Study of NVDA

- Nvidia denied reports that it had received a subpoena from the Department of Justice over antitrust concerns.

- “We have inquired with the U.S. Department of Justice and have not been subpoenaed. Nonetheless, we are happy to answer any questions regulators may have about our business,” a representative told CNBC.

- Nvidia (NASDAQ:NVDA) and other companies have received a subpoena tied to the Dept. of Justice’s probe into the Jensen Huang-led company on concerns that it violated antitrust laws, Bloomberg reported.

- U.S. officials previously reached out to several Nvidia competitors, including AMD (AMD), Intel (INTC) and AI chip startups, to collect information about the complaints, the news outlet added. The officials are concerned that Nvidia is making it harder to switch to competitors, the news outlet added, citing people familiar with the matter.

- Nvidia owns approximately 80% of the artificial intelligence accelerator market

- Nvidia told Seeking Alpha last month that it competes “based on decades of investment and innovation, scrupulously adhering to all laws, making NVIDIA openly available in every cloud and on-prem for every enterprise, and ensuring that customers can choose whatever solution is best for them.”

- Nvidia added that it would continue to support aspiring innovators in every industry and market and would provide any information regulators need.

- 09/01/2024 – Nvidia Set To Reach $10 Trillion Valuation As Blackwell Expected To Propel Chip Maker With ‘Fireworks Again’ In 2025, Analyst Predicts (msn.com)

- 08/29/2024 – Nvidia Reports Strong Quarter Amid Investor Jitters Over AI Boom’s Staying Power – WSJ AI chip giant gives bullish outlook despite recent challenges, though stock slips on complications with company’s newest product

- 08/22/2024 – Nvidia’s Jensen Huang sells $14 million in stock almost daily—raising questions about his successor (msn.com)

Five years ago Nvidia CEO Jensen Huang was worth a respectable $3.73 billion. At the time of writing, his net worth has ballooned to a little over $92 billion—and even then it’s down from its high of $119 billion earlier this summer.

While Huang has worked on Nvidia for more than three decades, it has only been over the past 12 months or so that the chipmaker’s stock price has really begun to take off, and with that comes scrutiny.

Investors are largely thrilled with their bet on the Santa Clara, California, business, and the man Mark Zuckerberg dubbed the “Taylor Swift of tech.”

But Nvidia’s meteroric growth has led some experts to question whether the company’s corporate governance has matured as quickly.

They point to the fact that CEO Huang has been offloading approximately $14 million’s worth of shares on a near-daily basis for months this summer. He still retains more than a 3.5% stake in the business.

This, inevitably, raises questions about why Huang is selling instead of holding.

- 08/19/2024 – AMD Deal Shows AI Chip Business Isn’t Just About Chips – WSJ Acquisition of ZT Systems brings needed hardware expertise, while divestiture plans should spare margin hit

Advanced Micro Devices AMD 3.21%increase; green up pointing triangle is buying a server company but has no plans to get into the server business. In the booming market for artificial-intelligence systems, that actually makes sense.

The chip maker better known as AMD unveiled plans Monday to spend $4.9 billion to acquire ZT Systems, a privately held company that designs and manufactures servers and other types of data-center hardware. It will be AMD’s second-largest deal ever following the $35 billion takeover of programmable chip designer Xilinx announced in 2020.

That deal brought AMD a business generating more than $3.6 billion a year in revenue. ZT Systems had revenue of more than $10 billion over the past 12 months. But AMD won’t be keeping most of it; the company said Monday that it plans to seek a buyer for ZT’s manufacturing business once the deal closes. AMD instead will be getting about 1,000 “world-class design engineers with deep expertise in motherboard, power, thermal, networking and rack design,” Chief Executive Officer Lisa Su said on a conference call Monday morning.

It is a $5 billion acqui-hire, in other words—and one that Wall Street tentatively approves of. AMD’s stock was 2.5% higher Monday afternoon even as many other chip stocks slipped into the red.

- 08/09/2024 – TSMC’s sales surged 45% due to AI chip demand (msn.com) – AI demand is still very string

The company behind a majority of the world’s advanced chips is seeing its sales surge amid the artificial intelligence boom.

Taiwan Semiconductor Manufacturing Company (TSMC) reported revenue of NT$256.95 billion, or $7.9 billion, for July, up 23.6% from June, and up 44.7% from the previous year. In June, TSMC reported its net revenue in May grew 30% year-over-year to $7.1 billion. Sales from January through July amounted to NT$1,523.11 billion — up 30.5% from the same period last year.

TSMC chief executive C.C. Wei said on a call with analysts AI is “so hot” right now, and that all of its customers are integrating AI into products and devices. Wei said he expects chip production to catch up to demand by 2025 or 2026. In June, Wei reaffirmed previous projections that the chip market, excluding the memory sector, would experience 10% growth this year driven by AI demand.

- 08/03/2024 – Nvidia Reportedly Delays Next-Generation Blackwell AI Chip Due To Design Flaw (msn.com)

Nvidia reportedly is delaying its next-generation artificial intelligence chips by at least three months. Mass shipments may not take place until early 2025.

Nvidia told Microsoft and another key cloud customer that its Blackwell B200 AI chips will be delayed due to a design flaw found late in the production process, The Information reported Saturday, citing a Microsoft employee and other source.

- 07/17/2024 – TSMC, Nvidia, ASML shares fall amid US export restrictions and Trump’s Taiwan comments (msn.com)

The global semiconductor market is experiencing significant turbulence, with major players like ASML, Nvidia, and TSMC seeing substantial declines in their stock prices.

The downturn is fueled by reports of tighter U.S. export restrictions and escalating geopolitical tensions, particularly comments from former U.S. President Donald Trump.

The Biden administration is reportedly considering a significant crackdown on companies exporting critical chipmaking equipment to China, according to Bloomberg.

This potential policy shift aims to curb China’s technological advancements by leveraging the foreign direct product rule (FDPR), which allows the U.S. to control foreign-made products that incorporate American technology.

The ramifications of this rule are far-reaching, impacting non-U.S. companies and exacerbating market anxieties.

ASML, a key supplier of advanced chip manufacturing equipment, saw its Netherlands-listed shares drop by 6.5% in morning trading.

This decline occurred despite the company reporting better-than-expected earnings for the second quarter.

Notably, 49% of ASML’s sales during this period were in China, underscoring the potential risks associated with stricter U.S. export controls.

Trump’s comments add to geopolitical tensions

Further complicating the situation, former U.S. President Donald Trump made controversial remarks regarding Taiwan and its semiconductor industry.

In an interview with Bloomberg Businessweek, Trump suggested that Taiwan should compensate the U.S. for its defense, claiming that Taiwan had taken “about 100%” of America’s semiconductor business.

These statements have cast doubt on the U.S.’s commitment to defending Taiwan, especially if Trump were to return to the presidency.

Taiwan, home to TSMC, the world’s largest and most advanced contract chipmaker, plays a crucial role in the global semiconductor supply chain.

Following Trump’s comments, TSMC’s Taiwan-listed shares fell by 2.4% on Wednesday.

The geopolitical uncertainty introduced by these remarks is causing significant unease in the market, particularly regarding the stability of U.S.-Taiwan relations.

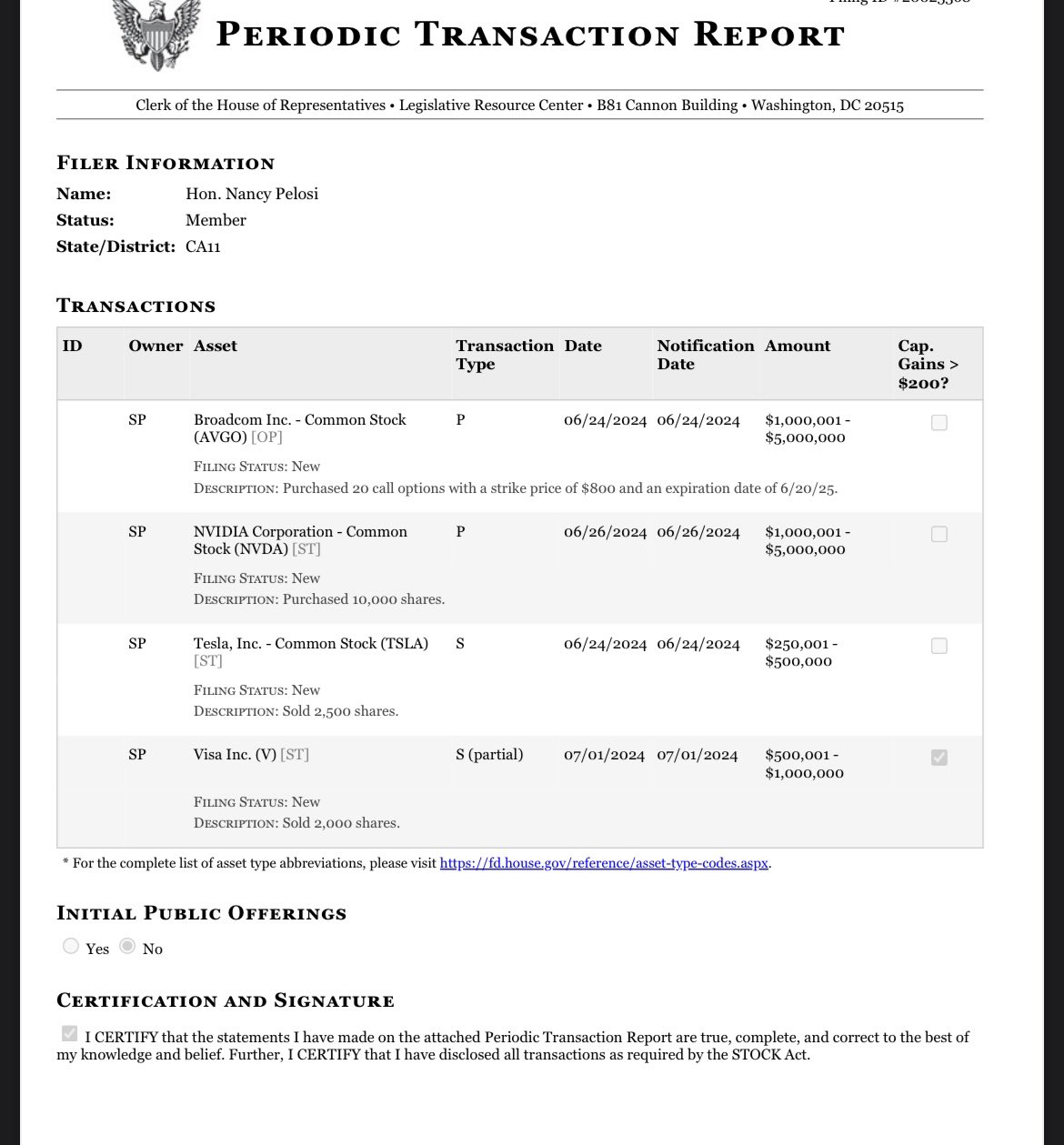

- 07/03/2024 – (1) Stocktwits on X: “BREAKING 🚨 Nancy Pelosi just bought 10,000 shares of $NVDA and $AVGO calls She also sold shares of $TSLA and $V The greatest trader is at it again! https://t.co/lPZeGbUQaa” / X She sold Tsla on 06/24, before vote on Elon’s pay package

Nvidia briefly eclipsed Microsoft and Apple this month to become the world’s most valuable company in a remarkable rally that has fueled much of this year’s gains in the S&P 500 index. At more than $3 trillion, Huang’s company was at one point worth more than entire economies and stock markets, only to suffer a record loss in market value as investors locked in profits.

Yet as long as Nvidia chips continue to be the benchmark for AI training, there’s little reason to believe the longer-term outlook is cloudy and here the fundamentals continue to look robust.

One of Nvidia’s key advantages is a sticky AI ecosystem known as CUDA, short for Compute Unified Device Architecture. Much like how everyday consumers are loath to switch from their Apple iOS device to a Samsung phone using Google Android, an entire cohort of developers have been working with CUDA for years and feel so comfortable there is little reason to consider using another software platform. Much like the hardware, CUDA effectively has become a standard of its own.

- 06/27/2024 – Nvidia’s Market Cap Plummets $500 Billion as CEO Jensen Huang Fails to Reassure Skittish Investors | Watch (msn.com)

Nvidia’s market cap dropped around $500 billion since it became the world’s most valuable company. Skittish investors were awaiting comments at its annual meeting that might reverse the trend. CEO Jensen Huang discussed Nvidia’s success but didn’t offer new information on how it will compete with rivals or details on its next-gen AI chip, Blackwell. Huang failed to provide a timeline for when Blackwell will be available, though he said it will be Nvidia’s most successful product. The stock stayed down more than 2% after the meeting.

Hotz is right about identifying one of Nvidia’s biggest advantages: It’s not Nvidia’s hardware, it’s its software. Cuda, the middleware layer that is used to implement A.I. applications on Nvidia’s chips, is not only effective, it is hugely popular and well-supported. An estimated 3 million developers use Cuda. That makes Nvidia’s chips, despite their expense, extremely sticky. Where many rivals have gone wrong is in trying to attack Nvidia on silicon alone, without investing in building a software architecture and developer ecosystem that could rival Cuda. Hotz is going after Cuda.

But there is more to Nvidia’s market dominance than just powerful silicon and Cuda. There’s also the way it can link GPUs together inside data centers. One of Huang’s greatest acquisitions was Israeli networking company Mellanox, which Nvidia bought for $6.9 billion in 2019. Mellanox has given Nvidia a serious leg up on competitors like AMD. Michael Kagan, Nvidia’s chief technology officer, who had also been CTO at Mellanox before the acquisition, recently told me that one of the ways Nvidia had wrung more efficiency out of its data center GPUs was to move some of the computing into the network equipment itself. (He likened it to a pizza shop that, in order to get more efficient, equipped its delivery drivers with portable ovens so the pizza would finish cooking as the delivery driver drove it to a customer’s house.) And Nvidia isn’t sitting still when it comes to networking either. At Computex, the company announced a new ethernet network called Spectrum X that it says can deliver 1.7 times better performance and energy efficiency for generative A.I. workloads.

Improvements like this will make Nvidia very hard to catch. Of course, Nvidia isn’t perfect. And we’ll have more on one area of the generative A.I. race where it may have stumbled in the Brainfood section below.