Study of AI

- 07/18/2024 – ‘Godmother of A.I.’ Fei-Fei Li Has Created a $1B Startup in Less Than 4 Months (msn.com)

In January, A.I. pioneer Fei-Fei Li began a two-year leave from her position at Stanford University and updated her LinkedIn to describe her current work as “something new.” That new venture has been revealed to be a startup called World Labs that has already achieved a $1 billion valuation merely four months after launching, as reported by the Financial Times.

Through her new company, Li is now working on creating spatial intelligence—a concept she delved into during an April TED Talk. “If we want to advance A.I. beyond its current capabilities, we want more than A.I. that can see and talk. We want A.I. that can do,” said Li during the talk. To illustrate the concept of spatial intelligence, she pointed to an image of a cat pushing over a glass. “In the last split second, your brain looked at the geometry of this glass, its place in 3D space, its relationship with the table, the cat and everything else, and you can predict what’s going to happen next,” she explained. “The urge to act is innate to all beings with spatial intelligence, which links perception with action.”

- 07/08/2024 – Why Nvidia, Tesla, Amazon And More Are Betting Big On AI-Powered Humanoid Robots (youtube.com) – great content on bots, worth viewing

- 07/05/2024 – Elon Musk on X: “Wise words from @AriEmanuel” / X

Endeavor CEO Avi Emanuel says Sam Altman is a conman and that Elon Musk gave him a lot of money to create a non-profit only for OpenAI to be turned into a for-profit company and we should not trust them to take sufficient caution with creating powerful AI

OpenAI has become somewhat of the poster child for AI advancements in recent years, opening ChatGPT up, offering more content for free and landing a big Apple partnership for iOS 18 to make it the LLM on everyone’s mind.

And, while the company still works to bring additional features from its ChatGPT-4o demo to fruition, its CEO already has his eyes on what’s next.

Sam Altman has been speaking at the Aspen Ideas Festival (via Decoder) about ChatGPT-5.

While Altman wasn’t keen to go into details on the next evolution of its LLM, Altman says it’ll offer a “significant leap forward”.

“I expect it to be a significant leap forward. A lot of the things that GPT-4 gets wrong, you know, can’t do much in the way of reasoning, sometimes just sort of totally goes off the rails and makes a dumb mistake, like even a six-year-old would never make,” he added.

Sam Altman’s mixed feelings about GPT-4

Back in May, Altman told a Stanford University lecture that “GPT-4 is the dumbest model any of you will ever have to use”, even going so far as to call the flagship LLM “mildly embarrassing at best”.

“It’s important to ship early and often and we believe in iterative deployment. If we go build AGI in a basement and then the world is kind of blissfully walking blindfolded along, I don’t think that makes us very good neighbours,” he said at the time.

That was followed by the very impressive GPT-4o reveal which showed the model solving written equations and offering emotional, conversational responses. The demo was so impressive, in fact, that Google’s DeepMind got Project Astra to react to it.

- 06/26/2024 – Prediction: 3 Unstoppable Artificial Intelligence (AI) Stocks Will Be Bigger Than Nvidia in 2030 (msn.com)

Developing those AI applications wouldn’t be possible without the data center graphics processing units (GPUs) designed by Nvidia (NASDAQ: NVDA). They contributed to an astronomical 427% increase in Nvidia’s data center revenue in the recent quarter, pushing sales to a record $22.6 billion.

That growth is the reason Nvidia’s valuation recently topped $3.2 trillion, making it one of the largest companies in the world.

Nvidia stock could also achieve a cheaper P/E ratio by falling. Whichever scenario plays out, here’s why I think AI titans Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), and Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL) will be worth more than the chip giant by 2030.

Jensen: Training a 1.8 trillion-parameter GPT model took about three to five months with 25,000 NVIDIA Ampere architecture GPUs. With Hopper, it would take about 8,000 GPUs and consume 15 megawatts over about three months. For Blackwell, in the same 90 days, it would need a quarter of the GPUs and a quarter of the power of prior models for the same task—only about 4 megawatts.

- Oracle shares popped on Wednesday, a day after the software company announced its fourth-quarter results that showcased a strong RPO backlog.

- The company reported $98 billion of RPO, the revenue it expects to receive from contracts in future quarters.

- CEO Safra Catz said the backlog is primarily driven by demand to use Oracle’s cloud to train AI models.

Executives from the company have recently taken advantage of these gains. As previously reported by Barron’s, Nvidia said in a late May regulatory filing that Chief Executive Officer Jensen Huang adopted the Rule 10b5-1 trading plan on March 14 to sell up to 600,000 shares through March 31, 2025.

He wasn’t alone. The filing also mentions three other executives at Nvidia who recently sold shares of the company. Debora Shoquist, Nvidia’s executive vice president of operations, on March 4 also adopted the 10b5-1 trading plan to sell up to 41,140 shares of Nvidia through June 2, 2025.

She was followed on March 22 by Chief Financial Officer Colette Kress, who adopted the same rule for the sale of up to 50,000 shares of common stock through May 15, 2025, the document shows.

Lastly, the filing says Nvidia’s executive vice president of worldwide field operations, Ajay Puri, adopted rule 10b5-1 for the sale of up to 100,832 shares of Nvidia’s common stock through July 11, 2025.

- 06/06/2024 – Nvidia ARM laptops may be in the works, and that could change everything (msn.com) It’s too early to speculate what Nvidia has in store for us, but by the looks of it, 2025 is already looking like an interesting year for laptops.

Imagine a laptop with an iteration of Nvidia’s ARM-based CPU combined with a powerful RTX graphics card, all enhanced by AI. Years ago, that would have sounded outlandish, but now it seems like it could actually happen.

In a recent interview with Bloomberg, Nvidia CEO Jensen Huang and Dell CEO Michael Dell more or less confirmed that Team Green will enter the AI-PC hype next year.

This could turn out to be a huge opportunity for Nvidia. Not only can the company help solidify Windows on ARM as a platform alongside the recently announced Copilot+ PCs but it might have what it takes to go beyond the boundaries and create a more holistic ecosystem that combines AI and gaming. Having firm control over the CPU could potentially unlock new levels of gaming experiences not only limited to laptops but also consoles and desktops.

It’s too early to speculate what Nvidia has in store for us, but by the looks of it, 2025 is already looking like an interesting year for laptops.

- 06/06/2024 – OpenAI CEO Sam Altman suggests GPT-5 may work like a ‘virtual brain’ with deeper thinking capabilities, demystifying it from the “mildly embarrassing at best GPT-4” (msn.com)

- 06/05/2024 – Tim Cook is about to reveal Apple’s plan to dominate the internet for another decade (msn.com)

- A 2005 deal between Apple and Google changed the way Americans use the internet.

- Apple may soon reveal a new arrangement that could do the same for the AI era.

- Tim Cook is expected to announce a partnership with OpenAI at WWDC to bring ChatGPT to iPhones.

On Monday, when CEO Tim Cook kicks off Apple’s Worldwide Developer Conference, he’s expected to unveil a new vision of artificial intelligence by announcing a partnership with OpenAI.

Bloomberg reported Wednesday that Apple is all but set to announce that the ChatGPT maker’s technology will be integrated into the iPhone operating system.

- 06/03/2024 – AMD Unveils Latest AI Chips, Accelerated Chip Update Timeline – WSJ

AMD has been making inroads in AI chips amid a shortage of Nvidia chips and a growing appetite for alternatives

- 06/02/2024 – AMD Announces Future AI Chips, Will Speed Rollout of New Models (msn.com)

- 06/02/2024 – Nvidia Goes All-In on AI Large and Small, Led by RTX AI Laptops (msn.com)

Nvidia, the company behind GeForce GPUs and high-end AI processing hardware, pushed to combine those two worlds at Computex 2024. The chipmaker revealed new ways that GeForce graphics hardware can bring faster, better AI tools to gamers and professionals alike. Nvidia’s plans start with leveraging the AI capabilities of its GeForce RTX GPUs (mobile and desktop) to enable a host of new automated, intelligent features.

- 06/01/2024 – He Turned 55. Then He Started the World’s Most Important Company. – WSJ Morris Chang had decades of experience before he founded a business that’s indispensable to the global economy. What can other middle-aged entrepreneurs learn from him?

- 06/01/2024 – Cathie Wood’s ARK Invest missed out on more than $1 billion in returns by selling Nvidia stock too early (msn.com)

- Cathie Wood’s decision to sell more than 1 million shares of Nvidia came as the stock rocketed to astronomical highs.

- Ark Invest has missed out on more than $1 billion in returns by selling Nvidia stock too early.

- Ark Invest sold 859,000 Nvidia shares in the fourth quarter of 2022, when the stock was trading below $150 per share.

- 05/30/2024 – AI in Education: Transforming Learning and Teaching (msn.com)

- 05/29/2024 – Bullish Nvidia Trade Soars as Day Traders Bet on Leveraged ETFs (msn.com)

A GraniteShares fund, which gives investors two times the daily return of the Jensen Huang-run company, is now up 450% over the past year, with a record $4.7 billion in trading volume last week. The $2.8 billion GraniteShares 2x Long NVDA Daily ETF (ticker NVDL) launched in December 2022.

GraniteShares has filed for at least 25 ETFs that track the performance of other single-stock ETFs that have daily 2x and 3x leveraged strategies.

“What we are providing is institutionally priced leverage to the masses — that’s the big breakthrough,” he added. “With leverage comes risk and these products are not without risk.”

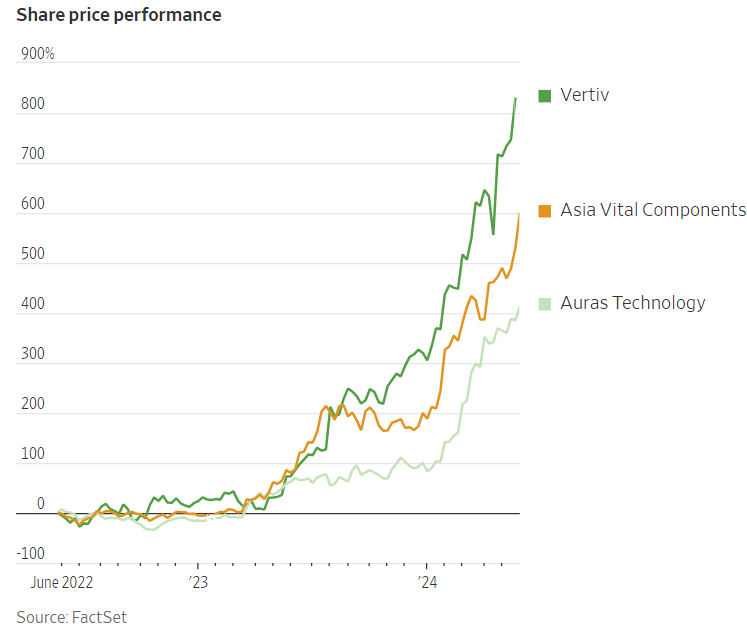

- 05/29/2024 – Cooling for AI Is a Hot Stock Market Trade—for Now – WSJ Companies like Vertiv that can help artificial-intelligence data centers dissipate heat have had gains of more than 600%

The explosive growth in AI has generated soaring energy demand in data centers, and lots of unwanted heat. That has cooked up opportunities for companies providing cooling systems for servers.

Electricity consumption for data centers in the U.S. is expected to grow around 30% from 2022 to 2026 to 260 terawatt-hours, according to the International Energy Agency. That is around 6% of total electricity demand in the country or enough to power 24 million American homes for a year. And most of that energy will dissipate as heat, which means a higher need for cooling systems.

Ohio-based Vertiv VRT -1.85%decrease; red down pointing triangle Holdings is one company riding the wave, providing both power and cooling systems for data centers. Its shares have surged nearly 700% since the end of 2022. Vertiv saw a 60% year-over-year increase in orders last quarter, excluding foreign exchange impact. That led to a record order backlog of $6.3 billion at the end of March. Around a third of the company’s sales came from thermal management for data centers.

Currently most data centers use fans to circulate air to keep temperatures down. But more powerful, and thus hotter, chips will stretch the limits of such air cooling systems. One way to overcome that is to run liquid coolant in pipes through servers to absorb heat. Liquid has higher heat capacity and transfers heat more quickly. For the same volume, water takes more than 3,000 times more heat than air to raise its temperature by one degree. More efficient cooling systems also allow data centers to pack servers closer together.

Goldman Sachs estimates that the server cooling market will reach $10.6 billion in 2026 from $4.1 billion this year. Within that market, liquid cooling will become more popular, with its penetration rate reaching 57% among AI servers in 2026, compared with 23% this year, according to the bank’s forecast. That will translate to better margins for cooling system providers given those systems’ more complex system design. Liquid cooling systems cost three to four times more than air cooling systems, according to J.P. Morgan.

Like those of U.S.-based Vertiv, shares of Asian manufacturers for components used in cooling systems have soared too. Shares of Taiwan’s Asia Vital Components 3017 -2.59%decrease; red down pointing triangle, or AVC, have risen 600% since the end of 2022 while Auras Technology 3324 5.64%increase; green up pointing triangle, also based in Taiwan, has gained 510%. Both companies are ramping up their production capacity to meet rising demand. Vertiv acquired CoolTera in December to boost its liquid cooling technology.

With technology giants from Microsoft to Meta pouring money into AI data centers, the excitement over cooling tech stocks is natural. But their shares are now trading at more than 40 times expected earnings, according to FactSet, compared with multiples below 20 before the AI frenzy. That has priced in a lot of growth potential already in a nascent industry whose future is difficult to predict.

Selling picks and shovels in the AI gold rush has been a winning trade, but investors need to keep a cool head.

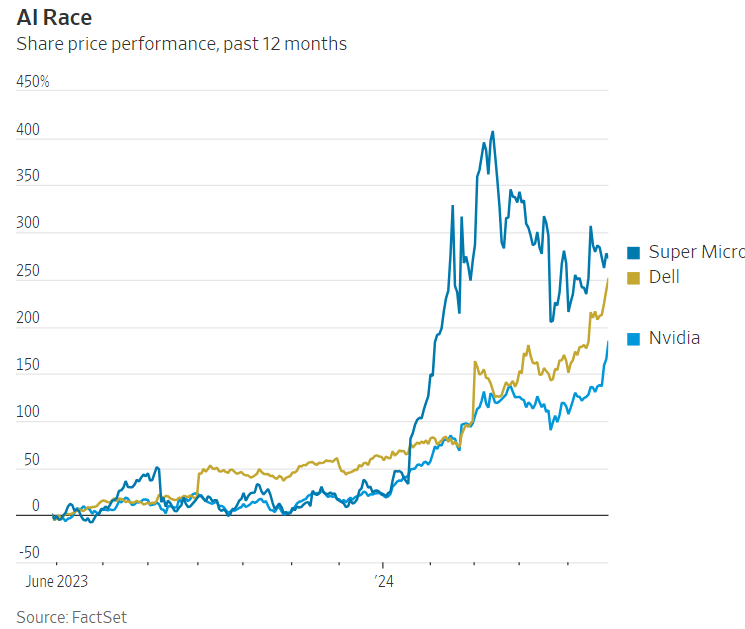

- 05/29/2024 – Dell Should Keep Shining in Nvidia’s Halo – WSJ Booming demand for AI servers is boosting storied tech giant as PC industry recovers

Investors’ enthusiastic reception sets a seemingly high bar for Dell ahead of its next earnings report, set for Thursday afternoon. Dell’s server revenue beat Wall Street’s projections by 16% for the fiscal quarter that ended in July 2023, giving the stock a 21% lift the following day. In March, Dell reported that its AI server backlog nearly doubled during its fiscal fourth quarter. That sent the stock up 32% the following day.

A new class of machines with on-device AI is also hitting the market this year, creating the potential for further uplift. Bernstein analyst Toni Sacconaghi rates Dell’s shares as a buy, even while admitting to worries about the sustainability of the AI server business.

“That said, we see several other levers (storage, traditional servers, and AI PCs), which can be meaningfully accretive to EPS in FY25,” Sacconaghi wrote in a note last week.

That is doable, especially given the strong demand Nvidia said last week that it expects to see for its new class of chips launching later this year. Dell’s main constraint might be getting its hands on enough of those chips given the tight supply seen across the industry.

But Ng noted that Dell’s server customers “appear to have priority in GPU supply.” Dell also has a tight relationship with Nvidia, with Chief Executive Officer Jensen Huang joining Michael Dell onstage at Dell’s annual developer conference last week and singling him out from the audience during the keynote of his own big show in March.

“Nobody is better at building end-to-end systems of a very large scale for the enterprise than Dell,” Huang said at that event.

None of Dell’s competitors in the IT equipment space got such a shout-out. But turning those words into actual sales will be vital considering the premium Dell is now fetching to more traditional rivals such as Cisco and Hewlett Packard Enterprise. It has some big numbers to serve up.

- 05/27/2024 – Nvidia CEO Jensen Huang talks blowout quarter, AI, inferencing, ongoing demand, and more (youtube.com)

- 05/25/2024 – Khan Academy CEO on how AI will change education | Watch (msn.com)

- 05/27/2024 – AI Is Driving ‘the Next Industrial Revolution.’ Wall Street Is Cashing In. – WSJ Old-school stocks in the utilities, energy and materials sectors are outpacing the wider market

Demand for artificial intelligence is still booming, a year after the phenomenon first took Wall Street by storm. Far beyond the tech sector, investors are finding winners in old-school pick-and-shovel stocks.

Deep-pocketed companies are investing heavily in AI technology, which has meant a windfall for chip makers such as Nvidia NVDA 2.57%increase; green up pointing triangle and a host of businesses—such as suppliers of power, labor and raw materials—to operate their products.

Wall Street is taking notice. The utilities sector of the S&P 500 has returned 15% over the past three months, topping all other corners of the index. Energy and materials stocks have outperformed the broader market, which has advanced 4.2% over that period. Share prices are surging for industrial firms that stand to benefit from data-center expansion and renovation.

Nvidia’s earnings report last week showed that demand for AI capabilities is only gaining steam. The company booked $26 billion in sales for its latest quarter, more than triple the total from a year earlier. The graphics-chip manufacturer’s stock is trading at record levels, more than doubling this year.

“The next Industrial Revolution has begun,” with businesses and countries converting existing data centers into “AI factories,” Chief Executive Jensen Huang said on an investor call.

Big-tech companies such as Microsoft and Meta Platforms are spending billions on Nvidia’s chips and related infrastructure to build out their own AI capabilities. The government could be joining in: A bipartisan Senate group recommended tens of billions of dollars in new federal spending related to AI in the years ahead.

“That is where the investable opportunities are,” said Lauren Goodwin, economist and chief market strategist at New York Life Investments. “It’s data-center builders and operators, power and utilities.”

Data center executives have said that surging demand means longer delivery times for essential equipment such as backup generators and cooling systems.

“We have seen a broadening out of the AI trade. It’s no longer dependent on just one stock,” said Nadia Lovell, senior U.S. equity strategist, global wealth management at UBS. “Chips are foundational, but they’re not the whole house.”

The Global X U.S. Infrastructure Development ETF has returned 13% this year, outpacing the S&P 500’s 11% advance.

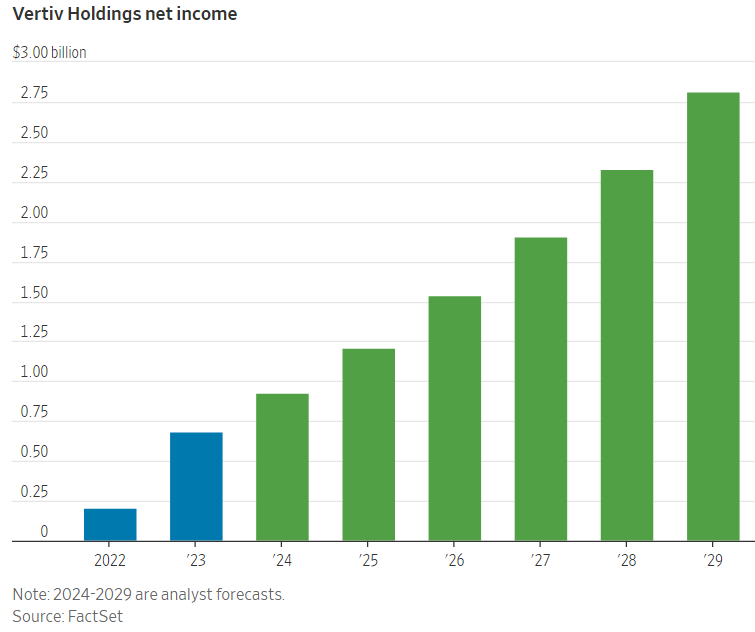

Shares of Vertiv Holdings, which makes equipment that powers and cools data centers, have more than doubled this year. The company said new orders grew 60% from a year earlier in the first quarter. Wall Street analysts had expected about 15% growth and have revised their profit forecasts sharply higher for the years to come.

“Though still in its early stages, AI is quickly becoming a pervasive theme across our end markets,“ Vertiv CEO Giordano Albertazzi said last month.

Eaton, a company that makes power-management equipment, has advanced 42% this year. Johnson Controls, which manufactures electronic systems for commercial buildings, is up 28%.

Infrastructure stocks could get a further boost if the Federal Reserve cuts interest rates later this year, as many investors expect. Investors will be watching Friday’s release of the personal-consumption expenditures index, the Fed’s preferred inflation gauge, for clues about the path forward on rates.

The rally has left shares trading well above their long-term averages. Eaton trades at 31 times its expected earnings over the next 12 months, while Vertiv trades at 40 times. The S&P 500’s multiple is 21 times.

The unfolding spending boom means high valuations for industrial firms are less of a risk than usual, according to Joseph Ghio, an analyst at Williams Jones Wealth Management. “These companies are less cyclical than they used to be,” he said, adding that he thinks Eaton can nearly double its profit over the next five years.

His firm owns shares of Eaton and Quanta Services, which supplies skilled labor to power companies, on behalf of clients. Quanta stock is up 31% this year.