Study of RUT and TNA

- 07/16/2024 – Stock Market Rally Broadens to Small Caps in Another Win for the Bulls – Markets Insider (businessinsider.com)

- The S&P 500 rally is broadening beyond mega-cap tech stocks to smaller companies.

- That’s a great sign for the sustainability of the current bull market.

- “Never forget, the lifeblood of a bull market is rotation and we see that happening the remainder of this year.”

According to Bespoke Investment Group, the small-cap Russell 2000 Index is on track to notch a five-day win streak of more than 10% after it gained an additional 2.5% on Tuesday.

Bespoke Investment Group

“If today’s rally holds, this will be the Russell’s 5th straight trading day of 1%+ gains. There have only been four other five-day streaks of 1%+ gains in the index’s history dating back to 1979,” Bespoke said in an email on Tuesday.

Perhaps what’s more impressive than the massive rally in small-cap stocks is that large-cap stocks have largely missed out on the gains over the past week.

“If today’s move holds through the close, this will be the biggest five-day outperformance that the Russell 2000 has ever seen against the S&P 500!” Bespoke said, with the relative outperformance nearing nine percentage points.

And according to UBS, the rotation into smaller-cap stocks, which is considered healthy for the broader market, could have legs if four things happen.

The bank said in a note on Tuesday that as long as inflation remains contained, the Fed starts cutting interest rates, the economy continues to grow, and earnings growth extends to smaller companies, the broadening out of the stock market rally should continue.

In other words, a lot has to go right for this small-cap trade to work, which leaves UBS somewhat cautious on its recent rally.

“While all of these four factors seem very much possible and, on the table, it might take a disappointment in only one area to send any signs of broadening into reverse,” UBS said, adding that the first two conditions seem more likely than the last two.

But Shannon Saccocia, CIO of Neuberger Berman Private Wealth, expects small-cap earnings to see big improvements going forward.

“This broadening out is consistent with our view that earnings outside of the largest U.S. stocks have opportunities to deliver earnings growth in the second half of the year, while the top names are likely to experience an incremental deceleration in earnings growth – although admittedly still at attractive absolute and relative levels,” Saccocia told Business Insider via e-mail on Tuesday.

Carson Group chief market strategist Ryan Detrick also sees a sustainable rally in small-cap stocks going forward.

“We’ve expected this bull to broaden out and now that inflation is last year’s problem and interest rate cuts are on the way, it has provided cover for investors to move into the more rate sensitive smaller names. In the second half of this year, we expect to see things like small/midcaps and industrials and financials to take the baton from large cap tech, which would be perfectly normal at this stage of the bull market,” Detrick told Business Insider in an e-mail on Tuesday.

And such an event would ultimately dispel the bearish concern among some investors: that the stock market rally is too narrow.

“In a healthy bull market, you want to see wider participation,” Detrick said. “Never forget, the lifeblood of a bull market is rotation and we see that happening the remainder of this year.”

- 07/16/2024 – Stock Market Today: Dow Jumps More Than 600 Points; Bank Earnings in Spotlight — Live Updates (wsj.com)

Investors are extending their rotation from shares of mega-cap tech companies to small-cap stocks. – this happens so fast, I cannot capture it fast enough.

The Russell 2000 rose 3.5% on Tuesday, its fifth consecutive session of gains. It closed at the highest level since January 2022.

The small-cap index has outperformed the Nasdaq Composite by about 11 percentage points over the past five trading days, the largest degree of outperformance since December 2000, according to Dow Jones Market Data.

The Russell 2000 has beaten the S&P 500 by about 10 percentage points over the same period, the widest five-day outperformance on record, based on data going back to 1986.

- 07/15/2024 – Fundstrat’s Tom Lee is bullish on small caps (cnbc.com) “We have small caps even more oversold and valuations — whether you look at medium P/E, which is now at 10 times 2025 earnings — even lower,” Fundstrat’s Tom Lee told CNBC. “So we think that this move could be something like 10 weeks and as much as 40%. So I think it is just startin. Also the short interest is high on IWM so far

- The Russell 2000 could rally 40% amid a shift in Fed policy, Fundstrat’s Tom Lee told CNBC.

- The rotation out of large-caps will become evident in August, weighing on the S&P 500, he said.

- This rally should be bigger than the one seen last year, Lee added.

A rally may be brewing in overlooked parts of the stock market.

On Monday, the small-cap Rusell 2000 climbed 1.8%, reaching a high not seen in two and a half years. The index has notched gains amid signs of buckling in large-cap peers and a rotation out of the biggest winners of 2024 as markets position for rate cuts.

Last Thursday, the tech-heavy NASDAQ shed 2% as the Russell rose 3.6%.

“We have small caps even more oversold and valuations — whether you look at medium P/E, which is now at 10 times 2025 earnings — even lower,” Fundstrat’s Tom Lee told CNBC. “So we think that this move could be something like 10 weeks and as much as 40%. So I think it is just starting.”

June’s consumer price index report gave the Russell 2000 its green light to rally, he said, given how “astonishingly soft” the data was. That month, inflation cooled off more than expected, bolstering expectations that the Federal Reserve would cut interest rates come September.

- 07/09/2024 – Highlights from the Value Investing Seminar in Italy; Out-of-favor sectors | Stansberry Research

I started with this chart from Bilello’s Week in Charts post on small-cap stocks, which have been trailing badly this year:

In fact, it’s not just this year – they’ve been trading at a quarter-century low relative to the S&P 500:

The last time this happened, small-cap stocks outperformed by a wide margin:

It’s a similar story among value stocks, which have also been trading at a quarter-century low relative to growth stocks:

Similarly, they also subsequently outperformed by a wide margin:

Lastly, I showed that U.S. stocks have outperformed international ones for 16 years running – recently reaching an all-time relative high:

I concluded my presentation by saying that I would hang on to the large-cap tech winners that I had picked a year ago… but would also look to put new cash to work in small- and mid-cap value stocks and, if they’re within your circle of competence, international stocks.

In tomorrow’s e-mail, I’ll share highlights from some of the other presentations at the Value Investing Seminar, so stay tuned for that.

- 07/22/2020 – small businesses are struggling, stimulus plan is only temporary help, vaccine is the only solution

Small Businesses Brace for Prolonged Crisis, Short on Cash and Customers

Hopes for a quick economic recovery from the coronavirus pandemic have been dashed, and companies are exhausting rescue funds. Many are shutting down or slashing jobs again.

Chris Mittelstaedt successfully navigated his San Francisco Bay Area fruit and snack delivery business through the dot-com bust, the 2008 financial crisis and the first few months of the economic ravages of the coronavirus pandemic.

But, along with many of America’s small-business owners, his hopes for a quick economic recovery have been dashed. Surging Covid-19 cases in many parts of the country and fears of additional outbreaks are forcing him to face a longer-term financial crisis.

Congress sought to allay those strains with PPP funds. The program provided a quick influx of cash to struggling businesses, allowing many of them to retain employees or bring back workers. The loans are generally forgivable if businesses spend a certain share of the funds on payrolls and meet certain other requirements.

The federal government as of July 21 had approved about five million PPP loans, worth a total of $518 billion, according to the Small Business Administration, the agency overseeing the program.

But lawmakers designed the PPP to help owners manage through a V-shaped recovery—a steep but brief collapse in demand, followed by a swift rebound. Many firms have now burned through the loans, but sales have only barely picked up—leaving them without funds to keep paying their full pre-pandemic workforce.

On Friday, Treasury Secretary Steven Mnuchin said Congress should consider automatically forgiving PPP loans taken out by the smallest U.S. businesses and offer a second helping of aid to some firms.

- 06/03/2020 – this is very good for TNA and FAS and economy in general

POLITICS: Senate passes bill to give businesses flexibility in spending coronavirus aid, sends it to Trump

- The Senate passed a bill to ease rules about how small businesses can use Paycheck Protection Program loans and still get them forgiven.

- Sen. Ron Johnson earlier blocked an attempt to unanimously approve the legislation, seeking assurances about later changes.

- The measure now heads to President Donald Trump for his signature.

- 05/17/2020 – Lawmakers and government officials are preparing to make significant changes to the Paycheck Protection Program, amid cooling demand for government-backed loans and criticism from business owners who say they can’t tap the funds. Good for TNA

U.S. Expected to Revise Small-Business Aid Program

Changes likely to give firms more flexibility and time to spend funds from the Paycheck Protection Program

- 05/16/2020 – The main reason that Russell2000 is lagging way behind mid- and large sector (SP500) is it has tech sector shortage (only 15.11%). But given its large percentage of health care sector, R2000 might out perform in the second half of this year. In addition, Russell 2000 are a forward indicator of the economy, it might breakout.

Why Small-Caps Are Lagging in This Economic Downturn

Prior to Covid-19, lower rates from the Fed should have created an optimal opportunity for the Russell 2000 to outpace large-cap indices.

if small-cap stocks and specifically the Russell 2000 are a forward indicator of the economy, we may be approaching a breakout zone if the Russell 2000 gains begin outpacing those of the S&P 500 and large caps. According to Stephen Mathai-Davis, CEO of Quantalytics AI, “during the rally at the start of Donald Trump’s presidency, for every one unit gain in the S&P 500, the Russell 2000 was going up nearly one-and-a-half times.”

Although this recovery will be much different because of Covid-19 and the effect that it is having on small business, the Russell 2000 could again be an indicator once the economic tide begins to turn.

Too bad I forgot to sell RUT2000 in my 401k plan back in Sept, I reminded myself once but forgot to execute!!!!!!!!

In the recent slide, small-cap stocks have particularly taken it on the chin—with the Russell 2000 down 2.4% in September and 13.9% in October. That underperformance should continue, warns RBC Capital Markets’ head of equity strategy, Lori Calvasina. Small-caps were so popular earlier in 2018 that the trade became crowded, she wrote last week, with the Russell 2000 futures’ positioning in September matching its December 2016 highs, and still only halfway back to previous lows.

Calvasina recommends hugging the sidelines. She notes that so far in the second half, 44% of Russell 2000 companies have trimmed their 2018 and 2019 margin estimates, compared with 38% of the S&P 500. The reason: higher labor and materials costs.

- 08/15/2017 – Summary

- The Direxion Small Cap Bull 3X (TNA) exchange-traded fund (ETF) is a leveraged, high expense-ratio fund from Direxion Investments that aims to produce 300% of the daily investment results of the Russell 2000 Index. In the period between 2010 and 2015, TNA performed well, with a rate over return exceeding 35%. Introduction of TNA is here or TNA_ Investopedia.

- TNA a small-cap focused and U.S.-centric ETF. While TNA’s management only binds itself to being 80% invested in the Russell 2000, the performance between the two mirrors very closely.

- The sector composition of the Russell 2000 changes depending on changing market caps for listed U.S. companies. However, it’s usual for nearly 25% to be financial services companies, with other significant exposure to health care, technology and consumer discretionary sectors. No single company’s stock comprises more than 1% of the index.

- The fund facts of TNA/TZA are listed in this TNA_TZA_Factsheet

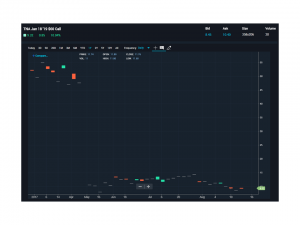

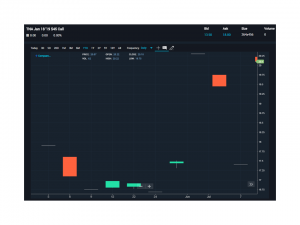

- There are 2 years options of TNA/TZA which I can trade (see following figures of Jan 19″ calls, strike prices $50, $45, $60, respectively).

- Due to the upcoming tax reform, the current historical low interest rate and the deregulation of financial industry, I think I can long on TNA Calls.

Jan18 2019 $50 call, min $13.2 max $17.80

Jan18 2019 $40 call, min $16.5 max $20.10

Jan18 2019 $60 call, min $9.6 max $14.90