Study of Macro (part III)

- 09/18/2024 – Fed Cuts Rates by Half Percentage Point – WSJ Officials are hoping to prevent a gradual cooling in the labor market from turning into a deeper freeze

The Federal Reserve voted to lower interest rates by a half percentage point, opting for a bolder start in making its first reduction since 2020. The long-anticipated pivot followed an all-out fight against inflation the central bank launched two years ago.

Eleven of 12 Fed voters backed the cut, which will bring the benchmark federal-funds rate to a range between 4.75% and 5%. Quarterly projections released Wednesday showed a narrow majority of officials penciled in cuts that would lower rates by at least a quarter point each at meetings in November and December.

- 09/18/2024 – WATCH LIVE: Federal Reserve Chair Powell speaks after Fed announces interest rate cut | PBS News

WASHINGTON (AP) — The Federal Reserve on Wednesday cut its benchmark interest rate by an unusually large half-point, a dramatic shift after more than two years of high rates helped tame inflation but that also made borrowing painfully expensive for American consumers.

The rate cut, the Fed’s first in more than four years, reflects its new focus on bolstering the job market, which has shown clear signs of slowing. Coming just weeks before the presidential election, the Fed’s move also has the potential to scramble the economic landscape just as Americans prepare to vote.

- the tune of FOMC is critical, if it is bearish, then negative for the market

- 25pt or 50 pt cuts are no difference

- both presidential candidates are somewhat good for the market. historically, right after presidential election in one or two months, the market is good

- 09/13/2024 – 25bps or 50 bps Cut? – ValuePlays

I think the Fed does 25bps as they’ve signaled it, and I can’t imagine a justification for 50bps, barring something dramatic before the meeting

“Davidson” submits:

There is tremendous speculation for the Fed to cut 50bps(0.5%) this month. The history of Fed Fund shifts track the T-Bill rate after a couple of weeks leaving Fed Funds at a premium. That premium has hovered around 20bps over last 10yrs+. If this pattern holds, then we need to see T-Bill rates drop to 4.75%-4.8% range for a couple weeks to permit the Fed to act. We are not close yet even though it appeared we might drop below the spot rate 4.96% of a couple of weeks ago. Since then, T-Bill rate has hovered near 5%+/- and is 4.92% today. Unless we see the T-Bill rate below 4.8%, 25bps cut appears out of range and 50bps too far for the Fed to lead that far ahead which it has not done since the early 1980s.

The pressure to lower Fed Funds has been present for ~24mos with the consensus having the European Central Bank already cutting with perhaps another cut just around the corner. That they still face high inflation seems out of character with the recent cut. This does show the pressure traders can put on Central Bankers to alter stated policies.

Friday The 13th: The Cutting Cycle

BY TYLER DURDEN

FRIDAY, SEP 13, 2024 – 11:00 AM https://www.zerohedge.com/markets/friday-13th-cutting-cycle

By Philip Marey, Senior US strategist at Rabobank

Friday The 13th: The Cutting Cycle

Market speculation about a 50 bps rate cut by the Fed next week returned overnight after the Financial Times and the Wall Street Journal called the Fed’s rate choice between 25 and 50 bps a close call and former FOMC member Bill Dudley said there was a strong case for 50.

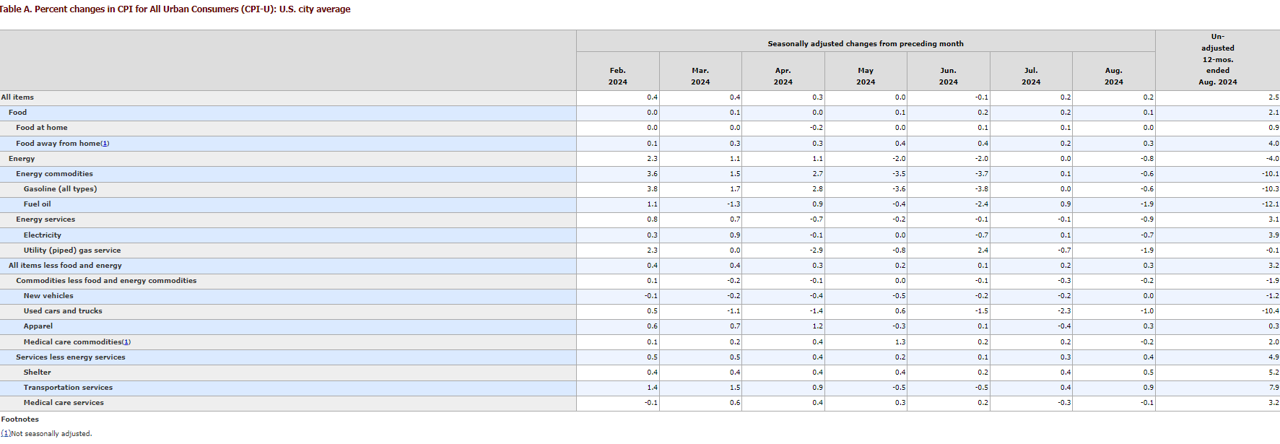

The index for shelter rose 0.5 percent in August and was the main factor in the all items increase. The food index increased 0.1 percent in August, after rising 0.2 percent in July. The index for food away from home rose 0.3 percent over the month, while the index for food at home was unchanged. The energy index fell 0.8 percent over the month, after being unchanged the preceding month.

The shelter index increased 5.2 percent over the last year, accounting for over 70 percent of the total 12-month increase in the all items less food and energy index. Other indexes with notable increases over the last year include motor vehicle insurance (+16.5 percent), medical care (+3.0 percent), recreation (+1.6 percent), and education (+3.1 percent).

- Wall Street is gearing up for one of the most important economic releases of the year Friday.

- The consensus is for the nonfarm payrolls report to show growth of 161,000 for August and a slight decline in the unemployment rate to 4.2%.

- Markets are certain the Fed will start lowering interest rates in a couple weeks, with the possibility of a jumbo cut depending on what Friday’s report shows.

- Companies hired just 99,000 workers last month, less than the downwardly revised 111,000 in July and below the consensus forecast for 140,000, according to payrolls processing firm ADP.

- The report corroborates multiple data points recently that show hiring has slowed considerably from its blistering pace following the Covid outbreak in early 2020.

- The ADP data showed that while hiring has decelerated significantly, only a few sectors reported actual job losses.

- 09/05/2024 – Trump Adopts Elon Musk’s Proposal for Government Efficiency Commission – WSJ Former president also reiterates calls for lower corporate tax rate and steep regulation cuts

Trump Says He Would Ban Mortgages for Undocumented Immigrants – WSJ The Republican nominee said it would help bring down home prices

Former President Donald Trump said he would ban undocumented immigrants from obtaining home mortgages, a move he indicated would help ease home prices even though these buyers account for a tiny fraction of U.S. home sales.

Home loans to undocumented people living in the U.S. are legal but they aren’t especially common. Between 5,000 and 6,000 mortgages of this kind were issued last year, according to estimates from researchers at the Urban Institute in Washington.

Overall, lenders issued more than 3.4 million mortgages to all home purchasers in 2023, federal government data show.

Trump, the Republican presidential nominee, made his comments on Thursday during a policy speech to the Economic Club of New York in Manhattan.

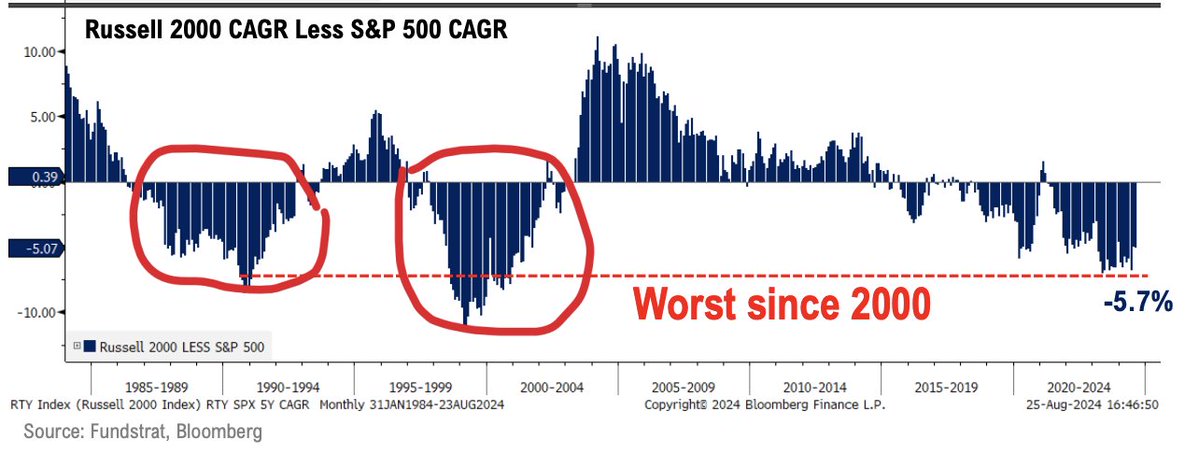

- 09/03/2024 – (1) Thomas (Tom) Lee (not drummer) FSInsight.com on X: “good stuff @SeanMFarrell 👀👀 👇 #tuesdaymusings” / X

The base case for the next 8 weeks is challenging for #stocks and #equities – but an opportunity will emerge to #buythedip This is what we are watching . Great speaking with @JoeSquawk @andrewrsorkin on @SquawkCNBC today.

“I think a 7-10% pullback can happen over the next 8 weeks, but it would be a situation to buy the dip” … “It’s a strong market… Don’t think we’ve seen the tops for 2024.”

- 09/03/2024 – Investors should be cautious for the next 8 weeks, says Fundstrat’s Tom Lee (youtube.com) – what are my action plans for this?

- the stock market could be volatile for the next 8 weeks

- correction of -7% or -10% is not surprising. get ready to buy this deep

- market has been up 7% for the past 6 weeks, expect volatility

- it changes from inflation scare to growth scare, could be continue

- Fundstrat’s viewpoints