t be short anything in Asia.”

David Tepper is buying ‘everything’ in China: ‘ETFs…futures…everything’ (msn.com)

‘Everything…everything — ETFs, we do futures…everything. Everything. This is incredible stuff for that place, ok, so it’s everything.’ — David Tepper, founder, Appaloosa Management

Chinese stocks continue to enjoy a lift Thursday following a monetary stimulus announced earlier this week.

What Happened: To meet China’s economic growth target of approximately 5% this year, leaders promised to deploy “necessary fiscal spending,” per Reuters.

The 24-man Politburo meeting did not provide details on fiscal spending. Reuters reported Thursday that China is planning to issue 2 trillion yuan ($284 billion) of special sovereign bonds this year in an effort to stimulate the consumer.

The report also indicates that the Ministry of Finance plans to issue 1 trillion yuan of special sovereign debt primarily aimed at stimulating consumption. Some of the proceeds raised through the issuance of these bonds are expected to be used to increase subsidies for consumer goods renewals and business equipment upgrades.

Funds will also be used to provide roughly 800 yuan per child to households with two or more children.

China also plans to inject another 1 trillion yuan to help local governments with debt problems.

The moves out of China mark the country’s latest attempt to revive an economy that has battled deflationary pressures and growth headwinds due to property declines and wavering consumer confidence.

Chinese leaders said the stimulus is aimed at putting an end to declines in the housing market and pushing economic growth toward its 5% goal. Chinese authorities also reportedly plan to increase support for small and medium-sized businesses to help lower operating costs.

According to a separate report from Bloomberg News, China is also considering injecting up to 1 trillion yuan into its biggest state banks to help expand lending capacity, primarily through the issuance of new special sovereign bonds.

“This is a different type of stimulus,” said Hao Hong, chief economist at Grow Investment Group.

“If done through special bond issuance it’s a fiscal stimulus and can stabilize the banks as property prices continue to decline. It will ensure that the banks lending capability won’t be affected.”

Why It Matters: Several China-based stocks are surging Thursday on a more optimistic outlook for economic growth, led by some of the biggest online retail names.

Billionaire David Tepper suggested in a TV appearance that he’s building a large position in Chinese equities.

“I didn’t know that they were going to bring out the big guns,” Tepper said on CNBC’s “Squawk Box.” “When that came in, we got a little bit longer … more Chinese stocks. And so I have limits, historic limits, that I probably set a long time ago. I don’t go above 10% or 15%. Well, that’s probably not true anymore.”

The valuations of China stocks are exceptionally low, even after the jump in China this week, Tepper added. A lot of China-based companies have single-digit price-to-earnings multiples and double-digit growth rates.

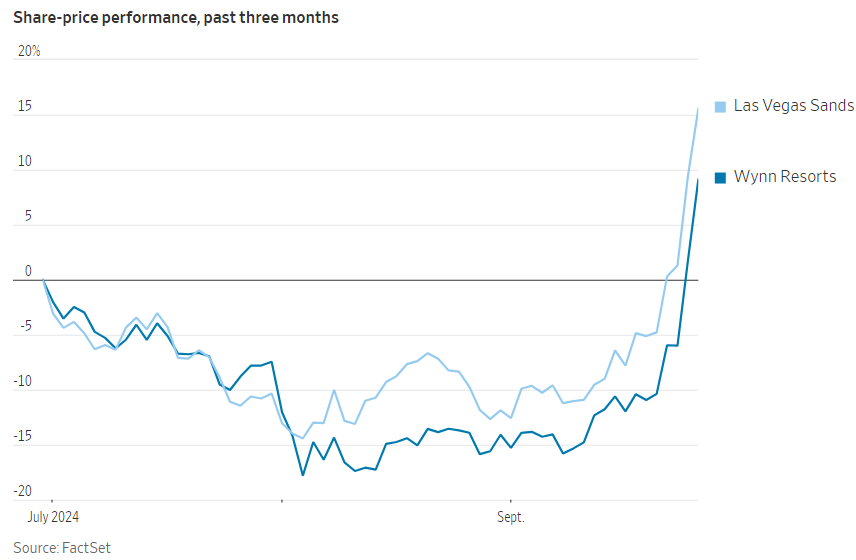

While Tepper boasted that he’s buying “everything” in China, he didn’t name specific companies. He did say his firm Appaloosa Management, has been adding to Wynn Resorts (NASDAQ:WYNN) and Las Vegas Sands Corp (NYSE:LVS), which have heavy exposure to China.

Wynn Resorts was up more than 7% at last check, while Las Vegas Sands shares were up about 5.5%.

- 09/25/2024 – 7 takeaways from China’s most significant stimulus package since the pandemic | South China Morning Post (scmp.com)

The slew of measures announced were “bold by historical standards”, analysts said, as they represented the first time the central bank had offered a combination of rate cuts, reserve requirement ratio (RRR) cuts and structural monetary policies at the same time.

Specifically, analysts hailed the measures announced by the PBOC as the “most significant stimulus package since the early days of the pandemic”, but said greater fiscal support would still be needed to drive a turnaround in growth, with the world’s second-largest economy struggling to show an obvious rebound.

- 09/25/2024 – Pan Gongsheng – Wikipedia

Pan Gongsheng (Chinese: 潘功胜; pinyin: Pān Gōngshèng; born July 8, 1963) is a Chinese economist and politician who is the current Chinese Communist Party Committee Secretary and governor of the People’s Bank of China (PBC). He served as the Director of the State Administration of Foreign Exchange from 2016 to 2023. At the PBC, he has worked on the monetary policy of China.

Pan received his Ph.D. in economics from Renmin University of China. He did his post-doctoral research at Cambridge University and was a research fellow at Harvard University.[1]

Home-Management Team-Pan Gongsheng (pbc.gov.cn)

BEIJING, Sept. 24 — China’s central bank, top securities regulator and financial regulator on Tuesday announced at a press conference a raft of monetary stimulus, property market support and capital market strengthening measures to boost the country’s high-quality economic development.

MONETARY STIMULUS

Pan Gongsheng, governor of the People’s Bank of China, said China would cut the reserve requirement ratio (RRR) by 0.5 percentage points in the near future, providing about 1 trillion yuan (about 141.82 billion U.S. dollars) in long-term liquidity to the financial market.

Depending on the liquidity situation in the market, RRR may be further lowered by 0.25 to 0.5 percentage points within the year, Pan said.

He said that the central bank will reduce the interest rate of seven-day reverse repurchases from 1.7 percent to 1.5 percent.

The reduction was aimed at guiding the loan prime rate and deposit rate to move downward and maintaining stability in the net interest margin of commercial banks, said Pan.

Pan said the central bank would keep monetary policy accommodative, strengthen monetary policy regulation, make monetary policy regulation more precise, and create a sound monetary and financial environment for stable economic growth and high-quality development.

China targets economic growth of around 5 percent in 2024.

The country’s economy maintained stable expansion in the first half of the year despite rising challenges from home and abroad.

Data from the National Bureau of Statistics (NBS) showed that China’s gross domestic product (GDP) grew 5 percent year on year in the period to 61.68 trillion yuan. In the second quarter, China’s GDP expanded 4.7 percent year on year.

MORTGAGE RATE CUTS

Pan added that China will lower mortgage rates on existing home loans to a level similar to those of newly issued housing loans.

The average reduction in mortgage rates for existing home loans is expected to be around 0.5 percentage points, he said.

“The new policy, which is conducive to further reducing borrowers’ mortgage interest expenses, is expected to benefit 50 million households, or a population of 150 million,” said Pan.

This move is expected to reduce the total interest expenses for households by approximately 150 billion yuan per year on average, which will help boost consumption and investment, he added.

The minimum down payment ratio for both first and second homes will be unified, with the nationwide minimum down payment ratio for second homes to be reduced from 25 percent to 15 percent, Pan said.

On May 17, China announced the establishment of a 300-billion-yuan re-lending facility that supports local state-owned enterprises to buy commercial homes for affordable housing.

Pan said the central bank will increase its funding proportion in the affordable housing re-lending policy from the original 60 percent to 100 percent.

“This adjustment will help accelerate the reduction of inventory in the commercial housing market,” Pan said.

China’s large and medium-sized cities saw month-on-month declines in both new and second-hand home prices in August, NBS data showed.

FINANCIAL MARKET SUPPORT

Moreover, the central bank will create new monetary policy tools to support the stable development of the stock market, said Pan.

The central bank will establish a swap program for securities, funds and insurance companies to obtain liquidity from the central bank through asset collateralization. The program will significantly enhance companies’ ability to acquire funds and increase their stock holdings, Pan said.

The central bank will also create a special re-lending facility to guide banks to provide loans to listed companies and their major shareholders for buybacks and increasing shareholdings, he said.

Experts consider the release of the new batch of policies a positive signal of strengthening policy coordination and efforts to achieve the annual economic growth target.

The central bank’s policies, which exceed market expectations, will boost market confidence, stimulate the vitality of business entities, stabilize credit levels, and enhance the sustainability of financial support for the real economy, said Wen Bin, chief economist at China Minsheng Bank.

To better channel funds into the capital market, China will issue a guideline that seeks to improve the entry supporting system of various types of medium and long-term funds into the capital market, according to Wu Qing, head of the China Securities Regulatory Commission.

The commission will also release six measures to promote mergers and acquisitions, and work with various parties to facilitate the circulation of private equity and venture capital funds in the process of fundraising, investment, management and withdrawal, Wu said.

More efforts will be made to protect the legitimate rights and interests of small and medium-sized investors, and firm actions will be taken to crack down on illegal activities such as financial fraud and market manipulation, according to Wu.

Li Yunze, head of the National Financial Regulatory Administration, said China plans to increase the tier-1 capital of six major commercial banks.

The capital will be injected in an orderly manner, with coordinated advancement, phased implementation and tailored policies, said Li.

Tier-1 capital refers to the core capital held in a bank’s reserves, including common stock and disclosed reserves.

China’s major stock indices surged following the release of the policies and measures, with the Shanghai Composite Index and the Shenzhen Component Index both closing with an increase of more than 4 percent.

- 09/24/2024 – China Tries to Jolt Ailing Economy – WSJ Central bank cuts interest rates and dangles loans for stock-market investors as concerns around world’s second-largest economy intensify. PBOC Gov. Pan Gongsheng said further easing is in the pipeline, with another reduction in bank reserve requirements expected before year-end. The central bank also announced it would offer 500 billion yuan in loans, equivalent to roughly $70 billion, to funds, brokers and insurers to buy Chinese stocks as part of an effort to lift the country’s ailing stock market. It said it would put up another 300 billion yuan to finance share buybacks by listed companies.

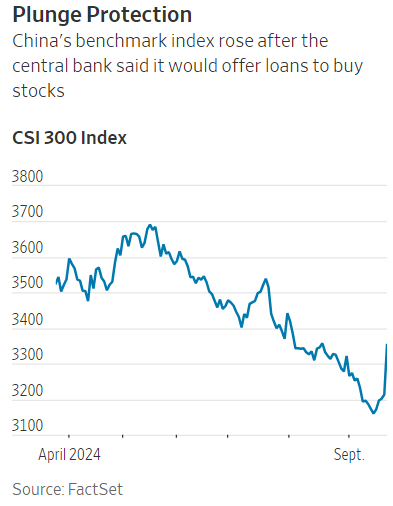

Plunge ProtectionChina’s benchmark index rose after thecentral bank said it would offer loans to buystocks.

China’s central bank announced a blitz of measures to support the country’s weakening economy and energize its moribund stock market, an unusually broad package that signals growing unease in Beijing after a run of downbeat numbers on jobs, spending and inflation.

Economists said that while the blast of support is welcome, it won’t be enough to pull China’s economy out of a low-growth rut marked by falling prices, a festering real-estate crisis and spiraling tensions over trade.

Instead, Beijing needs to get a firmer grip on the real-estate downturn and take robust steps to boost consumption if it is to spark a durable revival in the economy, many economists said.

The People’s Bank of China said Tuesday that it would cut its benchmark interest rate and lower the amount of cash that banks need to hold in reserve—a bid to free up more resources for lending. It also said it would cut the interest rate payable on existing mortgages and lower down payments for second homes.

At a press conference in Beijing, PBOC Gov. Pan Gongsheng said further easing is in the pipeline, with another reduction in bank reserve requirements expected before year-end.

央行重磅出击, 降准、降息、下调存量房贷利率_新浪财经_新浪网 (sina.com.cn)

今年以来央行主要货币政策措施一览

2月5日,人民银行下调金融机构人民币存款准备金率0.5个百分点(不含已执行5%存款准备金率的金融机构),释放中长期流动性超过1万亿元。

2月20日,作为个人住房贷款和企业中长期贷款定价参考基准的5年期以上LPR下降25个基点,创LPR改革以来的最大下调幅度。

5月17日,人民银行发布《关于调整商业性个人住房贷款利率政策的通知》,取消全国首套住房和二套住房商业性个人住房贷款利率政策下限。下调个人住房公积金贷款利率0.25个百分点。

5月17日,人民银行、金融监管总局发布《关于调整个人住房贷款最低首付款比例政策的通知》,对于贷款购买商品住房的居民家庭,首套住房商业性个人住房贷款最低首付比例调整为不低于15%,二套住房商业性个人住房贷款最低首付比例调整为不低于25%。

7月22日,中国人民银行宣布下调7天逆回购操作利率10个基点,这是去年8月以来央行首次下调政策利率。同时,央行授权全国银行间同业拆借中心公布,1年期、5年期LPR分别下调10个基点。

Stock Market Today: Dow Futures Waver; Chinese Stocks Surge on Stimulus Blitz (wsj.com)

A big move in Beijing is rippling through global markets.

China’s central bank unveiled a blitz of measures to support an ailing economy and energize the stock market. The move lifted indexes in Asia, European luxury stocks, and U.S.-listed shares of Chinese companies such as Alibaba. Commodity prices rose.

While investors welcomed signs that China is taking more decisive action to shore up its economy and markets, economists remain skeptical that these initiatives alone will be enough to pull the country out of its low-growth rut.

- 09/24/2024 – Chinese stocks soar on stimulus plan. Can the rally continue? – MarketWatch China stimulus package is most significant since pandemic, economist says

China’s stock market surged the most in more than two years and industrial commodity prices bounced after Beijing on Tuesday unleashed a swathe of stimulus measures intended to revive the world’s second biggest economy.

But amid the euphoria there was skepticism among many observers that the pledges would provide a sufficient economic boost or spark a sustained stock market rally.

People’s Bank of China governor Pan Gongsheng said in a rare public briefing that a short-term interest rate would be cut, the amount of capital banks were required to hold in reserve would be reduced, and there would be a batch of support for the beleaguered housing sector and the struggling equity market as the government strived to lift economic growth to its 5% annual target.

“This is the most significant PBOC stimulus package since the early days of the pandemic,” said Julian Evans-Pritchard, head of China economics at Capital Economics.

The PBOC’s stimulus proposals sought to address the sclerotic housing sector in particular, telling banks to reduce mortgage rates by 0.5%, and lowering the minimum down-payment ratio to 15% for second-home buyers, from the current 25%.

Furthermore, the PBOC will allow commercial banks to use 100% from the 300 billion yuan ($43 billion) relending loan facility to finance loans they offer to state-owned firms for acquiring unsold flats for affordable housing, up from the current 60%.

Broader measures to encourage bank lending and borrowing included cutting the seven-day reverse repo rate by 0.2 percentage points to 1.5%, and banks’ reserve requirement ratio by 50 basis points in the near future, which the PBOC said would free up about 1 trillion yuan ($142 billion) for new lending.

And there was direct support for the stock market, too, with the PBOC saying it will set up a 500 billion yuan swap facility that insurance companies and asset managers, amongst others, can tap to invest into equities. Also, there will be a 300 billion yuan lending program to help companies buy back their stock.

- 09/23/2024 – China central bank releases slate of support measures amid a deepening economic slump (cnbc.com)

- People’s Bank of China Gov. Pan Gongsheng announced a flood of support measures in a rare press conference Tuesday amid a deepening economic slump.

- Beijing will cut the amount of cash banks need to have on hand, known as the reserve requirement ratio, or RRR, by 50 basis points in the near term, he said.

- Pan also said the PBOC would cut the 7-day repo rate by 0.2 percentage points, and signaled that a 0.2-0.25% cut in the loan prime rate could follow.

- 09/23/2024 – China’s Central Bank Announces Rate Cut, Injects Liquidity – WSJ The People’s Bank of China cut the 14-day reverse repurchase interest rate by 10 basis points to 1.85%

China’s central bank has lowered a short-term policy rate and pumped more liquidity into the financial system, as it continues efforts to help boost the economy.

The People’s Bank of China cut the 14-day reverse repurchase interest rate by 10 basis points to 1.85%, and injected 74.5 billion yuan, equivalent to $10.6 billion, of liquidity via the policy tool, it said on its website on Monday.

The latest cut is a reflection of the reduction in the 7-day reverse repo rate in July, during which the PBOC didn’t conduct a 14-day reverse repo operation, said Zhiwei Zhang, an economist at Pinpoint Asset Management.

The central bank also injected 160.1 billion yuan through 7-day reverse repo agreements, keeping the interest rate unchanged at 1.7%, it said Monday.

Last week, the PBOC unexpectedly held its benchmark lending rates steady, despite rising expectations for easing following the U.S. Federal Reserve’s own rate cut.

Economists anticipate the Chinese central bank will lower its 7-day reverse repo rate—now seen as the key rate for pricing benchmark lending rates—in the coming months, as the Fed’s cut gives it more room for monetary policy easing.

- 02/24/2023 –

Spy Balloon Fallout Highlights Fragility Of U.S.-China Relations

Xi has promoted an economic strategy of “dual circulation,” emphasizing self-reliance and leveraging the country’s massive market to generate GDP growth.

US-China relations are heading towards an irreversible downward spiral, with Washington sanctioning more Chinese firms with alleged ties to military intelligence.

President Biden has been criticized by Republican members of Congress for being too soft on China and may be inclined to further strengthen the U.S.’s “anti-China” containment policy.

- 02/15/2023 –Potential upcoming catalysts

- holiday season for e-commerce companies

- end of release of regulatory laws. Chinese government’s crack down on big tech might come to end by the end of the year

- reconfiguring growth and household properties will be shift to equities. cash flows will be substantially higher.

- IPO of Ant’s financial (one news here)

- 中金:北京证券交易所宣布设立,中国资本市场迎来新格局

- upcoming Biden-Xi summit by end of the year

- One Upside to Economic Woes May Be China-U.S. Thaw

Strong exports and weak domestic demand in China, paired with scarce goods and inflation in the U.S., underline the two economies’ mutual dependency - Jack Ma reappears in Hong Kong

- The Biden administration has continued the tough public façade of confronting China on trade.

- China to relief and abandon CV-zero Policies

- relief of Chinese real estate market crisis

- The pursuit of COVID-zero and the consequential lockdowns sparked panic-buying, boosting online sales

- With Xi Jinping’s third-term re-election largely assured, investors could also be relieved by a likely continuation of an administration they are familiar with.

Risks

- delisting of China stocks from us market

- downfall of China economy

- bad outcome from upcoming Biden-Xi summit

- fraud is uncovered in Chinese stocks and crash the stock price. Possibly in specific stocks, hard on all stocks

- VIE cancellation – biggest risk

- Real estate property market will drag down the whole economy (Property accounts for about 70% to 80% of household wealth in China, and drives about 10% of household income, according to Moody’s.)

- In China, War and Stagflation Jitters May Permanently Damage the Market

- a new draft of China’s overseas listing rules that may be finalized as soon as this month

- SEC might delist VIE stock, SEC warns of investment risks. Aug 17, 2021, SEC Chairman Gary Gensler issued his most direct warning yet about investing in Chinese companies, reiterating a call for more disclosures of risks. “When American investors think we’re investing in a Chinese company, it’s much more likely that we’re actually investing in a company in the Cayman Islands,” he said in a video message. “In certain sectors like technology and the internet, the government of China actually doesn’t allow ownership and investment from people outside of China. To get around this, China-based. operating companies establish contracts with shell companies in other countries.” Outlook: Gensler is asking SEC staff to take “a pause, for now” in approving IPOs of shell companies that Chinese firms use to list shares in the U.S. He also wants investors to have more information about how those firms are structured and what money is flowing between the Cayman Islands and China. “That means disclosing the political and regulatory risk that the government of China could, as they’ve done a number of times recently, significantly change the rules in the middle of the game.”

-

01/30/2023 – China’s PMI comes bakc?

China’s factory activity likely contracted more slowly in January: Reuters poll

China’s factory activity in January is expected to have contracted more slowly than in December, a Reuters poll showed on Monday, with production hampered as workers continued to fall sick after the government dismantled its “zero-COVID” regime.”

“Early signs suggest that conditions improved in January,” according to a note from Capital Economics, “and any lingering supply-side issues will matter less at a time of year when factories wind down production in any case,” they added while forecasting a PMI reading of 50.0.

The world’s second-largest economy continues to face major external headwinds on the demand-side, however, with China’s export-orientated manufacturers continuing to report shrinking order books as fears of a global recession linger.

China’s cabinet pledged on Saturday to boost consumption as to help drive the economy’s recovery. Over the Lunar New Year holiday, consumption increased 12.2% on the same period last year despite concerns that the services sector might be hobbled by staff shortages resulting from COVID.

China aims to boost consumption and imports as global demand cools

China’s cabinet said on Saturday it would promote a consumption recovery as the major driver of the economy and boost imports, state broadcaster CCTV reported, at a time of cooling global demand as major economies teeter on the brink of recession.

At a meeting chaired by Premier Li Keqiang, China’s state council – which functions as the cabinet – also vowed to speed up the rollout of foreign investment projects, maintain a stable yuan, ease cross-border travel and help companies to participate in domestic and overseas trade shows.

- Many of the largest Chinese e-commerce companies found themselves in the sights of the U.S. Trade Representative, Thursday, due to their alleged roles in the buying and selling of counterfeit goods online.

- Affiliates of Alibaba (NYSE:BABA) and Baidu (NASDAQ:BIDU), as well as PinDuoDuo (NASDAQ:PDD) were among those companies on the latest “notorious markets” list by the Office of the United States Trade Representative [USTR], Ambassador Katherine Tai. The list includes 42 online sites, and 35 traditional outlets that Tai said are involved in “substantial trademark counterfeiting” and copyright piracy.

- 02/16/2022 – Appaloosa sold all 525,000 shares of Alibaba (BABA, Financial), trimming 1.85% of its equity portfolio.

David Tepper Drives Into General Motors, Boots Alibaba

- 01/19/2022 – China cuts benchmark rates twice on Monday and Thursday, and more to come in the coming months, in order to bolster its economy. Enshrined stability as the “top priority” for China’s economy in 2022, in a meeting chaired by Mr. Xi. In face of downward economic pressure, China’s top economic planning agency, the National Development and Reform Commission, said Tuesday that Beijing is expediting the rollout of major infrastructure projects to counter uncertainties early in the year. – all these will be good tailwinds for CWEB and global energy market

China Cuts Benchmark Rates to Bolster Flagging Economy – WSJ

Move follows raft of economic data released by China that showed slowing growth in final months of 2021

China’s central bank lowered its benchmark lending rates, stepping in to support a slowing economy that has been weighed down by a slump in the property market during a politically important year for leader Xi Jinping.

The People’s Bank of China said Thursday that it cut its five-year loan prime rate, a benchmark for medium- and longer-term loans including mortgages, to 4.60% from 4.65%—the first such cut since April 2020. The Chinese central bank also lowered the one-year loan prime rate by 10 basis points to 3.70%, the second cut to that rate in as many months.

The moves were widely expected by analysts and traders after the central bank on Monday lowered rates on its one-year medium-term lending facility by 10 basis points, to 2.85%, underscoring Beijing’s shift to a looser policy stance as economic clouds gather.

“China’s easing cycle is in full swing now,” Sheana Yue, a Singapore-based economist at Capital Economics, told clients in a note Thursday. Ms. Yue predicted that the central bank would continue to slash rates in the coming months, which in turn would help to shore up housing demand.

On Sunday, China’s top law-enforcement body issued a rare warning about the political implications of domestic economic weakness, warning that, “with the economic downturn, some deep-seated problems may surface.”

“Once economic and financial risks are mishandled, they can easily be transmitted into the social and political sphere,” read the commentary, which was published by the Communist Party’s Central Political and Legal Affairs Commission, which oversees the country’s police, prosecutors and courts.

Last month, the Communist Party’s top decision-making body, the Politburo, enshrined stability as the “top priority” for China’s economy in 2022, in a meeting chaired by Mr. Xi.

In face of downward economic pressure, China’s top economic planning agency, the National Development and Reform Commission, said Tuesday that Beijing is expediting the rollout of major infrastructure projects to counter uncertainties early in the year.

Economists at investment bank Nomura are worried about the rising economic and social costs of China’s zero-tolerance Covid containment strategy, as well as the weak property market and slowing export growth. They say that a much more aggressive easing policy is needed to keep the economic recovery on track.

As it is, the easing bias of China’s central bank contrasts with the policy direction of the Federal Reserve and other developed-world central banks, which are preparing to wind down pandemic-era stimulus to curb high inflation.

Alibaba, JD.com rally as China’s central bank cuts key interest rate

- Chinese Internet stocks surged Thursday, as an interest rate cut by China’s central bank spurred a rally among the likes of Alibaba, JD.com and Weibo.

- Prior to U.S. stock market opening, the People’s Bank of China cut its one-year loan prime rate for the second time this month, to 3.7%, in an effort to relax the country’s economic policies. The move had an immediate effect on China’s leading Internet and tech companies, which often react to new Beijing economic measures.

- Evidence of that was seen in Alibaba (NYSE:BABA), as its shares climbed more than 5%; JD.com (NASDAQ:JD), up by 10.4%; Baidu (NASDAQ:BIDU), which rose almost 6%; DiDi Global (NYSE:DIDI), up almost 7%, and Tencent Holdings (OTCPK:TCEHY) and Weibo (NASDAQ:WB), both of which climbed more than 6%.