Study of Macro and Inflation (Part II)

Schedule of Releases for the Consumer Price Index (bls.gov)

Schedule of Releases for the Consumer Price Index

| Reference Month | Release Date | Release Time |

|---|---|---|

| October 2023 | Nov. 14, 2023 | 08:30 AM |

| November 2023 | Dec. 12, 2023 | 08:30 AM |

| December 2023 | Jan. 11, 2024 | 08:30 AM |

| January 2024 | Feb. 13, 2024 | 08:30 AM |

| February 2024 | Mar. 12, 2024 | 08:30 AM |

| March 2024 | Apr. 10, 2024 | 08:30 AM |

| April 2024 | May 15, 2024 | 08:30 AM |

| May 2024 | Jun. 12, 2024 | 08:30 AM |

| June 2024 | Jul. 11, 2024 | 08:30 AM |

| July 2024 | Aug. 14, 2024 | 08:30 AM |

| August 2024 | Sep. 11, 2024 | 08:30 AM |

| September 2024 | Oct. 10, 2024 | 08:30 AM |

| October 2024 | Nov. 13, 2024 | 08:30 AM |

| November 2024 | Dec. 11, 2024 | 08:30 AM |

Release Schedule | U.S. Bureau of Economic Analysis (BEA)

| Personal Income and Outlays, July 2024 | August 30 | 08:30 AM |

| Personal Income and Outlays, August 2024 | September 27 | 08:30 AM |

| Personal Income and Outlays, September 2024 | October 31 | 08:30 AM |

| Personal Income and Outlays, October 2024 | November 27 | 10:00 AM |

| Personal Income and Outlays, November 2024 | December 20 | 08:30 AM |

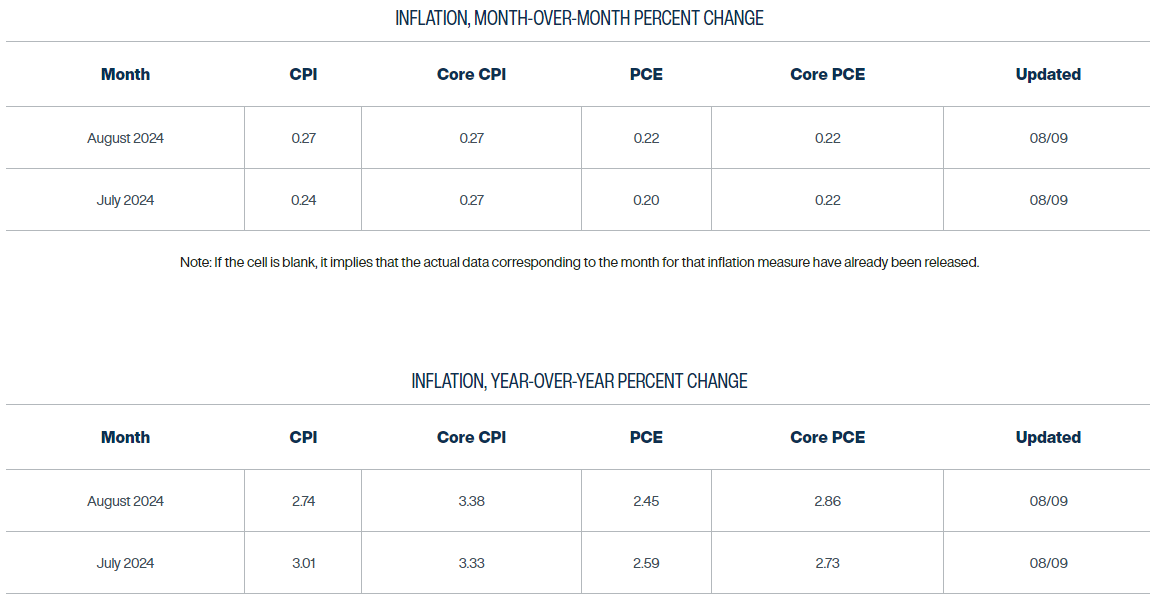

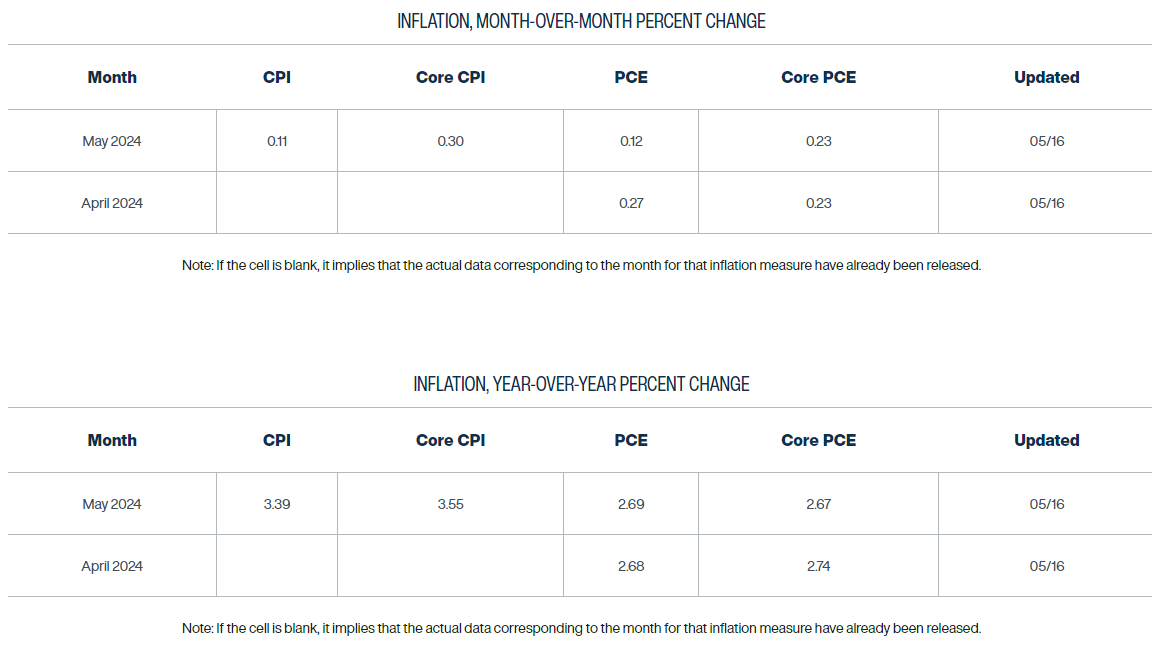

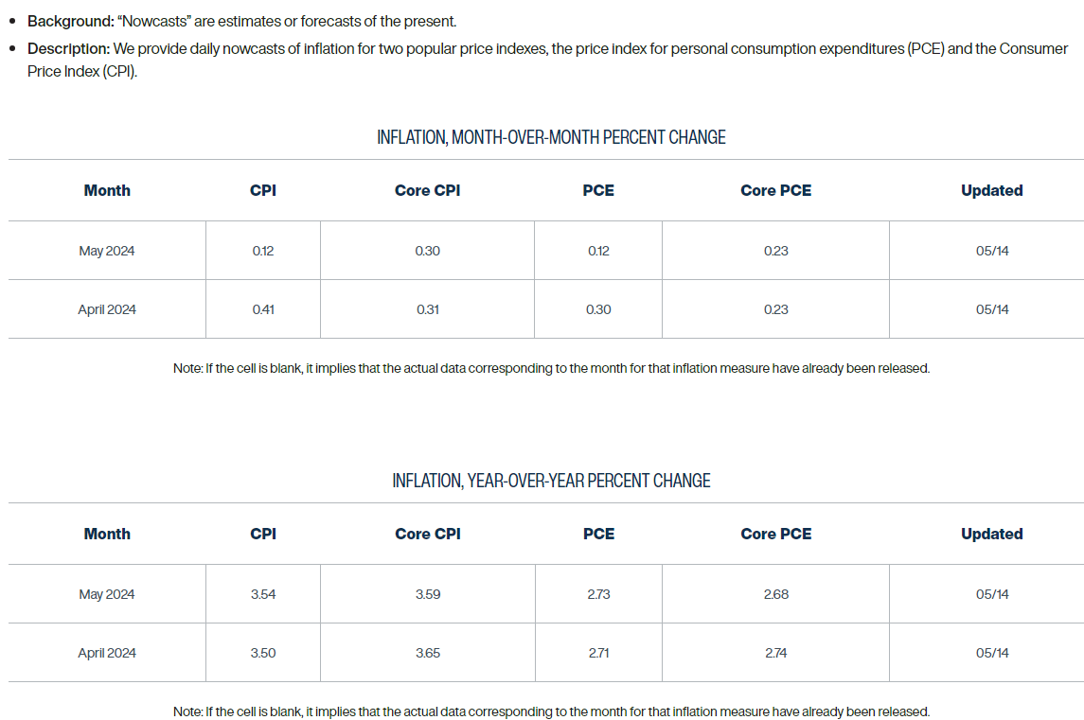

Inflation Nowcasting (clevelandfed.org)

important web sites on inflation data

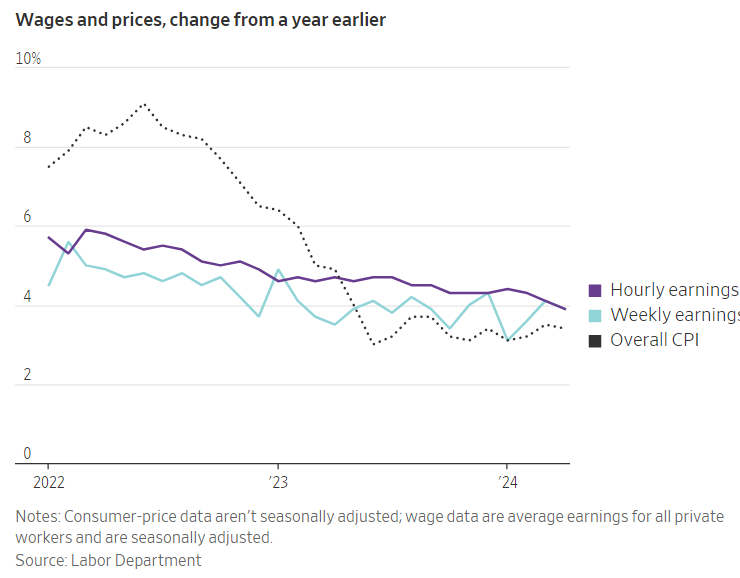

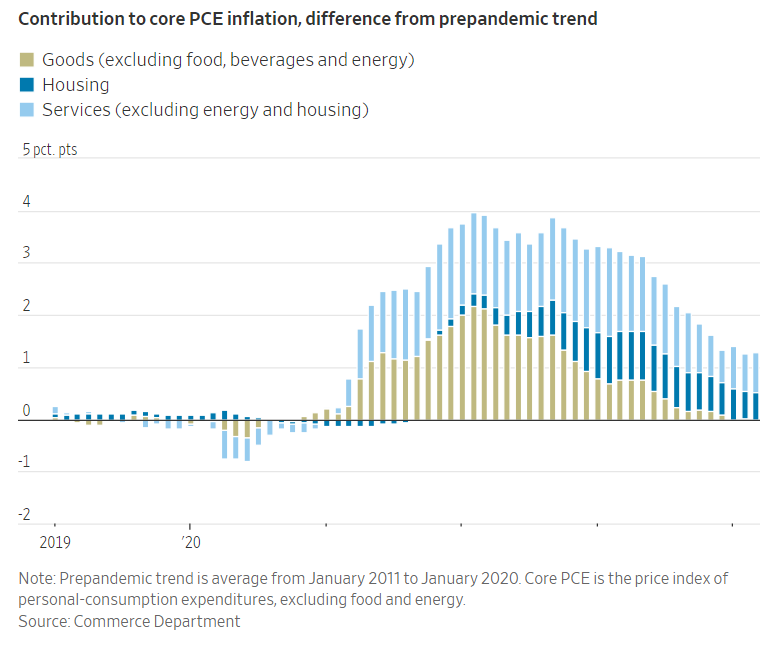

- Tilson’s viewpoint – Looking forward, as I’ve written many times, I continue to believe that a strong economy will keep overall inflation between 3% and 4%. This would keep the Fed on the sidelines, neither raising nor cutting rates. That means stock prices will be driven primarily by corporate earnings, which I expect will remain robust – hence, my constructive outlook for the markets.

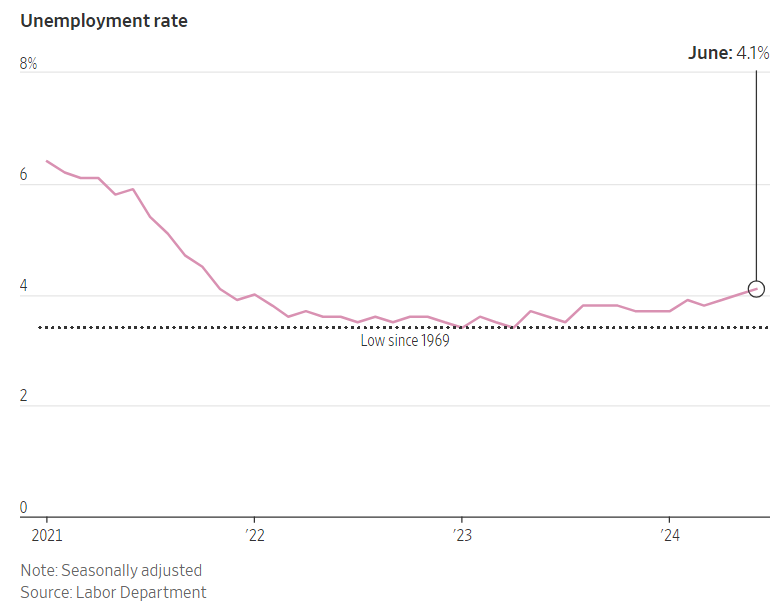

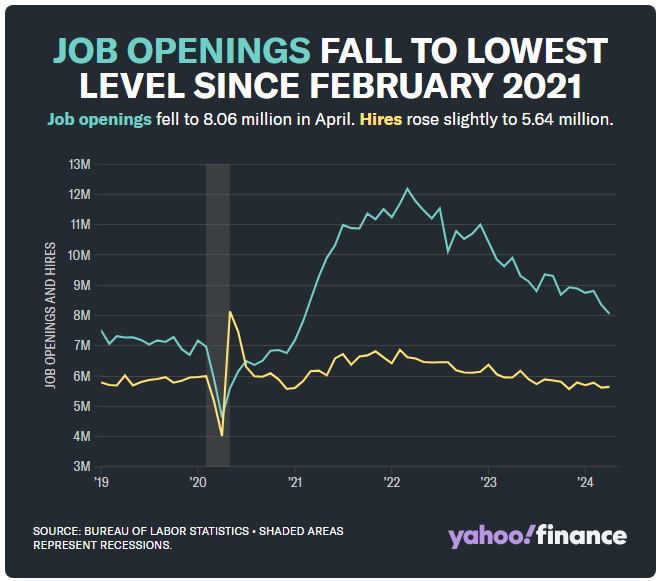

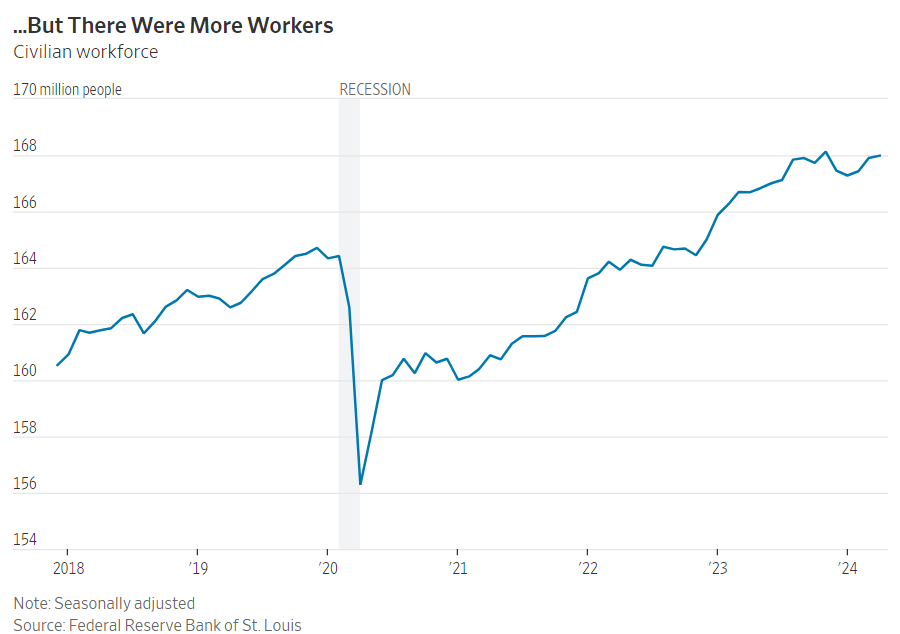

Unemployment, now at 3.9%, has held below 4% for more than two years, the longest such stretch in more than half a century. Unfilled job openings have declined significantly from a peak in early 2022, but remain well above prepandemic levels.

“All the hand-wringing about a slowdown in the labor market has been premature,” says Lara Rhame, chief U.S. economist at FS Investments. “People have a tendency to mistake normalization for weakness, when in fact the labor market remains quite strong.”

Time isn’t on the Fed’s side this year, however. Rate cuts at the Federal Open Market Committee’s June and July meetings are widely thought to be off the table, given the lack of progress on inflation so far in 2024. The September meeting will be “live,” meaning a decision could be made in the moment, but again, the data aren’t likely to cooperate, due to the economy’s enduring strength and technical factors.

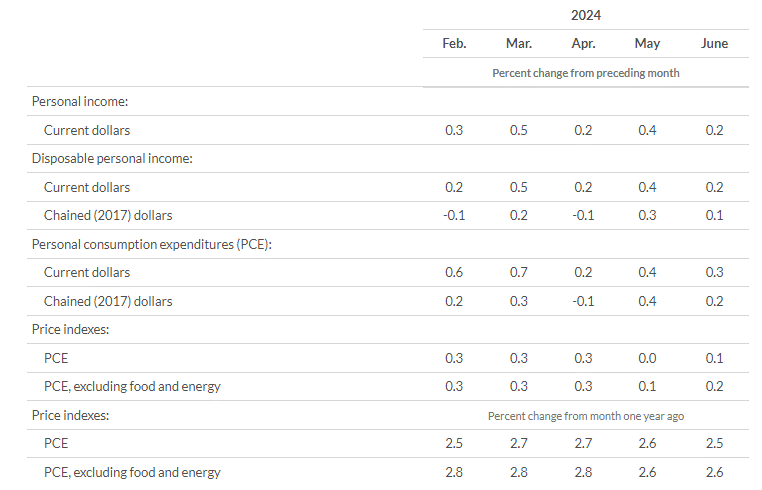

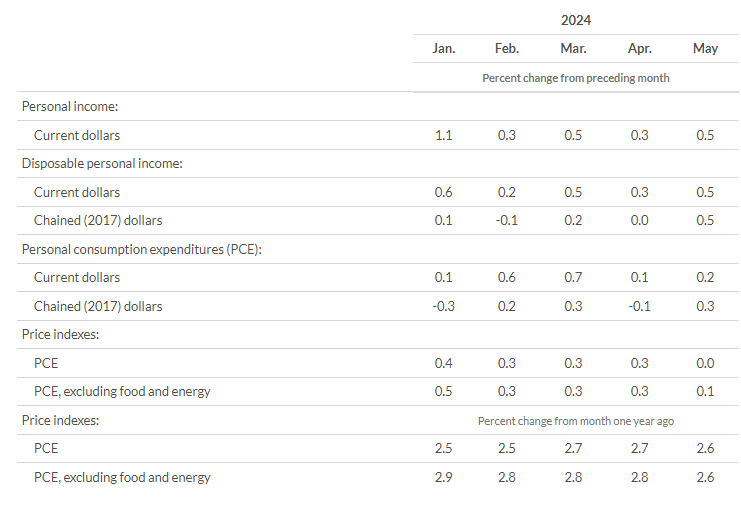

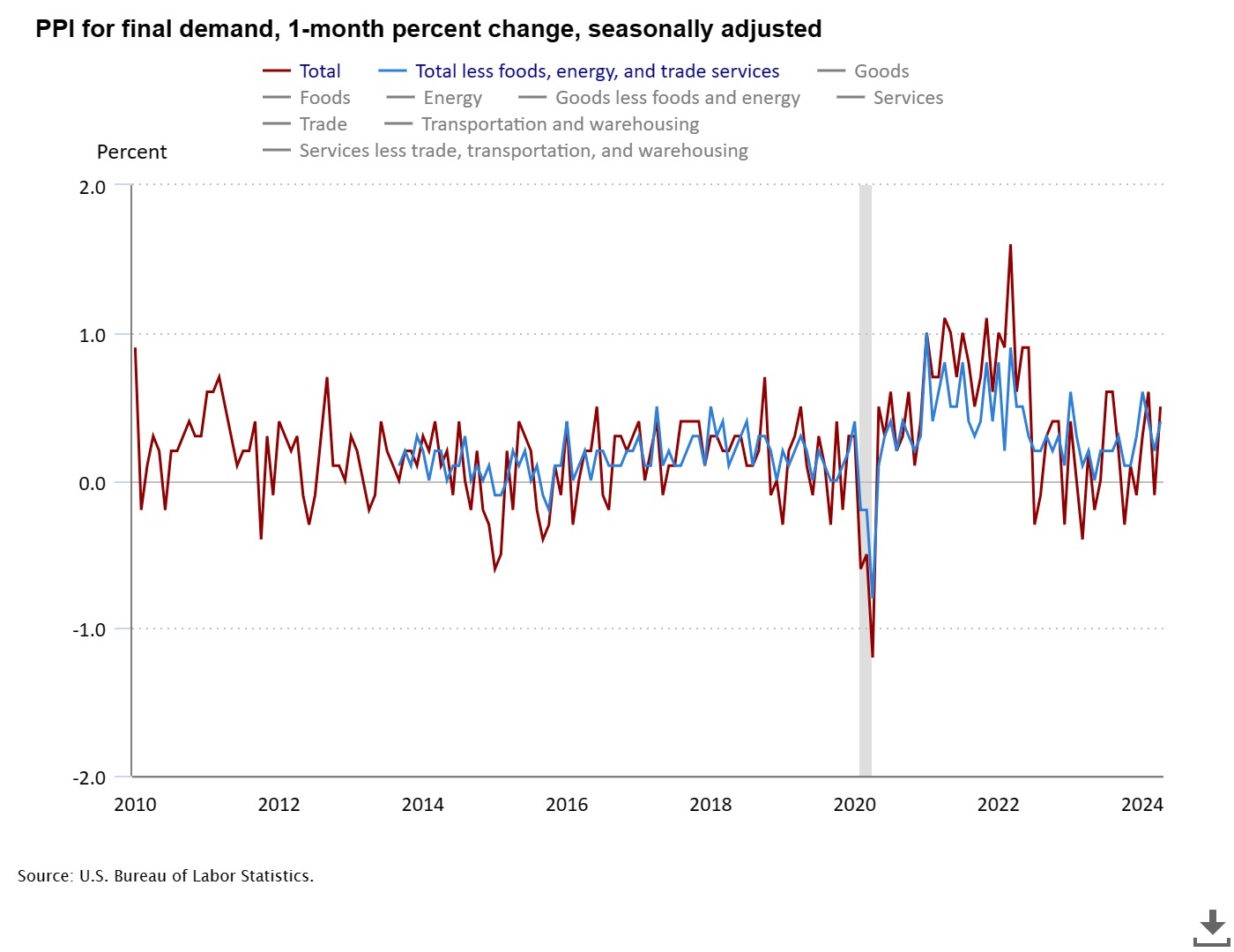

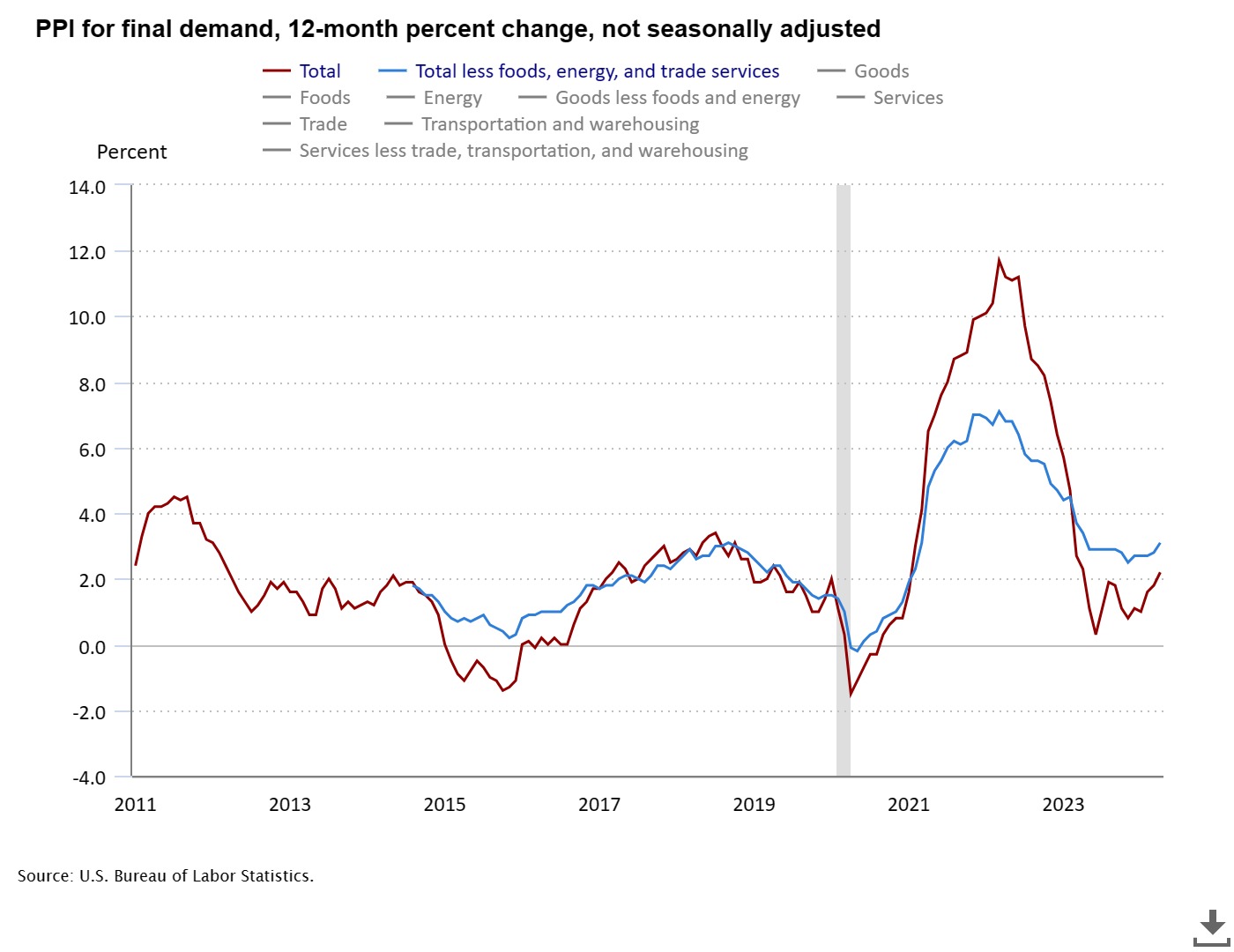

Base effects are one example. The PCE price index rose by 0.1% in May 2023, 0.2% in June of last year, and 0.1% in July. If inflation increases at a faster pace during the same months this year, the inflation rate will rise year over year, making it difficult for Fed officials to gain the confidence they desire that inflation is cooling toward 2%. The PCI price index hasn’t risen by less than 0.3% a month so far in 2024.

What about the November meeting? It will begin on Nov. 6, the day after Election Day, and unless the data scream for a change in interest rates, FOMC members probably won’t want to make waves, given the timing.

That leaves December as the last opportunity for a rate cut in 2024, but there are strong arguments for the status quo to hold.

For one, tighter monetary policy has been offset in the past two years by looser fiscal policy, and there is little reason to expect diminished federal largess in an election year—or in 2025, either. “Nothing is so permanent as a temporary government program,” as economist Milton Friedman famously said.

The U.S. federal budget deficit is on track to hit $1.5 trillion in the current fiscal year that ends on Sept. 30, equivalent to about 6% of U.S. GDP. That’s a powerful boost to growth that will continue to flow into the economy through the end of the year.

Monetary policy, meanwhile, might have a less powerful impact on the real economy than in past interest-rate cycles, partly because of the legacy of ultralow rates that prevailed from 2009 to 2022. As a result of that period, millions of homeowners are sitting with 30-year mortgages fixed at rates below 4%. Corporations likewise took the opportunity to refinance at historically low rates and extended their borrowings, while many of the largest U.S. companies are net interest earners.

Still, monthly data on jobs, inflation, and economic activity will move the market in the months ahead, and could inject more volatility. Election uncertainty will become more front of mind as November approaches and could be another source of turbulence. But absent a data shock that materially changes the Fed’s calculus, the stock market probably will sail through the noise.

“Nominal growth is still really good,” Rhame says. “And if you have the growth, you don’t need rate cuts for markets to continue to move higher.”

Economists immediately predicted the BoC would cut again in July.

The European Central Bank is most likely to follow suit on Thursday, financial markets foresee.

Cooling US jobs market looms over central bankers at Jackson Hole (ft.com)

- NVDA maintain the AI growth of general market

- the median PE of IWM is still 10.7, will below the SP500’s 17

- lots of cash is still outside of stock market, will rotate in sometimes

- Fed’s September’s action on rate cut will fuel the IWM

Rotation into small-caps, industrials and financials post-NVDA results is a sign of market strength. Still “summer of small-caps” Overall, we see the resilience in equities as sign of market strength — to state the obvious, when largest stock declines but the overall market gains, this is not a weak market. Get the FIRST WORD from

Tom Lee only at FS Insight!

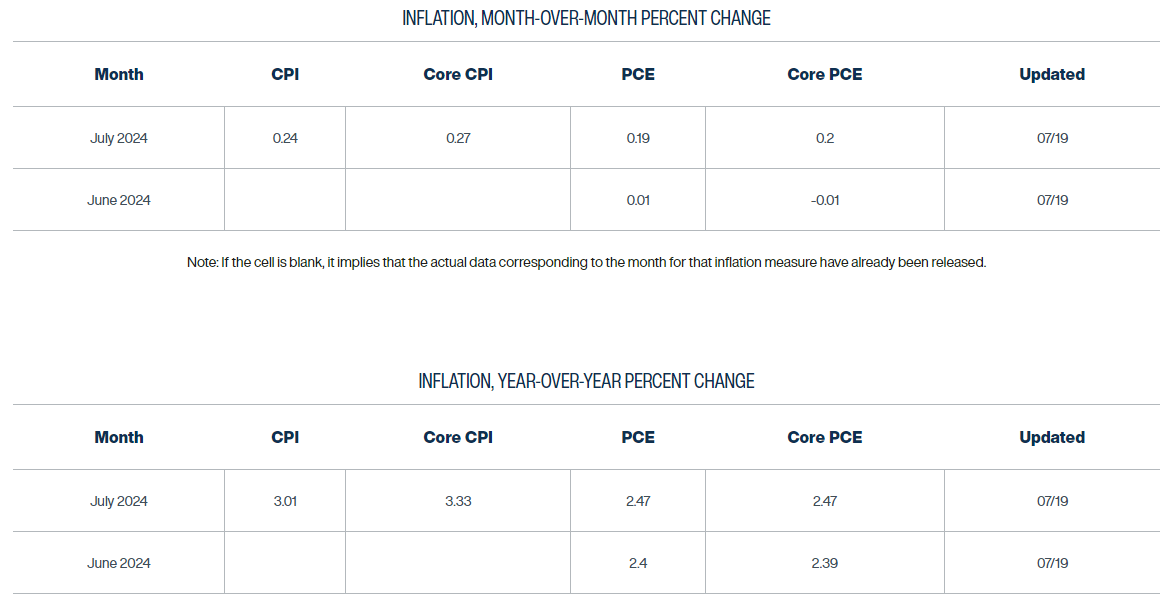

- The Commerce Department at 8:30 a.m. ET Friday will release its personal consumption expenditures price index.

- For the July reading, the Dow Jones consensus sees little change in recent trends — 0.2% monthly increases in both headline and core prices, and respective gains of 2.5% and 2.7% annually.

- The report could influence the September rate decision even as policymakers appear to have their focus elsewhere these days.

- 08/21/2024 – ‘Several’ Fed Officials Saw Case for Cutting Rates in July, Minutes Show – WSJ Some policymakers saw ‘a plausible case’ for cutting rates by 0.25 percentage point at the July 30-31 meeting

Some Federal Reserve officials saw a case for reducing interest rates at their most-recent policy meeting but ultimately favored holding off for more evidence of slowing inflation, according to minutes released Wednesday.

They may be wishing now that they hadn’t waited.

The minutes showed that “several” of the 19 Fed officials saw “a plausible case” for cutting rates by 0.25 percentage point at the July 30-31 meeting or indicated “that they could have supported such a decision.” Their position was based on declines in inflation and a rise in the unemployment rate that were already showing up in economic data.

Since the meeting, there has been even more evidence of cooling inflation and a weakening labor market. The most recent cause for concern: Data revisions by the Labor Department on Wednesday showed that employers might have added 818,000 fewer jobs in the 12 months through March than previously believed.

The benchmark federal-funds rate is currently set in a range between 5.25% and 5.5% following a series of aggressive increases by the Fed in recent years. That is widely believed to be a drag on economic growth, but one that policymakers viewed as necessary to bring inflation down from 40-year highs in 2022.

Fed Chair Jerome Powell acknowledged in a press conference after the July meeting that some of his colleagues examined the case for reducing interest rates that day. But he said they “overwhelmingly” preferred to wait until September.

- 08/21/2024 – Jobs Report Revision: U.S. Job Growth Weaker Than Initially Reported, Data Shows – WSJ Employers might have added 818,000 fewer jobs in the 12 months through March, the Labor Department says

The job market from early 2023 through early this year wasn’t as hot as it seemed at the time, the Labor Department suggested Wednesday.

Compared with the still-official numbers, employers might have added 818,000 fewer jobs in the 12 months through March, the department said. That means the economy could have added around 178,000 jobs per month over that period, as opposed to the current estimate of 246,000 jobs per month.

Wednesday’s report marked the first step of an annual process by which the Labor Department updates older payroll figures using data from state unemployment tax records that is more comprehensive, but less timely, than its monthly employer survey. It is only a preliminary estimate of a revision that will be made to the official numbers in February.

- 08/20/2024 – Kansas City Fed’s Jackson Hole Symposium Set for Aug. 22 To 24 – Federal Reserve Bank of Kansas City

The Federal Reserve Bank of Kansas City will convene its annual Economic Policy Symposium, Aug. 22-24 in Jackson Hole, Wyoming. The 2024 event, which marks the symposium’s 47th year, will focus on the theme “Reassessing the Effectiveness and Transmission of Monetary Policy.”

This year’s theme will explore lessons learned from the response of monetary policy to both the pandemic and the subsequent surge in inflation.

The full agenda will be available at kansascityfed.org on Thursday, Aug. 22 at 8 p.m. EDT/6 p.m. MDT. Federal Reserve Chair Jerome Powell’s remarks will be streamed on the Kansas City Fed’s YouTube channel, External Linkyoutube.com/kansascityfed on Friday, Aug. 23 at 10:00 a.m. EDT/8:00 a.m. MDT.

Papers and other materials will be posted on the Kansas City Fed’s website as they are presented during the event.

- 08/19/2024 – Exclusive: Fed’s Kashkari Says Weaker Job Market Should Open Door to September Cut (wsj.com)

Minneapolis Fed President Neel Kashkari signaled he would be open to lowering interest rates at the central bank’s next meeting because of a rising possibility that the labor market weakens too much.

“The balance of risks has shifted, so the debate about potentially cutting rates in September is an appropriate one to have,” Kashkari said in an interview.

In June, Kashkari had said he thought a rate cut might not be warranted until the end of the year. But the rise in the unemployment rate, to 4.3% in July from 3.7% at the start of the year, points to greater risks of an undesirable slowdown.

“If we were not seeing evidence that the labor market was weakening, if the unemployment rate was still in the 3.7% to 3.8% range, I don’t think I would be even debating, ‘Hey, is now the time to cut rates?’” said Kashkari. Instead, he said, the conversation has shifted because “inflation is making progress and the labor market is showing some concerning signs.”

- 08/16/2024 – Kamala Harris to Unveil Economic Agenda: Expanded Child Tax Credit, 3 Million New Homes – WSJ Democratic nominee to address thorny economic issue by calling for more construction, tax incentives

WASHINGTON—Vice President Kamala Harris will call for the construction of 3 million new housing units in her first four years in office and a substantial expansion of the child tax credit to support families with newborns, according to campaign officials.

The initiatives are part of Harris’s emerging economic plan, which she is expected to outline in a speech on Friday in Raleigh, N.C.

The vice president and Democratic nominee will propose restoring the expanded child tax credit of up to $3,600 a child, which was put in place in 2021 amid the Covid-19 pandemic and expired at the end of that year. She will also throw her support behind a new further expansion of the tax credit that would provide up to $6,000 in total relief for middle- and low-income families during the first year of a child’s life.

Both tax-credit proposals would require congressional approval, and could face opposition from Republicans. Some GOP lawmakers, including Sen. JD Vance, former President Donald Trump’s running mate, have also called for an expansion of the tax credit.

In addition to the housing proposals and the child tax credit, the address Friday will touch on alleged corporate price gouging and lowering costs for families, including the price of prescription drugs, aides said. Rising prices have become a point of debate between Harris and Trump, the Republican presidential nominee.

Harris’s campaign didn’t lay out the costs of her proposals or propose a plan for paying for them.

- 08/15/2024 – (1) Michael Burry Stock Tracker ♟ on X: “Burry shockingly sold out of all his Gold He is now heavily bullish on the consumer, strength of the dollar, China, and the US Job Market We think we have a good reason why he changed his mind on the US economy… 🧵 A thread worth reading below https://t.co/sryRQSmZYU” / X

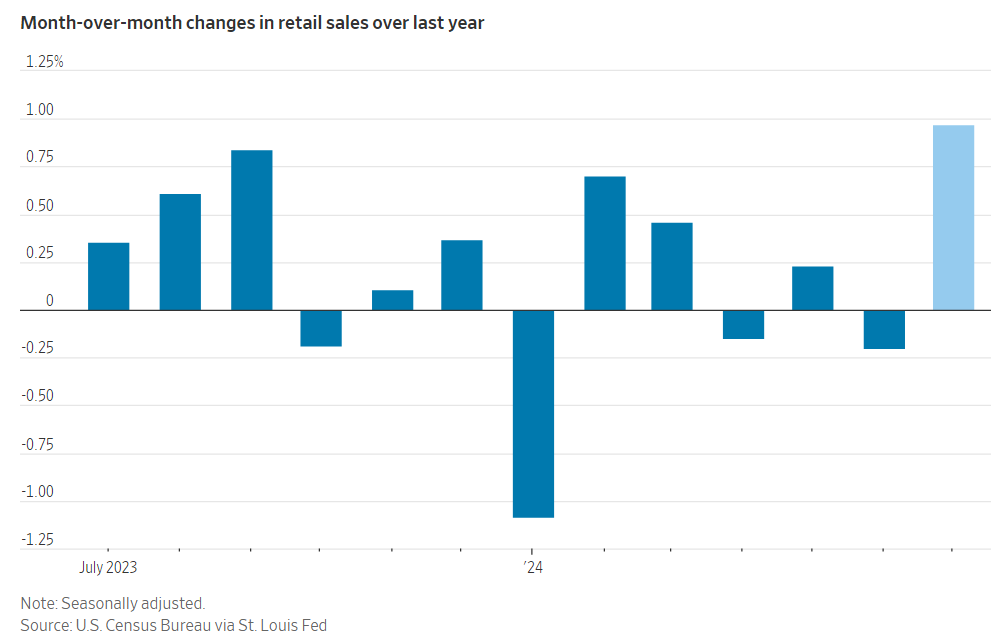

- 08/15/2024 – Retail Sales Jumped 1% in July on Higher Vehicle Spending (wsj.com)

American households boosted their retail spending last month, with strong vehicle sales helping to drive a higher-than-expected reading for last month.

Retail sales—a measure of spending at stores, online and in restaurants—rose a seasonally adjusted 1% in July from the month before, the Commerce Department said Thursday.

That was a strong pickup from June, when sales were revised down to a 0.2% decrease.

Economists surveyed by The Wall Street Journal had expected retail sales rose just 0.3% in July.

“The ongoing resilience of consumer spending should ease recession fears,” said economist Michael Pearce of Oxford Economics.

St. Louis Fed President Alberto Musalem becomes the latest Fed speaker to signal he can support a rate cut. Key points from his remarks on Thursday morning: • The U.S. labor market “is no longer overheated” • The labor markets “no longer pose a clear upside risk to inflation” • Recent data has bolstered my confidence that inflation will return to target • Absent new shocks, risks of inflation rising has declined, while risks to unemployment to increase • “The time may be nearing when an adjustment to policy may be appropriate”

Forecasters who translate the CPI and PPI into the PCE expect core prices rose 0.16% in July. This would hold the 12-month rate steady at 2.7%. The six-month annualized rate would fall to 2.7% from 3.4% in June. The three-month annualized rate would fall to 1.9% from 2.3%.

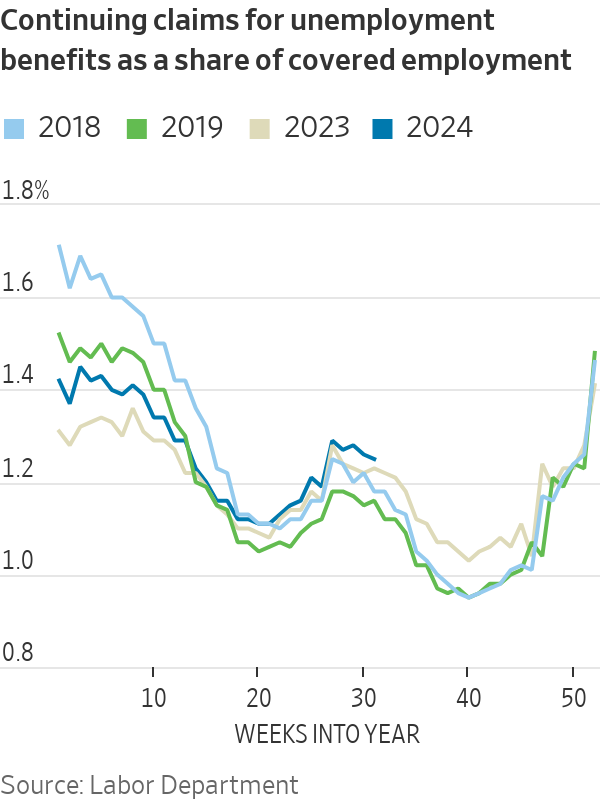

Filings for unemployment benefits decreased from the week prior, providing some relief for investor fears of a weakening U.S. labor market.

Initial jobless claims, a proxy for layoffs, reached 233,000 during the week that ended Aug. 3. That was down from the prior week’s revised 250,000, which was a recent high.

Analysts had expected 240,000 initial jobless claims for the most recent week.

U.S. stock indexes and Treasury yields rallied after the data, following muted moves beforehand. The three main indexes were well over 1% higher in early trading and the 10-year yield hit 4%.

Timestamps:

00:00 Intro

04:51 Welcome Tom Lee

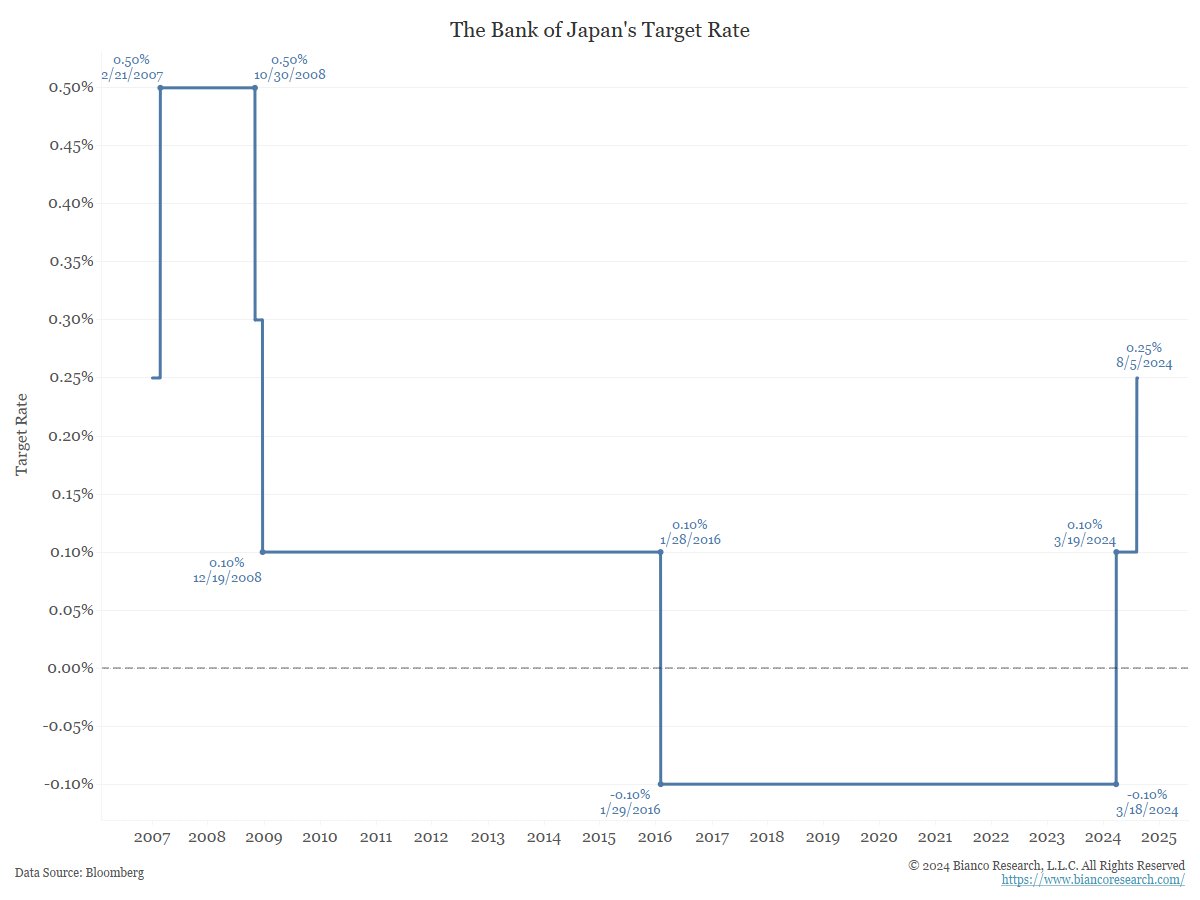

09:39 How Bad Was This Really? unemployment rate jumps, BOJ rate increases, carry trade

13:12 Is It Over? maybe, but it will not be surprised to see a couple of institutes fail due to this shook of volatility, need some time to settle

19:22 What Happens Next? watch sept unemployment report (for August)

22:22 Carry Trade – Risk maybe, but it will not be surprised to see a couple of institutes fail due to this large jump of volatility, need some time to settle

23:52 The Recession Case – oil shook, war shook, other shooks might push into recession

28:00 Comparing To The Past

31:35 Why Tom Was Right

36:05 Wall St Temp Check

40:42 $BTC And $ETH Price Predictions

43:14 Election Impact – Kamala good for high tech; Trump good for small business

- 08/06/2024 – Bank of Japan Walks Back Talk of Rate Increases After Roiling Markets – WSJ Nikkei surges as deputy governor says central bank won’t tighten when markets are unstable

TOKYO—A week after Japan’s top central banker shook up global markets with comments about raising interest rates, one of his deputies walked them back Wednesday and promised not to raise rates when markets are unstable.

The pledge by Bank of Japan Deputy Gov. Shinichi Uchida led to a sharp recovery in Tokyo stock prices and a fall in the yen. That moved markets closer to where they were before the July 31 news conference by Gov. Kazuo Ueda, in which he suggested he wanted to keep raising rates despite lackluster consumer spending in Japan.

In a speech to business leaders in northern Japan, Uchida said Japan wasn’t in the position of the U.S. and Europe several years ago, when surging inflation led central bankers to push rates up rapidly.

“Therefore, the bank will not raise its policy interest rate when financial and capital markets are unstable,” Uchida said.

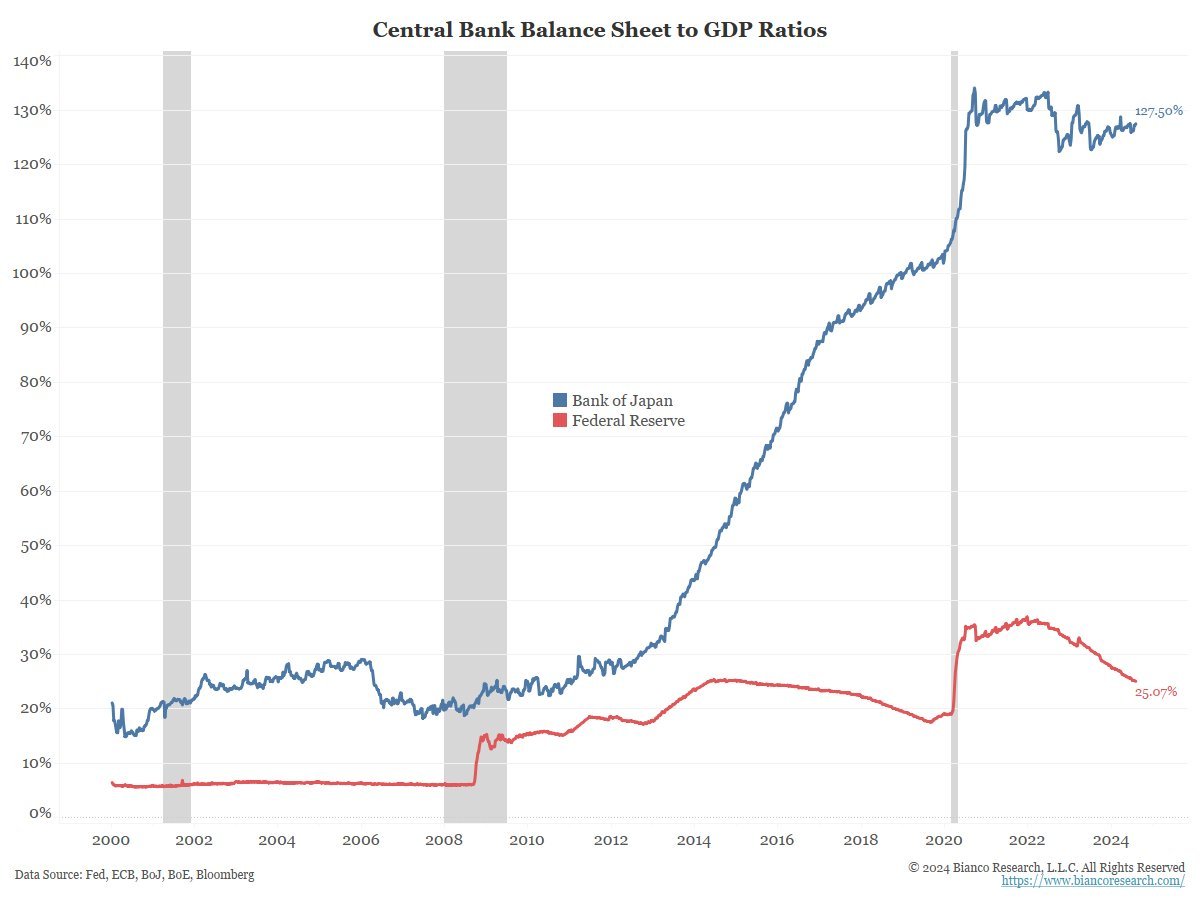

- The Fed’s expansionary monetary policy tools could be at risk due to the Bank of Japan’s catch-22 situation and the unraveling global macro carry trade.

- The BoJ intervention is impacting the yen’s value, potentially impacting US equity markets, and the carry trade unwinding.

- Potential implications for the Fed’s ability to support the market, volatility in US markets, and need for caution.

- Caution advised for S&P 500.

The most problematic outcome I see is if the BoJ sells U.S. debt to support the yen. This would certainly jolt the market because the higher U.S. treasury yields will hurt U.S. equities while forcibly closing out much of the remaining carry trade positions via a major spike in the yen (a possible short squeeze scenario).

The BoJ holds about $1.1 trillion of the $35 trillion total U.S. government debt. That probably won’t be absorbed so easily. If the Fed backstops the sudden selling pressure by creating base money dollars to buy the U.S. treasuries that BoJ is selling, then these dollars will very quickly end up in the hands of people selling yen to the BoJ (who would be using the dollars to buy yen). Would these people invest in U.S. assets? If they don’t then that would be more net selling pressure on the dollar, which could be inflationary for the U.S.

I think it could be possible that Japan may explore a form of capital controls if this still does not work. That could be another point of deglobalization, which is also inflationary.

Breaking The Fed Put?

The Fed put is a term used to describe the Fed being able to bail out the market with a liquidity injection. The Fed has always been able to create base dollars to lend to the U.S. government or to prop up asset prices.

The Japan fiasco could interrupt this because for the first time there may be an active large seller of U.S. treasuries which would be absorbing much of the base money creation. So, rather than the money going to the U.S. government to help with fiscal stimulus, you’ll have dollars being sold to prop up the yen. This weakens the dollar, is inflationary, causes higher U.S. yields, and hurts U.S. assets.

The Fed may find itself in a challenging dilemma of raising rates to fight off a resurgence in inflation or cutting rates to stimulate the economy and boost asset prices. And I’m not sure how effective cutting rates would be if inflation destroys real returns and absolutely wrecks the American consumer while the job market is weakening. For this reason, I think the Fed put may be on its last legs, even if in the future it could return.

Final Thoughts

If any of this transpires, we could see sizable volatility in the U.S. markets. The VIX has already been pushed up over 23, from around 12, which means that SPX options have on average doubled their implied volatilities. The market is in a major risk off environment right now.

I think it would be good to sit some of this out. Those who trade volatility need to be careful. On the one hand, volatility is at year-long highs and that is generally a good time to sell volatility. On the other hand, a lot of things could quickly happen to make the VIX climb much higher. If you are selling SPX or SPY options, position sizing matters. Smaller sizes are your friend in case volatility goes even higher from here. The more volatility climbs, the more marginally aggressive you can be.

We didn’t discuss many of the other things. AI stocks are seeming to get some lower multiples. Warren Buffett has slashed his stake of Apple (AAPL) and is raising cash. The tensions in the Middle East are getting worse. There’s a lot to dislike right now.

The long term view is that the S&P 500 remains a bet on the U.S. economy which is still the strongest in the world. These are very sound fundamentals. Don’t worry too much. Don’t sell in a panic. If you want, check out my hedging article for some ideas.

- 08/06/2024 – Fed Cut? Not Now, But Soon – ValuePlays

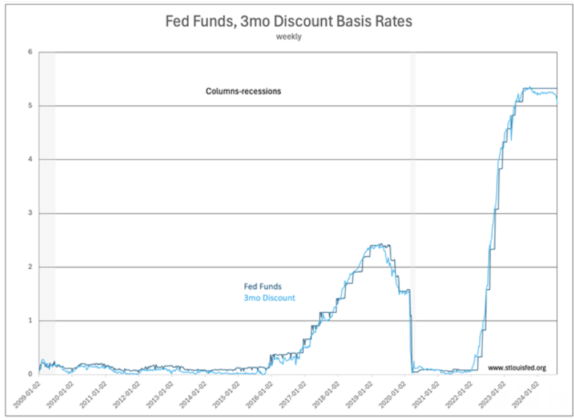

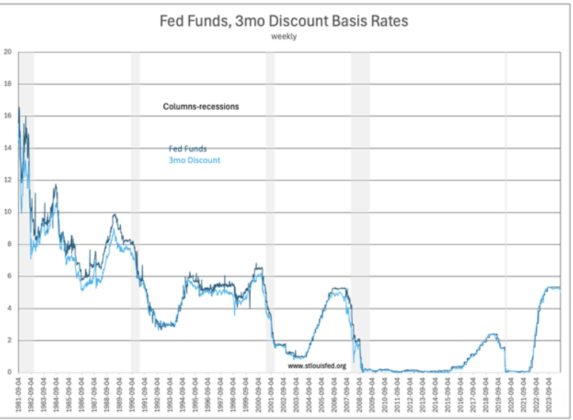

Remember, the Fed actually follows rates contrary to what most believe.

“Davidson” submits:

The relationship between the Fed Funds rate and market rates has long been misunderstood by my analysis. We have many decades of belief that the Fed adjusts the Fed Funds rate to maintain economic stability/activity. The data does not support this belief. Two charts weekly from Sept 1981(the longer picture) and from Sept 2009(the detailed picture) show the Fed’s history of rate shifts vs the 3mo Treasury rate quoted on a discount basis. Long-term, the Fed keeps Fed Funds above the 3 month Treasury rate. It is how the Fed adjusts Fed Funds in detail that reveals that the Fed follows the 3mos changes with a lag of several weeks. As the 3mos Treasury shifts, the Fed steps up or down Fed Funds clearly with a lag as can be seen in the detailed history.

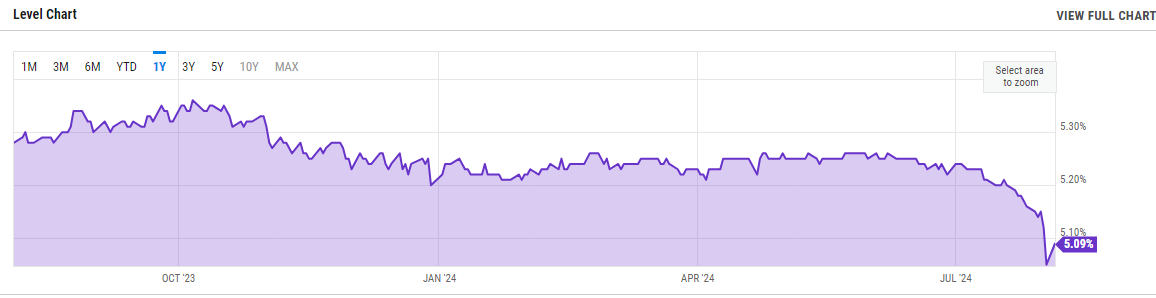

Currently with Fed Funds at 5.33% and the 3 month Treasury discounted rate at 5.05%, Fed Funds rate is a 0.27% premium or barely a single cut of 0.25% away. This is too close for the Fed to act In my experience. The 3 month Treasury needs to decline to 4.75% before the Fed will lower rates closer to 5% and still keep Fed Funds rate near the traditional premium it desires. My experience indicates that despite many who are panicked by the current market decline calling for a rate cut by the Fed, it will more likely act according to the level of the 3 month Treasury, a market determined rate.

If the 3 month Treasury declines to 4.75%, then expect the Fed to follow with lower Fed Funds rate, not before.

3 Month Treasury Bill Rate Market Daily Analysis: H.15 Selected Interest Rates | YCharts

- 08/06/2024 – Market Selloff Upends Fed Rate-Cut Calculus – WSJ A further slowdown in the labor market could lead to a larger half-point rate cut next month

- 08/06/2024 – (1) Herbert Ong on X: “🚨 NEWS: Institutional investors bought the dip, retail traders sold aggressively • Institutional investors bought $14 billion during market hours, significantly above average. • Retail investors sold aggressively, with a net selling imbalance of -$1 billion, well below their https://t.co/8YDqHrZH48” / X

NEWS: Institutional investors bought the dip, retail traders sold aggressively

- Institutional investors bought $14 billion during market hours, significantly above average.

- Retail investors sold aggressively, with a net selling imbalance of -$1 billion, well below their 12-month average.

- S&P ETFs saw strong demand with inflows exceeding their average by several standard deviations.

- Nasdaq 100 ETFs and fixed-income ETFs experienced significant outflows amid market turbulence.

- U.S. stocks, including Nasdaq and S&P 500, recorded substantial declines amid recession fears and economic data concerns.

JP Morgan says Institutions bought the dip while Retail panic-sold aggressively. Retail sold -$1 BILLION -2.5 standard deviations BELOW the 12m average Institutions bought +$14 billion +2.9 std dev ABOVE the 12m average

- 08/06/2024 – This Doesn’t Look Like Recession. Here’s How One Could Happen. – WSJ A recession isn’t an on-off switch. It’s a process, and there’s still time for the Fed to short-circuit that process

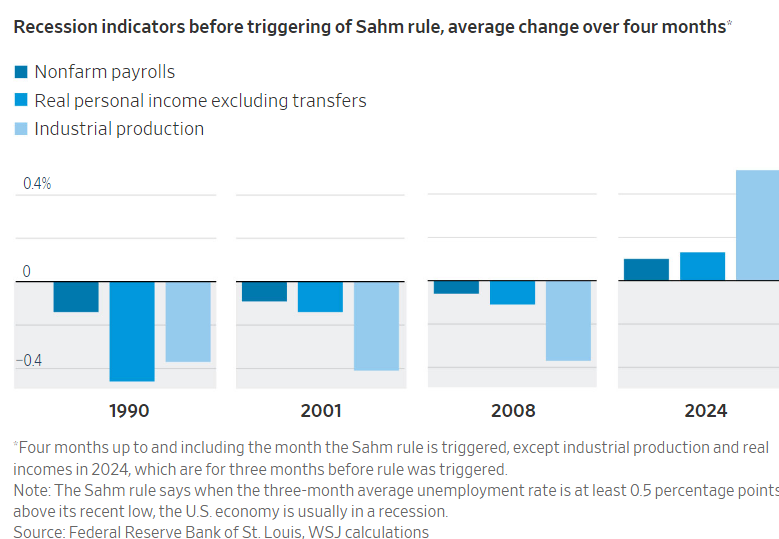

To decide if it’s raining, it’s better to stand outside than count umbrellas. Similarly, to determine whether recession has begun, better to look at the indicators the NBER uses than the Sahm rule. Three—payroll employment, industrial production and real (inflation-adjusted) incomes, minus government transfers—were all shrinking in the four months up to and including the month the Sahm rule was triggered, in 1990, 2001 and 2008. In all three, a recession had begun several months earlier.

In the four months through July, payrolls were growing, and in the three months through June, so were real incomes and industrial production. If a recession had already begun, it would be a very unusual one. (Sahm said last week she didn’t think a recession is imminent).

The reasons for a weaker market matter. Sometimes overleveraged market participants dump stocks for reasons having nothing to do with the economy. The Bank of Japan’s rate increase has caused a sharp rise in the yen, forcing a wave of selling by investors who had bet heavily on it staying low.

Whether such deleveraging leads to recession depends on whether the financial system also starts to crack, as it did in 2008. Of that, there’s so far little sign. Treasury bond yields were little changed Monday. They would fall sharply if panicked investors were flocking to safety.

It would be worrisome if stocks were forecasting weaker profits and sales ahead. Some prominent examples aside, such as McDonald’s, Intel and Delta Air Lines, companies aren’t saying that. Analysts reduced profit estimates last month by an average amount, according to FactSet.

1) The stock market had one of its most volatile days ever yesterday…

At one point yesterday, the CBOE Volatility Index (“VIX”) – which is often called the market’s “fear gauge” – nearly tripled (in a single day!) and closed a whopping 65% higher than Friday.

As this tongue-in-cheek post on X yesterday notes, the only comparable days were during the global financial crisis and the COVID-19 crash:

The S&P 500 Index fell as much as 4.3% yesterday and finished the day with a 3% loss.

2) A range of factors contributed to the chaos (as the late Charlie Munger explained, extreme occurrences – both good and bad – are rarely caused by one thing… rather, they are almost always the result of what he called “lollapalooza effects”)…

Last week’s economic report showed strong 2.8% GDP growth – up from 1.4% in the first quarter – but the U.S. economy added only 114,000 jobs in July. That was significantly below expectations, and the unemployment rate increased to 4.3%.

Additionally, the Global Manufacturing Purchasing Managers’ Index fell to 49.7 in July from 50.8 in June – indicating a contraction in global manufacturing activity for the first time in seven months.

All this raised investors’ concerns that the U.S. economy is slowing – raising fears of a hard landing instead of a soft one.

Meanwhile, the Bank of Japan’s decision last week to raise interest rates for only the second time in two decades (albeit to only 0.25%) surprised investors and triggered a frantic unwinding of a popular, leveraged “carry trade”…

A carry trade is when an investor borrows money from a country with low rates and a weak currency – such as Japan and the Japanese yen – and then invests that money in assets of another country with a higher rate of return – such as Mexico and the peso.

However, if the weak currency suddenly strengthens, as the yen has done in the past month, surging from 162 to the dollar to 145 today – a stunning move in a market usually measured in pennies – it can trigger huge dislocations.

This carry trade was a classic case of “picking up pennies in front of a steamroller” – a phrase describing investments in which there are small, steady profits… but also the risk of catastrophic losses. (For other examples of this – and how they often blow up – see my e-mails from June 4 and January 20, 2023.)

The major Japanese stock index, the Nikkei 225, plunged 12.4% yesterday, after falling 5.8% on Friday – its worst two-day performance in history. It’s down 25.8% from the all-time high it hit less than a month ago.

Now, you might be wondering why events in Japan are causing turmoil here. Bloomberg columnist Matt Levine explained it well in his column yesterday: The Good Trades Have Gone Bad. Excerpt:

Market crashes usually have the same mechanism. People like a thing, so they buy it, so it goes up. More people like it, so they buy more of it, so it goes up more. It goes up steadily enough that people think “ehh I should borrow some money to buy even more of this thing,” so they do. Eventually a lot of very leveraged investors own a lot of the thing.

Then something goes wrong with the thing, its price goes down, the leveraged investors get margin calls, and they have to sell the thing to pay back their loans. Their losses are big enough that they have to sell other things, things that were fine, to pay back their loans on the thing that went wrong.

The big leveraged investors who owned a lot of the thing that went wrong also all own the same other things, also with leverage, so there is a generalized crash in the prices of the things that big leveraged investors own.

I suspect that the “big leveraged investors” Levine refers to, who got caught with their pants down on the yen carry trade, are also long the tech- and AI-related stocks that have been driving the market… and hence we’re seeing spillover effects.

I’ll also note that the markets have been unusually tranquil, which breeds complacency and excess leverage.

In a post on X yesterday, Ben Carlson – who writes the popular financial blog “A Wealth of Common Sense” – shared this clever chart showing that a 2% daily move in the S&P 500, which used to be commonplace, had been rare:

3) My regular readers shouldn’t have been surprised by the weaker economic numbers…

In my e-mail exactly a week ago, I opened it by writing: “A number of data points over the past week have convinced me that the U.S. economy is slowing.”

In particular, I quoted two of my friends for more insight…

The first – an investor in many private companies across the country – told me that “the economy is rolling over. Our really good businesses are doing fine, but many of the others are in real trouble.”

The second friend runs a wholesale distribution business that serves thousands of customers that, in turn, directly serve millions of Americans all over the country every day.

As I explained in his case:

He told me that there’s definitely a slowdown – for example, he’s now seeing his customers’ businesses down 8% year over year in recent months, except for a few that are executing superbly and/or serving high-income customers…

Overall, my friend’s customers are “worried and scared.”

That said, I also mentioned that neither of these two friends were predicting a big recession… and nor was I.

As I concluded:

So my general message to investors is: If you own the stocks of quality companies or index funds and have a long-term (at least three years and ideally five or more) investment horizon, don’t do anything.

But if you’re overinvested in stocks – let’s say your portfolio is 90% stocks and it really should be 75% – or are hanging on to some stocks in which you have low conviction, it’s probably not a bad idea to trim a little bit.

4) So after the recent turmoil, has my advice changed?

In a word, no.

The economic fundamentals haven’t changed – and remain solid. Yes, the economy is slowing… but as I wrote a week ago, “keep in mind that this softness is coming after the economy was white-hot, which the Federal Reserve deliberately cooled by raising rates rapidly to bring down inflation.”

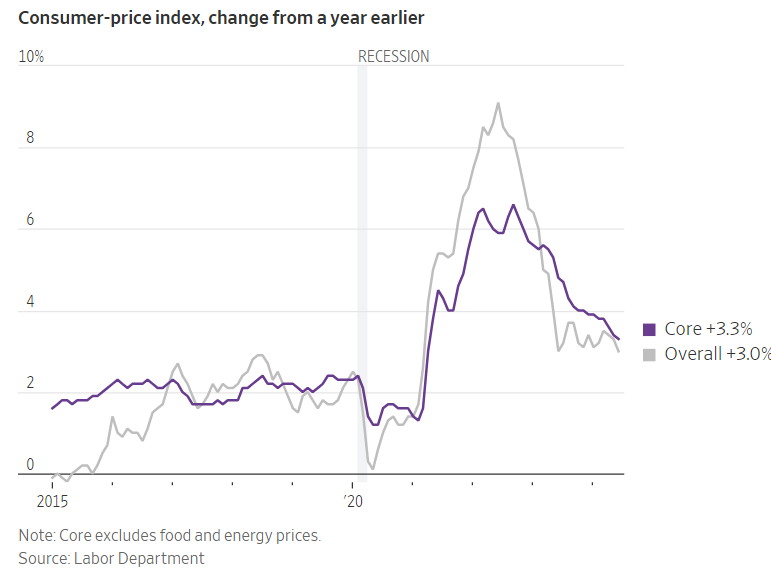

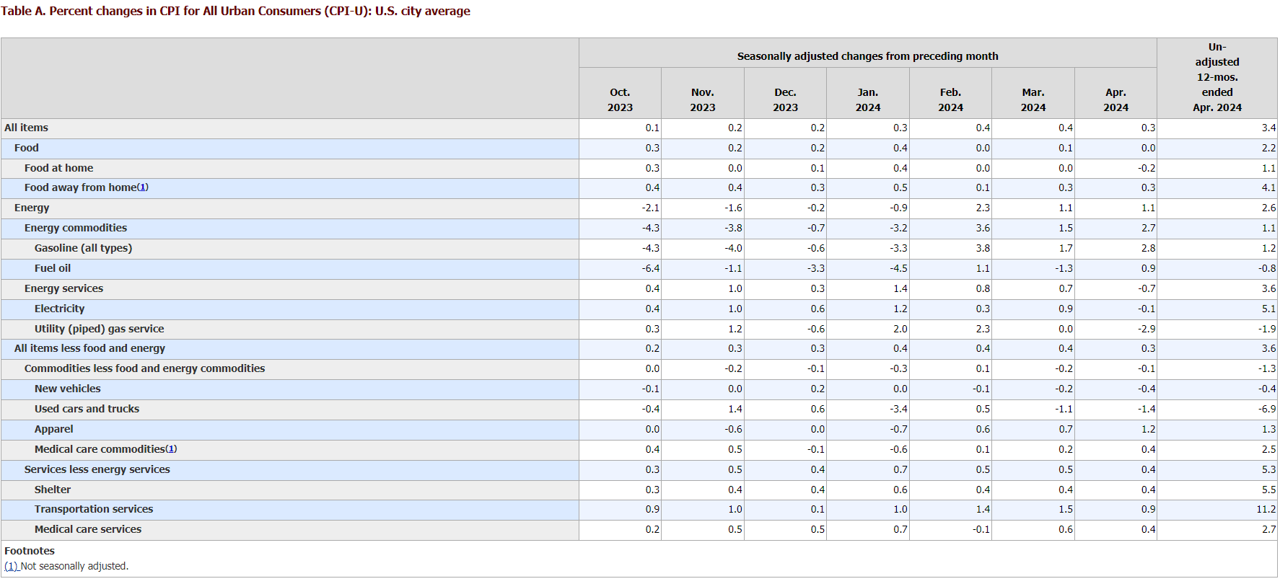

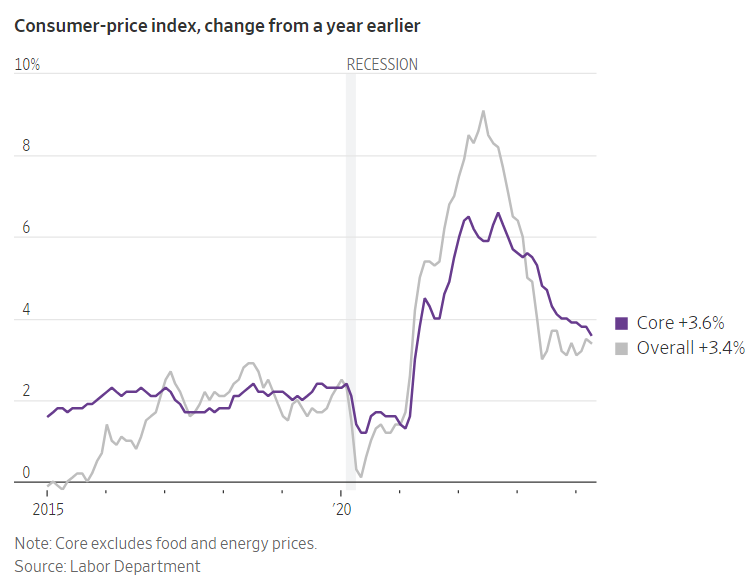

And inflation remains muted. In the July 11 report for June, month-over-month prices declined 0.1% – the first monthly decline since May 2020. And the core price index, which excludes volatile prices of food and energy, increased 3.3% year over year – the lowest yearly increase since April 2021.

The comparisons to the global financial crisis and the COVID crash are ridiculous. It’s more like 1987, as this Wall Street Journal article from yesterday notes: Is This 1987 All Over Again? What’s Driving the Market Meltdown? Excerpt:

The S&P made 36% in the eight months to its August 1987 peak, similar to the 33% it rose in the eight months to the end of June this year. As in 1987, this year’s gains came in spite of tight monetary policy and higher bond yields. Just like today, in 1987 investors were on edge and ready to sell to lock in the unexpected profit.

The losses are smaller so far, but lucrative trades have reversed, just as they did for the market as a whole in 1987.

Needless to say, anytime in 1987 – even on the eve of the infamous Black Monday crash on October 19, when the Dow Jones Industrial Average fell 22.6% – would have been a great time to invest.

The S&P rose 16.6% in 1988, another 31.7% in 1989, and has kept on chugging, as you can see in this chart of the value of $100 invested on January 1, 1987 (I’ve circled the Black Monday crash, which is barely detectible):![]()

What happened yesterday is simply a reminder that stocks can be volatile.

As the table below from a recent post on X from Creative Planning’s Charlie Bilello shows, this is the S&P 500’s 29th decline of 5% or more from its highs amid the massive overall run higher since March 2009:

I tend to agree with betting site Polymarket, which as of earlier this morning shows only a 15% chance of a recession this year and a 92% chance that the Fed will cut rates (a 50% chance for a cut of 0.5% and a 42% chance for a cut of 0.25%) at its September meeting (but only a 18% chance of an emergency rate cut this year).

In summary, I of course can’t say for sure what the market will do in the coming days and weeks. But I think it will soon recover, as it has done the past 28 times before this current dip… So tune out the short-term gyrations and keep focusing on the long run.

- 08/03/2024 – Lousy Jobs Report Forces Fed to Reckon With Hard Landing – WSJ Policymakers have been focused squarely on inflation. Now they need to worry about the labor market, too.

The script is being flipped for the U.S. economy.

For 2½ years, high inflation has drawn a nearly single-minded focus from the Federal Reserve and the White House as the nation’s foremost economic challenge.

But in the span of a week, punctuated by a surprisingly lackluster July hiring report on Friday that sent markets reeling, the labor market has become the locus of concern for economic policymakers in Washington.

Warren Buffett’s Berkshire Hathaway has been in selling mode.

The famed investor’s Omaha, Neb., company revealed Saturday that it sold nearly half its Apple AAPL 0.69%increase; green up pointing triangle shares in the second quarter, slashing its mammoth position in the iPhone maker after significant sales earlier in the year.

Berkshire sold a net $75.5 billion in stocks in the three months through June, helping boost its cash hoard to a record $276.94 billion, including cash equivalents, the company’s financial statements show.

The disclosures come after Berkshire in recent days methodically trimmed its investment in Bank of America, its second-largest stock position after Apple.

A number of congressional Democrats criticized the Federal Reserve following Friday’s soft jobs report, saying the central bank should have lowered interest rates this week.

“Fed Chair [Jerome] Powell made a serious mistake not cutting interest rates,” Sen. Elizabeth Warren said in a post on X, formerly Twitter. “The jobs data is flashing red. Powell needs to cancel his summer vacation and cut rates now—not wait 6 weeks.”

With inflation still above its 2% target, the Fed decided on Wednesday to keep overnight interest rates at their current level around 5.3%.

Powell strongly suggested in Wednesday’s press conference that the Fed would start lowering rates at its next meeting, scheduled for Sept. 17-18. He defended his decision to hold off on easing policy by arguing that the labor market appears to be in a process of “gradual normalization” rather than an abrupt slowdown.

The latest jobs report underscored questions about that view. Hiring slowed sharply in July and the unemployment rate rose to its highest level since 2021.

- 08/01/2024 – Dow tumbles nearly 500 points after fresh data ignite fears about slowing economy (msn.com)

Stocks kicked off August sharply lower after a round of economic data on Thursday spurred concerns the economy may be slowing faster than anticipated while the Federal Reserve maintains a restrictive monetary policy.

The Dow plunged more than 700 points, before paring losses to close at 40,347.97, down 494 points, or 1.2%. The S&P 500 lost 1.4%, and the Nasdaq slid 2.3%, or more than 400 points.

Equities initially opened higher, buoyed in part by gains in Meta Platforms after its quarterly results topped expectations and the Facebook parent issued an upbeat outlook for the third quarter. Its shares closed up 4.8% at $497.74.

Stocks turned lower, however, after data showed a measure of manufacturing activity from the Institute for Supply Management (ISM) dropped to an eight-month low in July at 46.8, signifying contraction.

“The ISM is really what started the ball rolling today and then selling causes more selling,” said Tim Ghriskey, senior portfolio strategist at Ingalls & Snyder in New York.

The small-cap Russell 2000 slumped 3%, its biggest daily percentage drop since Feb 13. Small caps have been among the first stocks to benefit as investors rotate out of more expensive stocks.

Nvidia slumped 6.7% in a broader chip stocks rout sparked by Arm Holdings’ conservative revenue forecast and Qualcomm flagging a revenue hit from the impact of trade curbs, dragging those stocks down 16% and 9.3%, respectively.

Federal Reserve chair Jerome Powell is navigating a minefield of political pressure from both Democrats and Republicans.

Democrats are pressuring Powell to cut interest rates, which he didn’t do at Wednesday’s Fed meeting. Meanwhile, Republicans don’t want Powell to do anything before the election. Yet, the central bank is expected to remain rigorously independent to ensure its decisions are made solely based on economic data and market conditions and not influenced by any political considerations.

- 08/01/2024 – Bank of England Cuts Interest Rates After Fed Held Off – WSJ U.K. central bank lowers key rate for the first time since 2020, a day after the Fed kept rates at a two-decade high

LONDON—The Bank of England cut its key interest rate for the first time in over four years, leaving the Federal Reserve among a dwindling number of central banks that have yet to cut borrowing costs in the face of cooling inflation.

The U.K. central bank lowered its benchmark lending rate by a quarter-percentage point to 5% Thursday. It had kept rates at their highest levels since 2008 for the past year, crimping lending and heaping pressure on the U.K.’s heavily indebted government. Investors went into the meeting split over whether the central bank would cut now or wait for further signals of ebbing inflation.

The Fed on Wednesday opted to keep interest rates steady in a range between 5.25% and 5.5%, a two-decade high. But Fed Chair Jerome Powell said officials could cut them in September.

While the Fed has stood pat, the BOE’s move aligns it with most other developed-market central banks, which have begun cautiously lowering rates but aren’t expected to return soon to the rock-bottom levels seen before the inflation crisis.

“Inflationary pressures have eased enough that we’ve been able to cut interest rates today. But we need to make sure inflation stays low, and be careful not to cut interest rates too quickly or by too much,” said the bank’s governor, Andrew Bailey.

Fed Clears Path for September Rate Cut – WSJ

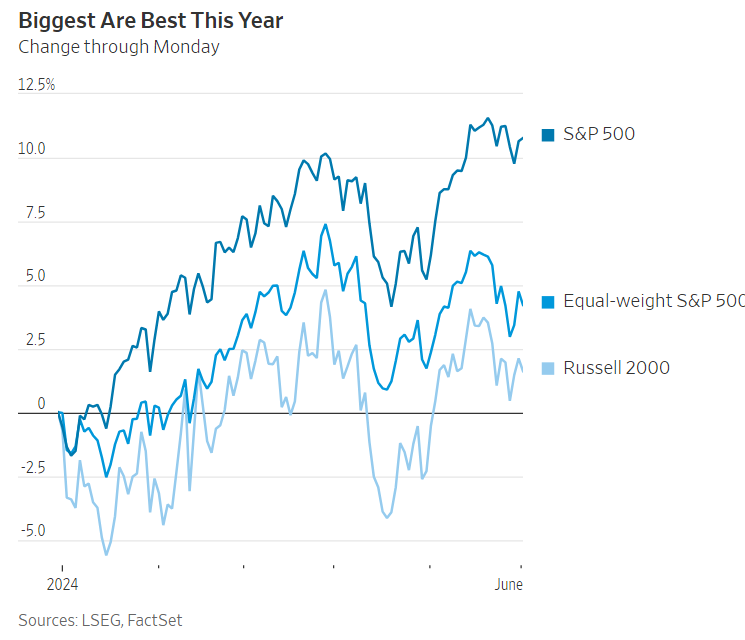

- Small-cap stocks represented by the Russell 2000 index was the standout winner last week, along with the Dow Jones Industrial Average (DIA). The DIA is comprised of 30 stocks that include some of America’s largest financial companies, and that gives the Dow much more of a “value tilt”.

- It was a few very large-cap stocks that have been fueling this year’s rally in stocks. The S&P 500’s return for the first half of the year has been mainly driven by less than 10 mega-cap stocks, with Nvidia leading the way.

- This past week saw a shift (another rotation), as we are now beginning to experience momentum picking up in the equal-weighted S&P 500 index (RSP).

Investors are increasingly bullish on small-cap stocks, driven by optimistic projections for the interest-rate-sensitive segment of the market to thrive as the market approaches the onset of a Federal Reserve rate cut cycle.

July has been a pivotal month, as small caps significantly outperformed large caps, especially in the tech sector, which dominated during the nearly two-year bull market.

The Russell 2000 index has surged nearly 9% month-to-date compared to a 3.6% decline for the tech-heavy Nasdaq 100 as of July 25.

The performance gap of nearly 13 percentage points in favor of the Russell 2000 over tech marks the best month for the “long small cap, short tech” trade since April 2002, highlighting the strength and speed of the ongoing market rotation.

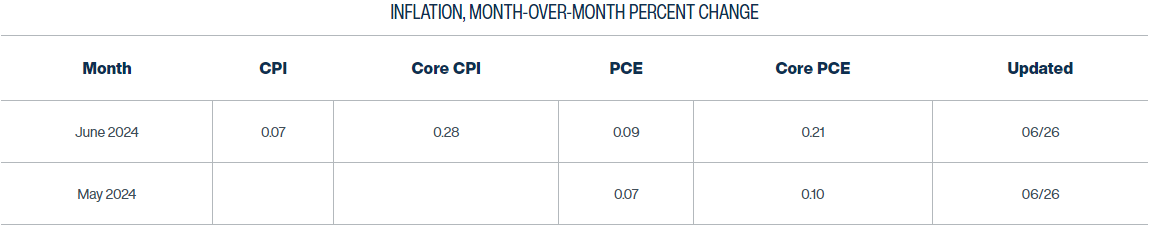

- 07/19/2024 – Inflation Nowcasting (clevelandfed.org) – big drop of PCE and core PCE might give a big lift to IWM, KRE and XBI

- Trump told Bloomberg Businessweek the Fed should not cut rates before the presidential election.

- However, some economists and lawmakers say cuts should happen soon.

- The Fed has two interest rate decisions before November; traders expect cuts to start in September.

In a June 25 interview that was published on July 16, Trump said the Fed may cut rates before the election, but it’s something Fed Chair Jerome Powell and Fed members “know they shouldn’t be doing.”

His comments are at odds with what some economists and Democratic lawmakers have said about the need for cuts soon.

Trump warms to Powell ahead of potential rate cuts: ‘I would let him serve it out’ (msn.com)

“I would let him serve it out,” Trump said regarding Powell’s Fed chair term in an interview with Bloomberg published Tuesday, “especially if I thought he was doing the right thing.”

Trump warned the Fed should hold off on interest rate cuts, which are widely viewed as being economically stimulative, before the November election, Bloomberg reported.

“It’s something that they know they shouldn’t be doing,” he said, according to Bloomberg.

- 07/16/2024 – Stock Market Today: Dow Jumps More Than 600 Points; Bank Earnings in Spotlight — Live Updates (wsj.com)

For anyone who has complained that market gains have been too concentrated in technology giants, today was for you.

A rotation of investor interest out of big tech and into the rest of the market began on Thursday last week, sparked by a cool monthly inflation reading. It gathered momentum on Tuesday, though the exact trigger this time wasn’t clear — it may have been retail sales data for June that came in flat compared to expectations for a decline, or just decent quarterly earnings reports from banks and others. Rising expectations that Donald Trump could again be elected President, bringing with him lower corporate tax rates, likely also played a role.

While the cause was less than obvious, the effect was crystal clear on Tuesday. The S&P 500 rose 0.6% despite some of its biggest components — Nvidia, Microsoft, Meta Platforms and Alphabet — all posting losses. The Nasdaq finished up just 0.2% while the Dow Jones Industrial Average jumped 1.8%, or 743 points. The Dow was boosted by its unique price-weighted structure and a 6.5% rally in its biggest component, UnitedHealth Group, which reported surprisingly strong earnings.

As was the case last Thursday, small caps outperformed, with the Russell 2000 index jumping 3.5%. Regional banks were standout performers for the second straight day, with the KBW Nasdaq Regional Banking index soaring 4.5%.

Outside of technology companies, one notable decliner was Charles Schwab, which fell 10.2% after reporting earnings. As Heard’s Telis Demos writes, wealth managers are having to pay clients more on brokerage deposits, despite expectations that the Federal Reserve will soon start cutting rates.

Speaking of the Fed, traders are now treating it as a virtual certainty that the central bank will cut rates by September, with futures markets pricing a 99.8% chance of that, according to the CME FedWatch tool. The Fed could pour even more gasoline on this market fire by moving even earlier in July, or else it could douse the fire quickly with a few cautious comments on inflation.

Investors are extending their rotation from shares of mega-cap tech companies to small-cap stocks. – this happens so fast, I cannot capture it fast enough.

The Russell 2000 rose 3.5% on Tuesday, its fifth consecutive session of gains. It closed at the highest level since January 2022.

The small-cap index has outperformed the Nasdaq Composite by about 11 percentage points over the past five trading days, the largest degree of outperformance since December 2000, according to Dow Jones Market Data.

The Russell 2000 has beaten the S&P 500 by about 10 percentage points over the same period, the widest five-day outperformance on record, based on data going back to 1986.

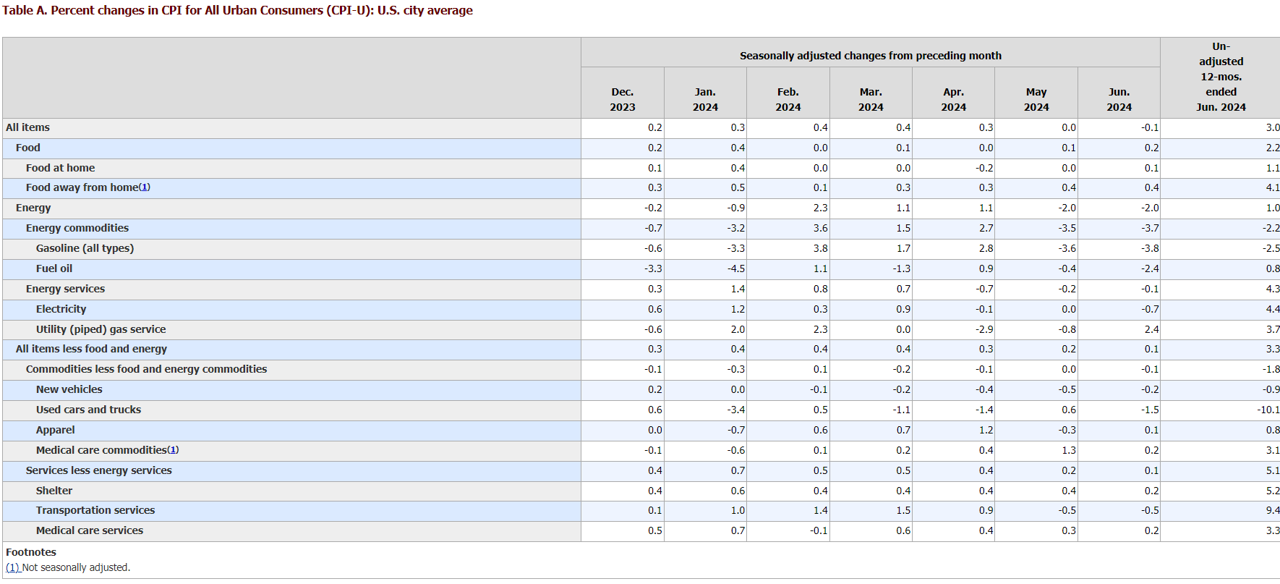

- 07/12/2024 – Consumer Price Index Summary – 2024 M06 Results (bls.gov) The shelter index increased 0.2 percent in June. The index for rent rose 0.3 percent over the month, as did the index for owners’ equivalent rent; these were also the smallest increases in these indexes since August 2021. The lodging away from home index decreased 2.0 percent in June, after falling 0.1 percent in May.

All items less food and energy The index for all items less food and energy rose 0.1 percent in June, the smallest increase in this index since August 2021. The shelter index increased 0.2 percent in June. The index for rent rose 0.3 percent over the month, as did the index for owners’ equivalent rent; these were also the smallest increases in these indexes since August 2021. The lodging away from home index decreased 2.0 percent in June, after falling 0.1 percent in May.

All items less food and energy The index for all items less food and energy rose 0.1 percent in June, the smallest increase in this index since August 2021. The shelter index increased 0.2 percent in June. The index for rent rose 0.3 percent over the month, as did the index for owners’ equivalent rent; these were also the smallest increases in these indexes since August 2021. The lodging away from home index decreased 2.0 percent in June, after falling 0.1 percent in May.

The energy index fell 2.0 percent in June, as it did in May. The gasoline index decreased 3.8 percent in June. (Before seasonal adjustment, gasoline prices fell 3.9 percent in June.) The electricity index decreased 0.7 percent over the month and the fuel oil index decreased 2.4 percent. The index for natural gas rose 2.4 percent in June. The energy index increased 1.0 percent over the past 12 months. The gasoline index fell 2.5 percent over this 12-month span. The index for electricity increased 4.4 percent over the last 12 months and the index for natural gas rose 3.7 percent. The index for fuel oil rose 0.8 percent over the same period.

- 07/12/2024 – Milder Inflation Keeps Door Open to September Interest-Rate Cut – WSJ Rise in consumer prices eased to 3% in June, further extending a recent slowdown in price increases. Thursday’s report could be especially comforting to policymakers because it showed housing costs are slowing after a mammoth run-up following the pandemic. Housing inflation, which reflects the cost of renting and accounts for about one-third of the CPI, has kept overall prices high.

U.S. inflation eased substantially in June, extending a recent slowdown in price increases that clears a path for the Federal Reserve to cut interest rates by the end of the summer.

The consumer-price index, a measure of goods and services costs across the economy, fell slightly from May, dropping the year-over-year inflation rate to 3%, which was the lowest since June 2023.

Core prices, which exclude volatile food and energy items and are seen as a better gauge of underlying inflation, rose 0.1% since May. That was the mildest increase since January 2021, when large swaths of the economy were still frozen by the pandemic.

Altogether, the report showed prices cooled broadly in the second quarter and were below economists’ expectations—the reverse of what happened in the first three months of the year, when inflation was surprisingly brisk.

Thursday’s report could be especially comforting to policymakers because it showed housing costs are slowing after a mammoth run-up following the pandemic. Housing inflation, which reflects the cost of renting and accounts for about one-third of the CPI, has kept overall prices high.

Economists and Fed officials have long anticipated that this inflation would ease because rents for new housing units have been cooling for 1½ years. But the figure often trails market conditions by many months. The latest report seemed to provide welcome confirmation that official inflation gauges are now capturing those developments.

Price increases were generally subdued across a range of categories. The costs of air travel and staying at a hotel fell particularly sharply from the previous month.

- 07/09/2024 – Powell Inches the Fed Closer to Cutting Rates – WSJ At a congressional hearing, the Fed chair made a subtle but important shift in his assessment of the risks facing the central bank. While almost all of Powell’s commentary suggested it was a matter of when—not if—the Fed would cut rates, he repeatedly spurned efforts by lawmakers to pin him down on the exact timing. “I’m not going to be sending any signals about the timing of future actions,” he said.

“Elevated inflation is not the only risk we face,” Powell told the Senate Banking Committee during the first of two days of testimony Tuesday. “We’ve seen that the labor market has cooled really significantly across so many measures.…It’s not a source of broad inflationary pressures for the economy now.”

That assessment is notable because Fed officials have long cited an overheated labor market as a primary risk to bringing inflation back down.

While almost all of Powell’s commentary suggested it was a matter of when—not if—the Fed would cut rates, he repeatedly spurned efforts by lawmakers to pin him down on the exact timing. “I’m not going to be sending any signals about the timing of future actions,” he said.

Economic projections released last month showed most Fed officials expect to cut interest rates once or twice this year if inflation slows and growth is solid but unspectacular. Their next meeting is July 30-31. Markets are focused on whether officials at that meeting might provide stronger hints that they could cut rates at their subsequent gathering in September.

- 07/09/2024 – Fed Chair Powell says economy no longer overheated, setting stage for rate cuts (msn.com)

The US is “no longer an overheated economy” with a job market that has “cooled considerably” from its pandemic-era extremes and in many ways is back where it was before the health crisis, Fed Chair Jerome Powell said in remarks to Congress that suggested the case for interest rate cuts is becoming stronger.

“We are well aware that we now face two-sided risks,” and can no longer focus solely on inflation that nevertheless still “remains above” the central bank’s 2% target, Powell told the Senate Banking committee on Tuesday. “The labor market appears to be fully back in balance.”

Powell in his prepared remarks told senators that inflation had been improving in recent months and that “more good data would strengthen” the case for looser monetary policy.

Powell’s comments appeared to show increasing faith that inflation will return to the Fed’s target, and contrasted the lack of progress on inflation in the first months of the year to recent improvement that has helped build the Fed’s confidence that price pressures will continue to diminish.

Powell’s comments may firm expectations for changes to the policy statement to be released after the Fed’s July 30-31 meeting that at least open the door to a September rate cut now given a roughly 70% probability by investors – barring a surprise jump in coming inflation readings.

“He’s beginning to tee up a rate cut,” said Brian Jacobsen, chief economist with Annex Wealth Management in Brookfield Wisconsin. “They view risks in not cutting soon enough. It used to be that they were singularly focus on inflation.”

- 07/05/2024 – Case for September Rate Cut Builds After Slower Jobs Data – WSJ, Jobs report shows the unemployment rate ticked up to 4.1%, indicating slack in what has been a strong labor market

The Labor Department reported on Friday that the U.S. added a solid 206,000 jobs last month, slightly beating expectations and continuing a remarkably strong run. But the unemployment rate ticked up to 4.1%, a sign of slack in a labor market that has already shown some hints of gradually slowing down.

There were other indications as well that the job market is continuing to cool. Average hourly earnings were up 3.9% in June from a year earlier, marking their smallest gain since 2021. The counts for both April and May were revised lower by a combined 111,000 jobs. The labor force participation rate, the share of working-age people who were employed or seeking work, ticked up to 62.6%—an indication that more people entered the labor market.

The jobs report seems to have affirmed investors’ view that the economy is slowing, but not in a drastic way that would prompt more aggressive rate cuts. For President Biden’s re-election campaign, the continued job growth counts as a positive, but the rise in the unemployment rate robs it of a valuable talking point. The June report marked the first time since 2021 that the unemployment rate clocked in above 4%.

There likely wasn’t anything alarming enough in Friday’s payroll report to lead Fed officials to push for a July rate cut. But eventually, some Fed officials will say that the risks of a further weakening in the labor market aren’t desirable, even as others may argue that inflation still isn’t showing enough progress to cut rates.

While July may be too early for a rate cut, a mild inflation report next week could lead to Fed doves who are more worried about labor-market weakness to argue that it is time for the central bank to tee up a September rate cut.

One risk is that experience has shown the labor market can go from strong to weak in short order. While the unemployment rate of 4.1% is still historically low, it is up from 3.4% early last year.

The Sahm rule, a rule of thumb popularized by economist Claudia Sahm, says that if the average of the unemployment rate over three months rises a half-percentage point or more above the lowest the three-month average went over the previous year, the economy is in a recession. Over the past three months, the unemployment rate has averaged 4%—0.4 percentage point above the three-month average low of 3.6% over the past year.

High interest rates take time to fully work their way into the economy, but lately they have more clearly damped activity. Even though wages have been rising faster than prices, growth in consumer spending has slowed. “Signs of strain continue to emerge among consumers with low-to-moderate incomes, as their liquid savings and access to credit have increasingly become exhausted,” Fed governor Lisa Cook said in a speech last month.

If consumers cut back too much, employers could respond by cutting staff, turning what has been a virtuous cycle of rising employment and rising spending into a vicious one.

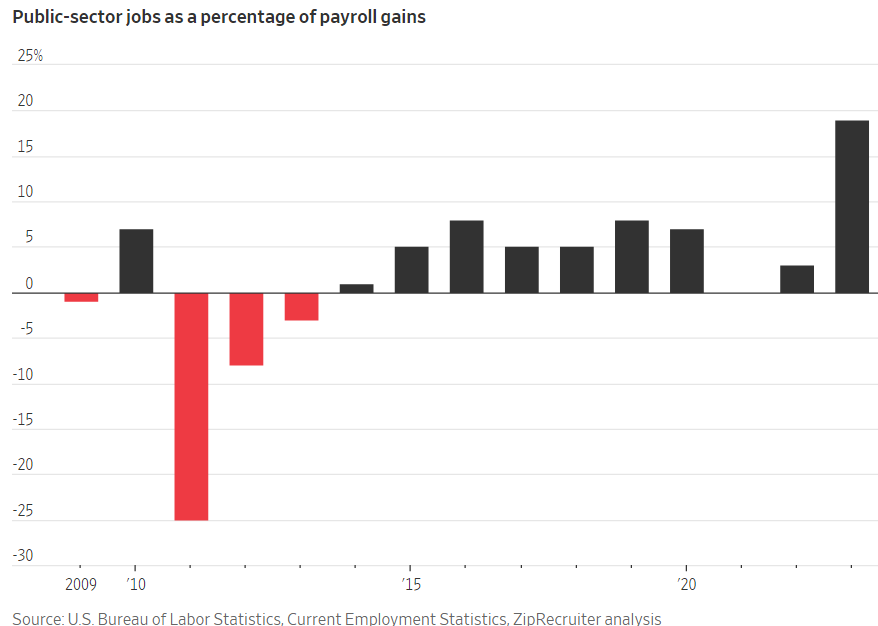

Job growth over the past year has been driven by three sectors: Healthcare, government, and leisure and hospitality. Together, they have accounted for 1.7 million of the 2.7 million jobs the economy has added over the past year. Much of that outsize growth is a matter of catching up, since all three sectors were much slower to get back to their prepandemic job levels than other employers.

Employment in all three sectors still appears low relative to their prepandemic job-growth trends. But it is unclear at what level demand for workers will be satiated, and once it is, overall job growth could slow markedly.

Hatzius thinks the best thing to do is watch the unemployment rate, which measures the share of people working or seeking work who are unemployed. If it keeps turning higher in the months ahead, it will be an indication that the labor market has moved from a point of balance to one of deterioration.

The Big Employer Still Adding Jobs and Boosting Pay: The Government – WSJ As many companies slow hiring, the public sector is adding workers

While many companies have been cutting staff and freezing new hires this year, the government is laying out the welcome mat.

Public-sector jobs at the federal, state and local level have risen by 327,000 positions so far in 2023, according to the Bureau of Labor Statistics. That is approaching one-fifth of all new American jobs created in the first eight months of the year. In contrast, public-sector jobs accounted for 5% of employment growth during the equivalent period last year.

“After two years of very underwhelming government hiring, it’s a necessary catch-up,” said Julia Pollak, an economist at online jobs site ZipRecruiter.

Much of the recent hiring spree has been to backfill jobs left open by millions of teachers, police officers and other public servants who quit during the pandemic. Other roles at government agencies languished because the public sector couldn’t effectively compete against private employers that were offering pay raises and signing bonuses to attract talent during several years of a white-hot labor market.

But just as layoffs hit sectors from tech to finance, government agencies have boosted funding for new hires and have dangled richer perks. This year’s growth in public-sector jobs represents the highest share of overall U.S. payroll gains since 2001, when the government hired masses of workers focused on public safety after the 9/11 terrorist attacks, Pollak said.

Minutes of the Federal Reserve’s June meeting show officials are not in any agreement over how many months of good inflation data might be needed before the central bank might be confident enough that low inflation was here to stay before cutting interest rates.

Officials “noted that the uncertainty associated with the economic outlook and with how long it would be appropriate to maintain a restrictive policy stance,” the minutes said.

FOMC Minutes June 11–12, 2024 (federalreserve.gov)

- 07/02/2024 – Fed’s Jerome Powell Turns Dial Toward Interest-Rate Cut Later This Year – WSJ The central bank is trying to pull off a soft landing in which inflation slows without a serious downturn

Officials will have three more months of data on hiring, inflation and spending before then, making it difficult to firmly stake out a view right now on what may be a finely balanced decision. Powell declined to say whether he was setting the table for a September cut. “I’m not going to be landing on any specific dates here today,” he said.

Investors in interest-rate futures markets see a roughly 70% chance that the first Fed cut occurs by September, according to CME Group. U.S. stock indexes rose Tuesday, with the S&P 500 and Nasdaq Composite hitting records.

To determine whether and when to lower interest rates, officials must balance two risks. The first is that a continuing cooling in the labor market accelerates in a way that is hard to stop once it starts. The second is that lower rates ignite economic activity and allow inflation to settle out above their goal.

- 07/02/2024 – Fed Chair Jerome Powell: US inflation is cooling again, though it isn’t yet time to cut rates (msn.com)

Speaking in a panel discussion at the European Central Bank’s monetary policy conference in Sintra, Portugal, Powell said Fed officials still want to see annual price growth slow further toward their 2% target before they would feel confident of having fully defeated high inflation.

“We just want to understand that the levels that we’re seeing are a true reading of underlying inflation,” he added.

Powell also acknowledged that the Fed is treading a fine line as it weighs when to cut its benchmark interest rate, which it raised 11 times from March 2022 through July 2023 to its current level of 5.3%. The rate hikes were intended to curb the worst streak of inflation in four decades by slowing borrowing and spending by consumers and businesses. Inflation did tumble from its peak in 2022 yet still remains elevated.

In Full: Goolsbee on Fed Policy, Inflation, Labor, Rates | Watch (msn.com)

Traders are preparing for the release of the Personal Consumption Expenditure (PCE) price index data, widely regarded as the Federal Reserve’s preferred inflation measure, scheduled for Friday.

May’s PCE Price Index Report: What Economists Expect

- The PCE price index is expected to slow from 2.7% year-on-year in April to 2.6% year-on-year in May, as estimates gathered by Econoday show. The consensus range is between 2.5% and 2.7%.

- On a monthly basis, the PCE price index is seen advancing at a 0.1% pace, slowing down from the previous 0.3%.

- The core PCE price index is set to ease from 2.8% to 2.6% year-on-year in May, which could mark the lowest level since March 2021.

- On a monthly basis, the core PCE price index is predicted to slow from 0.2% to 0.1%.

Inflation Nowcasting (clevelandfed.org)

06/17/2024 – Rent Hikes Loom, Posing Threat to Inflation Fight – WSJ

- 06/16/2024 – How to be a Profitable Trader in 2024 (make the year COUNT) (youtube.com)

- 06/12/2024 – Fed Projects Just One Cut This Year Despite Mild Inflation Report – WSJ Central bankers see inflation returning closer to their goal next year after longer wait on reductions

Federal Reserve officials penciled in just one interest-rate cut for this year, indicating most are in no hurry to lower rates, even after a widely watched report Wednesday showed inflation improved last month.

New economic projections showed 15 of 19 officials expect the Fed to cut rates this year, with that group roughly split between one or two rate cuts. The median, or midpoint, of those projections reflected expectations of one rate cut.

Fed officials meet four more times this year, in July, September, November and December, and the rate projections could temper expectations of a September cut that investors anticipated earlier Wednesday after the inflation report.

- 06/12/2024 -The heaviest concentration in history

- 06/06/2024 – European Central Bank Cuts Interest Rates for First Time Since 2019 – WSJ A scenario where the ECB cuts rates further while the Fed stays put would risk reducing the euro’s strength against the dollar, pushing up the cost of imports and lifting eurozone inflation higher. This could delay further loosening in Europe, whose economy is in bigger need of relief than the robustly growing U.S. economy.

The ECB said it would reduce its key interest rate to 3.75% from 4%, its first rate cut in almost five years. Future interest-rate decisions will be based on incoming economic data, the bank said in a statement. The ECB’s rate-setting committee “is not pre-committing to a particular rate path,” the bank said.

The rate cut is a significant moment for investors and the world economy. It marks an inflection point in recent monetary policy and sends a signal that relief is on the way for households, indebted governments and businesses that have reined in investments in the face of high borrowing costs.

The cut also potentially puts the ECB and the Fed on different tracks and widens an existing gap in borrowing costs between the U.S. and Europe. While this could boost Europe’s growth in the short term, the gap could also complicate the work of policymakers, especially in Europe.

The Bank of Canada on Wednesday trimmed its key policy rate by 25 basis points to 4.75%, in a widely expected move that marked its first cut in four years, and said more easing was likely if inflation continued to ease.

Bank of Canada Cuts Rates to Become First G-7 Central Bank to Ease Policy – WSJ Gov. Tiff Macklem signals more cuts are possible as inflation cools

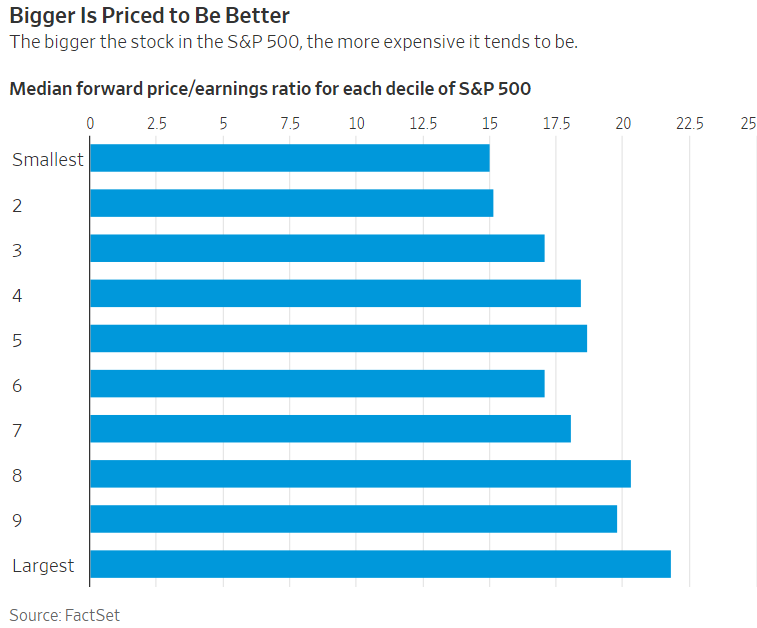

- 06/05/2024 – Big Tech Companies Unplug Stock Market From Reality – WSJ The big-vs.-small-stocks phenomenon reflects the same disconnects we see in the broader economy. If rate cuts do come to pass, the little guys should finally get the chance to put Big Tech in the shade. lowly valued companies were regarded as less reliant on future profits that are worth less in a world of higher rates. The Big Tech stocks that dominate the market sit on huge cash piles, while the biggest companies chose to lock in low interest rates for a long time by refinancing their bonds before the Fed began raising rates in 2022. Smaller companies tend not to have cash piles on which to earn fat savings interest and have more need to issue bonds to raise cash. The smallest don’t even have access to the bond market, one reason the Russell 2000 index of smaller companies has lagged so far behind the S&P this year, eking out a gain of just 1.6%.

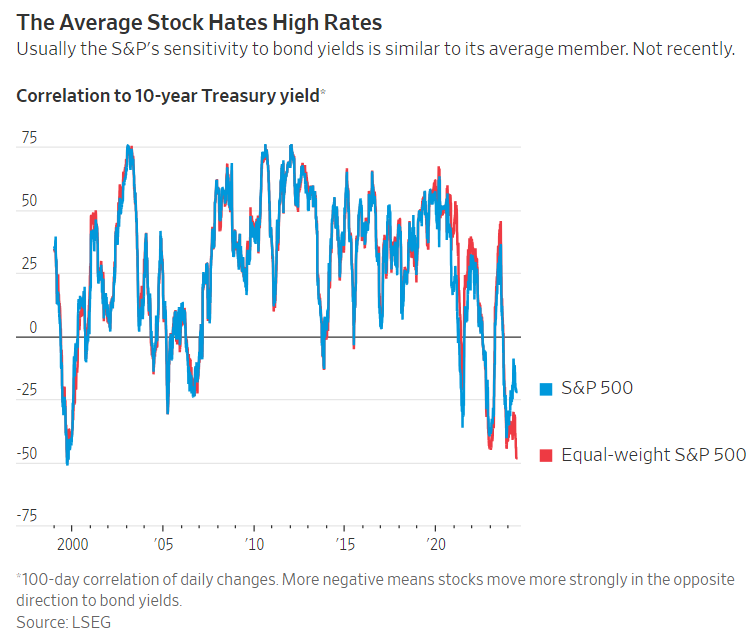

Big Tech stocks aren’t just dominating the market. They’re also hiding just how scared investors are that the Federal Reserve will keep rates higher for longer.

The average stock in the S&P 500 is hurt more by rising yields—and helped more by falling yields—than any time this century. Yet the S&P itself is far less affected by the outlook for interest rates, because the Big Tech stocks that make up so much of the standard, value-weighted index are insulated from the Fed by their enormous cash piles.

Aside from AI, I think this is best explained by corporate profits and interest rates, and to a lesser extent concern about the economy.

The Big Tech stocks that dominate the market sit on huge cash piles, while the biggest companies chose to lock in low interest rates for a long time by refinancing their bonds before the Fed began raising rates in 2022. Smaller companies tend not to have cash piles on which to earn fat savings interest and have more need to issue bonds to raise cash. The smallest don’t even have access to the bond market, one reason the Russell 2000 index of smaller companies has lagged so far behind the S&P this year, eking out a gain of just 1.6%.

The oddity about the market’s reaction this year is that it is almost exactly the opposite of what happened in 2022. Then, Big Tech stocks plunged as investors marked down their heady valuations, dragging the S&P down 19% over the year. Meanwhile the average stock was down just 13%, as smaller, lowly valued companies were regarded as less reliant on future profits that are worth less in a world of higher rates.

Why the difference? The AI excitement offsets the valuation hit. The rate shock this year—from expecting six Fed cuts to just one or two—is a different scale to 2022, when rates soared from zero to 4.5%. And investors have woken up to the long-dated debt and cash hoards that shield so many of the biggest stocks.

Investors outside the Big Tech sector are right to worry about higher rates. For those looking for bargains, the high valuation of the S&P hides the fact that its smallest 50 members are almost as cheap, at a median 15 times forward earnings, as the index as a whole was at the nadir of the Covid-19 panic in 2020.

If rate cuts do come to pass, the little guys should finally get the chance to put Big Tech in the shade.

Job openings fell in April to their lowest level since February 2021 as the labor market shows further signs of cooling off from the hiring boom that followed the US economy reopening after the pandemic.

New data from the Bureau of Labor Statistics released Tuesday showed there were 8.06 million jobs open at the end of April, a decrease from the 8.35 million job openings in March.

- 06/01/2024 – Eurozone Inflation Rises as ECB Considers Rate-Cut Path (msn.com)

- 06/01/2024 – The Fed Won’t Cut Rates This Year (msn.com)

The Federal Reserve isn’t likely to lower interest rates in 2024. Elevated inflation, a resilient economy, and a still-strong, if softening labor market argue against the need for easing monetary policy, especially as these conditions are expected to persist through year end.

- 05/27/2024 – ECB ready to start cutting interest rates, chief economist says (msn.com) The European Central Bank will likely cut interest rates from historic highs at its meeting on June 6th. If the ECB diverges from the Fed by cutting interest rates more quickly it could cause the euro to fall and push up inflation by raising import prices, but Lane said the ECB would take any “significant” exchange rate move into account. He noted that “there has been very little movement” in this direction so far. The euro has risen recently against the U.S. dollar from a six-month low in April.

“Barring major surprises, at this point in time there is enough in what we see to remove the top level of restriction.” — Philip Lane, ECB chief economist

The European Central Bank will likely cut interest rates from historic highs at its meeting on June 6th, suggested its chief economist, Philip Lane, in an interview with the Financial Times on Monday. And he brushed off fears that doing so before the U.S. Federal Reserve could backfire.

Investors are betting that the ECB will lower its benchmark deposit rate by a quarter percentage point from its record high of 4% at next week’s meeting after eurozone inflation fell close to the bank’s 2% target.

He said the pace at which the central bank lowered eurozone borrowing costs this year would be decided by assessing data to decide “is it proportional, is it safe, within the restrictive zone, to move down”.

“Things will be bumpy and things will be gradual,” said Lane, who will draft the proposed rate decision before it is decided by the 26 members of the governing council next week.

If the ECB diverges from the Fed by cutting interest rates more quickly it could cause the euro to fall and push up inflation by raising import prices, but Lane said the ECB would take any “significant” exchange rate move into account. He noted that “there has been very little movement” in this direction so far. The euro has risen recently against the U.S. dollar from a six-month low in April.

- 05/22/2025 – Minutes of the Federal Open Market Committee, April 30–May 1, 2024 (federalreserve.gov) overall, negative viewpoint on the disinflation process. Even though this minute was before the release of May 15 (good inflation) report – not good for KRE and XBI which are sensitive to the interest rate

- The manager turned first to a review of developments in financial markets. Domestic data releases over the inter-meeting period pointed to inflation being more persis-tent than previously expected and to a generally resilient economy. Policy expectations shifted materially in re-sponse. The policy rate path derived from futures prices implied fewer than two 25 basis point rate cuts by year-end. The modal path based on options prices was quite flat, suggesting at most one such rate cut in 2024. The median of the modal paths of the federal funds rate ob-tained from the Open Market Desk’s Survey of Primary Dealers and Survey of Market Participants also indicated fewer cuts this year than previously thought. Respond-ents’ baseline expectations for the timing of the first rate cut—which had been concentrated around June in the March surveys—shifted out significantly and became more diffuse.

- Although credit quality for household loans remained solid, on balance, delinquency rates for credit cards and auto loans in the fourth quarter remained notably above their levels just before the pandemic. For residential mortgages, delinquency rates across loan

- the share of nonperforming CRE loans at banks—defined as loans past due 90 days or in nonac-crual status—rose further through March, especially for loans secured by office buildings

- the fair value of bank assets was estimated to have fallen further in the first quarter, re-flecting the substantial duration risk on bank balance sheets.

- The economy was expected to maintain its high rate of resource utilization over the next few years, with pro-jected output growth roughly similar to the staff’s esti-mate of potential growth. The unemployment rate was expected to edge down slightly over 2024 as labor mar-ket functioning improved further, and to remain roughly steady thereafter.

- The risks around the forecast for economic activity were seen as skewed to the down-side on the grounds that more-persistent inflation could result in tighter financial conditions than in the staff’s baseline projection; in addition, deteriorating household financial positions, especially for lower-income house-holds, might prove to be a larger drag on activity than the staff anticipated.

- housing services inflation had slowed less than had been anticipated based on the smaller increases in measures of market rents over the past year. A few participants remarked that unusually large seasonal patterns could have contributed to Janu-ary’s large increase in PCE inflation, and several partici-pants noted that some components that typically display volatile price changes had boosted recent readings. However, some participants emphasized that the recent increases in inflation had been relatively broad based and therefore should not be overly discounted.

- Participants noted that they continued to expect that in-flation would return to 2 percent over the medium term. However, recent data had not increased their confidence in progress toward 2 percent and, accordingly, had sug-gested that the disinflation process would likely take longer than previously thought.

- Participants discussed several factors that, in conjunction with appropriately re-strictive monetary policy, could support the return of in-flation to the Committee’s goal over time. One was a further reduction in housing services price inflation as lower readings for rent growth on new leases continued to pass through to this category of inflation. However, many participants commented that the pass-through would likely take place only gradually or noted that a re-acceleration of market rents could reduce the effect.

- Several participants stated that core nonhousing services price inflation could resume its decline as wage growth slows further with labor demand and supply moving into better balance, aided by higher labor force participation and strong immigration flows. In addition, many partic-ipants commented that ongoing increases in productivity growth would support disinflation if sustained, though the outlook for productivity growth was regarded as un-certain.

- Participants assessed that demand and supply in the la-bor market, on net, were continuing to come into better balance, though at a slower rate.

- Participants discussed a range of risks emanating from the banking sector, including unrealized losses on assets resulting from the rise in longer-term yields, high CRE exposure, significant reliance by some banks on uninsured depos-its, cyber threats, or increased financial interconnections among banks. Several participants commented on the rapid growth of private credit markets, noting that such developments should be monitored because the sector was becoming more interconnected with other parts of the financial system and that some associated risks may not yet be apparent.

- Participants generally noted that high interest rates could contribute to vulnerabilities in the financial system.

- Although monetary policy was seen as restrictive, many partici-pants commented on their uncertainty about the degree of restrictiveness. These participants saw this uncer-tainty as coming from the possibility that high interest rates may be having smaller effects than in the past, that longer-run equilibrium interest rates may be higher than previously thought, or that the level of potential output may be lower than estimated. Participants assessed, however, that monetary policy remained well positioned to respond to evolving economic conditions and risks to the outlook. Participants discussed maintaining the cur-rent restrictive policy stance for longer should inflation not show signs of moving sustainably toward 2 percent or reducing policy restraint in the event of an unexpected weakening in labor market conditions. Various partici-pants mentioned a willingness to tighten policy further should risks to inflation materialize in a way that such an action became appropriate.

- 05/22/2024 – Data did not increase Fed’s confidence that inflation is heading toward 2%: FOMC minutes | Seeking Alpha

After the Federal Reserve’s March policy meeting, Fed Chair Jerome Powell said the policymakers were looking for more evidence that the economy was making progress in reaching the central bank’s inflation goal. They didn’t get that confidence at their most recent meeting.

At its April 30-May 1 meeting, “recent data had not increased their confidence in progress toward 2%, and, accordingly, had suggested that the disinflation process would likely take longer than previously thought,” according to the minutes of the Federal Open Market Committee’s last meeting on April 30-May 1.

The Federal Reserve kept its policy rate unchanged at 5.25%-5.50% at its last meeting, citing a lack of further progress toward its 2% inflation goal in recent months.