Study of macro 2021

Geopolitics and macroeconomics are very critical for investment. Therefore, I need to study it thoroughly:

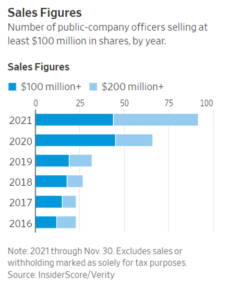

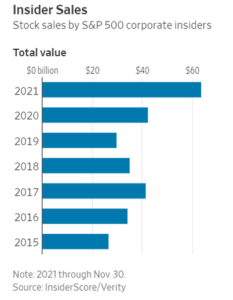

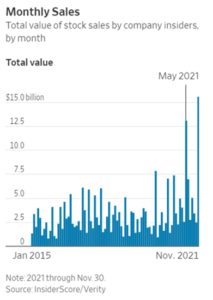

- 12/10/2021 – be alert that companies insiders are selling stocks at historical levels

Elon Musk, Other Leaders Sell Stock at Historic Levels as Market Soars, Tax Changes Loom – WSJ

Insiders like the Waltons, Mark Zuckerberg and Google’s co-founders have sold $63.5 billion through November, up 50% from 2020

- 12/03/2021 – US needs to contain China like Soviet Union – Today’s China isn’t the Soviet Union, but the country’s formidable strengths conceal grave weaknesses. Slowing growth, political sclerosis and looming demographic catastrophe threaten the regime. The best check on autocratic aggression remains the strength and unity of the democracies. The U.S. can work with allies to slow Chinese innovation through technological denial policies that limit its access to cutting-edge semiconductors, vast troves of American data and other crucial goods. It can complicate China’s overseas expansion by highlighting the corruption, authoritarianism and local resentment that its Belt and Road Initiative often fosters in developing countries. – Is delisting Chinese companies part of containment strategy?

Containment Can Work Against China, Too – WSJ

There are important differences between Xi Jinping’s China and the Soviet Union, but the Cold War still offers clear strategic guidance for the U.S.

Today’s China isn’t the Soviet Union, but the country’s formidable strengths conceal grave weaknesses. Slowing growth, political sclerosis and looming demographic catastrophe threaten the regime. Through his belligerence, Mr. Xi has made rivals of countries near and far. His strategy, such as it is, appears to involve seeking near-term wins—subduing Taiwan and weakening U.S. alliances in the Pacific, establishing a technological sphere of influence encompassing countries around the world—to offset, and perhaps even reverse, the accumulating effects of longer-term problems.

If Washington can block those advances, then Mr. Xi’s narrative of inevitable Chinese ascent will start to look hollow. And his successors will someday have to turn inward and address, through domestic reform and diplomatic moderation, the country’s growing isolation and the clutch of economic, political and social tensions that Mr. Xi’s policies are accentuating.

The best check on autocratic aggression remains the strength and unity of the democracies. Knowing this, Mr. Xi longs to separate Washington from its friends. Any narrowly nationalistic American approach to competition will thus fail. The U.S. will need instead deeper cooperation with like-minded countries—on trade, technological innovation and defense—to build collective resilience against Chinese aggression and to generate the collective pressure that can throw Beijing on its heels for a change.

The U.S. can work with allies to slow Chinese innovation through technological denial policies that limit its access to cutting-edge semiconductors, vast troves of American data and other crucial goods. It can complicate China’s overseas expansion by highlighting the corruption, authoritarianism and local resentment that its Belt and Road Initiative often fosters in developing countries.

The most effective long-term strategies aren’t simply passive: They bait an enemy into blunders and drive up the costs that it must pay to compete.

A strategy of this nature will make for a tense, sometimes frightening struggle.

- 11/29/2021 – Tilson’s comments

If you were to tell me that the stock market will crash by 25% or more over the next year and asked me to identify the possible reasons for it, here are my top three:

a) Rising inflation and/or debt levels worldwide will roil debt markets and spook equity investors.

b) A new COVID-19 variant will emerge that is resistant to the current vaccines, leading to a surge in deaths and a return to lockdowns.

c) We will get into a shooting war with China – likely over Taiwan.

- 11/29/2021 – watch out the volatilities coming at the week ahead: Omicron, supply-chain disruptions, a lot of economic data, with reports due on consumer confidence, private-sector payrolls, manufacturing and nonmanufacturing activity, and initial weekly unemployment claims. Friday with the release of November employment and unemployment figures. That report, along with the issuance of the Fed’s Beige Book summation of economic conditions on Wednesday afternoon. the looming debt-ceiling negotiations on Capitol Hill (in which failure to come to an agreement would force a government shutdown)

Stock Market Today: November 29, 2021

Taking a look at the week ahead, the investment community will be keeping close tabs on COVID-19 and the Omicron variant as it spreads around the globe. The new strain may cause some problems for less-vaccinated countries in both Europe and Asia, and it remains to be seen if the current vaccines will provide enough protection against it. This comes as supply-chain disruptions and bottlenecking in international trade continues to impact global output. Investors will also soon get a lot of economic data, with reports due on consumer confidence, private-sector payrolls, manufacturing and nonmanufacturing activity, and initial weekly unemployment claims. The headline report will come on Friday with the release of November employment and unemployment figures. That report, along with the issuance of the Fed’s Beige Book summation of economic conditions on Wednesday afternoon, will be closely watched by monetary policy decision-makers ahead of next month’s FOMC meeting.

The Fed’s stance on monetary policy, the looming debt-ceiling negotiations on Capitol Hill (in which failure to come to an agreement would force a government shutdown), inflation concerns and related supply-chain disruptions, and the renewed fear of the COVID-19 Omicron variant are together forming a “wall of worry” for Wall Street, and this uncertainty may lead to a near-term spike in equity market volatility. Given this backdrop, investors may be best served by adding some quality names to their portfolios, which, as noted above, can be found among the issues ranked 1 and 2 for Safety by Value Line. The company’s stock-screening capabilities can make the potentially daunting task of identifying these stocks quite easy. For example, the mega-cap technology names offer the best combination of high-growth potential and safety, which also made them popular holdings at the height of the coronavirus pandemic last year.

- 11/27/2021 –

Margin Debt and the Market: Up 3.6% in October

- 11/26/2021 – Each “Crisis” Has Been A Buying Opportunity

“Davidson” submits:

Every market has multiple events deemed a ‘pending crisis’ which results in panics some longer and some shorter. One rule has held over many cycles and that has been, ‘Buy on every ‘crisis’ if the market reflects strong liquidity.”

Buy on every ‘crisis’ if the market reflects strong liquidity.

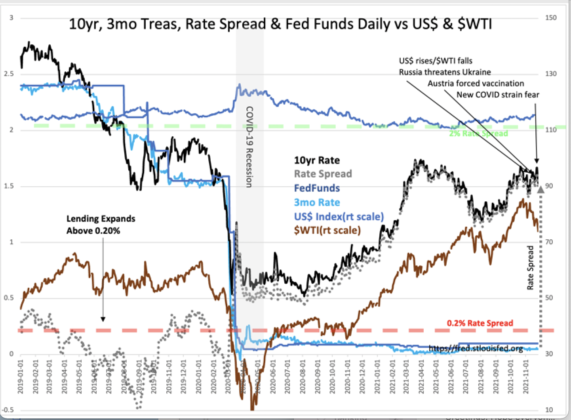

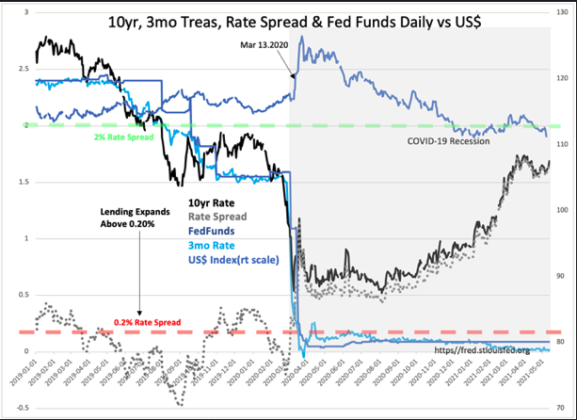

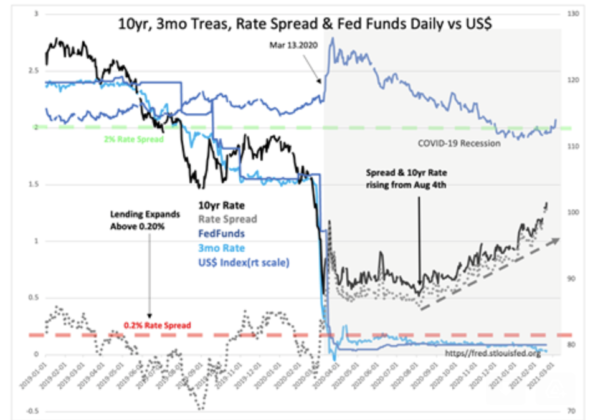

Liquidity and market psychology are highly correlated. If investors have adequate liquidity, then they do not panic when an earthshaking event hits the headlines as the new COVID strain has done today. The T-Bill 10yr Treasury rate spread is a combined proxy for liquidity and market psychology. It provides a measure for how far investors have ‘gotten over their skis’ in Wall Street parlance. Investors always panic on unexpected negative news and reassess market exposures vs the newly defined risk. Some will pare back positions on the first headline, while others will wait to be better informed as more detailed information emerges. Investor responses are dependent on how much one feels exposed to price declines. If one has adequate liquidity and market experience, one tends to ride out every new negative as something that can be worked through if a general economic expansion appears unthreatened. Those with the least experience tend to panic and sell positions precisely because they have been the least cautious at being prepared for unexpected negatives that more experienced investors have built into their strategies. It is the same every cycle.

The current T-Bill 10yr Treas rate spread is ~1.5-1.6% and has been widening since we exited the COVIS lockdown. Every important economic indicator, retail sales, employment and so on across every economic parameter reflects economic expansion. While a new COVID strain is to be expected, we have already had some 3,000 variants which is typical for a virus, it only becomes a “Black Swan” if investors are unable to deal with short term liquidity that arises from being overly committed to longer-term strategies with borrowed funds i.e., margin. This all-in investment position is reflected when the rate spread falls to 0.2% on rising T-Bill rates as investors commit all their capital including rainy day capital for higher returns. The history of this measure indicates ample liquidity exists to deal with today’s negative headline.

Today is a buying opportunity in my opinion within a strong economic expansion period.

- 11/02/2021 – Tilson still thinks “the mother of all economic booms” is still underway. Scott Grannis also thinks future economic growth will be at least decent

from Tilson’s daily

My friend David Berman of Durban Capital organized a birthday lunch for me yesterday. My colleague Berna Barshay and four other friends from the investment world joined us, so naturally, we talked about stocks.

My main takeaway from the conversation is that what I’ve been calling “the mother of all economic booms” is still underway.

In summary, while I tend to avoid making market forecasts, I think the odds are good that stocks will be up between now and the end of the year.

But the point remains (and is equally true today… I think): Just because things are getting foolish in the markets (or particular sectors) doesn’t mean they can’t get a lot more foolish…

Here are a few updated charts that track important information:

Today saw the release of September capital goods orders (Chart #1). Once again they were pretty strong. Capex (shorthand) is important because it is business investment in things that will enhance worker productivity in the future. This is therefore a good sign that future economic growth will be at least decent.

- 10/12/2021 – the three top possible risks on market from Tilson: In fact, I’d estimate that there’s only a 10% chance that the market declines more than 25% from today’s level at any point over the next 12 months, and there’s a less than 3% chance of a 50% decline. But the odds aren’t zero either…

1) If you were to tell me that the stock market will crash by 25% or more over the next year and asked me to identify the possible reasons for it, here are my top three:

a) Rising inflation and/or debt levels across the world will roil debt markets and spook equity investors,

b) A new COVID-19 variant will emerge that is resistant to the current vaccines, leading to a surge in deaths and a return to lockdowns, or

c) We will get into a shooting war with China – likely over Taiwan.

(Other possibilities not in my top three include an economic crash in China, a collapse of the cryptocurrency sector (whose market cap now exceeds $2.3 trillion), and a terrorist using a nuclear or biological weapon in a major city.)

To be clear, I don’t think a market crash due to these – or any other – scenarios is likely.

In fact, I’d estimate that there’s only a 10% chance that the market declines more than 25% from today’s level at any point over the next 12 months, and there’s a less than 3% chance of a 50% decline.

But the odds aren’t zero either…

- 10/03/2021 – really worth reading and prepare for it

The Volatility Squeeze

The next great short squeeze has begun; it will crash the market

- 08/27/2021 – ASA staffing Index and steel production level is back to 2019 level, all others are in the way to come back

Click here for this week’s Recovery Tracker

- 08/26/2021 – economic boom?

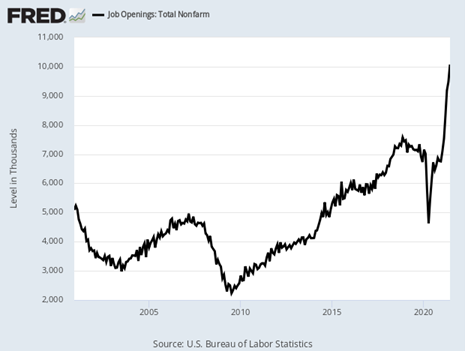

Speaking of the economic boom, check out this chart of nonfarm job openings (source) – WOW!

|

- 08/20/2021 – stock market might be too high for too long. Prepare for the pull back

S&P 500 hasn’t fallen 5% from a peak in nearly 200 sessions — what that tells market historians

the S&P 500 index SPX, 0.70% has seen a largely uninterrupted ascent to such a degree that this Friday, absent a sharp selloff, will mark the 200th session without a drawdown of 5% or more from a recent peak, making the current stretch of levitation the longest such since 2016, when the market went 404 sessions without falling by at least 5% peak to trough.

| Start data | End date | S&P 500 Gain During Streak | Days Without a 5% Pullback |

| Aug. 19, 1958 | Sept. 8, 1959 | 22.2% | 266 |

| Jan. 4, 1961 | Jan. 9, 1962 | 20.1% | 255 |

| Nov. 26, 1993 | June 8, 1965 | 23.4% | 386 |

| Oct. 12, 1992 | March 28, 1994 | 14.2% | 370 |

| Dec. 21, 1994 | July 12, 1996 | 41.4% | 394 |

| Oct. 21, 2014 | Aug. 20, 2015 | 6.9% | 210 |

| June 28, 2016 | Feb. 2, 2018 | 38.1% | 404 |

| Nov. 4, 2020 | Aug. 20, 2021 | 200* (assuming no fireworks on Friday) | |

| Source: Dow Jones Market Data |

It is extremely rare for the market to enjoy such a period of relative effervescence. Indeed, such lengthy stretches without a 5% pullback or better have occurred on only eight occasions in the S&P 500 index, the attached table shows.

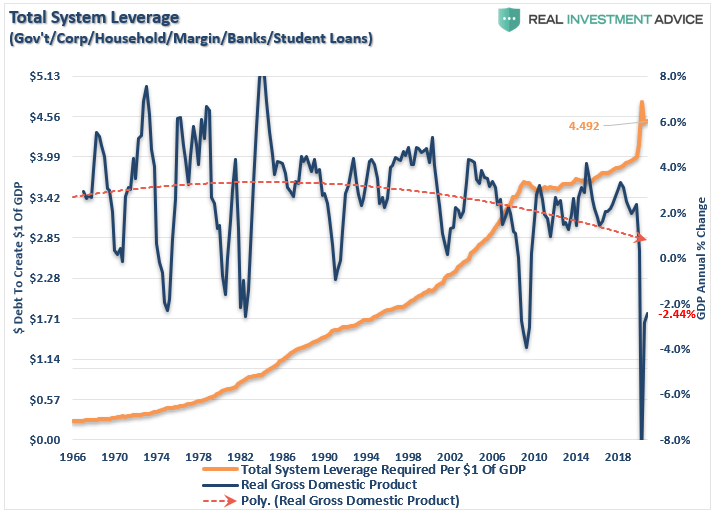

- 06/14/2021 – record corporate debt on historical low interest environment. What will happen if interest rate jumps?

Pandemic Hangover: $11 Trillion in Corporate Debt – WSJ

Stressed companies piled on debt as interest rates plummeted, but could face a reckoning in the next economic downturn

- 06/03/2021 – If the job growth in May coming out tomorrow is quite strong, inflation concerns could reappear, and the size of the expected infrastructure spending bill might wane.

Stock Market Today: June 3, 2021

Earlier this morning, Automatic Data Processing (ADP) reported that private-sector payrolls increased by 978,000 last month (the expectation called for 680,000 new positions), and at 8:30 A.M. (EDT), government figures showed that initial weekly unemployment claims fell to a pandemic era low of 385,000. The major averages, which have been rather directionless over the first two trading days of June, were down before the open. If the job growth in May coming out tomorrow is quite strong, inflation concerns could reappear, and the size of the expected infrastructure spending bill might wane.

Diving deeper into forces driving the markets, the equity futures are presaging a lower opening when trading commences stateside. The investment community did not like to hear that the Federal Reserve may soon begin tapering some of its bond-buying measures. The U.S. dollar weakened on this news. Likewise, investors both here and abroad are reacting negatively to reports that the United Kingdom is considering delaying the final stage of reopening by two weeks if hospitalizations and deaths from COVID-19 increase. Geopolitical tensions are heightened after Russia’s finance minister announced that with the country facing additional economic sanctions from the United States, it will remove all of the U.S. dollar assets from its National Wealth Fund and instead shift to euros, Chinese yuan and gold.

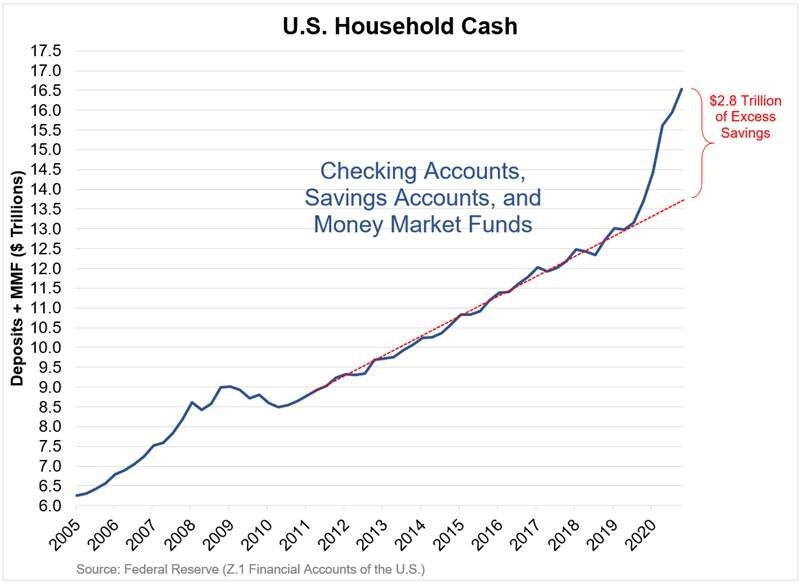

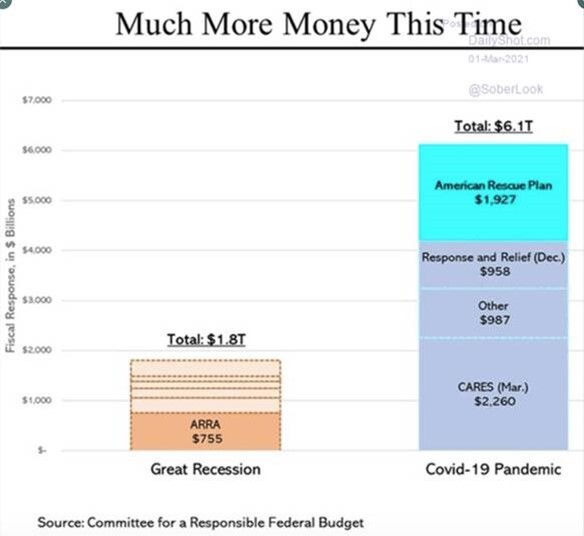

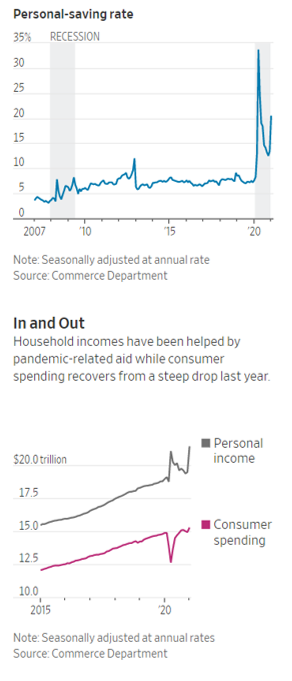

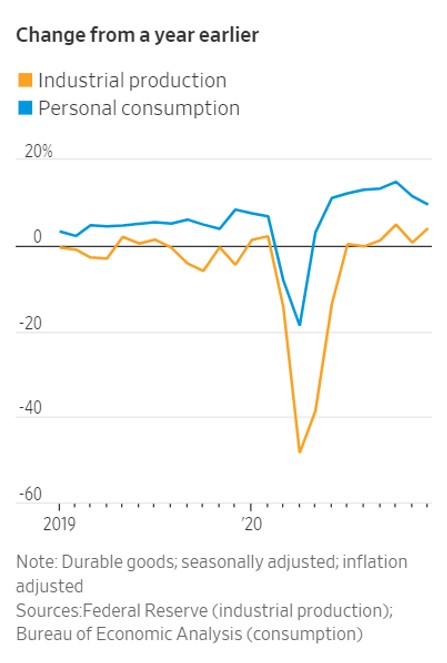

- 06/02/2021 – The U.S. economic recovery is unlike any in recent history, powered by consumers with trillions in extra savings, businesses eager to hire and enormous policy support.

The Economic Recovery Is Here. It’s Unlike Anything You’ve Seen. – WSJ

The U.S. economic recovery is unlike any in recent history, powered by consumers with trillions in extra savings, businesses eager to hire and enormous policy support. Businesses and workers are poised to emerge from the downturn with far less permanent damage than occurred after recent recessions, particularly the 2007-09 downturn.

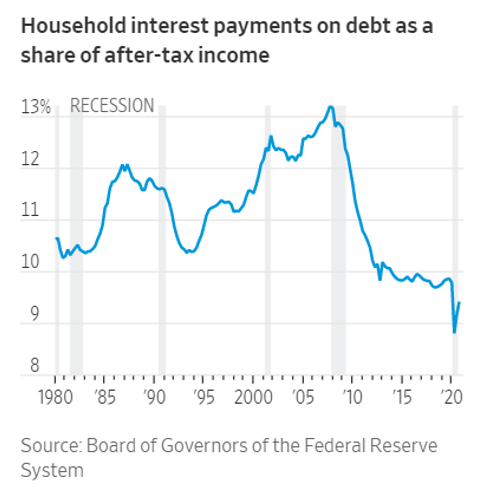

New businesses are popping up at the fastest pace on record. The rate at which workers quit their jobs—a proxy for confidence in the labor market—matches the highest going back at least to 2000. American household debt-service burdens, as a share of after-tax income, are near their lowest levels since 1980, when records began. The Dow Jones Industrial Average is up nearly 18% from its pre-pandemic peak in February 2020. Home prices nationwide are nearly 14% higher since that time.

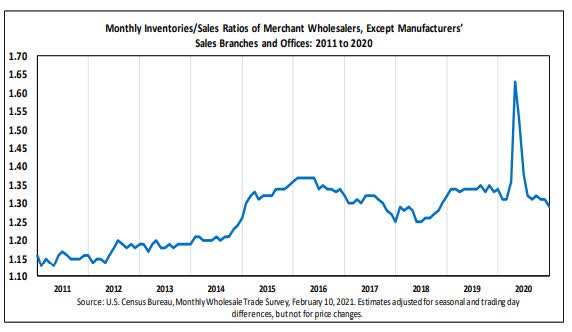

The speed of the rebound is also triggering turmoil. The shortages of goods, raw materials and labor that typically emerge toward the end of an expansion are cropping up much sooner. Many economists, along with the Federal Reserve, expect the jump in inflation to be temporary, but others worry it could persist even once reopening is complete.

“We’ve never had anything like it—a collapse and then a boom-like pickup,” said Allen Sinai, chief global economist and strategist at Decision Economics, Inc. “It is without historical parallel.”

- 05/30/2021 – Good to learn the stock history from Stanley Druckenmiller, especially on the parallels between the recent tech sell-off and the Dotcom Bubble

I really enjoyed this interview with investing legend Stanley Druckenmiller, who has never had a down year in more than four decades of investing and once compounded at more than 30% annually over 30 years. Here’s an overview of the topics he covers:

- What makes a great investor

- How he makes an investment decision

- Whether we are in another tech bubble

- What career advice he has for 20-year-olds

- What he thinks of crypto (bitcoin, ethereum, and dogecoin)

- Which Big Tech firm will be the first to reach a $5 trillion valuation

Here’s Druckenmiller on the implications of the “incredible wave of digital transformation”:

From 1995 to 2000, you had an incredible wave while the Internet was being built. What you have now is this incredible wave of digital transformation, particularly moving onto the cloud.

I used to say two to three years ago in some interviews that we’re in the bottom of the first or second inning in terms of digital transformation. And this is a 10-year runway.

Well, COVID sort of jumped you from the bottom half of the first inning to the sixth inning. I think [Shopify (SHOP) CEO Tobi Lütke] said we went from 2019 to 2030 [in terms of e-commerce sales] in one year.

I think the difference now is if you haven’t moved to the cloud, you’re dead because who you’re competing against, they can just beat you because the technology is so important.

So, now, full disclosure, I didn’t see what was coming in 2000. But I [have a difficult time coming up] with a scenario that this digital transformation thing is going to collapse and these SaaS [Software-as-a-Service] companies are going to go away.

The biggest problem you have now is the overall bubble and asset prices. The good news is if we had this conversation two months ago, the good [SaaS stocks] were like 45 times to 50 times sales. Not earnings but sales. They’re down to – there’s a range – I’d say now 10 times to 25 times sales for the good ones.

So, if the problem is price and – in my opinion – that is the problem: a lot of that has been wrung out. And I think if you hold these names for three to four years, they could easily grow into their valuations.

On which stock might reach a $5 trillion valuation first:

So, before I give my first guess: I have no idea.

If you put a gun to my head or we’re going to Vegas:

No. 1 would be Amazon.

No. 2 would be Microsoft.

Google could have a big pop, ironically, if the government breaks them up because their core search business is literally the best business I’ve ever seen.

But they keep trying all this experimental stuff that challenges shareholder value. But those guys are so rich. They’re more interested in changing the world right now and good for them.

On making concentrated, high-conviction bets:

When I’ve looked at all the investors [that] have very large reputations – Warren Buffett, Carl Icahn, George Soros – they all only have one thing in common.

And it’s the exact opposite of what they teach in a business school. It is to make large, concentrated bets where they have a lot of conviction.

They’re not buying 35 or 40 names and diversifying.

I don’t know whether you remember that Icahn a few years ago put $5 billion into Apple. I don’t think he was worth more than $10 billion when he did that.

[In 1992] when I went in to tell Soros that I was going to short 100% of the fund in the British pound against the Deutschmark, he looked at me with great disdain.

He thought the story was good enough that I should be doing 200%, because it was sort of a once-in-a-generation opportunity.

So, [these investors] concentrate their holdings. This is very counterintuitive.

In my thinking, [concentrating your bets] decreases your overall risk because where you tend to be in trouble is if you have 35 or 40 names.

If you start paying attention to one. If you have a big, massive position, it has your attention.

My favorite quote of all time is maybe Mark Twain: “Put all your eggs in one basket and watch the basket carefully.”

I tend to think that’s what great investors do.

On knowing when to sell and using stop losses:

The other thing to me [that makes a good investor] is you have to know how and when to take a loss. I’ve been in business since 1976 as a money manager.

I’ve never used the stop loss. Not once. It’s the dumbest concept I’ve ever heard. [If a stock goes down 15%] I’m automatically out.

But I’ve also never hung onto a security if the reason I bought it has changed. That’s when you need to sell.

If I buy X security for A, B, C, and D reasons, and those reasons are no longer valid, [I sell].

Whether I have a loss or a gain, that stock doesn’t know whether you have a loss or a gain.

You know, it is not important. Your ego is not what this is about. What this is about is you’re making money.

So, if I have a thesis and it doesn’t bear out – which happens often with me, I’m often wrong – just get out and move on.

Because I said earlier: if you’re using the most disciplined approach, you can find something else. There’s no reason to hang on to any security where you don’t have great conviction.

On the parallels between the recent tech sell-off and the Dotcom Bubble

Takeaway: Like the Dotcom Bubble, current tech valuations are “speculative”. However, Druckenmiller believes today’s high-growth tech stocks — particularly those involved with digital transformation (e.g., cloud stocks) — will be able to grow into these valuations within 3-4 years.

Stanley Druckenmiller: I’m seeing some similarities and I’m seeing some differences [with tech stocks today and during the Dotcom Bubble at the turn of the century].

Number one: valuations in both periods go to what I would call “speculative levels”.

Monetary policy was part of the issue in 1999, when [Fed Chairman] Alan Greenspan decided he would run an experiment and let unemployment go to lower levels than it had historically been.

It’s nothing like the crazy stuff we’re doing now, but that helps set it up for what was really going on back then.

Think about the fact that Netscape really didn’t really exist until 1995. So, other than some nerdy professors back in the early 80s, no one even had email, right? The internet was just sort of being built and the big winners in 1999 were companies like Sun Microsystem and Cisco, that were building the guts of the internet.

The growth was so rapid as this went on and valuations — combined with some easy money — got baked in.

But think of the internet infrastructure like the railroads 150 years ago. Think of the tech stocks like a company selling railway ties and building the guts of the internet.

When you’re building the railroad, your sales are going up +50, +60 or +70% a year. But once the railroad is built [you don’t need the railway ties anymore]. Your growth not only doesn’t go up 70%, it goes down because on a rate of change basis, you don’t need any more railroad ties.

None of us — me included — saw that in early 2000. A lot of these companies with estimates of +50-70% growth for the next 2-3 years had businesses that were literally about to collapse. So the NASDAQ went down 95%. Not 30%, but 95%. Because you had this combination of inflated values, way over-estimated earnings and then an earnings collapse.

Today, you have something similar and something different. Monetary policy is absolutely insane. We had no quantitative easing (QE) back then. And our [interest] rates weren’t 0%. They were 4% or 5% when they probably should have been 6% or 7%. No comparison.

So we have an asset bubble. Now that’s not just in tech stocks, it’s in everything. I know some of the [young] backers of Dogecoin might disagree.

If you’re an asset, you’ve been moving.

From 1995 to 2000, you had an incredible wave while the internet was being built. What you have now is this incredible wave of digital transformation, particularly moving onto the cloud.

I used to say 2-3 years ago in some interviews that we’re in the bottom of the first or second inning in terms of digital transformation. And this is a 10-year runway.

Well, COVID sort of jumped you from the bottom half of the first first inning to the sixth inning. I think [Shopify CEO Tobi Lutke] said we went from 2019 to 2030 [in terms of e commerce sales] in one year.

I think the difference now is if you haven’t moved to the cloud, you’re dead because who you’re competing against, they can just beat you because the technology is so important.

So, now full disclosure, I didn’t see what was coming in 2000. But I [have a difficult time coming up] with a scenario that this digital transformation thing is going to collapse and these SAAS companies are going to go away.

The biggest problem you have now is the overall bubble and asset prices. The good news is if we had this conversation 2 months ago, the good [SAAS stocks] were like 45-50x sales. Not earnings but sales. They’re down to — there’s a range — I’d say now 10-25x sales for the good ones.

So if the problem is price and — in my opinion — that is the problem: a lot of that has been wrung out. And I think if you hold these names for 3-4 years, they could easily grow into their valuations.

[In comparison] if you held the names in 2000, a lot of these companies you still would have lost 90% of your value, right? So those are the similarities and those are the differences.

- 05/28/2021 – what opportunities can I find in his plan?

Biden Unveils $6 Trillion Spending Plan – WSJ

WASHINGTON—President Biden’s $6 trillion budget proposal unveiled Friday charts his vision of an expansive federal government role in the economy and the lives of Americans, with big increases in spending on infrastructure, public health and education along with tax increases on corporations and the wealthy.

The Biden administration is seeking $1.52 trillion for spending on the military and domestic programs in fiscal year 2022, which begins Oct. 1, an 8.6% increase from the $1.4 trillion enacted last year, excluding emergency measures to combat the Covid-19 pandemic.

The proposal would shift more federal resources from the military, which would see a 1.6% rise in spending next year, to domestic programs such as scientific research and renewable energy, which would receive 16.5% more funding under the president’s plan in 2022.

The White House also detailed costs for its proposals to spend $4.5 trillion over the next decade on infrastructure and social programs, which the administration is hoping to advance through Congress this summer. The plan would provide $17 billion next year for infrastructure improvements, including repairs to roads, bridges and airports, $4.5 billion to replace lead water pipes across the country, and $13 billion to expand high-speed broadband.

Plans to provide universal preschool and ensure teachers at those schools earn $15 an hour would cost $3.5 billion in 2022. The budget would also provide $8.8 billion next year on direct spending on families, including $6.7 billion for affordable child care, and $750 million for paid leave, the costs of which would rise substantially in 2023 and beyond.

The budget incorporates the administration’s eight-year, $2.3 trillion infrastructure proposal and its $1.8 trillion American Families Plan and adds details on his $1.5 trillion request for annual operating expenditures for the Pentagon and domestic agencies.

- 05/24/2021 – the industrial, financial, energy, and consumer staples companies would fare the best in a period of higher prices (inflation). The earning power of the financial companies, particularly the banks, would be enhanced by higher lending rates.

Stock Market Today: May 24, 2021

The main theme on Wall Street this spring has been the rotation out of the high-growth stocks and into the value names. As noted, this has been brought about by continued concerns about inflation and the possibility that the central bank will raise interest rates ahead of its planned target of 2023. The value stocks in the cyclical areas have been the beneficiary of late, with the thought being that the industrial, financial, energy, and consumer staples companies would fare the best in a period of higher prices. They have the best ability to pass the higher costs along to the consumer, as people need food and energy products to live their lives. The earning power of the financial companies, particularly the banks, would be enhanced by higher lending rates. Investors, though, should note that this recent sector rotation is starting to make some of the value stocks a bit expensive versus their historical norms. Perhaps, the reason why we are seeing some selective movement back into the recent out-of-favor groups.

- 05/20/2021 – there is an enormous amount of cash sitting on the sidelines, estimated to be upwards of $4 trillion. – this has the potential to drive up the value and cyclical stocks

Stock Market Today: May 20, 2021

Investors should note that with many of the top hedge funds recently taking profits in the high-growth areas where valuations are stretched after tremendous advances last year, there is an enormous amount of cash sitting on the sidelines, estimated to be upwards of $4 trillion. This trend can either be good or bad news for traders. If further profit taking occurs, or if the funds simply hold their large cash balances, it could put further near-term downward pressure on stocks. But if the economy continues to recover and the inflation concerns prove transitory (the Federal Reserve’s current stance), there could be a rush of buying later this year. In this environment, even with the uncertainty of inflation and possible changes to the U.S. tax code lingering, we would recommend keeping a significant portion of funds in the equity market, particularly in the value and cyclical categories that will get a boost from further re-openings. With fixed-income yields low, bonds are still not providing much of an investment alternative to stocks. – William G. Ferguson

- 05/19/2021 – Great article on interest rate and stock market from Davidson

Market prices despite the many predictions by professionals have never followed a cohesive logic connected to fundamentals. Prices of everything bought/sold are set by market activity driven by market psychology of what things are worth. Markets fluctuate dependent on market psychology of the moment fed by media headlines. Human activity is market activity and includes product, service and information exchange. When you look deeper, products and services are items derived from information and innovation repurposed into business offerings on which individuals derive profit. Most stop their analysis at evaluating what stocks and bonds are worth, but what something is worth is at all times a moving target of information exchange. If the idea improves standards of living better than other ideas, it sells better and produces profit for the innovator. In the marketplace innovators offer ideas but it is consumers who make the judgement on utility. While businesses are believed to set prices, prices are in fact set by consumer willingness to purchase. This is an individual value judgement of one offering vs other offerings. What people believe things are worth differs frequently from fundamental measures. This is the crux of Momentum vs Value Investing. Momentum investors believe prices reflect intrinsic value but Value investors see prices as only what investors are willing to pay for fundamentals.

Markets always reflect a wide gap between prices and fundamentals with areas mispriced based on the themes of the moment. Today two themes are playing out, the ‘stay-at-home’ vs the ‘back-to-work’ as investors cope with the economic impact of COVID. Media headlines can be pessimistic one hour and optimist the next in an ebb and flow too fast to fathom with common sense. Advisors promoting their expertise (and seeking new clients) provide so many short-term streams of direction it is a muddle based on enigma.

How one makes sense of it all is to ‘connect the dots’, i.e. all the dots possible to find the fundamental drivers of market pricing. The ‘dots’ comprise a wealth of inputs but when one works through it, simple relationships become apparent. Over the short-term these patterns do not jump out of you but longer-term they are far more obvious. Net/net it is fundamentals over the long-term that drives market psychology despite the presence of an unpredictable quicksand of short-lasting themes. Short-term market themes provide head-fakes throughout every market cycle. This creates confusion for any investor with a short-term trading mindset. Short-term themes are very much like being in a house of mirrors. Bitcoin is one of these.

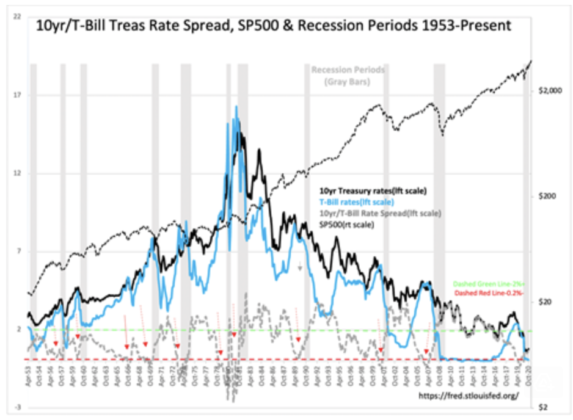

Rates are market prices set by market psychology. Rates, especially the Rate Spread is a good measure of the current state of investor psychology and provides insight to the overall condition of speculation during a cycle. Every cycle since the Fed has kept track of rates, since 1953, has displayed the same pattern:

In recession the yield curve is inverted and rates are at the low point of the cycle

- Emerging from recession 10yr Treasury rates rise while T-Bill rates lag as investors gain confidence and seek higher returns but keep some capital aside, rate spread widens.

- Middle of the cycle T-Bills rates begin to rise with 10yr Treasury rates as investor confidence expands. Roughly a 2% rate spread range. Bank lending accelerates with net income profits and economic activity is spurred higher.

- Speculation begins to develop and investors shift capital out of T-Bills forcing the rate spread to narrow.

- Speculation and bank lending continues till the rate spread narrows to 0.2% reducing lending profits significantly. Rates are at the top of the cycle. At this point, banks and investors are over-leveraged and additional capital coming into the economy and markets slows. Defaults in over-leveraged businesses creates a domino cascade into the next recession.

Rates are not fundamental measures of economic activity but a measure of market psychology and investor positioning. The fundamental measures that provide the economic background are employment indicators, measures of goods manufacturing and transport, measures of retail consumption and etc. The trends in fundamentals is what eventually drives investor psychology to shift capital seeking the better perceived risk/return at any point in time. Investors pushing rates higher in the shift from fixed income to equities does eventually impact the cost of doing business and hiring new employees. It is a feedback mechanism between market psychology and economic activity that is always present. This is a long-term relationship not the short-term impact reported to be shifting daily in the media. In ‘connecting the dots’, it is the long-term dots which connect best with the rest of the information being head fakes regarding actual long-term returns.

At this point in the current cycle, T-Bill rates remain near record lows as 10yr Treasury rates continue to rise. Even though it should be apparent we exited recession April 2020, more than 12mos ago, many continue speak as if we remain in recession and demand further stimulus.

There are copious levels of liquidity present. It appears we are roughly half way towards the next economic/market top with ~8mil individuals still to reenter the economy. There are pockets of rank speculation in SPACs, in Internet related ‘stay-at-home’ and new but untested technology companies and the latest craze, Bitcoin and other cryptocurrencies. The valuations are non-existent in many of these reflecting Momentum themes based purely on price with fundamentals and common sense lacking altogether. Cryptocurrencies are unconnected to economic activity. Fearing a top is not new for those involved only in these issues ignoring the fundamentals of long-term economics vs pricing. Recognize the differences in Momentum vs Value Investing and employ both in your thinking. Be balanced! Reassert that balance every day.

Connect the long-term dots and ignore what is in between as noise. The fundamentals remain in uptrends and the rate spread continues to indicate tops are a ways off into the future as do fundamentals. Perhaps there is a top in 3yr-5yrs. Not today!

- 04/14/2021 – central bank will reduce bond purchasing WELL before raising interest rate. Be aware of this

Fed chairman notes that most central-bank officials see rates remaining near zero through 2023

Federal Reserve Chairman Jerome Powell said Wednesday that the central bank will begin to slow the pace of its bond purchases “well before” raising interest rates.

The Fed has been buying at least $120 billion a month of Treasury debt and mortgage-backed securities since last June to hold down long-term borrowing costs. Since December, the central bank has said the economy must make “substantial further progress” toward its goals of maximum employment and 2% inflation before it scales back those purchases.

“We will taper asset purchases when we’ve made substantial further progress toward our goals, from last December when we announced that guidance,” Mr. Powell said in a virtual event held by the Economic Club of Washington, D.C. “That would in all likelihood be before—well before—the time we consider raising interest rates.”

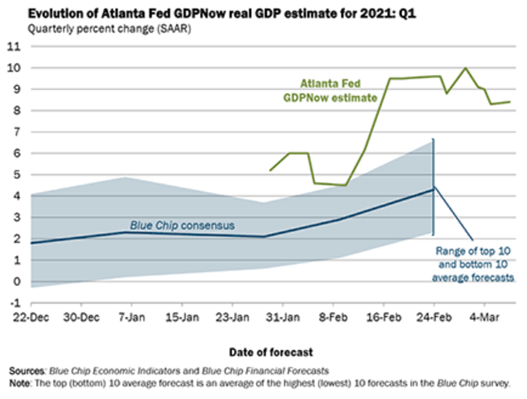

- 04/09/2021 – economy is on the cusp of a boom, inflation might come temporarily at spring

The economy is on the cusp of a major boom and economists believe it could last

- The economy is just starting a boom period, where second quarter growth could top 10%, and 2021 could be the strongest year since 1984.

- The second quarter is expected to be the strongest, but the boom is not expected to fizzle, and growth is expected to be stronger than during the pre-pandemic into 2022.

- A period of supercharged growth is just starting, and it is showing up in surging consumer spending and in an increasing shortage of skilled workers.

- With surging demand could come inflation, something the economy has avoided for more than two decades.

Fed Chairman Jerome Powell has gone out of his way to stress the Fed will keep policy low, and that he expects a transient jump in inflation in the spring.

Hyman, in his note, said it’s possible inflation could rise to 3%. The personal consumption expenditures price index, watched by the Fed, was up 1.6% on an annual basis in February, and JP Morgan economists expect it to rise to 1.8% in March.

Powell has said higher inflation should show up this spring because of the base effect, compared to last year’s weak numbers. He said inflation should be transitory, and bottlenecks in supplies should be temporary.

- 04/01/2021 – “We want to see progress by Memorial Day, we’d like to see this package passed by the summer. But I certainly expect when Congress returns that the president will be inviting members to the Oval Office.” – so the timeline is end of May to see progress, passed by the summer (June 21 ~ Sept 22).

White House hopes to see infrastructure bill passed by summer

President Biden hopes to see Congress pass his infrastructure and climate proposal by this summer, White House press secretary Jen Psaki said Thursday, setting a slightly longer timeline than his recently enacted coronavirus relief package.

Psaki told reporters at an afternoon briefing that the extra time will allow for more White House negotiations with congressional Republicans and Democrats, particularly since the legislation does not carry the same level of urgency as the American Rescue Plan that was signed into law last month.

Still, she said Biden would like to see “progress” by the end of May.

“The American Rescue Plan was an emergency package, we needed to get it done as quickly as possible to get the pandemic under control, to get relief, direct checks out to Americans,” Psaki said.

“We’ve got a little bit more time here to work and have discussions with members of both parties,” she continued. “We want to see progress by

“The American Rescue Plan was an emergency package, we needed to get it done as quickly as possible to get the pandemic under control, to get relief, direct checks out to Americans,” Psaki said.

“We’ve got a little bit more time here to work and have discussions with members of both parties,” she continued. “We want to see progress by Memorial Day, we’d like to see this package passed by the summer. But I certainly expect when Congress returns that the president will be inviting members to the Oval Office.”

The timetable is nevertheless viewed as ambitious for such a large package, and it’s possible that it could take several months to get a bill through.

, we’d like to see this package passed by the summer. But I certainly expect when Congress returns that the president will be inviting members to the Oval Office.”

The timetable is nevertheless viewed as ambitious for such a large package, and it’s possible that it could take several months to get a bill through.

- 03/29/2021 – Biden Administration, which is keen on rebuilding the nation’s infrastructure, is expected to speak on this topic on Wednesday. The business beat also will be in Wall Street’s focus, with reports due on consumer confidence, manufacturing activity, continuing jobless claims, and employment and unemployment activity. The jobs data will be released on Friday, and with the stock market closed, the employment data may make for an interesting first full week of trading in April when investors return from the long Easter holiday next Monday.

Stock Market Today: March 29, 2021

The Biden Administration, which is keen on rebuilding the nation’s infrastructure, is expected to speak on this topic on Wednesday. Conversely, with output possibly spiking in the summer and fall months and the U.S. government spending at a historic pace, it may bring concerns about inflation. Against this backdrop, we would tend to stay away from some of the higher-yielding equity groups, as their stocks may be hurt by a rise in bond yields. That would make fixed-income securities more attractive options for those investors looking for income. A rise in inflation also may weigh on some of the food processing companies, as higher input costs would likely their hurt earning potential going forward. It is worth noting that shares of General Mills (GIS) fell last week on such concerns.

So what lies ahead for investors in this abbreviated week of trading? (Note that the stock market is closed on Friday for Good Friday.) Our sense is that the volatility will continue, as investors monitor Treasury yields. The business beat also will be in Wall Street’s focus, with reports due on consumer confidence, manufacturing activity, continuing jobless claims, and employment and unemployment activity. The jobs data will be released on Friday, and with the stock market closed, the employment data may make for an interesting first full week of trading in April when investors return from the long Easter holiday next Monday.

- 03/29/2021 – Tilson thinks market can still go up

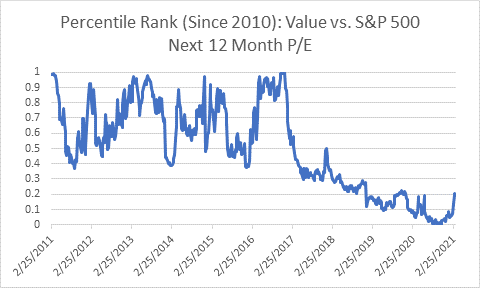

this chart with data from Jefferies Trading Desk makes me think value stocks (including banks) have a lot more room to run, as they’re still in the bottom 20% of their historical valuation range relative to the S&P 500 based on next 12 months’ price-to-earnings (P/E) ratio:

Turbocharged Economy Leaves Factories Struggling to Deliver.

- 03/29/2021 – this crash reminds me the warning from Burry on the danger of over-leveraged market – a surprising chaining reaction – be alert of the danger, try to avoid it and be ready for it

Hedge fund blowup sends shockwaves through Wall Street and the City

Shares in Credit Suisse (CSGN.SW) and Nomura (8604.T) sunk over 10% on Monday after both warned they faced potentially billions in losses linked to hedge fund Archegos Capital.

Hedge funds typically borrow money from banks to invest, a process known as margin trading. This allows funds to leverage up the cash they hold and increase their positions — potentially earning far greater returns if their bets come good. However, it also means hedge funds can theoretically lose more money than they hold in client funds.

If trades made on margin turn sour, banks will ask a client to put up more money as collateral to limit potential losses. This process is known as a margin call.

Archegos faced margin calls on its positions last week but failed to provide extra cash. As a result, banks began selling off stocks held on the hedge fund’s behalf — a fire sale known in the City as liquidating positions. The business press reported on Friday that Goldman Sachs (GS) and Morgan Stanley (MS) were selling huge chunks of shares in businesses including ViacomCBS (VIAC), Discovery (DISCA) and Chinese stocks Baidu (BIDU) and Tencent Music (TME). The block sales are estimated to be worth around $20bn (£14.5bn), according to the Financial Times.

“Things started going wrong for Archegos when shares of companies such as Viacom started to slide mid-last week,” said Michael Brown, a senior market analyst at Caxton Business. “It was at that point that margins were called, and couldn’t be provided, hence the block sales seen Friday.”

- 03/28/2021 – when economy is reopening, it might be good to invest in things like travel companies, restaurants, off-line shopping and “consumer experiences.”

Funds bet on a consumer boom to rival ‘Roaring Twenties’

Some of the world’s top money managers are betting on a post-pandemic spending boom that will boost real-world companies as economies reopen and people go back to their normal lives.

Investors from Aberdeen Standard Investments Inc. and GAM Investments to UBS Asset Management are increasingly pouring money into companies where face-to-face interaction is the norm — things like travel companies, restaurants, off-line shopping and “consumer experiences.”

- 03/25/2021 – Biden to announce details of $3T infrastructure plan on March 31 in Pittsburgh. Good for economy and energy and financial?

Biden to unveil multi-trillion dollar infrastructure plan in Pittsburgh next week

President’s infrastructure bill is expected to include tax hikes on wealthy Americans, corporations

President Biden said Thursday that he will travel to Pittsburgh next week to announce details of his multitrillion-dollar infrastructure bill, a sweeping measure that’s expected to include funds for roads and bridges, as well as address issues like climate change and income inequality.

“The next major initiative is – and I’ll be announcing it Friday in Pittsburgh in detail – is to rebuild the infrastructure, both the physical and technological infrastructure of this country so that we can compete and create significant numbers of really good-paying jobs,” Biden said during his first official White House press conference.

White House press secretary Jen Psaski said Wednesday Biden would provide more details about the proposal on Wednesday, March 31, in Pittsburgh.

The specific contours of the next big-ticket spending package are still unclear, but the measure is widely expected to include a slew of taxes hikes, including raising the corporate tax rate to 28% from 21%, increasing the income tax rate on individuals earning more than $400,000, expanding the estate tax, creating a higher capital-gains tax rate for individuals earning at least $1 million annually and paring back tax preferences for so-called pass-through businesses.

- 03/22/2021 – more to come on infrastructural plan. Mr. Biden is expected to discuss his agenda during his first formal news conference Thursday and in his first address to a joint session of Congress in the coming weeks.

White House eyes sweeping $3T spending proposal

A source familiar with the plans confirmed that administration officials are eyeing $3 trillion as the topline figure for its Build Back Better jobs and infrastructure proposal, though they cautioned talks are fluid and the final number could change. The sweeping package would constitute the White House’s follow-up to the $1.9 trillion economic relief measure signed into law earlier this month.

The new package is expected to be split into two separate bills. The first would focus on infrastructure, with spending on manufacturing and climate change measures, broadband and 5G, and the nation’s roads and bridges.

The other measure would include funds for pre-K programs, free community college tuition, child tax credits and health care subsidies, according to multiple reports.

The White House declined to confirm details of the proposal, saying nothing had been finalized.

Buttigieg’s Next Job: Selling $3 Trillion Infrastructure Plan to Skeptics – WSJ

‘When it comes to rail, why should Texas be inferior to China?’ asks former presidential candidate amid Republican resistance to funding for mass transit

Biden Administration Officials Put Together $3 Trillion Economic Plan – WSJ

President is expected to be briefed on the details of the multipart package this week

Mr. Biden is expected to discuss his agenda during his first formal news conference Thursday and in his first address to a joint session of Congress in the coming weeks.

- 03/21/2021 – Fed might be forced to increase interest rate by the end of 2022

Fed may hike rates sooner than 2023: NABE

The Federal Reserve has been targeting a range of 0.0%-0.25% for the federal funds rate since March 15, 2020

The National Association for Business Economics’ (NABE) March 2020 Economic Policy survey finds that almost half of respondents believe the Federal Reserve could tighten its monetary policy by the end of 2022. The survey, conducted between Feb. 22 and March 5, is a summary of the responses of NABE’s 205 members.

- 02/22/2021 – take time to understand this

https://seekingalpha.com/article/4407906-treasury-yield-stress-point

-

- 03/16/2021 – Sales slipped in February but are set to rebound strongly in March

Spending Is About to Spring Forward – WSJ

Sales slipped in February but are set to rebound strongly in March

Retail sales took a big step back in February. The next step almost inevitably will be a big one forward, but it is what comes after that that will matter most.

The Commerce Department on Tuesday reported that retail sales dropped 3% in February from January, which was more than the modest decline economists had expected. On the other hand, January’s sales jump was revised to an increase of 7.6% from a gain of 5.3%.

The causes of the zig and zag in sales aren’t hard to figure out. January sales were boosted by the government payments that began to arrive in late December. The fading of that boost would already have been a drag on February sales, and then winter storms hit, including the one that left millions of people in Texas without power.

Credit-card data from Bank of America and JPMorgan Chase show that sales so far this month already rebounded from February—and that is before the next set of government payments which are now on the verge of hitting many Americans’ bank accounts. Throw in the arrival of warmer weather that makes pandemic workarounds easier as well as the general sense of relief that the end of the Covid-19 crisis may be in sight, and March retail sales could be quite strong.

-

- 03/16/2021 – Regarding infrastructure plan Democrats want to pass a bill out of committee by Memorial Day and get a bill to Biden by September, though Congress is under pressure to move faster. So we might need to wait half a year on this.

Dems’ momentum hits quagmire over infrastructure plans

Democrats are facing big headaches as they try to craft a sweeping infrastructure and jobs package.

Fresh off a victory on the coronavirus relief bill, where they eschewed GOP support, President Biden and congressional leaders are homing in on one of Washington’s biggest legislative white whales as their next legislative priority.

The goal could test Democratic unity due to razor-thin margins in both chambers and early signs of contention over how to pay for the spending, including talk of a tax hike, and whether the bill should be narrowed in order to make it bipartisan.

Democrats want to pass a bill out of committee by Memorial Day and get a bill to Biden by September, though Congress is under pressure to move faster. It’s unlikely the White House would unveil its plan this month as officials take a victory lap on the COVID-19 relief bill and juggle a burgeoning border crisis.

Transportation Secretary Pete Buttigieg declined to specify a timeline Monday but told reporters that Biden would release an infrastructure proposal “in short order.”

“We’ve got a clock on everything we’re doing, especially because the present surface reauthorization is up in September. We’re not waiting until September in order to act. Conversations are taking place right now, as you’ve seen, Oval Office meetings with the president and leaders from both parties from both houses,” Buttigieg said.

The White House has said that Biden would like to move forward in a bipartisan fashion on infrastructure legislation, but it has not ruled out pursuing the budget reconciliation process.

-

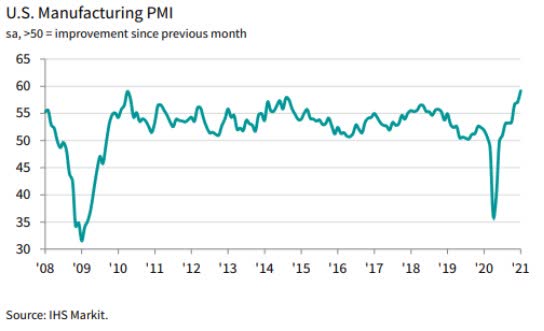

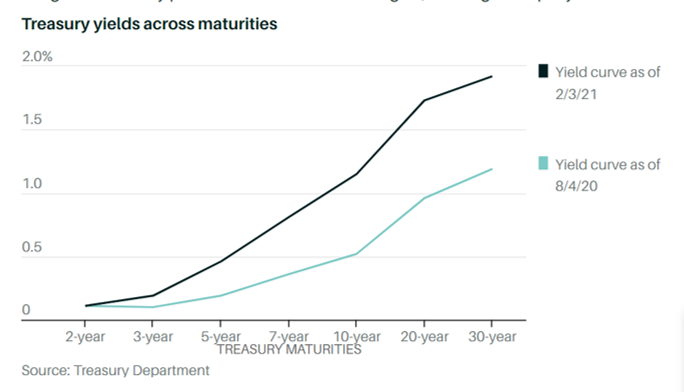

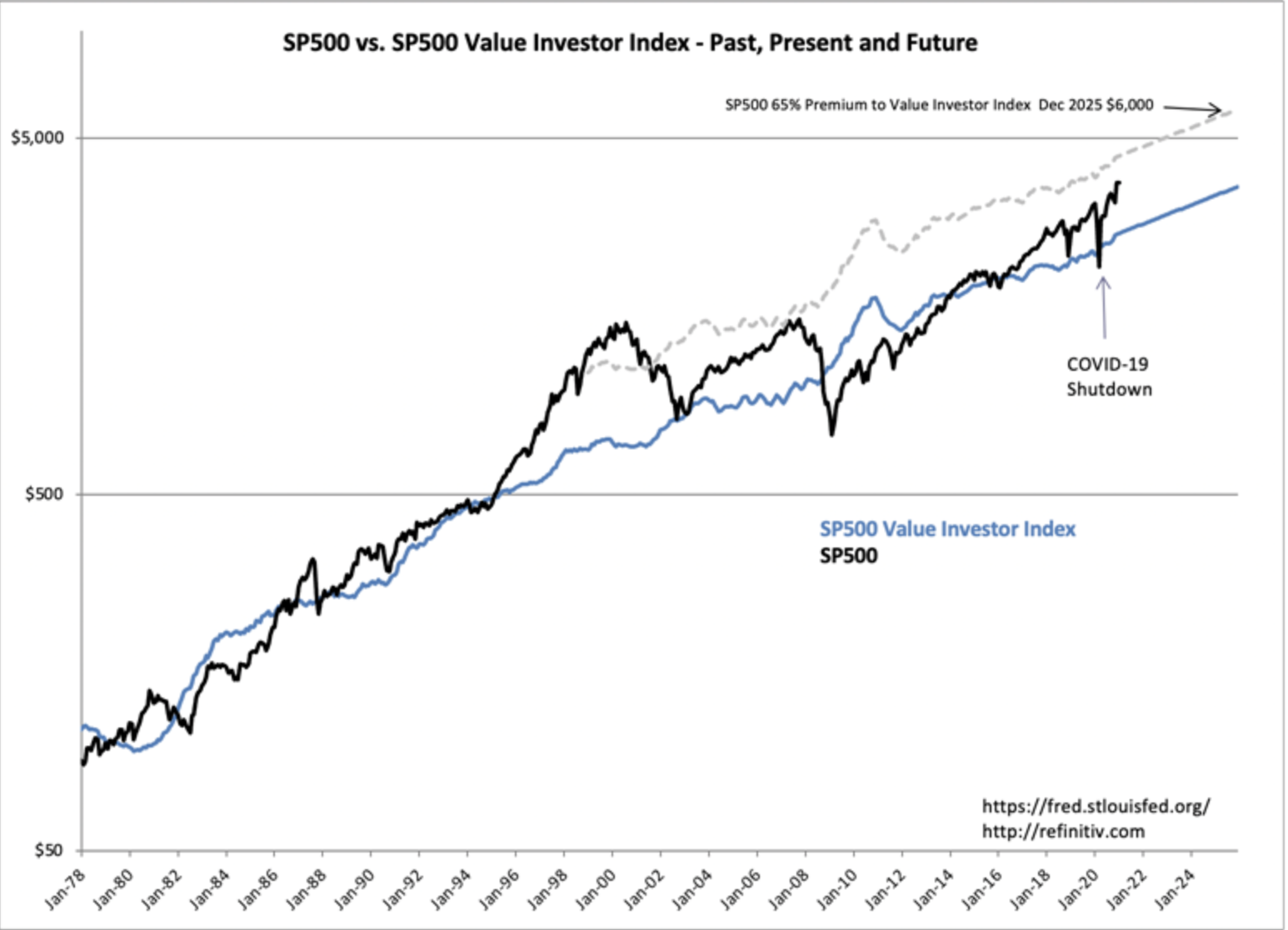

- 03/15/2021 – Historically, the T-Bill/10yr Treas rate spread has followed the same pattern since we have the rate record. The relationship in the T-Bill/10yr Treas rate spread has been a good market indicator. 2018-2019 was unusual in that the T-Bill/10yr Treas rate spread collapsed without recession due to issues with foreign autocrats forcing capital into the US 10yr Treasury for safety which resulted in an inverted yield curve yet no recession till COVID lockdowns. The T-Bill/10yr Treas rate spread still remains a decent indicator of market speculation. – It seems like David Tepper took advantage of this and made a lot of money in QQQ calls. With market psychology and the ever presence of unpredictable geopolitical events, predictions of this type have little precision. Simply, the next inverted yield curve will likely be the market peak. Along the way, investors will speculate in one theme or another. Using past measures of market psychology and fundaments suggests an SP500 peak of $6,000+ in 3yr-5yr. This estimate comes from the SP500 Value Investor Index.- market might still have some runway up for the the time being. Watch out for the inverted yield curve.

How high a market can climb in any cycle has many inputs all ending in peak enthusiasm at the time, i.e. “Market Psychology”. Everyone will have a reason why markets will not peak at the top, but the historical factor which has helped to time peaks since 1953 is the T-Bill/10yr Treas rate spread.

It works if one treats rates as reflecting investor psychology.

- Market Pessimism = Lower Rates

- Market Optimism = Higher Rates

Market pricing is fluid. Very fluid! Highly dependent on conditions leading up to peaks and especially tied to unexpected events. COVID as just experienced was one of these. Historically, the T-Bill/10yr Treas rate spread has followed the same pattern since we have the rate record. During recessions pessimism is high and rates across the yield curve are low. Typically, fear is so high that 10yr rates fall below that of T-Bills. This is called an “Inverted Yield Curve”. Gradually, some investors envision equity opportunities and sell a portion of their 10yr Treasuries to buy equities. The effect results in 10yr Treas rates rising with a rise in equity indices. Over time other investors follow suit. The widening spread of the T-Bill/10yr Treas rate spread reflects improved optimism and also stimulates bank lending with higher net income margins. As the business cycle gains momentum investors begin to shift ever more capital into equities causing both T-Bill and 10yr Treas rates to rise with the pace of 10yr Treas being higher. Further along in the cycle, investor optimism causes capital from T-Bills to enter equities as well creating a period when short and longer term rates rise in parallel. Speculation begins in earnest when the T-Bill/10yr Treas rate spread is 2.0% level. Still further in the cycle optimism overpowers any caution and speculation begins as T-Bill/10yr Treas rate spread begins to narrow. At market peaks, speculation is high and the T-Bill/10yr Treas rate spread has narrowed to 0.2% levels which causes bank lending to fall sharply. What follows is a collapse of speculation without additional lending. A recession follows, investors panic and rates fall sharply across the yield curve. After roughly 18mos of financial restructuring, default and write-offs, the next cycle begins anew.

The relationship in the T-Bill/10yr Treas rate spread has been a good market indicator. 2018-2019 was unusual in that the T-Bill/10yr Treas rate spread collapsed without recession due to issues with foreign autocrats forcing capital into the US 10yr Treasury for safety which resulted in an inverted yield curve yet no recession till COVID lockdowns. The T-Bill/10yr Treas rate spread still remains a decent indicator of market speculation.

Currently the T-Bill/10yr Treas rate spread is widening. The US economy is in a strong recovery outside of government lockdowns. Lockdowns are being eased every week. Employment is recovering, retail, housing, manufacturing and other indicators reflect a “V” shaped recovery. Market have always risen with these conditions and are expected to do so this time as well. Economic activity and the equity markets are likely to peak once we approach an “Inverted Yield Curve” condition. Using past measures of market psychology and fundaments suggests an SP500 peak of $6,000+ in 3yr-5yr. This estimate comes from the SP500 Value Investor Index.

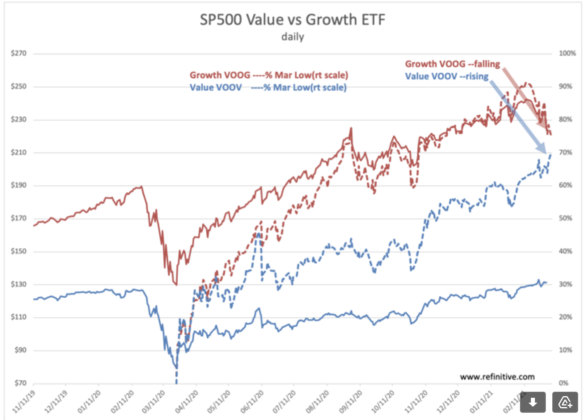

With market psychology and the ever presence of unpredictable geopolitical events, predictions of this type have little precision. Simply, the next inverted yield curve will likely be the market peak. Along the way, investors will speculate in one theme or another. COVID provided a focus which is now ending as seen in the correction of VOOG(SP500Growth ETF). The VOOV(SP500 Value RTF) is gaining investor interest. COVID is behind us and VOOV is very likely to out-perform VOOG for the next few years.

For now, markets remain in an uptrend as ~8mil-9mil currently unemployed individuals return to work. The sharp rise in the T-Bill/10yr Treas rate spread indicates a sharp rise in investor optimism. Current levels indicate much more is yet to come.

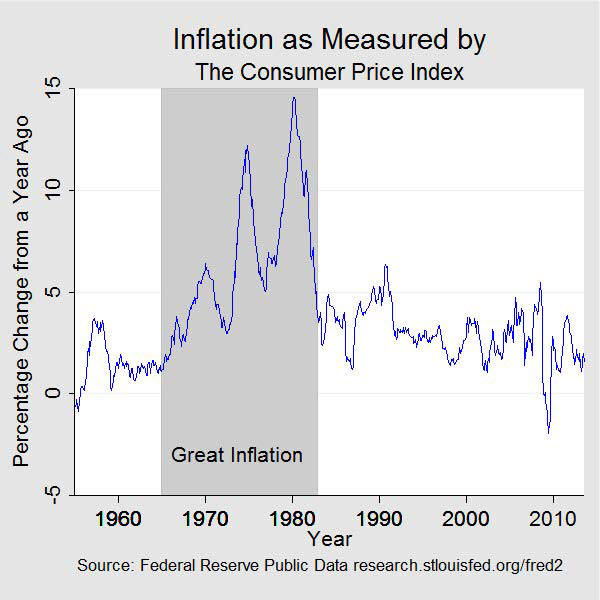

- 03/14/2021 – In order to fight the high inflation in 1965 to 1982, Fed tightened money and raised interest rate to slow down economy, but drove unemployment very high. Eventually, inflation dropped and unemployment dropped

The Great Inflation: 1965–1982

The Great Inflation was the defining macroeconomic period of the second half of the twentieth century. Lasting from 1965 to 1982, it led economists to rethink the policies of the Fed and other central banks.

Sections

- Forensics of the Great Inflation

- The Motive: The Phillips Curve and the Pursuit of Full Employment

- The Means: The Collapse of Bretton Woods

- The Opportunity: Fiscal Imbalances, Energy Shortages, and Bad Data

- From High Inflation to Inflation Targeting—The Conquest of US Inflation

The Federal Reserve after World War II

Lecture Materials: details on inflation

The Federal Reserve after World War II presentation (PDF) | Accessible Version

- 03/14/2021 – Yellen admits that we will have inflation which is manageable according to the 1970s as an important lesson. However, during this period, interest rates hit nearly 20% due to government policies, economy tanked, unemployment sky high. Only eventually, inflation died out. The cost was significant. see the history here (The Federal Reserve after World War II presentation (PDF))

Yellen projects full employment in 2022, interest rates to remain low

Yellen believes the Fed has learned lessons from high inflation during the 1970s

Treasury Secretary Janet Yellen believes that 2022 will see a return to full employment, crediting the race.

A rapid rise in employment may have a knock-on effect of creating rampant inflation. Yellen downplayed those concerns, though, calling it a “small risk” that is manageable.

“Prices fell a lot last spring when the pandemic surged. I expect some of those prices to move up again as the economy recovers in spring and summer,” Yellen explained. “That’s a temporary movement in prices.”

Yellen cited the 1970s as an important lesson, when interest rates hit nearly 20% due to government policies. The Federal Reserve has “learned” to manage expectations, and Yellen believes that the government has the tools to handle rising inflation – should it occur.

Further, the world’s trends appear to be in support of low interest rates: Yellen pointed to lower interest rates in years prior to the pandemic – trends she believes will continue even after the country recovers.

- 03/12/2021 – inflation is a process. The interplay between inflation and the bond market isn’t so different — yields lead growth, growth leads inflation, and inflation catches up last. “The real inflation story begins when the labor market fully heals,” Dutta adds. “The economy remains far from this point. Indeed, this year will likely bring with it a significant positive supply shock in the labor market as schools reopen.”

‘Inflation is a process’ Inflation might be coming. The data says: not yet.

In financial markets there are few things you can count on.

But one thing we know will surely come up sooner rather than later are widespread concerns about inflation.

The commodities cycle, the Treasury yield curve, growth forecasts, and easy comps all suggest that higher consumer prices are coming down the pike this year. Which made Wednesday’s report from the BLS on consumer prices hotly anticipated by investors.

When the numbers dropped, however, they landed with a bit of a thud. At least if you were expecting to see inflation starting to take off.

In a recent note, we saw one strategist note that the stock market leads earnings, earnings lead the economy, and economic growth catches up last. The interplay between inflation and the bond market isn’t so different — yields lead growth, growth leads inflation, and inflation catches up last.

In the summer, additional re-opening alongside easing supply chain pressures will likely result in pockets of inflation but not broad overall price pressures. Another look-through from the Fed’s perspective.

“The real inflation story begins when the labor market fully heals,” Dutta adds. “The economy remains far from this point. Indeed, this year will likely bring with it a significant positive supply shock in the labor market as schools reopen.”

And so we should expect plenty of fireworks on inflation data in the coming months, though none of this is likely to give the Fed any reason to change its forecasts. Even if — or perhaps especially if — the numbers might appear to suggest otherwise.

- 03/12/2021 – Biden admin’s next plan might be trillion-dollar infrastructure and clean-energy jobs package. Some Dems think it is better to also include health care and immigration reform, but some think it might be too much to get passed. The new package might come as early as May and final passage might not happen until the fall. Dem does not want to wait for 2022 because of the mid-term election. Dem wants to have bipartisan plan, even without it, they want to have good faith through reconciliation. – we will see what will happen.

Democrats debate fast-track for infrastructure package

fresh off his first major legislative victory, Biden himself says his nascent administration will turn next to a trillion-dollar infrastructure and clean-energy jobs package. And a growing number of Democrats are now urging the White House and Democratic leadership to use the special budget process to push it through the Congress to deliver critical roads, bridges and broadband projects to their districts and a potent campaign issue they can run on in the tough 2022 midterms.

“We need an FDR-like investment in our infrastructure,” Rep. Rick Larsen (D-Wash.), chair of the Transportation and Infrastructure (T&I) aviation subcommittee, told The Hill.

Yarmuth called infrastructure the “No. 1 priority for using reconciliation if we have to,” for both the Biden administration and congressional Democrats.

If talks with Republicans fall apart over the next two months, Yarmuth said, Democrats could begin the reconciliation process — passing another budget bill directing committees to draft individual pieces of the package — as early as May, shortly after Biden sends his fiscal 2022 budget request to Congress.

Final passage might not happen until the fall, Yarmuth said.

Still, there is reluctance in the party to a go-it-alone approach on infrastructure, a rare issue that polls well on both sides of the aisle. Centrist Sen. Joe Manchin (D-W.Va.) has threatened to derail Biden’s infrastructure package unless a serious effort is made to bring Republicans on board.

“I am not going to get on a bill that cuts them out completely before we start trying,” Manchin told Axios recently.

- 03/11/2021 – Gates and Buffett use farmland to fight against low interest rate and future possible hyperinflation? lots of fed subsid

Congress has reduced risk by underwriting crop prices and cash revenues

Bill Gates is now the largest owner of farmland in the U.S. having made substantial investments in at least 19 states throughout the country. He has apparently followed the advice of another wealthy investor, Warren Buffett, who in a February 24, 2014 letter to investors described farmland as an investment that has “no downside and potentially substantial upside.”

There is a simple explanation for this affection for agricultural assets. Since the early 1980s, Congress has consistently succumbed to pressures from farm interest groups to remove as much risk as possible from agricultural enterprises by using taxpayer funds to underwrite crop prices and cash revenues.

Over the years, three trends in farm subsidy programs have emerged.

- 03/10/2021 – Extending this relief could bring calm to anxious markets, and the Fed may consider it good housekeeping for monetary policy or Treasury-market functioning—though it might also be politically costly, as some top Democrats oppose extension. But it is unlikely to be a cure for rising rates in general.

Bank Regulation Tweak Unlikely to Be Cure-All for Treasurys – WSJ

Extending a pandemic rule enabling banks to hold more Treasurys may have a limited impact on rising yields

The latest example is whether or not the Federal Reserve will extend an emergency pandemic policy to exclude cash and Treasurys from banks’ supplementary leverage ratios, a key regulatory measure. Doing so would give them more capacity to gather deposits and buy government bonds. If the Fed doesn’t extend this after it is set to expire on March 31, the argument goes, there might be even more upward pressure on yields in the Treasury market.

Extending this relief could bring calm to anxious markets, and the Fed may consider it good housekeeping for monetary policy or Treasury-market functioning—though it might also be politically costly, as some top Democrats oppose extension. But it is unlikely to be a cure for rising rates in general.

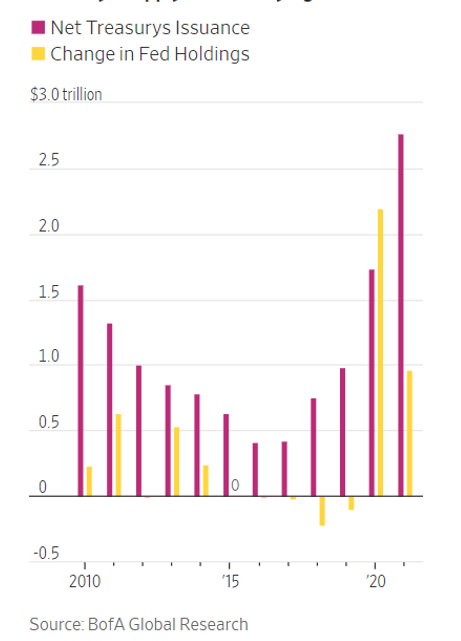

- 03/10/2021 – watch out the Fed supply of treasury bonds, too much again will push down yield a lot. So far might be OK because he Treasury Department may not need to increase the amount of notes and bonds it issues to fund the $1.9 trillion coronavirus relief package that President Biden is expected to sign shortly, analysts said, given its cash on hand and the size of current auctions.

Flood of New Debt Tests Bond Market – WSJ

Supply seen as one factor driving yields higher as investors anticipate economic resurgence fueled by vaccinations and government stimulus

Net new supply of two- to 30-year Treasurys is expected to reach $2.8 trillion this year, according to BofA Global Research, up from $1.7 trillion last year and around $990 billion in 2019. The Fed, meanwhile, is expected to purchase $960 billion of Treasurys, down from more than $2 trillion last year.

Supply may not be the primary factor driving yields higher. But it has been an accelerant, weighing on the market precisely because the economic outlook has already made investors hesitant to buy bonds, traders say.

One piece of good news for investors is that the Treasury Department may not need to increase the amount of notes and bonds it issues to fund the $1.9 trillion coronavirus relief package that President Biden is expected to sign shortly, analysts said, given its cash on hand and the size of current auctions.

- 03/10/2021 – no lock down of economy in 1920s during spanish flu, so America prospered after it

Mainstream inflation consensus and Rosenberg in the 1920s

As Wall Street veteran Bob Farrell pointed out, “if all experts and predictions match, something else will happen,” Rosenberg reminds us.

Rosie, as he is widely known, does not buy a comparison with the big names in the 1920s, nor a comparison with the period after the common Spanish flu.

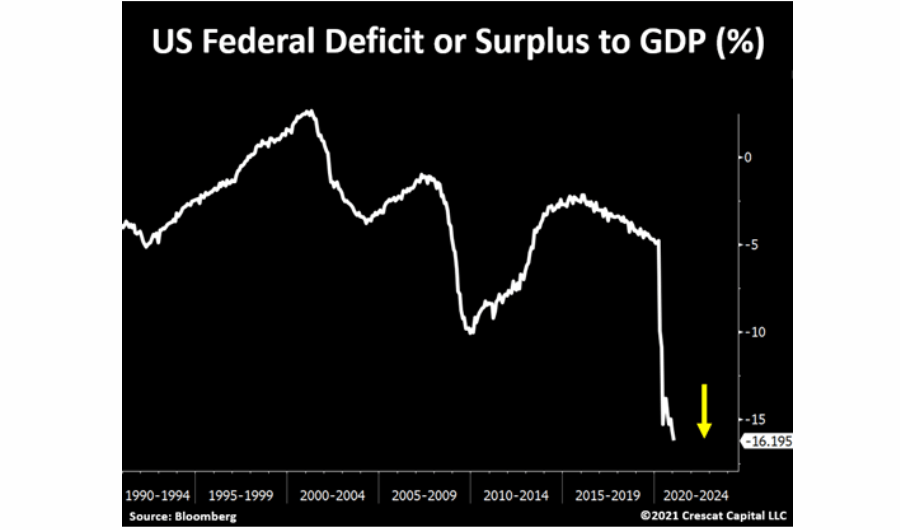

This time it is different, in his opinion, because of the size of the debt already in the system, there is no prospect of a global boom after overcoming the pandemic.

The main points of Rosenberg’s rationale (his emphasis) are:

For one thing, coming out of World War I, which ended when the Spanish flu began, the United States now accounts for half of the world’s manufacturing production. That’s because the war devastated the entire European economy and gave US industry the opportunity to gain global market share in exports and industrial production.

Second, the United States treated the Spanish flu quite differently. The economy was never completely blocked. People have just learned to live with the disease and eventually disappeared with herd immunity. At that time, no one asked the government for help. It was all about community and philanthropy. These were the days before welfare and unemployment insurance benefits and company bailouts. Public attitudes towards illness and death were very different, and there was no internet or social media that influenced people’s perceptions and aroused emotions.

At that time, the economy collapsed, but the government didn’t bother with the financial scale. As a result, when the crisis ended, in the 1920s, huge demand stagnated and the balance sheet was much better. Government debt to GDP was 10%, not over 100%. And its better public sector balance sheet allowed the federal government to cut taxes by the mid-1920s. The maximum marginal tax rate for businesses was initially raised from 10% in 1920 to 13.5% by 1926, but in 10 years; for individuals, that percentage went from 58% after the war to 24% by 1929. It was. Does anyone think the tax will drop soon in the US?

- 03/10/2021 – the infrastructure plan may got through reconciliation and have to go through bipartisan process since Manchin wants it. So the final approval might take several months. The way to pay for this might be some combination of higher taxes and a deluge of municipal bond sales subsidized by the federal government via direct payments or tax credits. “There is no dispute about how to finance infrastructure — as always, it will be financed via the U.S. municipal market, which has been the cornerstone of U.S. infrastructure financing since the Great Depression and will continue to stay so,” – what can I do with municipal market?

- With President Joe Biden’s Covid stimulus package set to become law, the White House now turns its attention to a once-in-a-generation infrastructure bill.

- During the campaign, Biden pitched a $2 trillion plan that aims to achieve carbon-free power generation by 2035 and creates “millions” of union jobs.

- Infrastructure is a bipartisan issue, but divisions exist between progressive Democrats and a coalition of moderates and Republicans.

- “Do not think of the infrastructure bill as just roads and bridges. Democrats view an infrastructure bill as the ‘infrastructure’ necessary to build the economy of the future,” Raymond James told clients Monday.

The West Virginia senator has also balked at efforts to alter Senate rules that would allow his party to enact its agenda over Republican opposition.

“I’m not going to do it through reconciliation,” Manchin told Axios over the weekend in reference to the infrastructure plan. “I am not going to get on a bill that cuts [the GOP] out completely before we start trying.”

Even if the president shares the left’s ambitious goals, one topic the Biden team has been even less keen to detail is how it plans to pay for such a massive undertaking. The answer is some combination of higher taxes and a deluge of municipal bond sales subsidized by the federal government via direct payments or tax credits.

The trick, of course, is striking the right balance.

Treasury Secretary Janet Yellen and others have offered oblique commentary on future, way-off-on-the-distant-horizon tax hikes. Last month, for example, she was quick to assure CNBC’s viewers that any tax increases to help pay for spending would only be introduced gradually.

“There is no dispute about how to finance infrastructure — as always, it will be financed via the U.S. municipal market, which has been the cornerstone of U.S. infrastructure financing since the Great Depression and will continue to stay so,” Rai told clients Friday.

-

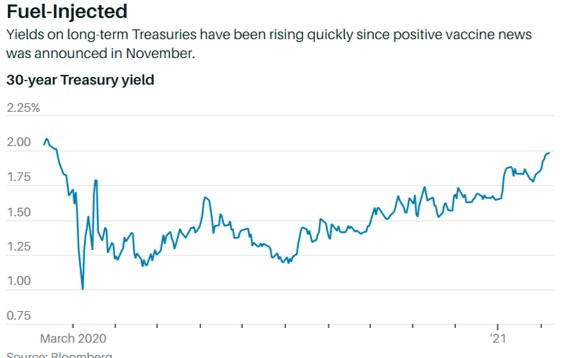

03/08/2021 – Tepper thinks rates have temporarily made the most of the move and should be more stable “in the next few months”, which makes it safer to be in stocks for now. Japan could start buying the U.S. government bonds again following the surge in yields. The potential buying could help stabilize the bond market. Another bullish catalyst for stocks in the near term is the coronavirus fiscal stimulus package. Tech stocks like “bellwether” stocks like Amazon are starting to look attractive after the pullback.

David Tepper is getting bullish on stocks, believes rising rates are set to stabilize

- Tepper, founder of Appaloosa Management, said it’s very difficult to be bearish on stocks right now.

- He thinks the sell-off in Treasurys that has driven rates higher is likely over.

David Tepper, founder of Appaloosa Management whose comments have been known to move markets, said it’s very difficult to be bearish on stocks right now and thinks the sell-off in Treasurys that has driven rates higher is likely over.

The major market risk has been removed, Tepper said, adding that rates should be more stable in the short term.

“Basically I think rates have temporarily made the most of the move and should be more stable in the next few months, which makes it safer to be in stocks for now,” Tepper told CNBC’s Joe Kernen, who shared the comments on “Squawk Box.”

Tepper believes Japan, which had been a net seller of Treasurys for years, could start buying the U.S. government bonds again following the surge in yields. The potential buying could help stabilize the bond market, Tepper said.

“That takes a major risk off the table, and it’s very difficult to be bearish,” Tepper told Kernen.

Another bullish catalyst for stocks in the near term is the coronavirus fiscal stimulus package that was just approved by the Senate, Tepper said.

The Democrat-controlled House is projected to pass the $1.9 trillion economic relief and stimulus bill later this week. President Joe Biden is expected to sign it into law before unemployment aid programs expire on March 14.

The hedge fund manager also said “bellwether” stocks like Amazon are starting to look attractive after the pullback. Shares of the e-commerce giant have fallen 9.7% over the past month, while Apple has dropped more than 11% during the same period.

- 03/04/2021 – Fed likes to maintain easy-money policies. Powell thinks the inflation is transient only due to reopen of economy, but he forgot to mention about the massive M2 and helicopter money, will we have hyperinflation like Burry speculates?

Powell Confirms Fed to Maintain Easy-Money Policies – WSJ

Fed chairman says economy is far from employment and inflation goals; he gives no sign the central bank would seek to stem rise in Treasury yields

Mr. Powell said it’s “highly unlikely” that the Fed’s goal of maximum employment will be reached this year. But he was less clear about whether the economy could show enough improvement this year for the Fed to start reducing its monthly asset purchases.

“I’ve so far been able to not reduce it to an estimate of time. I mean, that will come, I think, when we can see that,” Mr. Powell said, referring to the standard that the Fed wants to meet before scaling back its asset purchases.

- 03/04/2021 – watch out the infrastructure plan to come?

Biden, Buttigieg Push Infrastructure Plan – WSJ