Pershing Square owns 18.1M shares and 9.1M shares of Options in VRX

http://seekingalpha.com/article/4046656-tracking-bill-ackmans-pershing-square-portfolio-q4-2016-update

Summary

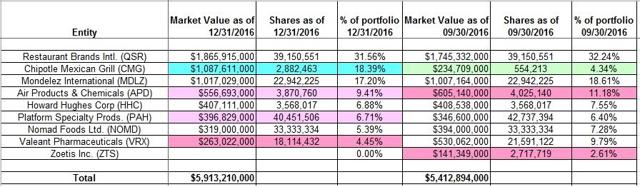

Ackman’s US long portfolio increased from $5.41B to $5.91B this quarter.

Pershing Square dropped Zoetis while substantially increasing Chipotle Mexican Grill during the quarter.

The largest three 13F positions are Restaurant Brands International, Chipotle Mexican Grill, and Mondelez International, and together they account for two-thirds of the portfolio.

This article is part of a series that provides an ongoing analysis of the changes made to Pershing Square’s US long portfolio on a quarterly basis. It is based on Ackman’s regulatory 13F Form filed on 02/14/2017. Please visit our Tracking Bill Ackman’s Pershing Square Holdings article for an idea on how his holdings have progressed over the years and our previous update for the fund’s moves during Q3 2016.

Ackman’s US long portfolio increased ~9% from $5.41B to $5.91B this quarter. The number of positions decreased from 9 to 8. The portfolio remains heavily concentrated with a few huge bets. The top three positions account for 67.15% of the total portfolio value: Restaurant Brands International (NYSE:QSR), Chipotle Mexican Grill (NYSE:CMG), and Mondelez International (NASDAQ:MDLZ).

In addition to partner stakes, the fund also invests the capital from Pershing Square Holdings (OTCPK:PSHZF), a public entity that debuted in Euronext Amsterdam in October 2014. This was set up primarily to increase the amount of capital invested that is permanent. Pershing Square Holdings has underperformed the S&P 500 since its EOY 2012 inception. Their original flagship fund’s (2004 inception) track record is outstanding with returns of ~20% per annum.

To learn more about Bill Ackman, check out the book “Confidence Game: How Hedge Fund Manager Bill Ackman Called Wall Street’s Bluff.”

New Stakes:

None.

Stake Disposals:

Zoetis Inc. (NYSE:ZTS): The 2.61% ZTS position was first purchased in Q3 2014 at prices between $32 and $37. Q4 2014 saw a whopping 650% stake increase at prices between $35 and $45. Q2 2016 saw an about turn: ~50% sold at prices between $44 and $49. Last quarter saw another ~87% selling at prices between $47 and $53. The disposal this quarter was at prices between $47 and $54. The overall cost basis was around $37. The stock currently trades at $55.15. Pershing Square harvested gains.

Stake Decreases:

Air Products and Chemicals (NYSE:APD): In Q2 2013, a new ~8% of the US long portfolio APD stake was purchased at prices between $80 and $84. By Q4 2013, the position was more than doubled at prices between $78.50 and $94.50. It had since been kept steady. Q1 2016 saw a ~63% stake reduction at prices between $103 and $133. Last quarter saw another ~47% selling at prices between $126 and $145. The stock currently trades at ~$142 and the stake stands at 9.41% (top five) of the US long portfolio. There was minor trimming this quarter.

Note 1: Pershing Square’s yearly investor update had the following regarding the APD stake: The position saw a 76% increase from average cost (July 2013 announcement) through Jan 20, 2017. That puts their cost basis at ~$82.50.

Note 2: Pershing Square also has a 12.95M share position in APD American style call options. Including that, the ownership stake is at ~7.5% of the business.

Note 3: The prices quoted above are adjusted for the spinoff of Versum Materials (NYSE:VSM) that closed in October 2016. The terms called for APD shareholders to receive one share of Versum Materials for every two shares held.

Note 4 Pershing Square’s activism led to the replacement of the CEO and the appointment of three new board members in June 2014.

Platform Specialty Products (NYSE:PAH): On 01/23/2014, Ackman disclosed a huge new stake in Platform Specialty Products Corporation in a 13G filing. Pershing Square was a PAH investor prior to its NYSE IPO. Q4 2014 saw a ~30% stake increase at prices between $21 and $28. Ackman’s cost basis is around $14. The stock currently trades at $13.01. This quarter saw a ~5% trimming at $8.78. Ackman controls ~20% of the business.

Note: The stock was down ~45% in 2015 and was flat in 2016.

Valeant Pharmaceuticals (NYSE:VRX): VRX was Ackman’s largest position at ~25% of the US long portfolio as of Q3 2015. The following quarter saw a ~15% reduction while there was a ~30% increase in Q1 2016. The stake was established in Q1 2015 at a cost basis of $196. This quarter saw a ~16% reduction at $14.85. The stock currently trades at $16.86.

Note: Pershing Square owns 27.2M shares (7.8% of the business) compared to 18.1M shares in the 13F. The difference is the 9.1M shares in options that are not included in the 13F.

Stake Increases:

Chipotle Mexican Grill: CMG is a large (top three) ~18% of the portfolio stake established last quarter at a cost basis of ~$405 per share. The stock currently trades at $423. For investors attempting to follow Pershing Square, CMG is a good option to consider for further research.

Note: Ackman controls ~10% of CMG.

Kept Steady:

Restaurant Brands International: QSR is currently the largest 13F position at ~32% of the US long portfolio. Pershing Square controls ~17% of QSR. Their yearly investor update had the following regarding QSR: Share price has increased 3.14x from average cost since June 2012 (Justice Merger that resulted in the original Burger King position). That puts their cost basis at ~$16. The stock currently trades at $54.97.

Note: Restaurant Brands International came about through the merger of Tim Hortons and Burger King Worldwide. Pershing Square had a huge investment in Burger King and those shares got exchanged for QSR shares.

Mondelez International: MDLZ is a large (top three) ~17% of the 13F portfolio stake established in Q3 2015 at a cost basis of ~$39. Q1 2016 saw a ~47% reduction at prices between $36.50 and $45. The stock currently trades at $45.37.

Note: Pershing Square also has a huge position in MDLZ American style call options. Including that, the ownership stake is at 6.4% of the business (99.3M shares).

Howard Hughes Corp. (NYSE:HHC): HHC is a ~7% of the US long portfolio position that was established in 2010 as a result of its spin-off from General Growth Properties (NYSE:GGP). The stake has remained untouched during the whole period. The stock has returned over 3x since the spinoff.

Note: Ackman’s ownership is at ~5.48M shares (13.2% of business) compared to ~3.6M shares in the 13F: ~1.92M shares in currently exercisable warrants are not included in the 13F filing.

Nomad Foods Ltd. (NYSE:NOMD): In June 2015, Pershing Square revealed a ~22% ownership stake in London listed SPAC Nomad Holdings at a cost of ~$350M. After a couple of acquisitions (Iglo Group & Findus Group) in 2015, the business moved its listing from London Stock Exchange to New York Stock Exchange in January 2016. Pershing Square controls ~19% (33.33M shares) of the company. The stock currently trades at $10.72.

Fannie Mae (OTCQB:FNMA) and Freddie Mac (OTCQB:FMCC) are other US long positions in the partnership – the holdings were disclosed in 13D filings on November 15, 2013 – as they are not 13F securities, they are not listed in the 13F report. Ackman held just under 10% of the outstanding shares of both these businesses – 115.57M shares of FNMA at a cost basis of $2.29 and 63.5M shares of FMCC at a cost basis of $2.14. The combined investment outlay was ~$400M. FNMA and FMCC currently trade at $4.23 and $4.03 per share respectively.

Bill Ackman also has a short book. Herbalife (NYSE:HLF) with a capital allocation of 9% is the only one that is publicly known. There is no regulatory requirement to disclose short positions and so only ones that Ackman voluntarily discloses are known.

The spreadsheet below highlights changes to Pershing Square’s US stock holdings in Q4 2016:

Disclosure: I am/we are long FMCC, FNMA, VRX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.