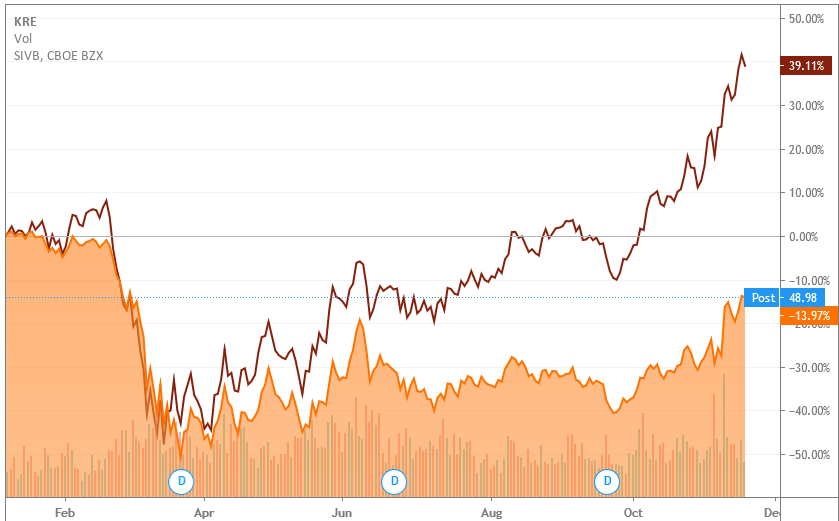

Study of DPST, KRE and FAS

- 02/24/2024 – realistic comments on small stocks

Small-Cap Stocks May Be At Risk According To NFIB Data | Seeking Alpha

- 02/24/2024 – this is the effect of friction on leveraged ETFs, be aware!!

XLF (all time high, 40.3 vs 41.17) vs FAS (1/3 less than ATH, 98.82 vs 150)

QQQ (all time high, 9% higher than ATH in 2021, 436.78 vs 404) vs TQQQ (0.385 less than ATH in 2021, 60 vs 89), so total is about 50% less than should be ATH

KRE and DPST

- 02/16/2024 – MSN InvestorPlace

The Latest Inflation Data Is Out – Here’s What It Could Mean for the Federal Reserve (msn.com)

According to FactSet, 79% of S&P 500 companies have now announced quarterly results, and 75% of these companies exceeded analysts’ earnings expectations. The S&P 500 is now anticipated to achieve fourth-quarter earnings growth of 3.2%, up from 2.9% last week and previous expectations for a 1.4% decline in the final week of January.

These positive results have continued to drive all of the major indices higher, with the S&P 500 breaking through 5,000 for the first time ever last Friday.

However, earnings season took a back seat this week as investors shifted their attention to the latest inflation reports and January U.S. sales results.

Consumer Price Index (CPI)

The Consumer Price Index (CPI) reading for January was released first thing Tuesday morning – and the data showed that inflation continues to cool, though not as quickly as economists had hoped. Headline CPI rose 0.3% in January and was up 3.1% in the past 12 months. That was higher than economists’ expectations for headline CPI to rise 0.2% month-over-month and for a 2.9% annual pace. However, it’s still down from December’s 3.4% annual pace.

Core CPI, which excludes food and energy, increased 0.4% in January and was up 3.9% in the past 12 months. This was also a little hotter than forecasts for a 3.7% annual pace and a 0.3% month-to-month rate. The annual pace of core inflation remained in line with December’s 3.9%.

Taking a closer look at the details…

- The food index increased 0.4% (“food at home” was up 0.4%, while “food away from home” rose 0.5%).

- The energy index fell 0.9% over the month thanks largely to a decline in gasoline prices.

- The index for used cars and trucks and the index for apparel both fell over the month.

-

But the big bugaboo with the CPI continues to be Owners’ Equivalent Rent (OER), which accounts for two-thirds of the CPI. OER rose 0.6% in January, which compares to the previous two months’ rise of 0.4%, and is now up 6% in the last 12 months. So, unfortunately, high shelter costs are still pushing the CPI higher.

U.S. January Retail Sales

The January retail sales report was released on Tuesday – and it was weak across the board. The Commerce Department announced that retail sales fell 0.8% in January, which was substantially lower than economists’ expectation for a 0.2% decline. This month-over-month decline marks the largest fall since March 2023.

Out of the 13 categories noted in the report, nine saw decreases from a month ago. Digging a little deeper into the details…

- Leading the decline was building materials, falling 4.1%.

- Sales at miscellaneous stores dropped 3%.

- Gas station sales fell 1.7%.

- Sales at furniture and home stores rose 1.5% and spending at bars and restaurants increased 0.7%.

Overall, this report was just really disappointing. I should also add that the Commerce Department revised the December retail sales numbers from a 0.6% gain to a 0.4% gain.

Producer Price Index (PPI)

This morning, the Labor Department reported a rather disappointing Producer Price Index (PPI) for January that was higher than economists’ expectations.

Now, the PPI is important because it measures the price of goods at the wholesale level. The PPI tells us what producers are paying for goods and services before they reach consumers. It’s considered a good leading indicator of inflation, so the markets were keen to get the report.

So, let’s dig into the numbers…

- PPI rose 0.3% in January and 0.9% in the past 12 months.

- Core PPI, excluding food, energy and trade margins, surged 0.6% in January and rose 2.6% in the past 12 months.

- Excludes food and energy, PPI rose 0.3% in January.

- Wholesale food and energy prices decreased 0.3% and 1.7%, respectively, in January.

The real problem with the wholesale inflation continues to be wholesale service costs, which rose 0.6% in January and is the largest monthly increase in the past 12 months (since January 2023). But the bright spot remains wholesale goods costs, which declined 0.2% in January and was the fourth straight monthly decline.

While this report came in hotter than expected, I do want you to know next month it should fall quite a bit because we’re cutting off a big increase from a year ago. What’s also clear is that the U.S. continues to import deflation from China.

China’s National Bureau of Statistics announced that consumer prices declined -0.8% in January, which is the biggest monthly drop since September 2009. Furthermore, wholesale prices based on the Chinese producer price index, plunged -2.5% in January.

And since the U.S. is importing this deflation from China, the Fed has to be careful because global deflation is spreading.

Reading Between the Lines

So, the big question for the market is: Will the Federal Reserve cut key interest rates on May 1 or June?

Based on the data from this week, I would say that June is more likely, but it is really dependent on market rates. Currently, the 10-year Treasury yield stands at about 4.29%, well below the federal funds rate of 5.25% – 5.50%. So, the Fed is still out of sync with market rates.

- 02/16/2024 – Bloomberg

Fed’s Barr Says Regulators Are Eyeing Commercial Real Estate Risk (yahoo.com)

(Bloomberg) — US regulators are “closely focused” on risks in commercial real estate loans, and have stepped up downgrades of supervisory ratings on lenders amid new strains on their finances, according to the Federal Reserve’s chief bank watchdog.

Supervisors are looking at what banks are doing to mitigate potential losses, how they are reporting risks to their boards and senior management, and whether they have enough reserves and capital to handle CRE loan losses, said Michael Barr, the Fed’s vice chair for supervision, in remarks Friday at Columbia University in New York.

“For a small number of banks with a risk profile that could result in funding pressures for the firm, supervisors are continuously monitoring these firms,” Barr said.

Regulators are tightening scrutiny after turmoil that felled three big regional lenders a year ago, while preparing a new round of international standards that have faced pushback from the industry. With more office and apartment buildings headed for distress, the central bank issued guidelines on Thursday for its annual stress tests that put extra emphasis on identifying risks in commercial property.

Barr cited concern about the impact on banks from the changing economic, interest-rate and financial situations.

“Because of the heightened risk environment and heightened supervisory attention, the Federal Reserve has issued more supervisory findings and downgraded firms’ supervisory ratings at a higher rate in the past year,” Barr said. “In addition, we have increased our issuance of enforcement actions.”

Barr is leading efforts to upgrade oversight after criticism by the Fed’s inspector general that followed the failure of Silicon Valley Bank a year ago. The approach that supervisors use for mid-size bank examinations “did not evolve with SVB’s growth and increased complexity,” and didn’t effectively transition the firm to the process used to examine large banks, according to the inspector general.

The Fed also has taken heat for the number of bank examiners who’ve left and other woes with front-line supervisory staff.

Read More: Bank Examiner Exits Risk Undermining Regulators’ Post-SVB Fixes

Barr said the Fed is looking to improve the speed, force and agility of its supervision to match the risks, size and complexity of the banks it oversees. Meanwhile, he said, as a regional bank gets bigger and more complex, there’s an expectation that its executives should also scale up their ability to manage the firm’s risk along the way.

“The goal is that the transition to heightened supervision for fast-growing banks is more of a gradual slope and not a cliff,” he said.

Banks still have mark-to-market losses on securities they hold due to higher interest rates, Barr said. That’s the same issue that led to SVB’s downfall. Other lurking concerns he cited include cybersecurity and the potential that artificial intelligence might be used to attack the banking system.

Read More: Dozens of Banks Rapidly Piled Up Commercial Property Loans

Commercial real estate isn’t all the same and it’s not all bad, Barr said. Some cities are doing better than others, he noted, and even within a given city, some high-end properties and buildings are faring better than others.

“So supervisors are looking under the hood” at the variety of CRE risks, Barr said. “We’re really looking at a very granular level.”

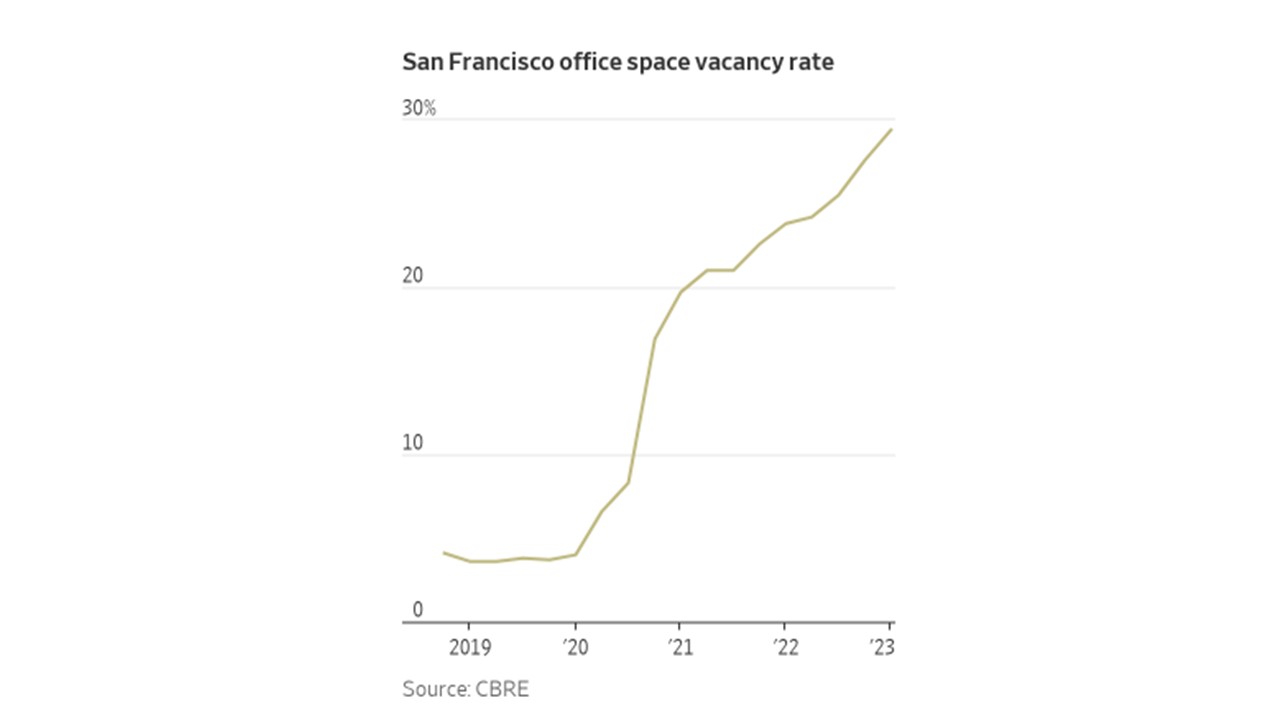

- Problems for the US commercial real estate sector seem to be getting worse — and spreading.

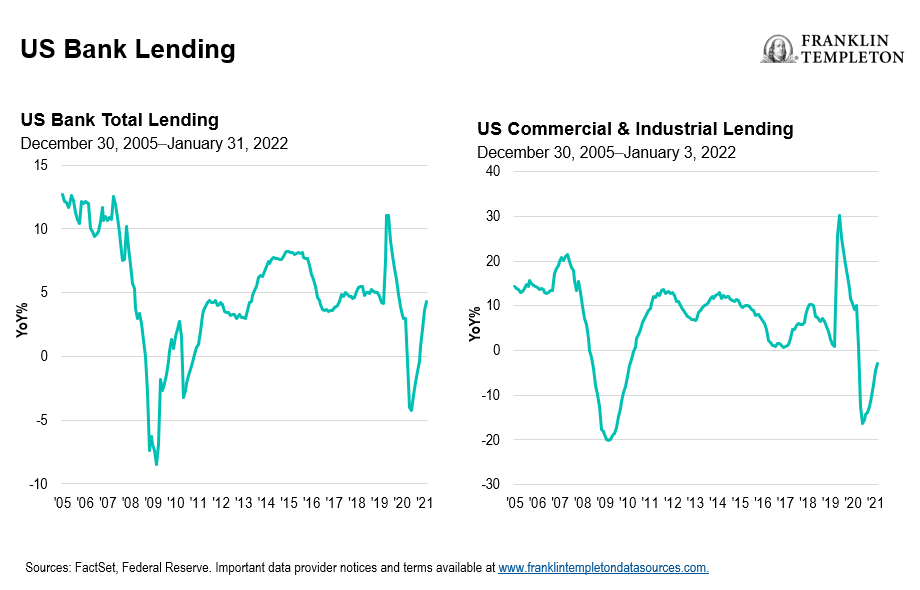

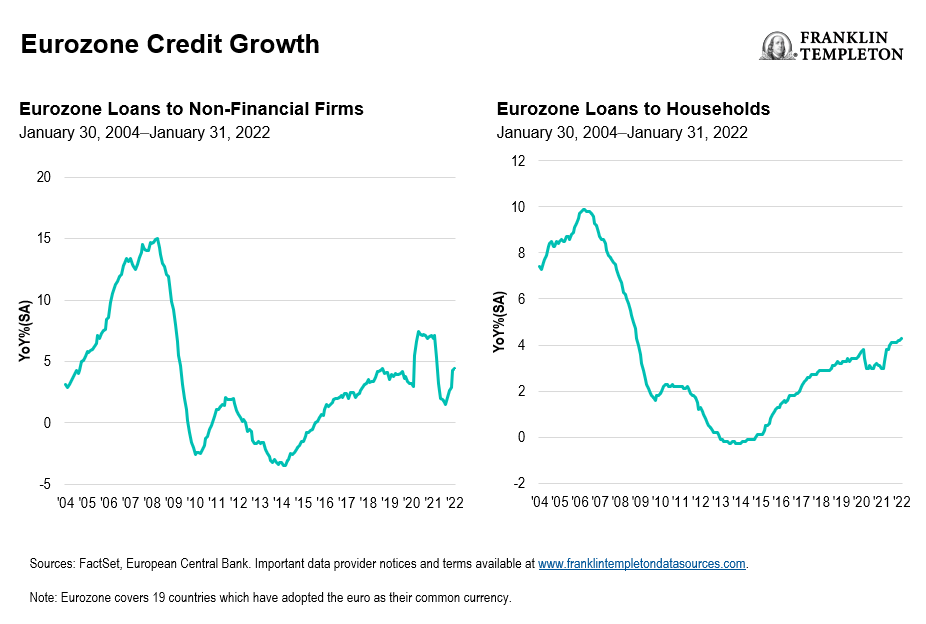

- Steeper interest payments, tighter bank lending, and declining asset values have slammed the sector.

- Some bold buyers plan to capitalize on the chaos by scooping up bargains.

The tremors rattling US commercial real estate are spreading to other countries and sectors, and threaten to escalate into a financial earthquake as refinancing deadlines loom.

- 02/16/2024 – Tilson

1) Right now, two of my colleagues have teamed up for the first time ever to sound the alarm on something they see brewing in the markets…

2) In my e-mail 10 days ago, my friend who’s an expert in the financial sector made the case for why he’s long Wells Fargo (WFC), despite being bearish on banks in general. As I said then:

My friend thinks this makes Wells Fargo a good value compared with the rest of the large banks, with a catalyst being an eventual exit from the regulatory doghouse and potential return to a more normal historical valuation and increased capital return to investors.

Sure enough, as CNBC reports, this news came out yesterday… triggering a 7.2% jump in the stock: Wells Fargo says regulator has lifted a key penalty tied to its 2016 fake accounts scandal. Excerpt:

- 02/16/2024 – By Nick Timiraos, Reporter

The Fed’s Preferred Inflation Gauge Likely Posted Largest Rise Since Early 2023 (wsj.com)

The Federal Reserve’s preferred inflation gauge is likely to show that price pressures firmed in January, ending a streak of much better inflation readings.

Core inflation—as measured by the personal-consumption-expenditures price index, which will be released later this month by the Commerce Department—is likely to have increased by 0.4% in January, according to forecasts from a handful of Wall Street economists.

Core inflation excludes volatile food and energy prices, which forecasters believe makes it better capture underlying price trends.

Forecasters are able to come up with reasonably accurate forecasts of the core PCE index after they see price data from two other inflation indexes produced by the Labor Department: the producer-price index, which was released today, and the consumer-price index.

Omair Sharif of Inflation Insights and Skanda Amarnath of Employ America both project the core PCE index rose 0.36% in January. Economists at UBS, Goldman Sachs and Morgan Stanley project increases of 0.42%, 0.43% and 0.43%, respectively.

Those readings would be the highest since February 2023, but they would still run below the 0.51% increase in January 2023. As a result, a reading of just below 0.4% would lower the 12-month change in the core PCE index to 2.8%, from 2.9% in December. A reading just above 0.4% would hold the 12-month rate steady from December.

At a six-month annualized rate, core PCE inflation is likely to be around 2.5% in January, up from 1.9% in November and December, according to Alan Detmeister, an economist at UBS.

Detmeister expects headline inflation as measured by the PCE rose by 0.35% in January, lowering the 12-month rate to 2.4% from 2.6%. The Fed targets 2% inflation.

Friday’s Economic News Highlight: PPI Inflation Comes in Hotter Than Forecast (wsj.com)

Another inflation gauge is in the spotlight, following Tuesday’s stronger-than-expected consumer-price index.

The producer price index, which is just out, rose slightly more than expected in January. The update weighed on stock futures and pushed benchmark bond yields above 4.3%.

Just Out:

The PPI rose by 0.3% last month, topping the 0.1% forecast by economists. The index declined 0.1% in December.

Housing starts fell by 14.8% to a seasonally adjusted annual rate of 1.3 million in January. Economists had forecast 1.45 million.

- 02/15/2024 – Tilson, be aware of potential shock from Commercial real estate

A recent Bloomberg article caught my eye – it underscores the bloodbath in commercial real estate: The Brutal Reality of Plunging Office Values Is Here. Excerpt:

Since the COVID-19 pandemic upended the use of real estate around the world, lenders have had little incentive to get tough on borrowers squeezed by soaring interest rates and take on loans that had lost value. Transactions ground to a halt as potential sellers were unwilling to unload buildings at distressed prices – an outcome that allowed them to pretend that nothing had fundamentally changed…

Across the country, deals are starting to pick up, revealing just how far real estate prices have fallen. That’s spurring widespread concern about losses that can ripple across the global financial system – as underscored by the recent turmoil unleashed by New York Community Bancorp, Japan’s Aozora Bank Ltd. and Germany’s Deutsche Pfandbriefbank AG as they took steps to brace for bad loans.

In Manhattan, brokers have started to market debt backed by a Blackstone Inc.-owned office building at a roughly 50% discount. A prime office tower in Los Angeles sold in December for about 45% less than its purchase price a decade ago. Around the same time, the Federal Deposit Insurance Corp. took a 40% discount on about $15 billion in loans it sold backed by New York City apartment buildings.

Charlie Bilello, in his latest Week in Charts, also shared data on what’s causing this.

As he shows in this chart, the office vacancy rate in the U.S. is up to 19.6% – the highest level in history:

And as he says with his next chart:

The main reason: workers are not going back to the pre-COVID model of five days per week in the office, with most major cities hovering around 50%. As long commercial leases continue to roll off, that means less space is needed going forward, with increasing vacancies over time.

- 02/08/2024 – Tilson

Despite my friend’s overall bearishness toward the sector, he does own one large-cap bank, Wells Fargo (WFC) – which I discussed in Tuesday’s e-mail – as well as five idiosyncratic “special situation” small-cap and even microcap bank stocks. I discussed two of these in yesterday’s e-mail: Eastern Bankshares (EBC) and Ponce Financial (PDLB).

Before I turn to his final three favorite stocks, I want to share my friend’s thoughts on general areas in which he regularly makes money…

One is when he owns the stock of a small bank that’s acquired at a healthy premium. Recently, some of this activity, he says, is being driven by credit unions, which have an advantage as acquirers relative to their corporate-bank peers because they are quasi-nonprofits owned by their depositors (or “members”).

As such, they benefit from a weird and unjustified loophole in which they don’t pay taxes (the credit-union lobby spends more money than the National Rifle Association to protect this status).

My friend thinks Oakland, California-based Summit Bancshares (SMAL), a thinly traded microcap with only a roughly $50 million market cap, is likely to be acquired.

Another attractive bank stock my friend owns is W.T.B. Financial (WTBFB). It’s the holding company for Washington Trust Bank, a community bank based in Spokane, Washington, with $11.4 billion in assets.

I was surprised to hear that my friend’s final favorite idea isn’t a bank – it’s aircraft-engine leasing company Willis Lease Finance (WLFC).

It trades at only 70% of tangible book value – and he thinks book value is understated because Willis depreciates the new engines it buys on a straight-line basis over 15 years to a 55% residual value and carries them on the balance sheet at the lesser of appraised value or depreciated value.

In reality, the value of the engines has actually appreciated over the first five years due to inflation and scarcity value driven by supply-chain disruptions.

- 02/07/2024 – Tilson

Here’s a picture of us visiting the Virgin Galactic (SPCE) spaceport – a stock we recommended at Empire at $10.20 per share shortly before it soared (we recommended partial sales after it doubled and then tripled, with our final exit recommendation at $50 per share, just before it cratered – one reader made $10 million on this one idea!):

Picking up where I left off in yesterday’s e-mail, I’m continuing my series on the banking sector…

Despite my friend’s overall bearishness toward the sector, he does own one large-cap bank, Wells Fargo (WFC), as well as some idiosyncratic “special situation” small-cap and even microcap bank stocks.

Turning to my friend’s favorite off-the-beaten-track bank stocks…

He likes Eastern Bankshares (EBC), which he says is “the jewel of the Boston banking market” – one of the most attractive in the country because of the area’s many large educational institutions as well as health care and tech companies.

His favorite was to play this is Ponce Financial (PDLB), which operates in the Bronx. It was sort of a ho-hum bank, with $266 million of common equity, but then it applied for the maximum from the Treasury Department, which handed it $225 million!

The pain in commercial real estate has been slow to unfold. While changes in office habits that have hollowed out downtowns are nearly four years old and rates began rising two years ago, landlords have been cushioned by rent from tenants on long-term leases that have been gradually burning off.

In all, more than $2.2 trillion of U.S. commercial property loans are set to come due by 2027, according to the data tracker Trepp. Many banks have given short extensions to loans that were due to expire over the past two years, putting the day of reckoning off to the future.

“The commercial real-estate pain in the office sector is just starting,” Anne Walsh, the chief investment officer of Guggenheim Partners Investment Management, said last month at the World Economic Forum in Davos, Switzerland.

She said small and midsize lenders especially face substantial numbers of loans to office landlords that refinance in the next 24 months, and likened the situation to a “rolling recession” for banks that could drag on for some time.

Some of the biggest risks come at the maturity of loans, which tend to run five to 10 years in term. As cheap loans from an era of low rates and high prices come due, landlords are increasingly unable to find new loans to replace them.

The warnings revived fears that troubles in the banking sector could resume after last March’s banking crisis, though many investors remain sanguine that most banks have ample reserves to absorb losses. Falling interest rates could also help provide relief among stressed borrowers. The Federal Reserve this week signaled it was thinking about when to lower interest rates but hinted a cut wasn’t imminent.

Regulators have been watching carefully, and worry about the prospects for further contagion into the financial sector, particularly if there were a significant recession.

- 05/06/2023 – Tilson

despite his overall bearishness toward the sector, he does own some idiosyncratic “special situation” stocks, all of which are small caps and even microcaps.

There’s one exception, however: He owns Wells Fargo (WFC). I’ll share his thoughts on it here and save the smaller stocks for tomorrow’s e-mail…

He argues that Wells Fargo was somewhat saved by the fact that, due to past scandals, regulators had imposed an asset-cap rule, which restricts its asset growth to no more than 3% annually. As he says, the asset cap pushed the company to focus on more profitable businesses while shrinking or ridding itself of less profitable businesses.

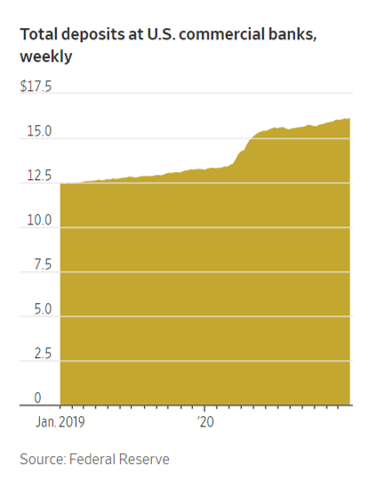

The asset cap also proved to be a blessing because it prohibited Wells Fargo from taking all of the extraordinarily high level of deposits that flooded other banks, which, as my friend discussed last week,

However, given his overall bearishness on the banking sector, he also says that he would keep the stock as a smaller position and/or offset it with a short position in the sector.

- 02/05/2024 – Tilson

Latest thoughts on the banking sector (part 4) | Stansberry Research

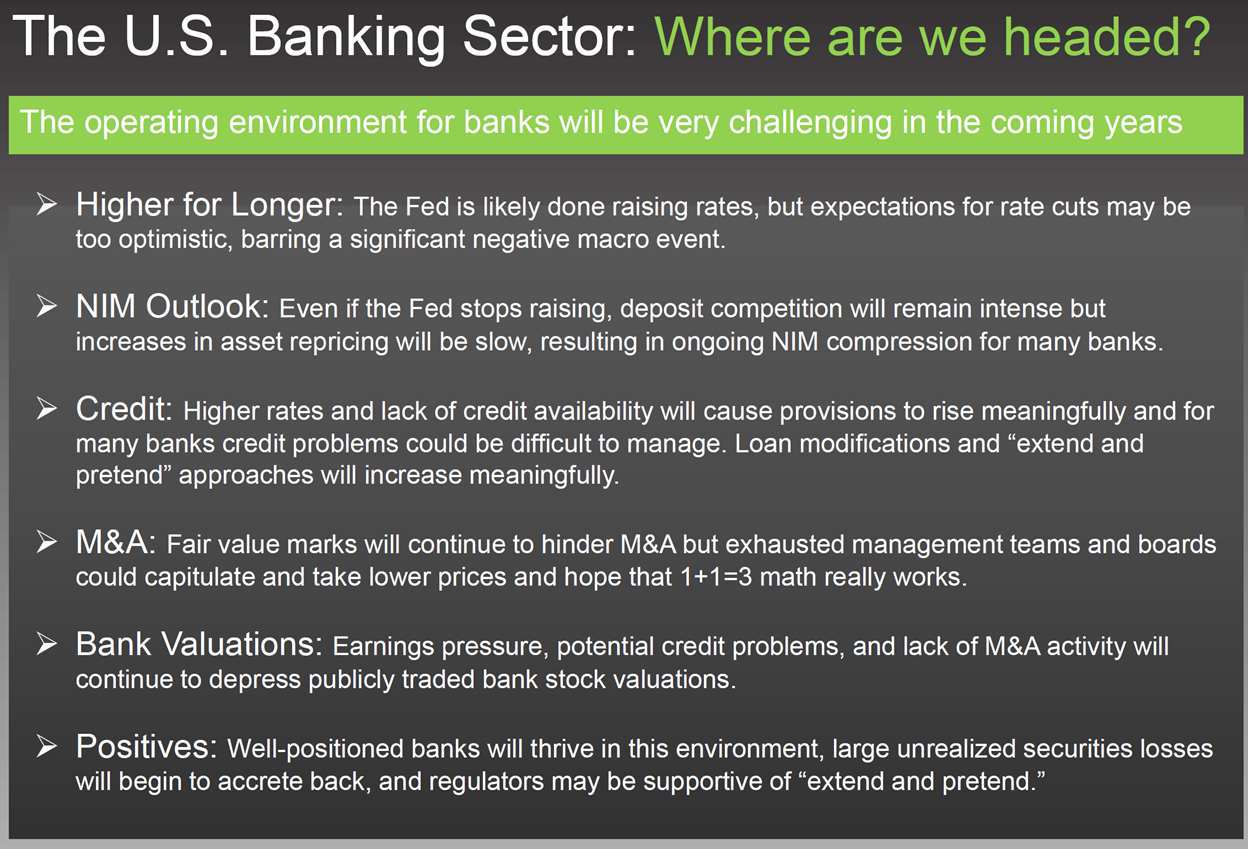

- this smartest bank analyst correctly predicted the headwinds of bank sector

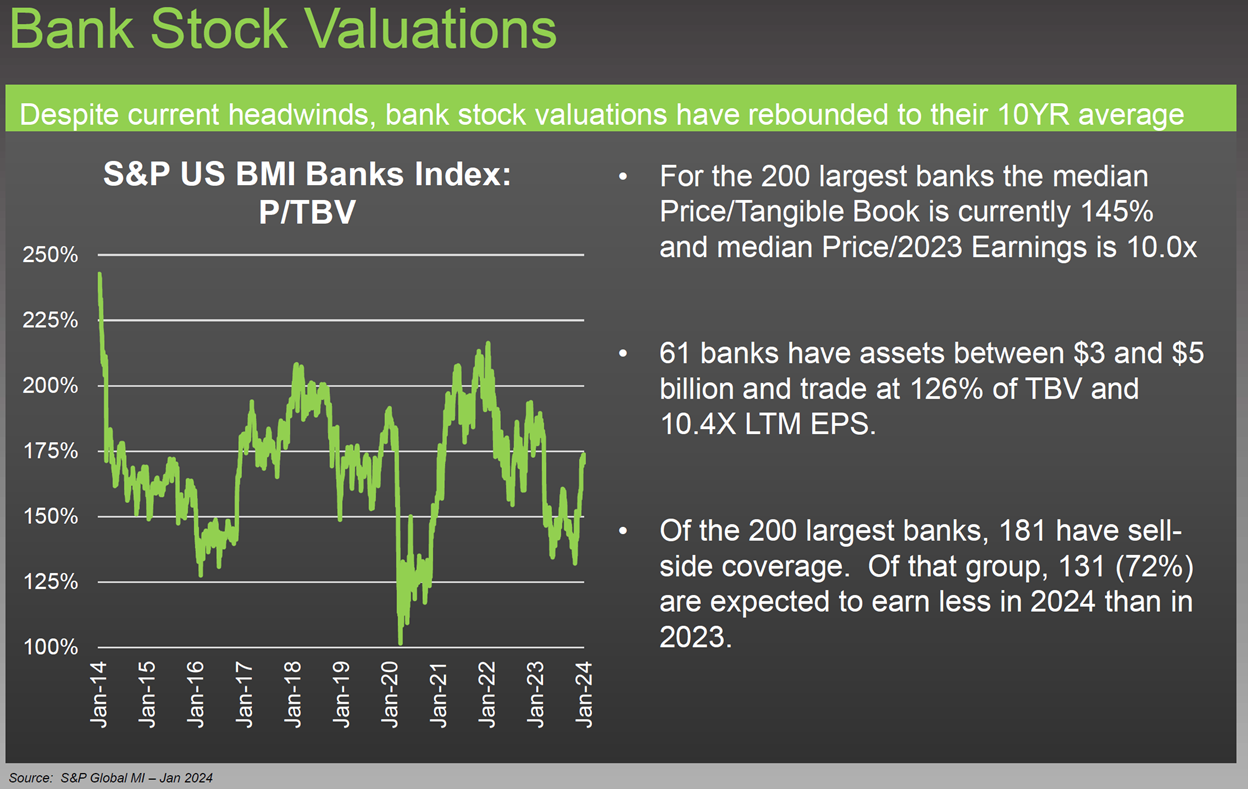

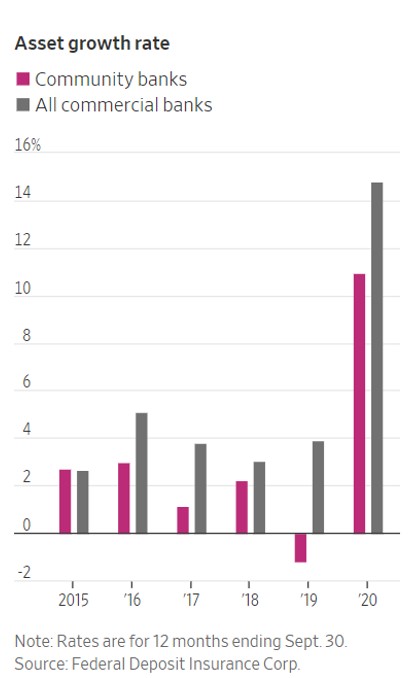

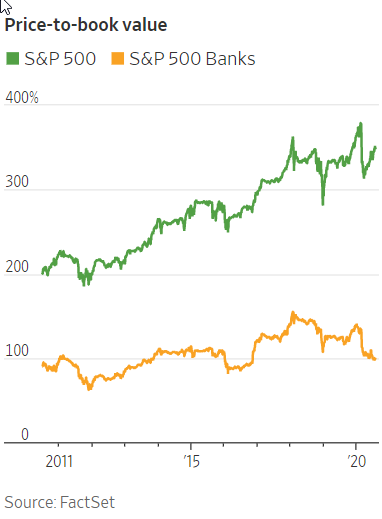

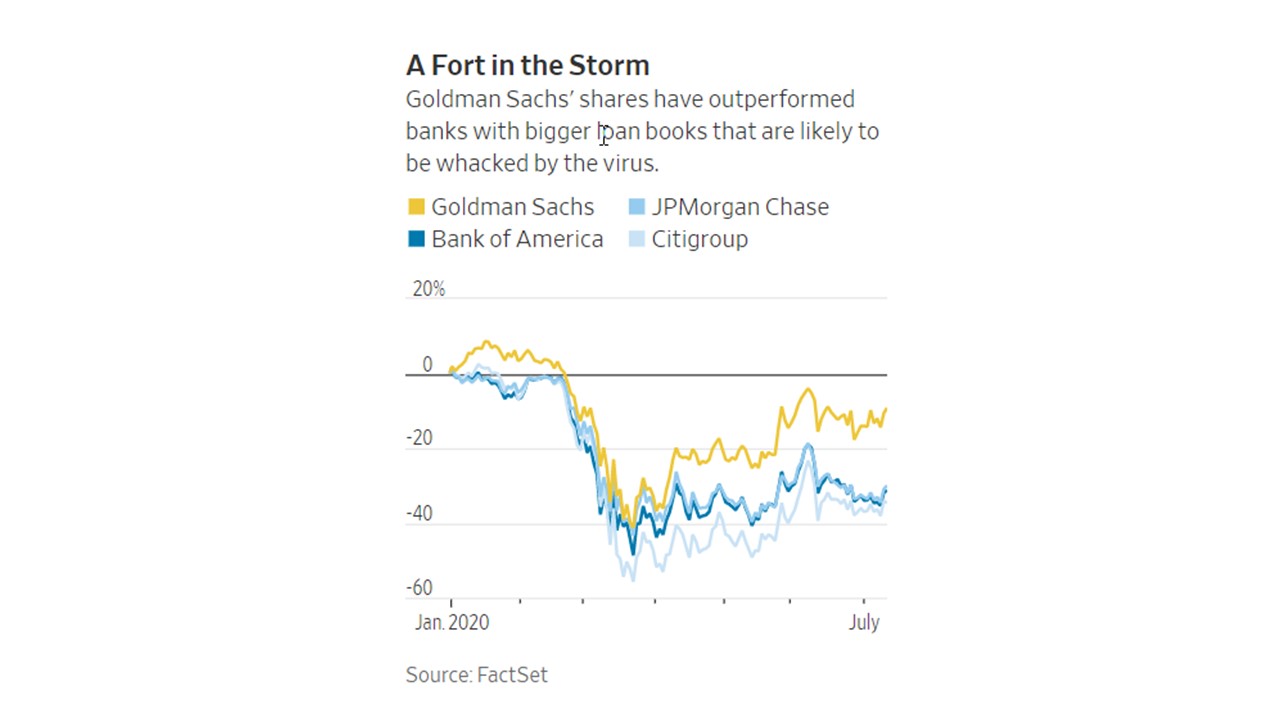

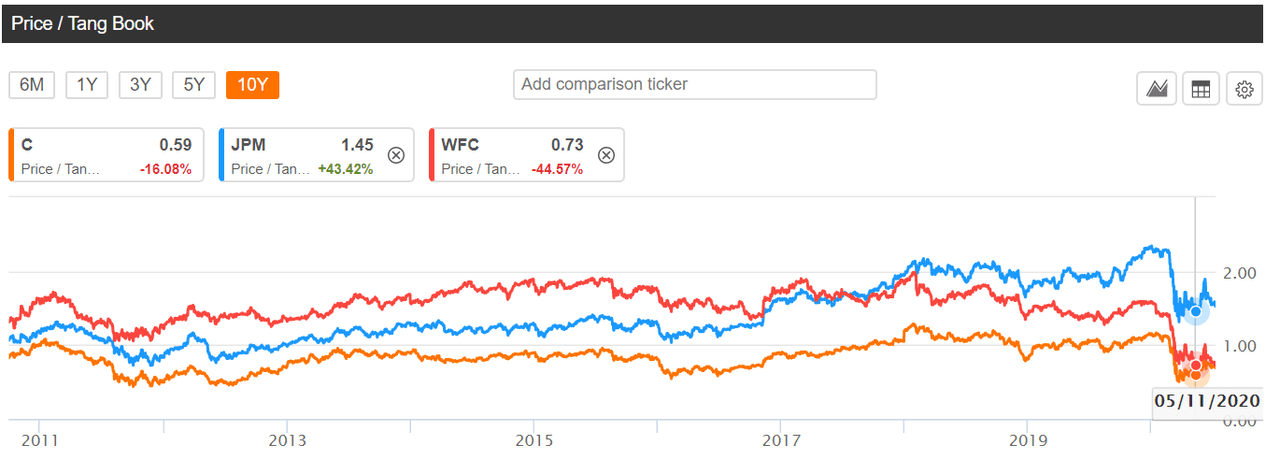

- Despite the many headwinds he has outlined – which I’ve shared in my recent e-mails, and will continue with today – and the fact that analysts expect 72% of banks will see earnings decline in 2024, bank stock valuations are back to their 10-year average price-to-tangible-book-value multiple

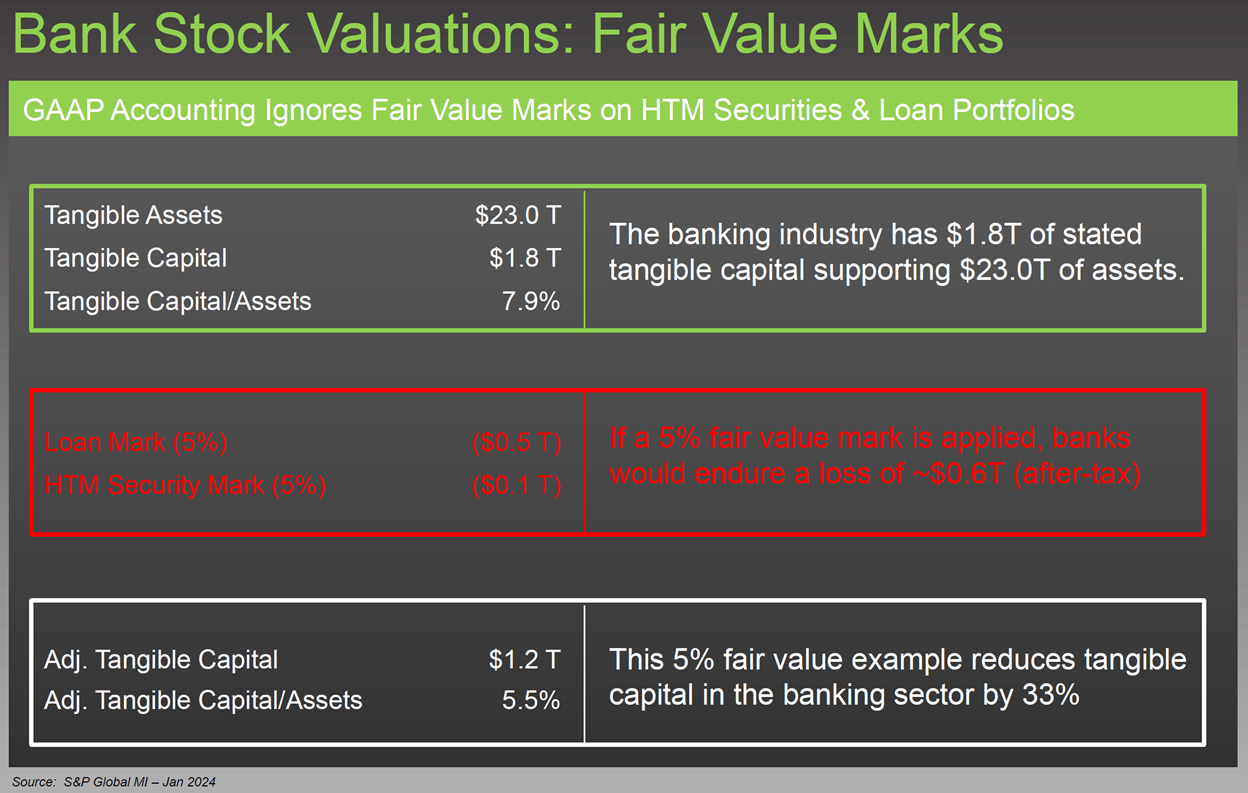

- In reality, the situation is even worse… because banks’ book values are inflated due to the fact that they aren’t required to do fair-value marks on their held-to-maturity (“HTM”) securities and loan portfolios. If banks had to mark both down by a mere 5%, this would reduce their tangible book value by 33%

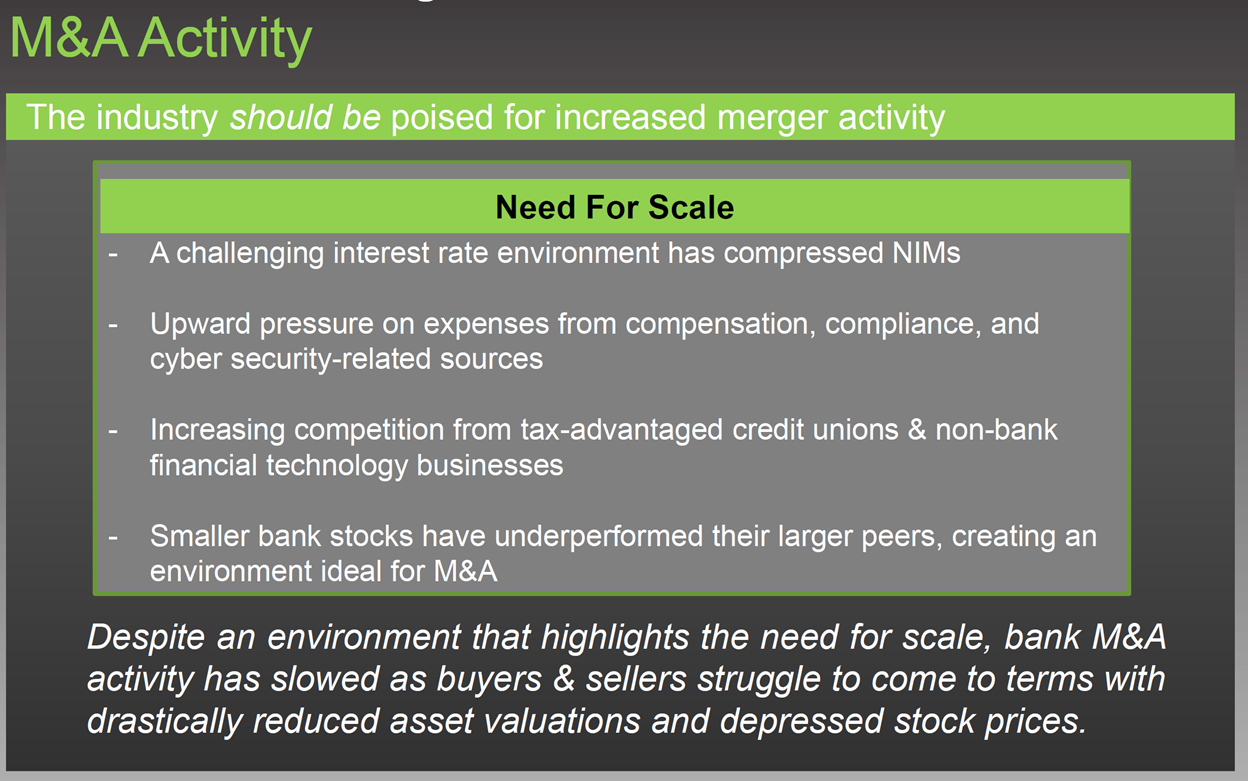

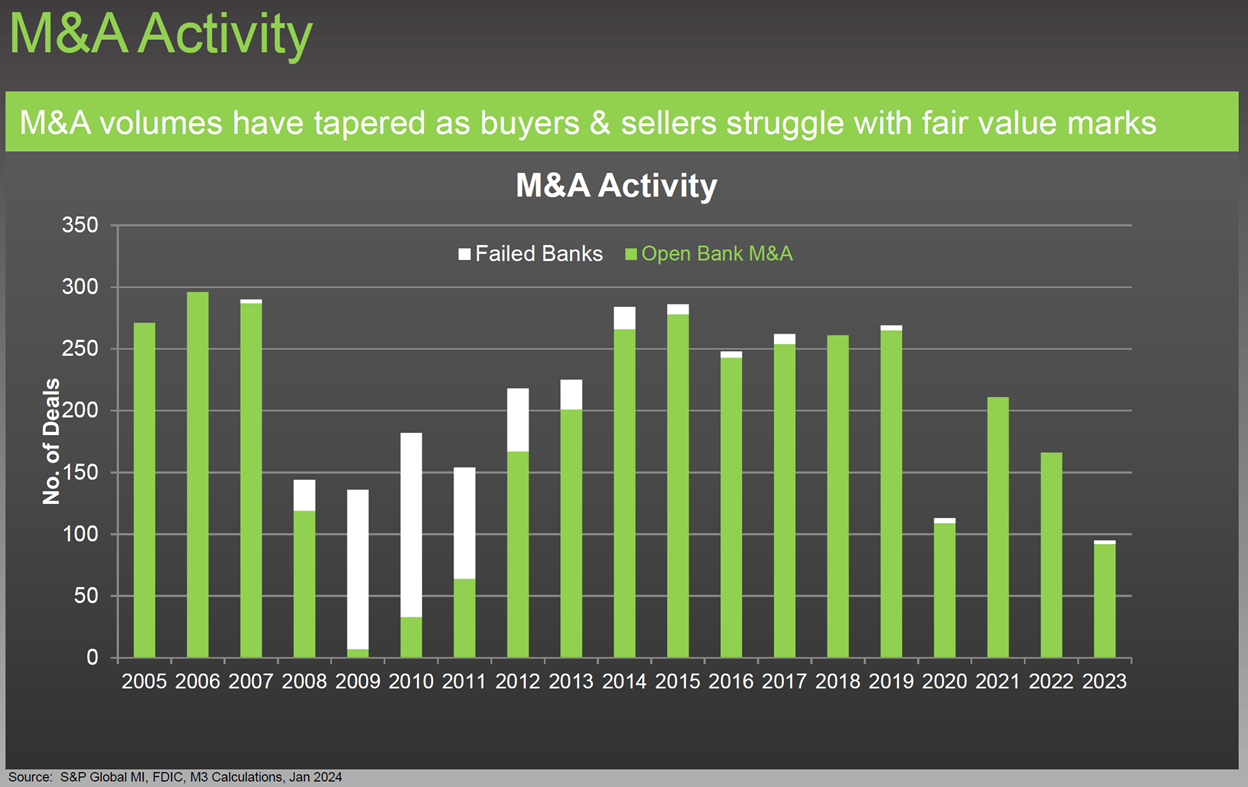

- Historically, one way investors can make money owning smaller banks is if they get acquired, usually at a nice premium, which should be happening for many reasons – but the sector headwinds are making it unlikely. As a result, bank merger and acquisition (M&A) volume has plunged to multidecade lows.

- conclusions

I summarized these in Tuesday’s e-mail:

- There are many headwinds for the banking sector: continued high interest rates, credit risk, deposits declining and becoming more expensive, etc.

- As he puts it: “A pretty positive scenario has to play out for valuations to be warranted – bank stocks are priced for perfection.”

- As such, he has sold all of his regional-bank stocks, including [Metropolitan Bank (MCB), Western Alliance Bancorp (WAL), and Zions Bancorp (ZION)].

In addition to NYCB, Japan’s Aozora Bank Ltd. dropped more than 20% after warning of a loss tied to investments in U.S. commercial real estate, and Deutsche Bank AG more than quadrupled its U.S. real estate loss provisions in the fourth quarter when compared to the year earlier.

I’m not sure this is necessarily symbolic of an immediate meltdown for all banks, but it certainly highlights all the risk that is in the banking system right now from both a credit and liquidity perspective.

Latest thoughts on the banking sector (part 2) | Stansberry Research

New York Community Bancorp Headed for Worst Close Since 2000 After Downgrade (wsj.com)

- 02/05/2024 – Powell on 60 minutes Read the Full Transcript of Powell’s Interview With CBS’s ‘60 Minutes’ (yahoo.com)

PELLEY: The value of commercial office buildings all across the country is dropping as people work from home. Those buildings support the balance sheets of banks all across the country. What is the likelihood of another real estate-led banking crisis?

POWELL: I don’t think that’s likely. So, what’s happening is, as you point out, we have work-from-home, and you have weakness in office real estate, and also retail, downtown retail. You have some of that. And there will be losses in that.

We looked at the larger banks’ balance sheets, and it appears to be a manageable problem. There’s some smaller and regional banks that have concentrated exposures in these areas that are challenged.

And, you know, we’re working with them. This is something we’ve been aware of for, you know, a long time, and we’re working with them to make sure that they have the resources and a plan to work their way through the expected losses. There will be expected losses.

It feels like a problem we’ll be working on for years. It’s a sizable problem. I don’t think — it doesn’t appear to have the makings of the kind of crisis things that we’ve seen sometimes in the past, for example, with the global financial crisis.

PELLEY: You believe it’s a manageable problem?

POWELL: I think it appears to be

PELLEY: We’re not gonna see bank failures across the country as we did in 2008?

POWELL: I don’t think there’s much risk of a repeat of 2008. I also think, you know, we need to be careful about making proclamations about the — particularly about the future. Things have surprised us a lot. But no, on this, on this, I do think it’s a manageable problem. I think we’re doing a lot to manage it.

There will be certainly — there will be some banks that have to be closed or merged out of, out of existence because of this. That’ll be smaller banks, I suspect, for the most part. You know, these are losses. It’s a secular change in the use of downtown real estate. And the result will be losses for the owners and for the lenders, but it should be manageable.

Given the volatility of market and long term perspective of long term financial industry, I plan to buy call options of FAS (or use call options of FAZ to hedge my portfolio).

- 05/03/2023 – Tilson

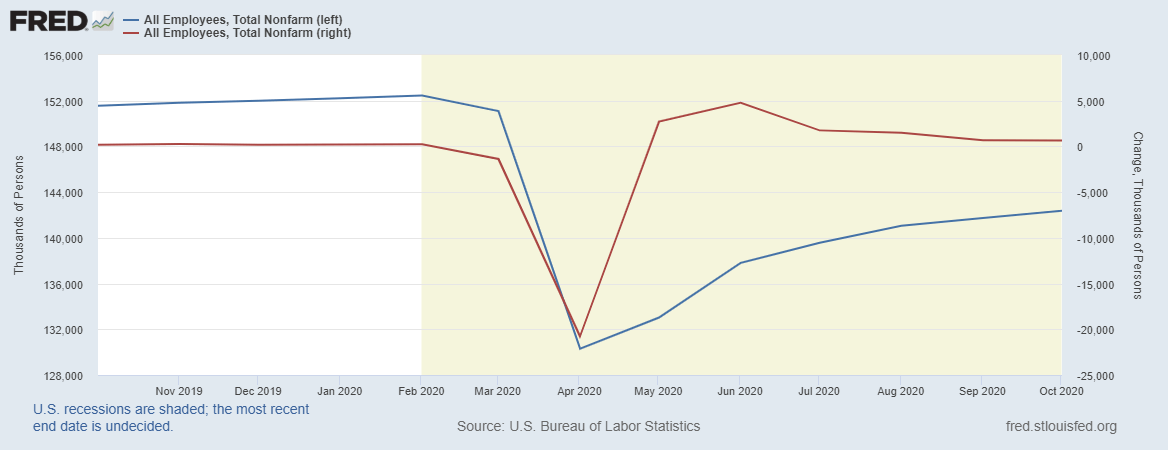

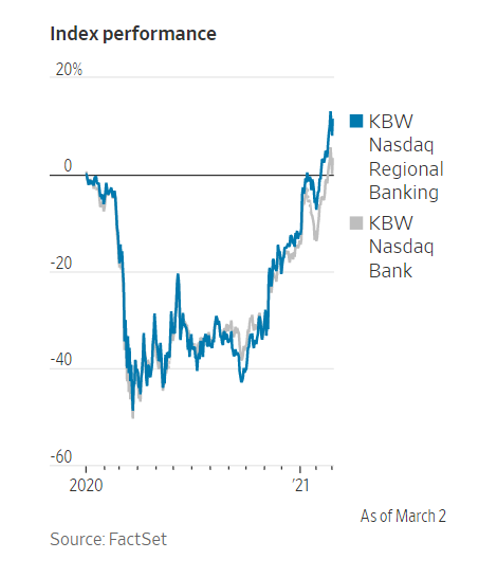

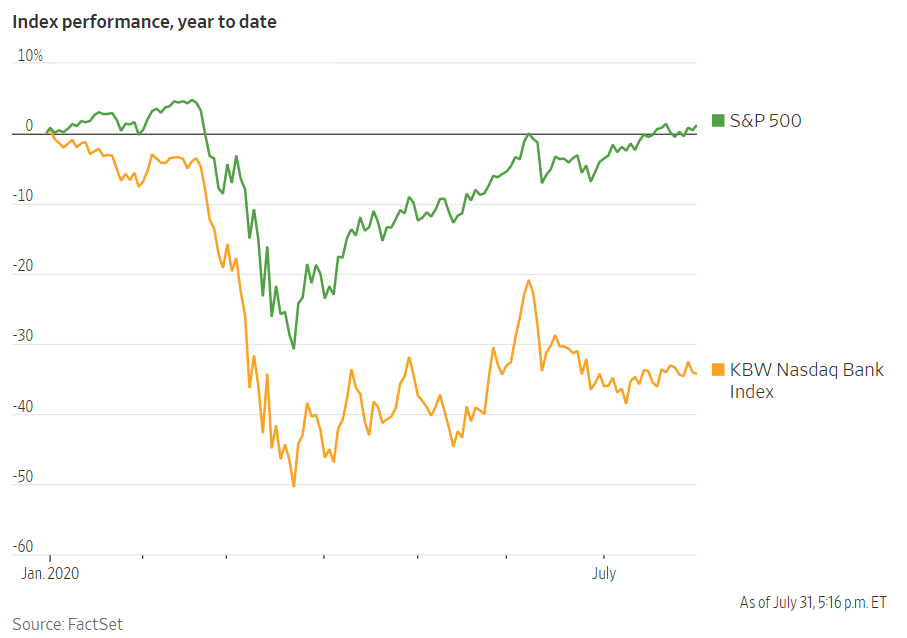

Regional bank stocks took a beating yesterday: Regional Bank Stocks Close at Lowest Level Since 2020.

For further insight into the reasons behind the sell-off, see this opinion piece from the U.K.’s Telegraph (subscription required, but you can bypass it by using Pocket, about which I wrote here): Half of America’s banks are potentially insolvent – this is how a credit crunch begins.

I think these fears are way overblown and that yesterday’s sell-off – and this hysterical, over-the-top, wrongheaded article – may mark a bottom for the sector, for two main reasons…

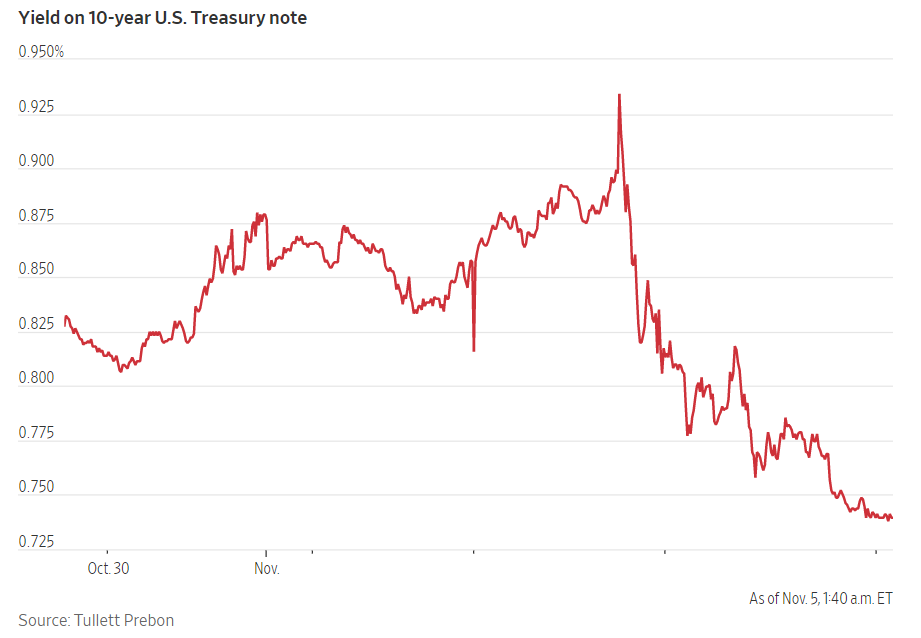

First, this “crisis” was caused by the Fed’s unprecedented sharp increases in interest rates, which you can see in this chart from the Wall Street Journal:

But here’s the thing: if the banking sector truly does enter a crisis, the Fed can quickly cease or reverse its rate hikes, eliminating the bondholders’ losses (here’s a good article in the Wall Street Journal trying to read the tea leaves on this: What a Fed Debate 17 Years Ago Reveals About Its Rate Deliberations Now).

This is a fundamental difference between today’s situation versus the global financial crisis, when banks had actual losses in their loan portfolios.

“Ah, but what about the losses banks are likely to incur in the coming years in their commercial loan portfolios?”

Banks will indeed take substantial losses… but investors are forgetting that these losses won’t be sudden, but rather spread out over time – which means that banks can offset losses with profits.

This is a topic I discussed at length in the Wells Fargo (WFC) chapter of my 2009 book about the financial crisis, More Mortgage Meltdown: 6 Ways to Profit in These Bad Times. Here are excerpts from the conclusion of that chapter:

- Potential future catalyst

- higher interest rate income when interest rate hikes

- Potential future risks

- flat yield curve, lower expected revenue contributions from non-interest revenue, higher expenses (tech and wages), potentially higher provisions are meaningful headwinds

- European banking and the commodity markets there…which are a complete trainwreck

- In general, DPST and financials are driven by a number of key factors:

- Go-to website for financial (DPST) stocks investment

- 08/01/2023 – Tilson

In my July 20 e-mail, I highlighted how I nailed the bottom of the crash in small and regional bank stocks in my May 3 and May 4 e-mails. In the latter, I quoted from “the smartest bank analyst I know,” who said that day:

The other thing that the markets seem to have wrong is they don’t realize that banks have reserved for loan losses and are still going to earn some money as we go through a potential credit cycle. Take Zions Bancorp for example: they have $618 million of loan loss reserves and are expected to earn another $800 million this year. Even if they only earn half of that they still have the power to cover a lot of credit losses.

Not that analysis seems to matter right now, as sentiment in the bank space is as bad as we can ever remember it…

The shorts are being very aggressive in some of the banks like MCB, WAL, ZION, etc. If there is even a hint of an improvement in deposit insurance, we could see a short squeeze for the ages that sends these stocks up 20%-plus in a matter of minutes, and many of them would still be dirt cheap.

Since then, the three stocks he recommended, Metropolitan Bank (MCB), Western Alliance Bancorp (WAL), and Zions Bancorp (ZION), are up 128%, 185%, and 92%, respectively, which has led to articles like this one in the New York Times, How Regional Banks Got Healthy Again, and this one in the Wall Street Journal, Banks Lean On ‘Hot’ Deposits to Shore Up Balance Sheets.

So is it time to take some profits?

I checked in with my friend yesterday to get his latest thoughts, which he gave me permission to share:

We would say it is quite generous to say that regional banks are suddenly healthy again. Yes, the fear has calmed, but the trends with funding costs are really awful and the earnings outlook for banks is definitely challenged. Banks still have very large amounts of long-term fixed rate loans and securities on their books, so as rates and funding costs continue to rise the portions of their balance sheet that are underwater grows larger.

If the Fed keeps on its path of raising, it is going to make matters a lot worse. There are still a handful of fairly large banks that are very thin on capital if you mark-to-market the balance sheet, and some that even get totally wiped out. The ugliest bank that nobody is talking about anymore is Charles Schwab (SCHW). It is crazy they passed the stress test, but then again Silicon Valley Bank and First Republic probably would have passed that stress test as well.

It feels like all the buying recently has been short covering and passive money driven as bank earnings expectations were so low it wasn’t difficult for most banks to beat the estimate. Overall, we have been reducing long exposure and adding to shorts as we think this bounce is a bit overdone.

- 05/01/2023 – as expected: the FDIC outlines three options for deposit insurance reform. But DPST/KRE tanks which might be caused by potential rate hike the day after tomorrow and Buffett’s/Munger’s warning on Commercial Real Estate crisis to bank. Question: when will congress work on this subject?

FDIC Signals Support for Narrow Changes to Deposit Insurance – WSJ

As part of its analysis, the FDIC outlines three options for deposit insurance reform:

- Limited Coverage: Maintaining the current deposit insurance framework, which provides insurance to depositors up to a specified limit (possibly higher than the current $250,000 limit) by ownership rights and capacities.

- Unlimited Coverage: Extending unlimited deposit insurance coverage to all depositors.

- Targeted Coverage: Offering different deposit insurance limits across account types, where business payment accounts receive significantly higher coverage than other accounts.

Of the three options outlined in this report, the FDIC believes targeted coverage best meets the objectives of deposit insurance of financial stability and depositor protection relative to its costs. These proposed options would require Congressional action, though some aspects of the report lie within the scope of the FDIC’s rulemaking authority.

- 05/01/2023 – the same warning (as that from Buffett) from Munger

Charlie Munger: US banks are ‘full of’ bad commercial property loans

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

https://www.ft.com/content/da9f8230-2eb1-49c5-b63a-f1507936d01b

The comments from the 99-year-old investor and sidekick to billionaire Warren Buffett come as turmoil ripples through the country’s financial system, which is reckoning with a potential commercial property crash following a handful of bank failures. “It’s not nearly as bad as it was in 2008,” the Berkshire Hathaway vice-chair told the Financial Times in an interview. “But trouble happens to banking just like trouble happens everywhere else. In the good times you get into bad habits . . . When bad times come they lose too much.”

Please use the sharing tools found via the share button at the top or side of articles. Copying articles to share with others is a breach of FT.com T&Cs and Copyright Policy. Email licensing@ft.com to buy additional rights. Subscribers may share up to 10 or 20 articles per month using the gift article service. More information can be found here.

https://www.ft.com/content/da9f8230-2eb1-49c5-b63a-f1507936d01b

Berkshire has a long history of supporting US banks through periods of financial instability. The sprawling industrials-to-insurance behemoth invested $5bn in Goldman Sachs during the 2007-08 financial crisis and a similar sum in Bank of America in 2011. But the company has so far stayed on the sidelines of the current bout of turmoil, during which Silicon Valley Bank and Signature Bank collapsed. “Berkshire has made some bank investments that worked out very well for us,” said Munger. “We’ve had some disappointment in banks, too. It’s not that damned easy to run a bank intelligently, there are a lot of temptations to do the wrong thing.” Their reticence stems in part from lurking risks in banks’ vast portfolios of commercial property loans. “A lot of real estate isn’t so good any more,” Munger said. “We have a lot of troubled office buildings, a lot of troubled shopping centres, a lot of troubled other properties. There’s a lot of agony out there.” He noted that banks were already pulling back from lending to commercial developers. “Every bank in the country is way tighter on real estate loans today than they were six months ago,” he said. “They all seem [to be] too much trouble.”

Charlie Munger reportedly warns of trouble for the U.S. commercial property market

- 04/28/2023 – Mr. Barr called for re-evaluating how regulators treat deposits above a $250,000 federal insurance limit. here is the report Fed-SVB-Barr

Fed Report on Silicon Valley Bank Collapse Finds Regulators Failed to Act – WSJ

The Federal Reserve’s banking supervisors failed to take forceful action to address growing problems at Silicon Valley Bank before it collapsed last month, the central bank’s top regulator said, signaling a broad push to toughen rules on the industry.

Mr. Barr on Friday called for revamping a range of rules that apply to banks with more than $100 billion in assets, and he called for re-evaluating how regulators treat deposits above a $250,000 federal insurance limit. Both banks had a large amount of such deposits, which fled quickly as trouble mounted.

Michael Barr, the Fed’s vice chair for supervision, said supervisors didn’t fully appreciate the extent of the vulnerabilities as SVB grew in size and complexity. When supervisors did find risks, they didn’t take sufficient steps to ensure the firm fixed those problems quickly enough, he said in a report Friday.

excerpt from Barr’s report

- Contagion from the failure of SVB threatened the ability of a broader range of banks to

provide financial services and access to credit for individuals, families, and businesses.

Fast and forceful action by the Federal Reserve, the Federal Deposit Insurance

Corporation, and the Treasury Department helped to contain the damage, but weaknesses in supervision and regulation must be fixed. - we are also going to evaluate how we supervise and regulate liquidity risk, starting with the risks of uninsured deposits. Liquidity requirements and models used by both banks and supervisors should better capture the liquidity risk of a firm’s uninsured deposit base. For instance, we should re-evaluate the stability of uninsured deposits and the treatment of held to maturity securities in our standardized liquidity rules and in a firm’s internal liquidity stress tests. We should also consider applying standardized liquidity requirements to a broader set of firms. Any adjustments to our liquidity rules would, of course, go through normal notice and comment rulemaking and have appropriate transition rules, and thus would not be effective for several years.

- Oversight of incentives for bank managers should also be improved. SVB’s senior

management responded to the incentives approved by the board of directors; they were

not compensated to manage the bank’s risk, and they did not do so effectively. We should consider setting tougher minimum standards for incentive compensation programs and ensure banks comply with the standards we already have - First, the combination of social media, a highly networked and concentrated depositor

base, and technology may have fundamentally changed the speed of bank runs. - a firm’s distress may have systemic consequences through contagion

Fed report on SVB collapse faults bank’s managers — and central bank regulators

Areas the Fed is likely to focus on include the types of uninsured deposits that raised concerns during the SVB drama, as well as a general focus on capital requirements and the risk of unrealized losses that the bank had on its balance sheet.

- 04/27/2023 – uncertainty of FRC

U.S. officials lead urgent rescue talks for First Republic – sources

First Republic is contemplating a major hit, and even a total loss for shareholders, as part of the options that would prevent U.S. regulators from taking it over, one of the sources said.

White House: Monitoring situation at First Republic, could step in if needed

Pressed to explain the administration’s views on whether to protect depositors in First Republic, as it did in the cases of SVB and Signature, Jean-Pierre said, “We have proven how we have moved really quickly in … taking decisive and forceful actions in the past, and I can assure you that you’ll see that again from this administration.”

Why No Buyer Has Emerged for First Republic – WSJ

There are some possible offsets. A bank that buys the assets at fair value might then quickly sell them to pay down expensive government borrowing or to cover the return of big banks’ emergency $30 billion in unsecured deposits. That would reduce the bank’s size and capital needs. The acquirer could also benefit over time as the acquired assets rise in value or pay off.

But the tricky math for an acquirer might help explain the current state of affairs, in which First Republic plans to restructure its business. One other plan under consideration, to have a group of banks buy assets from First Republic at above-market prices, could effectively socialize the costs of acquisition that would otherwise be borne by one buyer. This might be one reason for banks to hesitate in helping out now, for fear it would only allow an ultimate buyer of First Republic to get a far better deal. But getting a form of equity as part of the deal would help the group of banks all benefit in that scenario.

If that can’t be worked out, an alternative form of a full acquisition might be a government-arranged sale in which the acquirer gets a federal backstop for its losses.

The $30 billion reason for Wall Street to save First Republic ASAP

Why big banks are reluctant to rescue First Republic again

- 04/27/2023 – more CRE problem might worsen the bank industry, so be aware. Stress on the office-building market across the U.S. is not an isolated problem, because of the effect on tax levies and nearby shops and the potential impact on the financial sector, especially regional banks that are big lenders on commercial real estate.

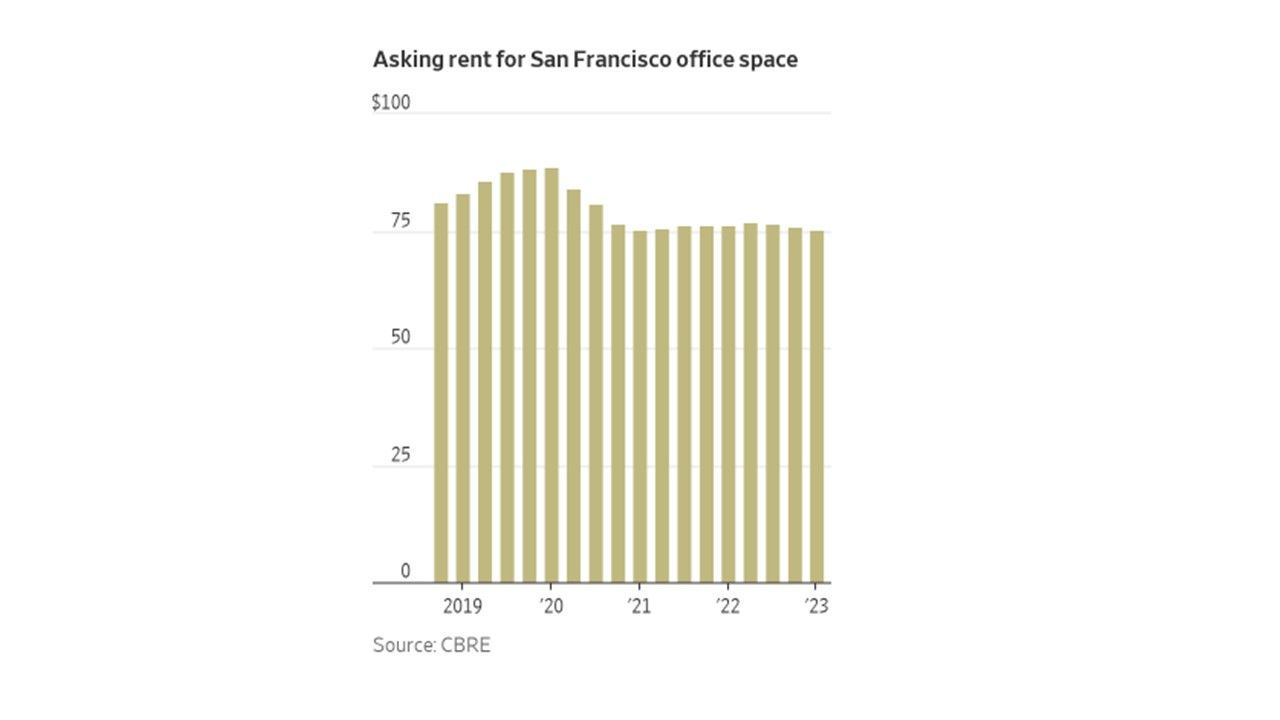

Fire Sale: $300 Million San Francisco Office Tower, Mostly Empty. Open to Offers. – WSJ

One building, a 22-story glass and stone tower at 350 California Street, was worth around $300 million in 2019, according to office broker estimates.

That building now is for sale, with bids due soon. They are expected to come in at about $60 million, commercial real-estate brokers say. That’s an 80% decline in value in just four years.

This is how dire things have become in San Francisco, an extreme form of a challenge nationwide. Nearly every large U.S. city is struggling, to some degree, with reduced office-worker turnout since the pandemic spurred remote work. No market was hit harder than San Francisco, for reasons including its high costs, reliance on a tech industry quick to embrace hybrid work, and quality-of-life issues such as crime and homelessness.

Stress on the office-building market across the U.S. is not an isolated problem, because of the effect on tax levies and nearby shops and the potential impact on the financial sector, especially regional banks that are big lenders on commercial real estate.

About $80 billion worth of loans backed by U.S. office buildings come due this year, according to data firm Trepp Inc. Most will need to be refinanced, at a time of higher interest rates and lower occupancy, threatening lenders with losses.

Wells Fargo & Co. recently said the volume of its office-building-backed loans that are classified as “nonaccrual”—meaning the bank no longer expects full interest and principal payment—jumped to $725 million in the first quarter from $186 million in the 2022 fourth quarter.

“This could be seen as a bellwether for the value destruction in the urban office market nationally,” he said, “especially those markets that are more technology and financial services-centric.”

Nearly 30% of San Francisco’s office space is vacant, which is more than seven times the rate before the pandemic hit, and the biggest increase of any major U.S. city, according to commercial real estate services firm CBRE Group Inc.

- 04/26/2023

First Republic Bank Is a Problem With No Easy Solution – WSJ

First Republic Bank FRC -29.32%decrease; red down pointing triangle is running up against a grim reality in its fight for survival: There are seemingly no good options.

Any solution would likely require assistance from regulators, the government or other lenders. But the darkening economic outlook, bad lending decisions and limits on Washington policy makers pose hurdles for any intervention.

That worked for a short period. But it didn’t solve the bigger issues: First Republic specialized in making huge mortgages, often at low rates, to wealthy borrowers, and that business model no longer works. Now the bank is sitting on a pile of loans that are mispriced for the current interest-rate environment.

- 04/25/2023 – still more sells than buys

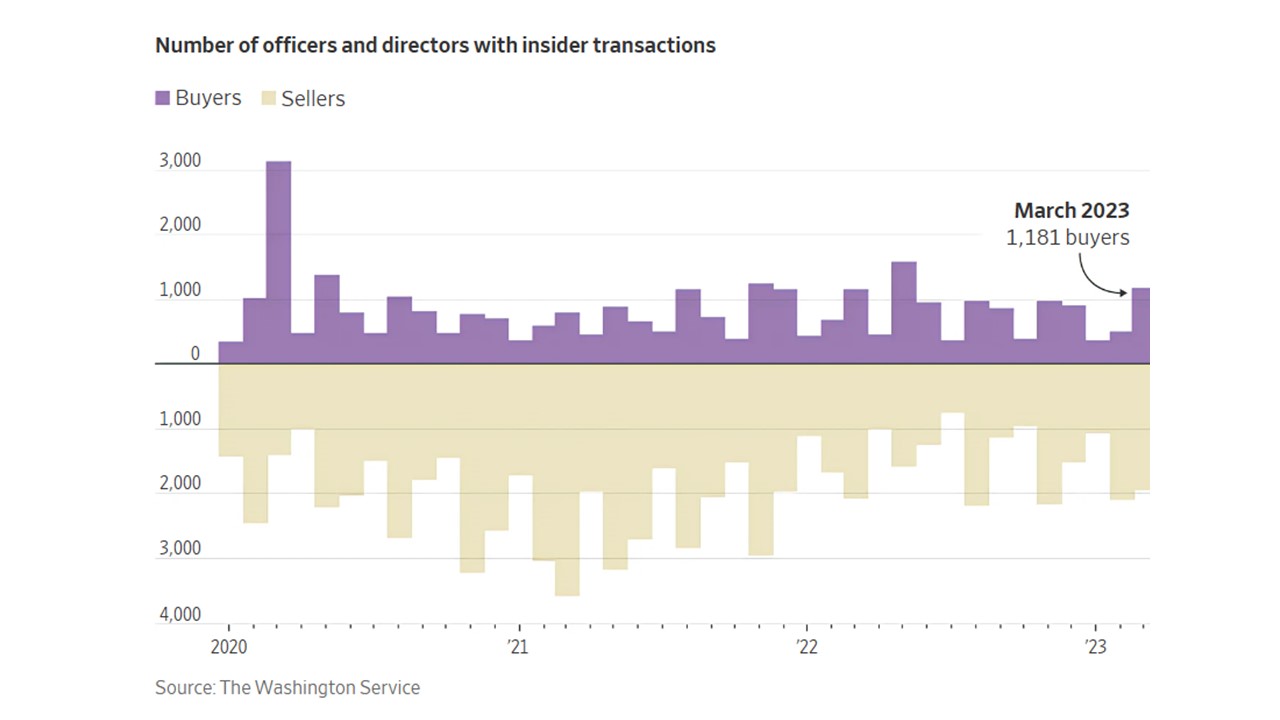

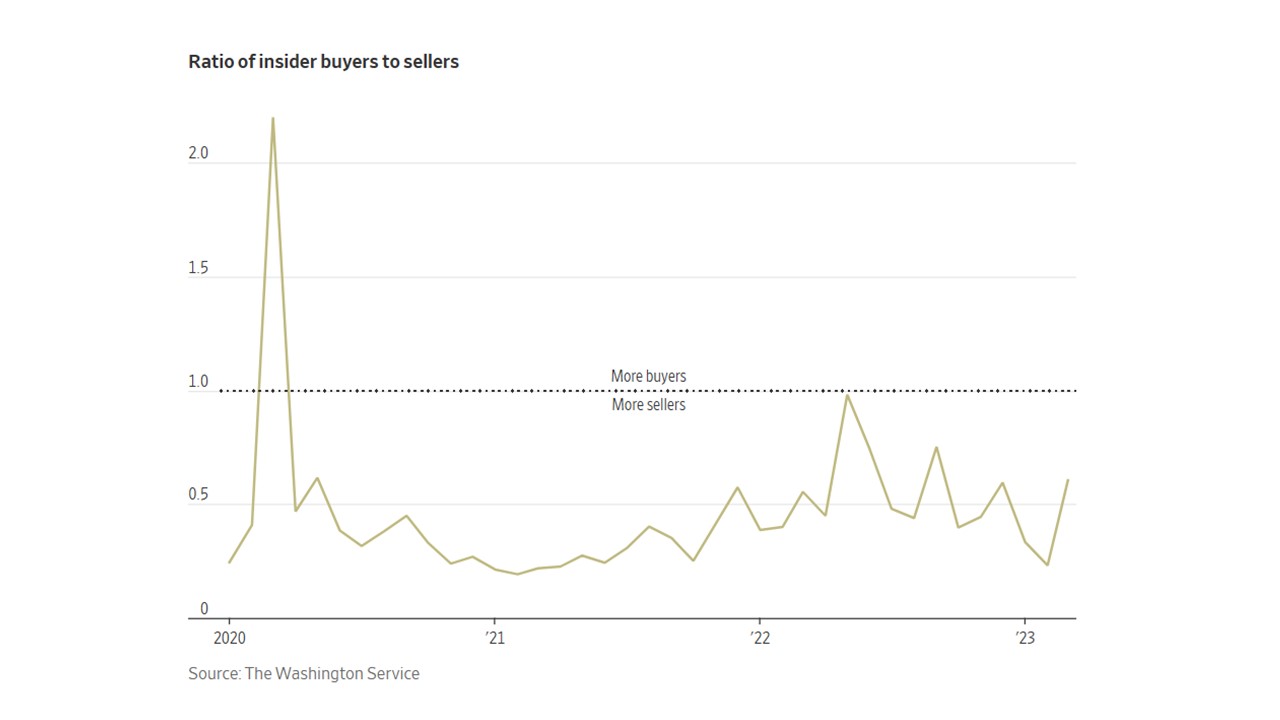

Corporate Insiders Step Up Stock Buying After Banking Turmoil – WSJ

The uptick in insiders’ share purchases signals corporate optimism, reassuring some investors

- 04/25/2023 – Tilson

This front-page WSJ story highlights the woes in the commercial real estate sector: Commercial Real-Estate Woes Run Deeper Than in Past Downturns. Excerpt:

Commercial real estate has experienced its share of busts in recent decades. This one is different.

Landlords are contending simultaneously with a cyclical market downturn and with secular changes in the way people work, live and shop. The sudden surge in interest rates caused property values to fall, while the rise of remote work and e-commerce are reducing demand for office and retail space.

Investors and economists say these two forces haven’t come together on this scale since the 1970s, when a recession followed surging oil prices and a stock-market rout while new technologies enabled jobs to move out of major cities. This time, the pandemic is largely responsible for accelerating the commercial property upheaval.

The U.S. office vacancy rate reached a milestone in the first quarter when it rose to 12.9%, exceeding the peak vacancy rate during the 2008 financial crisis. Despite low unemployment, that figure marked the highest vacancy rate since data firm CoStar Group Inc. began tracking it in 2000.

It is unknown how bad the commercial property downturn will get. Some analysts say it may well end up less severe than the previous two downturns, in the early 1990s and after the 2008 financial crisis, especially if the U.S. economy avoids a deep recession and interest rates start to come down quickly.

But the deeper problems facing office and certain retail landlords mean building values are less likely to rebound to new highs the way they did after those previous meltdowns.

I tend to agree with the bearish outlook in these articles… which is why I’m not bottom-fishing among the beaten-up shares of office REITs like SL Green Realty (SLG) (near a 14-year low), Vornado Realty Trust (VNO) (near a 30-year low), and Empire State Realty Trust (ESRT) (near an all-time low).

4) Despite the woes of First Republic and the office REITs, I remain bullish on the out-of-favor banking sector… especially the five stocks I recommended last week in the latest issue of our Empire Investment Report newsletter. I think all of these are classic “babies thrown out with the bathwater” situations.

I’m also glad to see insiders share my bullishness: Corporate Insiders Step Up Stock Buying After Banking Turmoil. Excerpt:

The recent uptick in insider buying, particularly in the financial sector, signals corporate optimism in the wake of banking-sector turmoil, providing some reassurance to investors as stocks bounce from last month’s lows. The major U.S. stock indexes have proved fairly resilient after March’s tumult, with the S&P 500 up 7.7% in 2023, though the index slipped last week…

Last month, officers and directors at financial firms made up more than half of all insiders who bought company stock, the highest share for the sector in at least two years, according to the Washington Service.

Insider buying in March was concentrated in regional banks, according to investment-research firm VerityData…

Eric Diton, president and managing director of investment advisory firm the Wealth Alliance, said the rush of stock buying from bank insiders confirmed his belief that the banking crisis is contained. He said he has an optimistic outlook on U.S. equities and is especially positive on dividend-paying stocks as he anticipates interest rates could soon ease.

“I’m a big fan of watching what corporate insiders do. This is not 2008,” Mr. Diton said, referencing the financial crisis.

- 04/20/2023 – Buffett’s interview on CNBC

- 04/12/2023 – Buffett on recent bank crisis

Buffett says U.S. bank deposits are safe and the government would backstop all of them if necessary

Warren Buffett says we’re not through with bank failures

- 04/09/2023 – will we see something new on deposit insurance coverage levels coming in May 1, 2023?

the FDIC will undertake a comprehensive review of the deposit insurance system and will release a report by May 1, 2023, that will include policy options for consideration related to deposit insurance coverage levels, excess deposit insurance, and the implications for risk-based pricing and deposit insurance fund adequacy. In addition, the FDIC’s Chief Risk Officer will undertake a review of the FDIC’s supervision of Signature Bank and will also release a report by May 1, 2023. Further, the FDIC will issue in May 2023 a proposed rulemaking for the special assessment for public comment.

The circumstances surrounding the failures of SVB and Signature Bank merit further thorough review by both regulators and policymakers. The FDIC’s Chief Risk Officer will undertake a review of the FDIC’s supervision of Signature Bank and intends to release a report by May 1, 2023. The FDIC will also undertake a comprehensive review of the deposit insurance system and will release by May 1, 2023, a report that will include policy options for consideration related to deposit insurance coverage levels, excess deposit insurance, and the implications for risk based pricing and deposit insurance fund adequacy.

The FDIC is committed to working cooperatively with our counterparts at the other federal regulators as well as with policymakers in the Congress to better understand what brought these institutions to failure and what measures can be taken to prevent similar failures in the future.

- 04/07/2023 – might be good news for DPST and KRE? Catalyst? the industry starts reporting quarterly earnings next week, the numbers will probably be good. The government shouldn’t overreact to the banking crisis by imposing more rules on the industry, Dimon said. In his CNN interview, he added that the Federal Deposit Insurance Corp. should “probably” lift coverage levels, currently capped at $250,000 per depositor.

Jamie Dimon Says Banking Crisis Is Near to Getting Resolved

Chase CEO Jamie Dimon thinks the SVB collapse will have a lasting effect. Here’s how

The US bank crisis that rattled global markets last month is probably nearing the end, even if more unforeseen failures occur, JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon said.

Only a handful of lenders have the problems that toppled Silicon Valley Bank, and when the industry starts reporting quarterly earnings next week, the numbers will probably be good, Dimon told CNN in an interview Thursday. Asked if more bank failures might come, he said he didn’t know.

“But if there are, I know honestly they’ll be resolved and it will probably be the last of them,” Dimon said. “I think we’re getting near the end of this particular crisis.”

The CEO also said it’s OK for a bank to fail if contagion to other lenders can be prevented. The banking system will reach that point with “monitoring, changing a few things,” he said. “Failure is OK, you just don’t want this domino effect.”

He added that the American banking system is safe, with lenders flush with “extraordinary” capital and liquidity.

- 03/28/2023 – risks of DPST and KRE

In Today’s Banking Crisis, Echoes of the ’80s – WSJ

Between 1980 and 1994, 1,617 banks and 1,295 thrifts either were closed or received government assistance. For thrifts, the story began with a government mandate forcing them to specialize in long-term mortgage loans funded with deposits. As the Federal Reserve raised rates, funding costs rose and many thrifts became insolvent.

Instead of raising the deposit insurance limit or expanding supervisory powers, Congress should require all assets held by banks to be marked to market. It should also invite supervisors from the San Francisco Fed and other agencies to explain why they failed to act. Was there political pressure not to? If so, from whom? Congress should press supervisors to intervene immediately to address similar problems at the 200 or so banks that are to some degree suffering similar weaknesses, rather than allowing those problems to fester.

Congress also should note that the unprecedented federal spending spree combined with accommodative monetary easing caused high inflation and forced the Fed to respond with dramatic hikes in interest rates that caused the losses at so many banks. Unintended long-term costs from myopic policy actions are a major threat again as Congress considers further expansion of deposit insurance.

The difference today, in contrast with the 1980s, is that SVB and Signature Bank relied largely on uninsured deposits, whereas thrifts and banks then had relatively few such deposits. As their risk of failure grew, uninsured depositors (who were slow to respond) still responded fast enough to prevent the banks from becoming deeply insolvent. If those deposits had been insured ex ante, we might now be quietly experiencing resurrection risk-taking from SVB and Signature Bank, with much larger losses to come in those banks and throughout the banking system. The failures of SVB and Signature illustrate the usefulness of what remains of market discipline, which comes from limiting deposit insurance. Regulation failed, but the market didn’t.

A Rapid-Finance World Must Ready for a Slow-Motion Banking Crisis – WSJ

In recent decades financial crises have tended to be fast-moving and violent. They usually revolve around a handful of companies or countries, and often climax over a weekend, before Asian markets open.

That template is grounds for hope that the worst of the current turmoil may have passed with the collapse of Silicon Valley Bank and Signature Bank and the forced merger of Credit Suisse with UBS Group AG this month, as well as the federal backstops implemented in response to these events.

But another template is also possible: the corrosive, slow-motion crisis. SVB collapsed because of a confluence of structural factors that to a lesser extent afflict many institutions. That could force many banks in coming years to shrink or be acquired, a process that also hampers the supply of credit.

When Moody’s downgraded the credit-rating outlook of the U.S. banking system earlier this month, it too cited the threat to many lenders’ deposits: “Banks with substantial unrealized securities losses and with non-retail and uninsured US depositors may…be more sensitive to depositor competition or ultimate flight, with adverse effects on funding, liquidity, earnings and capital.” High interest rates will add to these pressures until inflation returns to the Fed’s 2% target, it said.

Unless federal insurance is extended to all deposits, this suggests small and medium-size banks could be in for a prolonged period of pressure on their deposits, which could in turn force them to be acquired, or limit their lending. It won’t be a crisis in the usual sense of the word. But the end result may be the same.

- 03/27/2023

The Banking Crisis: A Timeline of Silicon Valley Bank’s Collapse and Other Key Events – WSJ

- 03/15/2023 – The last public report on that data will come Thursday, though the Fed will be able to monitor the program right up until its two-day meeting starts Tuesday.

One of the best ways to figure out what the Fed will do next is to look at regional bank stocks

- The probability for no Fed rate hike next week shot up to as high as 65%, according to CME Group data Thursday morning.

- Fed policymakers will resolve the question by watching macroeconomic reports as well as small banks for provide larger clues about the health of the financial sector

In a dramatic move Sunday evening, the central bank launched an initiative it called the Bank Term Funding Program. That will provide a facility for banks to exchange high-quality collateral for loans so they can ensure operations.

Inflows to impacted banks could be reflected through their share prices to indicate how well the Fed’s initiative is working out to maintain confidence in the industry and keep money flowing.

Fed officials also will get data in coming days to see how active banks are in taking using the facility.

If banks are using the BTFP to a large extent, that could indicate significant liquidity issues and thus serve as a deterrent to raising rates. The last public report on that data will come Thursday, though the Fed will be able to monitor the program right up until its two-day meeting starts Tuesday.

- 03/14/2023 – Tilson

In yesterday’s e-mail, after discussing the banking crisis, I concluded that “the entire banking sector is taking a hit… so I think it’s time to start looking for babies thrown out with the bathwater,” and mentioned Wells Fargo (WFC) and First Republic Bank (FRC), writing:

A higher-risk, higher-reward idea I’m exploring is First Republic, which I’ve been banking with both personally and professionally for more than a decade. It’s a first-rate institution with an excellent franchise, yet its stock was down more than 75% this morning.

Well, apparently there was some trouble buying the stock yesterday…

For example, it seems that TD Ameritrade (AMTD) – to protect its customers – wasn’t allowing market orders on such a volatile stock… which was the right thing to do. As you can see in this chart of yesterday’s price action, FRC hit a low of $17.53 in the morning and then, only four hours later, hit an intra-day peak of $42 – a staggering 140% increase – before closing at $31.21:

I want to repeat what I wrote yesterday:

The most important thing that the average investor needs to understand is that this is nothing like 2008, when the combination of a massive housing bubble, on- and off-balance sheet leverage, and widespread fraud created the biggest financial bubble in history. When it burst, it brought the world to its knees and required every existing – and many new – tools of the U.S. government to stabilize the situation.

Today, our banking system and economy are healthy, and there is no reason why the idiosyncratic problems of a few stupid banks – most notably, tech startup banker SVB Financial’s (SIVB) Silicon Valley Bank and crypto bank Silvergate Capital (SI) – should create a systemic problem.

- 03/13/2023 – Tilson

The most important thing that the average investor needs to understand is that this is nothing like 2008, when the combination of a massive housing bubble, on- and off-balance sheet leverage, and widespread fraud created the biggest financial bubble in history. When it burst, it brought the world to its knees and required every existing – and many new – tools of the U.S. government to stabilize the situation.

Today, our banking system and economy are healthy, and there is no reason why the idiosyncratic problems of a few stupid banks – most notably, tech startup banker SVB and crypto bank Silvergate Capital (SI) – should create a systemic problem.

To understand what happened at these banks, Bloomberg’s Matt Levine has an insightful explanation of Silvergate here: Crypto Bank Had a Boring Collapse. Excerpt:

Still the story of the end of Silvergate is just sort of boring and normal? It had an incredibly simple, boring, old-school and reasonably safe banking business model, borrowing short and lending long, taking demand deposits at low interest rates and investing the money in a fairly conservative portfolio of longer-maturity mortgages and bonds. What brought down Silvergate is:

- When interest rates go up rapidly, if your assets are all long-dated bonds, they will go down in value.

- Traditionally, banks deal with this risk by holding their assets to maturity and not marking them to market: If you have a 10-year loan and interest rates go up, the loan’s market value goes down, but if you just wait 10 years you’ll be repaid in full and it’s no problem.

- Silvergate, however, also lost most of its deposits because its depositors were mostly crypto firms and crypto collapsed. It couldn’t hold its assets to maturity, because it had a sudden huge need for cash to pay out those depositors. So it had to sell the assets, so it lost money, which left it thinly capitalized, which led to more depositors leaving, which led to more asset sales, which ended Silvergate.

And SVB here: Startup Bank Had a Startup Bank Run. Excerpt:

As Armstrong puts it, SVB had “a double sensitivity to higher interest rates. On the asset side of the balance sheet, higher rates decrease the value of those long-term debt securities. On the liability side, higher rates mean less money shoved at tech, and as such, a lower supply of cheap deposit funding.”

Also, I am sorry to be rude, but there is another reason that it is maybe not great to be the Bank of Startups, which is that nobody on Earth is more of a herd animal than Silicon Valley venture capitalists. What you want, as a bank, is a certain amount of diversity among your depositors. If some depositors get spooked and take their money out, and other depositors evaluate your balance sheet and decide things are fine and keep their money in, and lots more depositors keep their money in because they simply don’t pay attention to banking news, then you have a shot at muddling through your problems.

But if all of your depositors are startups with the same handful of venture capitalists on their boards, and all those venture capitalists are competing with each other to Add Value and Be Influencers and Do The Current Thing by calling all their portfolio companies to say “hey, did you hear, everyone’s taking money out of Silicon Valley Bank, you should too,” then all of your depositors will take their money out at the same time.

So these two banks were extremely dumb… But, to be clear, every bank is vulnerable in a panic since nearly all depositors have the right to withdraw all of their money at a moment’s notice – yet banks lend and invest those deposits, which means they’re not completely liquid.

Hence, the critical role of governments is to carefully regulate banks and step in early and forcefully when problems emerge.

The good news is that this appears to be happening.

- 03/10/2023

- So depositors should rest easy. As for investors in SI and SIVB, they’ll likely be wiped out, as they should be. But the entire banking sector is taking a hit… so I think it’s time to start looking for babies thrown out with the bathwater.One stock on my list is Wells Fargo (WFC), which was down about 6% this morning and is very close to a two-year low. It remains an open recommendation in our flagship Empire Stock Investor newsletter, where we’re up 65% on our position (versus 11% for the S&P 500) since we recommended the stock back in September 2020. (To subscribe to Empire Stock Investor and gain access to all of our back issues and get our 12 best new large-cap ideas over the next year, it’s only $49 – just click here to learn more.)A higher-risk, higher-reward idea I’m exploring is First Republic Bank (FRC), which I’ve been banking with both personally and professionally for more than a decade. It’s a first-rate institution with an excellent franchise, yet its stock was down more than 75% this morning.

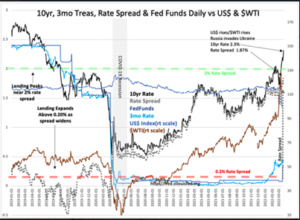

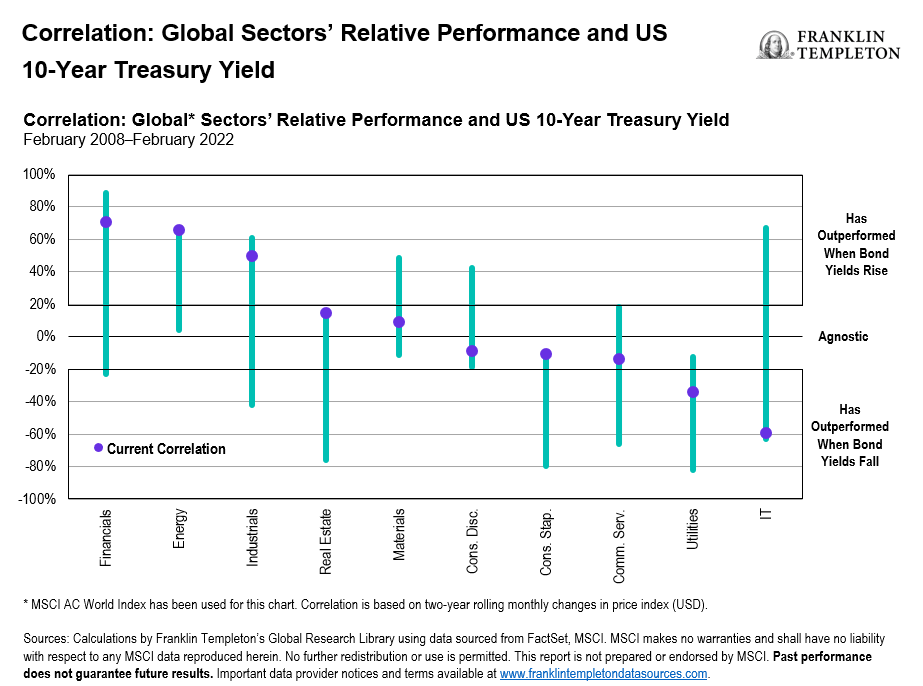

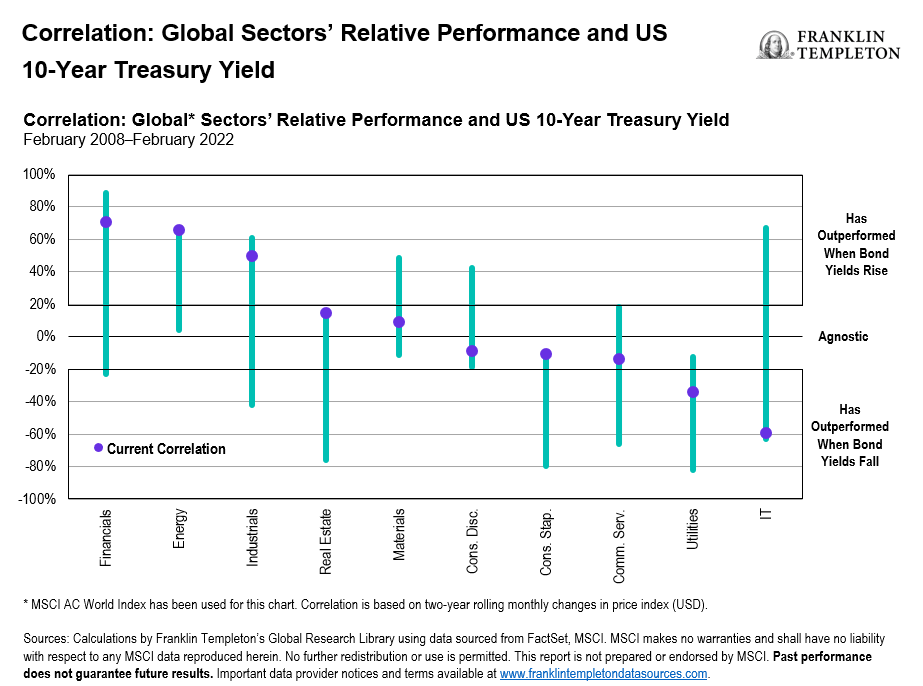

- 04/20/2022 – from Davidson: The T-Bill/10yr Treas Rate Spread has widened to 1.87% as of this morning. It has been so rapid that an update is justified. Many are concerned the rise in the 10yr Treasury to 2.3%+ as threatening economic expansion. History supports the contrary view.

- Point 1: Rising rates represent a shift from fixed income to equity as investor confidence builds for equity vs. fixed income.

- Point 2: A rising rate spread expands financing by financial institutions-the wider the rate spread the greater the liquidity

“Davidson” submits:

A rapid rise in 10yr Treas rates is occurring as capital moves into core economic issues. There is an investor shift in process that is difficult to perceive because market indices have become dominated by over-valued Momentum issues. These issues were so favored during the COVID lockdown that 10 names grew to represent 25%+ of the SP500. The rise in these issues overwhelmed all other issues. This forced fund managers to invest in these issues to prevent shareholder disaffection. Many growing companies fell 20%+ as the SP500 rose 30%+. Net/net nearly every fund manager became in part Momentum Investors or faced losing capital as investors chased price performance.

As the economy continues to expand, it is becoming ever more apparent that lockdown favorites have widely missed expectations. Peloton, Zoom, Docusign and many Chinese issues have fallen from extreme valuations. These few represent a mere sampling of investors chasing prices without consideration for fundamentals which came to dominate all the indices used by many to measure fund manager performance quarter-to-quarter. The correction today represents the shift out of these issues and towards issues more economically sensitive such as industrials and commodity related issues. The shift out of former favorites makes it appear the indices are in a major correction interpreted by many as forecasting recession. Underneath the still high-priced issues, economically sensitive issues are rising in price, just not yet enough to offset the former’s dominance. The T-Bill/10yr Treas Rate Spread indicates economic acceleration not recession.

Examples of COVID-issues correcting:

- Peloton Interactive(PTON): fell from $170+shr to ~$25shr represented a Pr/Sales 19x falling to < 2x.

- Docusign(DOCU): fell from $300+shr to ~$90shr represented a Pr/Sales 30x falling to less than 9x

- ZOOM Video Com(ZM) fell from ~$590shr to ~$115shr represented a Pr/Sales 51+ falling to less than 9x

The T-Bill/10yr Treas Rate Spread has widened to 1.87% as of this morning. It has been so rapid that an update is justified. Many are concerned the rise in the 10yr Treasury to 2.3%+ as threatening economic expansion. History supports the contrary view.

- Point 1: Rising rates represent a shift from fixed income to equity as investor confidence builds for equity vs. fixed income.

- Point 2: A rising rate spread expands financing by financial institutions-the wider the rate spread the greater the liquidity

Rising rates represents a positive shift in market psychology towards equities. Equities are viewed as the better risk/return potential based on the current investment context. When the 10yr rate rises faster than the T-Bill rate, investors are not fully committed keeping some portion of their capital as a reserve. When investors have comfortable reserves, unexpected events, while they may prove disconcerting, do not develop into market tipping points leading to recession. Reserve capital permits investors to bridge short setbacks. The history of the T-Bill/10yr Treas Rate Spread indicates it has often risen to 3%. The 2% benchmark represents a level typically reached before T-Bill rates begin to rise reflecting a further rise in investor confidence. It is when T-Bill rates rise to 0.2% of 10yr Treas rates that we see investors overly committed to equities and any confidence threatening event can panic us into recession. If we view the T-Bill/10yr Treas Rate Spread as market psychology indicator, then it becomes obvious why some events lead to recession while others of the same magnitude to not.

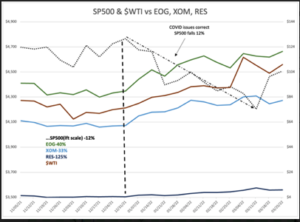

The sharp rise in the T-Bill/10yr Treas Rate Spread today represents increased investor commitments to equities. In the current inflationary climate, issues favored are energy related. These issues because they have been ignored for 7yrs and dominated recently by COVID-favored issues represent a historically low percentage of the indices. Their rise even though significant is only recently offsetting the correction of the COVID issues. One should always be selective to invest in the better managed companies. In SP500, $WTI vs EOG, XOM RES, The vertical market represents Jan 1, 2022 in weekly data from Nov 2021. The performances show the correction of COVID-favored issues began at the end Dec 2021. Capital shifts favored fossil fuel related issues. As $WTI continued to rise, algorithms that use oil prices as part of determining the trend of economic activity have stimulated buying in core economic issues which began to offset the COVID- issue correction the week of March 11, 2022.

It is never a stock market. It is always a market of stocks vying for the attention of Momentum vs Fundamental Investors. Once price trends are defined in core economic issues, we can expect Momentum Investors to pile in. The general advice at this time is to be fully invested in equities and to favor economically sensitive issues.

- 04/20/2022 – This steepening of the yield curve is good for financial companies’ earnings, which borrow short and lend long.

Stock Market Today: April 20, 2022

U.S. Treasury bond yields rose across the board, though long-term rates climbed more than those with shorter-term durations. This steepening of the yield curve is good for financial companies’ earnings, which borrow short and lend long.

- 04/04/2022 – history of DPST and Holdings of DPST

TOP 10 HOLDINGS

| COMPANY | SYMBOL | TOTAL NET ASSETS |

|---|---|---|

| Dreyfus Government Cash Management Institutional Shs | DGCXX | 10.18% |

| Financial Square Government Fund FST Shares | FGTXX | 7.04% |

| First Horizon Corp. | FHN | 1.86% |

| M&T Bank Corp. | MTB | 1.55% |

| People’s United Financial Inc. | PBCT | 1.55% |

| Signature Bank | SBNY | 1.46% |

| Comerica Inc. | CMA | 1.46% |

| East West Bancorp Inc. | EWBC | 1.46% |

| Zions Bancorp N.A. | ZION | 1.45% |

| Citizens Financial Group Inc. | CFG | 1.43% |

DPST HOLDINGS

SECTOR ALLOCATION

| Financials | 68.39% |

| Non Classified Equity | 0.40% |

ASSET ALLOCATION

| Stocks | 68.78% |

| Cash | 14.11% |

| Other | 10.55% |

| Bonds | 6.56% |

| Total Net Assets | $432.200M |

| Turnover | 147.00% |

- 04/12/2022 – to understand these two? COVID related loan loss provisioning and the release of these unneeded reserves into earnings

U.S. Banks’ Pandemic Hot Streak Is Coming to an End – WSJ

What goes up must come down. That is likely to be the story of banks’ first-quarter earnings.

A sense of normalcy has returned to Wall Street. Offices have once again filled up after two years of working from home. Bonanza profits driven by a white-hot market for deals are returning to earth.

Not everything is business as usual, however. The highest inflation in decades, coupled with Russia’s invasion of Ukraine, have resulted in volatile markets and cast uncertainty over how quickly the Federal Reserve will raise interest rates. Sanctions also have raised the possibility that some banks will have to write down their Russian business and take charges to their earnings.

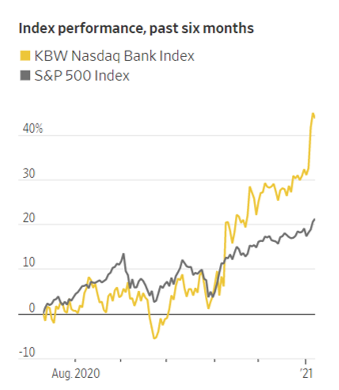

After outperforming the market over much of the past two years, the KBW Nasdaq Bank Index is down about 9% so far this year. Banks’ underperformance in the stock market coincides with falling first-quarter profit expectations. Analysts now expect banks in the S&P 500 to report earnings of about $28 billion, down 36% from a year ago, according to FactSet.

- 04/09/2022 – Net income for the six biggest U.S. banks is forecast to be down about 35% from last year, with a sharp deceleration in activity seen during March following the Russian invasion of Ukraine. Bank reports will be watched closely on the costs side, particularly with labor, technology and acquisition expenses rising. UBS thinks there could be a surprise to the upside for the sector with guidance likely to highlight that the benefits of higher rates and better-than-anticipated loan growth could offset higher credit cost provisions and weaker equity markets. also watch out Musk’s TED speech, and In the tech sector, a question-and-answer session next week at Twitter.

Stocks To Watch: Spotlight On Big Bank Earnings, Twitter-Musk Meeting, AACR Conference

Large-cap banks earnings preview: U.S. bank heavyweights will report earnings next week amid expectations that profit will fall sharply from the level recorded a year ago, when deal-making was revving higher. Net income for the six biggest U.S. banks is forecast to be down about 35% from last year, with a sharp deceleration in activity seen during March following the Russian invasion of Ukraine. Bank reports will be watched closely on the costs side, particularly with labor, technology and acquisition expenses rising. UBS thinks there could be a surprise to the upside for the sector with guidance likely to highlight that the benefits of higher rates and better-than-anticipated loan growth could offset higher credit cost provisions and weaker equity markets. The firm recommends Bank of America (NYSE:BAC) amid the rising rate environment, while warning that Wells Fargo (WFC) could underperform peers.

Tesla watching: Tesla (TSLA) will be in the spotlight once again next week, with investors sizing up the significance of the ramp-up of production that will follow the opening of the gigafactories in Berlin and Austin. Wedbush Securities forecasts Tesla (TSLA) could exit the year with an annual production run rate of 2 million vehicles, although the zero-tolerance COVID policy in Shanghai is a significant wildcard. Tesla’s scale advantage with production and EV tech is seen potentially creating separation with EV upstarts like Fisker (FSR), Lucid Group (LCID) and Rivian Automotive (RIVN) if the market turns further toward risk-off trading.

watch for Tesla (TSLA) CEO Elon Musk’s TED talk, which should attract a lot of attention following the large stake he recently took in Twitter (TWTR). The week is capped off with Ooma (NYSE:OOMA) hosting a virtual Investor Day on April 14.

In the tech sector, a question-and-answer session next week at Twitter (NYSE:TWTR) with employees and new board director Elon Musk could create some jolts.

- 04/07/2022 – The Fed has started its rate hiking cycle this past week, which is a tailwind for financials. The only catch is that higher rates are only good for banks if the spread between long and short term rates is increasing. And right now the yield curve is flattening, which is the opposite of what you want to see. banks didn’t participate meaningfully in the rally because of disappointment rates won’t increase larger and faster? expectations got scaled back. Also fears of credit issues due to the war on the corporate side and inflation on the consumer side. Those are two issues I hope will smooth out in the second half of the year

KRE: I Like Regional Banks Going Forward

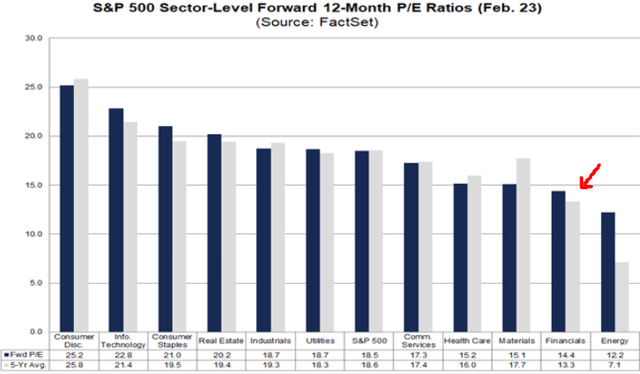

- Banks as a whole are a value opportunity, relative to the broader market.

- Regional institutions, which make up KRE, are less exposed to foreign risks due to their domestic nature.

- The Fed has started its rate hiking cycle this past week, which is a tailwind for financials.

Main Thesis/Background

The purpose of this article is to evaluate the SPDR S&P Regional Banking ETF (NYSEARCA:KRE) as an investment option at its current market price. This is a fund with an objective to “provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Regional Banks Select Industry Index.” I last covered KRE about five months ago, when I slapped a hold rating on the fund. In hindsight, this was a well-founded outlook, as KRE’s return since then has essentially been flat:

Fund Performance (Seeking Alpha)

With the markets seeing plenty of volatility so far in 2022, I wanted to take another look at KRE to see if I should change my rating. After review, I do believe a more bullish/buy rating is warranted for a few reasons. One, regional banks are attractively priced, as is the broader Financials sector, when we consider valuations compared to the broader market. Two, regional banks are less exposed to foreign revenue streams, which make it attractive in an environment where geo-political risks are dominating headlines. Three, the Fed’s rate hiking cycle, which is consistent with other central banks around the world, will provide a tailwind to lenders and financial institutions.

Why Consider Banks In This Climate?

To begin, I want to touch on a few key points as to why readers may want to consider banks/financial stocks more broadly. This is relevant to KRE, but also to the myriad other ways investors can play this space. The first is valuation. While most sectors are still sitting with forward P/Es above the five-year average (indicating stocks are a bit pricey), the Financials sector remains competitively priced. For comparison, note that Financials have a forward P/E lower than every other sector, with the exception of Energy:

Sector P/E Ratios (Google Finance)

Of course, this doesn’t necessarily mean the sector will out-perform, or even produce a positive return. But it should give investors some comfort, given the wild ride we have been on recently.

Regional Banks Are Predominately US-Focused – The takeaway here is simple. Regional banks are less at-risk of a sell-off from geo-political events. Their fortunes are not tied to Europe, Russia, or any other region aside from the U.S., for the most part.

Growth Through Mergers

Another positive for the broader regional bank sector has been the strong uptick in mergers and acquisitions over the past few years.

KRE is a nice way to play this concept, since it holds companies that are very under-weight the S&P 500 (or not included at all). Further, while Fed rate hiking may be a headwind for the broader market, it should be a positive catalyst for KRE, and other banking funds.

- 04/07/2022 – interest rate hike could help regional bank profits, especially if the U.S. manages to avoid a yield inversion. Regional banks often are more rate-sensitive than their larger peers because they don’t have other businesses, such as trading desks, that are less connected to interest rates.

4 Regional Bank Stocks Rooting for More Rate Hikes

Rate-sensitive regional bank stocks could be among the top beneficiaries of the Fed’s hiking cycle, especially if the U.S. manages to avoid a yield inversion.

The Federal Reserve recently announced a much-anticipated hike in interest rates – a 25-basis-point uptick that’s expected to be just the first of several this year. The Fed’s hawkishness is largely expected to be a boon for the financial sector, including a wide swath of America’s regional bank stocks.

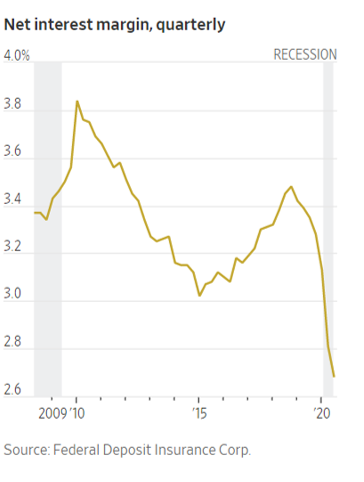

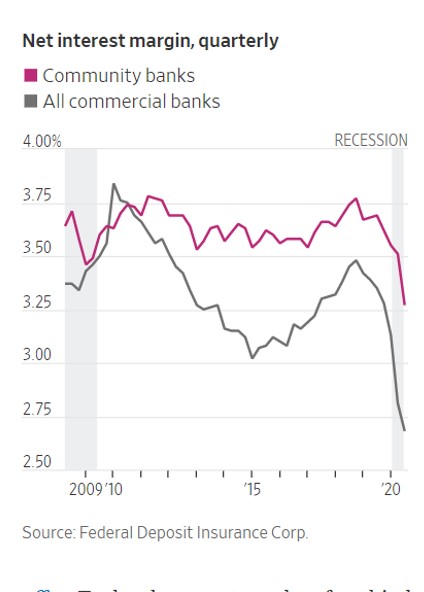

Bank stocks can, of course, enjoy a windfall from higher interest rates. The bank compensates the depositor at one interest rate, and then lends that money out at a slightly higher interest rate. The difference, or net interest margin, is an important source of revenue. (The risk, of course, is that too-high rates snuff out loan demand.)