BAC released its 4Q2011 8K on 01/19 and closed out the stormy 2011 year with better-than-expected revenue and meet-expectation EPS in the last one quarter. Share prices increased 2.35% on 01/19 and 1.58% on the second day.

There are a lot of details in BAC reports that we need to go through, I will post more on this in the future. Let us first start with some preliminary views.

Overall, it seems that everything is moving in the right direction as BAC management intended to do. The company continued to focus on streamlining the balance sheet by selling non-core assets, addressing legacy issues, reducing debt and implementing its customer-focused strategy while focusing on reducing expenses to position the company for long-term growth. BAC is gradually transforming into lean and efficient “New BAC”, equity ratio improved significantly, liquidity further enhanced, charge-offs reduced

significantly. It is a good sign that even with significant mortgage related costs incurred in 2011, BAC can still turn into profit in 2011 (0.15 EPS in 4Q 2011 vs -0.16 EPS in 4Q2010). However, we should closely watch out the implication of macro economies, EU debt woes and the hangover litigation of Countrywide.

Key takeaways

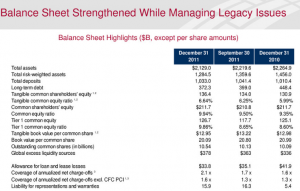

Mainly due to the sale of non-core assets, the tangible book value and book value per share reduced a little. TBV per share was $12.95 at December 31, 2011, compared to $12.98 at December 31, 2010. BV per share was $20.09 at December 31, 2011, compared to $20.99 at December 31, 2010. Remember that the share price of BAC at December 31, 2010 was ~14.00$ vs $5.56 at year end of 2011. The share price is still significantly undervalued nowadays.

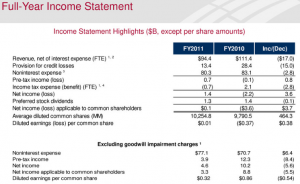

Net income and EPS turned in to positive in 2011 from negative territory in 2010. The turnaround on NI does not come from the more revenue but from significant truncation on provision of credit losses and noninterest expense. BAC issued 464.3 mil more common shares in 2011 which slightly diluted share holder value. However, to gather capital (to reduce debt ratio) through common stocks is much better than new debt.

Balance sheet becomes much stronger: total asset reduced a little due to the consolidation, total risk-weighted assets reduced, deposit increased, long term debt reduced, tier 1 common equity ratio jumped from 8.60% in 2010 to 9.86% in 2011. More importantly, the coverage of annualized net charge-offs increases from 1.6x to 2.1x, the coverage of annualized net charge-offs excl CFC PCI increases from 1.3x to 1.6x. The safety buffer on charge-offs increased significantly.

We should note that BAC ended 2011 with $15.9 billion reserved to address potential representations and warranties mortgage repurchase claims, a significant increase from the year-ago liability of $5.4 billion. What will happen in year 2012? If the litigation will drag on and on, and if the liability for representations and warranties increases, it will hurt the NI; If the liability does not grow, the NI will continue to become more and more positive due to the control on expense and cost, BS will become stronger and stronger. However, if the litigation gets settled (and the settlement fee will be paid in multiple years), most of this liability money will directly flow to NI and we will see a big boom in earnings.

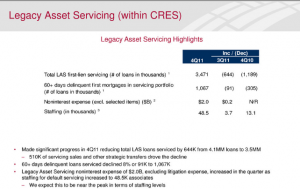

In addition, legacy asset servicing noninterest expense of $2B increased a lot as staffing for default servicing increased to 48.k associates. BAC “expect this to be near the peak in terms of staffing levels”. If this expectation is true, then we will see reduction of

this expense down the road.

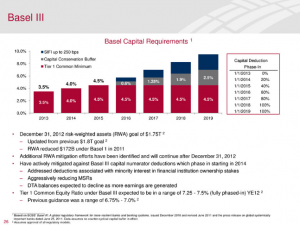

BAC’s Tier I common equity ratio under Basel III is expected to be in 7.25% ~7.5% in year 2012. This simply means that BAC common equity ratio in 2012 will be compliant with the hefty standard of Basel III in 2017! BAC will complete their milestone 5 years before schedule!! To this case, BAC will drastically reduce its equity exposure risk down the road.

Overall, the earning reports from BAC are very uplifting.

35 Responses to Scrutiny of BAC 4Q2011 8K reports – part I