Here is my study of FB, score 3.725/5

- 08/04/2024 – Mark Zuckerberg Warns Investors Meta’s A.I. Bet May Take ‘Years’ to Pay Off (msn.com)

- 02/21/2020 – FB (through IG) is tapping more revenue stream starting March, this might impact 2Q20. Good for election year.

Instagram Targets More Funding, Ad Revenue-Sharing, for Video Hub

The Facebook-owned company looks to pay more for videos on its IGTV app, though no formal funding program is in place

IGTV advertising could arrive as early as March, Ad Age reported on Tuesday.

Instagram declined to provide a timeline for ad products and revenue sharing for IGTV but has acknowledged that it is working on introducing an ad system for the platform.

- 11/12/2019 – FB pay might be another great cash cow for FB

Facebook takes on Venmo with new payments tool that can be used across its family of apps

- Facebook on Tuesday launched a new payments service that will operate across its family of apps.

- The new service, called Facebook Pay, is launching on the core Facebook and Messenger apps to start, but will later arrive for users on Instagram and WhatsApp.

- 06/18/2019 – Facebook“发币”,扎克伯格野心何在?

- 12/04/2017- Default checklist, score 3.7/5, Lynch checklist score 3.5/5, Fisher checklist score 4.1/5, Guru checklist score 3.6/5

detailed study (study_of_FB_Dec_2017), Valueline report ()

one new area of growth Facebook has a new app for kids

- 1/31/2019 – Facebook Posts Record Profit, Capping Grueling Year

Shares rise as social network shows resilience of its businesses as it battles through a string of challenges - 01/05/2019 – Facebook Begins New Year in Fixer-Upper Mode

Social-media giant strives to balance its push for growth with a commitment to improve security across platforms - 01/02/2019 – Facebook CEO Zuckerberg Says Problems Will Take Years to Fix

- 01/01/2019 – CNBC: Facebook’s worst year ever is now over. Here’s how its stock fared

- 12/29/2018 – Tech Stocks This Week: Amazon’s Big Holiday, A Bullish Call on Facebook, and More Record holiday sales at Amazon and a $160 price target for Facebook stock stole the show this week.

- 12/28/2018 – Facebook’s Fair Value Estimate

- 12/26/2018 – Why Facebook Is A Screaming Buy

- 12/26/2018 – Citron Research Backing Up the Sleigh on Facebook

– 2019 S&P Stock of the Year (Citron-Research-Backing-Up-the-Sleigh-on-Facebook) - 12/24/2018 – CNBC: Facebook is the ‘biggest concern’ among the FAANG stocks, analyst says

- 12/21/2018 – Facebook: Deal Of A Lifetime

- Facebook shares have been among the hardest-hit tech stocks in the recent correction, down 40% from recent peaks and hitting levels not seen since early 2017.

- The stock is priced at a historically low 19x forward P/E, which is unreasonable given 32% y/y earnings growth year-to-date.

- Facebook has new revenue streams arising in Watch, which the company says has 400 million MAUs (for sizing, that’s about one-fifth of Facebook’s overall base).

- The company has also ratcheted up its buyback program by 40%, indicating its belief in an undervalued stock.

- While Facebook is a headline-dominated stock, once negativity surrounding management chaos and internet regulation subside, investors will return focus to fundamentals.

- 12/11/2018 – It’s Darkest Before The Dawn For Facebook

- 11/20/2018 – Facebook Needs a Housecleaning

New York Times story reveals a deceitful scheme employed by senior executives to mislead the public, regulators and shareholders - 11/15/2018 – Facebook Will Fall Further

- 11/01/2018 – As Facebook Users Shift to Stories, Advertisers Look to Follow

Ad spend on Stories is growing but marketers are still playing catch-up

More than 1 billion Stories—montages of photos or videos that disappear after 24 hours—are shared daily across Facebook, Instagram and WhatsApp, Facebook said on its third-quarter earnings call Tuesday. “All of the trends that we’ve seen suggest that in the not-too-distant future, people will be sharing more into Stories than they will into Feeds,” Mr. Zuckerberg said on the call.

The experience of Instagram, where Stories arrived earlier, suggests that the price of Facebook Stories advertising will eventually catch up to feed ads. – another great revenue source!!!

The cost of 1,000 user impressions on Facebook Stories, which only rolled out globally to all advertisers in September, is around $4, compared with $5 on the news feed, according to marketing technology company 4C Insights.

- 10/30/2018 – Facebook Is All Good, for Now

The social network’s third-quarter results show the business is resilient, but also very much in transition

On the former, the company’s advertising revenue rose 33% year over year to $13.5 billion, while operating income climbed 13% to $5.8 billion. Per-share earnings came in at $1.76—easily beating Wall Street’s target of $1.46. Facebook added about 24 million daily active users during the quarter, notable given what seems a never-ending string of controversies involving privacy, fake news, shady political campaigns and even a large-scale hack.

But that growth in daily users—up 1.6% from the previous quarter—is still among Facebook’s slowest on record. And daily users in the U.S. and Canada—the company’s most important ad market—are flat over the past three quarters. Even Chief Executive Mark Zuckerberg noted on the company’s earnings call that the core Facebook News Feed service may be near a point of saturation in developed markets. He said the company is working to expand the business potential of its video offerings as well as its Instagram and WhatsApp services. But those are taking time, so News Feed will remain the company’s dominant business for some time.

- 10/26/2018

Challenges That Lie Ahead for Tech Stocks

Regulatory risks have not been adequately priced. In a changing investment environment, valuation models remain unrealistic.

Two factors are now going to attain increasing prominence for determining the health of the tech sector, especially for some members of the FANG group. The most ominous long-term investment risks for these particular tech stocks are twofold. First, the inexorability of increasingly substantive and burdensome regulations for the entire tech sector. Second, a potential collapse of questionable valuation methodologies or techniques, leading to a reassessment of current generous multiples. These are all fundamental and qualitative factors, most of which are difficult to quantify but are nonetheless serious for the long-term viability of tech stocks.

- 10/25/2018

The red hot ‘FAANG’ trade is officially over, now bet on your fellow ‘MAAN’

1. Some of FAANG’s current troubles are a reminder that we need more reason and less animal spirit. We suggest investors drop Facebook and Google and add Microsoft and look to “MAAN” as the new leadership group in global markets.

2. There are headwinds and tailwinds that will split the FAANG primarily the emergence of cloud and data privacy regulation.

3. The need to win back and preserve public trust is at the center of the battle waged by the data brokers in the group – Google and Facebook while Microsoft and Apple are turning data privacy and cloud into sources of growth and an opportunity to grab the moral high ground.

There are serious headwinds— rising costs for the business model itself, including significant regulatory scrutiny— facing Facebook and Google. In the other side, positive tailwinds will favor Amazon, Microsoft, and Netflix.

We suggest investors drop the ‘F’ and ‘G’ and add ‘M’. Consider “MAAN” as the new leadership group in global markets.

As we’ve written before, in 2018 there is brewing storm over data privacy, i.e. how a company uses your personal data to generate profits. Damage to shareholder value won’t be just in the form of rising costs and fines for FB and GOOG, it could eventually lead to significant declines in shareholder value due to customers losing trust in management teams—due to the privacy issue.

If you think FB and GOOG are established monopolies that will continue to profit – no matter the threat—thanks to dominant market share, remember that for decades, big tobacco was a monopoly source of consistent investor returns and dividends… until public attitudes changed. Within a few years, investors holding tobacco stocks lost significantly. And public attitudes towards data privacy have changed dramatically.

Every member of FAANG must increasingly deal with significant data governance issues. So why are some FAANG members better positioned than others? Why put not only your faith but your investment dollars in your “fellow MAAN” vs. selling everything in this correction?

Consider this:

- FB and GOOG use personal data to sell advertising as key point to their business model. In return, you get free stuff like sharing and communication platforms, email, video hosting. If attitudes change on that arrangement, they will have to require customers pay subscriptions. That is a significant headwind to both costs and revenue to their existing business model.

- AMZN and MSFT are also making huge profits from their “data management”, but in a more sustainable manner: via cloud and hybrid cloud services. True, both companies will face rising costs for protecting from cyber risk on those clouds, but that is built into to their business models, unlike FB and GOOG who will have to fight rising regulatory costs to sell premium advertising. Google does have cloud services, but it doesn’t drive the scale of profits as it does for MSFT and AMZN.

- FB and GOOG also benefit from not having to invest in user-created content (youtube, FB posts, Instagram, etc.). The lack of editorial supervision or ‘fact checking’—similar to what a professional media company is required to do — will increasingly be caught up in this brewing privacy storm.

- AMZN and NFLX by contrast are investing – and benefiting from—professional media content. They spend money and act like a media company, no data management problems here. No question however they have significant costs to creating or buying content.

- 09/27/2018 Why Facebook Offers Recovery Potential After Underperforming the S&P 500

- 08/01/2018 Facebook’s New Message to WhatsApp: Make Money

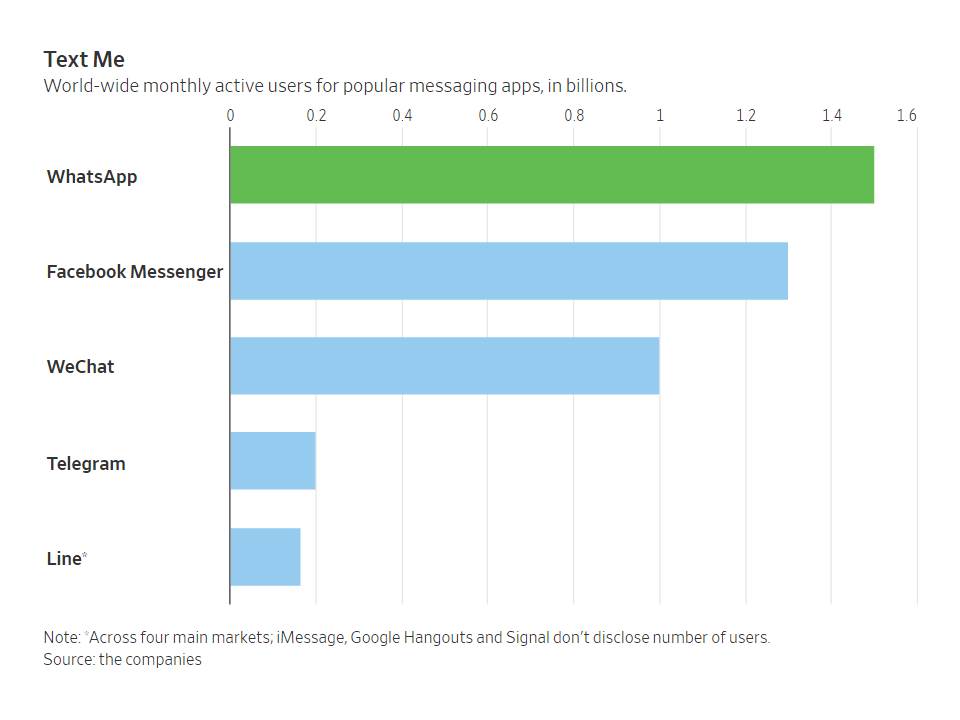

Messaging service WhatsApp, which has a user base of roughly 1.5 billion, is set to start showing ads in its Status feature next year - Facebook is opening up ways for video creators to make money

1. Facebook is testing monthly subscription plans and connect advertisers for branded content opportunities with its video creators.

2. The monetization options could potentially lure more creators away from Youtube - Buy Facebook because its video offering will be a blockbuster success, analyst says: Jefferies reaffirms its buy rating for Facebook shares. It predicts Facebook’s “Watch” product will drive significant sales.

- Mark Zuckerberg is ‘studying’ cryptocurrency, which could help Facebook catch Asian rivals

Neutral news

- 07/26/2018

Facebook insiders sold more stock than usual in the second quarter

- Top executives sold 13.6 million shares in the second quarter as the company struggled with data leaks and fake news scandals, up from 8.3 million in the first quarter, and roughly triple the amount they sold in the last quarter of 2017, according to data from InsiderScore.com.

- Executives sold in compliance with what’s known as Securities and Exchange Commission Rule 10b5-1, which is completely legal.

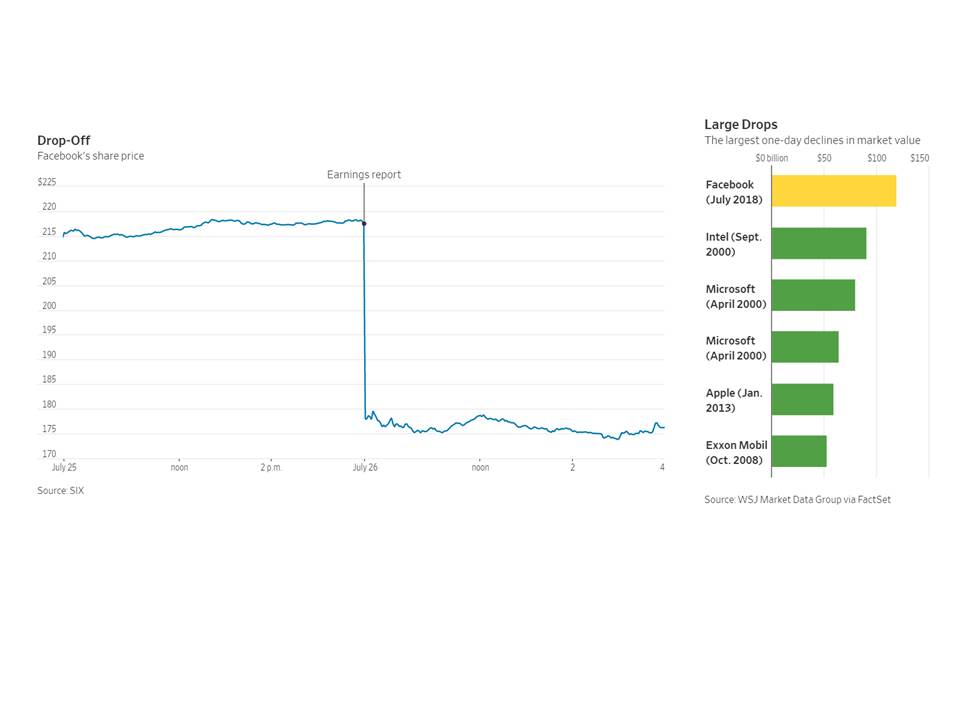

- Facebook reported disastrous second-quarter results that sent the stock tumbling to the largest one-day loss in market value by any company in U.S. stock market history.

However, their timing happened to be pretty good.

Of those 13.6 million shares sold by executives, the vast majority were offloaded by the company’s founder and CEO, Mark Zuckerberg. According to the data, he dumped 13 million shares in the second quarter, double what he sold in the first quarter of the year and 10 times what he sold in the fourth quarter of last year.

Three years ago, Zuckerberg announcedin a Facebook post he would sell 99 percent of his shares to fund philanthropic efforts. In a September SEC filing, Zuckerberg outlined plans to sell $6 billion in Facebook stock over the next 18 months to fund the Chan-Zuckerberg Initiative.

The company reported second-quarter results Wednesday that missed Wall Street expectations and sent the stock tumbling after the market closed. The social media giant’s market cap plummetedby $119 billion as its stock price fell by 19 percent.

- 06/05/2018 Behind the Messy, Expensive Split Between Facebook and WhatsApp’s Founders

After a long dispute over how to produce more revenue with ads and data, the messaging app’s creators are walking away leaving about $1.3 billion on the table

- Mark Zuckerberg’s Statement on Controversy Over User Data, detailed content (ZStatement on data Data)

Negative views

- 07/26/2018 Facebook Suffers Worst-Ever Drop in Market Value

Facebook shares fell 19% to $176.26, erasing about $119.1 billion in market value, after the Menlo Park, Calif., company warned late Wednesday about slowing growth. Facebook’s loss in market value Thursday is larger than 457 of the 500 companies in the S&P 500 and bigger than the aggregate valuation of the bottom 20 companies in the S&P 500.

- Facebook is facing its biggest test ever—and its lack of leadership could sink the company

1. Facebook’s reaction to a year of scandal has vacillated between defensive cluelessness and aloof silence.

2. Users are getting the message that information they post on Facebook can be used in ways they did not intend, and usage is starting to decline.

3. Meanwhile, executives are selling shares like crazy, including a plan by Mark Zuckerberg to sell almost $13 billion worth of shares by mid-2019. - Facebook shares slump amid continued fallout from Cambridge Analytica scandal

- Analyst shares 5 reasons — including more regulation — why Facebook shares may fall next year 1. “Facebook’s Video Strategy Remains a Mystery … we haven’t seen much progress” in the last six months.

2. “Will the Next Leg of Growth be Completely Pricing Led? … Facebook has apparently hit the upper bound of its ad load on core Facebook, the story has moved from a largely volume driven one to a largely pricing driven one.”

3. “Can It Meaningfully Monetize its Other Platforms? … Despite the significant transaction for Messenger and WhatsApp globally, Facebook’s ability to meaningfully monetize them still remains a major question mark.”

4. “Emerging Regulatory Risk … a more significant regulatory overhang … could pressure Facebook’s multiple.”

5. “Everyone Loves … It .. [With Wall Street’s] rating distribution that is this overwhelming positive, any hiccups in growth or profitability could lead to a downside reaction that is amplified.”