It is great interesting to read this short bio of Masayoshi Son. There are a lot of characters that I can learn from him to be the best of best.

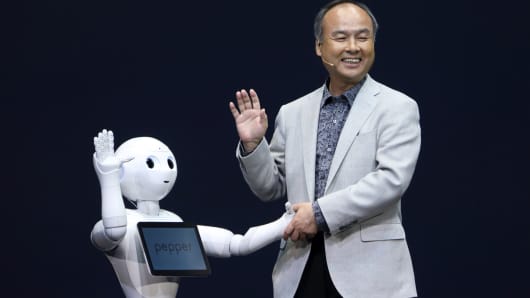

Masayoshi Son is shaking up Silicon Valley $1 billion at a time — here’s how he became one of tech’s most powerful people

- Masayoshi Son is one of the technology industry’s most influential investors.

- He’s known for his enthusiastic, even obsessive, excitement, and his long-term vision.

CNBC.com

SoftBank’s Vision Fund — a $100 billion private equity fund that’s outspending almost every other player in start-up investing — seemed to come out of nowhere this year.

But for the company’s firebrand leader, Masayoshi Son, an ambitious vision was ordained at birth.

“You are a genius, No. 1 in Japan,” Son said his father told him as a child, according to a 1987 interview obtained by Bloomberg. “You’ll be a big shot.”

It proved to be prophetic: Son is now one of the world’s richest men. He’s using his fortune and his deep connections in the tech industry to back a series of massive investments designed to secure SoftBank’s place in the next century.

In the past year alone, SoftBank or the Vision Fund have invested in, acquired or partnered with WeWork, Arm, Foxconn, Alibaba Cloud and more. More deals, like the acquisition of Boston Dynamics and Fortress Investment Group, are still in the works.

Now, Softbank is getting ready to make a major investment in Uber, one of the most highly valued private tech companies int he world. This would double up with Son’s investment in Didi Chuxing, the majority owner of Uber’s China operations. It would also be another touch point with new Uber CEO Dara Khosrowshahi, a board member of SoftBank-backed Fanatics.

Son has also invested in Grab, a ride-hailing company in Southeast Asia, and Ola, an India ride-hailing giant. (In 2016, top SoftBank executive Ming Maa joined Grab.)

Son has downplayed the role of his massive fund.

“The ‘gold rush,’ it’s just a money thing. It’s not important, it’s just a process. What is more important is human happiness. How do we help ourselves, humans, become happier?” Son said at the Future Investment Initiative in Riyadh, Saudi Arabia this year. “I’m a super optimist… There’s always a solution.”

Meanwhile, some entrepreneurs are running, not walking, to get Son on board at their company, according to Greg Wyler, founder of satellite tech company OneWeb. Softbank led a massive $1.2 billion round in the start-up less than a year ago.

“He has a thematic, deep understanding of technology — what global impact it has on people around the world, how their lives will be changed by technology,” Wyler told CNBC. “I can’t put him a bucket. Larry Page, Mark Zuckerberg, they may be are similar in this way or that way. Bill Gates has a certain style. I can’t do that with Masa. He’s more of this all-seeing person.”

‘Why am I not yet No.1?’

The pressure to be the best in Japan stuck with Son, born in summer 1957. Son saw his father, a pachinko parlor operator, work particularly hard as someone with Korean heritage — an outsider in Japanese culture.

Son told “The David Rubenstein Show” how he was so impressed by a book written by the CEO of McDonald’s Japan, he called his assistants at least 60 times long distance. When that didn’t work, Son flew to Tokyo unannounced to set up a meeting.

The executive told Son he should get into the computer business, Son told Rubenstein. By age 19, Son says he had a 50-year entrepreneurship plan, and went to college in the U.S. at Berkeley. There, the image of an Intel microprocessor inspired him to start a software distribution company.

From then on, Son was thinking how the personal computer would change the future. And he continued to ruminate on that question for 30 years, reinventing the focus of SoftBank several times.

“I lose sleep thinking, ‘Why am I not yet No.1?’,” Son said in a 1987 interview obtained by Bloomberg — just a few years after his business got off the ground.

“”Every time I explained any business plan or model, Masa’s first reaction was to say, ‘David, can this be ten times bigger?'””

His forward-thinking outlook gave him a reputation as an insightful investor.

“Everyone’s waiting for Mr. Son to make a false step, but he just doesn’t seem to make mistakes,” said Richard May, an analyst at West LB Securities in Tokyo, told the New York Times in 1995, when SoftBank agreed to buy Ziff-Davis Publishing Company, the publisher of PC Magazine, for $2.1 billion. “His positioning in the U.S. market has been very shrewd.”

Between 1987 and 2001, Son made investments that would launch SoftBank to notoriety — including Yahoo Japan, Ziff Davis and perhaps most importantly, a then-unknown internet company called Alibaba. It’s now worth more than $480 billion.

At the Bloomberg Global Business Forum earlier this year, Son said that he was drawn to Alibaba not because of the business model or technology, but because of the charisma and leadership of founder Jack Ma.

(In fact, Masa was able to spot both of the two biggest future e-commerce rivals in the world during the 1990s — even if he only successfully invested in one. Son pitched Amazon founder Jeff Bezos, who never made a deal, according to The Information.

Son always brought his big thinking to his investments. David Wei, a former CEO of Alibaba.com, told Reuters in 2014 how he nicknamed Son “Mr. Ten Times.”

“Every time I explained any business plan or model, Masa’s first reaction was to say, ‘David, can this be ten times bigger?'” said Wei. “In the cases I managed to answer, he would ask again, ‘What about ten times more?'”

Fighting spirit

By the peak of the dotcom boom, Son says he was briefly richer than Bill Gates. When some bum investments, like WebVan, went bust, Son has said his “fighting spirit” kept him going.

Son shifted to become a major player in Japanese telecoms.The company added its internet service in 2004 and mobile business in 2006.

In part, Son has said he’s been driven by a disdain for monopolies. SoftBank aggressively pursued top telecom player NTT in Japan by increasing internet speeds and lowering prices.

“When I started fighting with NTT, everybody called me crazy,” Son said in 2014, speaking at Recode’s Code Conference. “We had no experience, no capital, not even technology. I just had anger. Sometimes anger helps. It’s a source of energy.”

Son’s cell phone business roared to life in Japan, thanks to a distribution deal for the iPhone 3G in Japan. Son was in the process of buying Vodaphone’s Japanese cell phone business, but wasn’t done yet. Nonetheless, he decided to make a gutsy proposition to Steve Jobs.

“I called him up and went to see him — I brought my little drawing of an iPod, and I gave him my drawing,” Son told Charlie Rose in 2014. Jobs didn’t want the drawing, but ended up rewarding Son’s bold move with the exclusive deal.

Son then bought a majority stake in Sprint in 2012.

“[Sprint CEO Marcelo Claure] is a great CEO. He is a fighter, he is a challenger. He loves to be in the situation of fighting from underdog. His whole life is like that. My whole life is like that. So I think it’s an interesting moment to watch ” Son told CNBC in 2014.

Son’s also been pushing for a stake in T-Mobile, which has its own boisterous leader in John Legere.

“I strongly admire them, they are the maverick. I strongly admire the price disruption, all the services, redefining….which I did in Japan.” Son said of T-Mobile 2014, speaking at Recode’s Code Conference. (As of the beginning of November, the latest round of talks has stalled out.)

“If Japanese and Chinese people can work together we can make the largest economic circle in the world.”

Son has been accused of being in favor of “high risk, high return” investments before the Vision Fund. When Alibaba went public in 2014, Son defended the company against accusations that it represented a bubble.

“People can have a different point of view. My point of view is this is true beginning of Alibaba. I think the information revolution is just the beginning,” Son told CNBC in 2014. “It’s going to last next hundred years, 200 years. China is still going to grow…. I’m very, very optimistic.”

One former Alibaba employee told Reuters 2014 that Son came off as “conceited” even if he appeared modest. But the business worked because Son and Ma both had a streak of “crazy” in common.

While Son once eyed the the top echelon of Japanese society, over time, he became interested in power across the world.

“In the future, if the Japanese market and Chinese market can merge into one, this can form a bigger e-commerce market and surpass the U.S. market,” Son said in the Wall Street Journal in 2010. “We always talk about the U.S. economic circle. If Japanese and Chinese people can work together we can make the largest economic circle in the world.”

Masa’s inner circle

Son’s sudden massive spending spree is thanks in part to a tight inner circle he built through the ups and downs of SoftBank.

It reportedly only took 45 minutes for him to score a $45 billion check from Saudi Arabia’s sovereign wealth fund. He also scored cash from Apple, Qualcomm, Foxconn and Sharp. That’s no coincidence — Son has relationships with those companies dating back decades, partly through his relationship with Steve Jobs. He sold his first company to Sharp before he had even turned 21.

Son’s brother, Taizo, is now also reportedly a billionaire in his own right from his own tech companies and investment But he cites the early days of SoftBank as a life-changing period, according to Nikkei Asian Review. Taizo told Nikkei Asian Review he slept in a tent in a SoftBank warehouse, where he eventually met Yahoo co-founder, Jerry Yang.

OneWeb’s Wyler said his mutual relationships with Son, paired with around-the-clock due diligence, helped him seal a deal with SoftBank within 8 weeks.

“We had a number of our investors that already had strong relationships with Masa,” Wyler said. “Eight weeks is amazingly fast for deals of this size. There were very high levels of speed and integrity, where if you say you do something you follow through. And that’s what binds people to him. People who work with him, because of that high level of integrity, feel a high level of personal responsibility. He really is careful about his relationships and his bets.”

Start-up Mapbox, backed by Techstars co-founder Brad Feld, got an investment from SoftBank Vision Fund this year.

“It is no surprise that [Mapbox CEO Eric Gundersen] and Masa both have this bold vision. Both share an exceptional way of dreaming and executing,” Feld wrote of the deal. “I’m very loyal to my friends at Softbank and love any opportunity to work with them. Back in 1997, Softbank Technology Ventures (which became Mobius Venture Capital) was the first VC fund I helped raise. Ron Fisher, the Vice Chairman of Softbank, was responsible for watching over us, is one of my favorite people on the planet, and has been an incredible mentor to me.”

But the intensity of Son’s relationships also has a dark side. According to one onlooker quoted by The Economist in 2015, Son has a “habit of becoming intensely taken up with someone only to lose interest later on.”

For instance, last year Son seemed ready for retirement, and began publicly grooming former Googler Nikesh Arora to take over when Son turned 60. But in the middle of 2016, Son had an abrupt change of heart, and Arora was out.

“I had hoped to hand over the reins of SoftBank to him on my 60th birthday — but I feel my work is not done. I want to cement SoftBank 2.0, develop Sprint to its true potential and work on a few more crazy ideas. This will require me to be CEO for at least another five to ten years,” wrote Son.

Arora told CNBC this year that Son is one of the “most genius investors in the world” and he loves him “to death.” But he also told Fortune that Son has “an idea per minute” and tends to get carried away.

“He’s an interesting individual — I think his risk appetite hasn’t changed in 39 years,” Arora told CNBC’s Jim Cramer on “Mad Money.” “He just goes at things.”

Still, based on his interactions with Son, satellite CEO Greg Wyler said he hasn’t seen any reason to doubt Son’s commitment.

“He presents a calmness, a zen, happiness,” Wyler said. “It’s about a vision, as opposed to a ‘rah, rah, let’s go fight’ dynamic. He’s not trying to beat something. Just trying to accomplish something. He’s very natural and authentic what he’s doing. Some leaders are driven by the opportunity to harm someone else, that’s their success, rather than the success itself. A VC is driven by the stock price, Masa is really a partner. We all keep up on the financials and the metrics, but he understands how to grow the company.”

another article from Bloomberg on Masa Son “Inside the Eccentric, Relentless Deal-Making of Masayoshi Son”