Study of NAIL

- 10/22/2020 – the increase of 10-year Treasury yield negatively impact the housing construction stocks. Good time to get in?

Home Sales Are Still Going Strong. Why Housing Stocks Tumbled Anyway.

The benchmark 10-year Treasury yield has been pushing steadily higher in recent weeks, and on Thursday afternoon was trading around 0.85%, its highest point since June. Mortgage rates generally track movements in the 10-year Treasury yield.

- 08/26/2020 – good to look for construction material companies

Builders FirstSource and BMC Stock Holdings near all-stock merger deal

Builders FirstSource Inc. and BMC Stock Holdings Inc. are planning to combine in an all-stock deal that would join two of the largest suppliers of residential building materials, according to people familiar with the matter.

The impending agreement calls for BMC shareholders to receive 1.3125 shares of Builders FirstSource stock for each BMC share, the people said. The transaction could be announced as soon as Thursday.

- 08/13/2020 – good for housing market and overall economy. Not sure whether it can be sustained or not

Homes selling at record pace, with median prices hitting all-time highs

Median home sale prices hit a record high of over $311,000, up 9% year-over-year.

- 08/12/2020 – excellent housing market

Homes selling at record pace, with median prices hitting all-time highs

Median home sale prices hit a record high of over $311,000, up 9% year-over-year.

- 08/06/2020 – Lower mortgage rate, better NAIL

Mortgage rates fall to record low for eighth time in 2020

Homebuying demand continues as one of few bright spots in the economy

Mortgage rates in the U.S. fell to a record low for the eighth time this year, according to Freddie Mac, which brings the average home mortgage to 2.88 %.

Matthew Speakman, the Zillow economist, told MarketWatch that the lower rate is due to “the inability for the federal government to agree to a new fiscal relief bill last week finally tipped rates over the edge and down to new all-time lows.”

- 08/05/2020 – Mortgage applications decreased 5.1 percent from one week earlier, purchase activity is up 22% year-over-year.

Mortgage applications decreased 5.1 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 31, 2020.

The first graph shows the refinance index since 1990. The refinance index has been very volatile recently depending on rates and liquidity.

But with record low rates, the index is up significantly from last year.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is up 22% year-over-year.

Note: Red is a four-week average (blue is weekly).

- 08/04/2020 – increase of lumber price is boosted by strong housing market

Update: Framing Lumber Prices Up 81% Year-over-year

Here is another monthly update on framing lumber prices. Lumber prices are up 81% year-over-year.

This graph shows two measures of lumber prices: 1) Framing Lumber from Random Lengths through July 31, 2020 (via NAHB), and 2) CME framing futures.

Right now Random Lengths prices are up 81% from a year ago, and CME futures are up 60% year-over-year.

There is a seasonal pattern for lumber prices, and usually prices will increase in the Spring, and peak around May, and then bottom around October or November – although there is quite a bit of seasonal variability.

Prices fell sharply due to COVID-19, however prices have roared back (Note: Construction was considered an essential activity in many areas, so construction didn’t decline as much as some other sectors).

This is the highest price for Random Lengths lumber, and futures are just below the previous record set in 2018.

- 07/28/2020 – U.S. homeownership rate hit the highest level in almost 12 years in the second quarter

U.S. homeownership rate hits highest level in 12 years — but it could be a fluke

The U.S. homeownership rate hit the highest level in almost 12 years in the second quarter during the height of the coronavirus pandemic. But the gain could be a data collection fluke.

The rate grew to 67.9% in the second quarter, the highest since the third quarter of 2008 and up from 65.3% in the first quarter, according to the Census Bureau. The 2.7-percentage-point jump was also the largest on record.

But the bureau said the rate could have been affected by the data collection methods in the second quarter, which relied on only telephone surveys and no in-person interviews, which were suspended on March 20 due to the COVID-19 outbreak. As a result, the response rate was 12 percentage points lower than in the first quarter.

- 07/23/2020 – due to pandemic, people are buying houses to get more space, this might be a permanent trend

Will housing market head downhill for remainder of 2020?

Experts say sector has yet to show true pandemic-related ‘economic scarring’

“It’s important to emphasize here that while we expect a rebound in housing market indicators over the coming months, the threat of another dip remains real in the late fall and early winter, even if the virus DOESN’T make a significant resurgence,” researchers wrote. “This is because the upswing that we’ll see this summer is a result of pent-up demand from homebuyers and supply-in-progress from homebuilders that has simply been pushed off a few months.”

After backlogged demand is flushed out, however, Haus experts say the true “economic scarring” resulting from the pandemic will be evident.

Haus’ forecasts come as the market continues to show signs of resiliency. Existing home sales rose more than 20 percent in June, according to the National Association of Realtors, with growth throughout major regions of the U.S.

Unlike Haus, experts at the National Association of Realtors view the revitalization as “sustainable for many months ahead.”

- 07/23/2020 – Without further disaster relief, there will a significant housing and financial issue.

NMHC: Rent Payment Tracker Finds Decline in People Paying Rent as of July 20th

The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found 91.3 percent of apartment households made a full or partial rent payment by July 20 in its survey of 11.1 million units of professionally managed apartment units across the country.

This is a 2.1-percentage point decrease from the share who paid rent through July 20, 2019 and compares to 92.2 percent that had paid by June 20, 2020. These data encompass a wide variety of market-rate rental properties across the United States, which can vary by size, type and average rental price.

“The extended unemployment benefits and other government support that have proven critical to keeping apartment residents in their homes expire in just a few days,” said Doug Bibby, NMHC President. “Lawmakers are currently negotiating, but Members of Congress and Trump administration leaders need to understand that unless comprehensive action is taken now to protect the tens of millions of Americans who live in an apartment home, they risk destabilizing the nation’s housing market, undermining the nascent economic recovery, and turning the ongoing health and economic crisis into a housing crisis.”

- 07/22/2020 – the attraction of low interest rates outweighed concerns about the pandemic, plus buyers with pent-up demand seize and low inventory is good for the housing market

U.S. Existing-Home Sales Rose 20.7% in June

Monthly activity remains well below pre-pandemic levels as fears about job security and health keep many potential buyers sidelined

A sluggish U.S. housing market is staging a recovery amid the pandemic, shaking off high unemployment and a rising number of infections as buyers with pent-up demand seize on record-low mortgage rates.

Sales of previously owned homes rose 20.7% in June over the prior month to a seasonally adjusted annual rate of 4.72 million, according to data from the National Association of Realtors released Wednesday, the biggest monthly increase on record going back to 1968. The surge in existing-home sales follows other recent bullish indicators such as rising new-home sales, robust home-builder activity and a flood of mortgage applications.

“The housing market is hot, red hot,” said Lawrence Yun, chief economist for NAR, an industry trade group. “As we are coming out of the lockdown, we see this backlog of buyers…trying to take advantage of the record-low mortgage rates.”

Even with the jump in home sales, monthly activity remains well below levels that were seen before the spring lockdowns. June sales marked an 11.3% decrease from a year earlier. Many potential buyers remain on the sidelines, concerned about job security or the health risks related to visiting homes.

Other housing indicators suggest a more bullish mood is emerging. A measure of U.S. home-builder confidence rose in July to pre-pandemic levels, the NAHB said last week. Housing starts, a measure of U.S. home-building, also rose 17.3% in June from May, the Commerce Department said last week. Pending new-home sales rose to a record in June, Meyers Research said on Wednesday.

For Liz Morrison and David Mahaffey, the attraction of low interest rates outweighed concerns about the pandemic.

- 07/18/2020 – The housing sector looks like it’s in a V-shaped recovery even though the rest of the economy is not. Once housing recovers strongly, at least past historical experience shows, the rest of the economy can sort of follow that path.

Coronavirus gives millennials rare home-buying opportunity

Some have been saving for a home since the end of the Great Recession

Americans are fleeing big cities as the COVID-19 pandemic sparks a newfound appreciation for socially-distanced space in the suburbs.

The mass migration has created an opportunity for millennials and other first-time home-buyers, in particular, to take advantage of record-low mortgage rates and work-from-home opportunities, as long as they can outbid their peers in the urban diaspora.

“It is a competitive environment among buyers,” Dr. Lawrence Yun, chief economist at the National Association of Realtors, told FOX Business. “The good news is that mortgage rates are low.”

“The housing sector looks like it’s in a V-shaped recovery even though the rest of the economy is not,” he said. “But we know that once housing recovers strongly, at least past historical experience shows, the rest of the economy can sort of follow that path.”

- 07/17/2020 – U.S. homebuilding increased by the most in nearly four years in June

U.S. homebuilding surges as coronavirus crisis sparks flight to suburbs, rural areas

U.S. homebuilding increased by the most in nearly four years in June amid reports of rising demand for housing in suburbs and rural areas as companies allow employees flexibility to work from home because of the COVID-19 pandemic.

Housing starts increased 17.3% to a seasonally adjusted annual rate of 1.186 million units last month, the Commerce Department said on Friday. The percentage increase was the largest since October 2016. Data for May was revised up to a 1.011 million-unit pace from the previously reported 974,000.

Economists polled by Reuters had forecast starts increasing to a rate of 1.169 million units.

Permits for future homebuilding rose 2.1% to a rate of 1.241 million units last month. Single-family building permits increased 11.8% to a rate of 834,000 units last month. But permits for multi-family units dropped 13.4% to a rate of 407,000 units.

Demand for housing is being supported by cheaper mortgage rates. The 30-year fixed mortgage rate is at an average of 2.98%, the lowest since 1971, according to data from mortgage finance agency Freddie Mac.

- 07/13/2020 – another good news for NAIL

06/06/2020 – Pent-up demand plus buying season at spring time lifts home sale by 21%, great for NAIL and DRN.

Pent-Up Demand Lifts May New Home Sales 21%, Survey Finds

Real-estate brokers say business has increased as stay-at-home restrictions ease and mortgage rates remain near record lows

Sales of newly built homes surged in May, a new survey shows, the latest sign that the housing market is already recovering from a sharp drop in home sales due to the pandemic.

New home sales rose 21% in May from a year earlier, and the average sales rate per community rose 24% year-over-year, according to a survey of more than 300 U.S. builders conducted by John Burns Real Estate Consulting LLC.

The spring is typically the most important season for home builders, as families want to buy houses and move in before the start of a new school year. Some of the recent buying represents springtime demand that was delayed by a month or two, said John Burns, CEO of John Burns Real Estate Consulting.

Other buyers who planned to buy homes in 2021 or later are moving up their timelines, Mr. Burns said. “People don’t want to be quarantined again in a place they don’t like,” he said, “so if you were thinking about buying, even next year, you’re like, ‘Let’s do it now.’”

Market watchers caution that sales could slow later in the year as pent-up demand declines, especially if there is another wave of widespread job losses or a resurgence of the coronavirus.

- 05/20/2020 – Mortgage apps recovered very fast. Good news for housing market

Weekly mortgage applications point to a remarkable recovery in homebuying

- Purchase volume was just 1.5% lower than a year ago, a rather stunning recovery from just over a month ago, when purchase volume was down 35% annually.

- Mortgage applications to purchase a home rose 6% last week from the previous week, according to the Mortgage Bankers Association.

- 05/14/2020 – serial of good news for housing market

- More Sellers Are Listing Their Homes

- New listings Rebounding After Easing Restrictions

- Prices Are on the Upswing

- Demand Surpasses Pre-Pandemic Levels

- Homes Are Now Selling as Quickly as They Were Last Year

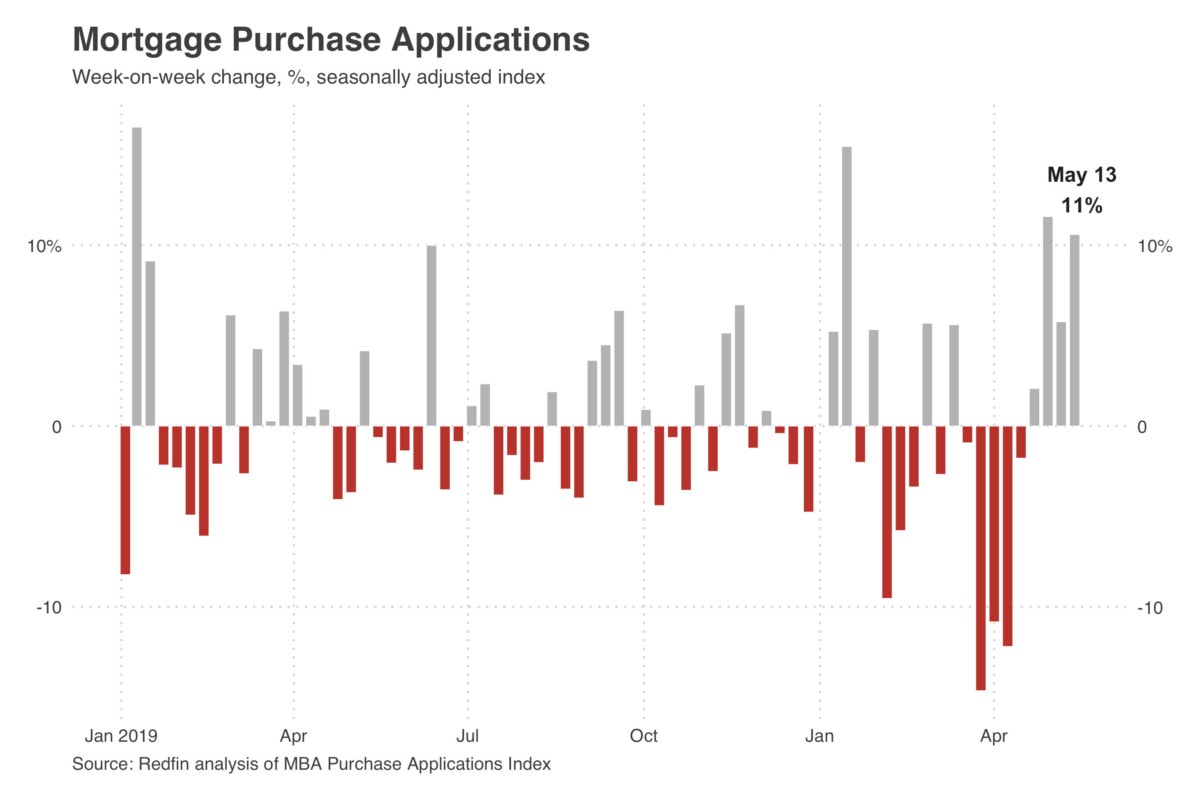

- More People Are Applying for Mortgages: Last week, mortgage applications rose 11% from a week earlier in the fourth-consecutive period of increases as buyers reentered the market, according to the Mortgage Bankers Association.

Charting the Coronavirus Pandemic’s Latest Impact on the Housing Market

As states start to relax stay-at-home restrictions amid the coronavirus pandemic, more Americans are putting their homes up for sale—and setting higher expectations for what their houses are worth. But supply has yet to catch up to homebuying demand, which has now eclipsed pre-pandemic levels.

Here are seven charts that illustrate the latest developments in the housing market as COVID-19 continues to transform residential real estate as we know it.

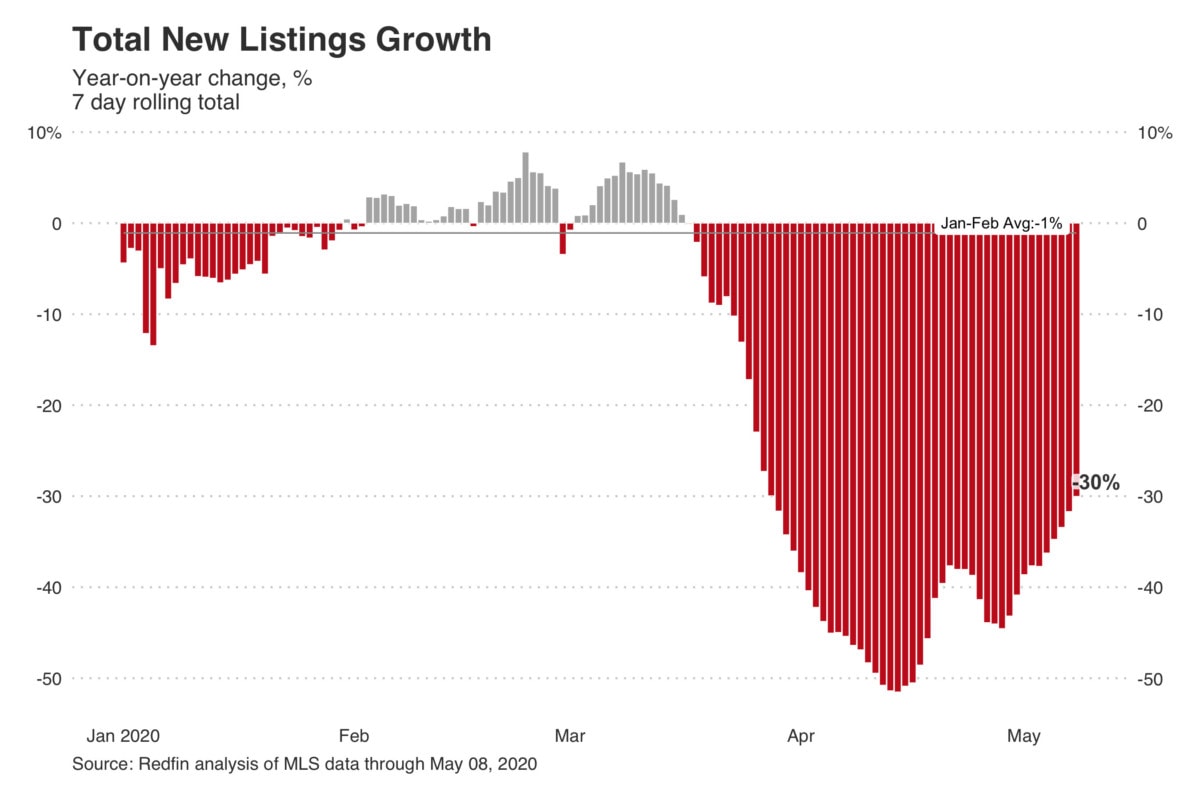

More Sellers Are Listing Their Homes

About 70,000 homes went up for sale during the week ending May 8. While that’s a 30% drop from the same period last year, it’s a substantial improvement over the 50% slide in new listings we saw in mid-April, indicating that home sellers are starting to reenter the market.

“New listings have increased every week for the past four weeks, but can’t keep up with demand,” Redfin Chief Growth Officer Adam Wiener said in his weekly market update Thursday. “Sellers who can wait are still sitting on the sidelines.”

As a result, the supply of homes—measured by the median number of active listings on the market—fell 24% year-over-year last week to about 701,000. That’s near the lowest level in the past five years.

Michigan Is Rebounding After Easing Restrictions

Michigan experienced a drastic resurgence in home listings after its governor allowed real-estate agents to resume business on May 7 following weeks of lockdown. New listings in Detroit were down just 9.8% year over year (to 2,157 homes) last week after plunging 65% only a week earlier. Similarly, new listings in Grand Rapids, MI fell just 20% (to 830 homes) following a decline of 61% the prior week.

Prices Are on the Upswing

Nationwide, listing prices are inching back up as homeowners raise their expectations for what they could reap in a sale. The median listing price climbed 5.4% year over year last week to $322,000—the highest in about two months—following a 1.7% dip in April that had brought prices to as low as about $302,000.

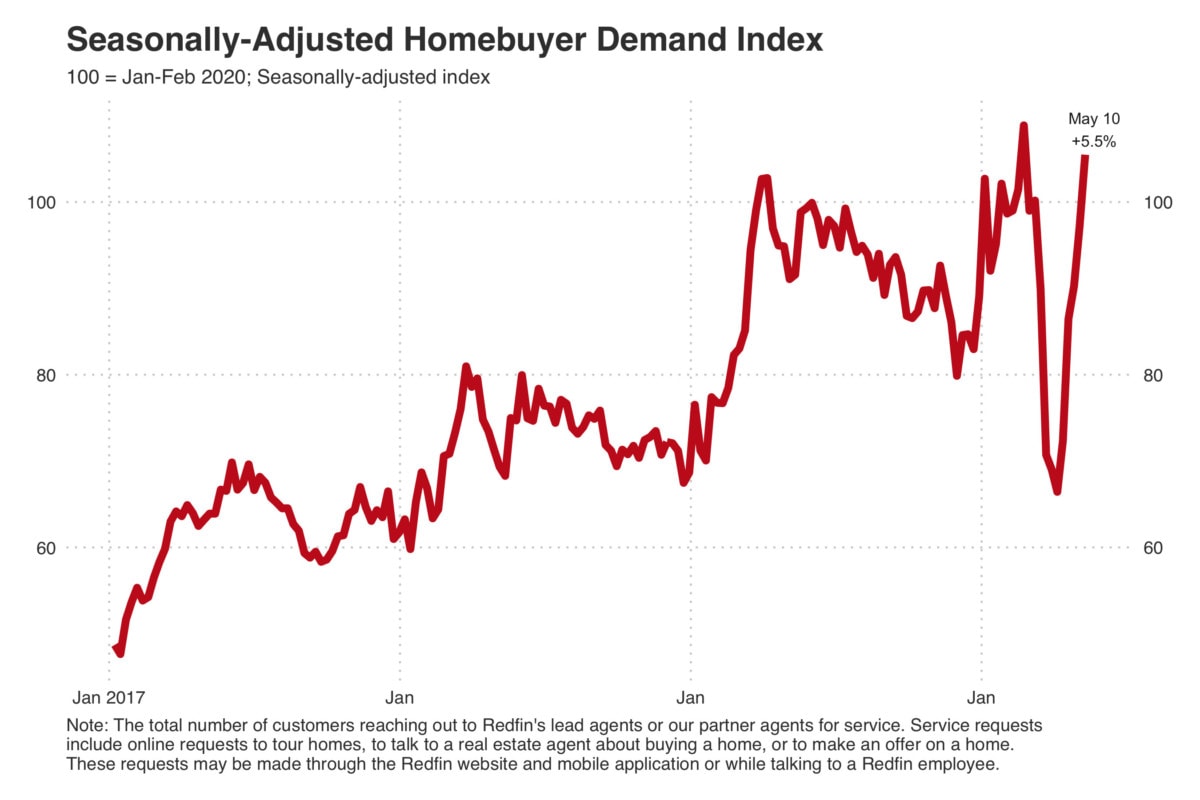

Demand Surpasses Pre-Pandemic Levels

Homebuying demand is making a comeback. The measure was 5.5% higher during the week ending May 10 than it was before the pandemic on a seasonally-adjusted basis.

“The V-shaped recovery in home-buying demand is powered by record-low mortgage rates and the loosening of stay-at-home orders in some states,” Wiener said. “After two months of waiting for the other shoe to drop, buyers who are still employed may also be a little more confident about their job security.”

Homes Are Now Selling as Quickly as They Were Last Year

Since the end of March, homes had been selling at a slower pace than last year, but that’s no longer the case. During the seven-day period ending May 8, nearly 45% of the houses that went under contract did so within two weeks of being listed—the same pace we saw at this time last year, and up from 36% during the prior week. In other words, growth in the share of homes finding buyers within two weeks is now flat compared with 2019.

More People Are Applying for Mortgages

Last week, mortgage applications rose 11% from a week earlier in the fourth-consecutive period of increases as buyers reentered the market, according to the Mortgage Bankers Association.

Of the 10 biggest states in the MBA’s survey, New York led the gains with a 14% climb. Illinois, Florida, Georgia, California and North Carolina also saw double-digit increases.

05/14/2020 – housing demand is back, inventory is down. Good for NAIL.

Home-Buying Demand Passes Pre-Coronavirus Levels; Inventory Down 24%

Four Key Housing Market Takeaways for This Week

- Home-buying demand has come roaring back, now 5.5% higher than it was pre-pandemic

- New listings have increased every week for the past four weeks, but can’t keep up with demand; inventory is down 24%. Hazel Shakur, a Redfin agent in Maryland said, “The sellers who are venturing back into the market now either need to sell…or they’re worried prices might fall in the future and want to get out while the getting is good.”

- Median listing prices are up 5% and bidding-war battle royales are back. David Hokenson, a Redfin agent in Seattle said, “My client was in a 24-offer bidding war for a 1960s home that grandma had never updated. It was listed for $360k, we bid $400k and didn’t even come close.”

- This past week, more than one in four Redfin buyers took their first home tour via video chat. Shellie Silva, a Redfin agent in Grand Rapids, says buyers from Chicago seeking lower prices skip the 3-hour drive around lake Michigan and just stream the home showings from their sofas.

Home-buying demand eclipses pre-coronavirus levels

In the last five weeks, home-buying demand has come roaring back. For the seven days ended May 10, demand was 5.5% higher than it was before the pandemic, on a seasonally-adjusted basis.

The v-shaped recovery in home-buying demand is powered by record-low mortgage rates and the loosening of stay-at-home orders in some states. After two months of waiting for the other shoe to drop, buyers who are still employed may also be a little more confident about their job security.

05/10/2020 – The Woman Who Foresaw the 2008 Housing Crash Is Bullish on These Home-building Stocks

Zelman’s Picks

Homebuilders

MORTGAGE INSURERS

- New homes will do better than existing ones: Over the past several years, new homes have been taking market share from resales, as builders have increasingly been adding affordable supply to the inventory-starved entry-level segment. In 2019, new homes represented 13% of total home sales in the U.S., up from a trough of just 7% in 2011. In the near term, we believe new homes will continue to take share, as homeowners pull listings from the market due to health concerns over having strangers visiting their homes. After the pandemic ends, we expect consumers to increasingly favor new homes for the reasons they have for several years—innovative floor plans and technological advancements, including home automation.

- home-building stocks offer a compelling value: Our top picks are Lennar [ticker: LEN] and PulteGroup [PHM], which are best-in-class. Lennar, at $51, is trading at 1.25 times tangible book, and Pulte, at $27, is at 1.4 times tangible book. These multiples are down sharply from the peaks in February. We also like M/I Homes [MHO], a small-cap builder in the Midwest and Southeast trading around $25. It’s at 0.7 times book. We expect the major builders to be profitable this year. We estimate that Lennar will earn $2.79 per share in 2020, down 52% from 2019. We see earnings rising to $4.57, a 64% increase, in 2021. For Pulte, we project $1.94 a share in 2020 earnings, 48% below 2019, and then increasing 54%, to $2.98, in 2021.

- Toll Brothers (TOL): We upgraded Toll in late March. The stock, now around $25, trades for 0.7 times book value. We estimate that Toll will remain profitable this year, with earnings of $1.15 a share, down 72% from 2019, but we see a rebound to $2.63 in 2021. Before the selloff, Toll rarely traded below book value. Its valuation offers a very compelling long-term risk/reward, even though the luxury market will remain more challenged than the entry-level market.

- We like the mortgage insurers at current valuations: given that we believe the industry is prepared to handle the rising wave of forbearances, given strong capital levels. We do not expect the increased level of forbearances to translate into material losses. If you don’t have the 20% down payment required by Fannie Mae and Freddie Mac for a home loan, you have to get mortgage insurance. Essent Group [ESNT] is a best-in-class operator, with a strong balance sheet and significant reinsurance protection on over 90% of its portfolio. That significantly mitigates the risk of losses. It’s trading at just 0.9 times book value. Another insurer, Radian Group [RDN] is trading at 0.7 times book value, and we believe the company has adequate capital resources to weather the coming forbearance wave. It also has a real estate services business that provides some diversification.

- We are cautious on UDR [UDR], Mid America Apartment Communities [MAA], and Camden Property Trust [CPT]: given their outsize exposure to noncoastal markets with a less resilient employment base and atypically elevated valuations relative to coastal-focused apartment REIT peers.