Study of RTX

- 01/28/2022 – war will benefits RTX’s bottom line?

US weapons makers celebrate ‘benefits’ from tensions with Russia

According to top executives, the rapidly escalating standoff could mean big bucks for investors

Rock bottom relations between Moscow and the West, along with the looming prospect of a conflict in Eastern Europe, bode well for firms cashing in on sending arms overseas, two of America’s largest weapons exporters have admitted.

As Washington spends increasingly large sums of cash on military equipment for Ukraine, Raytheon and Lockheed Martin told investors this week that escalation in the region bodes well for their bottom line, in transcripts released by investment site The Motley Fool.

On a January 25 earnings call, Raytheon CEO Greg Hayes said, “we just have to look to last week where we saw the drone attack in the UAE, which have attacked some of their other facilities. And of course, the tensions in Eastern Europe, the tensions in the South China Sea, all of those things are putting pressure on some of the defense spending over there. So I fully expect we’re going to see some benefit from it.”

- 10/12/2021 – good for RTX commercial side of business

Europe Inc. Returns to the Skies – WSJ

Business travel is making a comeback on the continent, aided by a high vaccination rate and digital Covid-19 certificates

- 02/23/2021 – root cause? fan blade out and engine cover?

Boeing 777’s Midair Malfunction Puts Focus on Engine Cover – WSJ

Investigators are trying to understand interplay between broken fan blades and engine cowling, which was ripped away

- 02/22/2021 – bad news for RTX

NYC-bound plane’s Raytheon engine broke apart on same day as United flight

A Boeing (BA +0.1%) 747-400 cargo plane headed for New York made an emergency landing Saturday afternoon in Belgium soon after takeoff from the Netherlands as its engine caught fire and broke apart.

- 02/03/2021 – If pandemic is gone, FCF of RTX might increase with current $4.5b to $8b or 9b a year, the stock price can be doubled

Why Raytheon Technologies Stock Is Set to Soar

The market is underestimating the growth potential of this aerospace and defense industry giant.

The case for buying Raytheon Technologies stock

- The company’s substantial defense industry exposure will contribute the earnings and free cash flow (FCF) necessary to cushion it as its commercial aerospace business goes through a multiyear recovery.

- Based on historical FCF and management’s guidance, the stock is a very good value.

- 12/09/2020 – It will be great for aerospace industry and energy industry if travel ban is reversed

Turning to Raytheon’s full-year guidance, management is expecting full-year organic sales growth of 0%-3% with FCF of $4.5 billion and adjusted EPS of $3.40 to $3.70. Frankly, these are attractive numbers for a business likely to engineer a multiyear recovery in earnings and FCF.

For example, FCF of $4.5 billion would put the stock on a price-to-FCF multiple of 22.4. That may seem superficially expensive — broadly speaking, a price-to-FCF multiple of around 20 is seen as a reasonable valuation for an industrial conglomerate — but recall that the company’s commercial aviation segment is still at the beginning of a long recovery path. In addition, the $4.5 billion figure includes $500 million of one-time merger and synergy expenses.

If you think that the commercial aviation industry will make a comeback, and you believe Hayes is right that Raytheon will get back to $8 billion to $9 billion in FCF “over the next several years,” then this stock is a very attractive buy at today’s levels. Those figures represent 8% to 9% of its current market cap. Throw in a dividend that currently yields 2.9% that you can collect while you wait, and the opportunity to earn excellent returns looks real.

- If Trump signs off on the policy proposal, it would reverse bans on inbound travel for U.S. allies put into place at the beginning of the pandemic as the virus surged overseas.

- Travel from China and Iran, two of the earliest hotspots for the virus and from which travel was restricted in January and February, would not be relaxed, according to these officials.

- 12/09/2020 – Biden admin’s defense secretary is RTX’s board of director, good news for RTX?

Biden defense pick earns $350K on Raytheon’s board

Raytheon Technologies has a backlog of defense orders valued at $72 billion

Lloyd Austin, the retired Army general chosen to serve as President-elect Joe Biden’s secretary of defense, earned more than $350,000 last year as a member of military contractor Raytheon’s board of directors, according to company filings.

Raytheon garnered $14.7 billion in sales in the three months through September, according to a statement, and its outstanding defense orders were valued at $70.2 billion, a little less than half of a $152.3 billion backlog.

- 12/08/2020 – good to authorize stock repurchase, not sure when though. Guest company is waiting to see more clearance of the market

Raytheon Technologies Board of Directors Authorizes $5 Billion Share Repurchase Program

WALTHAM, Mass., Dec. 7, 2020 /PRNewswire/ — Raytheon Technologies’ (NYSE: RTX) Board of Directors authorized today the repurchase of up to $5 billion of the company’s outstanding common stock. The new authorization replaces the company’s previous program, approved Oct. 14, 2015. Share repurchases may take place from time to time, subject to market conditions and at the company’s discretion, in the open market, through privately negotiated transactions or other means.

- 12/03/2020 – good for airline industry including RTX. We will see whether it will be finally approved or not

Treasury Chief Backs $20 Billion for US Airlines Payroll

U.S. Treasury Secretary Steven Mnuchin said on Wednesday he backs another $20 billion in additional government payroll support for U.S. airlines.

“I think that would be very meaningful in terms of employment and saving the industry,” Mnuchin said at a House hearing. A bipartisan proposal released Tuesday called for $17 billion in payroll support for airlines to extend the program for four months.

In October, American Airlines and United Airlines furloughed more than 32,000 workers after a prior $25 billion payroll assistance program expired.

- 12/01/2020 – this might or night not happen

The Covid Pandemic Could Cut Business Travel by 36%—Permanently

Between 19% and 36% of all business trips could disappear, given efficiencies developed during the lockdown, our Middle Seat columnist and airline experts estimate

“Brick-and-mortar retail has been devastated by ecommerce and I think this is a parallel story,’’ says Jay Sorensen, president of IdeaWorks, an airline-industry consulting firm and a member of our group. The others are Ben Baldanza, former chief executive of Spirit Airlines and a current board member of JetBlue, and consumer advocate Charlie Leocha, president of Travelers United, a passenger-advocacy organization.

Business travel has a disproportionate effect on airlines: The top 10% to 15% of customers at global carriers typically account for about 40% of revenue. Overall, Bank of America estimates business trips contributed $334 billion to the entire travel industry’s $1.1 trillion in revenue last year.

- 12/01/2020 – RTX is better than BA?

Better Buy: Boeing vs. Raytheon

Comparing the airplane manufacturer with one of its major suppliers

Three factors to consider

Unfortunately, it’s extremely difficult to accurately predict the shape of the recovery in the commercial aerospace market, so investors need to consider a range of outcomes. As such, three factors should be considered:

- The downside risk if there is a weak recovery. Which stock will be more heavily hit and therefore is more exposed?

- The upside risk of a strong recovery. Which stock will outperform if commercial aerospace performs better than current market expectations?

- What expectations have both sets of management baked into their guidance?

- 11/25/2020 – Is air travel business back?

Sources: White House Considers Lifting European Travel Restrictions

The White House is considering rescinding entry bans for most non-U.S. citizens who recently were in Brazil, Britain, Ireland, and 26 other European countries, five U.S. and airline officials told Reuters.

The Trump administration imposed the bans in a bid to contain the novel coronavirus pandemic. It is not considering lifting separate entry bans on most non-U.S. citizens who have recently been in China or Iran, the officials said.

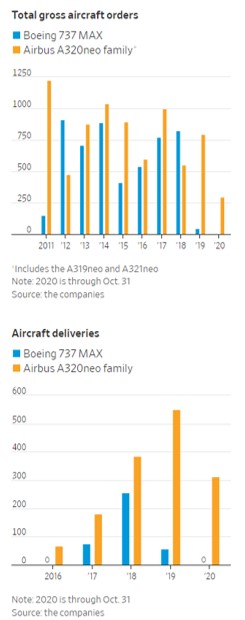

- 11/19/2020 – Boeing 737 Max’s come back could help RTX (Collins)

Boeing 737 MAX Cleared to Fly Again, but Covid-19 Has Sapped Demand

FAA’s order following two fatal crashes removes a major obstacle as pandemic creates fresh problems

The U.S. on Wednesday approved Boeing Co. BA -3.21% ’s 737 MAX jets for passenger flights again after dual crashes took 346 lives, issuing a set of long-anticipated safety directives and notices to airlines globally that will help resolve the plane maker’s biggest pre-pandemic crisis.

The Federal Aviation Administration’s official order to release the MAX, grounded since March 2019, came as the Chicago aerospace giant grapples with a host of new problems in the midst of the continuing health crisis.

The FAA’s mandate allows Boeing to resume delivering the jets to airlines and lets them carry passengers, pending completion of certain mandatory fixes and additional pilot training requirements spelled out in related documents also released by the agency. U.S. carriers said Wednesday that they would broadly reintroduce the MAX into their schedules starting early next year, while FAA chief Steve Dickson said he expected approvals from some foreign regulators within days.

Mr. Calhoun predicted a Covid-19 vaccine—if, as U.S. health officials suggest, it is available widely by the middle of next year—could help turn around Boeing’s crises, leading to a “run on the bank” for narrow-body airplanes. “It’s going to be the response when the recovery really does come,” he said last month.

RTX: FAA set to lift U.S. grounding of Boeing 737 MAX (from Seekingalpha)

- It’s the day Boeing (NYSE:BA) has been waiting for after nearly two years of scrutiny, corporate upheaval and a standoff with global regulators.

- FAA Administrator Steve Dickson is expected to sign an order today lifting the flight ban on the 737 MAX – once Boeing’s hottest-selling jet – as well as an airworthiness directive requiring new pilot training and software upgrades.

- A stall-prevention system called MCAS was faulted in the 737 MAX crashes in Indonesia and Ethiopia that killed 346 people in 2018/2019 and triggered a crisis that cost Boeing some $20B and tarnished its reputation.

- Resuming deliveries will open up a crucial pipeline of cash for Boeing and hundreds of parts suppliers whose finances were strained because of the ban. Those include: Spirit AeroSystems (NYSE:SPR), Triumph Group (NYSE:TGI), Hexcel Structures (NYSE:HXL), Howmet Aerospace (NYSE:HWM), Heico (NYSE:HEI), TransDigm (NYSE:TDG), Collins Aerospace (NYSE:RTX), Ducommun AeroStructures (NYSE:DCO) and BAE Systems Platform Solutions (OTCPK:BAESY).

- The role of the FAA also went under the microscope during the crisis, and the House unanimously passed a bill to reform how the FAA certifies airplanes on Tuesday, while a Senate panel is taking up a similar bill today. Boeing will also not be allowed to sign off on the airworthiness of some 450 already-built 737 MAXs, meaning in-person, individual inspections could take a year or more to complete, prolonging delivery of the jets.

- Anticipating FAA approval, American Airlines (NASDAQ:AAL) plans to relaunch commercial MAX flights on Dec. 29, while Southwest Airlines (NYSE:LUV), the world’s largest MAX operator, does not plan to fly the aircraft until Q2 of 2021.

- Leading foreign regulators in Europe, Brazil and China also must issue their own approvals after independent reviews, while Boeing still faces strong headwinds like a resurgent coronavirus pandemic and new European tariffs.

- When it does fly again, Boeing will run a 24-hour war room to monitor all MAX flights for issues that could impact the jet’s return.

- 11/11/2020- realistic and conservative comments and response from RTX

- even with vaccine, we would still expect that it will take until 2023, before the passenger travel levels rebound to pre-COVID levels. And we’ve also talked about and after we can go into this a little bit more, if you want, a little bit of a lag of six months to nine months for air traffic benefits to show up in the aftermarket.

- We saw commercial aerospace bouncing around what we think is the bottom of the decline and our defense businesses performed generally as expected in the quarter.

- we would expect all of the defense businesses to grow organically next year. So we feel good about our overall position, our competitive position, our technologies, our alignment with the national defense strategy, and of course, the strength of our defense businesses internationally. So from a bigger picture, outlook point of view, I’d say, nothing’s changed there.

- we’re confident that when the commercial aero volumes return, our businesses have that same cash generating power and capability. And all else equal, some of these additional actions we’re contemplating here could even improve upon that.

- We are committed to returning the $18 billion to 20 billion over the four years following the merger. Round number is, call it, close to $12 bil of that coming from dividends. it is our expectation, sitting here today that we will resume buybacks at some point next year.

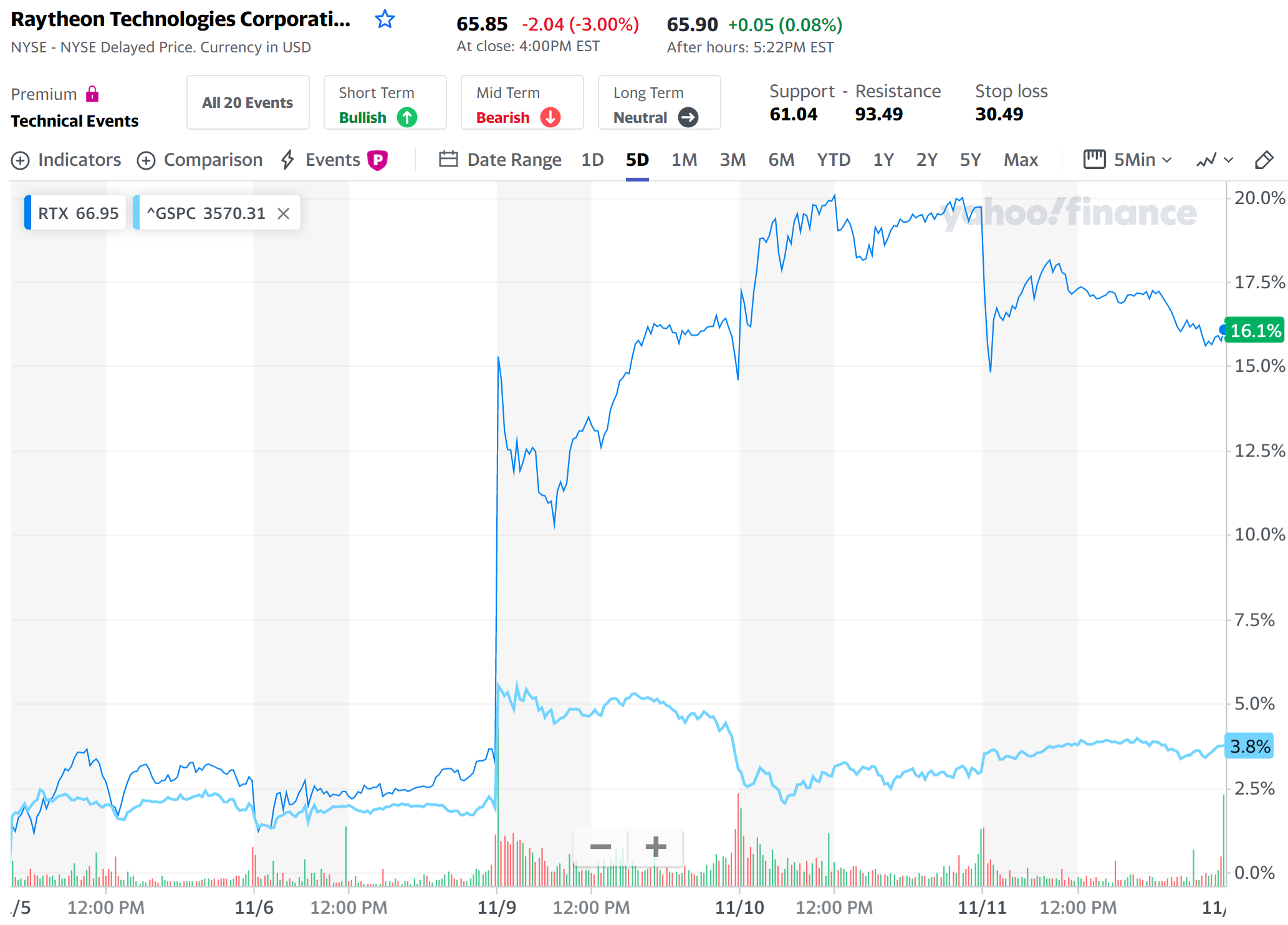

- 11/11/2020 – ready to switch from SP500 to RTX

- 11/11/2020 – J.P. Morgan analyst upgraded Raytheon target price goes to $79

Buy Raytheon, Spirit Because of Pfizer’s Vaccine News, Analyst Says. Here’s How Far Those Stocks Can Run.

J.P. Morgan analyst Seth Seifman upgraded shares of Raytheon Technolgies (ticker: RTX) and Spirit AeroSystems (SPR) to Buy from Hold. His Raytheon target price goes to $79 from $66, and his Spirit price target goes to $36 from $26.

The hope is that with an effective vaccine, commercial air traffic can recover. Coronavirus has decimated demand for air travel and recent traffic levels remain depressed. While the rest of the economy marches forward, aerospace remains stuck.

“To be clear, air travel remains severely depressed and Covid-19 should keep it that way into 2021,” wrote Seifman in his upgrade report. Pfizer, for instance, says it can manufacture 1.3 billion vaccine doses in 2021. That’s good news, but the vaccine can’t be distributed en masse overnight. “Nevertheless, stocks seem more poised to price in potential goodness before it fully arrives while looking through near-term badness.”

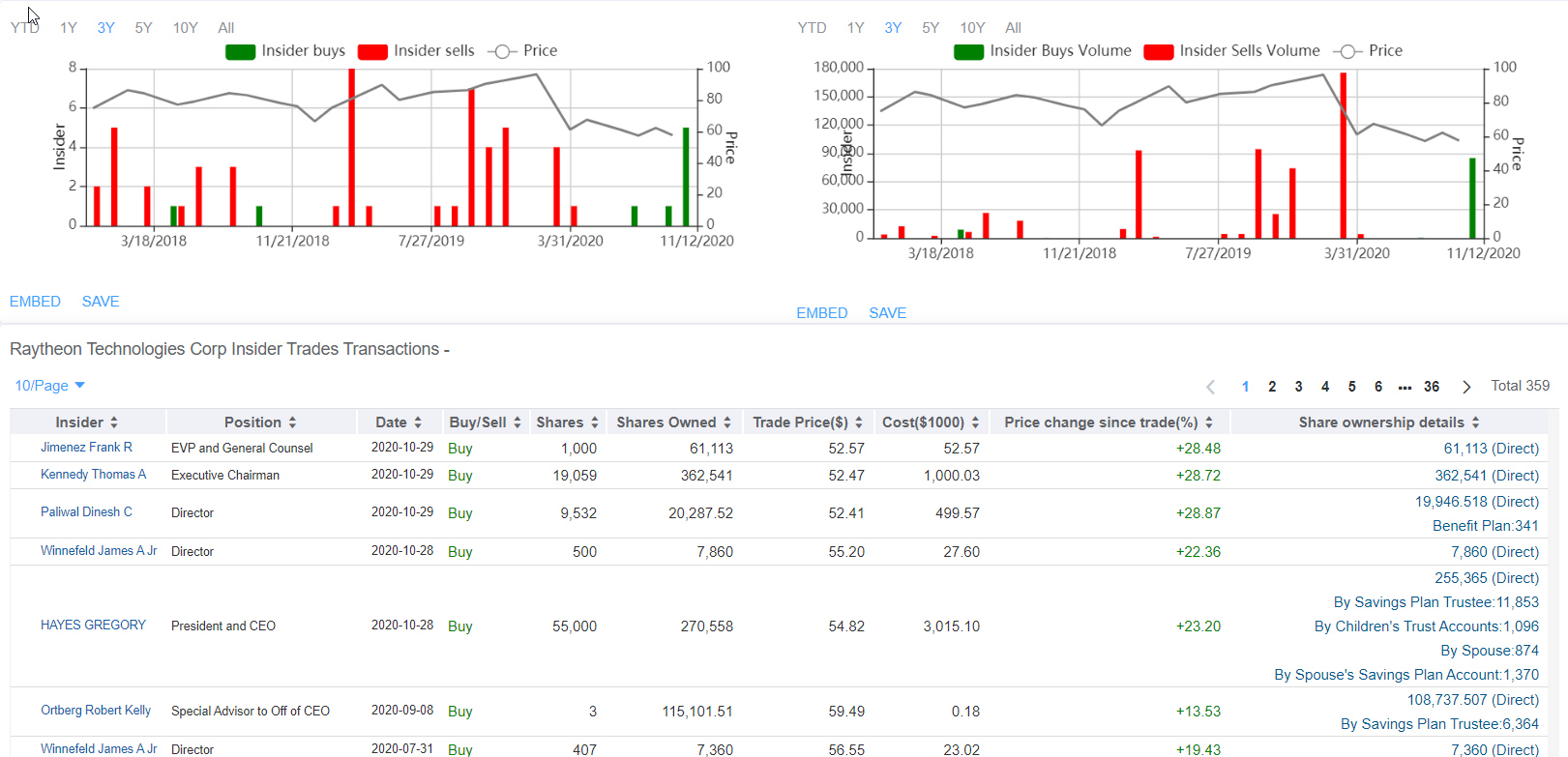

- 11/10/2020 – insiders buy, good signal?

- 11/09/2020 – RTX jumps 11% today due to vaccine news. There is a positive outlook on the stocks for investors with at least a one-year horizon. A second wave over the holidays is the biggest risk to the stocks near term, and anticipates a pullback this winter on another surge of new cases. So I need to get ready for buying again.

Airline Stocks Are Jumping Because a Vaccine and Stimulus Now Seem Real

Airlines stocks were soaring Monday morning on a twin-turbo charge of good news: vaccine progress and postelection hopes for a fiscal stimulus package, boosting the chances for more industry aid.

The stocks may also be getting a jolt from short-covering by traders who had bet against the stocks. American Airlines is the most heavily shorted stock in the S&P 500, with about 30% of the shares outstanding sold short. That makes it vulnerable to a short-squeeze, whereby traders scramble to cover their bets by buying shares. Trading volume in American was more than 88 million shares, well above the average daily volume of 61 million shares.

The stocks remain highly sensitive to Covid news, and short-covering won’t keep lifting the stocks if the virus news gets worse.

Seaport Global Securities analyst Daniel McKenzie wrote that a second wave over the holidays is the biggest risk to the stocks near term, and anticipates a pullback this winter on another surge of new cases. Capacity remains oversupplied by 30%, he estimates, despite sharp cutbacks in flight schedules.

But McKenzie reiterated a positive outlook on the stocks for investors with at least a one-year horizon. “The market is still “under-appreciating the efficiency and power of legacy networks in a smaller, post-Covid, consolidated industry,” he wrote. “Hence our comfort with airlines as multi-year earnings stories beginning in 2021, and thus valuations over the coming 12-months.”

- 10/28/2020 – Dow downed 3%, RTX downed 6% on the SEC criminal probes.

SEC Probes Raytheon Over Potentially Improper Payments

The regulator is looking into payments in the Middle East by Raytheon and a joint venture

Raytheon has had past brushes with the anticorruption law. An internal review in 2009 turned up possible areas of concern with regard to compliance with the FCPA, the company said at the time.

The matter came to a close in 2013, when the SEC and the U.S. Justice Department told Raytheon they had completed their own reviews of the company’s disclosure and wouldn’t be recommending enforcement actions.

- 10/27/2020 – mixed news for RTX’s earning report

Raytheon Shrinks to Fit Jet Downturn

Aerospace supplier is reducing head count, office and factory space as jetliner business slows

Sales at Raytheon’s Pratt & Whitney jet-engine unit fell by a third in the quarter, while revenue from aircraft parts halved as manufacturers reduced production and airline flying remained subdued.

Raytheon expects its sales of parts and engines to Airbus and Boeing to be down about 40% this year and in 2021 compared with last year, with minimal shipments of parts for the Boeing 737 MAX.

- 10/09/2020 – discussion on RTX

Raytheon and United Technologies Merge to Create Undervalued Defense Behemoth

Raytheon Technologies is a great company to buy right now at $62 per share.

Is RTX Stock a Buy? Raytheon Technologies Analysis 202

Based on the current number of shares of Raytheon common stock outstanding and reserved for issuance, UTC expects to issue approximately 648 million shares of UTC common stock to holders of Raytheon common stock in the aggregate in the merger. Based on the current number of shares of Raytheon common stock outstanding and reserved for issuance, and the current number of shares of UTC common stock outstanding and reserved for issuance, we estimate that, immediately following completion of the merger, former holders of Raytheon common stock will own approximately 43% and pre-merger holders of UTC common stock will own approximately 57% of the common stock of the combined company.

- 10/09/2020 – from 8th Annual Laguna Conference.

Dividend and Buyback: As far as the dividend I would tell you in my mind it’s sacrosanct. But we went through a lot of work with Toby O’Brien, our CFO and the team looking at all the downside scenarios and presented that to our board back in April. And I think everybody agreed we have got that financial flexibility we continue to pay the current dividend and to grow the dividend as earnings recover. So that is our commitment that the dividend will remain in place.

I mean unless something completely unforeseen happens but even in a big downside scenario we don’t see any issue with having liquidity to pay the dividend. Start to share buyback look I’d love to back up the truck yesterday but buyback kind of shares and again we’ve got liquidity. We’ve actually got borrowing capacity if we wanted to but I just think this is not the time with our airline customers and the OEM customers having such difficulty for us to go out and buy back a lot of shares.

Having said that as we do some of these divestitures I would expect that we would be using some of those proceeds for a share buyback as well as we get better clarity in 2021 about the shape of the recovery. I would hope to have to have some modest share buyback next year and then accelerate it into 2022 and 2023 as the recovery accelerates. So does that helps.

I would tell you the commercial aero team has jumped on this crisis and they’re driving about $2 billion in cost reduction and $4 billion in cash conservation actions this year. These costs actions include the elimination of more than 15,000 positions across our commercial aerospace and corporate organizations. That’s roughly a 20% reduction in SG&A at Pratt and about a 12% reduction at Collins. Those headcount reductions are nearly doubled the previous estimate of around 8,500 that we gave you back in July and we’re not done yet looking for further ways to reduce structural costs in all of our businesses.

There’s no doubt of course, the long term earnings power of RTX is substantial to continue to be well-positioned to deliver value over the long term and we’re going to continue to take a look at structural costs not just on the commercial side then on the defense side as well.

As far as liquidity, we’re in a strong position and we closed Q2 with about $7 billion of cash, $26 billion of net debt now we’ve also got revolvers in place of up to $7 billion. So no issues there on top of that we’ve closed three divestitures that we were required for merger approval. So we’ve received another $2 billion of net proceeds from those transactions. So liquidity is not an issue at all.

I think importantly we remain committed to the $18 billion to $20 billion of capital returning to shareowners over the next four years. We certainly have enough cash and liquidity to maintain the dividend and to begin [indiscernible] [ph] share buyback soon. At the end of the day Raytheon and UTC came together for three simple reasons. It was technology, talent and balance.

I would tell you the defense side of our business remains resilient and strong. Both the RIS and RMD had combined book to bill of about 1.2 in the second quarter; we’ve got a record backlog of $73 billion on the defense side of our business. And we continue to progress on some of our great franchise in the second quarter as you would know RMD booked a $2.3 billion order for TPY-2 Radars to the Kingdom of Saudi Arabia and a $300 million order for standard missile 3 from the Missile Defense Agency on top of a $1.4 billion order for a number of classified programs.

So great start to the year, it’s very strong. I would tell you the best news is on the defense side as we continue to grow that business and in fact this year we will probably add up or hire about 80 to 100 people. So a big reduction on the commercial side and strong growth on the defense side and you should also note that our defense technologies and advanced solutions are well aligned with the national defense strategy and we can talk more about that.

On the commercial side of course Pratt the combined GTF fleet has now reached over $5 million in revenue flight hours and Collins remains on track to achieve their $600 million of gross cost synergies from the acquisition of Rockwell Collins back in 2018. So we have strong businesses great franchises great technologies and each of our businesses is a leader in their respective market. We already see the potential for significant revenue synergies by combining the technologies across the business to generate some game changing solutions for our customers. So I believe we truly are stronger together.

I mean unless something completely unforeseen happens but even in a big downside scenario we don’t see any issue with having liquidity to pay the dividend. Start to share buyback look I’d love to back up the truck yesterday but buyback kind of shares and again we’ve got liquidity. We’ve actually got borrowing capacity if we wanted to but I just think this is not the time with our airline customers and the OEM customers having such difficulty for us to go out and buy back a lot of shares.

Having said that as we do some of these divestitures I would expect that we would be using some of those proceeds for a share buyback as well as we get better clarity in 2021 about the shape of the recovery. I would hope to have to have some modest share buyback next year and then accelerate it into 2022 and 2023 as the recovery accelerates. So does that helps.

Okay. Well, obviously we all – that’s a – those are a series of really good questions, Kristine. Let me talk about the airlines. They’re obviously in a cash conservation mode right now and they’re doing what they can to defer maintenance and manage their expenses. So, if you think about [indiscernible] as an example, about 65% of the fleet is flying today versus last year and yet the inputs into our overhaul shop are down 65%.

So we know people are deferring maintenance, that is – they’re using up green time on engines even if they have engines that need to be overhauled, they’re setting them down and taking and changing out engines and putting them on aircraft that can continue to fly. So we know that this is a practice and we’re working with all of our customers obviously to try and make sure that we can get through all of this together and I would tell you this is really — it has to be a joint effort.

We have to work with them to try and help them reduce maintenance costs in near-term. When will happen of course as we’ve seen in prior downturns is we will get a big slug of aftermarket of and these engines will all come back, they’re time-based overhauls. And that should provide a bow wave of aftermarket activity once the airlines are back on their feet. But again that is not a today or tomorrow story, that is going to be several years out. And so, we’re just going to continue to work with them as best we can and obviously keeping the fleet flying is the most important thing.

And again I would say there is also a bifurcation of the market and I think everybody is aware of, narrow bodies are coming back much more quickly. We see that in China, we see it in Europe, we see it in the US, whereas the wide body franchises are having a much more difficult time because they support international travel which is still down significantly more than domestic. Fortunately we don’t have a lot of engines out there on the wide body. Those are old PW4000 fleet that was on some A330s and some early Boeing 777s and Boeing 747s.

We expect most of those to be retired during the course of the next couple of years. We had already expected that though I mean those are engines that are averaging 22, 23 years of age usually at 25 years of age you don’t see the engine come through the shop anymore. So there will be some additional retirements. I’d tell you all of that has gone into our thinking in terms of where the aftermarket is today though and what the recovery slope looks like.

The good news is as we continue to ship GTF powered aircraft we’re replacing the fleet of retired engines faster but we’re actually adding more to the fleet than the retirements coming out. So I think it’ll all be fine. And again it’s all kind of contemplated in our view of how this recovery looks.

Synergies:

So let’s start out with the cost synergy piece, which I would tell you is progressing incredibly well. So that the biggest chunk and will get to over $200 million of those but when we talked about is a $1 billion of gross synergies. We’re obviously tracking to a much higher target internally recognizing that all the ideas that have been generated will fall, result in the savings we expect, but we feel very confident hitting the $1 billion plus of gross synergies.

But we feel very confident of hitting the $1 billion plus of gross synergies and for this year it’s going to probably about $200 million most of those are in the people side of corporate as we merge the two corporate offices and we complete the separation of carrier and Otis a lot of redundancy. So most of that is already in the bag I think all those folks have been notified and they are leaving during the course of the rest of this year. I think about the other big chunks of savings opportunity the biggest one will be on the procurement side.

Obviously the total bill for procurement is about $26 billion $27 billion we got about $10 billion of that is indirect and we’re going through line item by line item and making sure that we get the best deals from both sides. Again we’ll start to see those synergies a little bit this year but most of those will come until next year on the indirect side.

On the product side again lots of opportunities I can give you a couple of examples. One is simply on machining and castings by combining the buying power of our legacy aero businesses with legacy Raytheon businesses we’re able to add volume for legacy Raytheon with some of the higher volumes that Pratt and Collins saw in the machining centers as well as on the casting side.

So again we’ll start to see those savings next year and the year after. And the longer term savings really are around footprint. So just to give you some more data, we’ve got about 31 million square feet of office space at RTX. Obviously today we’re not utilizing very much of it. Our goal initially was to reduce that by about 10% or 3 million square feet by consolidating offices and exiting lease buildings et cetera. I challenged the team to think about this really differently in terms of how we go to work.

And from that perspective I think we can see maybe a 20% or 25% reduction in office footprint long-term, by long-term I mean over the next four to five years as we exit leases and move folks around to lower cost locations. Again, when you’re working remotely, I guess there everything is a low cost location, everything is a high cost location. But the fact is we don’t need all the office space that we have and we’ll continue to see opportunities there.

On the revenue synergy side we’ve got over a hundred revenue synergy opportunities already identified. Kelly Ortberg, who works for Collins Aerospace to run Rockwell Collins is also on our board now. He has leading this effort with the four business unit represents Wes, Roy, Chris and Steve. They’re meeting often as are their advance technology teams to go through these ideas. The first one that comes out of the box is probably future vertical lift where again we can combine packages and technology.

And a lot of these synergies are really from the legacy Collins side initially with the coms and GPS networks marrying those up with sensors and Wes and Roy’s business. But there’s many more I think in high temperature materials in some of the things that Pratt has seen that over time will be beneficial to a Wes’s missile business. So lots to go, and again I don’t have a dollar value for do yet. But clearly when we get to the next year and we get a chance to get the business unit presence in front of investors will we can articulate I think a much more definitive goal.

- 10/08/2020 – good competitive analysis

Best Military Tech Stocks to Buy | GD vs LHX vs LMT vs RTX

Who wins: General Dynamics stock (GD stock) vs Raytheon stock (dividend aristocrats)? Ep.28

- 10/08/2020 – Get to know CEO of RTX Greg Hayes, CEO seems an honest and sensible well balanced guy

10 Things You Didn’t Know About United Technologies CEO Gregory Hayes

Interview of Greg: Raytheon CEO Sees ‘Two-Year Tough Spell’ Ahead Due to Virus Pandemic

Apr.03 — Raytheon Chief Executive Officer Gregory Hayes says combining with United Technologies Corp. will create a “technology powerhouse” and that he is planning for a two-year “tough spell” because of the coronavirus epidemic. He speaks with Bloomberg’s Taylor Riggs and Mike McKee on “Balance of Power.”

Raytheon Technologies CEO on earnings, outlook, Covid-19 impact and more:

Raytheon Technologies CEO on Raytheon-UTC merger, coronavirus and more

Greg Hayes, CEO of Raytheon Technologies, joins “Squawk on the Street” to discuss the coronavirus impact, the merger between United Technologies and Raytheon, potential share buybacks and more The former United Technologies begins trading today under its new name, following the completion of the merger between United Technologies and Raytheon. Two companies spun out of United Technologies, Otis Worldwide (OTIS) and Carrier Global (CARR), begin trading today as separate public companies. Raytheon Technologies remains in the Dow Jones Industrial Average.

Watch CNBC’s full interview with United Technologies’ Hayes

Nov 27, 2018

UTX CEO Greg Hayes on the reaction to the proposed Raytheon merger

valuation of RTX: RTX Stock Analysis – is Raytheon Stock a Good BUY Today?- $RTX

- 06/15/2020 – RTX is a good buy?

Raytheon Technologies – A Great Aerospace Investment

Raytheon Technologies had a rather good first quarter despite the ongoing COVID-19 headwinds.

The company benefits from a large defense exposure, which supports sales and dividend payments.

While this market does not offer an easy ride up right now, I believe adding at current levels is a great long-term investment.

- 06/08/2020 – the merge of Raytheon and UTC might be great for both companies. I might can rotate some SP500 fund to RTX in my 401K

The Criticized Raytheon-United Technologies Deal Looks Smart Now

The pandemic has slammed the commercial aerospace business, but defense spending remains robust.

10/01/2019 – merger of RTN and UTC = RTX

Raytheon and United Technologies Merge to Create Undervalued Defense Behemoth

- 06/10/2019 – before RTN and UTX merge

Raytheon, United Technologies CEOs on why their merger is unlike others in defense